One of the striking features of the speculative talk about the future of the “dollar system” is the degree to which it hinges on highly politicized, small-scale trades between marginal players in the world economy e.g. Bangladesh and Russia, Argentina and China etc, rather than on close observation of the way the dollar functions in connecting giant pieces of the world economy. This lack of macroeconomic perspective is regrettable because it is not just the politics of the world economy that are shifting. The economics of the “dollar system” are not static either. The dollar system is a constantly evolving and shifting assemblage that is entangled with both the global business cycle and structural change in the world economy. In focusing on the geopolitical pressures generated by sanctions and other measures, we may be missing macroeconomic forces that add considerably to the pressure on weaker members of the dollar system.

***

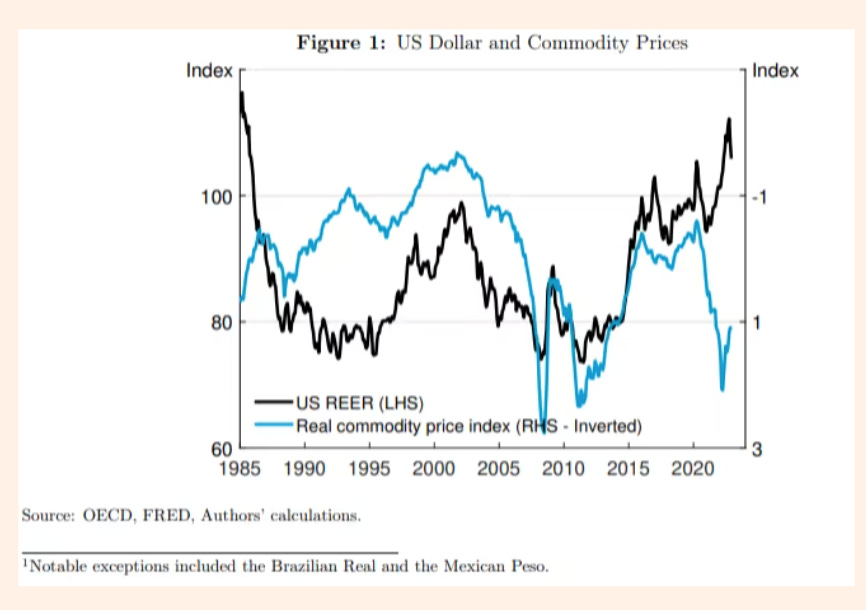

One of the remarkable developments of the global upswing following COVID has been the fact that commodity prices and the dollar have moved up and down together. As is brought out by this nice graphic from the FT, this is a reversal of a negative correlation that has held for forty years.

The logic behind the negative correlation between global commodity prices and the dollar might be explained as follows: Because so many commodities are priced in dollars, a rising dollar generally forced commodity exporters to offer their goods at lower prices so as not to place unreasonable demands on commodity importers. Since 2020 with that pattern reversed, the combined increase in the value of commodities and the dollar has applied huge pressure to importers of oil, gas and food.

This inversion of the commodity-dollar relationship poses a major challenge for the survival of the weaker members of the dollar system.

Was this change in the relationship in the dollar-commodity price nexus a coincidence or should we expect it to continue? A recent report by Boris Hofmann, Deniz Igan and Daniel Rees of the BIS suggests that it reflects structural changes in the US economy.

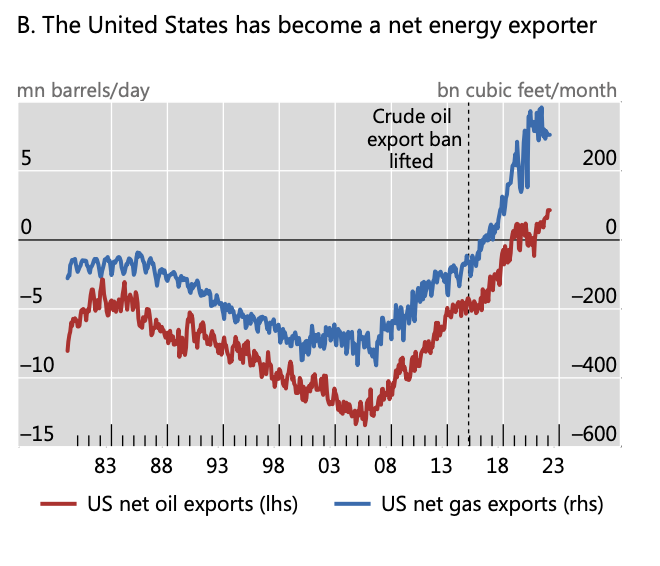

The crucial point is that in the last five years the the US balance in trade in energy has flipped. The US, which used to be a large net importer of oil and gas, has become a major net energy exporter.

This matters because an increase in the price of oil – the lead commodity of the world economy – now improves the terms of trade of the United States. And the terms of trade are strongly correlated with the strength of the dollar.

As the BIS team comments, whereas

“in the past higher energy prices were associated with worsening US terms of trade and a weaker dollar, today these patterns are reversed. A similar positive relationship between the terms of trade and the exchange rate is commonly found for commodity exporters, such as Australia and Canada, but not for commodity importers (see Cashin (2004), Rees (2023)). This suggests that – unless the United States becomes a major net energy importer once more – the combination of higher commodity prices and a stronger US dollar could be more common in the future than it was in the past.

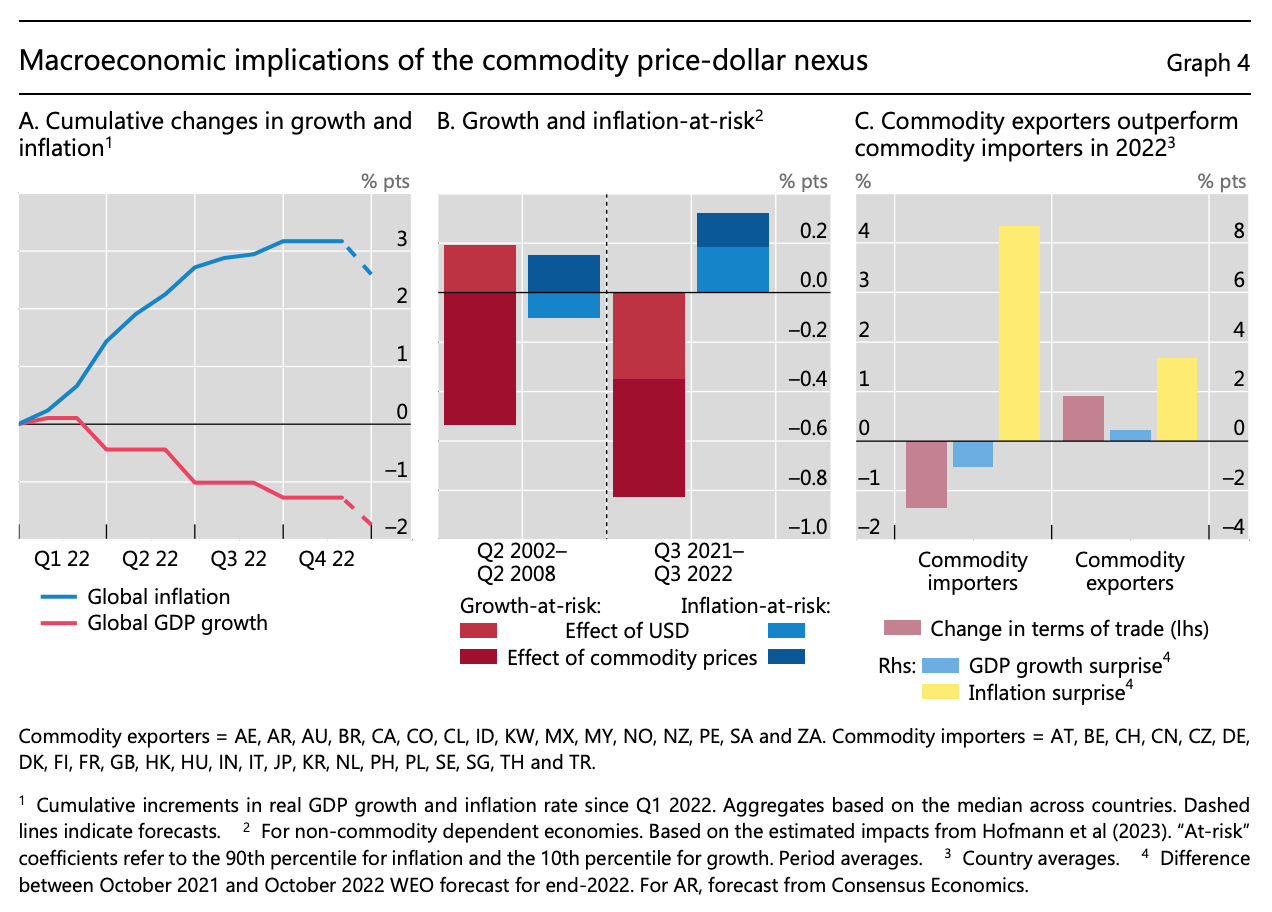

The result of this change in the “commodity price-dollar nexus” is extremely toxic for global growth:

movements in the US dollar now compound the effect of commodity prices changes on the global economy. Commodity price rises tend to stoke inflation and choke off growth in commodity-importing economies, while dollar appreciation tends to do the same outside the United States, especially in emerging market economies. The stagflationary effects of higher commodity prices exert themselves in part through higher consumer prices, which squeeze household incomes, and rising production costs for firms, which dampen investment. The stagflationary effects of a stronger dollar come through its dominant role in global trade and finance.2 The recent confluence of such incidents has significantly increased the risk that weak growth will coincide with high inflation. Consistent with this, inflation surged worldwide while growth fell in in 2022 (Graph 4.A).

The stagflationary impact of the dollar-commodity nexus is compounded by the similar impact of a strong dollar by way of the “credit channel”. A strengthening dollar tightens global dollar-credit and tends to strangle global investment and trade finance. In a recent episode of Odd Lots, Hyun Song Shin explained how the two effects have combined in the current cycle.

***

What does it mean for the dollar system that the US is now a major energy exporter?

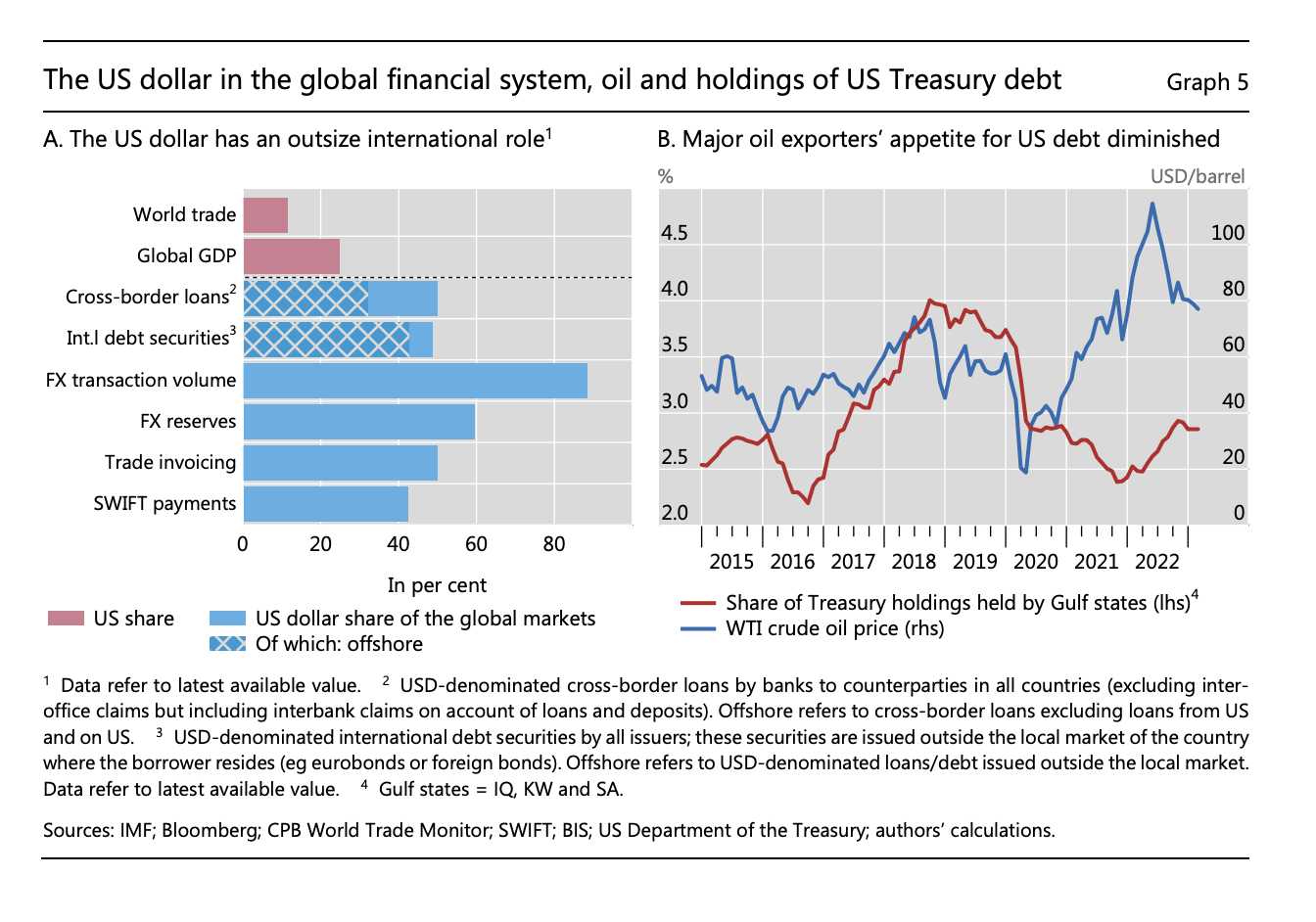

One of the constants in the global economy we have known since the 1970s has been the waxing and waning of the flow of petrodollars generated by US oil imports. As the BIS comments:

For decades, major oil exporters have priced their oil trades in US dollars. Often petrodollars have been recycled back into US Treasury debt and other US assets, reinforcing the dollar’s reserve currency status, as manifested in its dominant role in global trade and finance (Graph 5.A) and its outsize impact on global economic and financial conditions. Less US oil imports could mean fewer petrodollars flowing into the global financial system. This could reduce liquidity and affect currency choices in trade invoicing and reserve management.

This macrofinancial backdrop adds to the political and geopolitical pressures to move away from dollar invoicing of major commodities. As the BIS team comment:

Some commodity exporters may consider catering to the wishes of their new most important customers, as the stabilising impact of the dollar on their economies weakens. Commodity importers may welcome such a change if it shields their economies from the stagflationary effects of rising oil prices and dollar appreciation. Recent data lend some support to this notion. For instance, the major Gulf States have reduced their investments in US Treasury debt even as oil prices and, hence, oil export revenues have picked up (Graph 5.B), possibly indicating more non-dollar oil export invoicing. Moreover, the share of global trade invoiced in US dollars has declined from its peak in 2014 and the global share of foreign exchange reserves held in dollars has fallen to a three-decade low (Arslanalp et al (2022)).

As the BIS team sagely remark, the conversation about the future of the dollar has been on-going for decades and a shift in the dollar-commodity price correlation observed in the last two years is not going to decide it one way or another. But what this break does point to are are powerful range of pressures beyond geopolitics that affect, above all, the weakest members of the system. This may demand various practical adjustments including additional support from the multilaterial financial institutions. But above all it gives the lie to the idea that it is above all politics and geopolitics that are intruding into an otherwise well-balanced and well-defined system of global finance centered on the dollar. Those forces do, of course, impact global finance, but the dollar system that they are shaping is not in itself equal, balanced or unpolitical. Rather it is highly unequal, crisis-prone and constantly changing. It is by the interaction between macroeconomics, macrofinance and geoeconomics that the dollar system’s future will be decided.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters click below. As a token of appreciation you wil receive the full Top Links emails several times per week.