Book Review: Joe Biden’s First Term and the ‘West Wing’ Fantasy of American Politics

In “The Last Politician,” Franklin Foer presents the first half of Biden’s presidency as a series of made-for-television moments meant to inspire doubters and assuage critics. How will the history of the Biden administration be written: as the turning point when America began to heal or as a hiatus between moments of deadlock and adversity? Franklin Foer’s “The Last Politician,” an account of Biden’s first two years in office, is the first draft of an answer. It has the makings of high drama. Crisis follows crisis. The problem is that, from Biden’s bleak inauguration to the surprise result of the midterms, we know the story in advance. Read the full review at The New York Times

America Has Dictated Its Economic Peace Terms to China

By refusing negotiation over China’s rise, the United States might be making conflict inevitable. How far will mounting tension with China be translated into the economic policy of the United States? After a rash of sanctions and overtly discriminatory legislation, with action on U.S. investment in China pending, and with talk of war increasingly commonplace in the United States, the Biden administration knows that it needs to clarify its economic relations with the country that is the largest U.S. trading partner outside North America. Read the full article at Foreign Policy

Europe’s Energy Crisis That Isn’t

American critics chastise Europeans’ rejection of fossil fuels. But Europe is winning the bet. Russian President Vladimir Putin’s war on Ukraine has led to a reassertion of national security concerns in every facet of Western countries’ policy. The most obvious aspect is military security, with the United States and the Europeans ramping up ammunition production and wrangling over tank deliveries. But as far as Europe is concerned, the even more urgent priority is energy security. As Russia’s natural gas supplies were cut off and prices surged to record levels, European governments have spent more on subsidizing the energy bills of their populations, stockpiling gas, and bailing out bankrupt energy companies than they have either on their militaries or on supporting Ukraine. The emergency energy programs were short-term expedients. The urgent question now is which direction long-term energy security is to be found. The crisis struck Europe in the midst of an accelerated energy transition away from fossil fuels, one driven by climate concerns and a program of green industrial policy. Since 2020, Europe has been doubling down on green energy policy, with the Next Generation EU investment program, the Fit for 55 energy transition framework, rising carbon emissions pricing, and a flood of national programs.

Ones & Tooze: The Economic Philosophy of George Soros

Billionaire George Soros has been funding democracy promotion around the world for decades, through his Open Society Foundation. For his efforts, he’s become a bogeyman for the far right. But what economic philosophies drive Soros’s charity work? And how do they align with the business strategies that made him so fabulously wealthy? Adam and Cameron dig in. Find more episodes and subscribe at Foreign Policy.

Chartbook 238: Making & remaking the most important market in the world. Or why everyone should read Menand and Younger on Treasuries.

“The market for U.S. government debt (Treasuries) forms the bedrock of the global financial system. The ability of investors to sell Treasuries quickly, cheaply, and at scale has led to an assumption, in many places enshrined in law, that Treasuries are nearly equivalent to cash. Yet in recent years Treasury market liquidity has evaporated on several occasions and, in 2020, the market’s near collapse led

The west has failed to keep its promises on aid

US and EU attempts to respond to China’s Belt and Road Initiative have fallen dismally short Read the full article at The Financial Times

Now is a time of tough choices — including on the 2% inflation target

That goal should be subject to public scrutiny and judged against the demands of the moment Read the full article at The Financial Times

Europe should not be too relaxed this summer as big challenges await

From migration to Ukraine, Europe’s future worry list runs much deeper than fiscal rules Read the full article at The Financial Times

Chartbook

Sign up below for Adam’s bi-weekly newsletter, which includes economic data, images, & stories that matter.

Look out for Adam’s next book, Carbon, out in 2023.

Discussion with Wolfgang Schäuble

WEF 2020: Why Protests Are An Integral Part Of Democracy

GZERO World with Ian Bremmer – Is a 2nd Great Depression Coming?

Ones & Tooze: The Pencil as Economic Metaphor

Ones & Tooze: A Tale of Two Economies

Chartbook 236: Russia’s Long-War Economy

Book Review: Joe Biden’s First Term and the ‘West Wing’ Fantasy of American Politics

In “The Last Politician,” Franklin Foer presents the first half of Biden’s presidency as a series of made-for-television moments meant to inspire doubters and assuage

America Has Dictated Its Economic Peace Terms to China

By refusing negotiation over China’s rise, the United States might be making conflict inevitable. How far will mounting tension with China be translated into the

Europe’s Energy Crisis That Isn’t

American critics chastise Europeans’ rejection of fossil fuels. But Europe is winning the bet. Russian President Vladimir Putin’s war on Ukraine has led to a

Ones & Tooze: The Economic Philosophy of George Soros

Billionaire George Soros has been funding democracy promotion around the world for decades, through his Open Society Foundation. For his efforts, he’s become a bogeyman

Chartbook 238: Making & remaking the most important market in the world. Or why everyone should read Menand and Younger on Treasuries.

“The market for U.S. government debt (Treasuries) forms the bedrock of the global financial system. The ability of investors to sell Treasuries quickly, cheaply, and

The west has failed to keep its promises on aid

US and EU attempts to respond to China’s Belt and Road Initiative have fallen dismally short Read the full article at The Financial Times

Now is a time of tough choices — including on the 2% inflation target

That goal should be subject to public scrutiny and judged against the demands of the moment Read the full article at The Financial Times

Chartbook

Sign up below for Adam’s bi-weekly newsletter, which includes economic data, images, & stories that matter.

Look out for Adam’s next book, Carbon, out in 2023.

Discussion with Wolfgang Schäuble

WEF 2020: Why Protests Are An Integral Part Of Democracy

GZERO World with Ian Bremmer – Is a 2nd Great Depression Coming?

Ones & Tooze: Ruble Roulette

Ones & Tooze: China’s Economic Crisis

Chartbook 236: Russia’s Long-War Economy

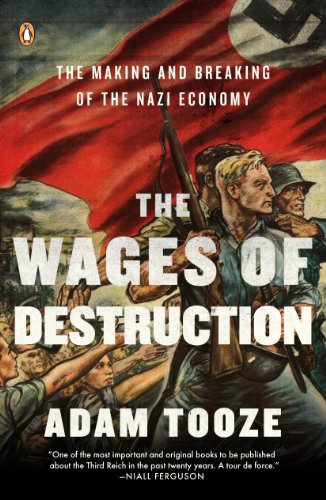

“A seriously impressive book, both endlessly quotable and rigorously analytical”

– Oliver Bullough, The Guardian