Is Russia’s war economy on the brink of crisis, or settling into a new “long-war” mode?

Subscribed

With the ruble having fallen to new lows and fear of inflation stalking the headlines, the Russian economy, in the 18 month of its war in Ukraine, is under pressure. For many Russians to see their currency plunging through the threshold of 100 roubles to the dollar came as a rude psychological shock.

Source: Trading Economics

Valdimir Solovyov, one of Russia’s best-known state TV presenters, bemoaned the situation: “What is happening in this country!? How did this exchange rate come about? Eventually, this will lead to a rise in consumer prices, and it will coincide with the election campaign,”.

Cameron Abadi and I took on the topic on the podcast. Check it out:

The shock at the sudden depreciation has exposed fault lines within the regime. Old rivals such as Putin’s chief economic advisor Maxim Oreshkin and central bank boss Elvira Nabiullina are openly squabbling, with Oreshkin putting the blame for the sudden depreciation at Nabiullina’s door. As he wrote in a recent article:

As these data demonstrate, the main source of ruble depreciation and inflation acceleration is loose monetary policy. The Central Bank has all the necessary tools to normalize the situation in the near future and ensure that lending rates are reduced to sustainable levels.

As the FT explained, Oreshkin blamed the rouble’s fall on the central bank after it eased monetary policy, which he said had led to an extra Rbs12.8tn in debt-fuelled demand that was overheating the economy. To try to stop the price rises, Deputy Trade and Industry Minister Viktor Yevtukhov met with retail chiefs to demand that they limit price rises for consumers.

And when Putin spoke to top economic officials recently his message was clear:

“Objective data shows that inflationary risks are increasing, and the task of reining in price growth is now the number one priority,” Putin said, with a note of tension in his voice. “I ask my colleagues in the government and the Central Bank to keep the situation under constant control.”

***

The West may take comfort in Putin’s worries. But the fact that exchange rates still matters, that the rising cost of imports impacts on the cost of living tells you something important and sobering. Despite sanctions, imports are still a significant factor in Russia’s economy.

In 2022 imports fall sharply, but have now recovered. The reason that the currency is depreciating is that exports have followed the opposite pattern. Exports boomed in 2022 and have now slumped under the double impact of global energy price movements and sanctions. The result is a shift in the demand and supply of rubles and foreign currency.

The slide of the ruble began in December 2022 just as new sanctions regime came into force – the EU oil embargo and the oil price cap imposed by the Group of Seven (G7) countries in December 2022.

The effectiveness of the sanctions is widely debated. Elina Ribakova offers an excellent analysis. Direct European purchases of Russian oil have stopped and Russia is accepting large discounts to sell oil through terminals in the Baltic and the Black Sea that have formerly served European buyers. The effect, ironically is to render the price cap part of the sanctions less relevant. With prices well below $60 per barrel from the terminals close to Europe, G7/EU providers of shipping services, including ship owners and insurance companies, are allowed to remain actively involved in the Russian trade, shipping oil to non-European customers. Meanwhile, at the Pacific Ocean ports that never supplied Europe, notably Kozmino, prices are well above the $60 barrel threshold and the price cap rules are being widely flaunted. EU shippers and insurers are heavily involved in the trade. There too, however, Russia is forced to offer discounts. The principal beneficiary so far is India.

Russia is no doubt finding numerous ways to undercut the sanctions, but the impact on its oil revenues is serious and this is showing up, directly and indirectly, in the balance of trade and the foreign exchange markets. Discounts for Russian oil have led to a significant drop in export earnings. In Q1 2023, Russia exported US $38.8 billion worth of crude oil and oil products, a 29% decline vs. the last quarter of 2022. The fall in oil earnings in turn hits fiscal revenues. Oil and gas tax revenues for the period January to April 2022 were 52% down on the same period last year.

None of this need have impacted Russia’s curent account balance or the exchange rate, if imports had adjusted equivalently. But the opposite has happened. Imports have bounced back strongly meaning that Russia’s account surplus – the excess of exports over imports – fell from $124 billion in January–May 2022 to $23 billion in the same time frame in 2023.

***

The other side of the sanctions system are the measures put in place to restrict Russia’s imports and they are working even less well than the system designed to limit Russia’s export revenues.

Russia does not pay for its imports only from current export revenue. After having much of its reserves impounded at the start of the war, the huge export surge of 2022 allowed Moscow to accumulate a large war chest in foreign exchange. In 2022 Russia saw net financial account inflows to the tune of US $283 billion last year. On top of the giant current account surplus of US $233 billion its coffers were flushed with returning resident capital. This was more than enough to offset the withdrawal of $130 billion in non-resident capital. With the Central Bank of Russia under sanctions, official balance of payments data show other Russian entities – banks and corporates – accumulating foreign assets to the tune of $147 billion of which half is held in the form of financial assets like loans and deposits. In 2023 these foreign exchange holdings are continuing to build, though at a slower rate.

Russsia’s new fx reserves, held particularly in Hong Kong and the UAE, provide it with huge purchasing power with which to break the import sanctions regime. As far as imports critical to the Russian war effort are concerned the figures are dramatic. According to the Yermak-McFaul working group, in 2022 Russian imports of critical components came to $26.0 billion, 16% down on 2021. But this was entirely due to the first impact of the war in March-June. By the end of the year, in Q4 2022 imports were running at $33.9 billion in annualized terms. If this has continued in 2023, and there is no reason to doubt that it has, it would imply that Russia is importing at a faster rate than before the war. Unsurprisingly, much of this is sourced from and via China with Hong Kong trading companies acting as intermediaries.

***

But the strong recovery of Russian imports is not just a matter of sanctions-busting and the nitty gritty of supply chains. In the aggregate, imports are a macroeconomic variable. The fall in Russia’s trade surplus tells you that Russia’s economy is running hot and demand for imported goods, even at higher prices, is strong. More generally, aggregate demand is straining against aggregate supply capacity.

It is, of course, true that Russia’s aggregate supply function is constrained. Mmny sectors of Russia’s economy has long suffered from underinvestment. And in some sectors, at least, the war is making that worse. Furthermore, Russia is suffering from labour shortages as a result of the war.

Already in December last year, Central Bank Governor Elvira Nabiullina warned that “the capacity to expand production in the Russian economy is largely limited by the labour market conditions”. A survey conducted in July by the Gaidar Institute in Moscow found that 42 percent of enterprises surveyed complained of a lack of workers. It has been interpreted as a sign of desperation, Putin last week decreed that restrictions on employing teenagers as young as 14 should be lifted. According to data quoted by TASS, the number of workers under 35 in Russia is at its lowest share of the labour market since the early 1990s, with the most significant decrease in 2022 amongst those aged between 25 and 29. This is hardly surprising when Russia is drafting hundreds of thousands of men for the front. It is also no secret that the war has exacerbated Russia’s long-term “brain drain”. It is estimated that 10 percent of the high tech workforce left Russia in 2022. Altogether, emigration and mobilisation may have cost the Russian workforce approximately 2% of male workers aged 20-49 last year. By the end of 2022 the ratio of vacancies to jobseekers in Russia had risen to 2.5, as compared to the ratio of 1.6 in the USA today, which is generally reckoned to be at full employment.

***

But, serious as these supply restrictions are, there can be little doubt that the main factor causing the shift in Russia’s current account and the pressure in exchange markets is not so much a shortfall in aggregate supply as the strength of aggregate demand.

In a war economy this is not surprising. But in Russia, after many years of austerity, it comes as a considerable shock. Added to which, the central bank after tightening rates in the spring of 2022 to 20 percent, subsequently cut them to 7.5 percent, putting Nabiullina in the crosshairs of critique.

At the start of the war, I and others argued that military Keynesianism was the obvious way for Moscow to cushion the blow of sanctions and ensure home front stability. Some have referred to this as jackboot Keynesianism. James Galbraith has even gone so far as to speak of the “gift of sanctions”. He sees sanctions as a shock which has freed Russia from an economic policy regime that stunted its growth.

“We conclude that when applied to a large, resource-rich, technically proficient economy, after a period of shock and adjustments, sanctions are isomorphic to a strict policy of trade protection, industrial policy, and capital controls. These are policies that the Russian government could not plausibly have implemented, even in 2022, on its own initiative.”

For all that, Russia is running nothing like a total war economy.

Defense spending, at least according to official figures, will come to c. 9 trillion roubles in 2023, or c. $100 billion. By one estimate, that is c. 6.2 percent of Russian GDP. That is comparable to the height of Reagan’s rearmament boom in the 1980s. If we allow for some undercounting, Russian spending might be in the ballpark of US spending during the Vietnam war, at around 9-10 percent of GDP. It is certainly far short of the early Cold War effort at the time of the Korean War, let alone the kind of total war effort that Ukraine is being forced to mount.

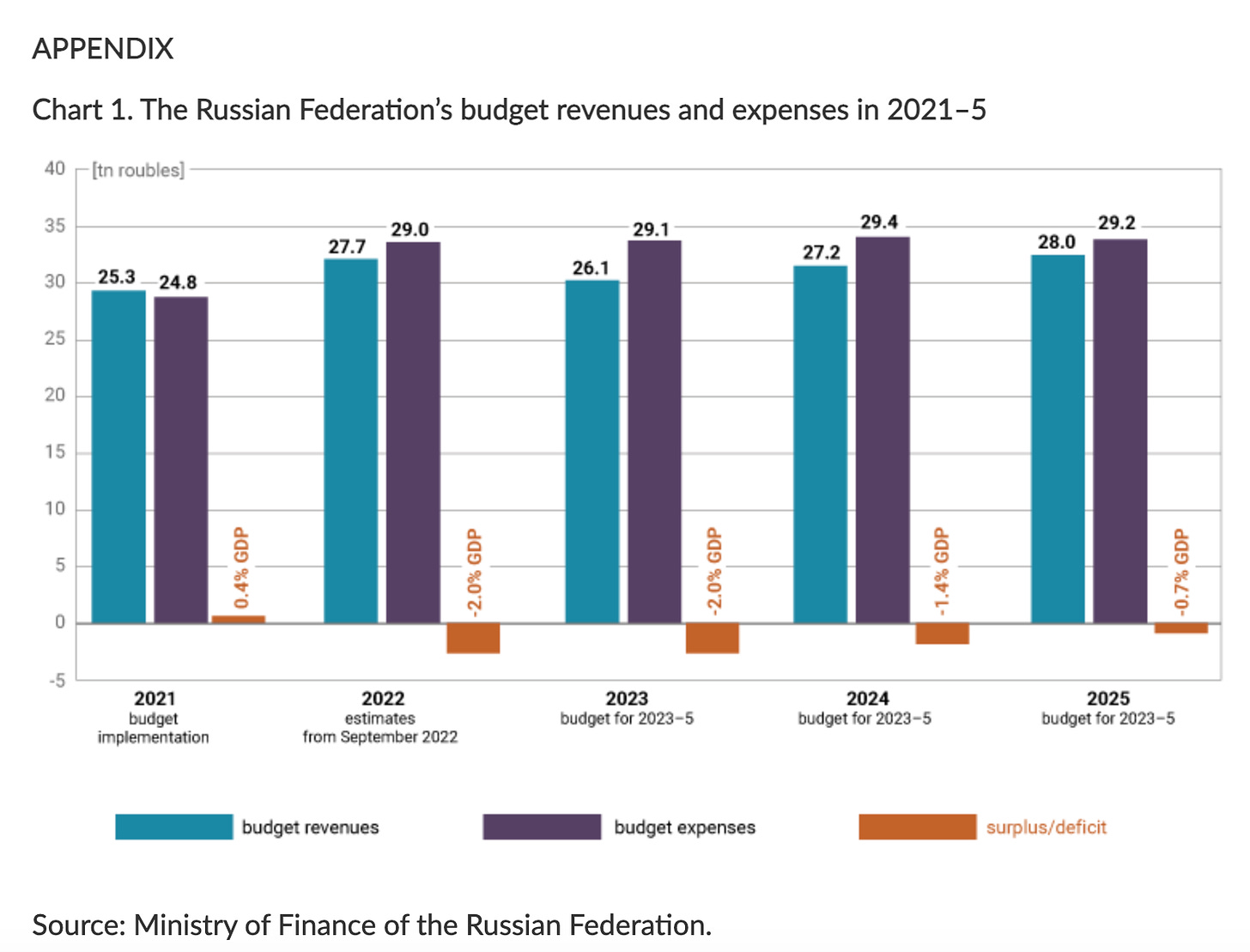

It is enough, in any case, to give a healthy boost to many sectors of Russian industry and to aggregate demand overall. If we take Russian budgetary figures at face value, Russia’s economy is feeling the effects of shifting from a fiscal surplus in 2021 of 0.4 percent of GDP, to a deficit in 2022 and 2023 of 2 percent of GDP.

That is clearly far short of the kind of deficit that would trigger hyperinflation and a currency collapse. But it is a large stimulus and assuming that Moscow is not successful in achieving the consolidation that Putin charted in his comments on the budget at the end of 2022, the taps will stay open. Fiscal and monetary conservatives will bewail the short fall of revenues and the sudden flush of borrowing. But from the point of view of Russia’s eocnomy and home front stability, it seems obvious that the kind of modes deficits that Moscow is running are by far the better option than premature budgetary consolidation.

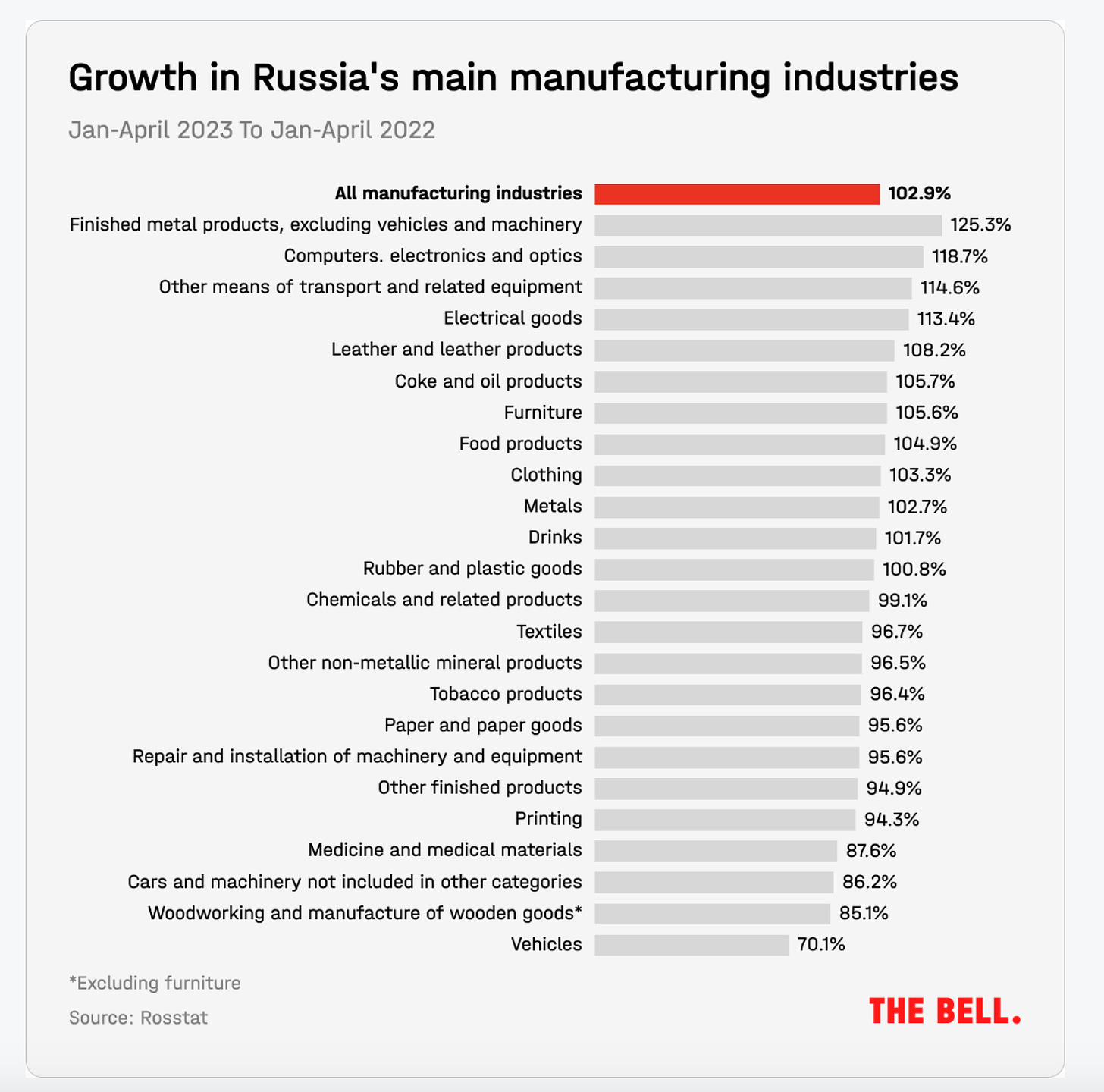

The effect is visible in strong growth in industrial sector favored in the war economy.

The construction sector is benefiting from demand generated by discounted mortgages: currently, 51% of loans come with state support.

***

Nor is this merely short-term. As Alexandra Prokopenko remarks in her analyis for The Bell:

The war in Ukraine is woven into the fabric of public life in Russia. Russia’s war in Ukraine is already in its 17th month. In that time, President Vladimir Putin has clearly demonstrated that he is not bothered by losses — whether they be financial, material, or human. His war will go on as long as he needs. And, judging by how the authorities have woven the so-called “special military operation” into Russian life, that will be a long time. The government has cash reserves and policy options (such as tax hikes) that mean the current level of military expenditure can be maintained. Putin has not unveiled a coherent plan for “eternal war,” but the Russian parliament has recently passed many laws that institutionalize the war; making it ever-present in day-to-day life.

Putin’s regime, the Russian economy and Russian society seem to be adjusting to a long-war basis, a permanent state of elevated, nationally orientated war-driven demand. Of course, this isn’t anyone’s idea of an ideal growth-regime. But then Russia was not in an ideal growth regime before the war either. And, with Russia’s strong balance of trade and considerable untapped fiscal resources, it is certainly sustainable.

Think tanks like the Higher School for Economics Institute for Social Policy are compiling scenarios for Russian society’s future development under the impact of the war. Their planning cooly estimates the probability of rising unemployment and losses of real income depending on how far sanctions are tightened. None of their scenarios predicts a collapse, though, in the worst case, poverty rates would rise and the middle class might shrink back to 1990s levels. Whatever weight one attaches to such studies, they show a. that intellectual life goes on and b. Russians are thinking through their long-term future.

The mood is one of contemplating scenarios and likely policy responses, not panic or emergency. Were the pressures on the Russian economy becoming visible in the summer of 2023 to further intensify, then as Tony Barber spells out in an excellent op-ed, Moscow has options:

Kremlin policymakers still have measures available to sustain the militarised economy. It would be possible, for example, to increase withdrawals from Russia’s National Welfare Fund, a kind of rainy-day reserve of liquid assets, including gold and Chinese renminbi. The authorities could also expand domestic bond issuance. Other options, which might address the problems of capital flight and a falling rouble, include the imposition of capital controls and a requirement for exporters to convert foreign exchange earnings into Russian currency. Last but not least, the government could increase taxes, or cut non-military state spending, or do both. The last two measures appear unattractive to the Kremlin, which has tried to maintain the illusion for citizens that life can go on more or less as usual despite the war. … In economic terms, however, the Kremlin wants to minimise or avoid steps that risk squeezing living standards and alienating the public ahead of next year’s presidential election. Although this will be a strictly organised political ritual rather than a genuine contest, the authorities still want to deliver an overwhelming victory for Putin. The higher the turnout, the more tightly ordinary Russians are locked in the regime’s embrace — so at least goes official thinking.

***

This increasingly long-term perspective in Moscow should be profoundly ominous for Russia’s opponents because it means that Moscow is now aiming to turn the war into the kind of war that least favors Ukraine – a long attritional struggle.

Moscow’s own timeline probably extends at least as far as January 2025. As Barber puts it:

Time is the all-important factor for the Kremlin. Its apparent calculation is that the Russian economy needs to hold out until the tides of political opinion turn in western countries, above all the US. Next year’s American elections are less than 15 months away, and Moscow is surely hoping they will produce a president and Congress less enthusiastic about paying for Ukraine’s war of self-defence. Remove or reduce US and allied military and budgetary support for Ukraine, and the prospects for its resistance to Russia’s aggression would indeed look bleak.

In war, the question of economics is always relative. However difficult Moscow’s position may be, that of Ukraine is far worse. As Barber concludes:

For Ukrainians, the present war is … a struggle for survival, as an independent state and as a nation with its separate, non-Russian identity. For Russians, the war is not remotely about national survival. One day it may be about the survival of Putin’s regime — but, judged from a purely economic point of view, that day is still some way off.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters click below. As a token of appreciation you will receive the full Top Links emails several times per week.