We are talking about the dollar again.

Debate is stimulated by the fact that the dominance of the dollar is out of of kilter with the increasing multipolarity of the world economy. We are in a period of high geopolitical tension and the US has chosen to weaponize America’s grip on the global financial system in a dramatic fashion.

Naturally, the structural imbalance and the use of financial sanctions triggers other players in the global system to seek ways to extricate themselves from the dollar system.

As Daniel McDowell shows in his important new book, Bucking the Buck, Russia had gone a long way to dedollarizing its financial balance sheet even before the current confrontation with the United States began.

Today Moscow is hatching deals with China to sidestep the American currency.

The Bangladeshi Finance Ministry has announced that it will be paying $318 million to a Russian nuclear power developer in Chinese yuan. As Bangladeshi sources told the Washington Post, “although the decision was made, the transaction is yet to be completed because payment details still need to be resolved. He declined to comment further, citing the diplomatic sensitivity of the issue.” As McDowell has noted on twitter, the Post reports that the deal will rely on the CIPS payments system. CIPS remains heavily reliant on SWIFT for messaging. Given SWIFT sanctions were cited (see above) as an impediment to using USD, this implies that some other messaging system is being used. Seems notable.

Crisis-ridden Argentina has negotiated the right to pay China in yuan for its imports.

Brazil’s new government has loudly proclaimed its desire to uncouple its trade with China from the dollar.

The Saudis and the Chinese are talking about invoicing oil in something other than dollars.

Data show a larger share of Chinese trade has recently been conducted in yuan. And the share of global reserves held as dollars is declining. There is talk of a “stealth dedollarization”.

***

Under the heading of “fin-fi” I’ve written in previous newsletters about the lure of the dedollarization narrative. As the counterpart to the increasingly multipolar world economy it seems only logical that the dominance of America’s national currency should diminish.

What is convincing about this vision is the fact that currency systems are woven deep into the fabric of the economy and the currency system in turn conditions patterns of trade and investment. A changing world economy would seem, necessarily, to need a new currency system to match. But what form will that take? Will it consist in the supercession of dominance dollar by the dominance of some other currency?

We should not look to history as a guide because we have little real experience to guide us. In the modern era there have been only two currency systems – sterling and dollar. The sterling system was ended by two massive world wars. The US-dollar system is, in many respects, quite different from the sterling-gold-City of London system that preceded it – stuff for a future post. Furthermore, since 1945 the dollar system, like the sterling system before it, has itself undergone several dramatic shifts – Bretton Woods, “free” float, the regime of global swap lines. To think of the “dollar system” as a rigid structure with clear limits, rules and boundaries set in Wall Street or Washington DC is misleading. It is far better thought of as a hierarchical and unequal but also open-ended network or assemblage which develops under the impulse of profit, capital accumulation and institutional initiatives from many different sources. Further evolution and modification, more often than not driven by crisis and crisis-fighting, is surely the most likely prospect. And that is what the data actually suggest is happening.

***

There is a decline in the share of reserves held as dollars. The absolute amount of this decline is sensitive to how we calculate the numbers, particularly the year we pick on which to base the value of the dollar. But the trend in the dollar share is down. What this means, however, depends on how we see the function of reserves in the system.

Since the emerging market financial crises of the 1990s, one of the most important modifications of the dollar system has been the accumulation of gigantic reserves by current account surplus countries. This provides a degree of insurance for states that fear that they might be hit by sudden stops and financial crises. It is a new regime that has seen the EM through both the 2008 and 2020 shock.

In the first phase of accumulation, most of those reserves were invested in US Treasuries. Why? Because those are the most liquid assets and thus most valuable in a crisis. But as reserves have built up, there have been imbalances in the demand and supply of dollar-denominated safe assets. And reserve managers have taken on new roles. As the funds they have to manage have ballooned and the memory of acute crises fades into the past, reserve managers have increasingly come to see themselves as portfolio-managers.

The job of portfolio managers is not to guard the national piggybank but to optimize the balance of risk and return. This entails diversification away from overcrowded US-dollar markets. And where do you put hundreds of billions of dollars worth of reserves, if not into dollars? The obvious pick are assets in other widely-traded advanced economy currencies. This is the trend observed by Serkan Arslanalp ; Barry J. Eichengreen ; Chima Simpson-Bell who track a rise in reserves held in “nontraditional currencies”.

Assets issued in those currencies offer, on occasion, a balance of risk and return that is marginally better than that of US dollars. But can this really be described as dedollarization? Surely not. The financial systems of all the countries on this list other than China – countries accounting for 75 percent of the total – are firmly anchored within the dollar system, a status indicated by the fact that their central banks are within the privileged circle of those to which the Fed extends dollar swap lines. So far, moves beyond the dollar system defined in these broader terms are of no great significance.

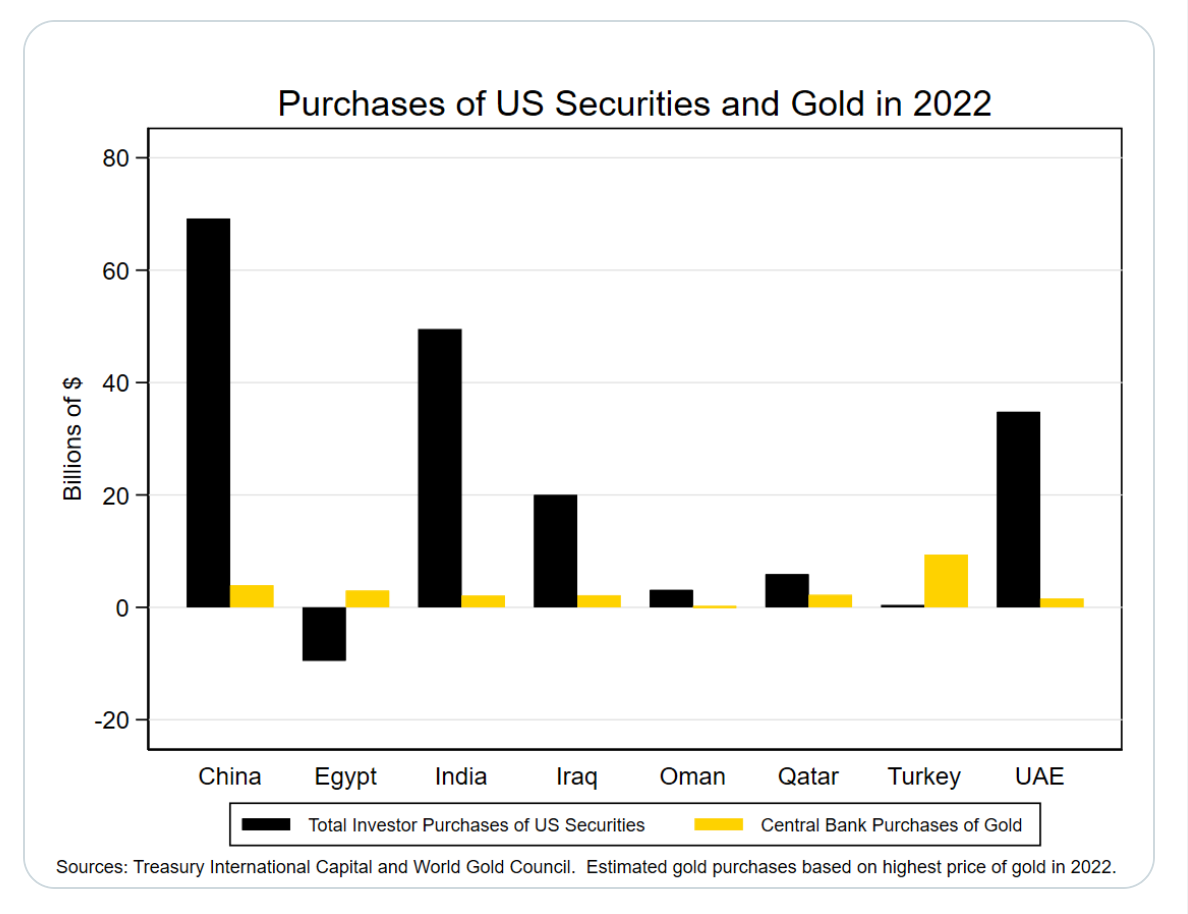

In a piece published in the FT earlier this year, Zoltan Poszar makes much of the fact that some central banks are buying gold. McDowell provides an excellent discussion of the role that gold has played in the dedollarization strategies of Russia and Turkey. But as far as the large central banks are concerned, gold purchases in 2022 were tiny compared to the ongoing accumulation of dollar assets.

Source: Colin Weiss, Twitter

As Colin Weiss points out, 3 of the largest sellers of FX reserves in 2022 were countries that participated in sanctions against Russia: Japan, Switzerland, South Korea. Amongst other sellers were an array of countries that had to sell dollars to resist the sharp depreciations against the US currency in 2022.

As far as trade is concerned there has been an increase in the share of China’s trade invoiced in yuan. But as Gerard DiPippo and Andrea Leonard Palazzi point out in a very useful CSIS post, this not a secular trend. Rather it is a partial return to levels of yuan-invoicing, which before 2015 were much higher.

Nor is it surprising that China’s trade should be in large part invoiced in its own currency. There is after all ample global demand for Chinese currency with which to buy Chinese goods. Europe conducts a far larger share of its trade in its own currency than does China and that does not constitute a threat to the dollar system.

Why should we be surprised if the Sino-centric Asia-Pacific economy increasingly invoices in yuan?

But that would look quite different from the bilateral deals we have seen in recent months. The deals done since 2022 have been motivated not by commercial but by explicitly political motives, largely centered on Russia’s ostracized position. They have been in large part bilateral agreements. They do not, therefore, suggest the emergence of an alternative yuan-based network of international finance and trade. The Russo-Bangladeshi agreement to transact in yuan is significant in this respect. But it is small scale and transparently politically motivated.

Shifting the trade in oil from dollars to yuan would be a more substantial shift. But it echoes half a century of similar suggestions none of which have so far produced a significant shift. And if the Chinese and Saudis actually followed through it would expose what is the underlying question which is, where the Gulf states would invest their petroyuan. Will the Saudis be willing to invest petroyuan in Chinese government debt in the face of capital account controls?

Were that to happen at scale, it would suggest. not just a modification but a retrenchment of the dollar’s. But, as Javier Blas points out on Bloomberg, the rise of the petroyuan is anyting but inevitable. Apart from anything else, the oil exporters must be concerned about how to contain demands from other countries. How would they react to demands for a petrorupee. Working within the existing status quo, however lopsided it may be, avoids having to pose the question of power and profit anew.

As Blas points out:

Ironically, the only new petrocurrency to emerge of late has been the dirham of the United Arab Emirates. India is using it to settle some oil transactions with Russia, bypassing US sanctions. But for the past 25 years, the dirham has been pegged to the US dollar — another indication that the petrodollar remains the only petrocurrency that really matters.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters click below. As a token of appreciation you wil receive the full Top Links emails several times per week.