This Valentines day, Americans gifted each other in the order of 58 million pounds of chocolate, much of it wrapped in 36 million heart-shaped boxes. It was a particularly busy period for the global chocolate industry, which in 2020 processed c. 5 million tons of cocoa beans into chocolate confectionary, generating around 130 billion dollars in revenue. The cocoa-chocolate business is an agro-industrial complex that has emerged from millennia of human ingenuity and entrepreneurship mixed with commerce, political power and violence. At the front end are well known chocolate brands, the likes of Cadbury, Mars, Lindt and so on. Behind them are the grinder-traders, giant agro-industrial trading corporations like Cargill. There would be no chocolate, however, without the cocoa beans and they are grown overwhelmingly on small peasant plantations, most no larger than 3 hectares, yielding 300-400 kg in beans per hectare and worked by c. 6 million farming families. Together with their families, perhaps 50 million people are directly involved in cocoa cultivation and processing, including many youths and children. A rough calculation suggests that the cocoa-farming dependent population worldwide outnumbers the entire farming population of the United States and Europe. At 14 million the main workforce on the cocoa farms significantly outnumbers the 9 million workers engaged in motor vehicle production worldwide.

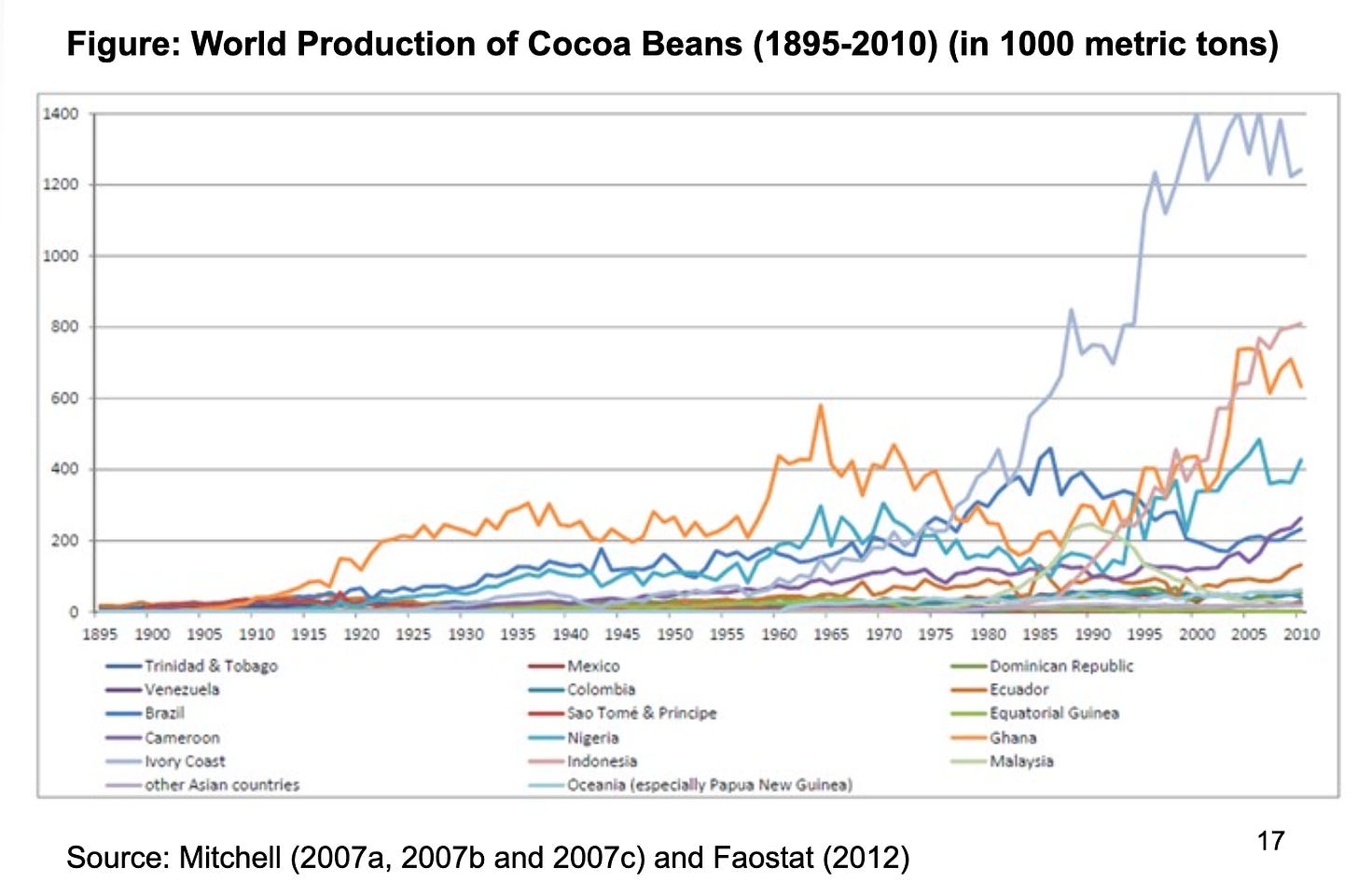

Recently, Indonesia has emerged as a major grower. Both Central and South America, the original home of the cocoa bean, still contribute to global supplies. But 70 percent of the world’s cocoa beans come from West Africa and 60 percent from the farms of just two states, Ghana and Cote d’Ivoire (CdI). In a year of good harvests, CdI with a yield of well over 2 million tons of beans, can account for 40 percent of the global production. De facto the global pyramid of chocolate confectionary balances on the peasant producers of Ghana and CdI who have been the drivers of a production revolution of huge scale.

***

What first catches the eye about this supply chain are the spectacular hierarchies of power. For journalistic purposes and in NGO campaigns, these hierarchies are commonly dramatized in two clichés. The first is the contrast between the tiny peasant producer and the agro-industrial multinationals. The second is that between Western consumers of chocolate and child labourers in the cocoa plantations.

One piece of recent research by Staritz, Tröstere, Grumiller and Maile maps the global supply chain as follows:

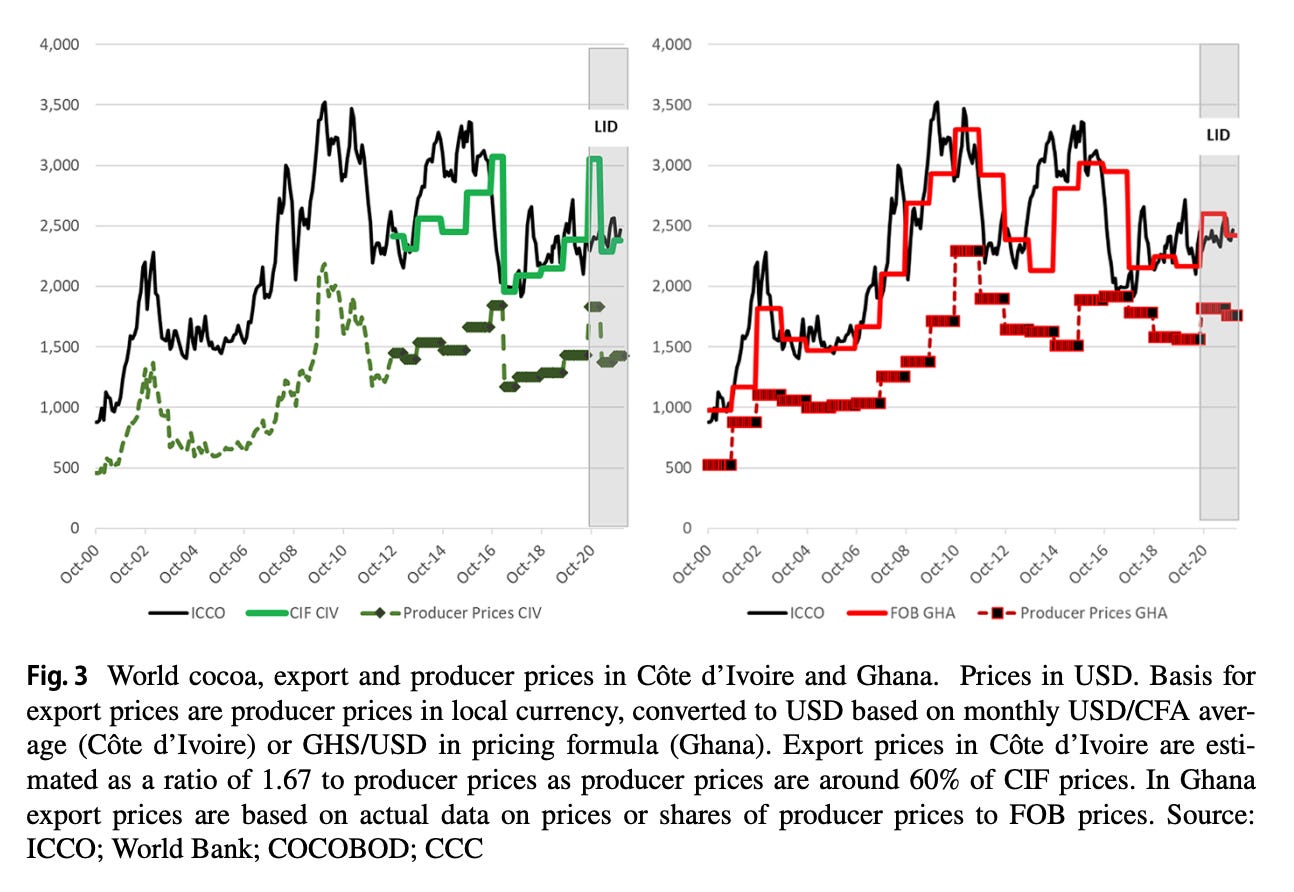

Along the top row you have the futures price for cocoa as determined by the interplay between financial investors, chocolate manufacturers and grinder-traders on markets in New York and London. The futures price determines the price at which cocoa beans are exported by the parastatal marketing boards of CDI and Ghana. They seek to maximize revenue in a market where they are subject to quality controls, and the constraints of limited financing and volatile exchange rates. CdI’s Conseil du Café-Cacoa and Ghana’s Cocoa Marketing Company oversee the buying or directly manage the purchase of beans from local intermediaries who deal directly with the cocoa farmers. The farm-gate price of the beans is set as a fraction of the export price under the supervision of bodies like the Producer Price Review Committee.

The net result of this price-setting mechanism, is that of the final value of the chocolate bar sold to consumers, the peasant producers garner around 5-6 percent. In recent years, unsurprisingly, given this gross imbalance cocoa farmers have struggled to make ends meet. It was recently estimated that more than half of Ivorian cocoa farmers and their families subsist on less than $1.20 a day. It is a set of relations that gives supply-chain, a rather different connotation.

Nevertheless, even in the face of falling incomes, farmers continue to cultivate their plantations. Maintaining the family comes first. Their land is valuable, but the prospect of selling up and moving to the overcrowded cities or trying other, no-less precarious lines of work, is daunting. So they hang on, in the hope of better times to come. And in the mean time everyone in the family must chip in.

Assessing the scale of child labour on cocoa plantations is a difficult business. But perhaps as many as 1.5 million children and young people are involved in one way or another in cocoa farming. A small minority, the most unfortunate, are trafficked and work in conditions akin to indentured labour. A larger group of children end up as casual migrant laborers on cocoa farms. But aside from these two groups, the overwhelmingly majority of children working in the cocoa plantations are family members helping their parents to sustain marginal family farms.

With regard to household labour, modern-day cocoa farming is typical of peasant farming in general and of household economies across the poor world. In the unregulated and unlicensed informal sector – the main form of employment in much of the developing world – the line between work and household economies is fluid and school attendance for children is haphazard. What is unusual about the case of cocoa is that such informal household economies are directly harnessed to global supply chains that deliver every day items of indulgence to consumers in the rich world. Furthermore, rather than peasant production of cocoa being a shrinking or residual system beating a retreat from the historic stage, the last century and a half has seen a huge surge in the scale of production without which the global growth in chocolate consumption would have been impossible.

***

Cocoa is not native to Africa. The beans were introduced from latin America in the course of the 19th century by European colonialists. But the widespread adoption and cultivation was from the outset the work of African peasants, notably on what the British then called the Gold Coast. Since cocoa, whether in the form of a beverage or chocolate, has never been a part of the West African diet, cocoa bean cultivation is a commercial, market-orientated operation. The beans are grown for one reason and for one reason only: to sell them for cash. And the entrepreneurialism of West Africa’s farmers has been astonishing. As Gareth Austin writes in the Economic History Review

Ghana exported no cocoa beans in 1892, yet 19 years later, at 40,000 tonnes year, it became the world’s largest exporter of the commodity. Output reached 200,000 in 1923, and passed 300,000 in 1936.

By 1950 Ghana entirely dominated the world market, having increased the global supply tenfold. As Órla Ryan records in her excellent book Chocolate Nations:

one British colonial official described the Ghanaian cocoa boom as ‘spontaneous and irresistible, almost unregulated’. In a government report in 1938, he wrote: We found in the Gold Coast an agricultural industry that perhaps has no parallel in the world. Within about forty years, cocoa farming has developed from nothing until it now … provides two fifths of the world’s requirements. Yet the industry began and remains in the hands of small, independent native farmers.

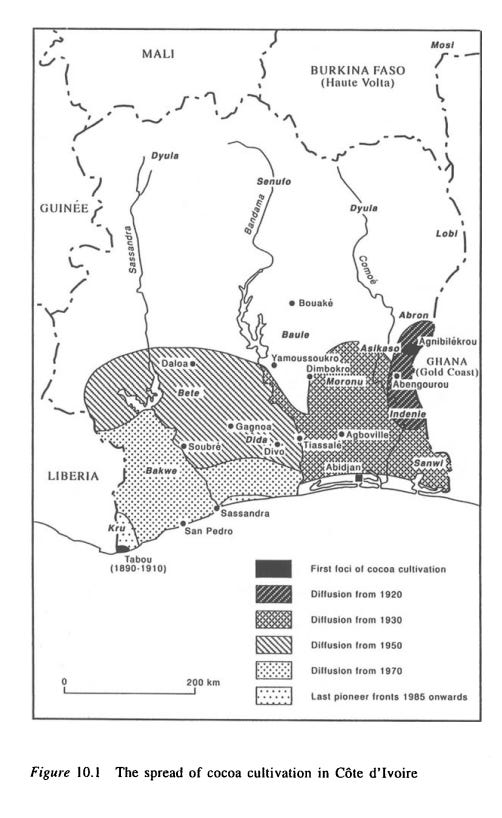

Following Ghana, the explosion of production in Cote d’Ivoire was even more dramatic. After being held back in the colonial period by French policy, in the sixty years since independence in 1960, CdI has unleashed a spectacular boom. Today, the peasants of CdI deliver at least forty times more cocoa beans to the global market than were harvested worldwide in 1900.

As impressive as it is, the African revolution in cocoa cultivation has ambiguous implications for the growers themselves. The production surge is crucial to understanding the power imbalances between corporations and peasants, consumers and child laborers. The situation is as unbalanced as it is, because the relentless peasant entrepreneurialism of Africa’s small producers, combined with the push of population growth and the availability of land, has made the supply curve highly elastic. Even with a voracious global appetite for chocolate, given the speed with which production has been been expanded, the trend in cocoa bean prices has generally been against the producers.

Source: Gilbert, 2016.

If this were a story of falling prices driven by productivity increases, in other words a story of intensive growth, it would be grounds for celebration. Everyone would be a winner. The fundamental problem is that cocoa farming in Africa over the last 130 years has been a dramatic example of extensive not intensive growth. It has been highly dynamic in terms of output but achieves that dynamism through mobilizing more resources, typically of labour or land.

Across West Africa, the moving frontier of cocoa cultivation was a land grab akin to those which drove agrarian growth across South America, or, for instance, in Manchuria in East Asia. In this case the settlers were African peasants and the land they was incorporated into production were the West African forests. The great French historian and analyst of cocoa François Ruf speaks of the “forest rent” harvested by the cocoa farmers. Ruf sees the history of cocoa as driven by a series of “pioneer fronts” that have extended around the world from South America to Indonesia and West Africa. As William Gervase Clarence-Smith and Ruf explain in their introduction to the edited collection Cocoa Pioneer Fronts:

A forest rent exists because it is rarely economically viable to replace decrepit cocoa trees by new ones in the same land, or to plant cocoa in land used previously for other crops, as long as forest is available. Planters clearing poorly regenerated secondary forest and former coffee groves to grow cocoa in eastern Madagascar found that they could not compete on the world market (Chapter 11 ). Producers clearing primary forest, in contrast, benefited from the fertility of virgin soils and low concentrations of weeds, pests and diseases. There have been a few examples of permanent cocoa cultivation in the same land, but they have usually depended on excessively expensive inputs of labour and capital. It is also possible to leave land fallow for very long periods before replanting cocoa, but forest regenerates slowly and incompletely, and it is normally more economical to use the land for other crops. Permanent techniques of cocoa cultivation are therefore likely to remain marginal until there is no more primary forest available in the world, either because it has all been cut down, or because it has at last been effectively protected (Ruf, 1991, 1995).

Apart from land, labour is of course vital to cocoa production. In the 19th century in Brazil and in Portugues São Tomé, slave labour was employed. As recently as 1900 São Tomé was still the largest producer. But in the 20th century forced labour and even large-scale plantations have failed to compete up with the energetic expansion of small-scale, family based peasant cultivation.

If the cocoa story is one of land-grabbing, this inevitably raises the question of competition for resources and the question of politics. Within Ghana, the main producer of the early 20th century, conflict was relatively successfully contained by a strong system of property rights. In CdI production was expanded in a helter-skelter fashion through mass in-migration to the cocoa territories. Not for nothing CdI, which saw the most dramatic surge in cocoa production in the late 20th century, would, in the early 21st century, become the arena for violent struggles over citizenship rights and control of land.

This brings us to the question of the post-colonial state. Alongside fundamental material factors such as the availability of land and the mobilization of labour, alongside the global balance of demand and supply, the chocolate industry has been shaped in fundamental ways by the political economy of African states. The cocoa supply-chain as we know it today encodes the history of policy choices by post-colonial regimes in Ghana and Cote d’Ivoire, a history in which fundamental questions about economic sovereignty and freedom were posed and answered largely in the negative.

***

Ghana was not just the premier cocoa producer of the world between 1900 and 1965. Not coincidentally, in 1957 it was also the first African state to gain independence. In Kwame Nkrumah it had the most charismatic leader of the early independence moment. Nkrumah insisted that Africa needed to achieve not just formal independence but also a qualitative leap in economic development. For Nkrumah this meant infrastructure and industrial development. Most spectacularly the newly independent Ghana would invest in hydropower and aluminium smelting, a project realized in the form of Volta Aluminium, a highly unequal partnership with America’s Kaiser corporation.

In Nkrumah’s vision, the springboard for Ghana’s leap towards industrial modernity would be the West’s addiction to cheap chocolate bars and Ghana’s cocoa beans. Nkrumah and his advisors resolved that it would be taxes on the cocoa farmers that would provide Ghana with the funds it needed to drive investment. It was a classic vision of development as first explicitly theorized in the Soviet Union in the 1920s. If Ghana’s first development plan after independence was drafted by Western-orientated economists, the second, finalized in 1962, relied heavily on Eastern European expertise. Not that Accra envisioned a collectivization of the Ghanian peasantry, or even villagization, as was later to happen in Tanzania. Instead, the newly independent Ghana focused on raising taxes on the cocoa-growing peasantry to feed industrialization.

As Órla Ryan reports in her book Chocolate Nations, according to the Ghanian Cocoa Marketing Board

In 1956/57, the average sale price of cocoa was £189 per tonne; the government took £40, leaving the farmer with £149. By 1964/65, the average sale price was £171; the government took £59, leaving the farmer with £112.

These high tax rates were a heavy burden on peasant cocoa production and they were bearable only so long as world-market prices remained high. In 1965 despite vain efforts to Accra to resist the trend, world market prices collapsed. The wheels were coming off Nkrumah’s development vision. In February 1966 whilst he was in Beijing, on one of his many foreign trips, Nkrumah was ousted by a coup.

Nkruhma’s fall from power was extremely popular at the time, but it ushered in a period of both political and economic uncertainty for Ghana. Though global cocoa prices recovered and then surged in the early 1970s, Ghana failed to take advantage because of domestic political chaos and punitive tax rates on cocoa exporters. In Ghana the implicit taxation on cocoa farmers increased from 20 per cent in 1960 to more than 80 per cent around 1980. Even more ruinous was the absurdly overvalued exchange rate which robbed Ghana’s farmers of any incentive to export their cocoa beans. The cocoa harvest collapsed by two thirds. Ghana was overwhelmed by foreign debts and reduced to trading cocoa beans for East German chemicals and Cuban sugar. In 1983 GDP per capita was 25 percent below its level at independence. Government revenue as a share of GDP, a basic measure of state-capacity, shrank from 17.3 percent in 1972 to 6.1 percent a decade later. The share of industry in Ghana’s employment fell from 14 to 12 percent. The effort to build a development strategy on cocoa had comprehensively failed.

Nkrumah and his supporters will to this day attribute the failure to the force of neo-colonial structures in the world economy. A more subtle critique from the left points to the malign and self-serving influence of bureaucratic elites within the post-colonial state that Nkrumah created to bring his vision of industrialization into effect. But as Cambridge economic historian Gareth Austin has pointed out (in a seminar at Edinburgh in 2018), we also need to avoid anachronistic retrospect. A strategy of labour-intensive industrialization may appear very attractive in the 21st century. Today Ghana like the rest of West Africa is struggling to cope with a population explosion. It desperately needs jobs. It seems implausible that the tertiary sector (services) alone can fill the gap. This confers on Nkrumah in retrospect the appearance of a prophet. But it is more than questionable whether Nkrumah’s proposed strategy made sense for Ghana in the 1950s.

The defining feature of Ghana’s economy in the 1950s, like that of the rest of Africa, was labour scarcity and land abundance. Hardly the ideal conditions to develop comparative advantage in low-wage manufacturing. It would likely have made more sense to focus development on basic infrastructure, health and education rather than attempting to leap to the “next stage” of industrialization. Nor is this an anachronistic retrospect. The analyst who argued against forced-pace industrialization at the time was none other than Nobel-prize winning Caribbean development economist Arthur Lewis, first in his report on the Ghanian economy in 1954 and then as economic advisor to Nkrumah between 1957 and 1958. After barely more than a year Lewis would resign from his post, accusing Nkrumah not only of padding his investment projects with political white elephants but also of authoritarian tendencies that Lewis in private declared to be “fascist”.

***

The alternative to milking the cocoa farmers to pay for industrialization was to base economic growth on their entrepreneurial energies. This meant perpetuating the existing division of labour and seeking to grow out of it by taking maximum advantage of the opportunities on offer. This was the approach adopted by Cote d’Ivoire after independence in 1960.

It is true that growth in CdI was, in a sense, waiting to happen. Under the French, peasant-based cocoa production had been stifled by colonial forced labour regimes and the French preference for cotton and rice production. The forest rent in CdI’s sparsely populated Southern and Western regions was waiting to be harvested. But, the pace at which farmers in CdI took advantage of these structural conditions was accelerated by policy and a general approach of laissez-faire.

After independence, CdI’s leader Felix Houphouet-Boigny, himself a prosperous farmer, adopted a policy that rejected both the colonial past and Nkrumah’s policy of industrialization in neighboring Ghana. As Órla Ryan explains in her excellent book Chocolate Nations, Houphouet-Boigny’s slogan was ‘the land belongs. to those who make it bear”. He liked to refer to himself as the nation’s “First Peasant”. CdI’s encouraged a free for all of migration to the cocoa and coffee-growing areas. Many of the migrants were from the Baoule, Houphouet-Boigny’s own ethnic group. Other cocoa pioneers came from the North of the CdI, and hundreds of thousands more came from Burkina Faso and Mali. The result was the second African cocoa revolution.

The result was spectacular economic growth. With enthusiastic backing from Paris, CdI was the anchor of the francophone African region. By 1986 CdI’s GDP per capita was rated at twice the African average. The result was a spectacular in-migration of people from around the French-speaking world. In the late 1980s, 190,000 Lebanese resided in CdI – mainly Shiite Lebanese fleeing the civil war. After independence, the population of French residents in CdI actually increased to over 40,000. In the late 1980s the ex pat constituency was so numerous and affluent that French politicians took to campaigning in Abidjan both for votes and financial backing.

On CdI’s cocoa frontier, the reshuffling of population was even more intense. In the South-west of Cote d’lvoire by the late 1980s, the native Kru and Bakwe were outnumbered to such an extent that they accounted for just 7.5 per cent of a population that had swollen by a factor of ten in a matter of a few decades. Baule migrants made up 35.7 per cent of the population. Burkinabe from neighboring Burkina Faso accounted for 34.4 per cent of the population. They were granted the right to vote and formed a captive electorate for the President.

The cocoa gold rush in CdI went well so long as the pro-migration political regime remained in place, cocoa prices stayed high and there was enough good land and other opportunities to go around. On the cocoa frontier, any conflicts were mitigated by the fact that locals could make a handsome return by selling their land to new-incomers giving them the means to start a new life in the booming towns and cities.

The Ivorian model was tested in the 1980s by a sharp fall in cocoa prices. Houphouet-Boigny’s regime responded by borrowing billions from foreign lenders and doubling down, diversifying into a variety of other agricultural sectors, including rubber. Then, in the late 1980s, the CdI’s African economic miracle came apart. As Jean-Pierre Chauveau and Eric Léonard describe the shock in the contribution to the Cocoa Pioneer Fronts:

Between 1988 and 1992, the effective farm gate price of cocoa fell to nearly a third of former levels. In 1988, and again in 1993, cocoa growers were not even able to sell their crop. All in all, farmers faced a reduction of 60 to 80 per cent in their monetary income

In an effort to resist falling prices, CdI boycotted global buyers, but that effort failed. In 1989, taking the advice of the IMF and the World Bank, Abidjan cut by half the payments to coffee and cocoa farmers. With the urban economy in free fall as well, the drift of the Ivorian population was back to the land. As one interviewee told, Órla Ryan, ‘Suddenly cocoa prices drop through the floor and the economy is not growing. Everyone wants to go back to the land. The problem is who owns it.’ Into this fraught situation, CdI embarked on its first openly contested democratic election. Capitalizing on the growing struggle for land, Laurent Gbagbo challenged Houphouet-Boigny accusing him of favoring foreign newcomers. Houphouet-Boigny won the election decisively, but the genie of xenophobia and ethnic sectarianism was well and truly out of the bottle.

Inter-communal pressure was compounded by ongoing economic crisis. In the course of the 1990s the more highly productive Baule plantations were increasingly displaced on the cocoa frontier by Burkinabe farms who relied on a subsistence model of family economy to weather the economics crisis. Whilst output plateaued, Cote D’ivoire, once the acme of stability in Francophone Africa, and the anchor for the region descended into inter-ethnic and regional strife. Twice, between 2002 and 2007 and then again in 2011 CdI was racked by civil war. Cocoa harvesting continued. No one could afford to see the harvest fail. But the period of CdI’s economic miracle was over.

***

After the bankruptcy of both the Ghanian industrialization model and CdI’s free-wheeling agrarian model of development, both were in search of new models of development. And in the 1990s it was Ghana that showed the way forward.

From the 1980s onwards under the more pro-peasant regime of Jerry Rawlings, production and investment recovered. Production was a fraction of Cote d’Ivoires but it tripled by the early 2000s to 600,000 for the first time surpassing the records set in in 1965. Crucially, Ghana resisted World Bank and IMF pressure to fully liberalize its price-setting system. The Cocoa Board shed the vast majority of its bloated staff but it continued to offer Ghanian farmers a fixed price for every harvest based on a fraction of what the Board was able to obtain in selling the cocoa beans for export. The fraction left with the farmers was far more generous than had been the case by the low point of the 1980s and since 1992 Ghana’s increasingly vibrant multi-party democracy ensured that it has stayed that way. No elected politician could afford to ignore the cocoa-farming interest.

CdI by contrast was by the late 1990s in such dire straits that it could not resist the IMF and World Bank’s pressure for full liberalization. By the early 2000s, Ivorian peasant producers would receive not a guaranteed price but whatever they could negotiate with commercial buyers. What would emerge from that haggling would depend on market conditions and the specific circumstances of buyer and seller. But what the peasants would no longer have to deal with was the bureaucracy of the indebted and rapacious state. The state for its part would be made able to function without exorbitant cocoa tax revenue by being put through a process of debt relief.

This at least was the theory. It did not work like that in practice. Instead, the stabilization board was abolished but Ivorian politicians set up five separate institutions, notionally to support the farming population, but each separately imposing levies that on net left the cocoa farmers with nor more than 35 and 40 percent of the export proceeds.

The model could survive in the 2000s because the trend in prices was positive and global demand was surging. New markets for chocolate were opening up in the emerging markets and particularly in Eastern Europe. But following the swithback of 2008-9, cocoa interests in the CdI had had enough of the liberalized model. In 2011, following the end of the second round of civil war, and a major scandal involving corrupt cocoa administrators, CdI reverted to a system of price fixing with the Conseil du Café-Cacoa setting an annual price that was revised during the course of the harvest. The CCC operates a scale called the “barème”, which defines prices and margins for farmers, traders and exporters on the basis of prices paid for export permits. The policy goal is to ensure that the minimum producer price for farmers is 60% and not below 50 percent of the world CIF reference price for Ivorian cocoa beans.

Since the early 2000s for all the institutional differences, there has been a strong convergence between both the model of pricing and the results earned by farmers in the Ghanian and Ivorian systems.

Meanwhile, in recent decades Ghana and CdI face ever more concentrated power on the side of the exporting firms. As Staritz et al report:

In Ghana, the number of cocoa bean trading partners decreased from about 100 in 2000 to 11 in 2013 (van Huellen 2015). In Côte d’Ivoire, grinder-traders own the top five exporters—Cargill, SUCDEN, Touton, Olam and Barry Callebaut—and bought 80% of the export contracts during the 2018–2019 season (Aboa 2019), which is the same share that the top 10 bought in 2010–2011 (Araujo Bonjean and Brun 2016). Grinder-traders not only have dominant positions as buyers, but they also are involved in internal marketing, particularly in Côte d’Ivoire, where they also act as exporters in external marketing.

The global cocoa industry has thus reached a new concentrated organizational form, with the cocoa controls agencies of Ghana and CdI, facing off with a compact group of exporters. It is a highly unstable balance. Following the sudden slump in world prices in 2016-7, CdI and Ghana entered into high-level talks and in March 2018 signed the Abidjan Declaration. They agreed to adopt a common strategy to drive up producer prices. In June 2019 they set a common floor price for the 2020-21 season of 2,600 per ton of which farmers were to receive 70%, or USD 1,820 per ton. In the face of buyer resistance the CdI and Ghana backed down to agree instead that prices would be set as normal, but buyers would pay a premium of $400 per ton to support farm incomes and in the event that this did not yield at least $1820 per ton for the farmer, the price setting agencies in CdI and Ghana would cover the gap. In effect they declared a minimum price guarantee. It was a substantial risk for the buying agencies and one that was immediately exposed by the COVID crisis. Faced with tumbling world prices, in mid year 2021 the Ivorian CCC slashed the price for CdI farmers to $1350 per ton. Meanwhile the global buyers, having agreed pro forma to the $400 per ton levy in favor of the farmers, have now taken to cutting the country premiums they previously paid to Ghana and CdI.

***

Ghana’s room for maneuver has been narrowed by the financial crisis that has forced it to seek debt restructuring from its creditors. It is possible that by expanding the cocoa cartel to Nigeria and Cameroon the producers can gain more leverage. But there are more fundamental factors that might shift the balance and disrupt the market. One influence may come from the side of demand. If chocolate consumption takes off either in India and China, as the chocolate firms hope, the demand for beans could be gigantic. CdI’s President Ouattara has recently been wooing Chinese investment in the cocoa sector. The impact on the market would be all the more spectacular because the frontier expansion of cocoa growing in West Africa has reached its limit. There is no more forest in Cote D’Ivoire to clear. The forest rent has been exhausted.

The stiffening of the conditions for extensive growth could betoken a shift in favor of the producers, creating the conditions for a strategy of intensification, as recommended, for instance by the World Bank.

The first approach would be to launch a “technological revolution” that would enable producers to increase their yields. Such a revolution is not just a pipe dream, as the techniques, such as shading, grafting, and irrigation, have all already been mastered by the Center for Agricultural Research in Côte d’Ivoire, and their application has already quadrupled yields (from 500 kg to 2,000 kg per hectare) on pilot farms. The challenge now is to scale up the use of such techniques

More worryingly reaching the limits of the forest frontier may signal the beginning of a more comprehensive crisis of the ecological conditions of cocoa farming, which would compound the limits to growth with the effects of increasingly severe cocoa blight and climate change. The crop is planted where it is, because of the sensitivity of the trees to precise climactic conditions. Currently, cocoa can only be grown 10-20 degrees either side of the equator. But those conditions are changing. The predicted two percent change in temperature over coming decades will fundamentally challenge the existing production regime. The cocoa frontier may be closing, but there is no end to chocolate’s turbulent history in sight.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, click here: