It is clear that the Russian economy emerged from the first shock of the war and sanctions in 2022 far better than many expected. The official data show a fall in 2022 of just over 2 percent and a prediction for at least some economic growth in 2023, no worse than that expected for Germany and better than the outlook for Britain.

Gdp contracted by just 2.2% last year, smashing many economists’ expectations, made in the spring, of an annual decline worth 10% or more. Uncomfortable, perhaps, but nowhere near enough to cripple Vladimir Putin’s war effort. Unemployment remains low, even if many people are being paid less. House prices have stopped rising, but there is no sign of a crash. Consumer spending is dragging on the economy, but not by much. In 2023 the imf even predicts that Russia will grow by 0.3%—a superior performance than Britain and Germany, and only marginally worse than the eu.

Putin’s reaction was to crow that the experts were wrong. As the FT reported:

“The real dynamics turned out to be better than many expert forecasts,” said Putin. “Remember, some of our experts here in the country — I’m not even talking about western experts — thought [gross domestic product] would fall by 10, 15, even 20 per cent.”

Some of the more fascinating coverage in the West takes the opposite view. Far from taunting his technocratic advisers, Putin should be thanking them for seeing Russia through the first year of his ruinous war.

It is clear from inside reports that many leading experts warned Putin against his military adventure. Some objected more or less publicly. A few resigned. Others, such as Elvira Nabiullina at the central bank, tried to bow out of public service, but were effectively ordered to stay put. The majority have worked on, whether out of fear, or a sense of duty towards their embattled country.

This narrative makes for a high-stakes moral drama. As one former central-bank official told the Economist

he was both impressed and appalled by his colleagues’ efforts to keep the war machine afloat. “They understood what they were doing, even while they comforted themselves by pretending the people who would replace them would be worse.” One high-level source close to the Kremlin says, “The elite are prisoners. They are clinging on. When you are there for that long, the seat is all you have.”

But as compelling as this is, viewing the issue in terms of morality can distract us from the underlying issues of economic management.

It makes sense to see the professional management of the central bank as key to stabilizing the financial situation in March and thus averting a financial crisis or a spectacular ruble crisis. On this score the essay by Oleg Itskhoki offers an excellent summary. Essentially, the financial system was placed under direct control and then Moscow waited for the shock to wear off and the proceeds of the oil and gas boom to roll in.

It was coolly done and it is reminiscent of the way in which Russia also road out the shock of the 2014 sanctions post Crimea for which Nabiullina was awarded not one but two prizes by her fellow central bankers.

But, as several of us argued back in March 2022, the track record of stability clocked up by Putin’s regime, the overcoming, again and again, of the trauma of 1998, comes at a heavy price in terms of macroeconomic imbalance. Nicholas Birman Trickett has been particularly forceful in arguing that since 2014 Russia has run a regime of ruinous macroeconomic austerity that contributed to trade surpluses that rival those of famously unbalanced economies like Germany and China. In their case huge trade surpluses in manufactured goods are the symptom of imbalance, in the Russian case it is the energy sector that becomes the fulcrum of a completely unbalanced political economy. What was squeezed, as a result, was investment in the development of new sectors of the economy. It is not just structural constraints, bad institutions or insecure property rights that inhibited Russian growth, but lack of aggregate demand, which validates and justifies investment.

To this extent the technocrats personified by Nabliuova are not really a counterweight to Putin’s authoritarian rule. They may be a source of financial stability. They may vainly seek to restrain his more aggressive impulses. But the objective consequence of their policies is to reinforce the constraints that increasingly define the parameters of Putin’s rule. Caught in an austerity straight jacket of their devising, Putin’s regime has backed itself into a socio-economic impasse that encouraged zero-sum rent seeking rather than growth. On this interaction I highly recommend the essay “Empire of Austerity” by Trickett.

For the defenders of the austerity consensus in Moscow, the war is objectionable not just on moral grounds, or grounds of grand strategy. They object because they correctly sense that it puts their entire edifice of financial constraint in question. Most recently, there are reports of tensions between the central bank and the Ministries of Putin’s government. These are only to be expected when a conservative central banker confronts a government that wants to move the society and economy on to a mobilization footing. Russia’s deficits are by no means gigantic by western standards, but they are rising abruptly.

In a war economic situation, different rules do apply. Though the central bank played a key role in containing the financial crisis, if you ask why Russian GDP has been relatively robust, then at least one of the key contributors is clearly the scale of government spending. This is a key prop for aggregate demand and a driver of a veritable boom in the military-industrial complex.

As the Economist reports:

Russia’s 2022 budget was planned at 23.7trn roubles ($335bn). Government figures indicate that actual spending in 2022 reached at least 31trn roubles. According to Natalia Zubarevich, an economist at Moscow State University, only about 2.5trn roubles of the extra spend are accounted for by benefits and other transfers: pensions, cheap loans, additional child allowances. That leaves roughly 5trn roubles unaccounted for; much of it, presumably, going on armaments. There are obvious signs of the economy being mobilised for war. Defence firms are working 24 hours a day, in three shifts. Uralvagonzavod, Russia’s main tank manufacturer, has enlisted at least 300 prisoners to fulfil its new orders. And steel production fell by just 7% in 2022, far less than the 15% some expected given the decimation of the car industry, heavily affected by sanctions that have interrupted the supply of semiconductors.

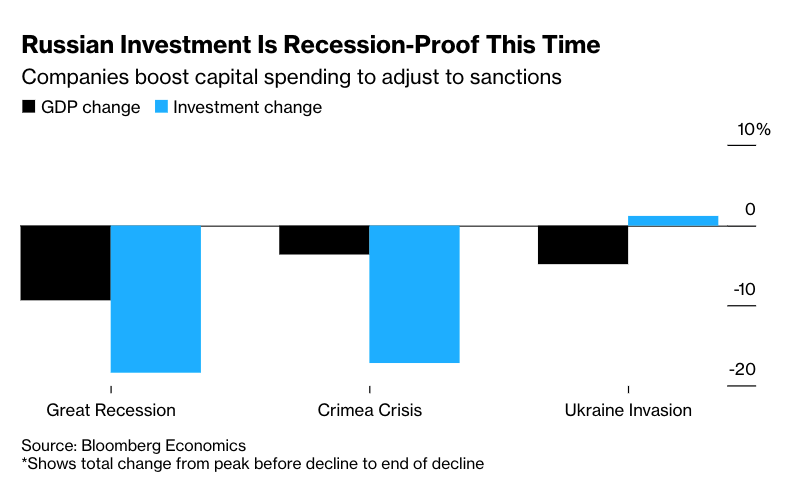

As Bloomberg reports, Russian businesses have responded to the crisis by investing at an unprecedented rate:

Companies big and small spent to replace foreign equipment and software or channeled money into building new supply chains to reach alternative markets. Facing initial forecasts for a decline of up to 20% in capital expenditure, Russia instead saw it increase 6% in 2022, according to Bloomberg Economics.

Beyond the hard core of the military industries, as Volodymyr Ishchenko has argued, Putin’s regime has increasingly resorted to “War Keynesianism”. Large salary payments to soldiers prop up incomes and compensate for higher inflation. They build a constituency loyal to the regime.

There will no doubt be some in Russia who see the wartime moment as a break from the financial corset of austerity and as a strategic opportunity to build a new nation-centered industrial growth strategy, in close partnership with China and possibly India. It is an unlikely prospect, indeed. In fact, as Alexandra Prokopenko argues, the Russian economy faces a decade of regress and mounting dependence on China and its currency.

Much of the investment unleashed by the crisis is make-shift rather than truly productivity enhancing. As Bloomberg reports:

The disappearance of many imports has become one of the forces warping Russia’s wartime economy, driving growth based on less sophisticated technology toward what its central bank termed “reverse industrialization.”

The effects of this investment in import-substitution will take years to make themselves felt. In the meantime, between the short-run of financial crisis, which threatened in the spring of 2022, and the long-run of stagnation that now awaits Russia, there is the middle ground of medium-term macroeconomic management. And this is where the politics will center in the coming year. In this balancing act two things are crucial. First, Russia must manage the bottlenecks imposed by sanctions. This is crucial to avoid sudden stoppages on the supply side. Second, it must ensure that aggregate demand continues to bubble along. In the face of increasingly serious energy sanctions that will be a tougher ask in 2023 than in 2022. But it will not be only a technical problem. It will also be a severe test of the coherence of the economic policy establishment in Moscow.

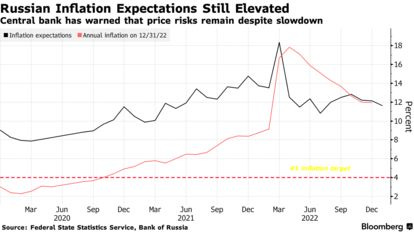

So far the truce between the war economists and the conservative advocates of continuity as personified by Nabiullina has held. It will be interesting to see whether that no doubt tense arrangement can continue into 2023. As in the West it will be fought out over technical questions such as inflation expectations and rate hikes.

Under its most recent outlook last October, the central bank anticipated its benchmark will average 6.5%-8.5% this year, meaning both hikes and cuts are possible. Economists unanimously predict that on Friday the key rate will stay at 7.5% for the third time in a row.

As the Economistsputs it:

However much the Russian economy is forced to cannibalise itself into a more primitive wartime outfit, its governing class understands there is no turning back, at least while Mr Putin is around. It heard the president declare in December that there would be “no limits” to the resources available for the armed forces. That means cuts elsewhere. Health and education spending will be reduced, suggests Ms Zubarevich. Russia’s sovereign-wealth fund, which stands at 10.4trn roubles, or 7.8% of gdp, can be drawn on. “The worse things get, the more necessary war will become,” says one former mandarin.

Will the compromise between the war party and the technocrats be to crush civilian public spending. Or will the budget simply expand? There will be those who ask where the money is to come from?

Russian #budget starts the year with a large #deficit of 1.8 trillion RUB (1.2% of GDP). Highly unusual and points to a larger deficit for the full year (depens on oil price, under current conditions 4-5% of GDP). Liquid assets in the National Welfare Fund amount to 4% of GDP. pic.twitter.com/jPNOJkLp90

— Janis Kluge (@jakluge) February 6, 2023

If Russia is really shifting on to a war footing it is, as far as domestic spending is concerned, an irrelevant question. There is no need to pilfer national welfare funds, other than as a matter of accounting. In a closed financial system, the answer lies with the central bank. But will the central bank play along?

Under the cover of technical argument, huge tensions are tearing at a regime that is caught within a trap of its own making.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, click here: