Source: FT

Few things matter more for the world economy in 2023 than China’s fortunes. Not since the reform period began, have there been more serious question marks over the trajectory of China’s growth.

The 2015-6 near-miss crisis, when the RMB depreciated and capital flooded out of China was a more acute moment of danger. Fear of a repetition still hangs over the current scene. But in 2015-6, the growth engine was not spluttering to the same degree. China did not face the kind of labour market pressures it does today, with youth unemployment rising towards 20 percent and graduates uncertain of their future employment. Nor was China in 2015/6 facing an avalanche in its real estate sector.

As 2023 begins, in its Article IV report on China the IMF rather blandly remarks:

As of November 2022, developers that have already defaulted or are likely to default—with average bond prices below 40 percent of face value— represented 38 percent of the 2020 market share of firms with available bond pricing. Despite these strains, the pace of restructuring has been slow, partially hampered by the potential for very large losses for pre-sale homebuyers due to the large backlog of troubled projects. The sector’s contraction is also leading to strains in local governments. Falling land sale revenues have reduced their fiscal capacity at the same time as local government financing vehicles (LGFVs) have also significantly increased land purchases.

However this is calculated precisely, a 38 percent default rate is bad news!

Everyone has long known that the pre-2021 boom in real estate was unsustainable. As the IMF points out

China’s residential housing sales averaged 1.5-1.6 billion square meters per year from 2018-2021, about 30-50 percent higher than estimated annual demand for the next few years based on demographic and housing stock factors.2

In a worrying signs of overheating, more and more floor space was at the initial stage of construction, whilst the pace of completions remained steady at c. 800 million square meters per annum, as it had been for more than a decade. There was a mounting gap between aspirations and the reality of delivery.

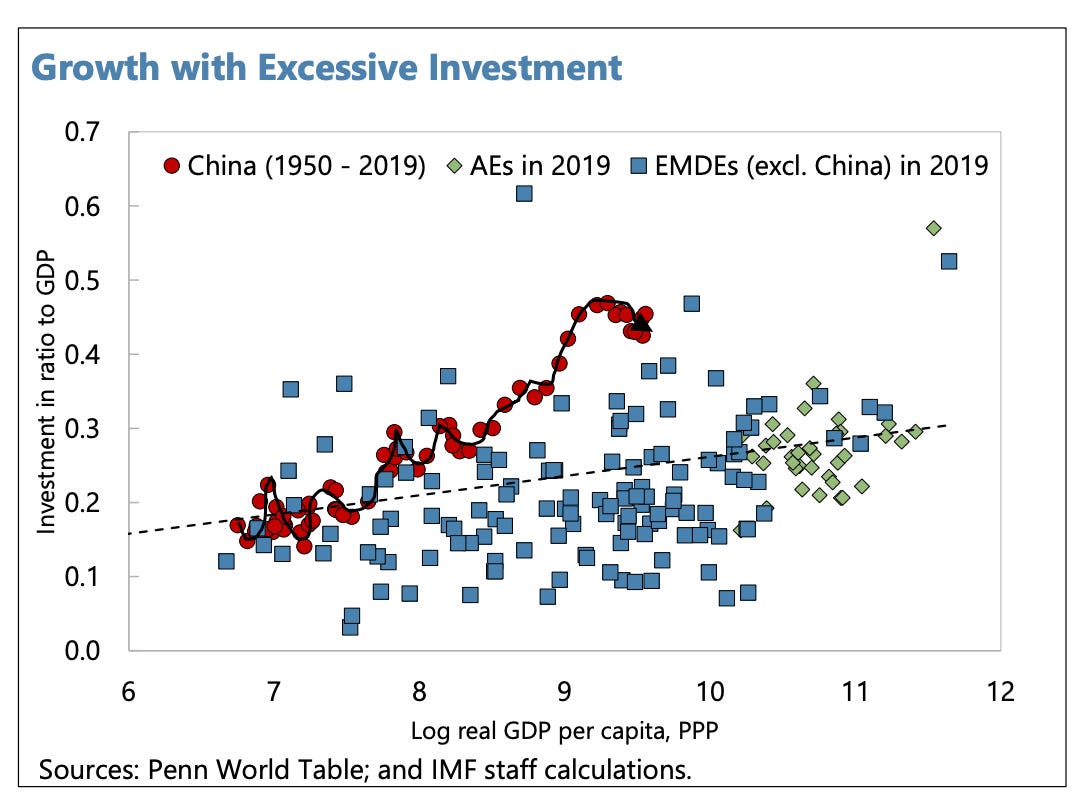

The construction boom, in turn, was the main driver of China’s massively unbalanced, investment-heavy, consumption-poor growth. Though, in recent years, the investment share has stabilized and consumption has begun to increase, the imbalance remains huge.

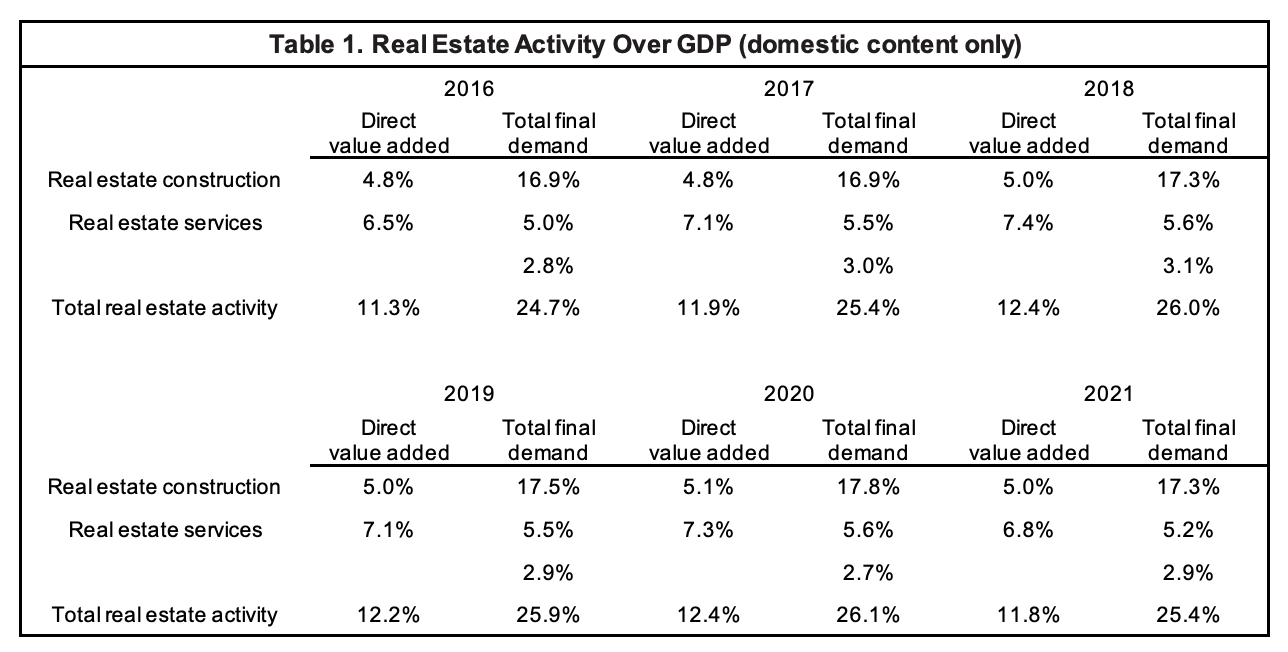

The latest estimates by Rogoff and Yang 2022 suggest that real estate development, directly and indirectly, has driven 25 percent of total economic activity in China.

Ever since the industrial revolution began in earnest in the 19th century, urbanization and real estate investment has driven surges of growth. Paris was transformed. Cities like Berlin and Chicago sprouted in the late 19th century. Stalinism stamped a new urban civilization into existence in the 1930s. Western Europe and Japan experienced rocket-ship growth after 1945 and a transformation of their urban landscapes. China has taken the dynamic of urbanization and growth to a new dimension.

Source: Rogoff 2021

In the late 1990s China still did not have a large private real estate market and real estate accounted for c. 8 percent of GDP. Over the following quarter century China experienced a revolution.

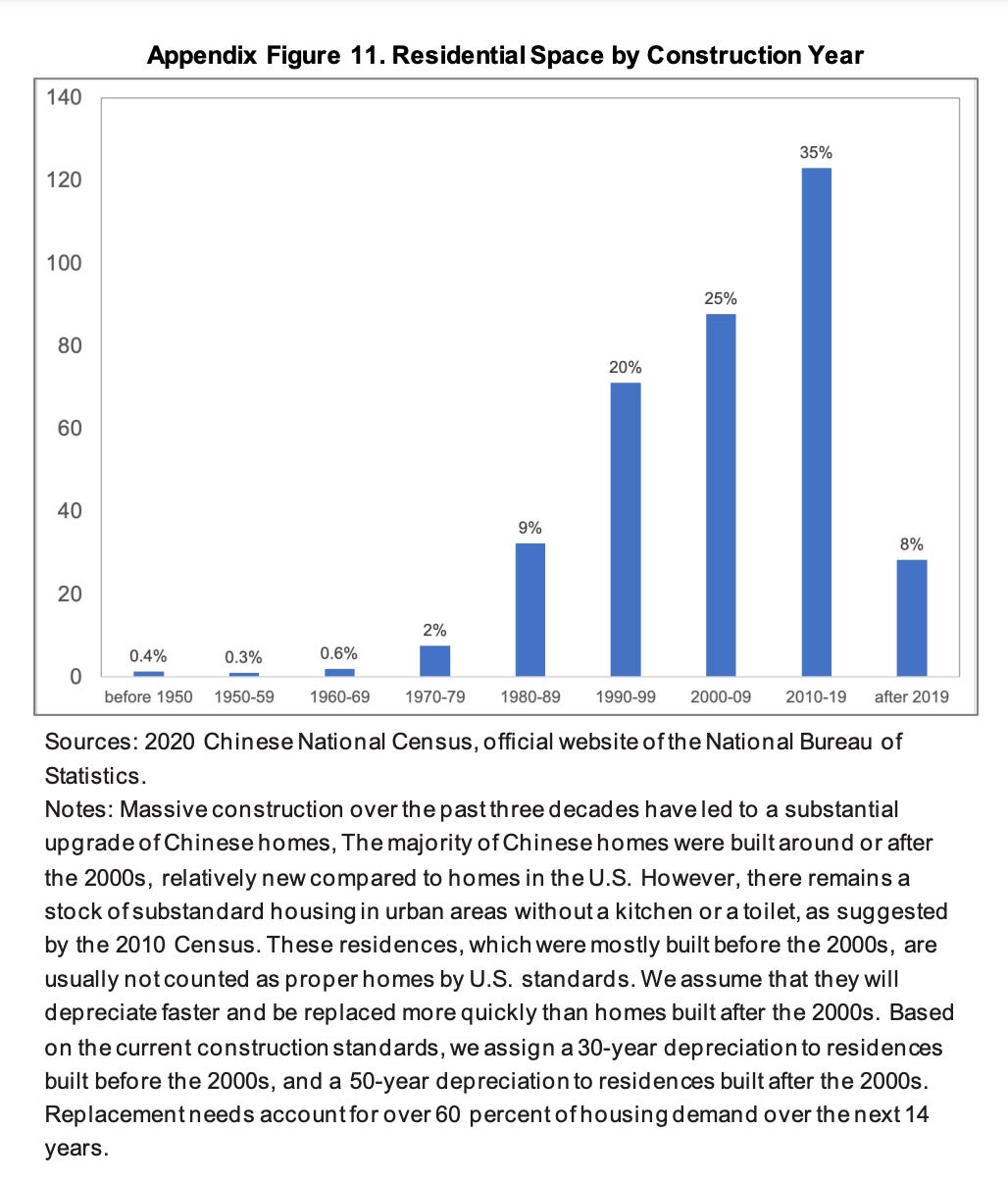

On the basis of census data, Rogoff and Yang estimate that 43 percent of all homes in China had been built since 2010, 68 percent since 2000 and 88 percent since 1990. If you put this in relation to total population it implies that in a single generation, China has built enough homes to house a billion people. The fabric of domestic life has been completely churned over in a matter of decades.

It is the demand for concrete and steel generated by this giant construction boom that has made Chinese growth so dirty. It is important to emphasize this point. As a driver of energy consumption, the rehousing of hundreds of millions of people, dwarfs China’s role as an exporter. It is important, of course, for Europeans and Americans to remind ourselves that in the course of globalization we have exported a substantial chunk of our pollution, much of it to China. But to imagine that it is our out-sourced emissions that drive China’s massive surge in energy consumption and CO2 emissions is to succumb to anachronistic Western-centric thinking. It is domestic forces that drive China’s growth.

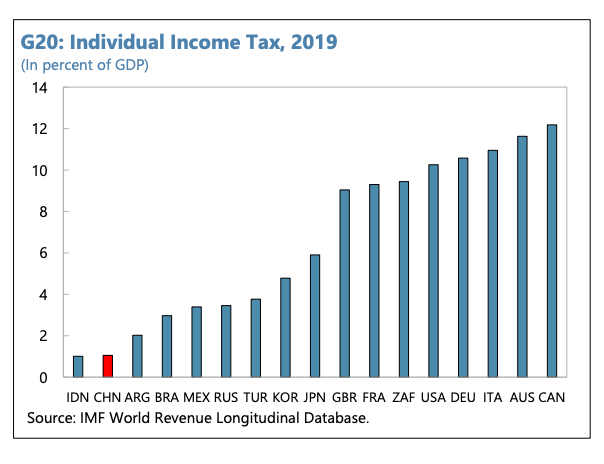

Will 2023 be the year in which China breaks with its heavy-industrial, construction-driven growth-model? Western experts, certainly, are agreed that what China needs is not more physical construction but a burst of institutional state-building. What China needs is a welfare state adequate to its new status as a high-middle income country and that will require a new fiscal constitution. Amongst G20 members China and India rival each other for the lowest share of income tax in GDP.

But whether or not China is to embark on a new growth path, the ongoing crisis in real estate has to be addressed, not to restart the unsustainable boom, but to put out the fire that threatens to consume the sector. Over the course of 2022, housing starts and sales crashed by 40 percent year on year.

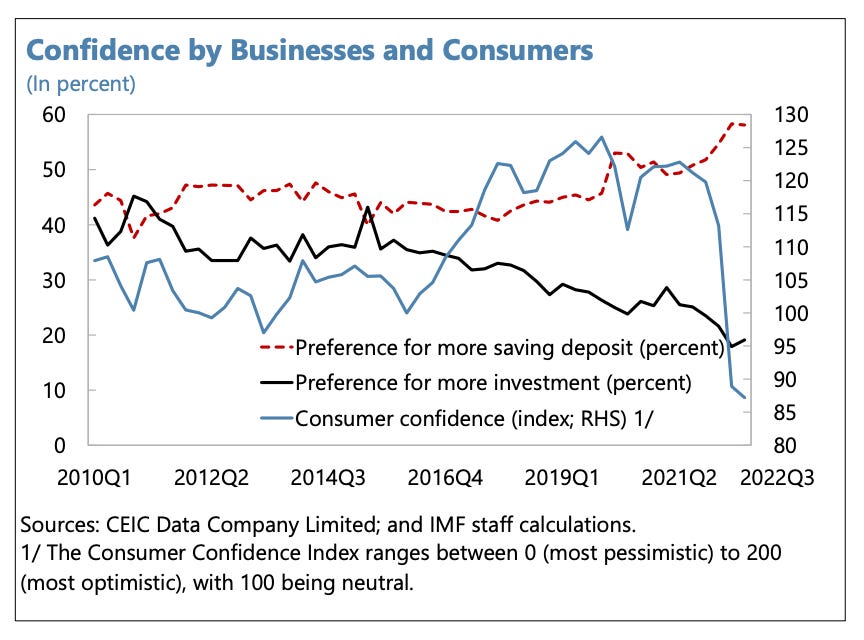

With most households having the majority of their wealth tied up in real estate. It is little wonder that consumer confidence went off a cliff in 2022. If you want a simple explanation for why zero COVID was abandoned, look at this data.

The fear of lockdowns & the imploding real estate bubble made for a truly depressing mixture. Lifting the lockdowns will help to raise the mood. But the pain in the real estate sector remains. Even the best possible outcome – a fully rebalanced recovery – cannot begin without a stabilization in real estate.

On the question of stabilization, China’s real estate crisis is unique not just for its scale. China’s real estate crisis was long predicted. But the crisis did not come about as a result of a “natural” business cycle, as, for instance, in the North Atlantic housing crash in 2007-8. In China the crisis was brought on deliberately in 2021-2022 in an effort to deflate the bubble preemptively. In this respect the situation is unique in economic history. Not only has there never been a housing boom on this scale. But the attempt to deliberately curb it and bring it under control is also unique in its ambition.

As Robin Wigglesworth points out, the IMF report shows the Chinese authorities in a relatively calm mood. It is tempting for Western observers to read this as window-dressing, or whistling in the dark to steady your nerves. We should not rule out the possibility that Beijing truly believes that it can contain and manage the fallout from a wind-down, which it has itself engineered. Abandoning the zero-covid policy, with all its implications, is the first and most important decision, necessary to stabilizing the real estate sector.

Across the board in 2022 Beijing shifted from a restrictive and deflationary course to one of re-stimulating the real estate economy.

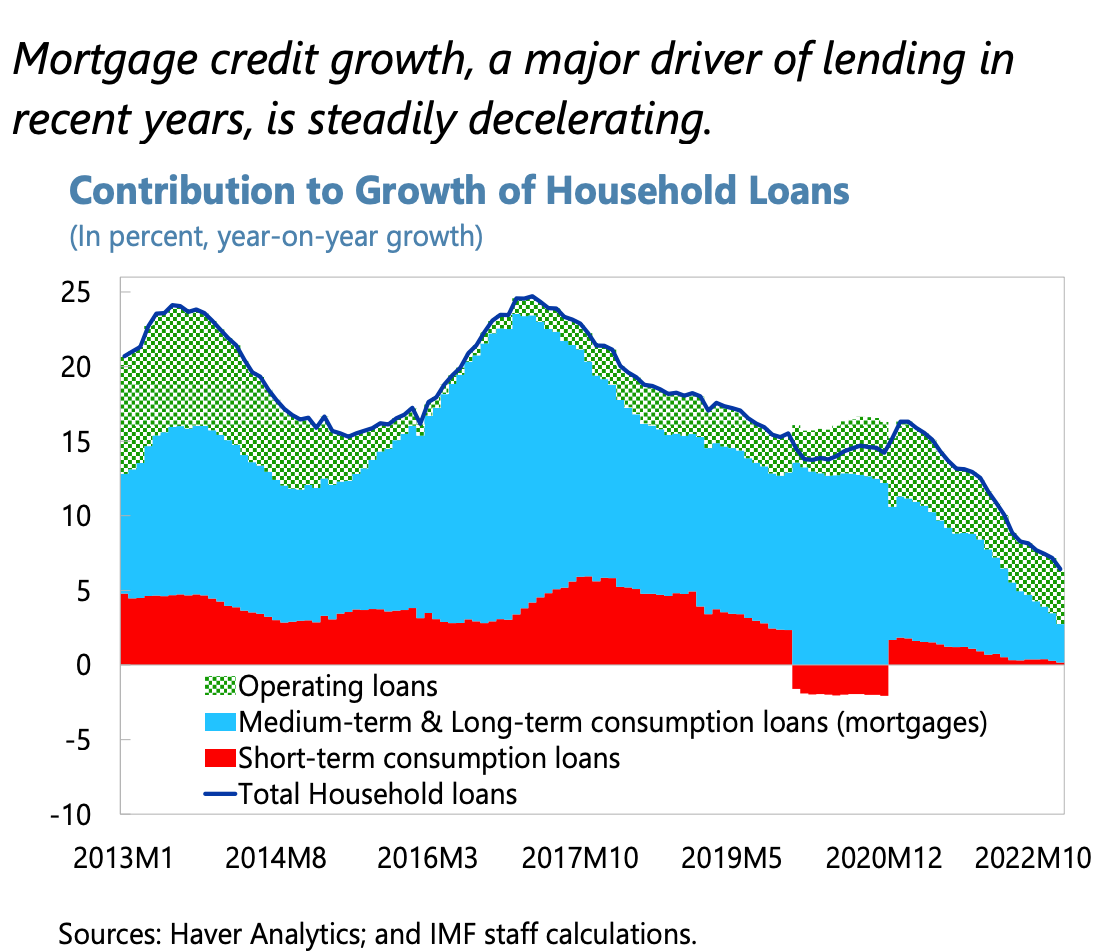

The temptation will be great to use classic monetary policy tools to revive the housing market. A sharp decline in mortgage lending and borrowing from banks to Chinese households has been a key driver of the real estate crash since 2021.

Falling mortgage borrowing has squeezed Total Social Financing, one of the key indicators of economic activity in China’s hybrid public-private, mixed economy.

But should one welcome a revival in mortgage lending? Certainly, reversing the tough red lines policy on real estate credit adopted in 2021 would suggest pragmatism. But it would also demonstrate a failure to break with the existing growth model. As Michael Pettis has tirelessly explained, Beijing would be caught up in repeating the strategy that led China into the unsustainable boom in the first place. Managing the crisis like that would be impressive exercise in what used to be called “fine-tuning”, but in strategic terms it would be a dead end.

A strategy that was directed not towards restarting the boom, but towards cauterizing the wound and restoring a platform of confidence, would instead focus on the most painful element of the crisis, the millions of Chinese households who have made large down-payments on apartments that are only partially completed or not even begun. As the IMF comments:

A key underlying challenge to restoring confidence and securing an orderly transition is the large backlog of partially built housing. In the years prior to the crisis, developers expanded their use of presales of unfinished homes as a de facto form of financing, in part by using home purchase deposits to cover the cost of unrelated projects. The annual ratio of housing pre-sales to completions—an indicator of the growth of unfinished housing—reached an average ratio of two in the last four years, up from about one in the decade through 2015. Residential real estate under construction as a result reached 6.9 billion square meters at end-2021, ten times the average floor space completed by the sector each year. The slowdown in sales has sharply limited the availability of funds to finish construction on many pre-sold projects, particularly for distressed developers. The rising risk of non-completion for some of these projects impairs the realizable market value of developer assets, worsening their solvency and liquidity problems, and affects homebuyers’ willingness to purchase homes before they are completed. This not only limits developers’ capacity to continue investment, but risks sizeable losses for households and the banks that funded these purchases via mortgage credit. Homebuyers’ decreased confidence in the pre-sales model also limits the traction of policies aimed at stimulating housing demand. Without stabilization for pre-sold housing demand, a large segment of partially finished housing would be at risk of noncompletion. While significant data gaps make the task of estimating the cost of completing troubled developers’ partially built housing inevitably imprecise, a range of estimates suggests the cost could be significant. The average of the midpoints of three estimation approaches places the gross cost of completing distressed developers’ pre-sold projects—with no funding from additional sales or restructuring recoveries—at roughly 5 percent of GDP, with one approach implying costs well above that.

So, simply to stabilize the Chinese real estate market, not to unleash a new boom but to clean up the most serious overhang from the last few years of excess, will require a commitment of in the order of 5 percent of GDP even if the resources are perfectly targeted. That is a measure of the challenge ahead.

The stakes are immensely high. The housing boom in China since the 1990s is probably the largest single driver of wealth accumulation the world has ever seen. Stopping it was an audacious act of policy. Managing the fall out is a severe test for Beijing. If it were to succeed, it would be an example of macro-prudential economic management on a truly world historic scale. If it fails, the “China dream” promised by Xi is in jeopardy.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, click here: