South African coal

Ahead of COP27 the most interesting climate/energy read was David Pilling’s remarkable FT report on the difficulties in implementing the decarbonization agenda at South Africa’s ESKOM, one of the most touted schemes to come out of COP26 in Glasgow.

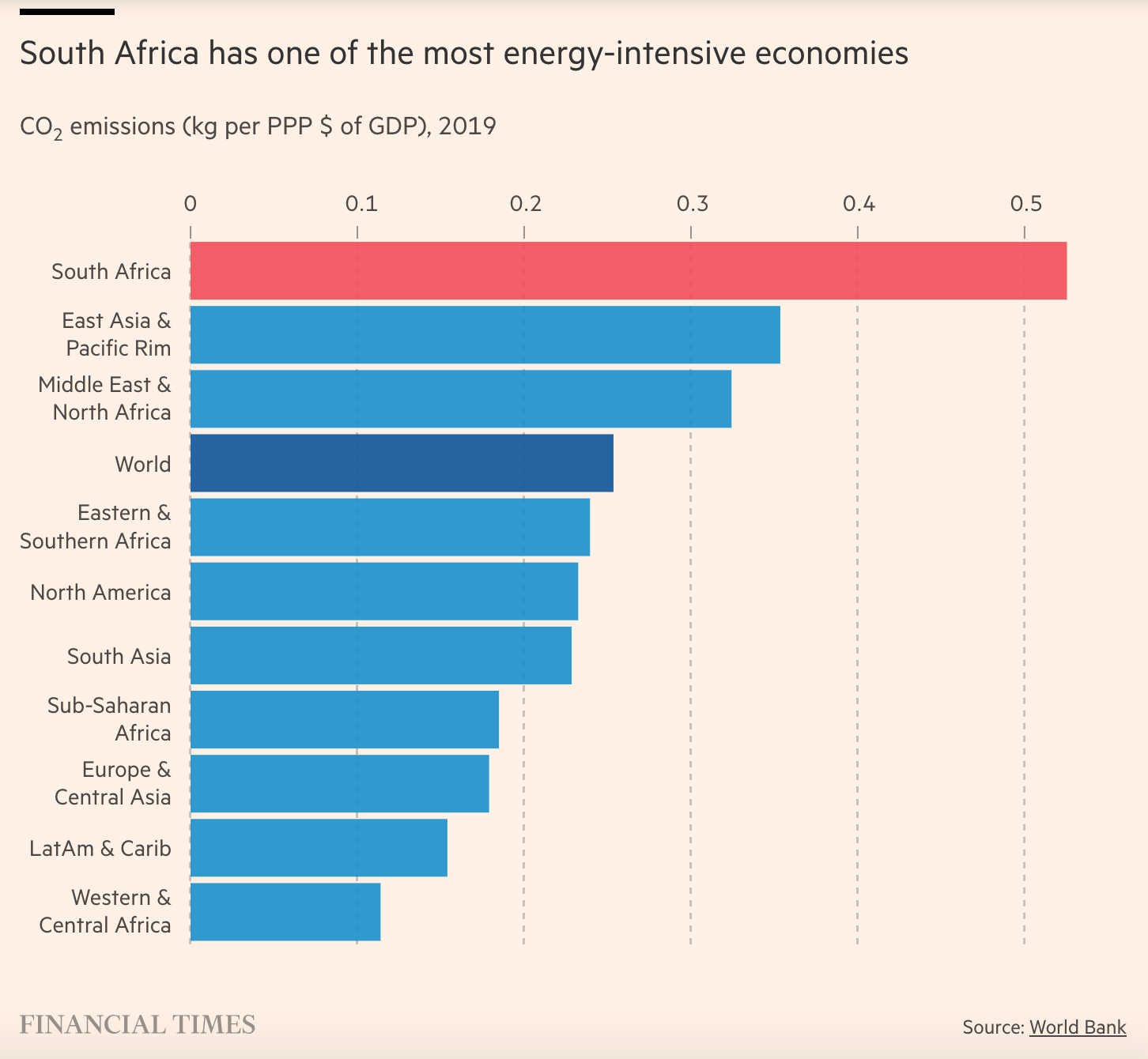

South Africa’s coal-heavy power system makes it one of the most carbon-intensive per unit of GDP in the world.

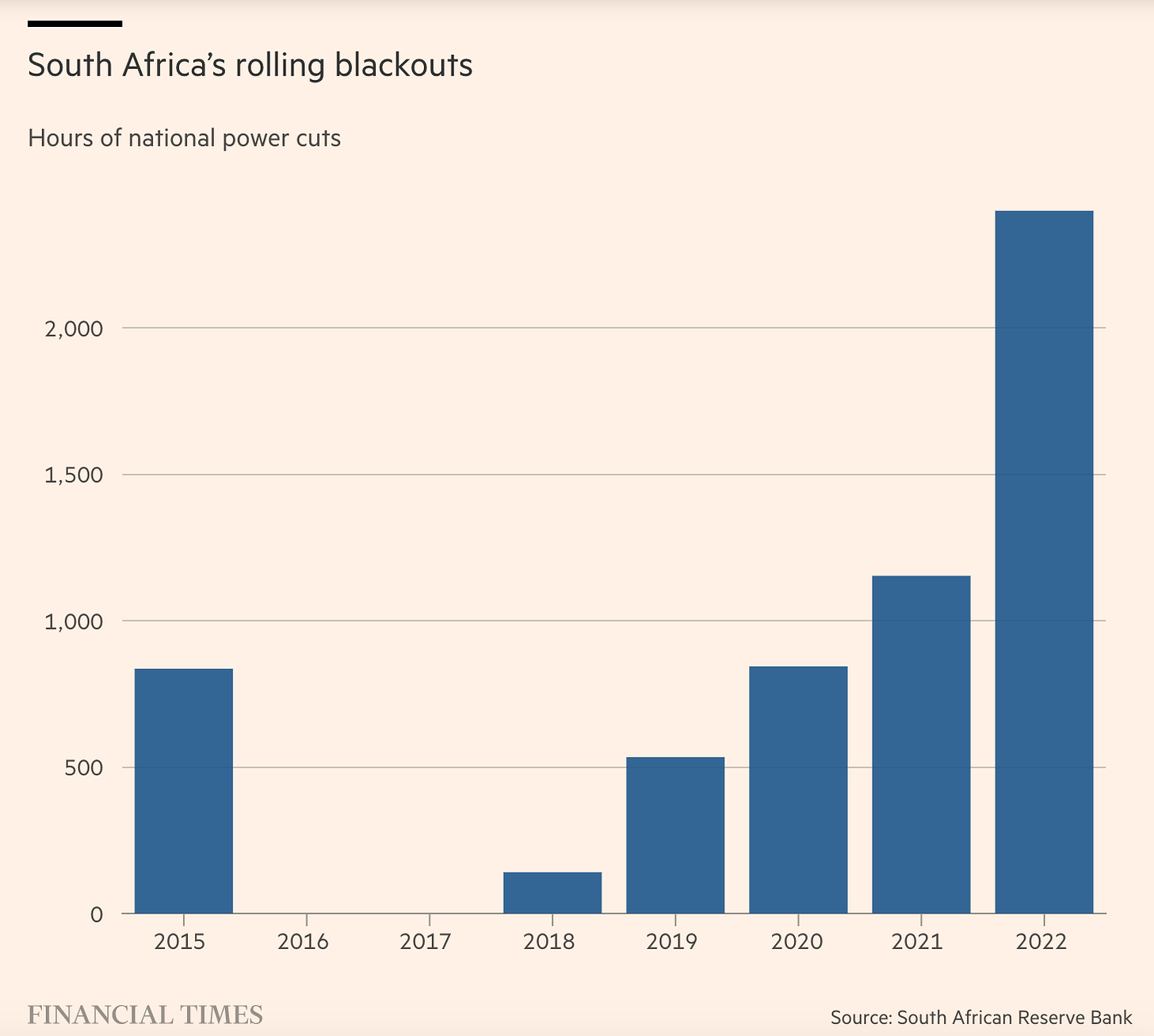

But ESKOM fails woefully to actually supply reliable power.

Indian should be a key player at COP27

On the Indian perspective an essential follow is Navroz Dubash of CPR, @NavrozDubash

Here is an excellent short piece in the Hindustan Times on the key issues of loss and damage and finance.

Also this CPR podcast.

Meanwhile in Egypt, “polycrisis” is framing the inaugural speech by Egypt’s Prime Minister

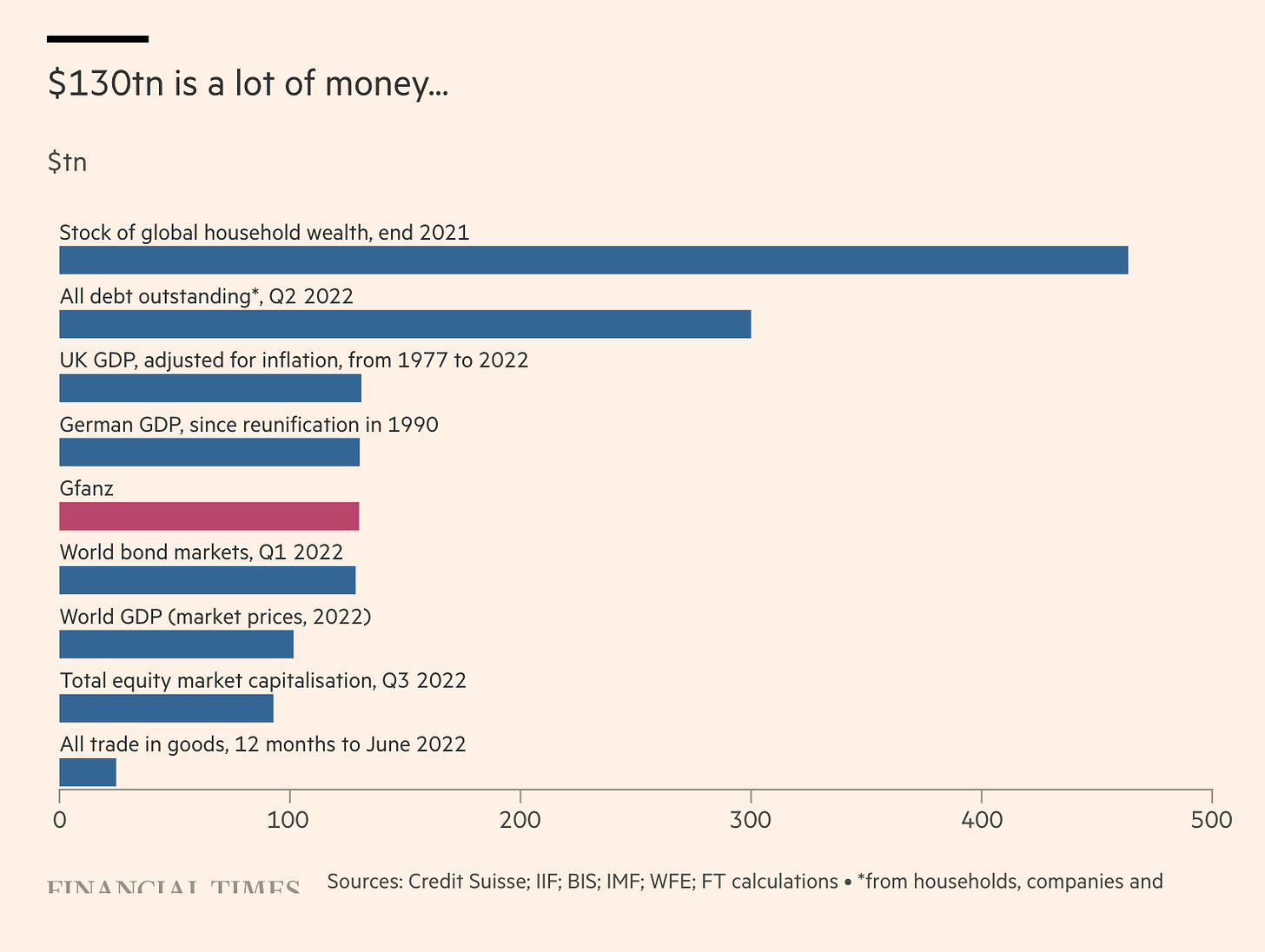

The Finance sessions continue the derisking agenda that has been rolling for many years, but Mark Carney’s GFANZ dream is in trouble.

This piece marks a notable turn in the tone of FT coverage from @KenzaBryan.

The split from the UN-backed body reflects the difficulties Carney’s team has had keeping this self-governing club of financiers together. It came under intense pressure from mutinous American banks reluctant to divorce the fossil fuel sector in the middle of an energy crisis. It also faced a backlash by litigious rightwing political forces who criticise “woke investing” and say the financial sector’s first duty ought to be to shareholders. Contacted for an interview, Carney sent the FT a written statement in which he said the perceived risk of antitrust penalties over collective action had been a “big challenge” for Gfanz this year, and called on governments to “move more rapidly” on setting guidelines for company transition plans.

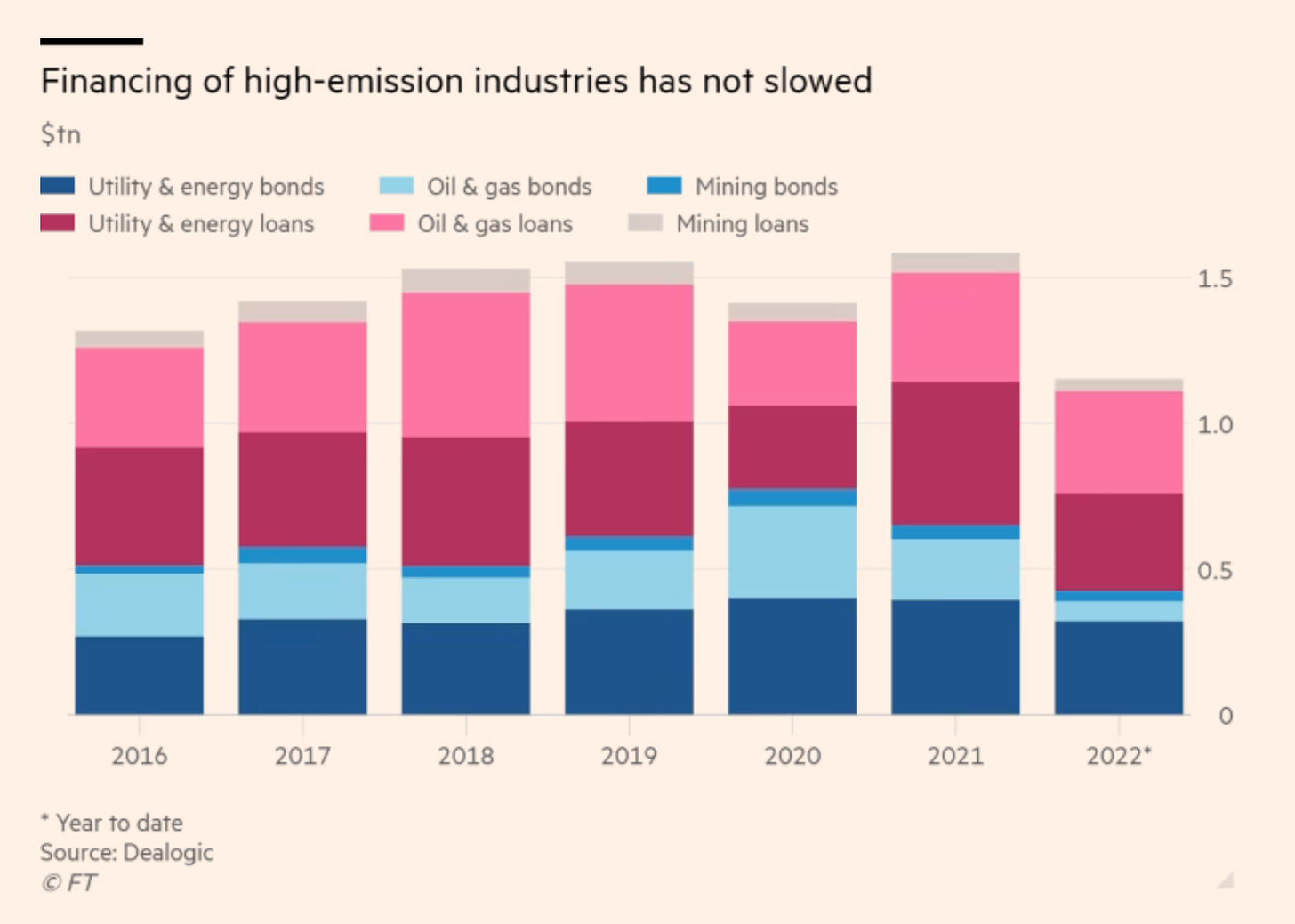

Despite all the high-minded talk, high-emission financing continues at an unchanged pace:

Read the FT piece and then read this blistering thread from

shocking that this @FT long read/autopsy of GFANZ as body for voluntary decarbonisation says nothing about central banks' work to decarbonise private finance, some kickstarted by @MarkJCarney himself at Bank of Englandhttps://t.co/OczC1qGzLc

— Daniela Gabor (@DanielaGabor) November 9, 2022

And also this by Daniela on EU-Namibia Green hydrogen deals

look @nssylla #greenhydrogen https://t.co/FCPujyFCyG

— Daniela Gabor (@DanielaGabor) November 8, 2022

Meanwhile, as Tim Sahay highlights, the US is doing clean energy deals with UAE that dwarf all the discussion about rich country support for climate finance at COP27.

41/ Rich countries had promised developing countries a measly $100 billion in climate finance.

— Albert Pinto (@70sBachchan) November 1, 2022

Today US signed a $100 Billion clean energy deal with UAE to finance 100 GW of energy globally! Dubai doing it all @njtmulder. https://t.co/JPfUDdcpLa ht @ProfessorKaren (tweet #33) pic.twitter.com/OFJD7DIJek

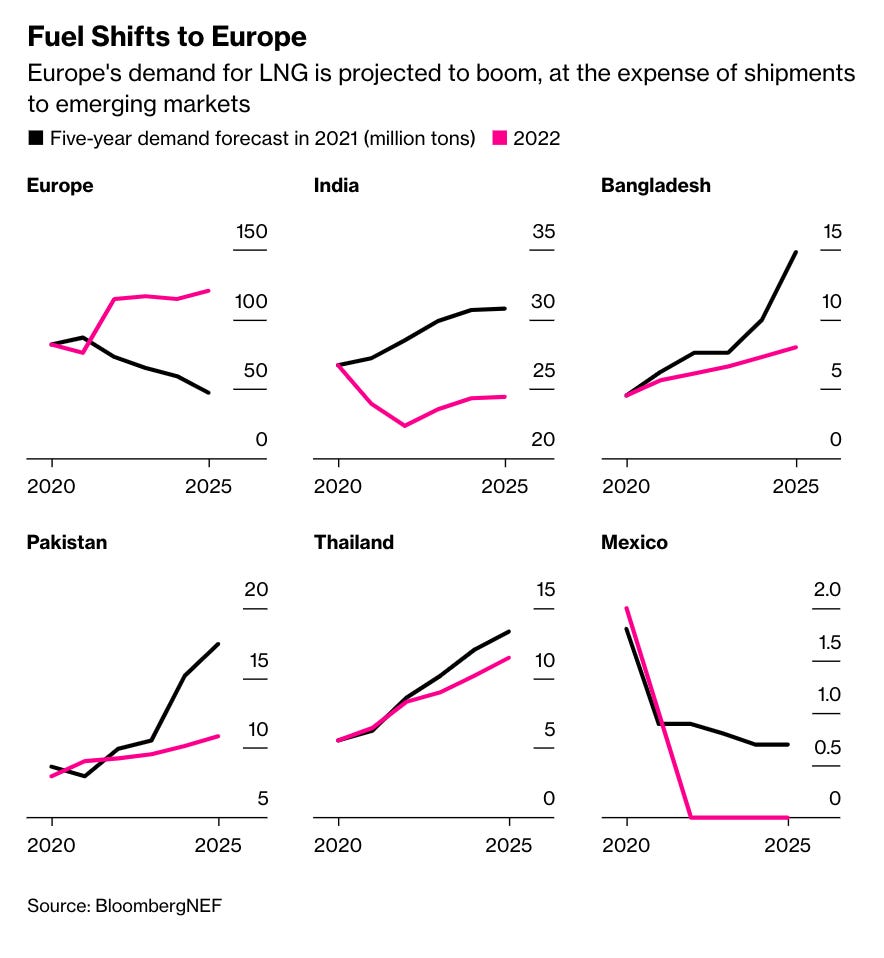

And surging European demand for LNG is now forecast to squeeze out developing Asian consumers, according to this dramatic Bloomberg report.

So a strategic question now is whether emerging market green developmentalism and “electrostates” can overcome the headwinds.

Yep. The escalation of green developmentalism in Asia and the new green industrial policy("onshoring") in US & Europe must be seen as parallel developments. We discussed this question w @triofrancos in our Polycrisis launch roundtable in Oct. More soon! https://t.co/L6Oeqx8Mfj pic.twitter.com/kgWxDc9O7r

— Albert Pinto (@70sBachchan) November 1, 2022

More COP27 coverage on Chartbook Newsletter, when interesting news comes in.

***

Thank you for reading Chartbook Newsletter. I love sending out the newsletter for free to readers around the world. I’m glad you follow it. It is rewarding to write, but it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press this button.

Several times per week, paying subscribers to the Newsletter receive the full Top Links email with great links, reading and images.

There are three subscription models:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club.

To get the full Top Links and become a supporter of Chartbook, click here