As interest rates are driven up to counter inflation, as geopolitical tensions rise and commodity prices grind against each other, the world economy is in a labile place. Under this kind of pressure, what bends, what breaks and what simply implodes?

Amongst the general categories of risks there are:

- Recession – a painful but “orderly” contraction of economic activity.

- Big shifts in balance of payments, triggering lurching adjustments in capital flows.

- The risk of acute energy crises whether due to spiraling prices or sudden stops to supply, these may compound (a) recessions by forcing a shutdown in production, (b) inflict social crises and © trigger market malfunction, thus contributing to ….

- Surprising (and unsurprising) financial “events”.

- As the shocks add up, they raise the risk of public and private debt crises with dramatic macroeconomic fall out and ever-more complex debt renegotiations for which the institutional structure is very inadequate.

The list of more specific stresses, crises and worries so far includes, debt crises like the Sri Lanka disaster, unrest around the world triggered by the surge in energy prices, the FTX implosion, the UK gilt market blow up, the longevity of the BoJ yield curve policy, apparent signs of tightening liquidity in US Treasury markets, worries about global housing markets. One might also add the slow-motion crisis in Chinese real estate, though this is to a large extent internally driven and the extent of the spillover to the rest of the world has yet to be seen.

In a chartbook mini-series I am going to try to map this complex conjuncture of shocks and crises.

***

To start with it is useful to distinguish different crisis logics. First of all we should distinguish crises that are driven (1) by fiscal and monetary policy choices, from (2) exogenous macroeconomic shocks (say in trade flows due to global energy price shocks, or Fed interest rates policy), (3) private balance sheet positioning (risky levels of leverage, or currency mismatch), and (4) the misfiring of complex financial engineering (derivatives, CLOs etc).

The importance of distinguishing between crisis logics is brought home by the narratives that have been spun about the UK Treasury market panic. This has been widely interpreted as a matter of fiscal credibility – with the lesson being that the Chancellor must fill a “50 billion pound black hole” by hiking taxes and cutting spending.

In fact, much of the action was driven, on the one hand by the policy stance of the Bank of England and on the other hand by derivatives contracts through which pension funds multiplied their exposure to gilts. If you remove support from the gilt market by pivoting to Quantitative Tightening and you do so when the market is spring-loaded with a outsized quantity of derivatives designed to protect you against falling interest rates, then, whatever your fiscal stance, you should clearly be prepared for trouble.

It is not for nothing that Andrew Bailey of the Bank of England feels it necessary to deny on television news that he was responsible for deposing Prime Minister Truss.

To interpret a complex event like the UK financial shock as a simple morality tale of fiscal prudence is not to assert the logic of economics against feckless politics, but the contrary. It is to instrumentalize a crude interpretation of a complex event to impose the political priority of budgetary consolidation.

Getting the politics of interpretation right is important because that in turn determines how you read a factor like “Fed interest rate policy” in the UK context. For those preoccupied with nailing Truss-economics to the wall, it was crucial to discount outside influences. And that tendency was reinforced by the effort on the part of Truss’s apologists to explain away the UK’s disaster by reference to “global forces”. On the other hand, if we want to understand the UK crisis as part of the global credit cycle and do justice to the role of the Bank of England, then references to the Fed’s role in driving global tightening may actually be from from irrelevant. Both the Bank of England and the ECB are caught up in the dollar-based credit cycle.

On the other hand there are cases where applying Occam’s razor is called for. The simpler the explanation the closer to the truth it comes. One such cases is clearly the crypto-implosion. As Daniela Gabor pointed out already five years ago, FTX was a disaster waiting to happen.

5 years ago, I told you how FTX would fall https://t.co/rVgJEjtcRW

— Daniela Gabor (@DanielaGabor) November 12, 2022

It was either wrong-headed, spectacularly naive or it was a more or less deliberate conceived Ponzi scheme.

Both the UK gilt market debacle and the crypto implosion are distinct from the pressures unleashed by the turmoil in global energy markets, which leaves energy importers facing fearsome increases in costs and spiraling bills for energy subsidies. These really are classic macroeconomic/policy-driven shocks that trigger balance of payments crises, devaluations etc.

But these macroeconomic pressures may be compounded by elements that belong more squarely in the macrofinancial realm – by way of financial engineering or balance sheet effects. For instance, both the UK and Germany can “afford” the higher import bills due to the surge in oil and gas prices. Neither the Euro nor the sterling will go into free fall on the news from energy markets. What Europeans are struggling with, are social crises on account of the inability of those on tight budgets to afford huge energy bills, a nasty bout of inflation and financial crises. In a matter of weeks energy supply companies in both Germany and the UK were bankrupted by the maturity mismatch on their balance sheets between long-term energy supply contracts with consumers and surging prices on spot markets. The result were expensive bailouts that added to the stress on government balance sheets.

Meanwhile, in energy markets themselves, it was clear already at the start of the year that trading houses would struggle to access the liquidity they need to make markets in commodities whose value has suddenly multiplied. Meanwhile, Bangladesh, Sri Lanka and Pakistan cannot buy LNG cargos at all, not only because they are too expensive, but because traders do not regard them as creditworthy clients. When there is no shortage of people clamoring for LNG cargos, they are the last in line.

Needless to say, all these macrofinancial complications of energy crises would pale by comparison with a “liquidity hiccup” in the US Treasury market as in 2020, or a meltdown in global mortgage finance driven by a loss of short-term funding, as in 2008.

***

Apart from the logic of the crisis-drivers, scale and systemic interconnection are the other dimension along which we need to organize any survey of the current situation.

The FTX crypto blowup is spectacular and will generate pages of excellent financial journalism, but at $30 billion it is a minor blip in the broader scheme of things and the damage is largely confined to investors who though they may be prominent in the media are not systemic to the wider financial system. This is not to say that interconnections were not there. Some large and supposedly sophisticated actors got involved in crypto, and FTX in particular, so it is a blessing that it imploded before it grew to any larger size.

The important point is that the crisis-forcing pressures of the current moment – rising interest rates, diminished risk appetite, general disillusionment with “tech” – drove a crisis in crypto, but the causal chain does not run in the other direction, at least not in a systemically relevant degree.

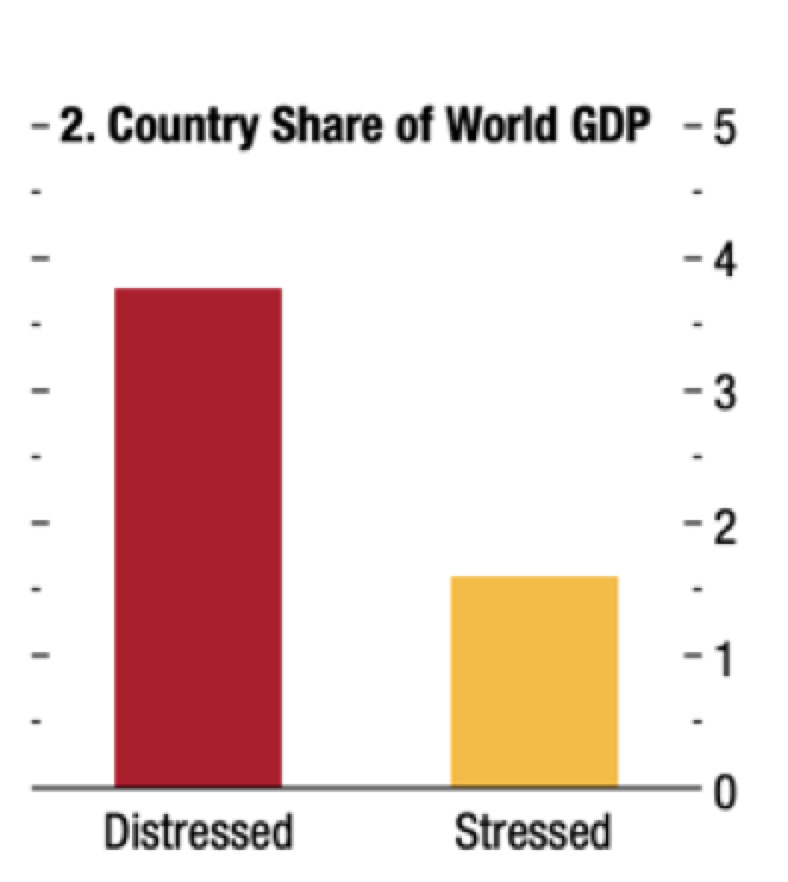

The same is true for the many debt crises in developing and emerging market economies. This graph from the latest IMF WEO is telling.

There may be dozens of economies approaching debt-distress. The IMF may have a record “to do”-list, but the economies involved are generally poor and small, so they make up a minor share of the world economy. There is seemingly no prospect of a 1980s-style debt crisis that blew back on America’s biggest banks.

The state of the world economy drives the poor and heavily-indebted into crisis, but as far as the world economy is concerned, causality does not run the other way around to a significant degree. We live in a world of dualism in which a large part of the world’s population is excluded from the “systemically relevant” circuit.

The question is whether a calculus framed above all in terms of shares of global GDP does justice to the complexity of an increasingly multipolar global order. A debt crisis is a crisis of the state, which may have disruptive effects both nationally and regionally, as in the case of Sri Lanka. The developing economies facing potential debt crises that are “too big to fail” (as measure above all in geopolitical terms) – the likes of Pakistan or Egypt – will attract coalitions of backers, including China and the gulf states. This will make any resolution of the debt problems very complicated, but will also likely prevent a full-blown, Sri Lanka-style collapse.

At the other end of the spectrum from these “small fires”, are three macro-risks that are gigantic in scale and systematically important.

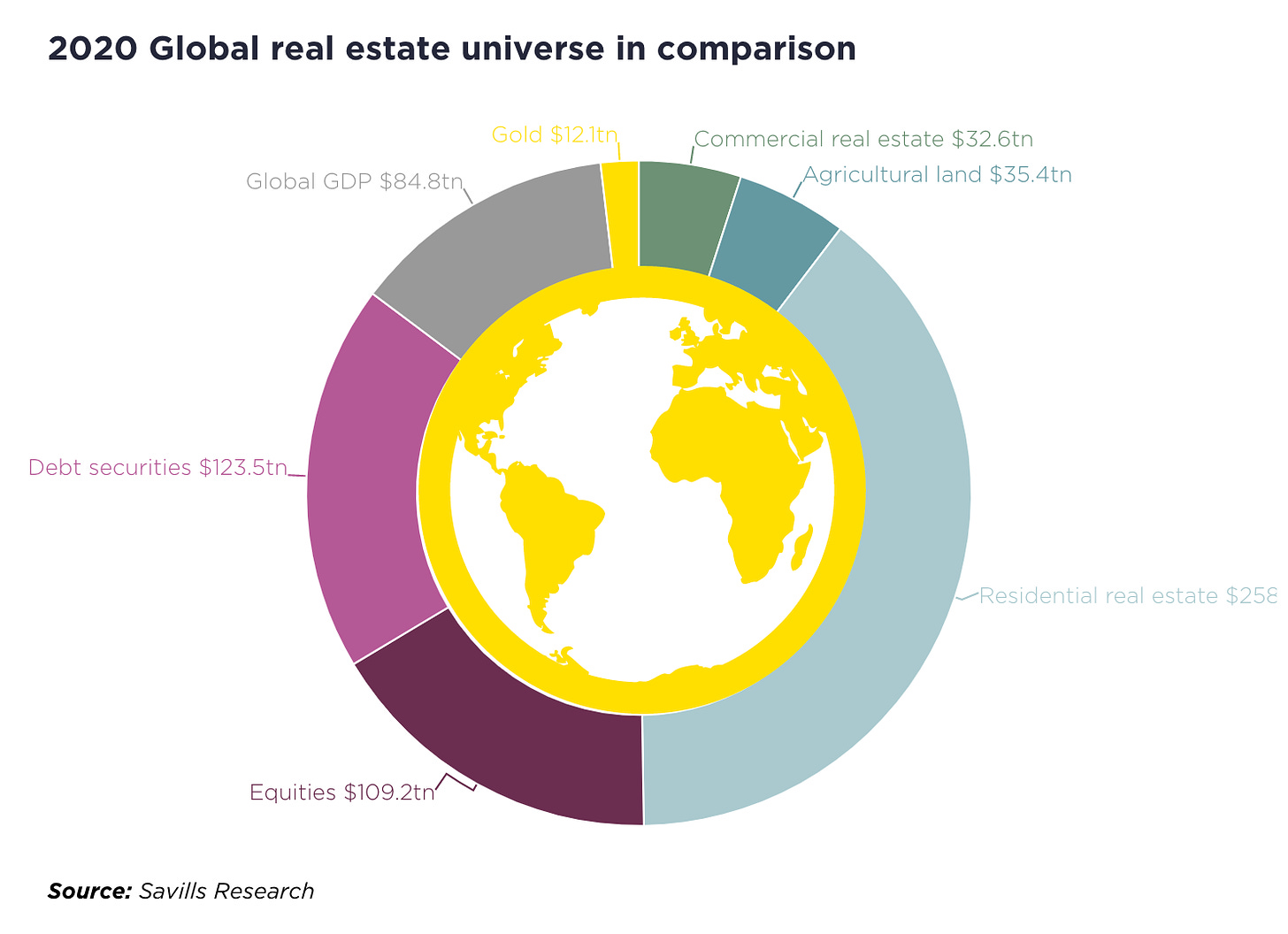

The biggest of all is global real estate. At $258 trillion, real estate dwarfs all other asset classes. By far the largest slice is in the USA.

Source: Savills

Real estate is the foundation for vast amounts of leverage. Even small tremors in the funding chains for real estate are a matter of systemic concern, whether at the national level (in the case, for instance, of Canada), or globally (in the case of the US). As mortgage rates in the US have more than doubled in a matter of barely more than 6 months the sector is reeling, whether or not there will be repercussions for housing finance is a key issue, to be discussed in a later newsletter.

Next in size and importance is the US Treasury market, which matters not just because of its size – $ 23.7 held by US and foreign investors, and counting – but because of its essential function in the organization of flows of liquid funding. If liquidity issues were to develop in the US Treasury market, as they did in 2020, it poses a threat to the functioning of the entire global financial system.

Finally, there are globally significant cross-country connections between creditor and debtor countries. In 2022 the ominous trio of Russia, China and Saudi Arabia are all seeing their dollar earnings swelling.

Global trade imbalances have not, so to speak, been friend shored.

— Brad Setser (@Brad_Setser) November 2, 2022

Far from it.

The combined goods surplus of China, Russia and Saudi Arabia is at a record level. So too, for that matter, the broader current account surplus. pic.twitter.com/oW6z2rQ5vp

But due to a complicated array of factors, reserves are not increasing at the same rate. Russia is effectively cut out of the global financial system. China too operates a regime of exchange control.

As far as global financial stability is concerned, the piece of the puzzle that matters most is Japan. Japan is no longer running large trade surpluses, but its accumulated stock of foreign assets makes it a key global player. Furthermore, the hunt for yield by Japanese asset managers causes Japan to be a major buyer of international assets, independently of its trade balance. Japanese pensions funds and savings banks are major owners both of US Treasuries and European sovereign debt, notably French public debt.

The calculus for Japanese investors, depends on expectations about interest rates in the US and Europe relative to those in Japan, and the likely future direction of the yen. Those risks can be hedged by way of derivatives, but hedging is not cost-free and Japanese investors have to access swaps and dollar-funding to balance out their books, for which they also have to pay a price.

It is a complex edifice. How fragile is being tested by the dramatic depreciation of the yen since the start of the year.

What has driven that depreciation is the gap that has happened up between the Fed and the Bank of Japan with regard to interest rates. Whereas the Fed is hiking, and the ECB and the Bank of England followed suit, the Bank of Japan has maintained its policy of yield curve control. This difference makes sense in light of the much lower inflation rate in Japan. But the impact on asset markets and the exchange rate is raising the pressure on the Bank of Japan to abandon its policy. Were it to do so, it would be the last central bank to end its support of bond markets. How large the shock might be remains to be seen.

So this is the scene, an unfinished, open-ended landscape, which we will be surveying in the upcoming mini-series on tensions around the world economy. The historical novelty of our situation should not be underestimated. We have not been here before. The extent of global leverage, the degree of interconnectedness, the rate at which interest rates are being hiked, the involvement of central banks around the entire world, the interlock with a new array of geopolitical tensions, all mark this as a significant moment of historical departure.

The first installment will address the issue of the IMF and its adequacy to the current situation of global financial stress.

***

Thank you for reading Chartbook Newsletter. I love sending out the newsletter for free to readers around the world. I’m glad you follow it. It is rewarding to write, but it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press this button.

Several times per week, paying subscribers to the Newsletter receive the full Top Links email with great links, reading and images.

There are three subscription models:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club.

To get the full Top Links and become a supporter of Chartbook, click here