You are invited to become not just a subscriber to Chartbook Newsletter, but a supporter of the project.

Chartbook Newsletter is a blast to write. But it is also very time-consuming. To see where it should fit in my portfolio of other activities, I am launching a paid subscription model.

Don’t panic. If you like the newsletter but can’t afford a paid subscription, I get it. You don’t have to do anything. You will continue to receive Chartbook, as before. But, if you can afford it, if you think the content is valuable, if you would like to support the mission, or simply buy me the equivalent of a cup of coffee once a month, there are three options:

- The annual subscription: $50

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club: If you really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club with a recommended contribution of $120 annually, or another amount at your discretion. Good karma guaranteed.

To support the project please click here:

What are you contributing to? The continuation of Chartbook Newsletter as you already know it. A bunch of great content c. 40 post per annum. A list of forthcoming projects and a full-length appeal can be found in the last mailing.

A HUGE thank you to everyone who has already hit the subscribe button. Your support is a great encouragement.

********

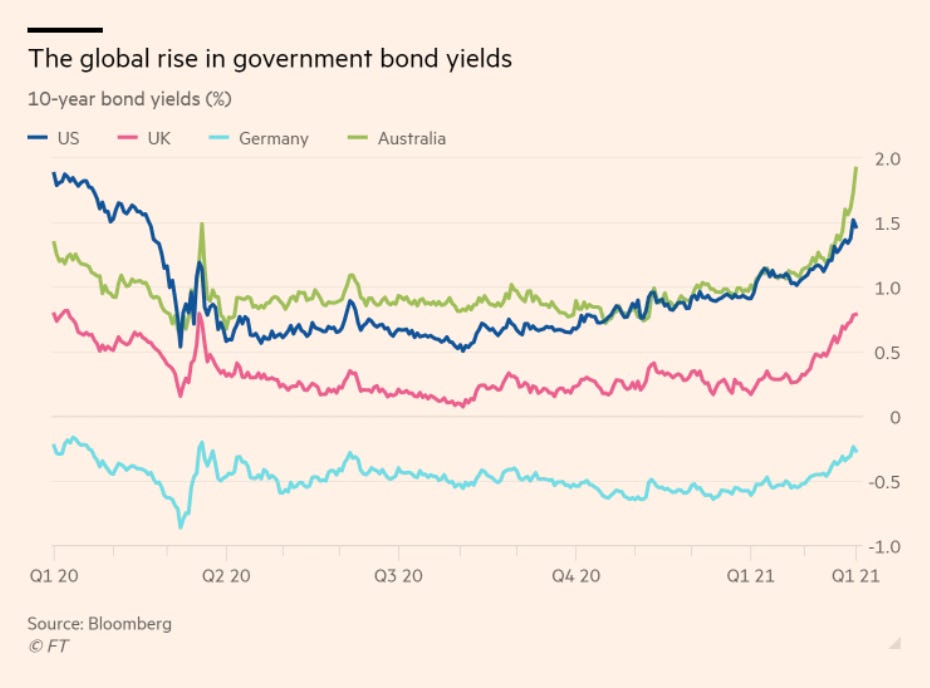

In the last couple of weeks, as financial markets have digested the implications of Democrat control of Congress and a giant second stimulus, US government Treasuries have sold off and yields have moved sharply upwards.

Source: FT

This has unleashed a wave of discussion about the return of bond vigilantes. See for instance Robin Wigglesworth’s excellent piece in the FT.

The phrase “bond vigilante” is normally attributed to Ed Yardeni a Wall Street economist who coined it in the 1980s to describe the role of bond markets in disciplining governments.

“Bond Investors Are The Economy’s Bond Vigilantes”, Yardeni once declared. “So if the fiscal and monetary authorities won’t regulate the economy, the bond investors will. The economy will be run by vigilantes in the credit markets.” As Yardeni later spelled out: “By vigilantes, I mean investors who watch over policies to determine whether they are good or bad for bond investors … If the government enacts policies that seem likely to reignite inflation”, Yardeni elaborated, “the vigilantes can step in to restore law and order to the markets and the economy.”

The image of markets making law, imposing discipline on errant governments hangs over the entire period of neoliberalism. Bond vigilantes is just one of the terms commonly used to describe the power of bond markets. The phrases suggest a variety of nuances. There is also talk of vulture funds and taper tantrums. Each assigns a rather different role to bond investors – as enforcers, opportunistic profiteers or spoiled children. In a nasty twist I have suggested that during the Eurozone crisis, rather than free-booting vigilantes it would be more apt to talk in terms of government-condoned death squads.

On another occasion it will be interesting to return to these terms apart. In this post I want to ask a more basic question. As far as the United States is concerned are bond vigilantes real?

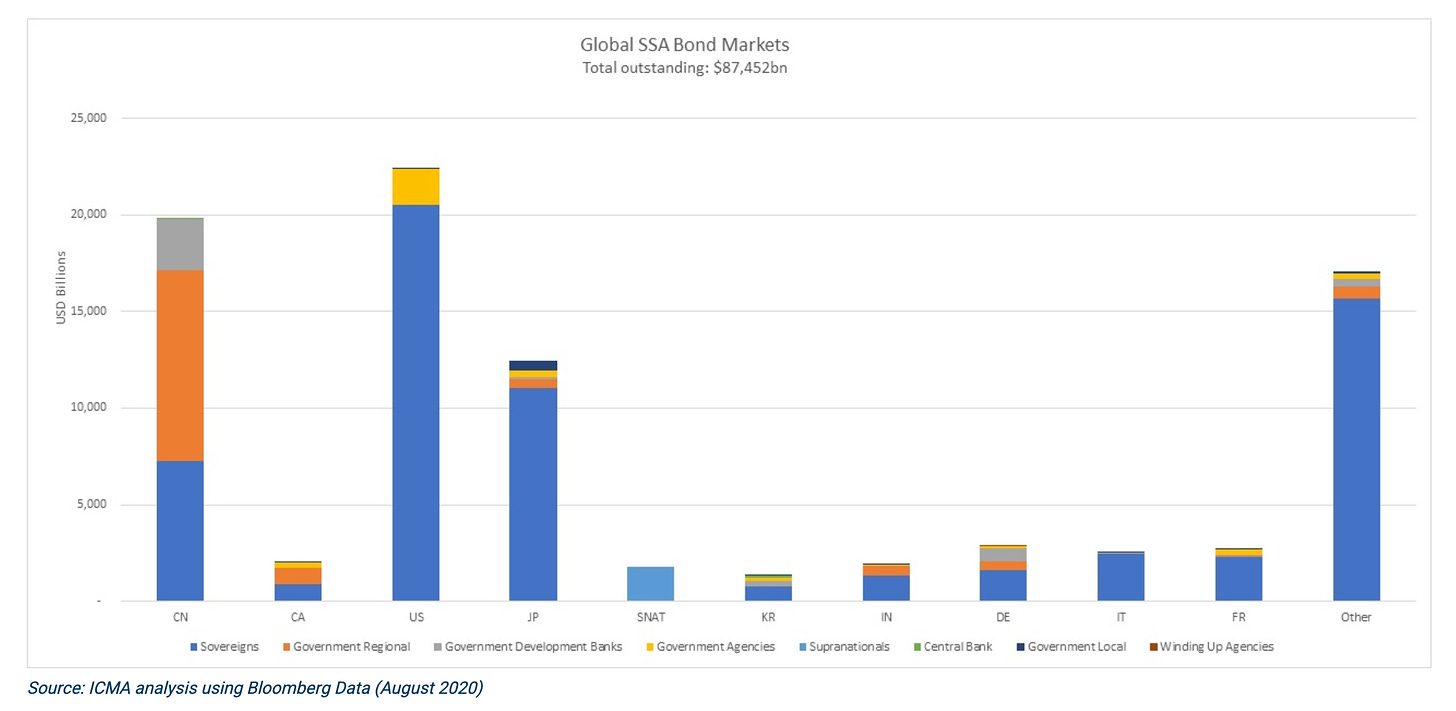

I am going to focus on the United States because it is by far the largest issuer of sovereign debt. And because in 2021 what we are most immediately concerned with are the shift going on in the US Treasury market.

Source: ICMA Group

Are bond vigilantes real?

When Ed Yardeni was interviewed by a curious student in 2011, his take was surprisingly circumspect.

As far as the United States was concerned, “Dr. Yardeni explained that it would be difficult, and perhaps impossible, to prove the existence of bond vigilantes empirically, as the phenomenon has only occurred once or twice in the post-war economy. It is easy to see evidence of bond vigilantes abroad in fiscally unsound countries such as Greece, but there is less compelling evidence that this mechanism occurs in the United States, with the only clear exceptions being the previously mentioned activity in the 1980’s and 1990’s.”

So, as of 2011, according to Yardeni himself, there were, in fact, only two plausible moments of bond vigilantism in US history – the 1980s and the 1990s.

Bond yields certainly rose sky-high in the 1980s but that is normally explained in terms of the Volcker shock i.e. an abrupt shift in policy on the part of the Federal Reserve.

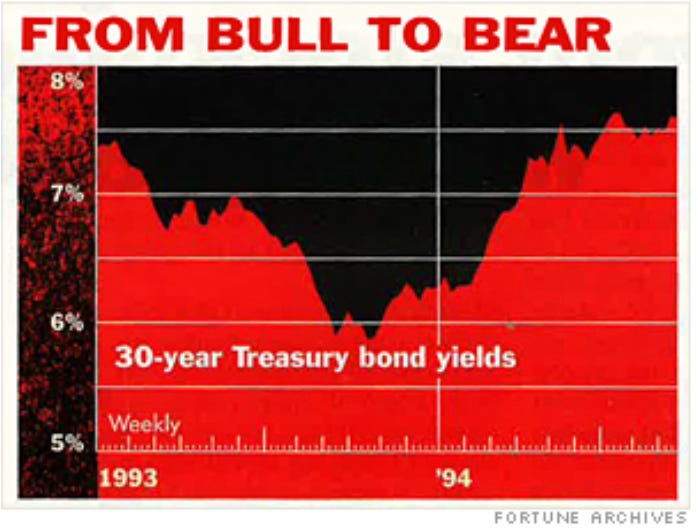

1994 seems like a more plausible case.

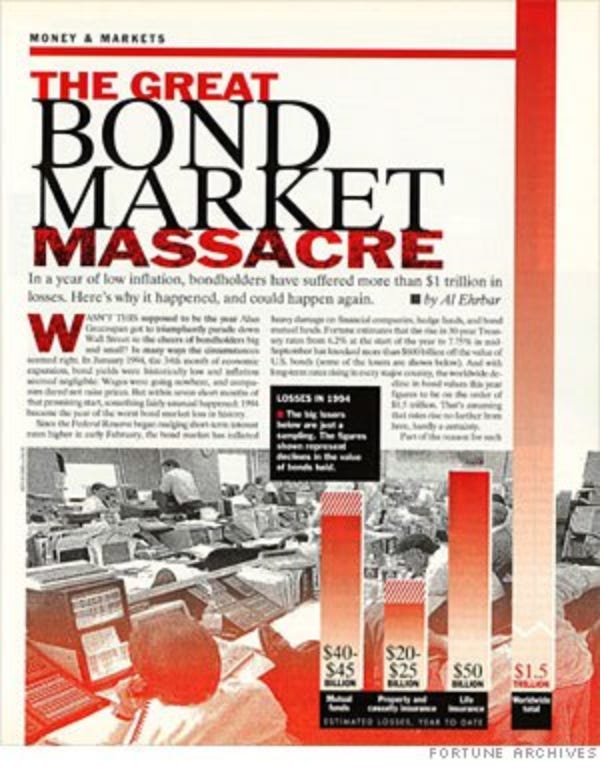

Between October 1993 and November 1994, as bonds sold off, 10-year Treasury yields climbed from 5.3% to 8.0%, a 2.7% spike in 13 months. From January to November 1994 analysts estimated that holders of bonds suffered a $1 trillion loss. Treasuries lost about $500 billion, corporate bonds lost $300 billion and municipal bonds lost $200 billion. Investors suffered losses. So too did brokers who held fixed income assets in inventory. Profits in the security industry plunged from $8.6 billion in 1993, which was a record year, to $1.8 billion in 1994.

What became known as the bond market massacre”, took place amidst the political turmoil surrounding the first Clinton term and the rise to power of Newt Gingrich and the new right in Congress.

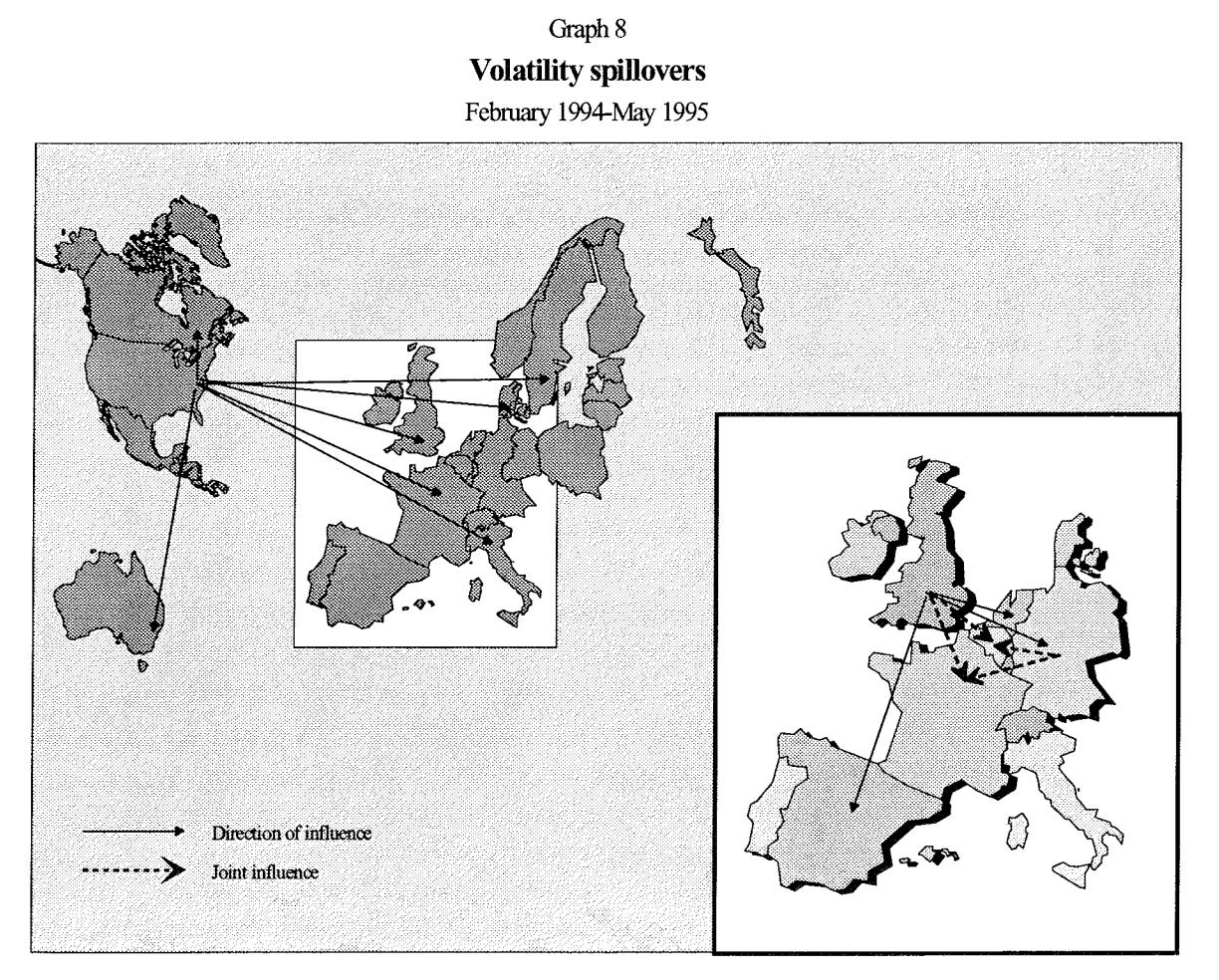

As an early BIS study by Borio and McCauley showed, in 1994 the volatility spread from the US around the world.

It was in the wake of this experience, in November 1994, that James Carville, Clinton’s legendary political advisor, ruefully remarked: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”“

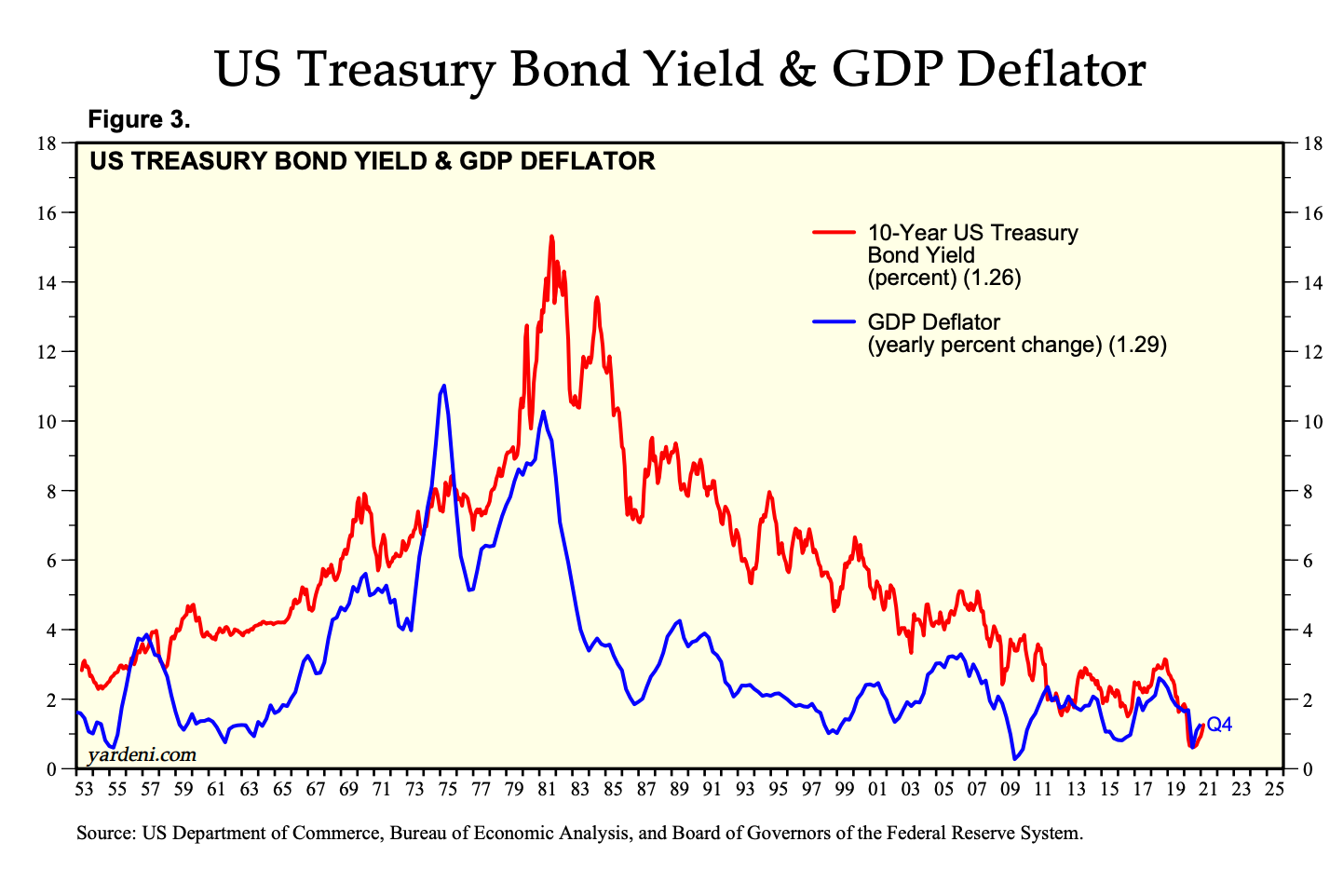

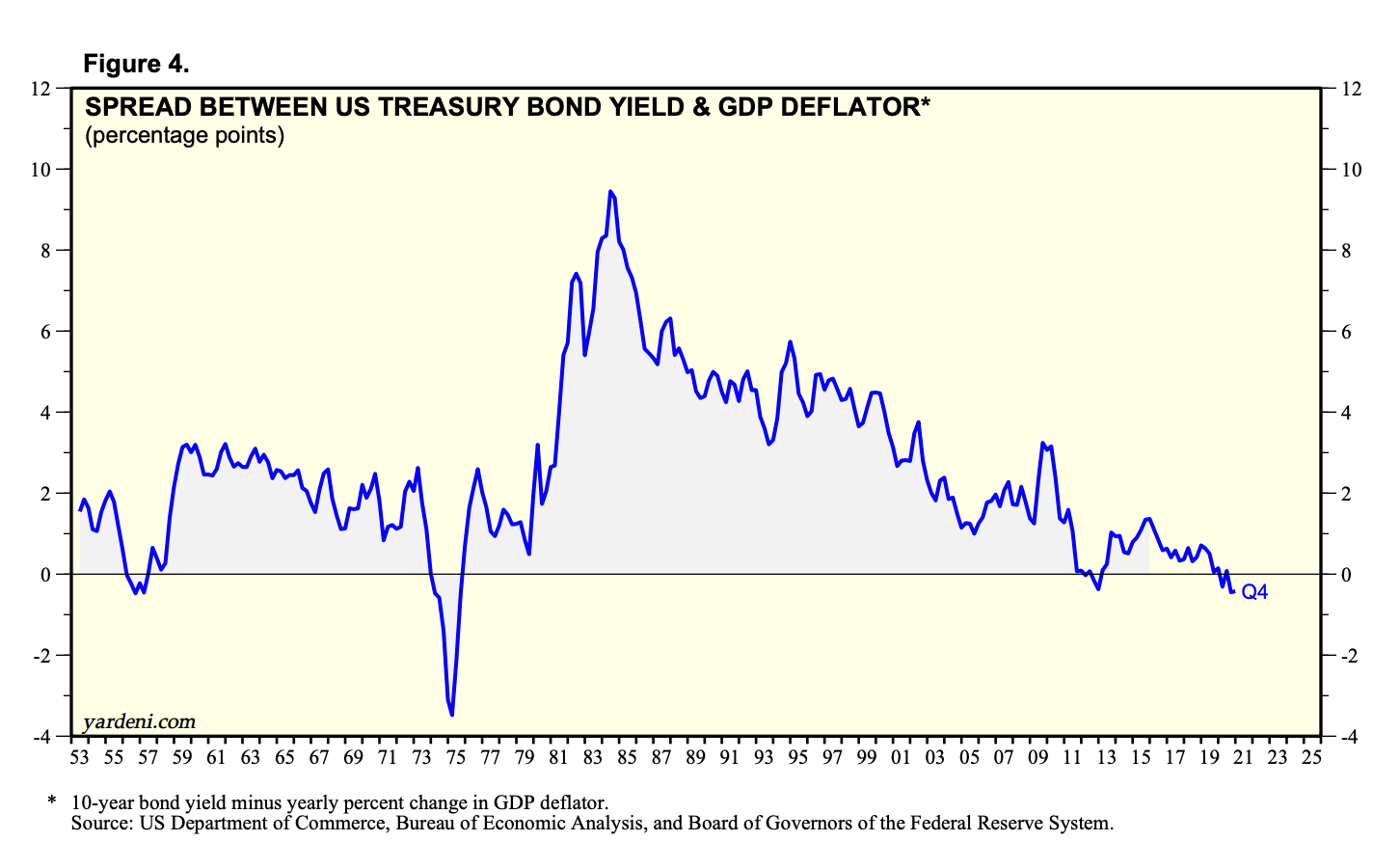

The interest rate shock of 1994 certainly scarred the Clinton administration. But when viewed against the long-run trajectory of US interest rates and inflation you have to know what you are looking for to identify it as a significant moment.

Source: Yardeni

Furthermore, 1994 was not a spontaneous bond market attack. It too was triggered by the Fed.

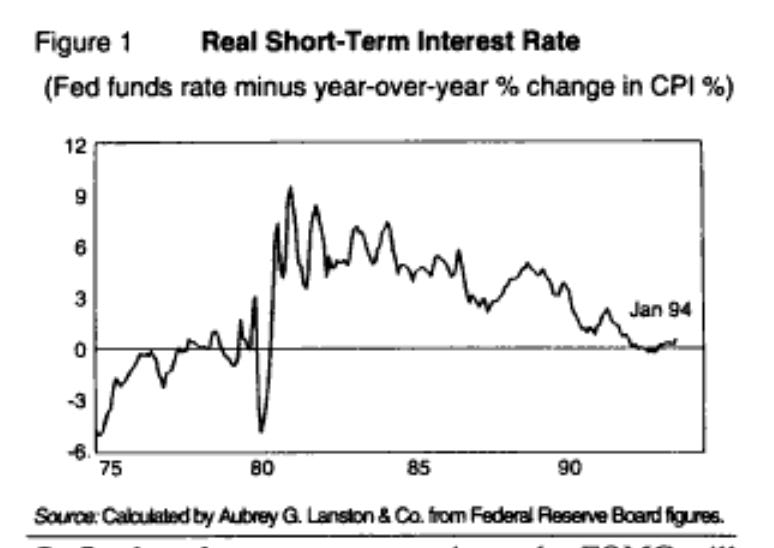

In the summer of 1993 Alan Greenspan had become worried about the acceleration of inflation. Even though the Clinton administration in August 1993 had forced through the fiscal consolidation plan that would return the US Federal government to surplus, Greenspan wanted to add further dampening pressure. He was convinced that allowing for inflation expectations real interests rates had fallen to zero.

The series of interest rate increases that began on February 4 1994 capped Greenspan’s victory in the struggle for control over economic policy that dominated the first term of the Clinton Presidency.

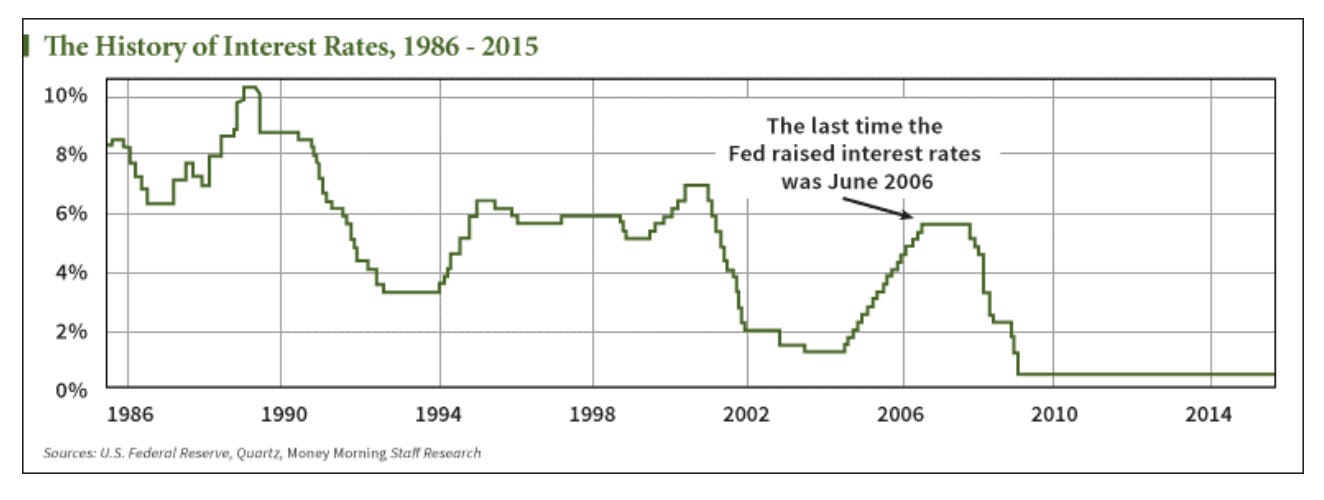

Source: Money Morning

The story is well told by Bob Woodward in his gushing account of Greenspan’s time at the Fed.

Greenspan’s approach was not as draconian as that of Volcker in 1979, but he was raising rates when inflation was around 3 percent and unemployment was already stuck above 6 percent.

Perhaps Carville was merely being polite in not wishing to be reincarnated as Alan Greenspan. If anyone was doing any intimidating it was surely the Fed not the bond markets. It was to gain some political purchase on the Fed that Clinton in the spring of 1994 nominated Alan Blinder as Vice Chair, and Janet Yellen to the Fed board.

Source: NYT

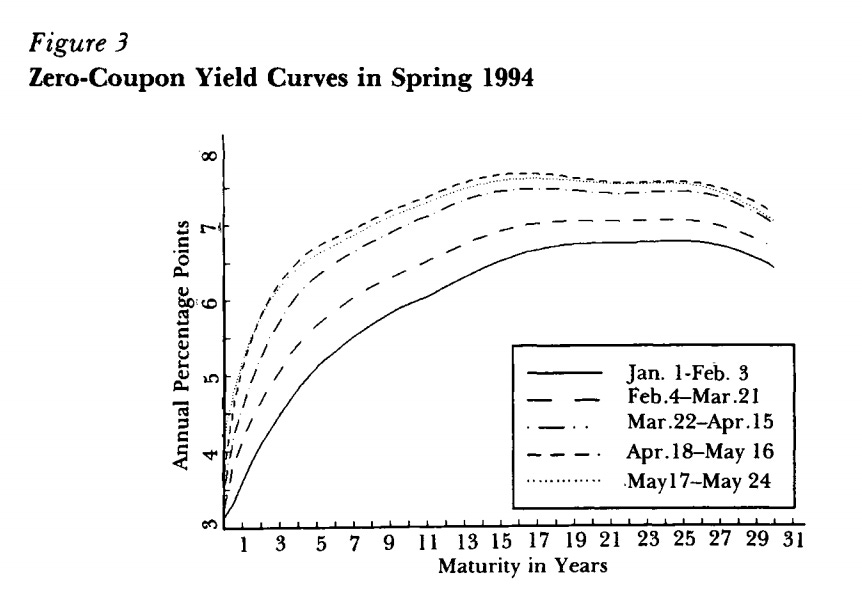

If the tightening of interest rates by the Fed was what Greenspan intended, the shock of 1994 consisted in the dramatic bond market reaction. What particularly surprised economists, is that the rise in rates happened across the yield curve.

This was surprising because the Fed acted on the short end and a commitment to stop inflation ought to have made long-term bonds more attractive. But, in fact, bonds sold off across the entire curve, driving up long-term yields as well.

Source: Campbell 1995

As far as I have been able to find, the economic literature on this moment is scanty.

To explain the savage reaction of the markets there are two main explanations. One is that the markets took Greenspan’s decision to raise rate as a signal that the Fed had inside information about future inflation risks to which the market was not privy. If the Fed was raising rates then it was time to sell bonds. The alternative explanation is that the Fed’s intervention raised uncertainty about the future course of policy and this raised the premium that investors required to justify holding bonds of any kind.

Both are plausible. They are hard to distinguish from each other. Neither neatly conforms to Yardeni’s image of dauntless bond investors enforcing the financial law where government authority has collapsed.

Especially in light of the fact that the Clinton administration was in fact committed to fiscal consolidation, it seems less like a case of vigilantism than one in which bond markets piled on to the pressure being applied by Greenspan. What the Fed did not reckon with was how large that reaction would bee. In any case, the interplay between the bond market, Greenspan and the Fed was clearly crucial.

In November 1994 a new breed of radical Republican swept the House. Newt Gingrich emerged as the dominant figure in Congress. Even if the Clinton administration had not been committed to fiscal consolidation, that did the trick. The era of “starving the beast began”.

One is left wondering whether there are in fact any actual examples of true bond market vigilantism in the American case. And if not, what the rhetoric is really about. Is it a little bit like the right to bear arms? Is it a form of preemptive bullying on the part of market heavies?

In any case, the historical record suggests that US bond markets do not act alone. They exist in a massively reflexive relationship with fiscal and monetary policy, which has taken on new dimensions in light of three historically novel facts: first the huge scale of Federal government debt, second the emergence of repo markets as central to the new model of market-based finance and third the hyperactive role of central bank intervention.

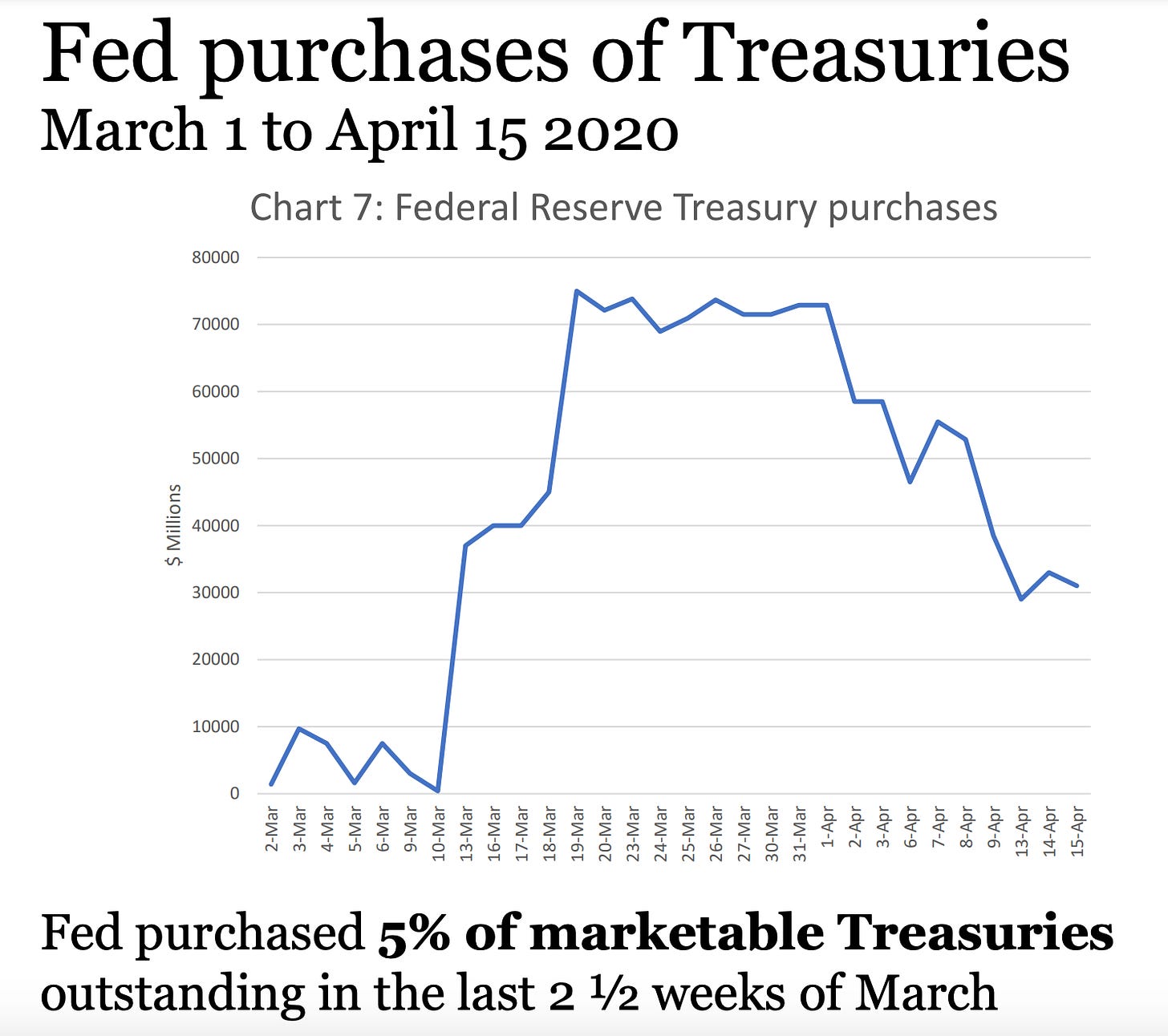

As Carolyn Sissoko has recently reminded us, in March 2020 the Fed bought a staggering 5 % of the entire stock of marketable Treasury securities in the space of just over two weeks.

In light of that kind of firepower, talk of wild west vigilantes can only seem quaint. If market forces have sway it is because they have been invited in.