Low skills levels are a…

Low skills levels are a major drag on the slower moving European economies and even on Spain. @OECD @paul1kirby h/t… https://t.co/ETveFgcr6A

Low skills levels are a major drag on the slower moving European economies and even on Spain. @OECD @paul1kirby h/t… https://t.co/ETveFgcr6A

Classic clerical and skilled manual occupations have shrunk sharply in Europe over the last twenty years.… https://t.co/xDcsYZq4Jt

@joesmith323 @SoberLook v interesting question. would like to dig into this. check out @SoberLook for cite.

3.1 % growth for fifty years: All talk of local deindustrializations has to be checked against this basic fact abou… https://t.co/kiFMCetTDz

Over the next five years the US government will be the only globally significant issuer of widely traded “safe asse… https://t.co/9VBZxWLndX

Investment in oil&mining is tiny & of US GDP. But since "much of the economy is on autopilot, … big swings at the… https://t.co/Y98YB9HLOQ

Will the yield curve invert next year? @DeutscheBank is worrying. h/t @SoberLook Generally this is a trigger for cr… https://t.co/AQeFa4j7Ge

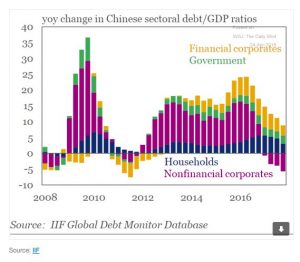

Growth in China’s "social credit” (broad based measure of credit creation) is now running at “only” 12 % PA. That c… https://t.co/csPOE61isO

Outside its sprawling financial sector the Chinese economy is deleveraging. @SoberLook @IIF https://t.co/syEPkXyM3c

After months of good news the EZ outlook is now heading in the other direction. @SoberLook https://t.co/KXCnrkO6Y9

@Birdyword Thanks Mike. I really hope you enjoy.

"None of this math will matter if capitalism is broken.” And that is the upside! Otherwise @jmackin2 thinks that US… https://t.co/RPi8mDAGag

There are European welfare states and then there is everyone else. For all the talk of neoliberalism, austerity and… https://t.co/QT87Z3d1FH

“Postwar” for some, more war for others! Number of conflicts that European countries have been involved in since 19… https://t.co/XSYH7aoZ9Y

The first migration map I ever made, this visualisation shows the key international migration flows in NW Europe in… https://t.co/1yhvszMU6H

The spread of "European Ancestry” worldwide. If the definition were to include those of Turkic descent the spread w… https://t.co/WFcWDwWiUv

Heading back to Texas? What it looks like when a trade war interrupts a shipment of sorghum to China. RB Eden chang… https://t.co/VnT4F9GuJa

In face of falling rupee and anxious bond markets, India is going "Asian EM": building a huge forex reserve.… https://t.co/9m7YEuNSs5

17 year squeeze: UK real earnings are not now expected to recover to pre-2008 level before until 2025. There is no… https://t.co/qKQm8qIazr

In the last 12 months 197,000 more people flew out of Puerto Rico than flew in = 140,000 above trend. @SoberLook… https://t.co/kz2YhNqAHB

Collapse in Venezuelan production is key to OPEC’s success in restricting production and propping up oil prices.… https://t.co/rAJE53khi7

Amazon is three companies in one: tech-retail-logistics. Its median worker worldwide makes an annual salary of $28,… https://t.co/rNO8JZuSlC

Ten years on from the crisis, the international dollar operations of global banks outside the US are, as ever, heav… https://t.co/oyabF781JR

The global dollar bond market has boomed but bank credit in $ from non-US banks is still the main source of elastic… https://t.co/ecHUS9FBNM

What’s Mandarin for Run on Repo? Chinese investment vehicles are growing and committing larger share of portfolio t… https://t.co/0bmGYGGex9

Will US authorities allow Chinese shipping giant Cosco to buy out Orient International which controls 11 % of US im… https://t.co/U4nutp5DsH

Shadow banking with Chinese characteristics: IMF GFSR tries its hand at mapping the undergrowth.… https://t.co/i2toKkAuyp

The sources of credit for highly indebted poor countries are shifting dramatically. For all the skepticism on Sino-… https://t.co/hxDXtwAPmk

Which EM are most exposed to professionally managed fund investors? https://t.co/jTVAmgzDD7 https://t.co/lZmN3OegA6

Power dynamics of bond market: Seems reasonable to assume that sovereigns most at risk of classic bond vigilante at… https://t.co/mJ5Edh9j1o

Debt crises in the making? 2017-2018 is a record period for sovereign international bond issuance. Double issuance… https://t.co/4uCSNFKLWH

The market for synthetic CDO is not what it was, but it is coming back! https://t.co/jTVAmgReuF https://t.co/R09RUzN30O

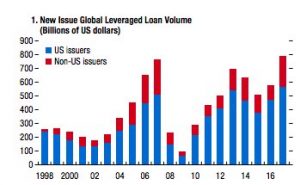

Should we be worrying about the leveraged loan boom both in US and ROW? The IMF is! https://t.co/jTVAmgReuF https://t.co/bI0ECWUpWX

Energiewende? 8 years on from Merkel’s big energy policy initiative Germany not even in top 10 of @McKinsey_MGI ene… https://t.co/GyLJTEhdKn

15 percent of global bonds are still in negative yield territory, helping to trigger demand for risky assets and se… https://t.co/v3xhZWOQUp

When we talk about the rise of Asia it is worth remembering that 85 % of India and 50 % of China cannot access or