Some notes from New York

Rising prices have unleashed an intense debate about inflation risk. Predictably this is particularly intense in Germany. The leadership trio at the helm of the ECB – Christine Lagarde, Isabel Schnabel and Philip Lane – are being tested. At the same time there is a new boss at the Bundesbank. And there is a new German government with an FDP-man (supposedly a conservative when it comes to fiscal policy) at the Finance Ministry. The Finance Ministry doesn’t set policy on inflation, but defining the terms of the inflation debate helps, at the same time, to set the terms for the debate on fiscal policy – more/less stimulus. This is also, inevitably, a war of position between different personalities and institutions in Germany’s increasingly diverse economic policy landscape.

The polite end of the conversation are interventions by accredited members of Germany’s official board of economic advisors, such as Volker Wieland, in the pages of the FAZ, asking for urgent ECB action on interest rates.

Wirtschaftsweiser: Wieland fordert von EZB Zinserhöhung schon 2022https://t.co/t5XRyEespB

— Gunther Schnabl (@GuntherSchnabl) January 17, 2022

Then there is Germany’s tabloid Fox-style Bild Zeitung (Circulation c. 7.8 million. By far the most influential daily news source in Germany).

*** Neues aus dem Populistenzirkus ***

— André Kühnlenz (@KeineWunder) January 17, 2022

Rote Ecke: Hr Doktor Krämer @DrJoergKraemer

Blaue Ecke: Fr Professor Doktor Schnabel @Isabel_Schnabel

Ratet mal, warum wer den Titel im Handle trägt? Alle Fachfragen & der verschwundene Diskussionsstil wurden eh am Wochenende geklärt👉🧵 pic.twitter.com/bT9M3xLmGG

In the corner of the inflation-hawks the stalwart chief economist of Commerzbank Dr Jörg Krämer and on the other side Isabel Schnabel of the ECB who is accused of disregarding the inflation threat. Schnabel has been regularly singled out for attack by the Bild Zeitung. “Your saving are in for it, when SHE (sic) is minding our money” (Wehe dem Sparschwein, wenn SIE über unser Geld wacht!) screamed one headline.

“This woman makes German savers tremble”. The relentless scare-mongering and the relentless emphasis of Dr Schnabel’s gender are typical of Bild coverage.

But banging the inflation drum is by no means confined to the populists. In September, Schnabel called out a large slice of the German media for their sensationalist reporting of the inflation numbers.

As Schnabel noted:

It is therefore important to offer a factual explanation for the recent price increases and an assessment of future risks, especially in Germany where many supposed experts and the media are again rousing people’s fears without explaining the reasons behind the price movements (Slide 5). Allusions are being made to conditions in the Weimar Republic. Comparisons are being drawn to the 1970s, when inflation in Germany was almost 8%. And there are warnings of a “meltdown” and a “runaway train” if interest rates remain low.

Schnabel has allies. Notably, Marcel Fratzscher of the DIW. In October he delivered this fantastic mega-thread on how not to think about rising inflation.

Die #Inflation von 4,1 % im September löst viel Empörung aus. Der Schuldige ist für manche in 🇩🇪 klar: es ist die #EZB, die die Inflation in die Höhe treibt und die #Sparer „enteignet“.

— Marcel Fratzscher (@MFratzscher) October 2, 2021

Der Alarmismus ist falsch, manipulativ und schädlich.

Ein Thread mit Zahlen und Fakten: pic.twitter.com/2eSDyV8Nsp

Another source of good sense is André Kühnlenz @KeineWunder who is an essential follow on the entire German-speaking world, Eurozone and more. Here he is, calling out TV and radio coverage of the inflation story.

In diesem Sinne, liebe Kollegen von @boerseARD @DLF @heutejournal @ZDFheute, schaut doch mal genauer hin, welche *Experten* da wirklich Eurem demokratischen Auftrag aus der Zivilgesellschaft nachkommen… Wär schon cool… 😎 10/10https://t.co/kmVgPudqgW

— André Kühnlenz (@KeineWunder) January 17, 2022

In this spirit, kudos to Die Zeit for publishing this well-balanced exchange between Philippa Sigl-Glöckner and Hans-Werner Sinn. This doesn’t imply that I favor “two-siding” this story. But, in this particular instance, “balance” is commendable.

Besser als Kaffee um den Puls auf Touren zu bringen: Eine Diskussion mit @HansWernerSinn zu Inflation, Schulden u dem Arbeitsmarkt moderiert u verständlich zu Papier gebracht von @lisakatharina u @schieritz. Danke an Sie alle, das hat großen Spaß gemacht! https://t.co/PxI7R9e9YM

— Philippa Sigl-Glöckner (@PhilippaSigl) January 13, 2022

Somewhat surprisingly given the intensity of this fight, Schnabel actually helped to stoke the fires by taking up the question of “greenflation” in a recent speech. That led to a lot of exaggerated and hypothetical talk about how the energy transition was going to necessitate a more hawkish central bank stance. The energy transition is taking its sweet time. But, for largely unrelated reasons, gas prices have gone haywire. Putting two “and x” together it is easy to arrive wherever you fancy.

The following weekend, Schnabel took the pages of the Süddeutsche Zeitung to clarify her stance. The SZ is generally regarded as a liberal paper. The tone of the questions gives a pretty good idea of how tough it is being a central banker in Germany.

At the same time, Lagarde reassured the Handelsblatt that she was serious about inflation too.

As the excellent Sebastian Dullien points out, one of the real mysteries in the current moment is the fear of a wage-price spiral.

Yup. I am really wondering where some people get the idea of a price-wage spiral in Germany from. https://t.co/1pxKy9SOZr

— Sebastian Dullien (@SDullien) January 14, 2022

As @heimbergecon explains there is nothing in the wage data for the Eurozone to suggest such a spiral.

While many continue to worry about higher inflation in the €zone and predict a wage-price spiral/accelerating inflation…

— Philipp Heimberger (@heimbergecon) January 14, 2022

… the Eurozone wage data so far clearly reject this story, as wage growth remains muted.

Chart with the most recent data via @OliverRakau. pic.twitter.com/WqKwYB6h6D

For a wage-price spiral to be operative what you would need is pressure not just on wages, but on unit labour costs (wages adjusted for productivity) and even the Bundesbank does not actually fear that for 2022. On the contrary, the outlook for the growth of unit labour costs in 2022 is a miserable 0.2%!

Wichtig für Lohndruck auf die Inflation sind nicht die Arbeitnehmerentgelte/Tarifverdienste an sich, sondern die Lohnstückkosten (Risiken gibt es bei >+2%): Also um wieviel die Löhne stärker wachsen als das BIP… Für Deutschland sieht die @Bundesbank 0 Risiko 2022… #K_Notizen pic.twitter.com/ukBPZeTMOA

— André Kühnlenz (@KeineWunder) January 12, 2022

The real issue, as Marcel Fratzscher points out, is not so much inflation per se, but the distributional issue of how families on low incomes cope with a surge in the price of key consumer goods.

Die #Inflation in 🇩🇪 lag 2021 bei 3,1 % und sinkt wieder (0,2 % MoM im Dez). Das ist zu hoch,aber kein Grund zur Panik.

— Marcel Fratzscher (@MFratzscher) January 7, 2022

Die ungleiche #Verteilung ist das wirkliche Problem:steigende Mieten, Energie- und Lebensm.preise für Menschen mit geringen Einkommen. https://t.co/M2hB4FI6TN

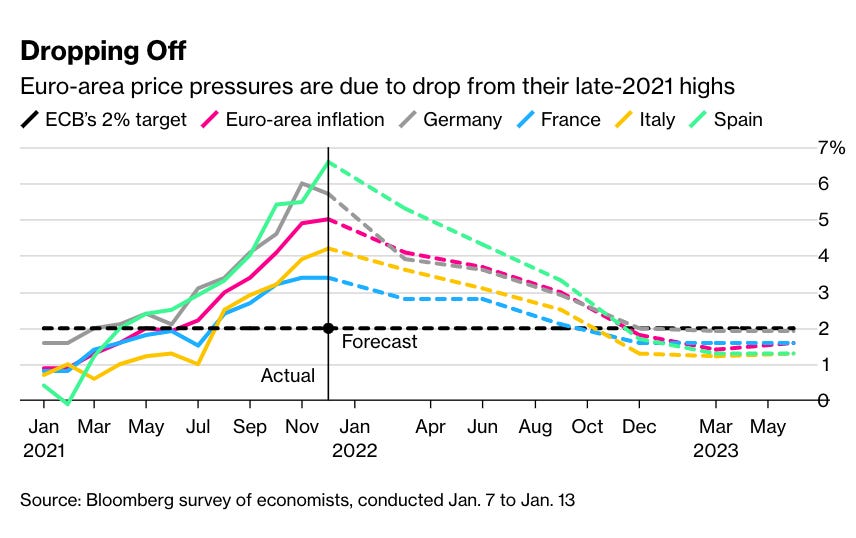

For Europe as a whole, the latest surveys of Eurozone economists suggest a rapid deceleration of inflation in the course of 2022. As Bloomberg reports: “The worst may over for firms and households feeling the pinch of higher prices in the euro area as inflation is fading from a record high.”

But every day the battle goes on. In this thread Fratzscher and Schnabl trade blows over the question of the symmetry of the ECB’s inflation target.

Ein widersprüchliches Argument von @WielandVolker: die #EZB solle Inflationsprognosen ignorieren und sich nur auf die #Inflation heute stützen,obwohl sie diese heute fast gar nicht, sondern nur für die nächsten 1-3 Jahre beeinflussen kann.

— Marcel Fratzscher (@MFratzscher) January 17, 2022

So würde die EZB der Wirtschaft schaden. https://t.co/jDvX1UpX0R

It is going to take time for a lot of German commentary to assimilate the idea that the target really is 2 percent not LESS than 2 percent. Watch this space.

*****

I love putting out Chartbook. I am particularly pleased that it goes out to thousands of subscribers around the world for free. But it takes a lot of work. If you would like to contribute to the cause, sign up for one of the subscription options here.