On the US inflation debate in January 2022

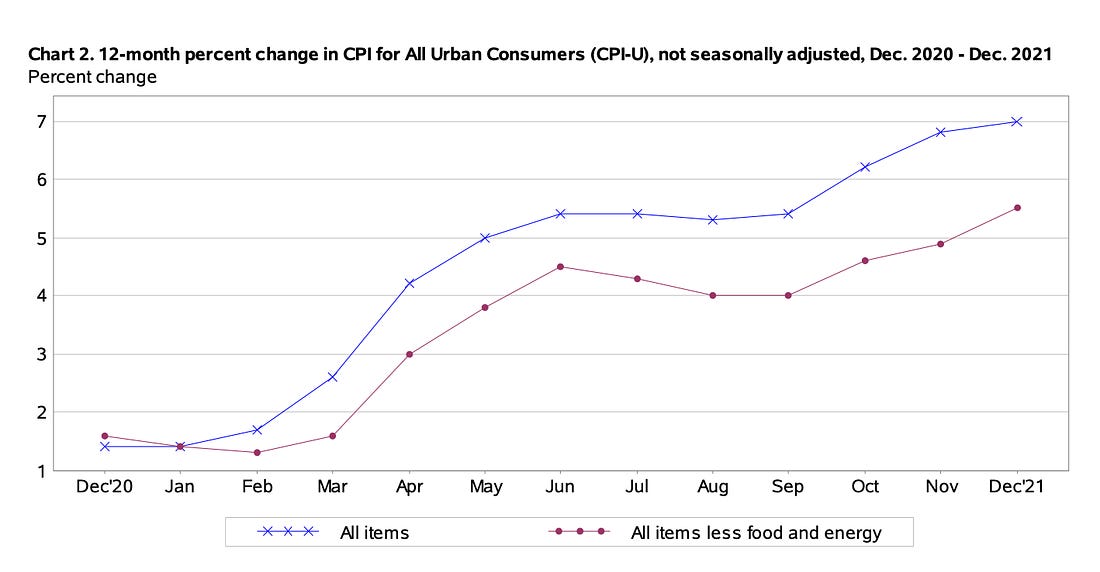

After the record series of “prints” for US CPI inflation in October, November and December 2021, there was a sense that the balance of policy argument had shifted. Inflation could no longer be dismissed as a temporary aberration. “Team transitory” and “team sectoral” were on the ropes.

From around the US economy, there was a rash of more or less amusing stories about shortages of essentials, like baking goods.

The Omicron wave got everyone baking again.

— Joe Weisenthal (@TheStalwart) January 18, 2022

At the grocery store, baking categories of goods have seen the highest level of stockouts lately https://t.co/XdijFoiawA pic.twitter.com/03nwXVsIQm

And a BBQ-crisis in Texas.

Wtf I’m a hawk now https://t.co/RvLUpshgYo pic.twitter.com/Y1TMQ1a9t5

— Joe Weisenthal (@TheStalwart) January 17, 2022

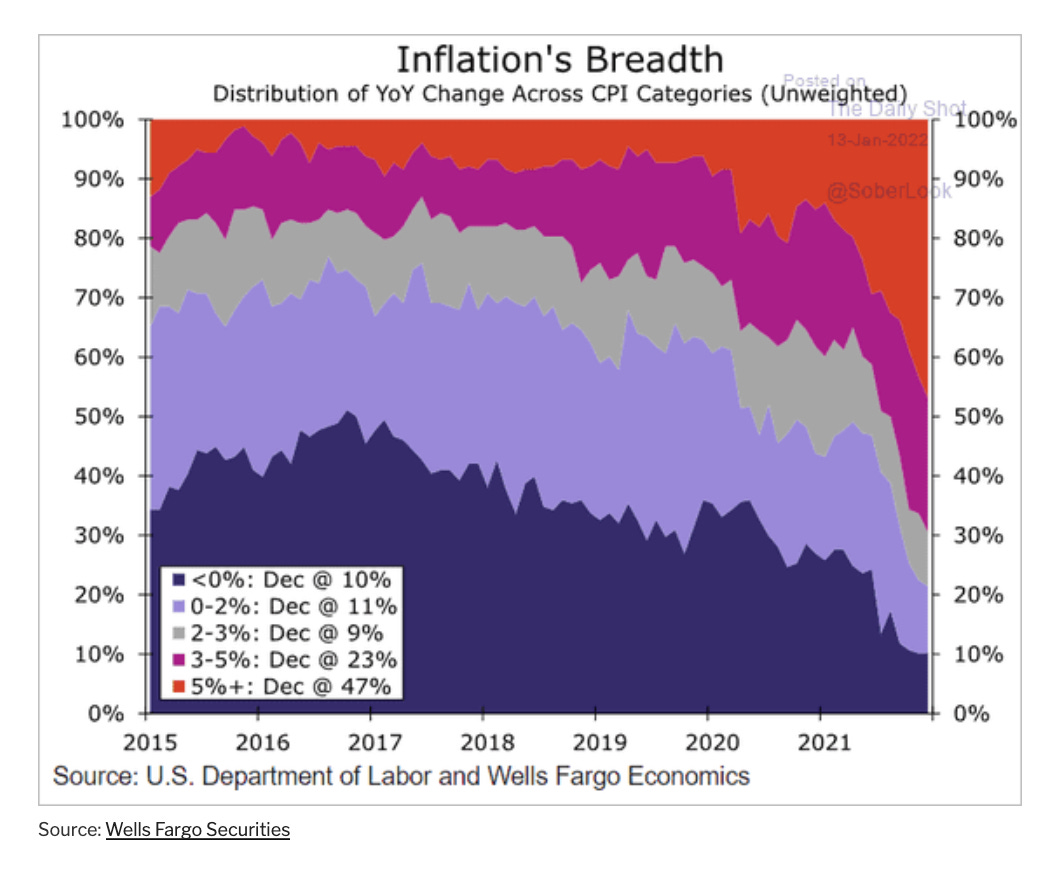

But the real source of concern was that inflation may no longer be confined to particular sectors. It may be becoming broad-based.

The share of CPI components rising by more than 5% has surged.

Source: Daily Shot

If the price rises are becoming a truly broad-based macroeconomic process embracing much, if not all, of the economy, it is time for the Fed to act. A monetary policy signal – a rapid ending of asset purchases and a move to raise rates – is essential to ensure that inflation expectations remain anchored and this post-COVID price adjustment does not become a general landslide. Policy Tensor has been as vigorous, as ever, in making the case for Fed action.

Policy Tensor

The Term-Structure of Inflation Expectations

Policy Tensor

Some interesting pushback from folks on econ twitter. People seem convinced that the current bout of inflation is broad-based. That result can hardly be argued with: But people seem to be less convinced that the current bout of inflation is not transitory but persistent. I am not a fan of the transitory vs permanent team sport. The issue is not inflation…Read more

For a less econometric, political economy approach to the inflation process, check out this excellent thread by Max Krahé of the Berlin think tank Dezernat Zukunft. He applies it to Europe, but his logic on how sectoral and distributional struggles might, or might not become a general inflation applies to the US as well.

THREAD: It's a distribution- not an inflation time bomb that's ticking.

— Max Krahé (@maxkrahe) January 19, 2022

Why? In Europe, inflation is sectorally concentrated, esp. in energy & food. It's bottleneck- (and savings-overhang-), not wage-driven. We're temporarily poorer than expected. (1/n)https://t.co/AtfquSNj9x

In Europe, as I argued in Chartbook #71, there is precious little evidence for generalized macroeconomic price pressure. But what about the US? Is the US different?

Clearly, the CPI data for the last few months have been exceptional, but do three rounds of price increases a “general inflation” make? In the last week we have seen a series of heavy-weight interventions resisting this mood-swing. Team transitory is not throwing in the towel. It is coming back strong.

For starters, it is worth reminding ourselves that a degree of modesty in making any firm predictions is called for. As this excellent thread by Dom White from December spells out, no one has a good model for our current situation.

I’ve spent a lot of this year thinking about inflation, so thought I’d write a little thread trying to summarize some of my thoughts. If you can’t be bothered to get to the end, the punchline is that there’s still a load we don't understand …

— Dom White (@DomWh1te) December 20, 2021

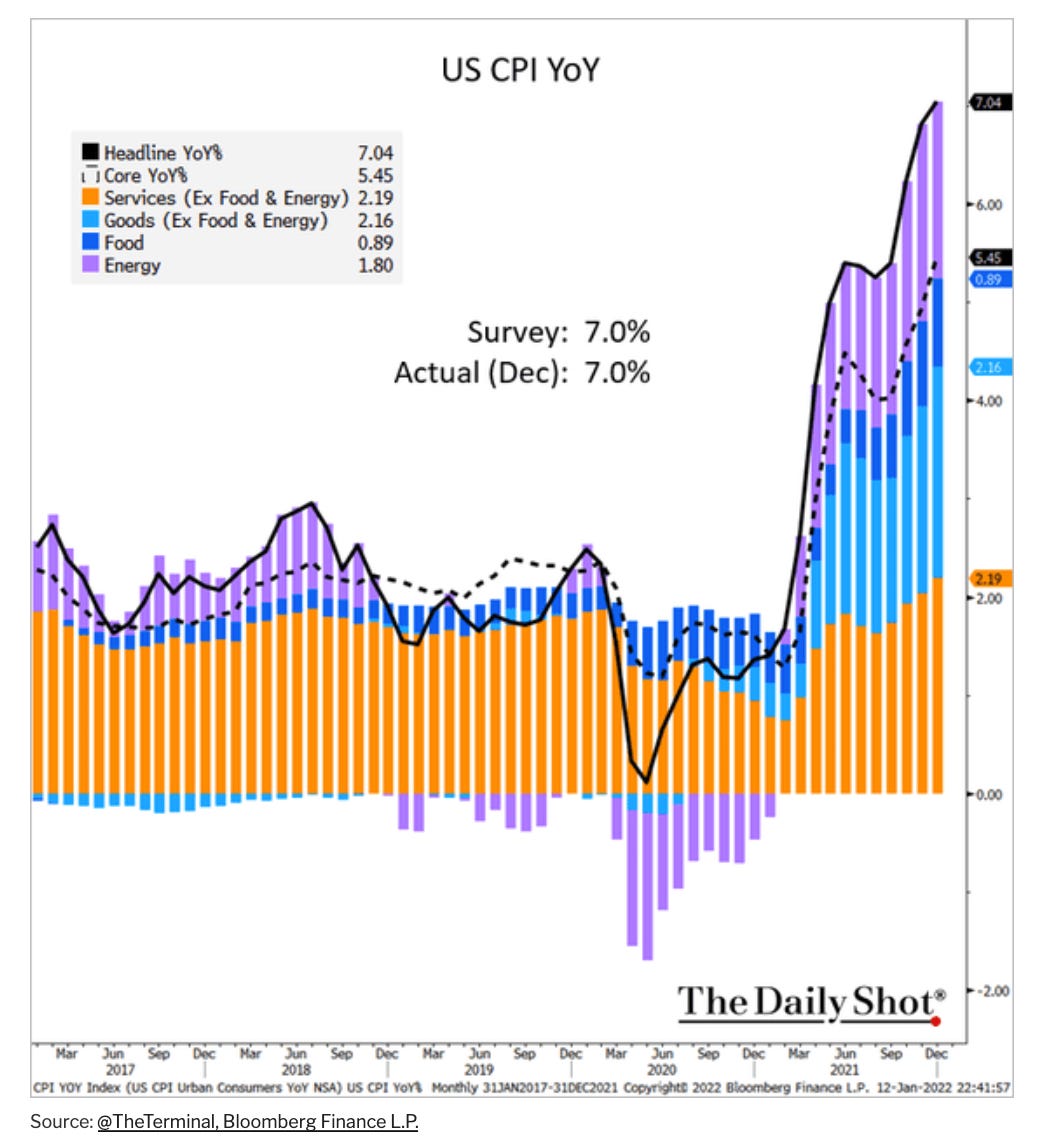

When the December CPI numbers were released, the Council of Economic Advisors issued this calming analysis.

About half of the year-over-year headline inflation was due to energy and vehicle-related price increases. 3/ pic.twitter.com/UJ5TeBRQjS

— Council of Economic Advisers (@WhiteHouseCEA) January 12, 2022

Well, you might respond, Biden’s economists would say that, wouldn’t they. So let’s canvass some other well-informed people.

Joe Weisenthal at Bloomberg has been tracking the supply chain story as closely as anyone. He remains unconvinced that we are facing anything more than a transitional shock.

So what exactly is overheating? What’s “too hot?” The most plausible answer is that the speed with which we’ve returned to normal is extremely fast, and that’s taxing the system as a whole. This seems reasonable. It has been an extraordinary rapid bounce back, at least from the perspective of past downturns. And not only has the bounce back been very rapid, consumption patterns have changed amid the bounce back. As everyone knows by now, people are buying a lot more “stuff” relative to services, and as such the price of durable goods has shot up.

One takeaway from all this is that it may be too soon to bury the t-word, “transitory.” Sure, nobody uses the word anymore. Most people seem to be too embarrassed to even say it out loud. But there are still reasons to think that the big upward pressure we’ve seen in prices is related to the rapid journey back to trend and the shift in consumer demand. And it’s important to remember that the rapid journey back to trend is a good thing.

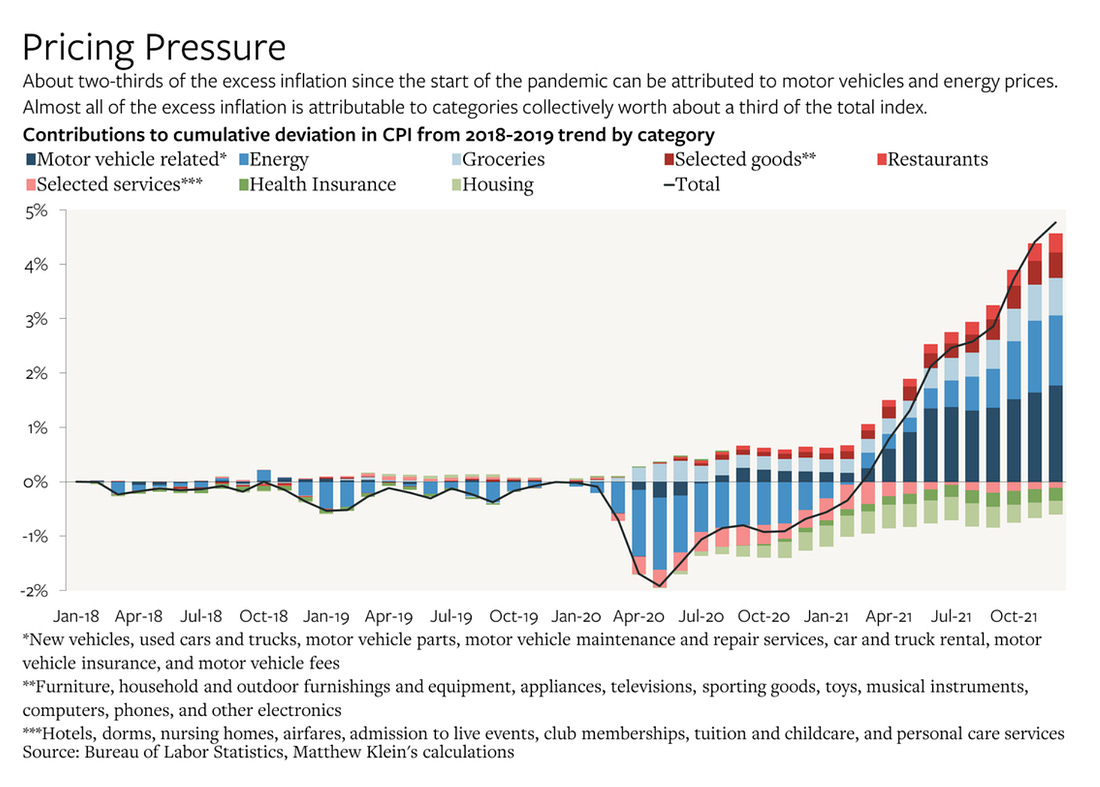

Matt Klein on his Overshoot Substack (Yes, it is pricey, but man is it good! Highly recommended) continued his forensic examination of the data.

Matthew C. Klein

The graph below is key. About two thirds of the deviation of CPI from pre-COVID trend can be attributed to just two categories – motor vehicles and energy prices. Almost all of the excess inflation is attributable to components collectively worth one third of the overall index.

Crucially, as Martin Sandbu makes clear in his excellent recent article in the FT, prices in the service sector, which accounts for the bulk of CPI weighting, have shown little acceleration at all. Normally, inflation in the US service sector runs ahead of the overall inflation rate (there is less global competition). Normally, this is offset by deflation in the goods sector. Exceptionally, due to the COVID-rebound deflation in the goods sector has flipped to inflation, particularly in cars and energy.

The service sector rate of inflation (pertaining to by far the largest part of the economy) remains still largely unaffected by any broad-based inflation.

Source: Daily Shot

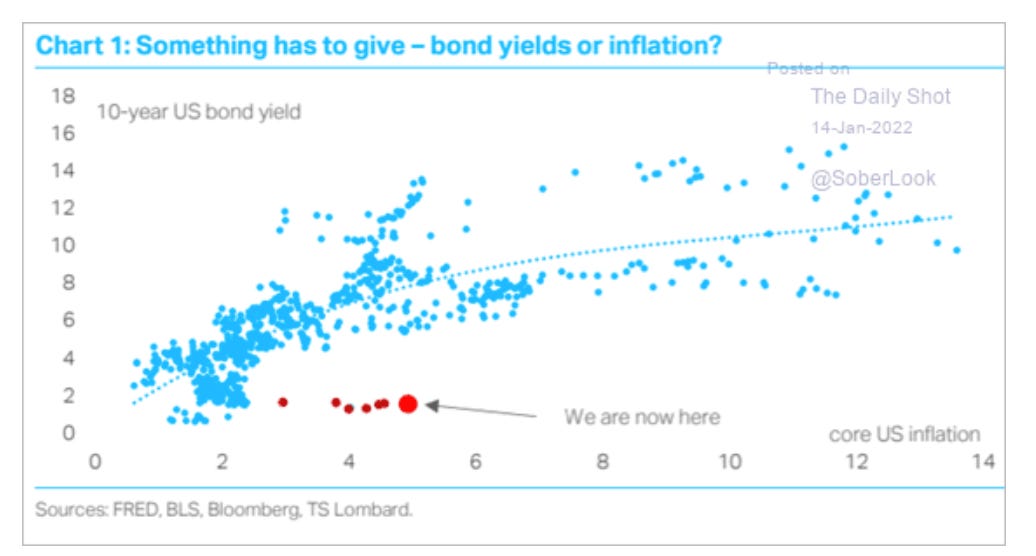

What about the markets? In recent weeks, yields on US Treasuries have twitched upwards. But we are a long, long, long way from the major capital allocators giving any signal that they fear sustained high rates of inflation. The trillion dollar question is what are the expectations on which this stability in the Treasury market is based?

Source: Daily Shot

The question of market expectations naturally points us towards the Fed and the expected interest rate hikes in 2022. But it also raises the question of the “fiscal theory of inflation”. Back in December, the Economist magazine devoted a long article to the idea. Remember back before 2020, in the “before times” when we used to argue that monetary policy was not enough. We needed fiscal policy to break out of secular stagnation, lowflation etc. Well, in 2020-2021 we got a fiscal policy jolt. And it has worked. We have inflation.

John Cochrane is rolling out a major new theory also called the fiscal theory in inflation, which he explains in relatively simple terms in this article. This is worth returning to, but as I read Cochrane, his theory expresses a pessimism not so much about our immediate prospects, as about the long-run consequences of running economic policy with a gigantic public balance sheet. How long will it be before bond holders realize that the public authorities cannot afford to raise rates, inflation expectations become unanchored and an avalanche of bond sales ensues?

This would seem to be a long-term theory of crisis, rather than an immediate theory of the price level. But this may be a superficial reading on my part.

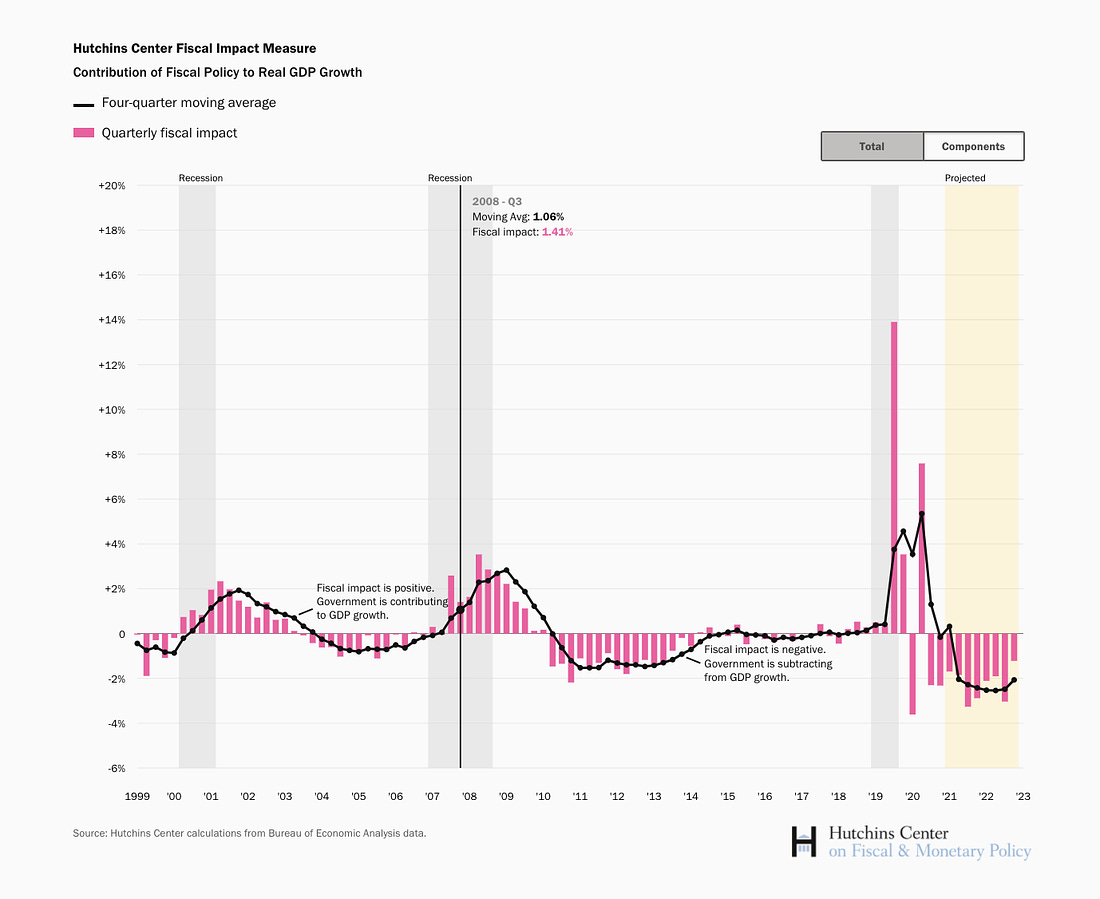

Certainly, in the short-run the outlook for fiscal policy is one more reason to be skeptical about the idea of an accelerating inflationary process. According to the outlook from the Hutchins Center all we have to look forward to is fiscal contraction.

Source: Data Hutchins Center

All things considered, the main reason to worry about inflation may be precisely that people are talking about it. Whatever its effects in the markets, in the political arena inflation talk is not neutral. Inflation tends to hurt the Democrats. Policy Tensor has put together a statistical model here. Inflation worry certainly seems to be hurting Biden and, heaven knows, he has enough to worry about. As I summarize them in this anniversary piece for the Guardian, his prospects are not looking good.

If one takes this argument seriously, then what the Biden administration needs is for the Fed to do the bare minimum necessary to anchor inflation expectations, calm public fears and the markets. Unfortunately, the calm in the markets is now based on pricing in four interest rate hikes. Let us hope that this is not more than the economy can bear.

****

I love putting out Chartbook. I am particularly pleased that it goes out to thousands of subscribers around the world for free. But it takes a lot of work. If you would like to contribute to the cause, sign up for one of the subscription options here.