After a year of political turmoil and financial embarrassment, Britain ends 2022 shaken. There is a new spate of talk about national decline. Once again the UK is falling behind. The outlook is uncertain. It is symptomatic that Perry Anderson chose already in 2020, to author yet another gigantic essay for the New Left Review on the UK.

I generally avoid writing about the UK. My feeling about the country are too conflicted. But the discussion going on right now makes it irresistible. It seems as though half a century or more of debate are once again up for grabs.

Though the British elite had a first attack of nerves around 1900 as imperialist rivals emerged on the scene, the decline debate as we know it today originated in the 1950s, within the frame of US hegemony, at a moment when imperial humiliation in Suez coincided, as Jim Tomlinson has shown with the publication of new comparative productivity figures by the OECD. As Anderson explains, in the early 1960s, the original agenda of the New Left Review – then squarely based in the UK – was to respond to what at the time was a

gathering sense of crisis in Britain. This conjuncture was compounded of a growing realization of economic decline relative to capitalist competitors abroad; popular discredit, amid scandals and divisions, of the Conservative political regime of the period, culminating in its passage from Macmillan to Home; national humiliation at failure in suing for entry to the Common Market, vetoed by France; and widespread disaffection with, and ridicule of, the hierarchical social order presiding over these misfortunes.

Sixty years on, you might think that nothing has changed, at least not for the better. What I am afraid of, and what I fear that the revived talk of decline and declinism obscures, is that things have, in fact, changed, but for the worse.

***

Speaking personally, the question of “whither Britain?” has accompanied me throughout my life. As I will spell out in a sequel to this newsletter, it has indirectly shadowed much of my work. This year I’ve been involved as a Commissioner on the Resolution Foundation’s Economy 2030 enquiry. As a preliminary summation, in July the Foundation produced the Stagnation Nation report. This was put to good use by Will Davies in the LRB, one of the really worthwhile contributions to the current decline debate. The other essential piece to read is David Edgerton’s essay in the Guardian.

We need to talk about the state of Britain, the situation is dire. But the evocation of earlier debates about decline, debates which stretch back to the 1950s and beyond, is not just beside the point. It distracts from alarming novelty of the current situation. If you don’t engage with the data, the incoherence and repetitive structure of those earlier debates about decline, can seem to justify a relativistic or downright apologetic stance. Ding-dong exchanges between Brexiteers and Remainers have not helped to clarify the situation. Whilst Brexiteers chase the vanishing dream of “global Britain”, the national economic collapse that, according to “Project Fear”, was supposed to follow Brexit, never arrived either. That is not to say that the economic impact of Brexit will not be severe. The latest predictions are nasty. See for instance the CER. But the Brexit effects have not yet been fully felt.

More importantly for our purposes, the shock of 2016 cannot by itself explain what really ought to alarm us, namely the astonishing stagnation in productivity and real incomes that now stretches back over more than a decade. This stagnation, and this is the essential point, does not fall into the pattern familiar since the 1950s, of stop-start, of repeated currency crises and of more or less disappointing cycles of growth. Though it takes place at a high level of average income, the current stagnation is unlike anything in the last quarter millenium. The prospect of future damage from Brexit, only renders the outlook more bleak. In light of the UK’s situation and its likely future prospects, to indulge in the familiar back and forth between declinism and anti-declinism is to indulge in escapist nostalgia.

Perry Anderson in his mammoth NLR review of British developments over the last sixty years, asks the right question: is the question of decline still relevant?

How far did ‘decline’, as an organizing framework for analysis of developments in Britain, lose its purchase on them once ‘globalization’ arrived, in the shape of a common deceleration of growth and acceleration of financialization across the advanced capitalist world, with the liberation of capital markets, extension of supply chains and generalization of neo-liberal regimes that set in during the eighties? Could it be said, in Sartre’s terminology, that a double detotalization—of both unit and path of analysis—has since overtaken the particular line of enquiry – into the genealogy of decline – pursued by the journal (New Left Review)? The answer can only lie in the actual record of the economy, viewed comparatively, and of the agency of the state that has presided over it.

On the question of the British state, which occupies most of Anderson’s essay, there is much more to be said. But, on the economy, Anderson equivocates and misses the mark.

After reviewing the profoundly disappointing results of the last 15 years, he concludes:

Between 2007 and 2016, a labour-productivity standstill without historical precedent, at a miserable 0.09 per cent a year, costing an unexampled output shortfall estimated at close to 20 per cent of the pre-financial crisis trend. As for growth, over the same period per capita increase in gdp was just 0.19 a year. So far as renaissance went, Britain was back at square one.

This interpretation of the economy as subject to the recurrence of familiar problems helps to sustain Anderson’s claim that the NLR’s preoccupation with decline is still relevant. Britain’s national economic problems have not been resolved. But this begs the question. Are they the same problems? And is this the same pattern of underperformance?

With his casual gesture towards recurrence – “back at square one” – Anderson gives the game away. The British economy in 2022, is not back where it was at the end of a cycle of modernization efforts in the 1960s, or in the 1990s at the end of the Thatcherite project. That would be a far more optimistic outlook than that which it actually faces today.

For most of the last 60 years when critics have spoken of decline they have tended to exaggerate the extent of the malaise. GDP and per capita income actually continued to increase. In the 1970s they did so quite buoyantly. By contrast, since 2009 there is nothing exaggerated about declinist talk. For a significant part of the British population real incomes actually fell. The shocking novelty lies in the fact that decline and stagnation are not figures of speech, but a literal reality.

In posing the question of decline’s relevance, Anderson suggests that we must choose between an analysis centered on the general tendency towards secular stagnation affecting capitalists societies at large, and a historically rooted account of British decline as a national problem. That choice is false. What we need is an account of uneven and combined development which explains why after several decades of relatively parallel growth, the UK should have suddenly and sharply diverged from its own historical trajectory, including the entire history of the decline debates, and from the trajectory of its peers.

The UK may not be entirely alone in this experience.

In the postwar period, Italy and the UK were part of a convergence club. For Italy that was nothing short of a “miracle”. In 1987 – in the famous “sorpasso” – Italy’s GDP (by some measures at least) overtook that of the UK. The UK elite experienced that same convergence as “decline”. But this was what you might call, decline 1.0, not actual decline, but the experience of being caught up with by more rapidly growing European economies. Today, the UK’s problems are not those of Italy. The two economies are quite different. But, in both Italy and the UK, what we need to account for is not just slow growth, but growth interrupted. What both the UK and Italy are experiencing in the early decades of the 21st century, is something different, not growth-underperformance, so much as sustained stagnation, literal decline and repeated failure to recover adequately from severe shocks.

What we need to explain is something you might call deconvergence. Cumulated over time the alarming prospect is that rather than tagging along in the bottom half of the pack, Italy and the UK may fall out of the convergence club of advanced economies. We are not there yet, at least as far as the UK is concerned. But if current trends are extended further into the current decade, it will become hard to deny that we have entered a new era. To couch the current situation in the familiar terms of declinism and anti-declinism, to suggest as Anderson does that the UK economy is “back to square one”, obscures this reality more than it illuminates it.

***

The extent of Britain’s decoupling from the economic development of other rich countries is well captured by data for median household income per person – a good measure of “average” living standards.

This figure from @TheEconomist tells the story of #BrokenBritain really clearly pic.twitter.com/NmIzUKL48c

— Simon Hix (@simonjhix) December 17, 2022

To see how significant a departure this is from Britain’s own trajectory, data from the IFS are telling. Throughout the period between World War II and 2007, for all the back and forth about decline, real household disposable income in the UK grew relentlessly on a logarithmic curve. Since 2007 that is no longer the case.

.@xiaoweixu_ presents on the "dire" outlook for living standards.

— Institute for Fiscal Studies (@TheIFS) November 18, 2022

Real household disposable income per capita is expected to be a third lower in 2027–28 than we might have expected in 2008. pic.twitter.com/B99nkIQ62U

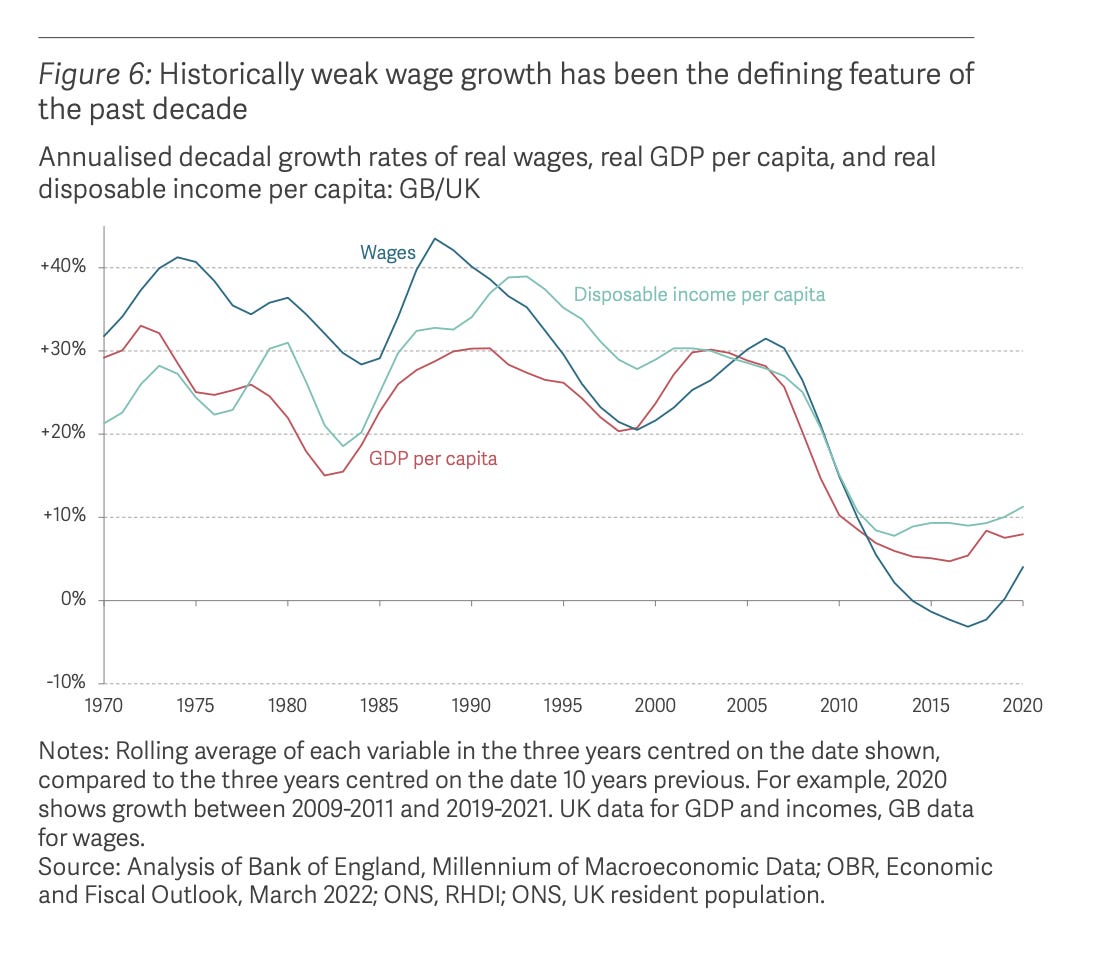

Disposable income is connected by way of complex and contested distributional mechanisms to real wages. Since the 2000s the UK has seen an unprecedented collapse in real income growth.

Source: Resolution Foundation

The collapse in real wage growth mirrors trends in productivity, which again show a sharp break with previous experience.

UK Productivity since 1970. Someone/something broke our economy pic.twitter.com/BB7eVpbtC8

— Richard Jones (@RichardALJones) January 5, 2018

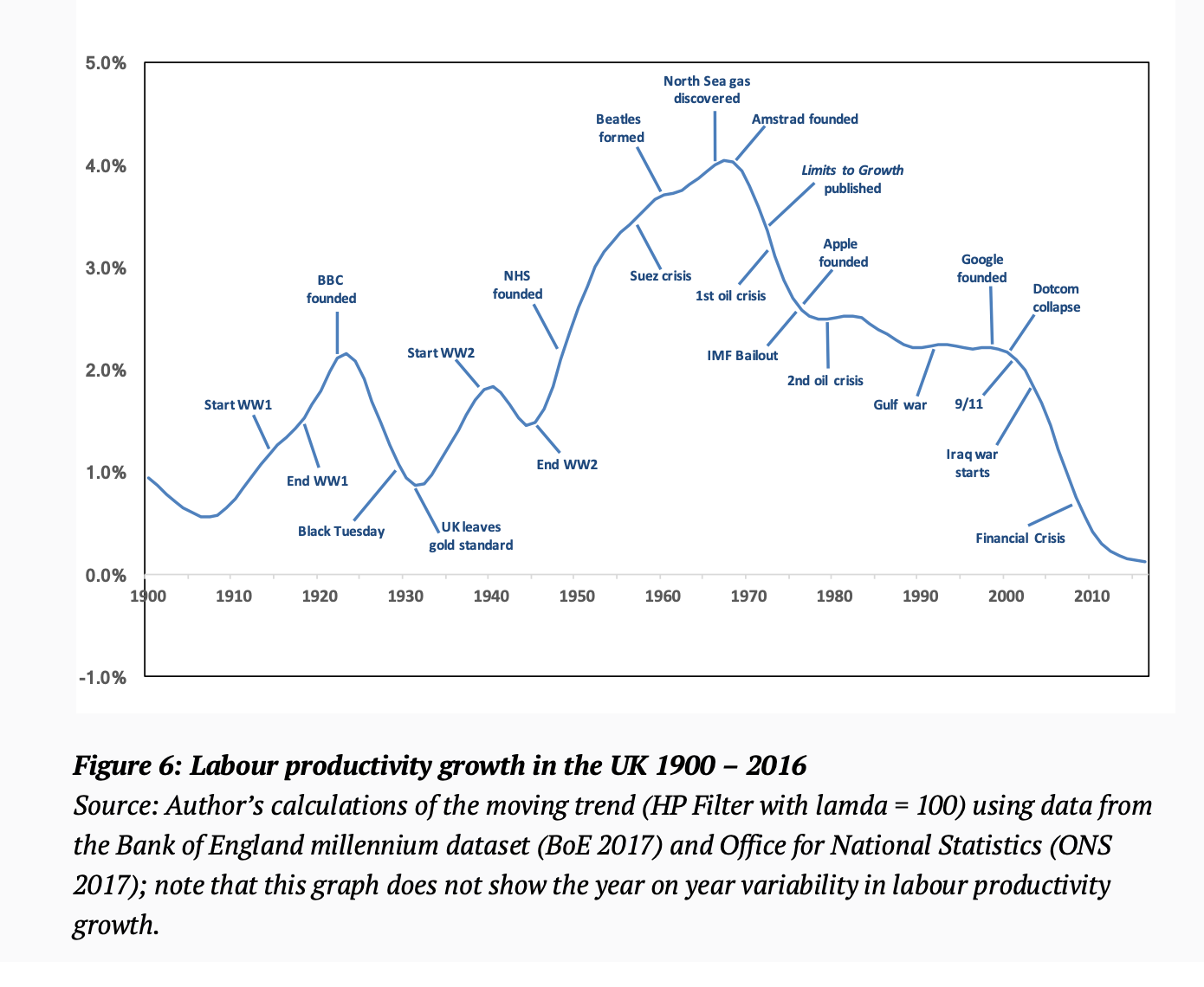

Bear in mind that thee period 1971-2005 includes the entire cycle of 1970s crisis, Thatcherite revival, the shock of 1992, the Blairite revival. Whether the mood was declinist, revivalist or post-declinist, in succession, or all at once, it all averaged out at a steady trend of 2.3 per annum growth in labour productivity. In 2009 that trend snaps and a new era begins of near stagnation in labour productivity.

To see how remarkable this is, look at data not for the last 50 years, but for the last 120 years. We used to talk as though the 1970s brought a fundamental crisis in the British economy. And, clearly, there was a step down in labour productivity growth between the 1960s and the 1970s. Much of the neo-Marxist literature on the underlying crises of capitalism revolves around that Break. It was as nothing compared to the catastrophic deceleration in productivity seen since 2008.

Source: Tim Jackson

Applying a Hodrick-Prescott filter to long-run data, Nick Crafts and Terence Mills conclude that the current productivity slowdown in the UK is the worst not only in the last 120 years, but in the last 250 years i.e. since the industrial revolution of the 18th century.

It is a fundamental mistake, therefore, to conflate the UK’s current situation with earlier periods of concern about relative decline, or to talk as though Britain is back to “square one”, as though its situation was that of the 1960s when the New Left Review kicked off its illustrious run. This is a break on a much more serious level.

***

As Crafts and Mills emphasize. Identifying the break in labour productivity growth is one thing, explaining it is another. Crafts and Mills admit that a complete explanation is elusive.

The most obvious common factor in explaining the UK’s miserable trajectory is that it represents the accumulated consequences of a sustained failure to invest.

But as important as underinvestment undoubtedly is, it does not explain why the problems appeared as sharply as they did around 2008-9. Crafts and Mills point in addition to three more specific factors:

… a combination of adverse circumstances, itself unprecedented, may be responsible for a large part of the evaporation of productivity growth since 2008. The unfavourable conditions include the ebbing away of the ICT (information and communications technologies) boom, the implications of the financial crisis and, in the recent past, impending Brexit.

The first two at least can be related to the combined and uneven development of global capitalism as a whole.

The financial crisis of 2008 delivered a devastating blow to the UK financial sector, which had previously been a driving force of (measured) growth.

As Crafts and Mills point out, the banking crisis of 2008-9 was unprecedented in UK history. Unlike in the United States or Germany, the UK avoided banking crisis in the Great Depression of the 1930s. Furthermore, in the 1930s a new generation of technological innovation – electrification, motorization – gave a dramatic uplift to the UK economy, whereas in the early 21st century, the ICT revolution ran out of steam. As Crafts and Mills report:

the contribution of ICT capital to labour productivity growth averaged 0.82 percentage points per year during 1996 to 2007 compared with only 0.19 percentage points during 2008 to 2018 (The Conference Board, 2019). Similarly, the contribution of TFP growth in ICT production fell from 0.23 to 0.04 percentage points (EU KLEMS, 2017). 6 Cumulated over the 10 years from 2008, this implies labour productivity in 2018 was about 8.5% lower than if the earlier ICT contribution had been sustained

These are factors which affected the UK economy badly, but were common to most capitalist economies. And then, the UK suffered the self-inflicted wound of Brexit, which has further knocked back economic growth and productivity.

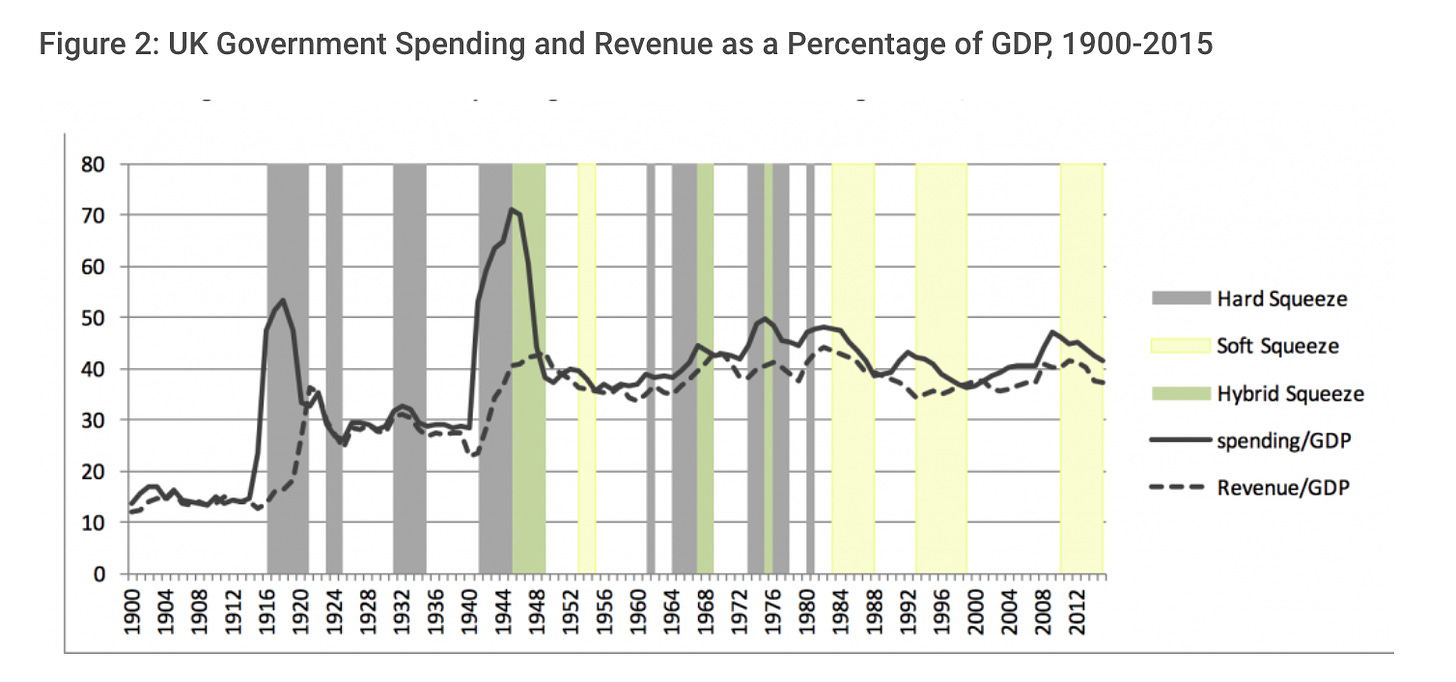

What is missing from the Crafts and Mills account is the factor of public policy. As John Burn-Murdoch of the FT has highlighted in a brilliant dissection of Britain’s current malaise, there is a starkly clear association between party of government and public investment in the UK.

The austerity squeeze of the Tory-led coalition in 2010 was not the first of its kind.

But the key point is that the British economy in 2010 was no longer in the state of earlier decades. The 2008 shock was unprecedented and as Burn-Murdoch emphasizes the shocks that lay ahead were more dangerous.

It would be presumptuous to imagine that we already have a complete explanation for the way in which global and local developments have converged in Britain to produce the deconvergent outcomes of the last 15 years. But it will help if we start by recognizing that this is indeed a new era. Declinist discourse always had an element of temporal confusion about it, but to continue to indulge in that shadow-boxing, in the face of discontinuities that register on the scale not of decades but of hundreds of years, is to reduce political and economic debate to national pantomime.

****

Thank you for reading Chartbook Newsletter. I love sending out the newsletter for free to readers around the world. I’m glad you follow it. It is rewarding to write, but it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, click here: