On December 13 Ghana reached staff-level agreement on a $3 bn IMF credit package. In addition it is seeking to negotiate a 30 percent haircut with private creditors on tens of billions in bonds. Already in September Ghana’s 2026 eurobonds plunged to a record low of 59.30 cents on the US dollar. By the end of October yields had surged to 38.6 %, up from less than 11% at the end of 2021. Meanwhile, inflation is headed to 40 percent and the cedi is the worst performing currency not just in Africa but of all currencies in the world.

You could shrug and say that this is Ghana’s second IMF deal in 3 years and its 17th since independence in 1957. Plus ça change. But it is more than a national crisis. It is the latest sign that the entire model of market-based development financing is in crisis.

The fact that borrowers like Ghana find themselves in trouble at this moment is not surprising. The hiking of interest rates occurs in waves and whenever it happens it hits the weakest. We don’t call it a global dollar credit-cycle for nothing. This year, as the Fed has hiked, the average emerging-market dollar yield has doubled to over 9%. Debt issued by stressed frontier market borrowers has seen yields surging to 30 percent or more.

But to treat the news from Ghana as “just another predictable crisis”, is to trivialize and to fail to grasp the significance of the current moment.

Ghana is an important African success story. In recent times it has been the site of sustained efforts to improve labour practices and the terms of trade for peasant cocoa farmers. In 2020 its stress-free elections contrasted favorably to the democratic anxiety in the United States. Ghana has been praised for its efforts to extend health insurance to 70 percent of the population, topped up with cash benefits for the poorest. Accra boasts a vibrant fashion and design culture. The interior is touted as destination for adventurous trekking tourists.

An ample flow of money was key to this success story. And not just the volume of funding mattered, but how it flowed.

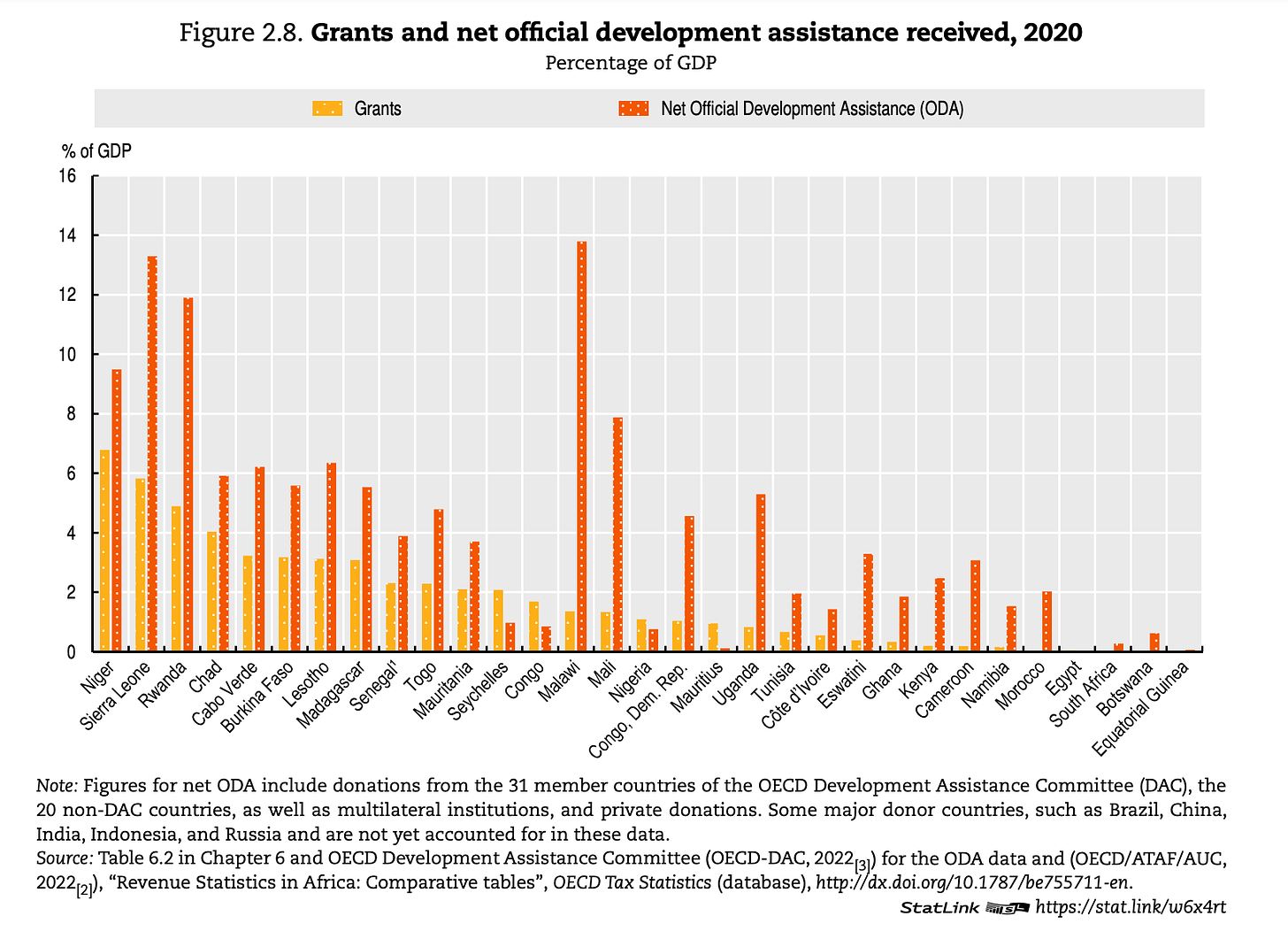

Up to the Millenium, the main form of lending to Africa was concessional bilateral lending by Paris Club members. That ended in the early 2000s with the Heavily Indebted Poor Countries Initiative backed by the International Monetary Fund and World Bank. That wrote down a huge slice of unpayable debt. In the aftermath, new bilateral concessional lending by the Paris group of creditor countries was reduced to a trickle. Instead, led by the United States they have provided support above all in the form of grants and development assistance. This is less encumbering than concessional loans, but it is also restricted in volume. In a substantial economy like Ghana, let alone an economy the size of Nigeria, grants and development assistance are unlikely ever to achieve transformational scale.

Meanwhile, lending by the World Bank and other Multilateral Development Banks has provided a relatively steady flow of funding. But the big new player in the development finance scene is China. At its peak in 2017 Chinese development lending was larger than that of the World Bank. China’s large-scale funding met much suspicion and has now run out of stream. Much of it has had to be renegotiated with stressed borrowers. Which leaves the question. What is the development vision that “the West” actually offers to the developing world? Over the last twenty years, insofar as the West has had a model of development funding, it has been one of public-private partnership: develop the financial infrastructure of borrowing countries so as to enable them to attract funds from private lenders on global markets.

source: @David_McNair

Since 2008 the surge in non-Chinese private lending dwarfs all other funding flows to Africa. In part it was driven by genuine development on the part of the borrowers. But, in the era of quantitative easing, it was also impelled by the search for yield in frontier markets. As QE is replaced by QT and interest rates in the US rise sharply, that funding model that is now in question.

The Ghana crisis matters beyond its immediate impact, because it was the poster child for this model of private finance. Ghana issued its first eurobond for $750mn in 2007 and has since become a leading example of a country financing development through private borrowing abroad. Of Ghana’s total public debt of US$55.1 billion (78% of GDP) in March 2022, 40.2% (US$28.3 billion) was owed to external parties. And of the external debt, about 57% was owed to commercial creditors. Amongst the big names currently holding Ghanian debt are Boston-based Fidelity that holds $94.5 million of Ghana’s dollar bonds. Goldman Sachs Group Inc. and PIMCO have $72.2 million and $68.5 million on their books respectively.

It wasn’t just hype. Ghana has one of the best educated labour pools in Africa and relatively good governance. It is the world’s second-biggest grower of cocoa and Africa’s No. 2 gold producer. It began exporting oil in late 2010. In 2011 growth peaked at 14% pa and rapid growth continued through the 2010s. But with hindsight the early 2010s were the crest of the boom. From 2014 the going for Ghana and other developing economies got rough. Headwinds included the spillovers from the slowdown in China and the 2014-2017 commodities price slump. The budget was thrown out of balance by spending ahead of hotly contested elections in 2012 and 2016 and the economy struggled with a power crisis that locals dubbed the ‘dumsor’.

Despite these difficulties, the administration of President Nana Akufo-Addo, elected in January 2017, initiated a major national development push. The government scrapped fees for high school students. The Ghanaian state also had to deal with an insolvent and fraud-riddled financial system. Between 2017 and 2019, the Bank of Ghana led a reform push that shut down banks, savings and loans, micro-financial institutions, finance houses, and investment institutions. To cushion the shock to financial confidence, the government raised another $3 billion in bonds to pay customers of the defunct banks and financial companies. In 2021, Accra embarked on the restructuring of the finances of the power sector. Crucially, it absorbed the unpaid power bills of Ghana’s state-owned enterprises onto the public balance sheet.

By 2019 the deficit had surged to such a degree that Ghana was forced to negotiate a deal with the IMF. Within months, the conditions of that program were then torn to shreds by the impact of the COVID crisis. Ghana’s situation is truly one of polycrisis.

The lockdowns and border closures of 2020 and the fall of oil prices, resulted in lost revenue to the Ghanaian government of US$2 billion. On top of that COVID-19 expenditures increased total government expenditure by US$1.7 billion, giving a total fiscal impact of almost US$4 billion in 2020. Meanwhile, the promised assistance from rich countries in the form of vaccines and financing failed to materialize.

With inflation surging and interest rates going up, it is little wonder that President Akufo-Addo spoke ominously of a confluence of “malevolent forces”. And this beleaguered situation only intensified in 2022. In February Moody’s downgraded Ghana’s sovereign debt from B3 to CAA1. The finance ministry responded by accusing the rating agencies of “what appears to be an institutionalised bias against African economies”. The government blamed a 50 per cent fall in the cedi on “speculators” and black marketeers.” As recently as October the President insisted that any suspicion of debt restructuring was far from the truth. Bondholders had nothing to fear. Ghana would prove the ratings agencies wrong and honor all its debts.

But the wheels were already coming off the bus. By the summer of 2022 Moody’s estimated that Ghana’s debt had reached 80 per cent of GDP and debt interest payments would take 57.7% of government revenue, which is second in the world only to Sri Lanka on 72.8%. The IMF puts Ghana’s debt-to-GDP ratio even higher at 90.7% compared to only 31.3% in 2011. At least $3.5 billion in loans and bonds come due next year. Bright Simons of the Imani think-tank described Ghana’s most recent budget as a “Frankenstein’s mash-up”.

Unable to access international markets, Ghana’s government has increasingly resorted to taking out domestic loans. But given soaring inflation it has been forced to offer interest rates of almost 30%. When the government risked defaulting on local debt, the central bank stepped in to provide funding thus jeopardizing its own legal lending thresholds.

Nor was the pressure coming only from the financial markets. Surging inflation has fed through to local business and consumers. In October, in the Ashanti region, which is normally loyal to the President’s New Patriotic Party (NPP) party, traders mounted strikes and jeered the Presidential convoy. The protests also extended to Accra’s commercial hubs. The Ghana Union of Traders Association demanded action to address the “free fall of the cedi”. Along with traders, drivers are a key link in Ghana’s economy. After mounting a series of protests earlier in 2022, Ghana’s drivers announced a 40 percent hike in fairs to make up for the spiraling costs of petrol and tires. Perhaps most worrying is the situation in farming where farmers have reduced acreage and switched crops in response to soaring fertilizer prices and the collapsing cedi. The worry is that this will lead to a shortage of maize and spiraling prices for consumers. Faced with this increasing dislocation and uproar, parliamentarians began calling for Finance Minister Ken Ofori-Atta, a former investment banker and Yale-SOM alumnus, to resign.

Finally, in November the government capitulated and announced that it would open talks with the IMF with a view to to securing $3bn in funding that would enable it to produce a coherent budget for 2023. To balance the books it also needed concessions from its creditors. The government wants a haircut and a suspension of interest payments on foreign bonds for three years. Domestic debt investors would be asked to exchange existing securities for new ones with a reprofiled schedule of interest payments rising from zero coupon to 10%. To restore creditor confidence the President is promising to impose savage fiscal discipline with a view not only to ending deficits but reducing debt to 55% of gross domestic product by 2028. To support the currency the Bank of Ghana is hiking interest rates fast. As a desperate emergency measure, vice president, Mahamudu Bawumia, announced that Ghana would require large mining companies to sell 20% of the metal they refine to the nation’s central bank, for local currency, allowing the government then to barter the gold for essential fuel imports. Meanwhile the government has hired Lazard Ltd, Global Sovereign Advisory and Hogan Lovells US LLP to advise it in the negotiations with the creditors. Some of the bondholders have turned to Rothschild & Co and Orrick, Herrington & Sutcliffe LLP as advisers.

***

The situation in Ghana is bad, but it is by no means alone. Whereas in 2008 the African continent was largely insulated from the shock of the global banking crisis, it is now, as a result of being more integrated into the global economy, feeling the pinch from global movements in prices and interest rates. Since 2020, Zambia, Chad, Mali and Ethiopia have either defaulted or entered talk to restructure their debt. Tanzania, Mozambique and Benin have attracted emergency support from the IMF.

Ethiopia, Africa’s second-most populous country with a population of 118 million people, requested a debt restructuring in early 2021. It has been held up by the civil war that erupted in November 2020.

Nigeria, on paper Africa’s largest economy and a major oil producer, ought to be one of the beneficiaries of higher oil prices. Earlier this year Nigeria’s Bank of Industry and Federal Government issued Eurobonds at only moderately increased interest rates. But Nigeria is hobbled in its ability to profit from the commodity market surge because its oil production is languishing at less than half the level it reached in early 2020. It has no refining capacity. The state budget is burdened by a fuel price subsidy that consumed $12 billion this year. The World Bank warns that by 2025 debt service could rise to 169% of government revenue. Plans to issue $950 million in debt on international markets were cancelled in May, due to unfavorable conditions. Ideally, Nigeria would borrow mainly on domestic markets, but at less than 15 percent the rates offered on local debt are less than inflation which is running at 21 percent, so debt offers attract disappointing bids. Finance Minister Zainab Ahmed is looking for ways to reprofile Nigeria’s debts. But no one wants to engage in humiliating debt restructuring ahead of the upcoming election.

Kenya also started 2022 planning to make a new issue, but cancelled a KSh115bn ($982m) Eurobond sale last June after yields doubled to 12%. Instead, it is now in talks with its Chinese creditors.

When the headlines announce that Ethiopia, Kenya and Ghana are all in trouble, that could be read as a series of national stories. But it is more than that. General narratives are fashioned out of particular cases and over the last 15 years Kenya, Ethiopia and Ghana have been amongst the most important success stories of the African continent. The current rash of crises puts that entire narrative in play.

Narratives are not merely window-dressing. They matter, because they fuel optimism and sustain belief, which infuses the assessment of analysts and credit rating agencies. Narratives are amongst the tools with which capital allocators manage the uncertainty inherent in any investment, but which is particularly intense in “frontier market” settings. Every investment implies a narrative. A crisis of the narrative thus puts the future in doubt, in every sense.

You might be tempted to say that we are better off not believing in stories. Instead, it is better to face realities. If debts are unsustainable, what we need are restructuring and a concerted effort to work out realistic funding terms.

Bad debts contracted for failed project risk becoming an albatross. If they cannot be paid, the one thing we know about debts is that they should be written off. The creditors take losses. The borrower suffer a loss of credit rating and then you reevaluate. This is not aberrant. It is normal. It need not be confrontational. As Ghana’s Deputy Finance Minister John Kumah reassured the press, there was no question of Accra unilaterally defaulting. “We know our bondholders, it’s not like it’s a big market out there. So it’s a matter of just constructing discussion and seeing how best we can all come to a position that protects either side and save the economy.” The question, of course, is who pays the the price. How large is the haircut imposed on the creditors? How brutal is the adjustment required of the borrowers? And how attritional and damaging is the process of restructuring itself?

In 2020 the G20 proposed the Common Framework for coordinating bilateral official creditors when it becomes clear that debt is fully unsustainable. But to enter on that process was judged by most borrowers to be too dangerous and uncertain. So far there are only three countries desperate enough to want to entrust their fate to the Common Framework, all of them are in Africa – Zambia, Chad and Ethiopia.

And beyond the resolution of any particular debt crisis the next question that must be top of the agenda is simply: what comes next? If debt is not sustainable, how is Africa’s urgent and huge need for capital to be met? The current level of poverty across much of Africa and the pressure of population growth can make calculations of debt sustainability and long-term viability seem quaint. Africa has no long-term, sustainable future without investment.

Ghana illustrates this pressure in microcosm. At independence in 1957, at the beginning of its trajectory of repeated renegotiations with the IMF, Ghana’s population was roughly 6 million. Today Ghanas’s population is 33 million, more than five times larger. Ghana’s capital Accra is now one of the hubs in a giant conurbation that stretches from Abidjan in Ivory Coast to Lagos in Nigeria. This huge and rapidly growing population desperately needs capital investment to meet basic needs, let alone keep up with rapidly-developing Asian economies.

Once Africa and Asia shared the condition of poverty. Increasingly, that is no longer the case. Of the people worldwide facing acute food insecurity at the end of 2022, two thirds are in sub-Saharan Africa – 123 million people or 12 percent of sub-Saharan Africa’s population. Of that desperate group, one-third have become acutely food insecure since the start of the pandemic in 2020.

In the areas of most acute deprivation, chronic poverty and environmental shocks compound each other. The four-season drought in the Horn of Africa is resulting in what the World Food Programme has declared to be the world’s worst food emergency. And the distress is further compounded by state-failure and armed conflict, notably in DRC, Ethiopia and South Sudan.

To handle such challenges, Africa need competent and capable states and they need funding. Take, for instance, the case of Kenya.

While it is struggling to balance its books, Kenya’s soldiers are being heavily recruited, amongst others by France, as a contribution to the East African Community Ragional Force in DRC. The intervention is aiming to stabilize parts of DRC occupied by the M23 – which is likely backed by Rwanda. Contributors to the joint intervention pay for their contingents themselves. The budget currently planned by the Kenyan ministry of defence for the intervention is estimated to be around €37m ($38m) for the first six months but it could easily rise to €50m over a year if the operation is extended. Kenya also contributes to Amisom, the African Union’s peacekeeping mission in Somalia. But Kenya’s financial situation is precarious and it is engaged in talks with both the IMF and its Chinese creditors. So concerning is the situation that it has been raised with the G7 and the EU, which may use the European Peace Facility (EPF) to help to pay for Kenyan peace-keeping.

For all the short-term funding difficulties, the question of development cannot be dodged. The ambition to turn “billions” of dollars of development lending into “trillions” that was announced in 2015 in conjunction with the Sustainable Development Goals, was not mere rhetoric. Only investment on that scale can match the needs of an African population that by 2050 is expected to reach 2.5 billion.

***

How are such sums to be raised? The question is daunting in its immensity and its implications. It would be utterly presumptuous to opine about it in short hand here. Instead, let us refer to what is surely the most constructive development agenda of the current moment, the Bridgetown Agenda championed by Prime Minister Mia Mottley of Barbados and forcefully articulated by advisors like Avinash Persaud. This is commonly presented as an answer to the question of how to mobilize funding to address the climate crisis. But, as far as Africa is concerned, the question of building a sustainable energy infrastructure is at the heart of the problem of development. Climate and development are one and the same problem. So the Bridgetown Initiative may serve as a framework for thinking about sustainable development more broadly.

The Bridgetown Agenda has many facets and aims at a comprehensive redesign of global financial architecture, but for our purposes the key point is the functional assignment that Initiative proposes between funding streams and types of sustainable development challenge.

The limited amount of grant funding, exponents like Persaud argue, should be focused on providing generous and timely relief in situations of acute crisis – natural disasters, health crises, the most urgent needs of postwar reconstruction and survival.

For adaptation challenges and their equivalents in other areas of development e.g. health and education, areas where investment is essential to ensure resilience and provide a platform for growth, but will not generate an immediate revenue stream, the most appropriate form of finance, of those available at scale, are concessional loans.

Presumably, loans might fund either specific projects or deficits incurred in the course of making generational investments in health and education. But whether they are contracted at home, in local or foreign currency, they beg the question of repayment.

The same goes for financing of those sectors where revenue streams are forthcoming, but risks are too high to allow unassisted private financing. In this case, to ensure that funding is available, development bodies should offer derisking by means of guarantees or first loss involvement. The terms of those deals will need to be carefully scrutinized to ensure an equitable distribution of risk and reward between all parties and they too pose the question of debt service. Derisking must not imply depoliticization. The devil, as critics like Daniela Gabor powerfully remind us, is in the detail.

Justice and the urgency of the situation dictates that there should be a large contribution at all three stages from funding bodies in Europe and the US in the form of grants, concessionary finance and derisking. But, strengthening African capacity is ultimate goal and this is why so many expert commentators place so much emphasis on the question of state capacity and above all fiscal capacity.

A fiscally competent state can borrow because it can tax. The acid test is the ability to borrow in your own currency whether from foreign or domestic lenders. Expanding local capital markets has been a priority of recent development thinking. This goes hand in hand with expanding local banking systems, which as in the global North, are often deeply entangled with public debt. In Ghana the banking sector holds half of the country’s domestic debt. In good times this is an engine of financial expansion as in the financial history of the West amply demonstrates. But in bad times it risks accelerating a doom-loop in which declining sovereign credit ratings drag down the financial standing of the banking system. The key is to ensure steady growth, feeding an adequate tax base.

For many African states this is a huge challenge. As David Pilling writes about Nigeria in the FT:

One measure of the trust that a nation’s people have for the state is the amount of tax they are willing to pay. However grudgingly, under an unwritten social contract people agree to part with a share of their income in the belief that the state will spend it more or less wisely. The public goods provided range from schools, hospitals and roads to police, national defence and the running of the government itself. Everyone benefits from improved services, a better educated and healthier population, safer streets and protected borders. On this measure, trust in Nigeria’s state is at rock bottom. According to the IMF, the country collected 6.3 per cent of gross domestic product in tax in 2020, the lowest proportion in the world, and far below the bare minimum the World Bank says is necessary for a functioning state.

Nigeria’s tax to GDP ratio is one fifth that of the average OECD country. More relevantly it is one fifth that of Tunisia and one fourth that of Morocco.

Source: OECD

Remarkably, Nigeria’s tax-take as a share of GDP actually decreased between 2010 and 2010. By contrast, that of Ghana increased, by roughly 3 percent. It isn’t enough.

Of course, it is true that it is easier to build a tax state at higher levels of income. But comparative data show the range of performance across Africa at similar levels of development.

Ghana does better than Nigeria, but it needs more. In Accra the Institute for Fiscal Studies argues that Ghana could raise an additional $47 million through extending personal income tax to the informal sector. It could raise $157 million in property tax and abolishing tax exemptions would bring in $790 million. But the biggest slice would be obtained by taking a 55% share of the revenue of the extractive sector, equivalent to the share that Nigeria takes from its oil industry or Botswana takes from mining. That would yield $4 billion. The reason that Ghana’s share of extractive revenues is so low, according to the IFS, is the small ownership share of national resource companies compared to international investors.

The quid pro quo, according to Ghanaian reformers, should be an all-out effort to ensure prudent management of public finance. A recent Auditor-General’s report identified about $1.8 billion worth of irregularities in public finance. As Adu Owusu Sarkodie puts in The Conversation:

When these irregularities are checked, the government will gain the confidence and support of the citizens. … Unfortunately, the pervasive and deeply entrenched nature of the country’s Fourth Republican clientelist politics which manifests in a ‘winner take all’ approach to governance has often distorted a much-needed national debate on what needs to be done and how it must be done

If we abstract from the 21st-century framing what every vision of sustainable development implies, is a giant transformation in political economy, a combined social and political transformation, centered on capital markets and the tax state. At other times and in other places, this might have been seen as the blueprint for a bourgeois revolution. Such a revolution entails the development of property right and markets, but public finances too are a critical arena of transformation and struggle.

What Joseph Schumpeter wrote in his essay “The crisis of the tax state” about the European state in the aftermath of the gigantic financial effort of World War I, is no less true for African states faced with the awesome development challenges of the 21st century.

“fiscal measures have created and destroyed industries, industrial forms, and industrial regions even where this was not their intent, and have in this manner contributed directly to the construction (and distortion) of the edifice of the modern economy and through it of the modern spirit …. The spirit of a people, … its social structure, the deeds its policy may prepare … all this and more is written in its fiscal history. He who knows how to listen to its message here discerns the thunder of world history more clearly than anywhere else.”

****

Thank you for reading Chartbook Newsletter. I love sending out the newsletter for free to readers around the world. I’m glad you follow it. It is rewarding to write, but it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, click here: