Did a piece for the NYT riffing on Chartbook #152 on the global anti-inflationary pivot and the attendant recession risk.

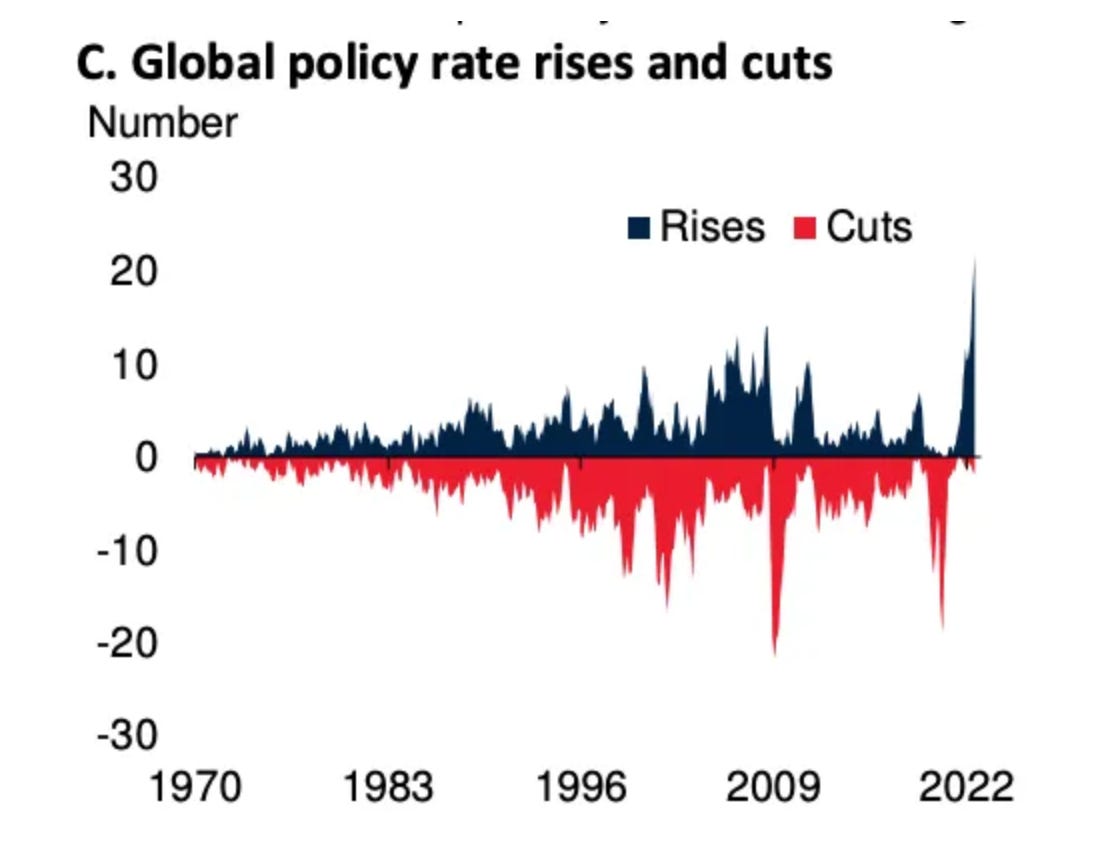

As interest rates rise around the world, as they never have before …

Source: World Bank

… the questions are

- Are interest rates too blunt a tool for dealing with a supply-side shock. Will central banks have to use really massive force?

- In fighting a global inflation on a national basis, will national deflationary pressure reckon with the spillover effects of what is de facto a worldwide tightening?

- Will something break and produce not a recession but a crisis, a crisis that the global financial architecture and safety nets are not adequate to coping with, so that a crisis becomes a disaster.

Thanks to help from Maury Obstfeld, to whom big thanks, I hope I have gotten my spillover risks clearly sorted out this time.

One is the “beggar they neighbor” effects of devaluations, which could lead to a prisoners dilemma style failure of coordination and very suboptimal outcomes. The logic here is as follows: I am unambiguously better off if I appreciate my currency to fight inflation. But other countries can respond. If we all engage in competitive appreciation – reverse currency wars – there may be winners and losers in relative terms, but we all end up with rates that are too high. To avoid this we need to coordinate.

The second effect is the global slack argument – inflation in one country is affected by inflation in another an effect which also operates under deflationary conditions. This is not zero sum. My efforts at deflation help other people to achieve the same desired goal. But, if national decision-makers don’t take this spillover into account, they may end up with more deflation than anyone wants i.e. a global recession.

Clearly what is called for is coordination of policy. That is lacking. Once more, global economic governance falls short of our globalized condition.

The Fed didn’t lead this tightening cycle. Amongst G20 members, Brazil did. It began to raise rates already in the summer of 2021.

But, in early 2022, the Fed took over and since then the global economic story has been dominated by the narrative of Fed tightening and a surging dollar. The dollar in turn puts pressure on everyone around the world – countries and companies – who has borrowed in dollars. The BIS puts that total at in excess of $22 trillion, of which, in rough terms, about a quarter is in Emerging Market and low-income countries. Some will have hedged exchange rate risks associated with that debt. Not everyone will and hedging has its price.

It should be said that there is no consensus around the strong dollar story as far as 2022 is concerned. Robin Brooks of the IIF has been insisting that what is really going on is not so much dollar strength, as weakness in the euro, sterling, the yen and the renminbi. Emerging market currencies have been doing relatively better.

People talk about Dollar strength, but that's really a misdiagnosis for what's going on. First, USD isn't strong against EM (blue). Second, where the Dollar is strong is vs European currencies like Euro and the Pound. We're not seeing a strong Dollar. We're seeing weak Europe… pic.twitter.com/A9WndH4fDl

— Robin Brooks (@RobinBrooksIIF) September 29, 2022

That is a useful corrective as far as currencies are concerned. But, it in on way refutes the broader point that the dollar is king. To avoid devaluation in 2022 what EM central banks have done is to hike interest rates hard and to intervene to prop up their currencies directly. Whether or not it shows up in actual devaluation, the dollar and Fed policy thus dominates the global financial cycle.

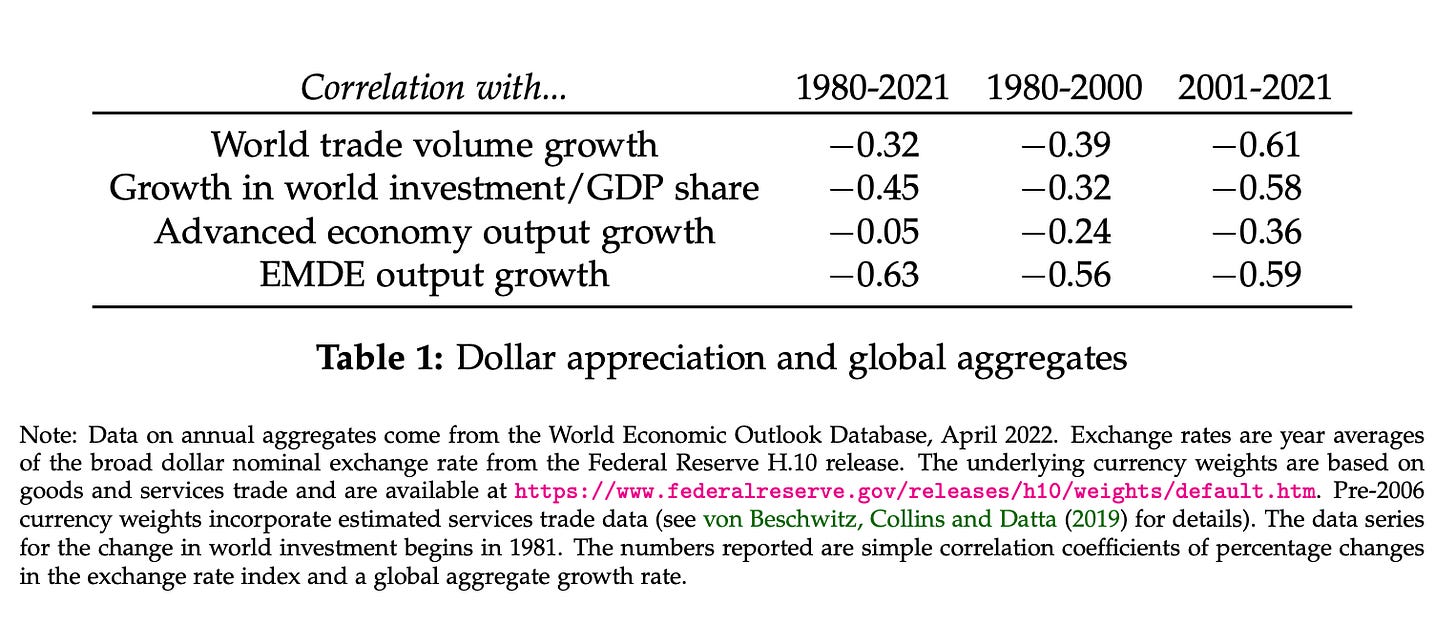

This is brought home with real force in an extremely useful and very readable new paper by Maurice Obstfeld of University of California, Berkeley and Haonan Zhou, Princeton University. In a series of vivid charts and tables they lay out how a strong dollar produces deflationary and recessionary pressure across the world economy.

Over the entire period between 1980 and 2021 a one percent appreciation of the dollar is associated with growth in Emerging Market and Developing Economies (EMDE) that is 0.63 percent slower. Furthermore, this association has strengthened since the millennium. The impact on world trade, notably, has increased from -0.39 to -0.61.

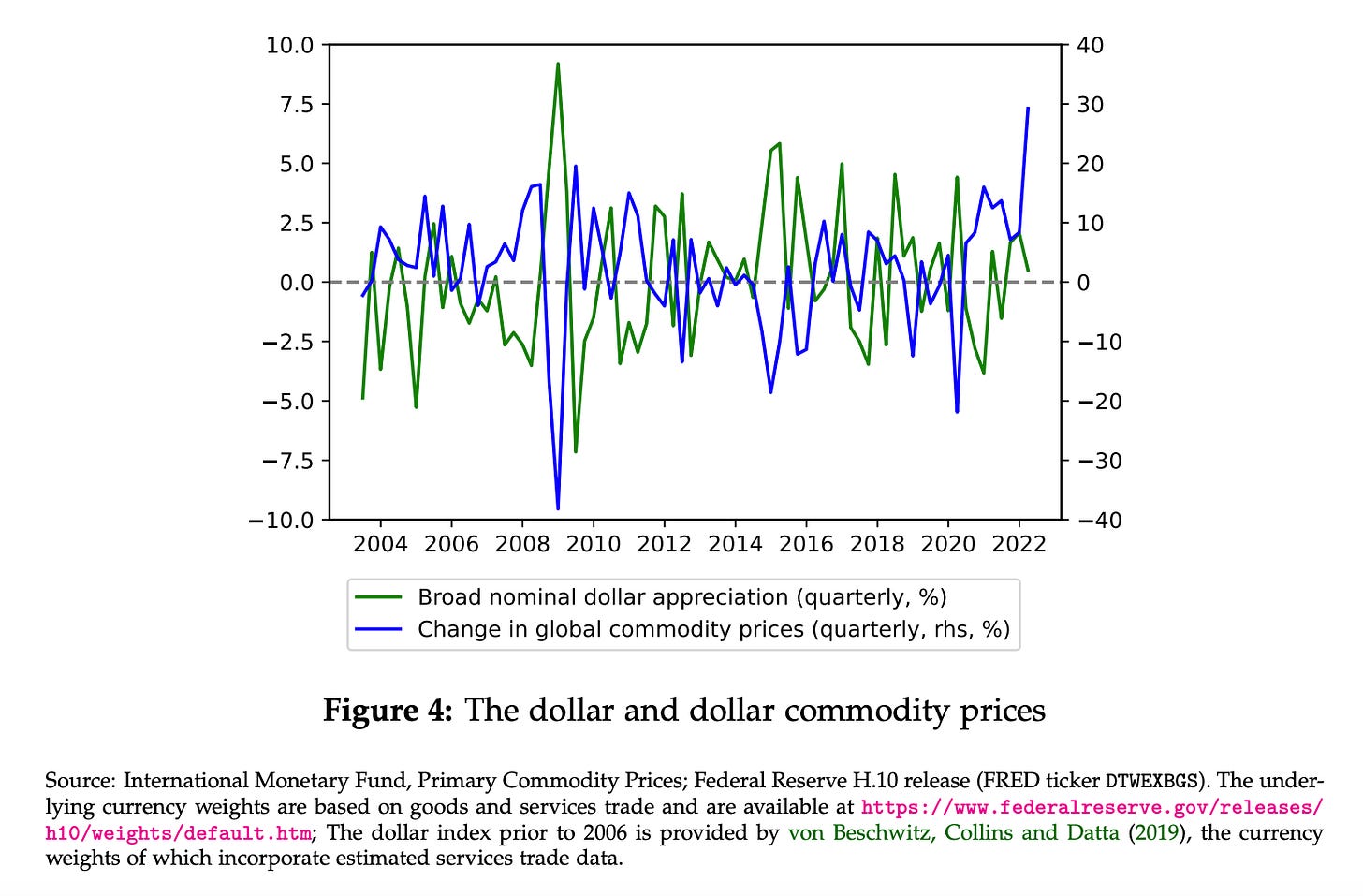

As Obstfeld and Zhou note, the dollar exchange rate moves inversely with global commodity prices (measured in real terms).

As commodity prices fall, not only does the growth in world trade slow down (commodities make up a large part of world trade) but trade in investment goods also slows. By way of trade and investment, fluctuations in the dollar are negatively associated with global growth.

It is worth emphasizing that this is surprising since the promise of the flexible exchange system adopted, in stages and by degrees, since the collapse of Bretton Woods in the early 1970s, was that it would insulate the real economy and real trade flows against the monetary shocks once transmitted by fixed exchange rate systems, or, formerly, the gold standard. But, in practice a large share of the world’s economies remain attached to various kinds of dollar peg, or are so closely associated with economies that are attached to exchange rate pegs that they are de facto linked themselves. In addition, as Silvia Miranda-Agrippino, Hélène Rey and others have shown, the flux of foreign capital across the world is so substantial and the impact of dramatic appreciation and depreciation of currencies so consequential, that central banks around the world track the Fed, willy-nilly. The Fed and US financial markets rule what is in effect a global financial cycle.

In the form of large capital flows this can bring substantial benefits for real economic development. But it also creates risks. In Chartbook #152 I highlighted some recent warnings of the pressures being exerted by the current cycle worldwide. This morning, UNCTAD released its Trade & Development Report for 2022 warning of the risk that the worldwide recovery from COVID may be stalled my an excessive and uncoordinated tightening.

Despite the vigor of the rebound in 2021 the world economy is some way short of its pre-COVID trend.

Setting Russia aside as a special case, the shortfall in output relative to pre-COVID trend for several major EM, notably India and Indonesia, are striking. This is a powerful corrective to the rather upbeat narratives for both those economies in 2022. Add in China, with an estimated 5% shortfall by 2023, and weighted by population that is a huge corrective to general complacency about worldwide COVID recovery.

As I argue in the NYT piece, recession is not the only risk. Will things break? In triggering crises it is balance sheets, as much as flow variables such as GDP, that are key. As UNCTAD reminds us:

With 60% of low-income countries and 30% of emerging market economies in or near debt distress, the possibility of a global debt crisis is high.

How long will they be able to withstand the pressure of a global tightening cycle?

Not only are central banks around the world raising interest rates. To fight devaluation they are also spending limited reserves. This is a striking factoid from the UNCTAD report.

Developing countries have already spent an estimated $379 billion of reserves to defend their currencies this year, almost double the amount of new Special Drawing Rights recently allocated to them by the International Monetary Fund (IMF).

In the first half of 2022 some of the most fragile economies in the world saw sharp devaluations.

This makes for a truly dangerous combination of forces. And if there is one thing we do know about the global financial architecture, it is not set up to deal with large-scale sovereign default. Once again hundreds of millions of people around the world, face huge and radical uncertainty. Not because uncertainty is something about the world that wise people accept, but because we have a financial system that systematically generates risks and we have not created the safety nets that would contain that risk and make it more manageable. And then we engage in uncoordinated policy action which put that entire system under massive pressure. Right now it is not even obvious that policy-makers are aware of the historic scale of the squeeze they are engaged in. In fairness some policy-makers like Lael Brainard are posing the question of global implications of Fed policy. But we need more than the occasional central banker’s speech. We are in what Kant described as a state of “selbstverschuldete Unmündigkeit” or self-inflicted immaturity. It is time to exit that condition.

****

I love writing this newsletter. It goes out for free to tens of thousands of readers around the world. But what sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, there are three subscription models:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club.

Several times per week, as a thank you, all paying subscribers to the Newsletter receive the full Top Links email with great links, reading and images.

To join the supporters club, click here: