This week I did a piece for Foreign Policy on the current strength of the dollar and what it tells us about how the dollar system operates under stress. You could see it as an updating of a longer essay I did back in early 2021 for Foreign Policy on the history of the dollar as the world’s anchor currency. The illustration was kinda great.

The 2021 piece was an an attempt to write a history of the dollar that did without a dramatic ending. It postulated more and more policy improvisation in a context of growing multipolarity as the likely future of the dollar as the leading global currency.

That deliberately low-key interpretation, postulating a future of open-ended, “muddling through”, in turn informed my reaction to the feverish debate about the future of the dollar system unleashed by Putin’s attack on Ukraine in February 2022.

Whereas many analysts were prompted by the war and the dramatic financial sanctions imposed on Russia to imagine futures radically different from the present – scenarios I dubbed finance fiction of “fin-fi” – I argued in Chartbook #107 that we should read this kind of speculative financial writing as symptomatic rather than predictive or realistic. It is a symptom of the following tension:

(2) The world is multipolar and so is global trade. Western policy must adjust to that.

(3) There is a huge asymmetry in the world right now between the financial system that remains spectacularly euro-dollar centered and the new multipolarity of power, trade and economic activity.

(4) Given this asymmetry there is a fascination in the cultural and political sphere with the way this glaring asymmetry could be overcome. Not only that, there is a positive desire to see the asymmetry overcome. There is a relish in the discomfiture of the West. The euro-dollar lock feels like the final frontier of Western power, long overdue for overthrow.

(5) Fin-fi is one of the media in which that sense of impending historical change expresses itself.

(6) Given the situation from which it emerges we should read the proliferating genre of Fin-fin symptomatically. It expresses a world historic tension. In some cases it delineates trajectories and seeks to map strategies for policy and investors. In other cases these texts are better read are acts of diplomacy (Larry Fink) motivated by complex constellations of interests.

(7) We should guard against taking Fin-fi literally as a guide to the future rather than as a fascinating expression of the tensions inherent in our current moment.

(8) Identifying and grasping a tension conceptually, is illuminating and engaging for the reasons stated. But the satisfaction thus derived should not be confused with gauging realistically the likelihood of that tension actually being resolved, certainly not in a “logical” direction.

Despite the obvious interest of certain key players in the global economy in finding alternatives to the dollar, its preeminence in global trade and finance is well buttressed.

If rather than speculating in Fin-Fiction mode about future currency systems, we stay with the troubles of the actually existing dollar system, what became more and more evident from the spring of 2022 was that the dominating story of the coming year would not by new alternatives to the dollar, but the strength of the US currency. In July 2022 the dollar hit the highest level in two decades.

This week’s piece in Foreign Policy picks up on the question of dollar strength and the tensions that it unleashes in the world economy.

For the world economy, the tightening of monetary policy by the Fed unleashes contradictory pressures. The currencies of major US trading partners like Japan have plunged to multi-decade lows.

For those with strong export sectors, selling goods not denominated in dollars, this can be a boon. But those heavily reliant on key imports, which are denominated in dollars, or those who are heavily indebted in dollars suffer an agonizing crunch.

For a typically excellent treatment of the question by the Odd Lots podcast hosted by Tracey Alloway and Joe Weisenthal, see this transcript of their interview with Jon Turek.

In the US economy as well, the sudden appreciation of the dollar unleashes contradictory pressures.

US consumers benefit from lower prices. In the second half of 2022 the strong dollar should be one of the forces helping to bring inflation – both by cheapening imports and slowing the world economy.

Source: Daily Shot

On the other hand, a strong dollar is not necessarily good news for US corporations that generate a lot of profit outside the US.

One of the reasons why earnings tend to be revised down across the board when the US Dollar is strong is that US companies generate a decent portion of their profits outside the United States.

— Alf (@MacroAlf) July 21, 2022

A stronger USD doesn't help there. pic.twitter.com/eMwlUTpYue

And it bears repeating that there are still parts of the US economy – notably export-focused manufacturing – that lose competitiveness and market share when the dollar rises. On this score I once again recommend Neil Irwin’s outstanding essay on the 2016 mini-recession in US manufacturing, which in November 2016 helped set the stage for the election of Donald Trump with the votes of the rustbelt.

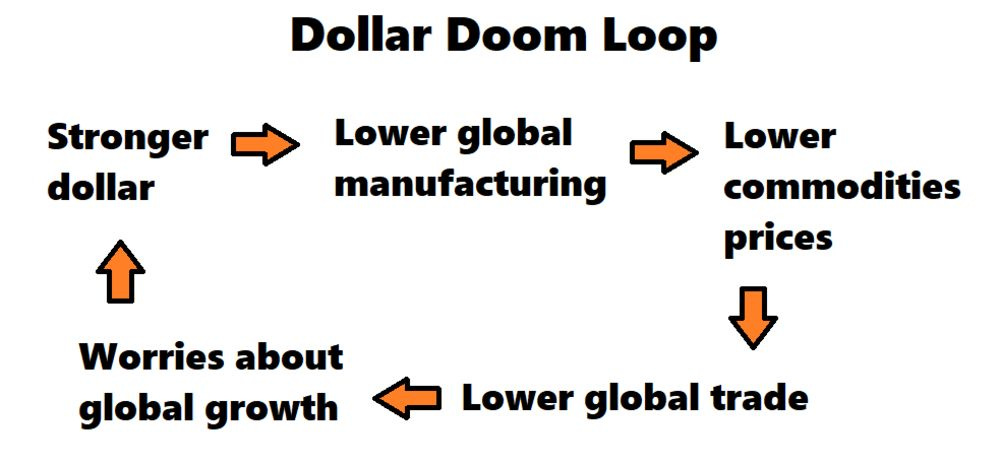

Add all this up and you could once again spin a strong narrative of dollar strengthening that ends with a bang. You might even have the makings of a “dollar doom loop”.

In Sri Lanka, of course, there has been a bang, a big bang.

But Sri Lanka suffered that fate because it is a weak, poor, vulnerable and badly governed part of the global economy. The rest of world economy may be fragile and unstable too, but it is not in Sri Lanka’s condition.

To return to an earlier point, the dollar system is well buttressed and it is well buttressed in part because it is enmeshed in a variety of strategies of de-risking. Some of these involve moderating the degree of attachment to dollar finance – by borrowing from foreign sources, for instance, but doing so not in dollars. The big EM markets have learned since the 1990s to manage their risks, a subject I take up (with all the necessary footnotes) in the chapter in Shutdown on the emerging market “toolkit”.

What holds the actually existing system of global finance together is not so much the dollar – pure and simple – so much as the sinews of finance, law and contractual construction knit by key players above all in Wall Street and – as Katharina Pistor has taught us – in London. The systems of English law and the legal code of the state of New York, are the preeminent codes for big debt deals.

To describe this nexus, the nerve center of the dollar system, in the recent Foreign Policy piece, I appropriate the term “Wall Street consensus” coined by Daniela Gabor, our great guide in all things macrofinance. The point of talking about Wall Street rather than the dollar is to highlight the players who actually make the system work, rather than the particular currencies they choose to operate in. But it is not by accident that 90 percent of global forex transactions – $6 trillion per day! – include the dollar as one currency in the pair.

The upshot is that the dollar system is not a giant anachronism with a bulls eye on its forehead – the conceit of the fin-fiction speculative genre. Nor is it a brittle and rigid system, prone to breaking whenever it stressed – as suggested by the doom-lop scenario. It is a sprawling, resilient network of state-backed, commercially driven, profit-orientated transactions, lubricated by the easy availability of dollars, interwoven with American geopolitical influence, a repeated game in which intelligent players continuously gauge their advantages and disadvantages and the (very few) alternatives open to them and then, when all is said and done, again and again come back for more.

****

I love putting out Chartbook and I am particularly pleased that it goes out free to thousands of readers all over the world. But it takes a lot of work and what sustains the effort is the support of paying subscribers. If you appreciate the newsletter and can afford a subscription, please hit the button and pick one of the three options.