Last month, China posted the largest trade surplus for a 30-day period ever recorded by any country in history. As Michael Pettis summarizes it:

“The net result was an astonishing $101.3 billion trade surplus, once again China’s (and the world’s) highest ever monthly trade surplus. China’s trade surplus year to date is 57% higher than last year’s record trade surplus, and amounts to 5% of China’s GDP.”

It was no fluke. July’s number followed an only slightly less staggering figure for June. Amidst the blanket coverage of inflation and the energy crisis, China’s balance of payments is a key indicator of the balance of the world economy.

In the silly Olympics in which countries compete to be “export champions”, China’s surpluses might be taken as a sign that China is “out-competing” its rivals. But, as Michael Pettis points out, the surplus is far better understood as a sign of economic weakness. Imports, driven by domestic economic activity, are lagging far behind the boom in exports as Chinese producers scramble for foreign markets to offset the lack of domestic demand.

8/10

— Michael Pettis (@michaelxpettis) August 7, 2022

It is precisely because the Chinese economy is performing so poorly that export growth and the trade surplus are so high. China's trade performance is a symptom of the problem, and not a locus of strength in an otherwise weak economy.https://t.co/KFqf32sQ7b

For decades Michael Pettis has been diagnosing the excessive reliance of Chinese growth on investment and the inadequate level of domestic consumption. The current conjuncture bears him out.

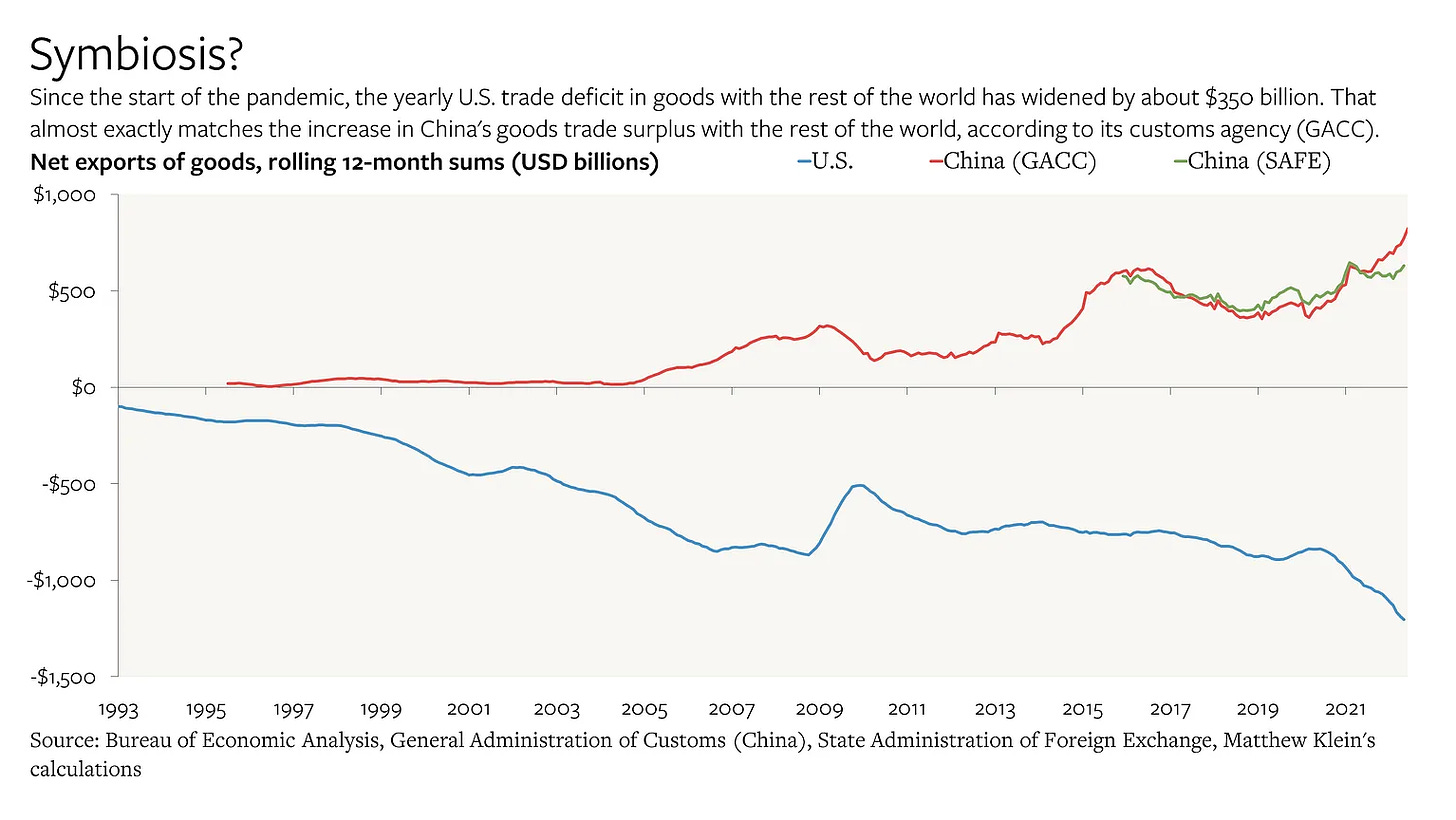

Matt Klein, Michael Pettis’s co-author in their excellent Trade Wars are Class Wars, expands on their diagnosis in his excellent Overshoot newsletter. As Matt Klein points out, China and the US’s mirror-image responses to the COVID crisis have resulted in mirror-image current account movements. The US stimulated consumption, whereas China relied on infrastructure spending. America’s surging deficit matches China’s mounting surplus.

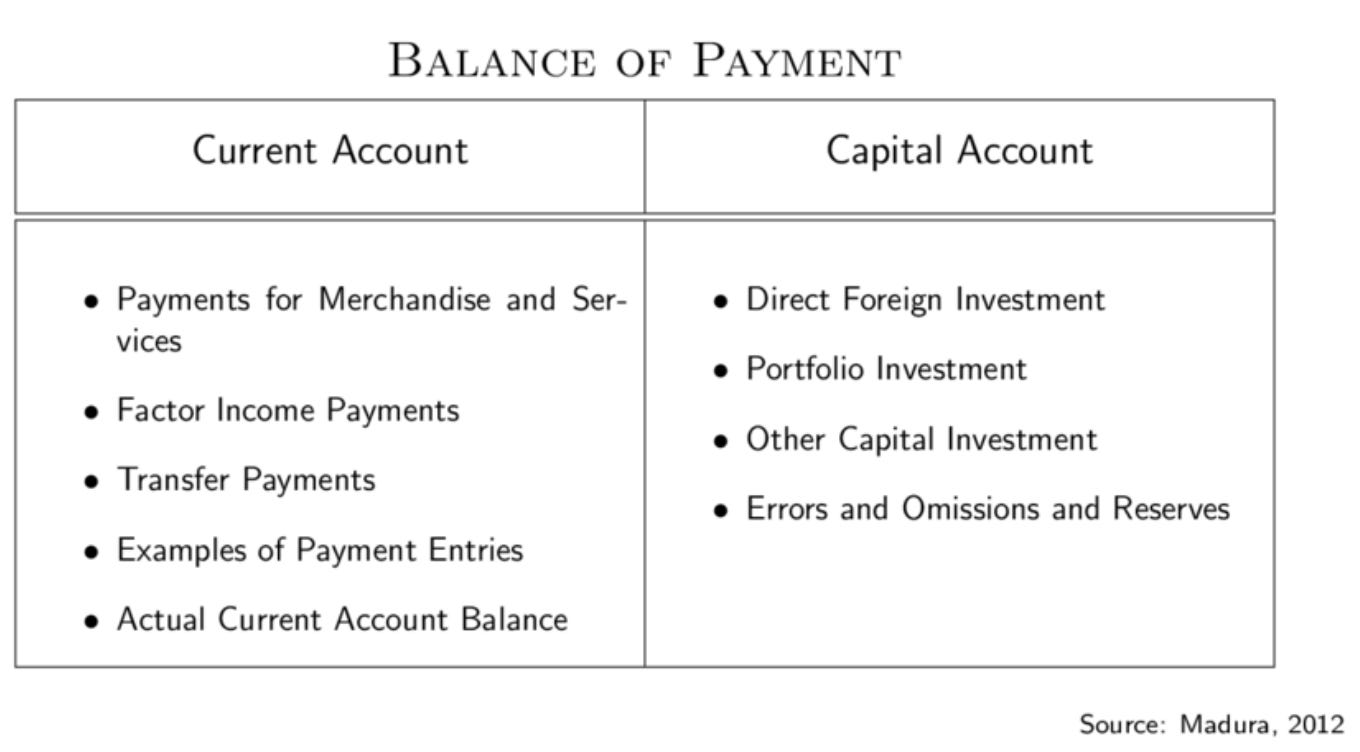

But the current account is only one side of the balance of payments.

By accounting identity, a trade surplus large enough to create an overall current account surplus must go hand in hand with a build-up of claims on the rest of the world economy on the capital account. This could take several forms, each of which has its own political economy.

In a state-managed system like China’s, with exchange controls regulating the flow of currencies across Chinese borders, the counterpart to a large trade surplus could be the accumulation of forex reserves in official hands. Or it could take the form of private transactions, a private capital outflow, which results in the accumulation by Chinese households or firms of net claims on foreign assets. To offset a current account surplus it is net changes on capital account that matters – the balance of Chinese claims on the rest of the world and foreign claims on China – so the counterpart to a current account surplus could also be a reduction of foreign claims on China, the result being a net shift “in China’s favor”.

The current and capital account are linked by accounting identity – the balance of payments must by definition balance. But capital flows are not simply reflections of trade flows. They have their own logic, governed by interest rate differentials, investor confidence and expectations of future profit. As the Fed tightens interest rates to combat inflation this moves investor to shift money towards the United States. In 2020 Chinese government bonds enjoyed a yield premium over their US rivals. That is no longer true.

Given America’s rapid recovery from the COVID shock, surging prices and huge trade deficit, a tightening of monetary policy is what conventional macroeconomics would prescribe. By attracting foreign capital this should facilitate both the financing and the eventual equilibration of the trade imbalance. But political factors give the development of China’s capital account in the last six months a particular coloration, at least in the eyes of many Western observers. Chinese investment abroad raises more and more overt political questions. Meanwhile foreign investors in China have to weigh the opportunities on offer against mounting anxiety about the policies of Xi’s regime and tension between China and the West.

So how does China’s capital account stand in relation to the giant trade surplus? What has not happened in 2022 so far, is a surge in Chinese foreign investment commensurate with its trade surplus. Chinese investment abroad, as for instance through One Belt One Road, has been run down in recent years. Furthermore, Chinese money is increasingly unwelcome abroad.

The movement of China’s reserves in recent years has been obscured by large transactions taking place on the balance sheets of policy banks. A substantial chunk of dollar earnings may be parked there, but pinpointing precisely where requires forensic accountancy.

Another possible avenue to offset the trade surplus on the capital account would be for Chinese households to acquire claims on foreign economies, whether through tourism, or the purchase of foreign assets. Before 2020, China’s growing tourism deficit was a major item in its balance of payments. Outflows on the tourism account were so large that many suspected that they hid substantial amounts of surreptitious capital flight.

Since 2020 Xi’s zero-COVID policy has put paid to easy flows of people and money across China’s borders. Meanwhile, the regime regards private outflow with increasing considerable suspicion. It is increasingly watchful of any sign of disloyalty and it is haunted by the memory of the near-miss crisis of 2015-6 when a tightening of monetary policy in the US coincided with a sudden loss of confidence in China’s economic growth and a dramatic outflow of Chinese reserves.

Today, confidence may be weaker still than it was in 2015-6. The incentives for rich Chinese to get at least some of their money out of the country are stronger. But the controls on capital outflows that were put in effect in response to the 2015-6 crisis are highly effective. The personal exchange quote of $50,000 per year is tightly policed. China has extended its oversight to overseas casinos, underground banking and bitcoin transactions. High-net worth individuals face long delays in processing passports. Chinese regulators survey business investment plans overseas with an eagle eye. The State Administration of Foreign Exchange has publicly committed to guarding against any risks to the exchange rate from “cross-border capital flows”. As Bloomberg reports:

Chinese regulators have been asked to exercise greater caution when it comes to reviewing new overseas spending and investment plans amid concerns among senior leaders that higher US interest rates could spur capital outflows … State-owned companies were similarly told that they should be cautious when spending and investing overseas, said the people who asked not to be named because they’re not authorized to discuss the matter publicly. No specific targets or limitations have been set on such expenditure abroad, they said.

So, if Chinese households and firms are blocked from acquiring additional claims on the world economy, the other way for the balance of payments to balance, is for foreigners to shed claims on China. And that is what seems to be happening.

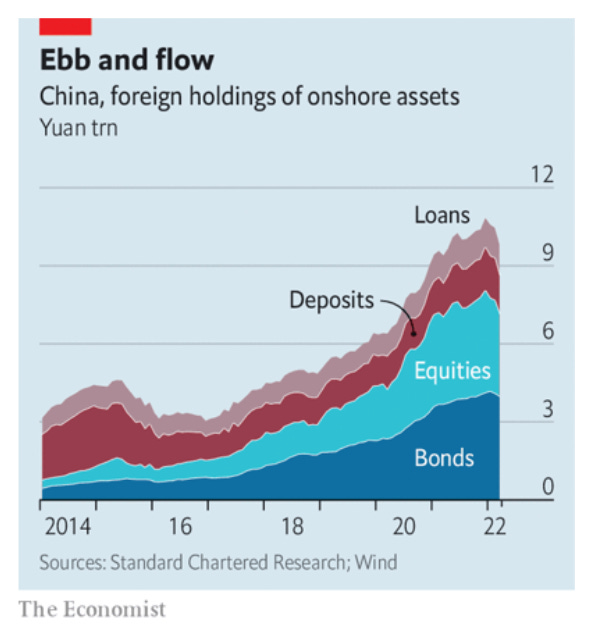

Since the start of 2022 Robin Brooks and his team at the IIF, which, as the trade body of global finance has a privileged insight into capital flows, have been tracking a dramatic reversal in foreign portfolio flows into China. There are some valuation effects in these numbers, as Chinese equity markets have sold off, this reduces the value of foreign claims. But, even allowing for these effects, on net, foreign investors have been off-loading Chinese debt and equities at record rates.

Source: Robin Brooks Twitter (AN ESSENTIAL FOLLOW)

The more benign view is that this sell-off is an effect of shifting interest rate differentials and relative growth rates. The Fed’s interest rate moves are a game-changer. China is not the only export surplus East Asian economy to be experiencing outflows. South Korea, India and Thailand have all been under pressure.

Admitting the grave situation, former vice-finance minister of China, Zhu Guangyao said that “the current US monetary policy adjustment is undoubtedly unprecedented in terms of scale and pace and this is the biggest pressure we are now facing.”

Though the outflows are substantial, they are modest relative to existing stocks of asset holding. China’s trade surplus and its tough foreign exchange controls means that it is not at risk of a dramatic devaluation that could trigger a comprehensive loss of confidence and large-scale capital flight.

One could downplay the data as a largely technical development. But since the outflows began in early 2022, at the same time as Putin’s attack on Ukraine, Western observers have put a far more dramatic and political interpretation on the capital flow out of China.

As one Indian source points, out there may be a direct connection between the war and Chinese capital outflows which has to do with Russian reserve liquidation.

Russia also sold part of its estimated USD 70 billion in reserves allocated to China which was also partly responsible for the huge outflow.

But, significant as this may be, it can account, at most, for only part of the flow.

The tone for Western commentary is set by the IIF itself, which publishes the data, on which reporting of the issue has heavily relied.

As Nikkei Asia comments hawkishly.

Investors are not simply adjusting positions for the short term, but reviewing their long-term strategy as they begin to pay closer attention to China’s political structure and value system –“We are debating whether we should keep investing in China when concerns are mounting about a possible Chinese invasion of Taiwan,” said an official at a leading Japanese pension fund, an active investor in Chinese securities. The exodus marks a sharp contrast to the last few years, when investment in Chinese securities shot up as markets opened and stocks from the country were included in global benchmark indexes. The ratio of Chinese and Hong Kong stocks in major emerging market funds rose to just under 40% a few years ago from little more than 10% in 2008. But that has since (by the spring of 2022) fallen back to 29% due to the triple whammy of the COVID-19 pandemic, tougher regulations on information technology and the Ukraine war. C

As an alternative to China, Nikkei touts friendshoring in finance:

ETFs linked to the Freedom 100 Emerging Markets Index, which uses the degree of a nation’s political and economic freedom as key allocation metrics, logged its largest ever inflow in March at $53 million. Norway’s sovereign wealth fund, the world’s largest, has decided to remove leading Chinese sportswear company Li-Ning from its portfolio in the face of alleged human rights violations. The price of Li-Ning shares fell just over 10% last month.

The Economist takes a similarly dramatic view of the balance of payments data for H1 2022. In its view what is off-putting to global investors is the increasingly “ideological” character of Xi’s regime:

The combination of a nosediving housing market and Xi Jinping’s uncompromising zero-covid policy is just one recent conundrum that has led foreign fund managers to question whether China is losing its pragmatic approach to managing the economy. Mr Xi’s insistence on using prolonged lockdowns to rid China of the Omicron variant and his backing for Russia’s war in Ukraine strike many investors as ideological. Add in the timing of his crackdown on tech groups such as Alibaba, an e-commerce company, and on the leverage of property giants such as Evergrande, and it is not hard to see why some of the world’s largest investment groups are questioning the quality of leadership in Beijing. …

In little over a year Mr Xi’s policies have had a profound—and painful—impact on global markets. They have knocked $2trn from Chinese shares listed in Hong Kong and New York. Chinese initial public offerings in these two cities have nearly ground to a halt this year. China’s property firms have sold just $280m in high-yield dollar bonds so far in 2022, down from $15.6bn during the same period last year.

Onshore markets were one of the linchpins of China’s relations with the outside world. The belief that they would continue to open up helped to maintain links with Western financiers hoping to strike it rich. Even as relations between America and China soured during the Trump years, a craving for onshore securities took hold of many of the world’s biggest financial groups. As a trade war dampened global sentiment, regulators in Beijing began expediting long-promised reforms, eventually allowing foreign financial groups to wholly own their onshore businesses.

The policies were a clear sign that Beijing meant business. And the West reciprocated. In 2018 msci added Chinese shares to its flagship emerging-markets index. Other index inclusions followed, creating a flood of foreign capital into onshore Chinese securities. Between the start of 2017 and a peak at the end of 2021, foreign financial exposure to yuan-denominated assets more than tripled to 10.8trn yuan.

That elation has fizzled. … The view from many investors is that, although China has never been more open to foreign capital, it has also not been this ideologically inflexible in recent memory. … Some leading investment groups are starting to air these views in public. BlackRock, a giant asset manager that has been expanding rapidly in China, said on May 9th that it had shifted its six- to 12-month view of Chinese equities to “neutral” from “modest overweight”.

What the Economist now fears is that a pessimistic doom-loop could take hold, with foreign skepticism undercutting those in China who still want to pursue a strategy of opening up:

The gloomy mood has been painful for China’s small and diminishing cohort of liberal technocrats, who are still promoting the idea of an open China that is at least mildly sensitive to the concerns of global investors. For years regulators have used carefully timed reforms to reward loyal long-term investors. As sentiment soured in April they succeeded in delivering long-awaited private-pension reforms in an attempt to woo asset managers. It was a salve regulators had been holding on to, in the expectation that sentiment would worsen early this year, says one fund manager.

It does not help that steps towards opening are “balanced” by repeated assertions of discipline by Beijing. As Al-Jazeera reports:

Last month, the China Securities Regulatory Commission formally issued guidelines mandating the establishment of communist party cells within global hedge funds that operate in China. “I think it will be problematic, but mostly because of the optics back at headquarters in the US,” Gibbs said, noting that many hedge fund managers specifically asked him about the measures at a recent conference he attended in San Francisco. “Those of us who operate in China long term understand the role the party plays and the importance of aligning with their goals for society. Actually, the conversations they have with you are often about issues of social compliance, like labour standards or equality, which is not necessarily a bad thing,” Gibbs added, describing the scrutiny as comparable to “Chinese-style ESG [Environmental, social and governance]”. “But in the US, we see the CCP [Chinese Communist Party] and think of the whole party apparatus, and so the idea of a party official in the boardroom sounds much scarier from an American perspective.”

***

Will financial decoupling gather pace, or will the first half of 2022 prove to be a temporary reversal of the longer-term trend towards integration? Clearly it is premature to reach conclusions.

Certainly a disorderly unwinding – a 2015-6 style shock writ large – with foreign investors leading Chinese money to the exit, seems unlikely. The memory of that incident is still too fresh and is crucial to informing a policy of tight controls.

Relief may also come from an unwinding of the tense constellation of 2022.

If the US economy slows over the rest of 2022 and into 2023, the Fed may pull back from tightening which will relieve pressure on the entire world economy. China’s growth may recover. After Xi’s election to third term on 20 October zero-COVID may be relaxed.

Beijing may continue to expand on the inducements offered to foreign investors, especially those operating in the financial sector. Mounting global tension and political concerns about Xi’s regime are a deterrent, but there is still ample scope for capital reallocation and deepening integration. Beijing has recently launched Swap Connect, a mechanism to allow overseas investors to participate in mainland China’s financial derivatives market. ETFs are being opened to investors through Hong Kong. Beijing is providing larger currency swap lines to support the liquidity of offshore yuan markets.

What 2022 makes clear, however, is that the direction of travel is open as never before. Up to now, Chinese trade surpluses – which as Pettis and Klein remind us can be the result of weakness as well as strength – have gone hand in hand with the deepening of Chinese integration into the world economy. They have led to an accumulation of huge Chinese claims on the rest of the world economy which outweighs the large claims that foreign investors have made in China at the same time. But, aA 2022 has demonstrated, a current account surplus can also go hand in hand with uncoupling, as foreign claims on the Chinese economy are unwound.

Of course this is sustainable only so long as there are foreign claims to unwind. But since foreign holdings of Chinese bonds and equities run to over $1.2 trillion, unwinding that pile of commitments may take some time.

****

I love putting out Chartbook and I am particularly pleased that it goes out free to thousands of readers all over the world. But it takes a lot of work and what sustains the effort is the support of paying subscribers. If you appreciate the newsletter and can afford a subscription, please hit the button and pick one of the three options.