As the Fed has announced its pivot to a tighter monetary policy, financial conditions in the US – a broad gauge of borrowing conditions – are now tightening more steeply than at any time since the early 1980s.

Source: FRB

Meanwhile, the inflation numbers remain stubbornly high. They will ease, presumably, only when the economy slows down significantly. The question is a. how rapidly inflation comes down and b. how hard the American economy lands. In the Fed’s fantasy, the economy turns swiftly, inflationary pressures rapidly recede and, consequently, the tightening of interest rates does not have to be too extreme.

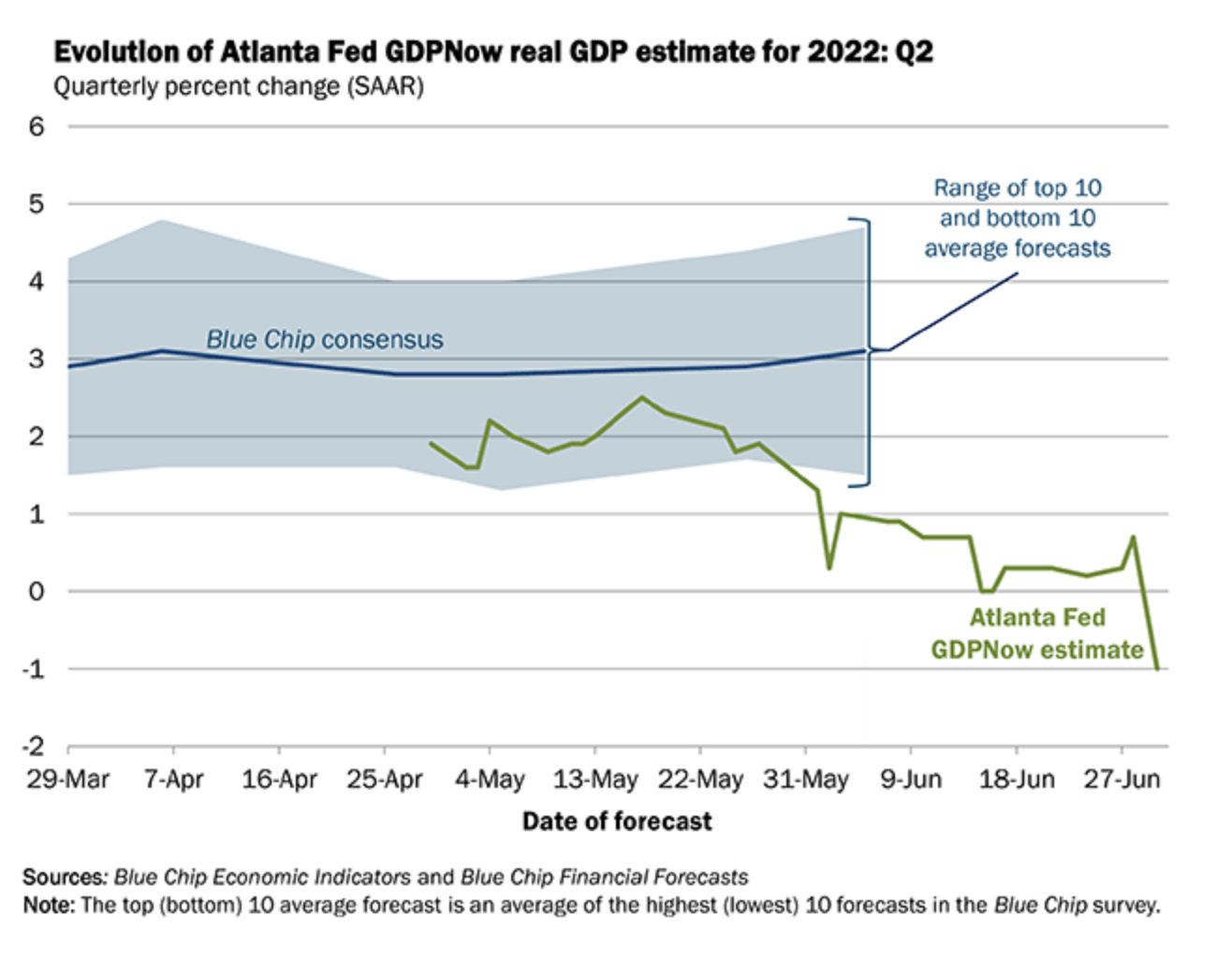

We are too early in the process to tell how rapidly the ship will turn. But talk of recession is already everywhere. Indeed, a recession may come sooner than many think. In the first quarter of 2022, thanks in part to bad trade data, US GDP contracted in real terms. Now, the Atlanta Fed’s widely cited Nowcasting model is predicting negative growth for Q2.

Source: Atlanta Fed

In this short video Patrick Higgins of the Atlanta Fed explains the logic of his model.

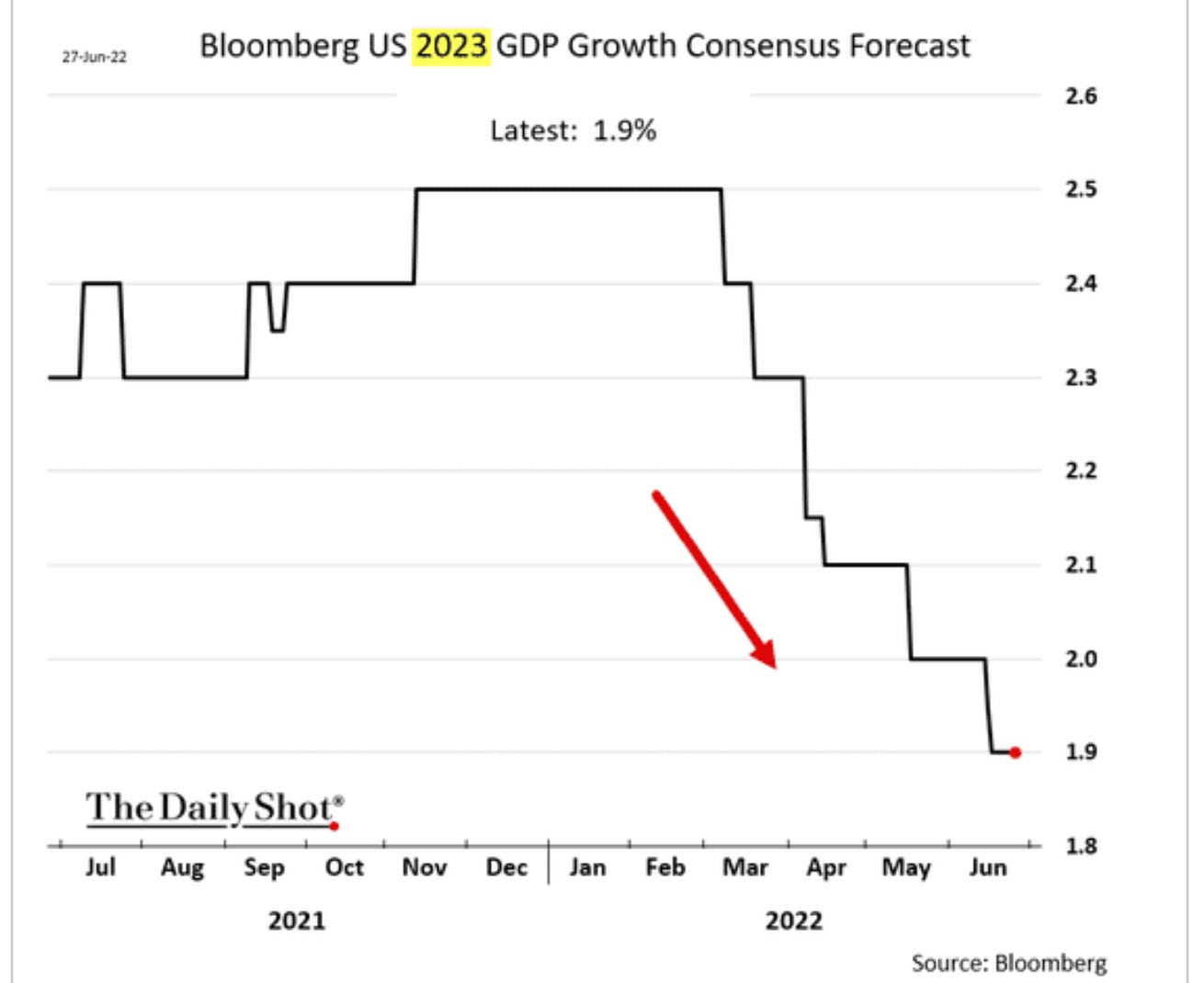

Were the Atlanta Fed to prove correct, we could already be in a technical recession i.e. undergoing two consecutive quarters of GDP contraction. That is not what the majority of economists expect. When asked when they expect the next recession, 71 percent of economists surveyed by Deutsche Bank expect that it to arrive in 2023. It is worth saying that if a recession does arrive in 2023 the consensus view seems to be that it will be mild – two quarters of mild contraction. The Bloomberg Consensus Forecast for 2023 as a whole, is for growth of 1.9 percent. That is not exciting. It is far less than was expected in the spring, but it is much better than nothing.

Source: Daily Shot NB: It is hard to overstate how excellent the Daily Shot newsletter is. If you can afford a subscription, it is worth every cent.

Meanwhile, real-time evidence is accumulating of a slowdown that is already underway. In the giant US housing market, mortgage applications to purchase a home dropped sharply last week and are now down 24% relative to 2021.

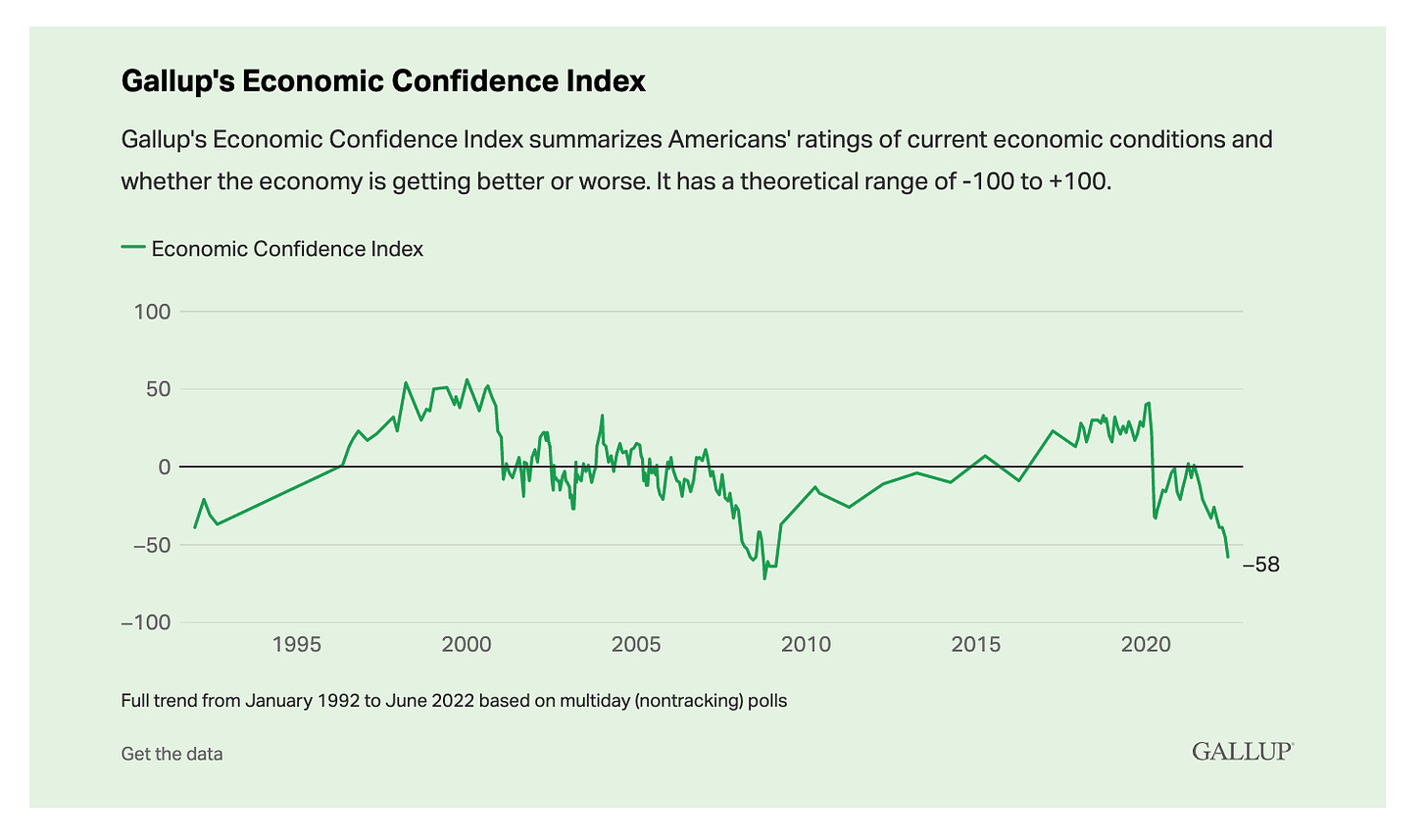

American consumers are the largest single source of demand in the world economy and like their counterparts in Europe, they are in a deeply pessimistic mood. Consumer sentiment as measured by the University of Michigan tanked in 2021. Now, the Conference Board indicator, which normally shows less pronounced swings, has also turned sharply in a negative direction.

The economic confidence index compiled by Gallup is at levels last seen during the 2008 crisis.

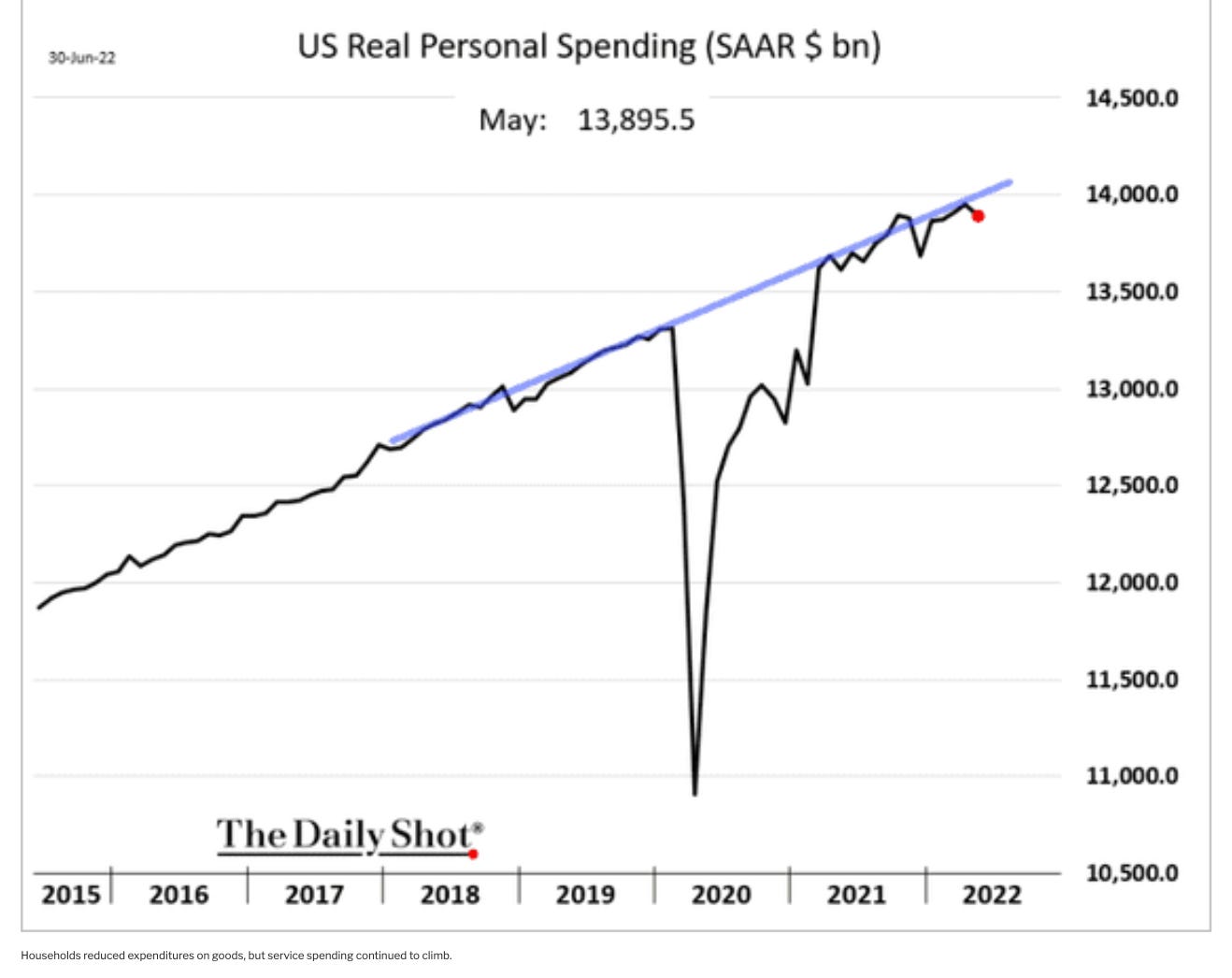

It is far too early to call it a new trend, but, in real terms, US personal spending fell in May to what is presumably an annualized total of $13.896 trillion.

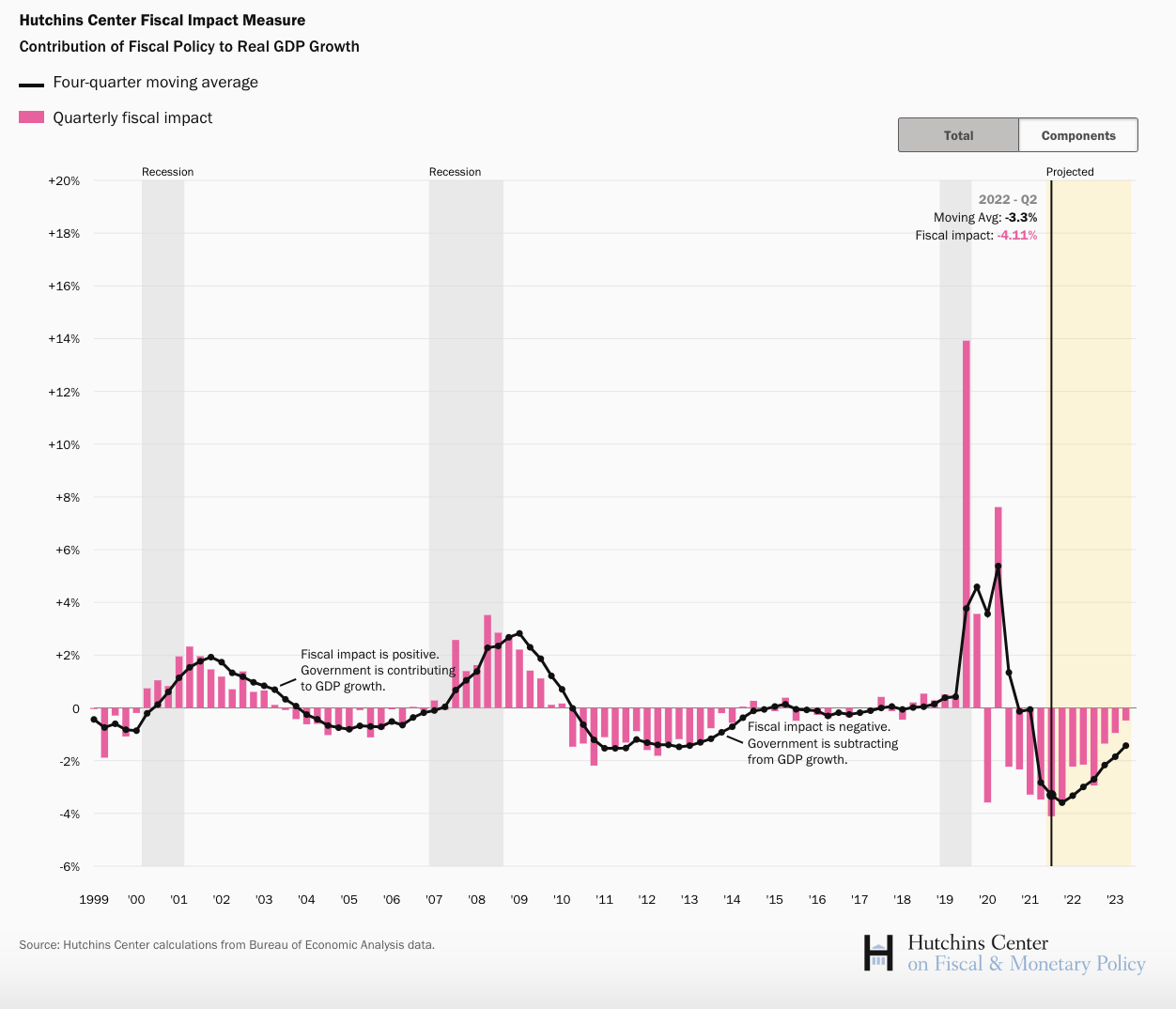

One other major source of aggregate demand, is American government spending. After the stimulus of 2020 and 2021, fiscal policy is now exercising a drag effect on the US economy.

Source: Brookings

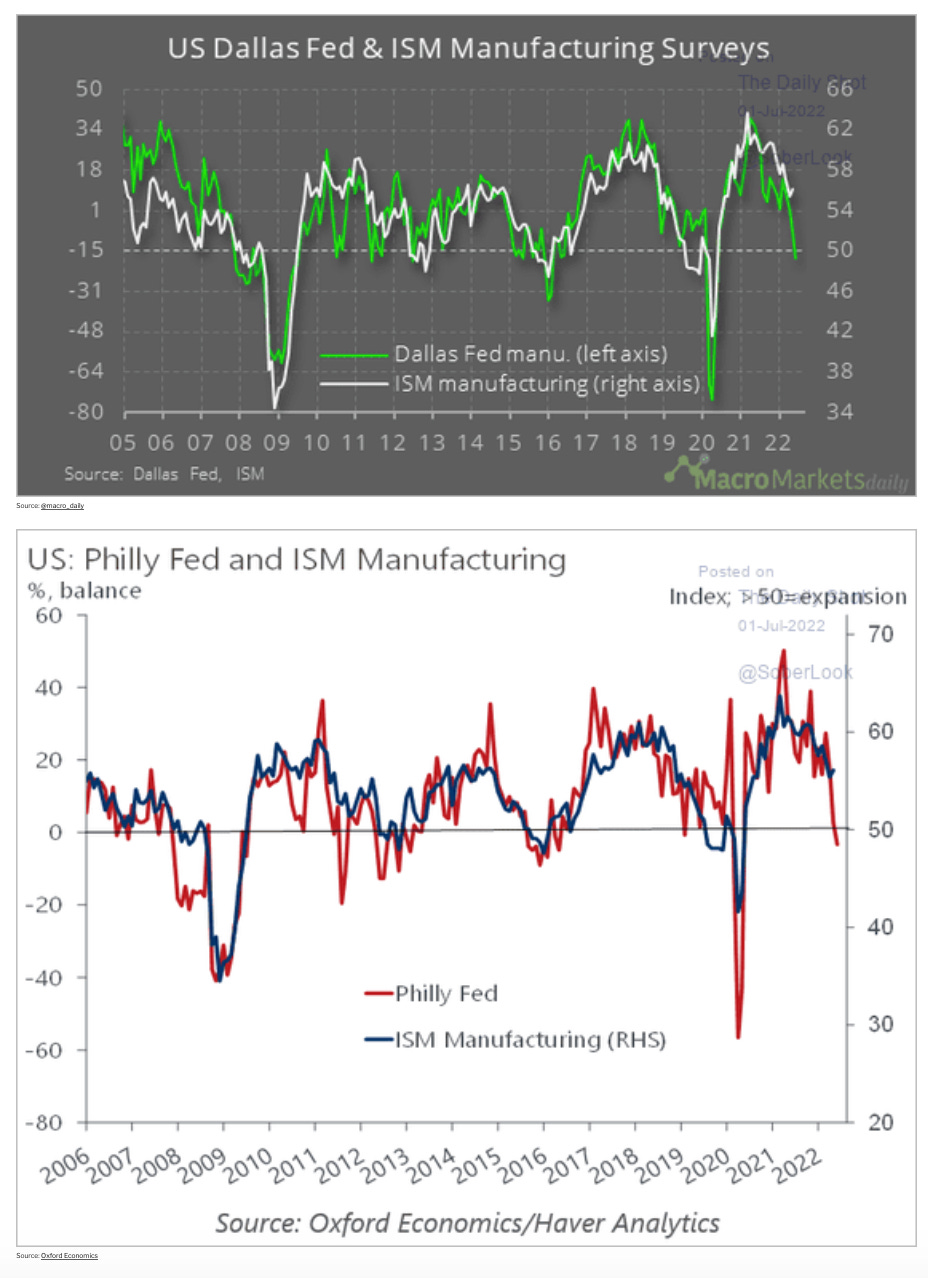

All the surveys of manufacturing in the Federal Reserve regions are now pointing in a negative direction.

On America’s railroads the loading of cyclical inputs to production – steel, wood, paper etc – is well below the rates seen in recent years.

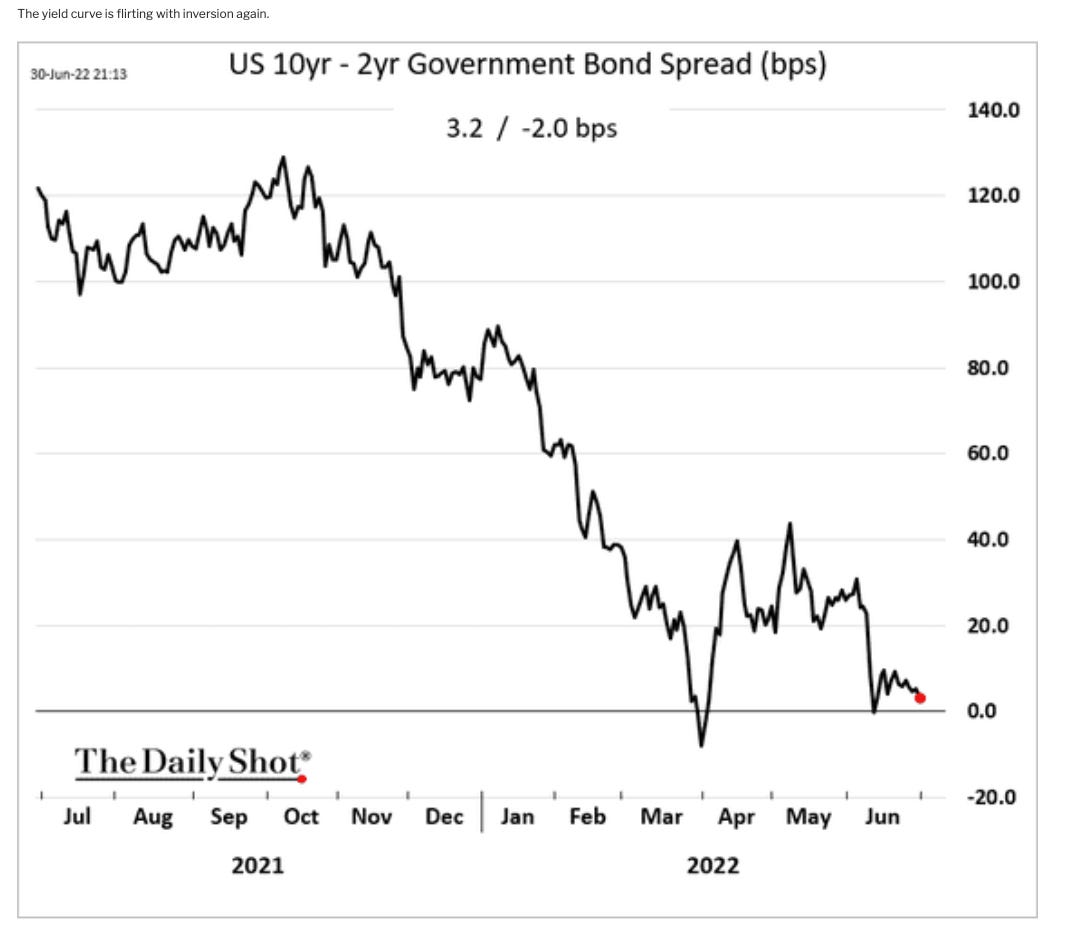

As the conviction of a recession has grown in financial markets, longer-dated US Treasury debt has become more attractive (its value is less likely to be eroded by inflation) and the yield spread between short-term and long-term debt has tightened.

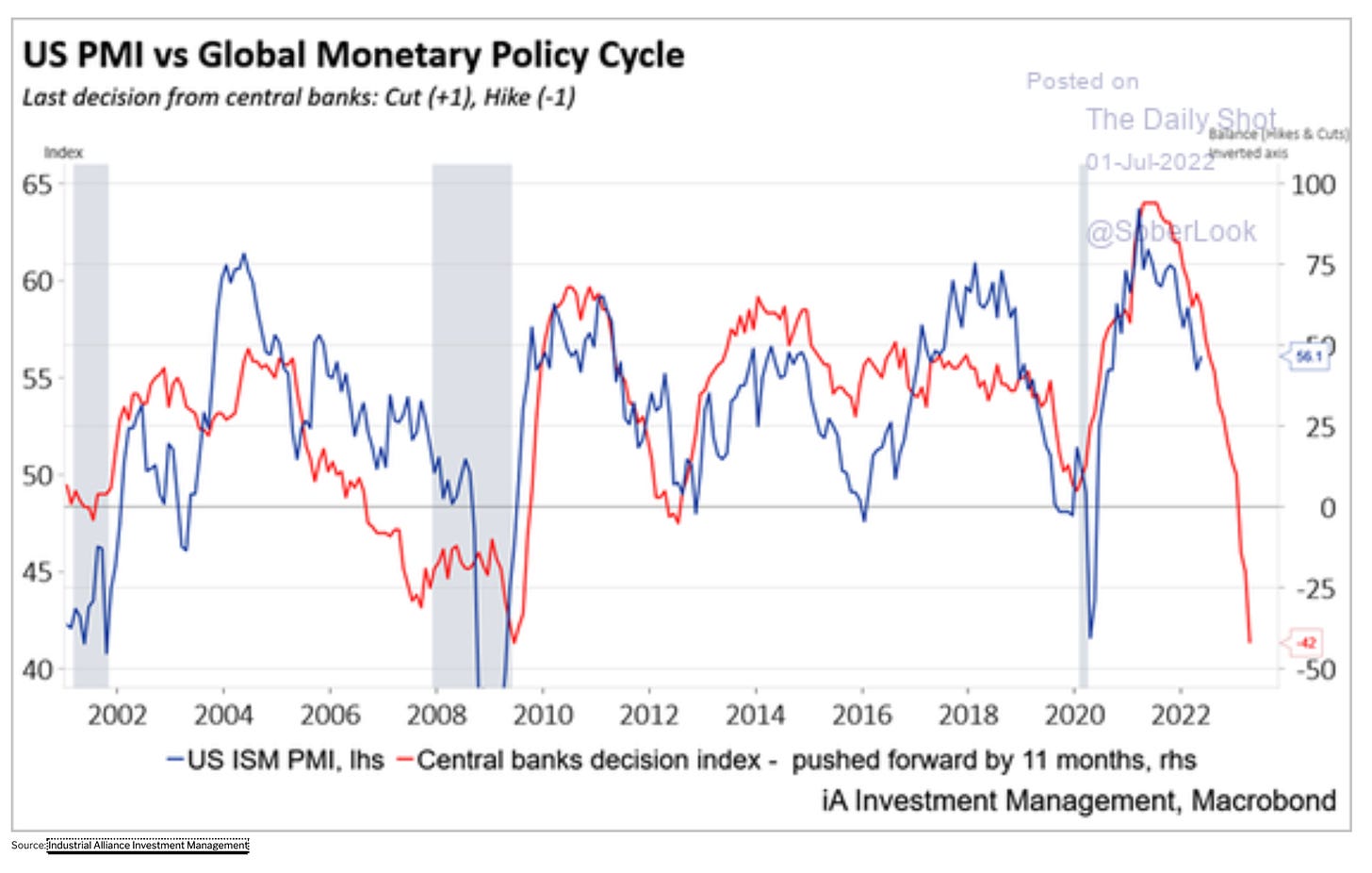

The Fed is the lead elephant of the central banks, but the tightening of policy by central banks around the world generally betokens nothing good for US business. It would be surprising if we did not see a significant drop in the US Purchasing Managers Index in the coming months.

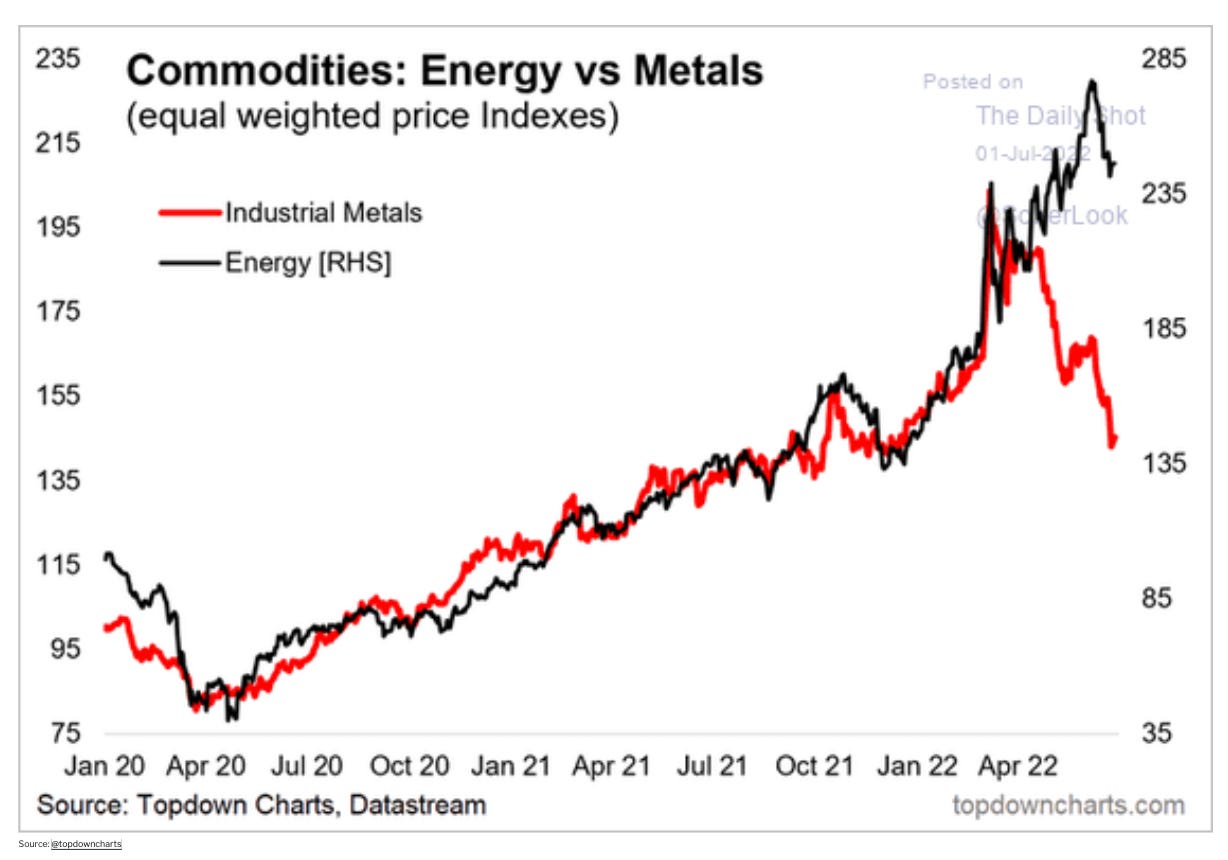

The shock of Russia’s war on Ukraine has concentrated global attention on the prices for energy and food. This reinforces the impression of a world facing an inflationary wave. But with regard to the business-cycle, the price of industrial metals may be a more telling indicator. Copper, known as the commodity with an economics PhD, has sold off hard, today hitting 17-month lows.

All told, you might say that this is a gloomy outlook. And there are those who are increasingly skeptical of the possibility of a soft landing. But, it is surely far too early to tell. If the aim of the game is to control inflation by bringing about a slowdown, then the evidence we are seeing, so far, is precisely what you would look for. What remains to be seen is how the different recessionary forces interact, and whether they brew up into really heavy weather.

*****

I love writing Chartbook and I am particularly pleased that it goes out free to thousands of readers all over the world. But it takes a lot of work and what sustains the effort is the support of paying subscribers. If you appreciate the newsletter and can afford a subscription, please hit the button and pick one of the three options.