A book to read

My brilliant friend Stefan Eich has a book out this week – The Currency of Politics – which I want everyone to read.

It offers an urgent and provocative analysis of political thinking about money from Aristotle to the present.

Stefan’s book is driven by questions that could hardly be more pressing: Why are we so afraid of the political malleability of money? What links political theories of money to moments of crisis? What makes money so tricky for democracies? And how can we democratize money?

These questions grew out of the politics of the 2008 banking crisis, which saw uninhibited central bank support for banks and financial markets, and out of the crisis of the Eurozone, where the ECB at times amplified pressure on the weaker and more indebted economies. His questions acquired further urgency with debates about MMT, “central banking for the people” and the question of how to finance the green energy transition. Stefan’s book is a milestone in the contemporary debate about money.

Eich laid out some of the key questions of his book in a wonderful twitter thread, which I am amplifying and embroidering on here.

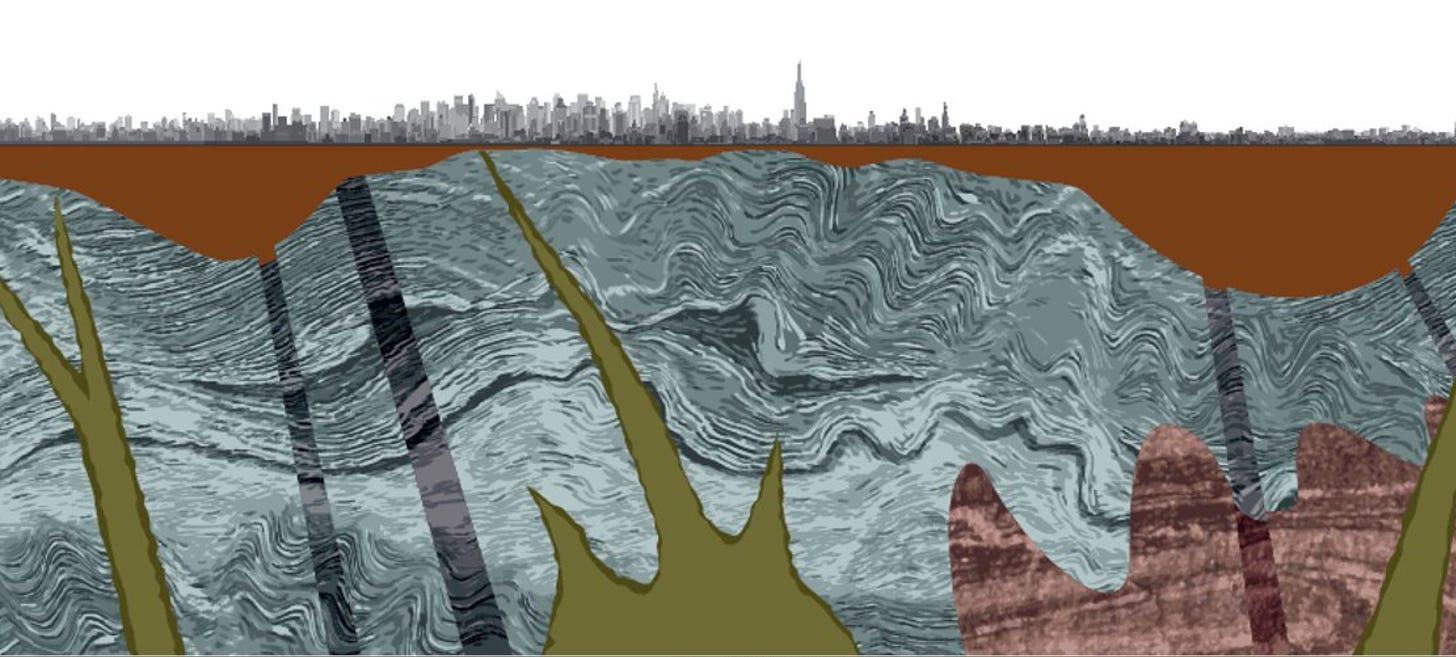

The Currency of Politics is not just a history of political ideas about money. It offers an argument about how histories of crises and genealogies of thinking about money are interwoven and layered. It is to that extent also an intervention at the level of the philosophy of history, which is precisely what we need at the current moment.

As Eich puts it,

The Currency of Politics is about the layers of past monetary crises that continue to shape our idea of what money is and what it can do politically. Grappling with past crises helped previous theorists to escape the blindspots of their own time. We must do the same today.

As Eich shows, thinking about money as a political institution turns out to have a very long and distinguished history. Aristotle, for example, thought that coinage was a political form of money that communities gave themselves to strive toward justice. Very much like law!

As Eich shows in an important article, “The Greeks, it has sometimes been observed, did not have a word for money (von Reden 1995, 173).” But, “(r)ather than simply concluding that the Greeks did not have a specific word for money in our sense, I argue that the Greek conception of nomisma contained a political dimension that we have since lost, …”. It is not the Greeks, but we who have lost track of the true understanding of currency, as a foundational instrument of political community.

You might suspect that a book that stretches from Aristotle to the New International Economic Order is overreaching. But first Eich has the skillset to pull this off – the benefits of a German humanistic education! Like Keynes, and unlike most of the rest of us in the early 21st century, Eich can read Aristotle in the original Greek and comment authoritatively on the texts. He wears his scholarship so lightly that you barely notice the extraordinary things he is doing in this regard. Plus, as Eich shows, these deep intellectual historical connections are native to his material. Keynes thinks about money through Aristotle, whereas others, like Locke, are trying to drive Aristotle out.

As Eich points out this gives further meaning to Keynes’s comment that: “Money is, above all, a subtle device for linking the present to the future.” Money does that not only as a store of value, but as Eich shows as a thread of political conversation about currency and power.

As Eich shows, while money might seem far removed from politics (let alone democracy!), the modern monetary system actually depends crucially on the state and central banks. That does not mean all states can make money as they please. Instead, money is always suspended between trust & violence.

The Currency of Politics not only recovers this complex politics, but also explains how money disappeared from political thought. To do so, Eich grapples with the Lockean politics of monetary depoliticization and maps various responses to it by Fichte, Proudhon, Marx, Keynes, & others. One of the truly surprising chapters of the book traces the thinking about money that was triggered by the financial demands of the Napoleonic wars and their aftermath.

One of the key messages of the book is that though repressed politics will not stay down. The fault lines and tensions repeatedly make themselves felt.

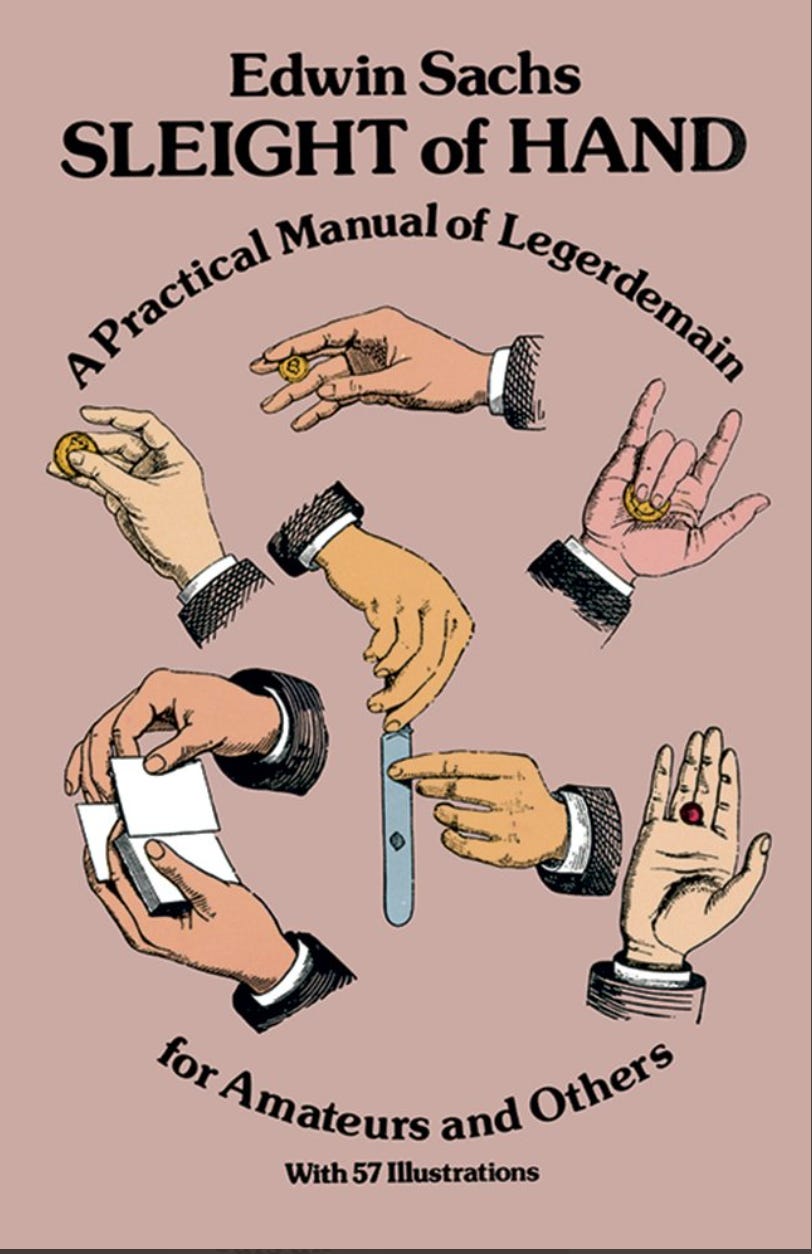

What follows from this, Eich asks? First, to present money as removed from politics is a magician’s sleight of hand. Even where it announces itself in an anti-politics, money is always already political. Instead, the depoliticization of money is better understood as a de-democratization.

If money is always already political the really key question is: What kind of politics should guide it? An oligarchic one? Or a democratic one? The suggestion of The Currency of Politics is that we should struggle to find ways to democratize our monetary systems.

As this image elegantly points out, all the heroic masculinist talk of Odyssean “self-binding” – a key image in central banker discourse about money – has, seen from the other side, a rather comical aspect.

By placing money outside politics we constantly affirm what Kant would have called a “self-incurred immaturity”. Do we really not trust ourselves? Can we afford, given the multiple challenges we face, not to grasp the potential for collective action that lies in mobilization of the monetary system? Can we use that potential for something other than the repeated stabilization of a jerry-rigged and inequality-forcing financial system?

This is a question which poses urgent questions for every polity that thinks of itself as a monetary sovereign. But it acquires added force when we seek to grasp, as Eich does, the tensions within the global dollar empire.

There are no easy answers to these questions. The book will provoke debate and will hopefully open up a channel for communication between monetary economics and political theory.

This seems all the more urgent given the delicately balanced macroeconomic situation in which we find itself.

Eich’s questions were stimulated by the moments of expansionary central bank agency that followed the 2008 crisis. We now face a very different situation. Rising prices have triggered fears of a return to the 1970s and pressure on central banks to raise interest rates and contain inflationary pressure. Faced with the disarticulation of the world economy in the wake of COVID and Putin’s war, we are seeing a reassertion of a conservative interpretation of central bank responsibility. All the more important is it to take stock of where we were just a few months ago.

It is an astonishing about face. In 2021 it seemed, for a brief moment, as though both the ECB and the Fed were escaping the long shadow of the 1970s and the preoccupation with the risk of accelerating inflation. Now we see them returning to the old script of inflation control by means of interest rate increases. Given the momentum of the recovery from COVID the trade offs of inflation control and unemployment are not yet painful. But in the second half of 2022 that trade off may begin to bite in a more severe form. At that point the question of the democratic legitimacy of central bank policy will be posed again.

Amongst other things the current moment is forcing us to ask:

What are the distributional politics and social justice effects of inflation under conditions in which organized labour is relatively powerless – viewing those effects holistically, both in labour markets an on balance sheets?

Does the inflation we are experiencing conform to the Friedmanite injunction that inflation is always and everywhere a monetary phenomenon?

To the extent that it is not useful to think of the current inflation as monetary first and foremost, what role should fiscal policy, price regulation and competition policy play in containing price pressure?

If central bank QE contributed to wealth accumulation in financial markets, what will be the effects of quantitative tightening? Will central banks become agents of a new kind of redistribution focused on balance sheets?

How do we weigh the global impact of US monetary policy and the pressure that Fed tightening imposes on dollar balance sheets worldwide?

Eich’s extraordinary book provides an essential guide to thinking about the politics of money in the midst of the unceasing poly-crisis that engulfs us. We are experiencing in real time the demonstration of his deepest point, which is that if we are to think the politics of money we must do so historically, from one crisis to the next and through the ideas, discourses and institutions that connect them.