Rising prices continue to dominate the headlines. The impact on household budgets is felt above all by those least well off. There is talk of a cost of living crisis that is having impacts on public health.

Meanwhile, fear of persistent and accelerating inflation dominates the monetary policy agenda. Central banks are winding up their asset purchases and hiking interest rates.

But what actually is driving the current inflation?

On both sides of the Atlantic, analysts have been busy decomposing the source of price increases. The results are striking

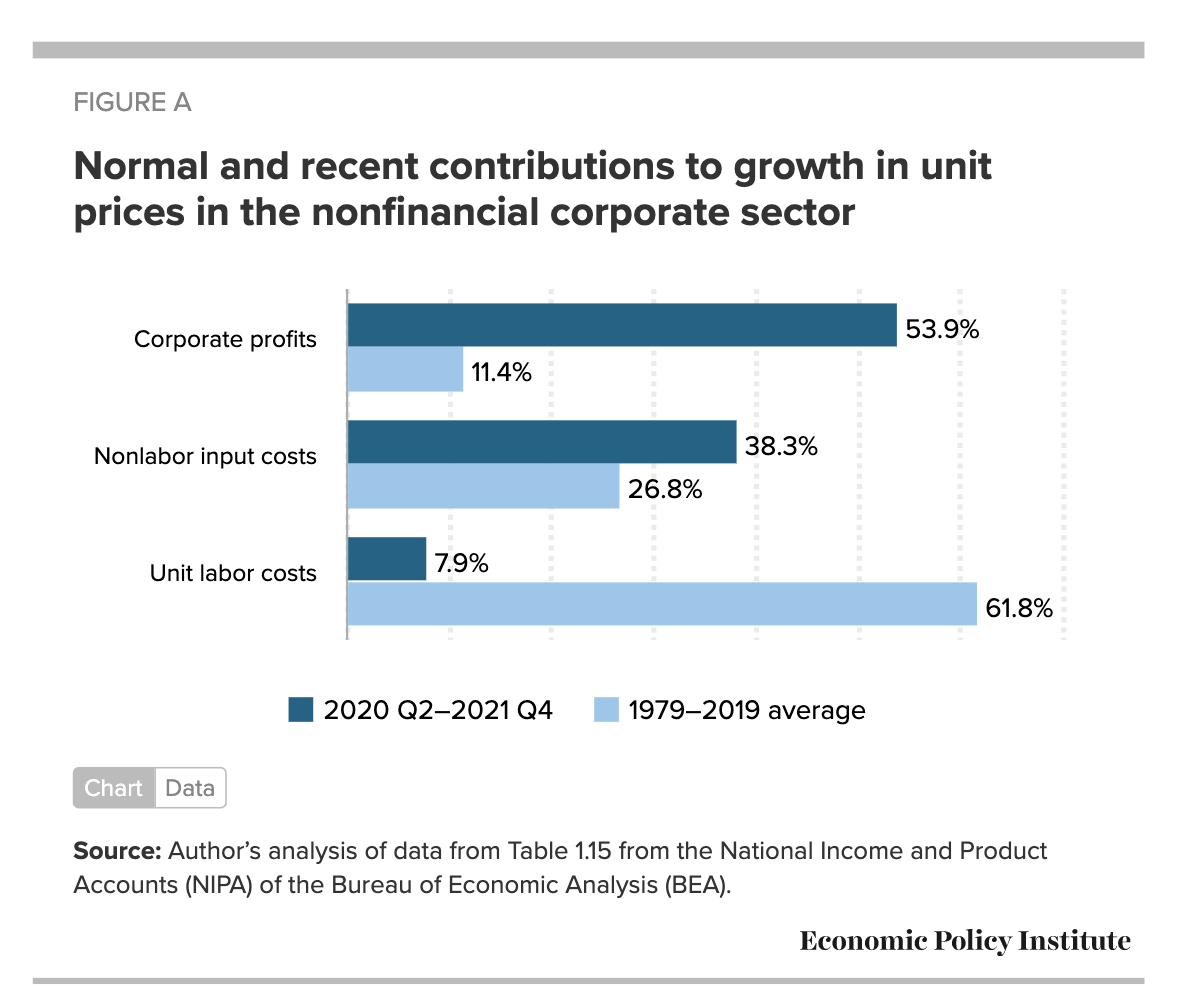

For the US Josh Bivens of the Economic Policy Institute has compared the factors driving the growth of unit prices between 1979 and 2019 with those contributing to inflation in the US since Q2 2020.

Source: EPI

Whereas in recent decades, unit labour costs (wages/productivity) have accounted for 62 percent of price increases and corporate profits for only 11.4 percent, with non-labour input costs (like energy) making up the rest, since 2020 the balance has been reversed. Since the COVID shock in 2020, wages have accounted for less than 8 percent of US price increases, as against corporate profits which accounted for almost 54 percent. Input costs, notably energy, have accounted for 38 percent.

Striking as they are, these data are consistent with the fact that real wages (nominal wages adjusted for inflation) in the US have fallen since 2021.

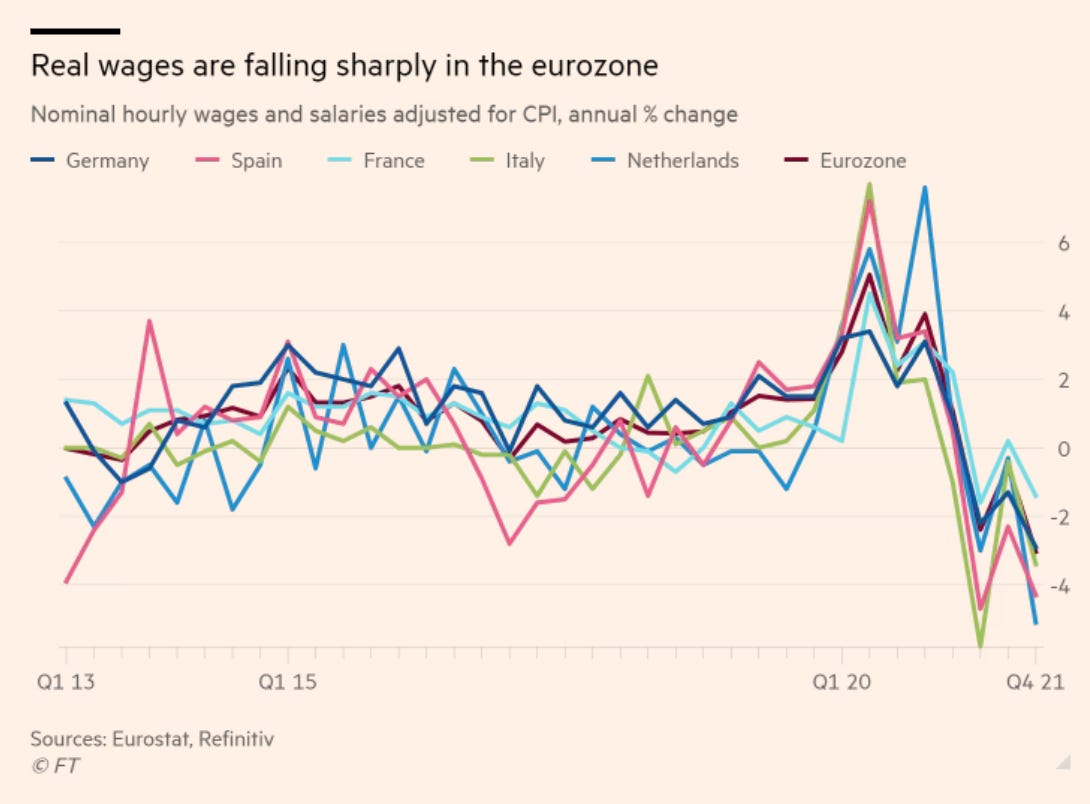

Real wages are also under pressure in the Eurozone.

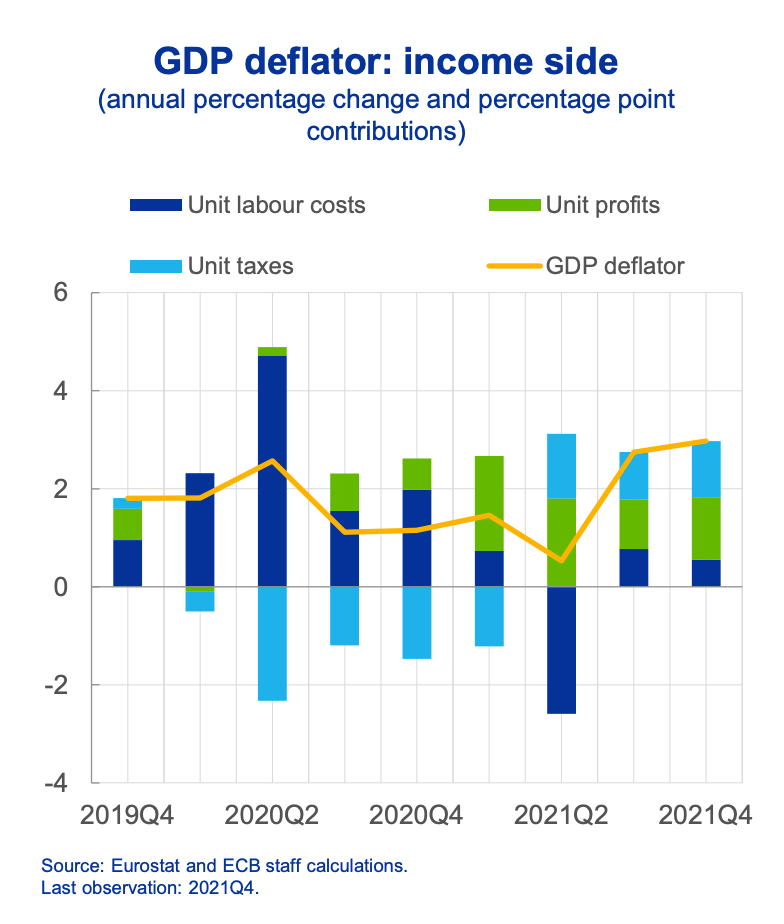

In a fascinating recent presentation the ECB’s Isabel Schnabel showed data which closely matched that of the EPI.

In the eurozone too, unit profits have made a far larger contribution to price increases since 2021 (here measured by the GDP inflator) than have unit labour costs – Q3 2021 being the moment when inflation really accelerated in Europe.

Is there any prospect of this imbalance shifting? Are we likely to see a wage price spiral that would compensate for the shift towards profits we have seen in recent quarters?

There is a lot of excitement in the US right now about the success of unionization drives at Amazon and Starbucks. But what about the macroeconomic perspective?

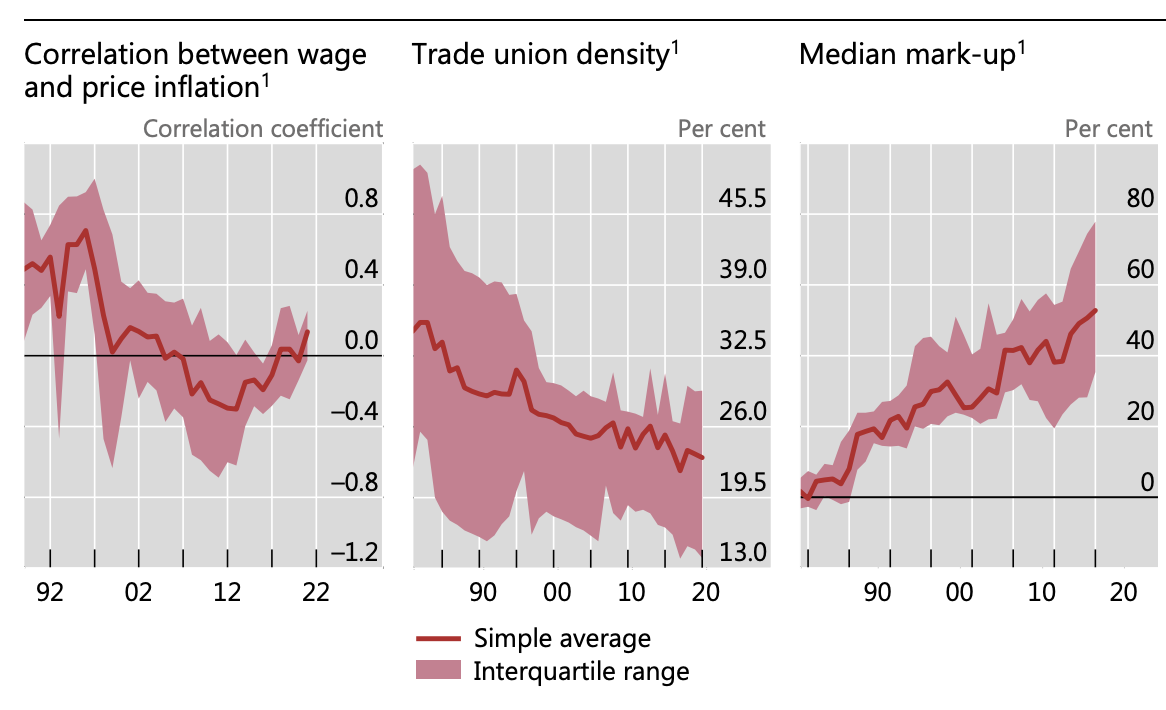

A team from the BIS consisting of Frederic Boissay, Fiorella De Fiore, Deniz Igan, Albert Pierres-Tejada and Daniel Rees has addressed itself to this question in a timely working paper asking: Are major advanced economies on the verge of a wage-price spiral?

Based on data for BE, CA, DE, ES, FR, GB, IT, NL, PT and US they show that in recent years all the evidence suggests a marked shift in bargaining power against organized labour.

Trade union density is down across advanced economies. Profit mark-ups have risen over the last thirty years whilst the correlation between wage and price inflation – which would be prima facie evidence for wage-price spirals – has declined to zero, or even fallen into negative territory.

As they also note:

… the indexation and COLA clauses that fuelled past wage-price spirals are less prevalent. In the euro area, the share of private sector employees whose contracts involve a formal role for inflation in wage-setting fell from 24% in 2008 to 16% in 2021 (Koester and Grapow (2021)).2 COLA coverage in the United States hovered around 25% in the 1960s and rose to about 60% during the inflationary episode of the late 1970s and early 1980s, but rapidly declined to 20% by the mid-1990s.3

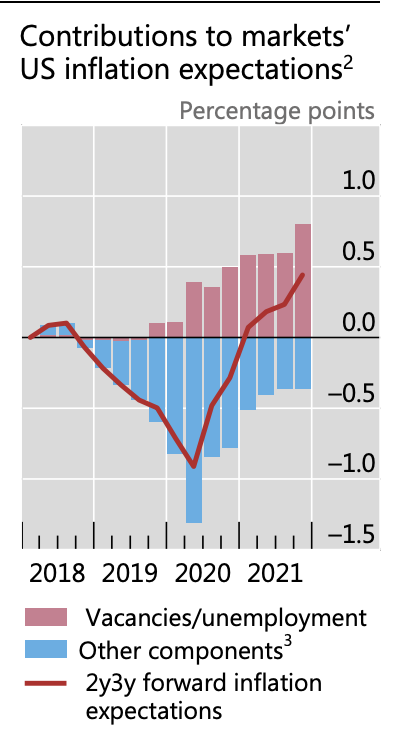

But will this stability last? Will surging profit margins and prices trigger a reaction? In a fascinating twist they point out that whether or not there is a wage-price spiral actually at work in the US economy right now, the financial markets appear to expect such a mechanism to come into effect.

This linkage in the minds of forecasters can be inferred from the data.

… there are tentative signs of inflation expectations unmooring. This is clearest for medium-term expectation measures. Professional forecasts point to inflation of over 4.5% in the United States and much of Europe over the next two years, and above 3.5% in many other AEs. In countries such as the United States where labour markets have tightened the most, job vacancies have become an increasingly important driver of medium-term financial market inflation expectations (Graph 2, fourth panel). As job vacancy rates have substantial predictive power for wage inflation (Domash and Summers (2022)), this could mean that market participants have already priced in the inflationary effects of future wage increases.4

Where might an actual wage-price spiral originate?

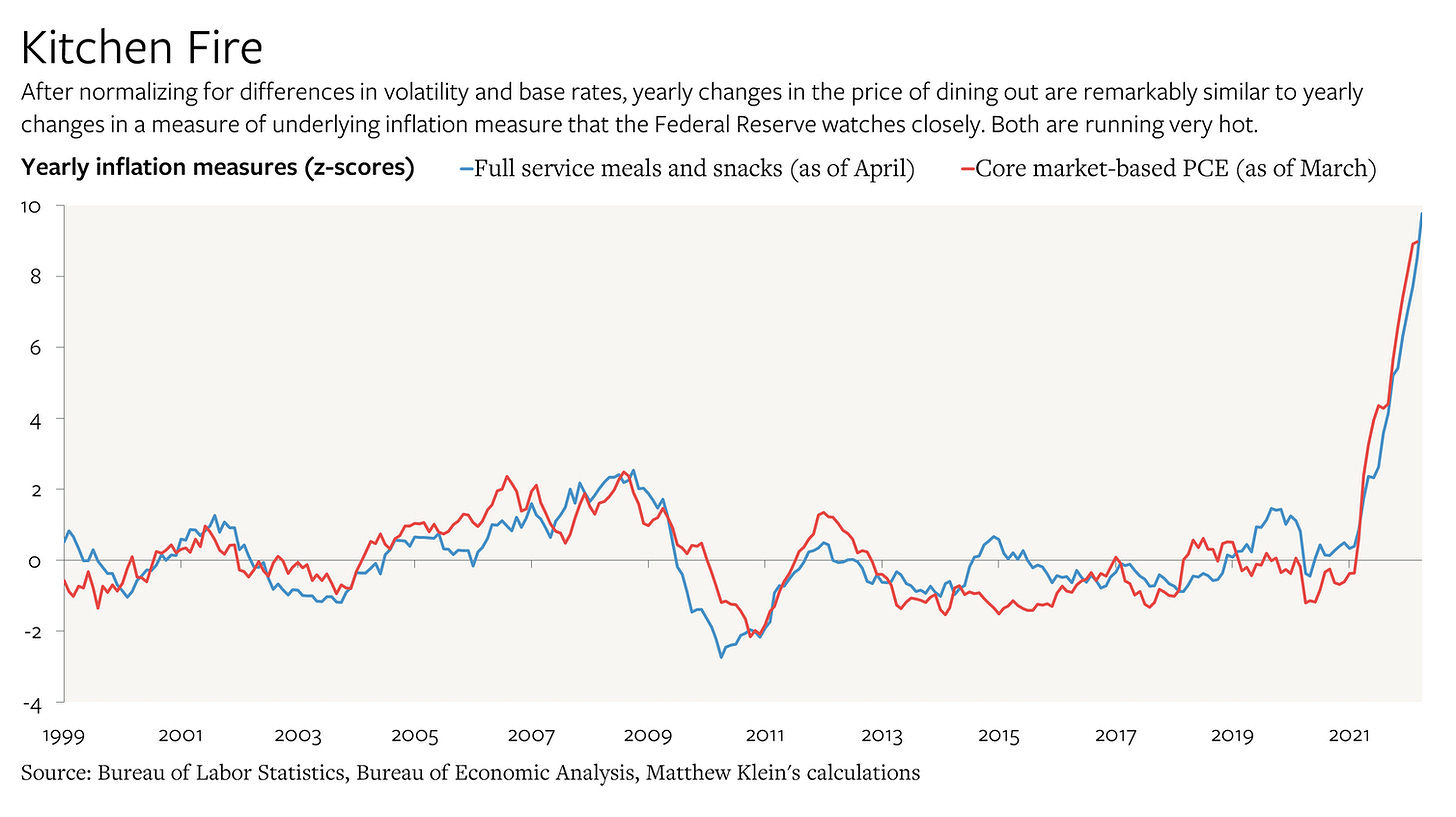

Large service sector employers like food services and restaurants have seen a burst of inflation. In a typically astute analysis of the most recent US inflation numbers, Matt Klein over at Overshoot – an essential substack subscription if you can afford it! – has highlighted the strategic significance of the price of restaurant meals for macroeconomic forecasting.

The cost of a sit-down restaurant meal captures the entire economy in a microcosm. Workers cook meals, take orders, and clean using a mix of durable equipment and perishable ingredients. The owner has to rent a venue with a kitchen and comply with whatever local regulations and mandates are imposed by the authorities. And since most restaurant customers consider dining out to be something of a luxury, their willingness to spend (and tip) is going to be sensitive to their own financial situation and prospects.

Thus, despite being a tiny component of the broader price index, there is a remarkably tight relationship between changes in the price index for “full service meals and snacks” and the underlying measure of inflation preferred by Fed officials. The picture does not look good.

On the other hand, as Matt goes on to point out, after a 30 % surge in H1 2021, restaurant worker wages seem to have settled down at a 5 percent rate of increase.

Rather than a permanent acceleration in pay growth, it looks more like a one-time recalibration commensurate with changes in the risks of the job and the opportunities available elsewhere. And since restaurant wages soared before restaurant prices did, the data could be consistent with the idea that price increases may soon abate.

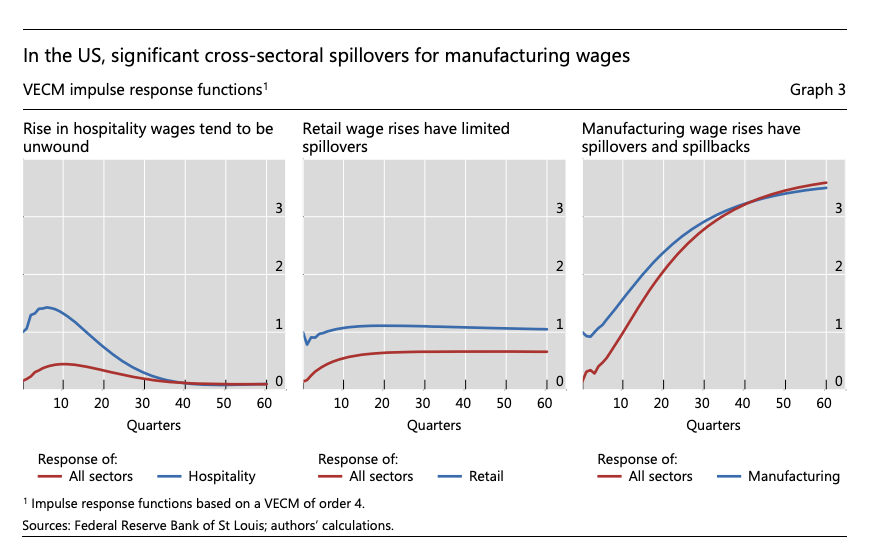

The BIS authors back up Klein’s analysis with some time series tests that compare the spillover effects of wage increases in particular sectors to the wider economy.

Historically, wage increases in leisure and hospitality have been short-lived and spillovers to wages in other sectors limited (Graph 3, first panel). Spillovers from retail trade wages to other sectors are somewhat more persistent, yet still small (second panel).5 The recent increase in manufacturing wages may pose greater risks, as wage growth in this sector has historically had large spillovers (third panel).6

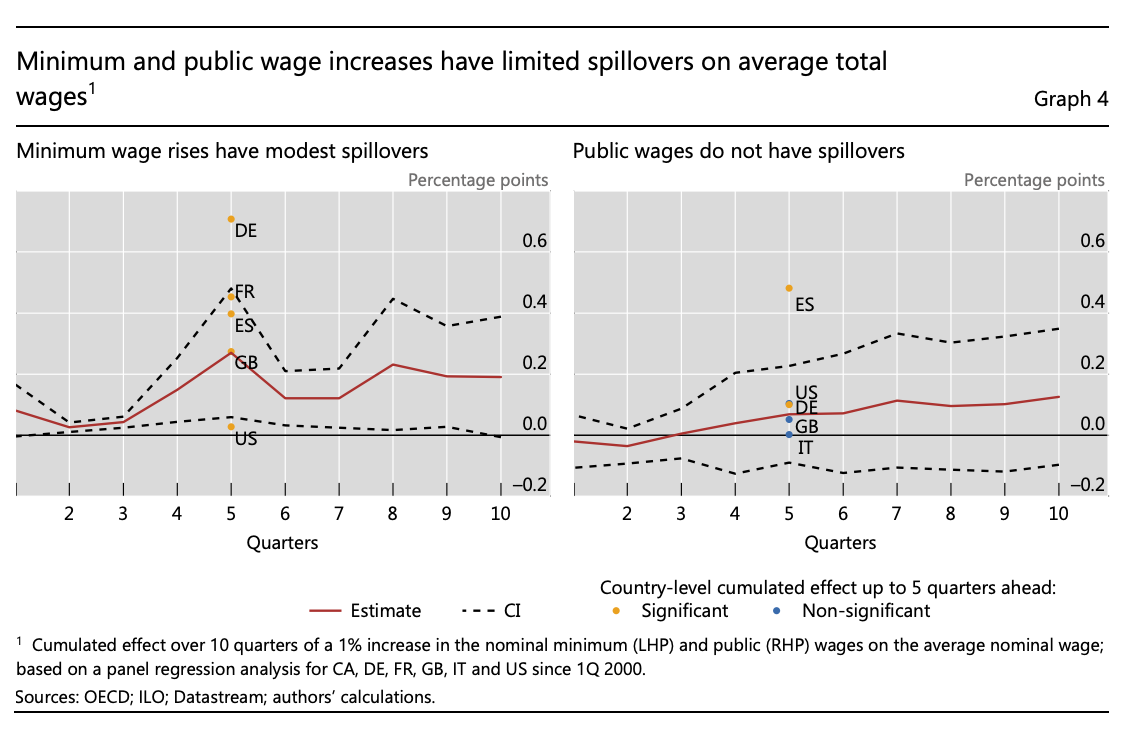

Manufacturing wage increases endure and spillover to the rest of the economy, those in major service sector occupations tend not to. As the authors note, as far as the most unionized sector in the US economy is concerned, the public sector, the news is not good for workers.

In the United States, the pay gap between private and public wages has actually widened since before the pandemic (Morrissey and Sherer (2022)).

The fascinating question in the current moment – to put is somewhat academically – is whether statistical relationships measured in recent decades characterized by persistent low inflation will carry over to a period with more rapid price increases. What if we are entering a period in which agency counts and history is made? That hope is surely what lurks behind the enthusiasm for charismatic labour organizers like Christian Smalls.

As the BIS authors note:

… the key question is whether the empirical regularities observed under low inflation will prove durable as inflation rises. Anecdotally, calls to make up for lost purchasing power in 2021 have been increasing. In the United Kingdom, for example, unions have recently pushed for pay rises of approximately 10%, while in France some unions have called for a 25% increase in the minimum wage. In the United States, several large companies have agreed to include COLA clauses in multi-year wage contracts following strikes in late 2021, and calls to unionise have risen. Pressure to increase minimum wages could rise, following the example of several states that have already done so in 2022, as inflation remains elevated. Public wages, which are set by collective bargaining in some countries and tend to have COLA clauses, could set the benchmark for private sector negotiations. And, if these wage rises do occur, their spillovers to other wages and prices could be larger today than when inflation was low.

Of course, the crucial thing to remember is that workers are not the only actors who might generate spillover effects. As the data for profits show, corporations and management have not been idle. They clearly sensed an opportunity in the aftermath of COVID and have seized it. The question is whether other social forces can do so too.

In light of that one should surely welcome Schnabel’s observation that

So far, workers are bearing the brunt of the inflationary shock, as nominal wage growth has remained muted. Yet only a relatively small number of wage contracts have been renegotiated since inflation started to increase strongly in the second half of 2021. The strength of the wage channel depends on the relative bargaining power of labour. And that bargaining power is arguably strengthening.

The frankness with which Schnabel speaks here of the “bargaining power of labour” is striking. It is striking because it implies not an idealized, atomized view of the labour market, but one that views employment terms as determined by collective struggle in which power is a relevant variable.

One of the basic ideas informing both Crashed and Shutdown was the view that central banks have the agency that they have enjoyed in the last twenty years in large part because they operate in a world of spectacularly lopsided class power. The modern model of the independent central bank may have been born out of the class struggle and inflationary wage-price spirals of the 1970s. But, as the BIS data attest, since the 1990s central bankers have operated in a world in which those forces are dead. You could do adventurous monetary policy precisely because there was no risk of unleashing a trade union-led, wage-price spiral, or even excessive fiscal activism on the part of elected politicians.

The profit surge in the first phase of the COVID recovery only confirms the stark imbalance of our social conditions. The current debate about inflation and wage-price spirals is – more or less openly – a debate about whether that class balance might be about to shift. And if so, will that shift be merely temporary – an effect of labour market tightness for instances – or will the energy of a new generation of union organizers, impelled in part by rising prices, produce a more lasting rebalancing?

It seems unlikely, but the fact that the question is posed at all is surely significant. When the question of distribution is posed as one not merely of dollars and cents but of social power, it becomes far more consequential and radical. It challenges the autonomy of technocrats in the basic sense that it challenges their grip on the main levers of the economy. Whatever distributional outcome those policy-makers prefer – and their preferences may be more or less progressive – it challenges their control and their ability to pursue what they believe to be optimal outcomes.

As the BIS authors unselfconsciously conclude:

Policymakers should be attuned to shifts in inflation expectations and to potential pressure to reinstate institutional structures that made economies more prone to wage-price spirals in the past.

******

I love putting out Chartbook. I am particularly pleased that it goes out for free to thousands of subscribers around the world. But what sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press the button below and pick one of the three options.

- The annual subscription: the $50 annual bargain rate

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility for the price of a fancy coffee.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions.