The damage being done to the Ukrainian economy every day by the Russian attack is mounting up at a dizzying pace. The bill, simply in terms of physical destruction, is likely in excess of $100 billion and counting.

Perhaps unsurprisingly this has triggered calls for a Marshall Plan for Ukraine.

I took up the theme in a new piece for New Statesman.

Having had Alan Milward as a Phd supervisor at the LSE and having taught the Marshall Plan for more than a decade at Cambridge, it was a return to old intellectual haunts.

If you fancy reading just one, short thing on the Marshall Plan make it the fantastic essay by David Reynolds in Foreign Affairs from 1997. This piece is Reynolds at his brilliant best. I defy anyone to pack more narrative and crucial detail into 15 pages.

As Reynolds observes, part of the problem of writing the history of the Marshall Plan is that propagandistic hype was an integral part of the plan and contributed materially to its political effectiveness. The legend is part of the project. Nevertheless,

amid the fuzzy figures and revisionist rollback a clear contrast stands out. Between 1948 and 1951, the United States pumped about $13 billion into Western Europe. Between 1948 and Stalin’s death in 1953, the Soviet Union extracted some $14 billion from Eastern Europe.18 These statistics are crude but telling. They deserve a place in any history of postwar Europe

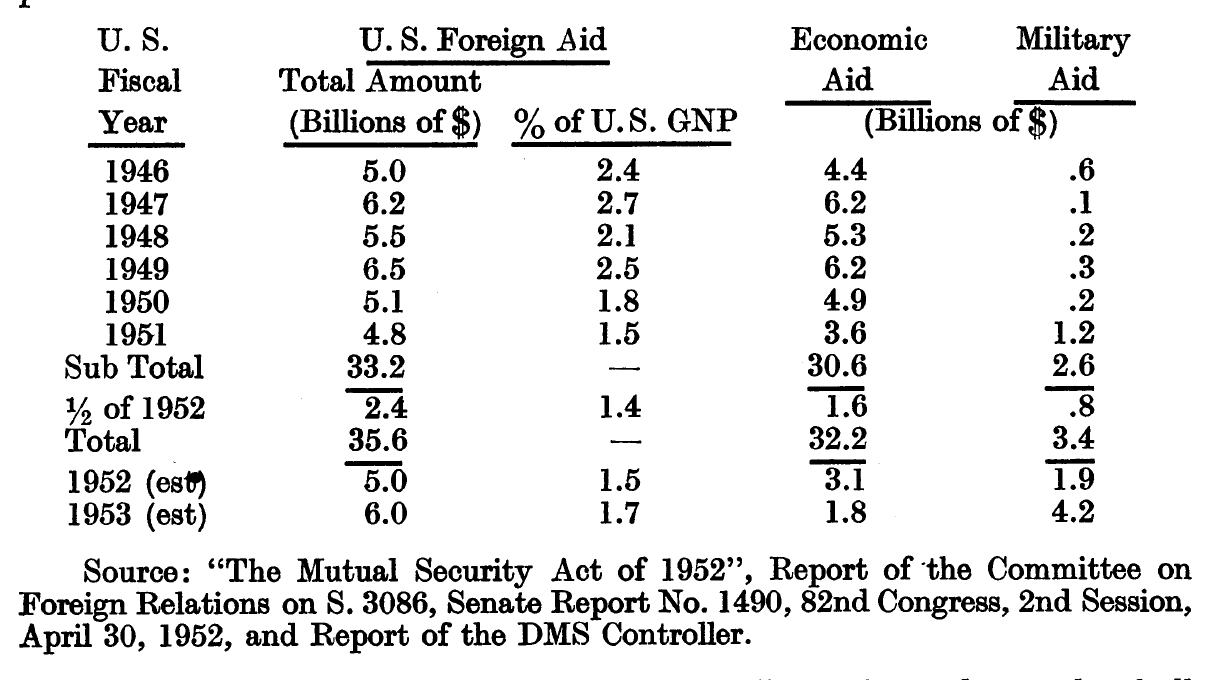

Indeed, by focusing on the $13 billion that can be attributed immediately to the Marshall Plan, we understate the scale of American financial engagement after 1945. Relief and financial assistance was delivered in many forms both before and after the Marshall Plan.

Source: Josef Berolzheimer in the FinanzArchiv 1953/54

As this table makes clear, if we take in view the overall flow of American aid to the rest of the world, the years of Marshall Plan disbursement do not particularly stand out. Already in 1946-7 the US was making large bilateral loans and supporting UN relief efforts. What made the Marshall Plan so different was the effort to craft a general program for longer-term economic rehabilitation and to do so on a coordinated European basis, rather than simply to compile national shopping lists.

Berolzheimer’s article, from which the data are taken, is a real find. As a note explains, Berolzheimer was a

staff member of the Mutual Security Agency. … He wishes to express his gratitude to Dr. Gerhard Colm, National Planning Association, for the review of the manuscript and valuable suggestions, and to Miss Anita E. Yale, MSA, for her assistance in preparing the statistical material.

The acknowledgement of Colm and the title of the essay – “The Impact of U.S. Foreign Aid Since the Marshall Plan on Western Europe’s Gross National Product and Government Finances” – are telling. The Marshall Plan was, amongst other things, a classic expression of the new era of macroeconomic governance and it was evaluated in those terms.

As Berolzheimer notes:

To measure the effect of United States foreign aid, the change of the gross national product may be the best available yardstick.

Any economist today is likely to agree with using gnp as a yardstick. The cautious way that Berolzheimer stated the point is telling. In the early 1950s, the conventional framework of macroeconomic analysis could not yet be taken for granted.

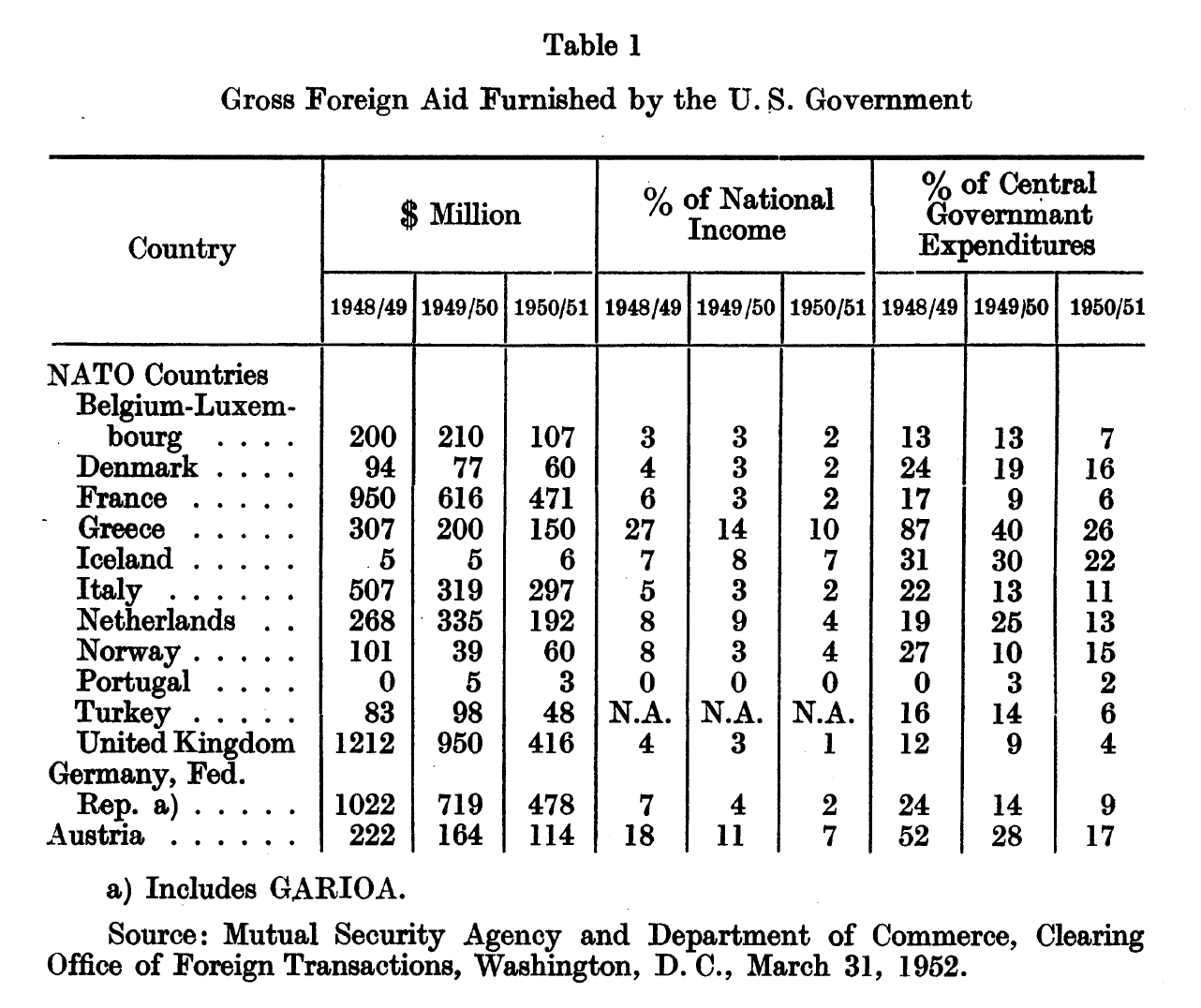

If one applied the metric of GDP, what was obvious, already at the time, was that many claims on behalf of the Marshall Plan were, likely, exaggerated. In relation to the national income of the recipient countries, the Marshall Plan was large but not overwhelming.

This was the basis for the revisionist critique of Marshall Plan hype delivered by Alan Milward in his famous book the The Reconstruction of Western Europe 1945-1951.

Published in 1984 Reconstruction remains, almost forty years later, by far the most heavy-weight economic assessment of the Plan. As Milward sought to establish, the Marshall Plan was not necessary to Europe’s recovery.

As Milward explained in a critique of Michael J. Hogan’s work, The Marshall Plan: America, Britain, and the Reconstruction of Western Europe, 1947-1952. New York: Cambridge University Press, 1987.

The official view, still loudly shouted by official American agencies throughout 1987 in a round of commemorative conferences in West European capitals and echoed in a blandly conformist radio program by the BBC, was that the Marshall Plan had “saved” Europe. Beneath this public conformity, however, the discussion had begun about whether the official line was true and from what, if anything, Europe had been “saved.” My own work argued that the alleged economic crisis of the summer of 1947 in Western Europe did not exist, except as a shortage of foreign exchange caused by the vigor of the European investment and production boom.”

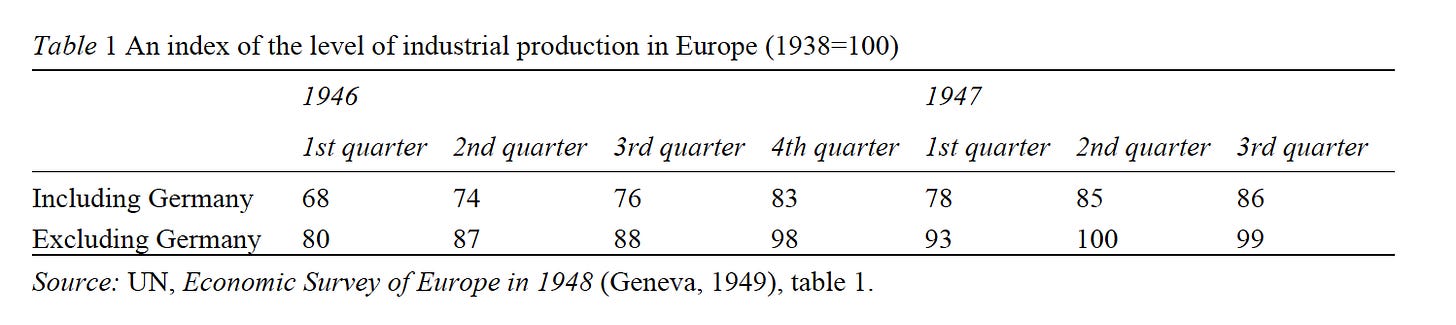

The boom that Milward is talking about is depicted in these indices for European industrial production before the arrival of the Marshall Plan.

Source: Milward, The Reconstruction

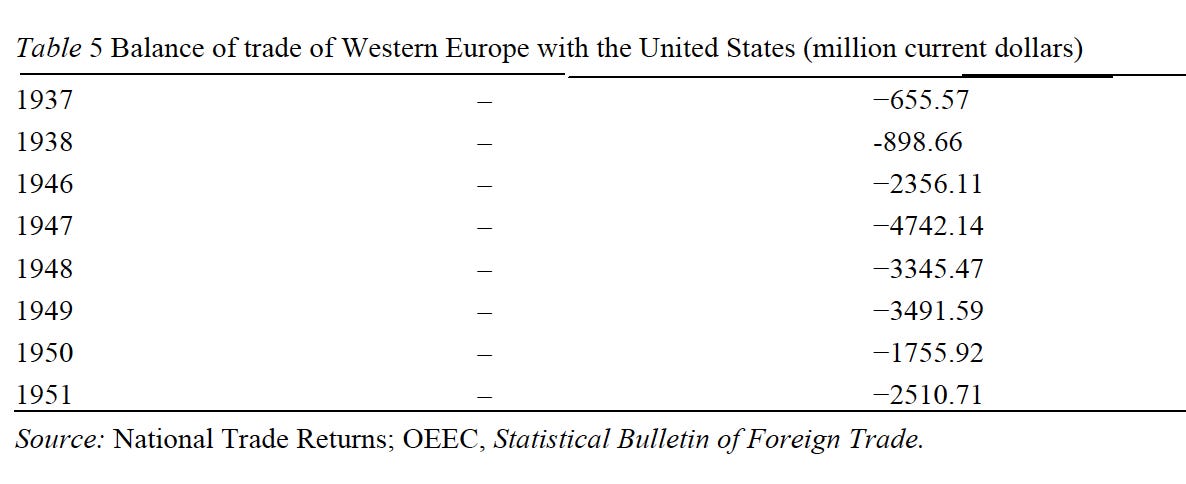

The result of this strong burst of growth was a dollar shortage driven by Europe’s hunger for imports from the dollar zone and its lack of exports.

Source: Milward, The Reconstruction

It was these deficits that were covered by American aid.

But was that aid essential to support reconstruction? To test this proposition Milward conducted a counterfactual exercise in which he imagined levels of food consumption and food import in Europe being frozen at their 1947 levels. According to his estimates, assuming this level of austerity, all the Marshall Plan recipients excepting France and the Netherlands would have been able to pay for their imports of machinery and raw materials. On that basis Milward declares the Marshall Plan not to have been economically necessary.

But, as Milward himself concludes, all this means is that we have to shift the argument from strictly economic concerns, to the terrain of political economy. Not freezing the level of consumption at the diminished level of 1947 was precisely the point. Imposing such austerity in Italy would, given the strength of the Italian Communist Party, have been very dangerous. And as even Milward must concede the Marshall Plan really did matter in France. It could not have realized its ambitious investment goals without American assistance, even if it had frozen consumption at 1947 levels. But if the Marshall Plan mattered in France, then it mattered for Europe as a whole. Why? Because, France was pivotal to the project of European integration.

It was not the sheer scale of the Marshall Plan that was crucial but its role in breaking bottlenecks – both economic and political.

The UK was the country that received the largest allocation but where, given the size of the UK economy, it mattered least in proportional terms. Nevertheless, as Jim Tomlinson pointed out in an excellent article in 2000, the role of funding provided by the Marshall Plan was to ease what Janos Kornai termed a “shortage economy”, in which bottlenecks became self-reinforcing.

Above all the Marshall Plan was a tool for driving European integration. American influence was crucial in cajoling the French into abandoning the original anti-German vision of the first drafts of the Monnet Plan in favor, in 1950 of proposal for the European Coal and Steel Community.

Less well-known but more important from an economic point of view was American sponsorship of the European Payments Union, the essential monetary stepping stone between the financial autarchy of the 1940s and the final adoption of Bretton Woods norms of convertibility in 1958.

On the history of the European Payments Union, Albert O. Hirschman left a characteristically charming memoir. At the time Hirschman was heading the European desk at the US Federal Reserve. He helped to bypass the vigorous opposition from the Treasury to the idea of creating an American-backed European monetary zone separate from the dollar sphere.

On the importance of the EPU, to which the Marshall Plan allocated $600 million dollars in support in its final stages, Barry Eichengreen is essential reading.

In 2004 JOHN AGNEW and J. NICHOLAS ENTRIKIN then of UCLA published a collection of essays – THE MARSHALL PLAN TODAY. Model and Metaphor – that summarized the state of the art in the economic history of the Marshall Plan.

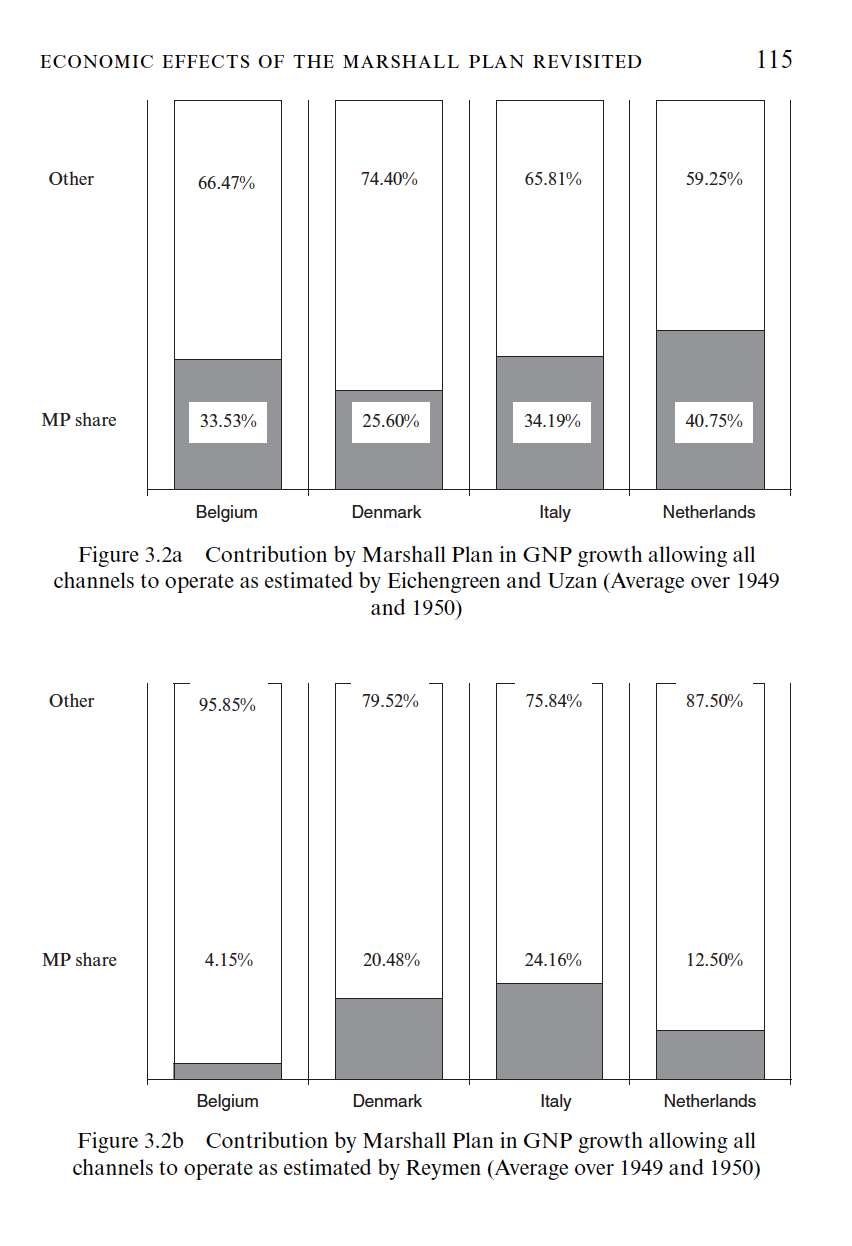

The tone was far from the triumphalism of the 40th anniversary in 1987. The results of an econometric exercise conducted by Dafne C. Reymen were typical.

The macoreconomic mode of analysis that the Marshall Plan had done so much to promote – with its focus on aggregative investment and growth – had now come to bury the Marshall Plan myth, with honor, but nevertheless to bury it.

The most recent major work on the Marshall Plan by Benn Steil offers a judicious conclusion:

“DID THE MARSHALL PLAN work? to the extent that it was intended to allow the United States to disengage from Europe militarily, the answer is no. The Truman administration was ultimately obliged to conclude, reluctantly, that it had to commit to a military alliance, NATO, to bring its vision to reality. The Marshall Plan and NATO are therefore best understood as two parts of a wider European security policy, which was itself embedded in an emerging Grand Strategy of Soviet containment. But on this level, as a component of a broader strategy, the Marshall Plan did indeed work.

In invoking the Marshall Plan at this moment as an answer to the crisis of Ukraine that broader conclusion should be born in mind. Beyond the myth, a Marshall Plan is not a magic bullet! To be successful it must be part of a broader strategy. And given Ukraine’s needs it will need to be on a huge scale.

****

I love putting out Chartbook. I am particularly pleased that it goes out for free to thousands of subscribers around the world. But what sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press this button and pick one of the three options: