Every moment of stress in the global financial system is a test of lines of interconnection and power. The most obvious example of this right now is the sanctions regime imposed on Russia. That has provoked a surge in debate about possible alternatives to the dollar, ruble-yuan systems, commodity-based networks of finance etc. The line I have been taking in Chartbook is that talk of alternatives to the dollar is not so much premature as reflective of an unease with the present, which finds relief in Finance-fictions (Fin-Fi) that are less predictive than expressive. A realistic analysis needs to resist the temptation to escape into the future and instead to stay with the actually existing dollar system and its troubles. The urgent question to ask is how the lines of power and influence continue to operate within this system.

As US monetary policy tightens in response to the surge in global inflation, the effect is felt around the world. In the first instance this reads like a story of collateral damage. But might there be blowback? Might the effects of US tightening on the wider world affect the United States itself? If so where will that blowback come from? Emerging Asia, or the advanced economies?

As I argued in Chartbook #108, one group of economies that are badly affected are the low-income and EM economies who see their borrowing costs rise.

The fear is of another “taper tantrum”, as in 2013-4 when Ben Bernanke hinted that the Fed was thinking about slowing its asset purchases (QE3) and this triggered a sudden tightening in funding costs for EM. In 2022 we again facing warnings of a global debt crisis. Sri Lanka is the most obvious casualty so far. There may be more to come.

This prospect ought to matter to US policy makers from a regional policy and geo-economic point of view. The fate of hundreds of millions of people hangs in the balance. But the question in Washington and New York will be: what are the implications for the US economy of this global reverberation from Fed tightening?

Certainly as far as Sri Lankan crisis is concerned, the implications for the US economy are negligible. US exports to Sri Lanka amount to a few hundred million dollars annually. There are no substantial financial connections.

This asymmetry in relations is true even for some very large emerging market economies. In 2020 the US Federal Reserve did not see fit to extend a central bank liquidity swap line to Indonesia. Why not? Because first and foremost the Fed’s interest in global financial stability is dictated by its responsibility for US financial stability and it is not plausible to argue that a liquidity squeeze in Indonesia will blow back seriously on the United States.

This asymmetry of monetary power is very pronounced with regard to the emerging markets and low income countries integrated into the dollar system. But weighted in dollar-terms they are small parts of the system. They are not too big or too systemic to fail. With regard to the big nodes in the system – Europe and East Asia – the interactions are two-way.

In the North Atlantic financial system, centered on the axis between Wall Street and the City of London, the influences run both ways and the response from US policy-makers reflects that. In the 2008 financial crisis the Fed extended as much liquidity support to European banks as it did to American banks. The Fed dispensed this largesse because it did not want to find out how an acute crisis at Barclays or Deutsche Bank might blow back on the US financial system.

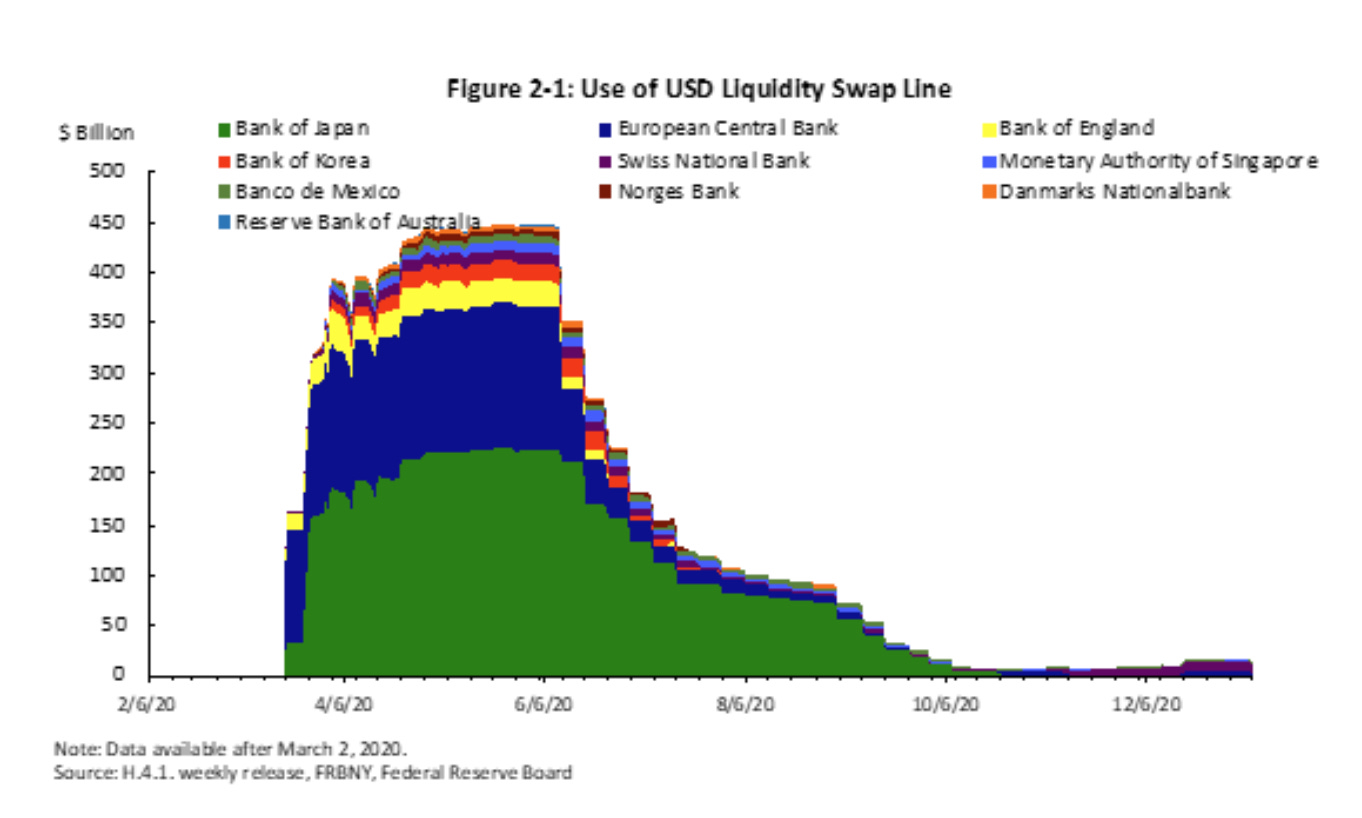

In 2020 the swap lines were put in place again. And this time rather than the ECB it was the Bank of Japan that was the main taker of dollar liquidity.

Source: Junko Oguri Yale SOM 2021

In 2022 as well, it is, once again, not the Euro-US axis that is being tested, but the Japan-US axis.

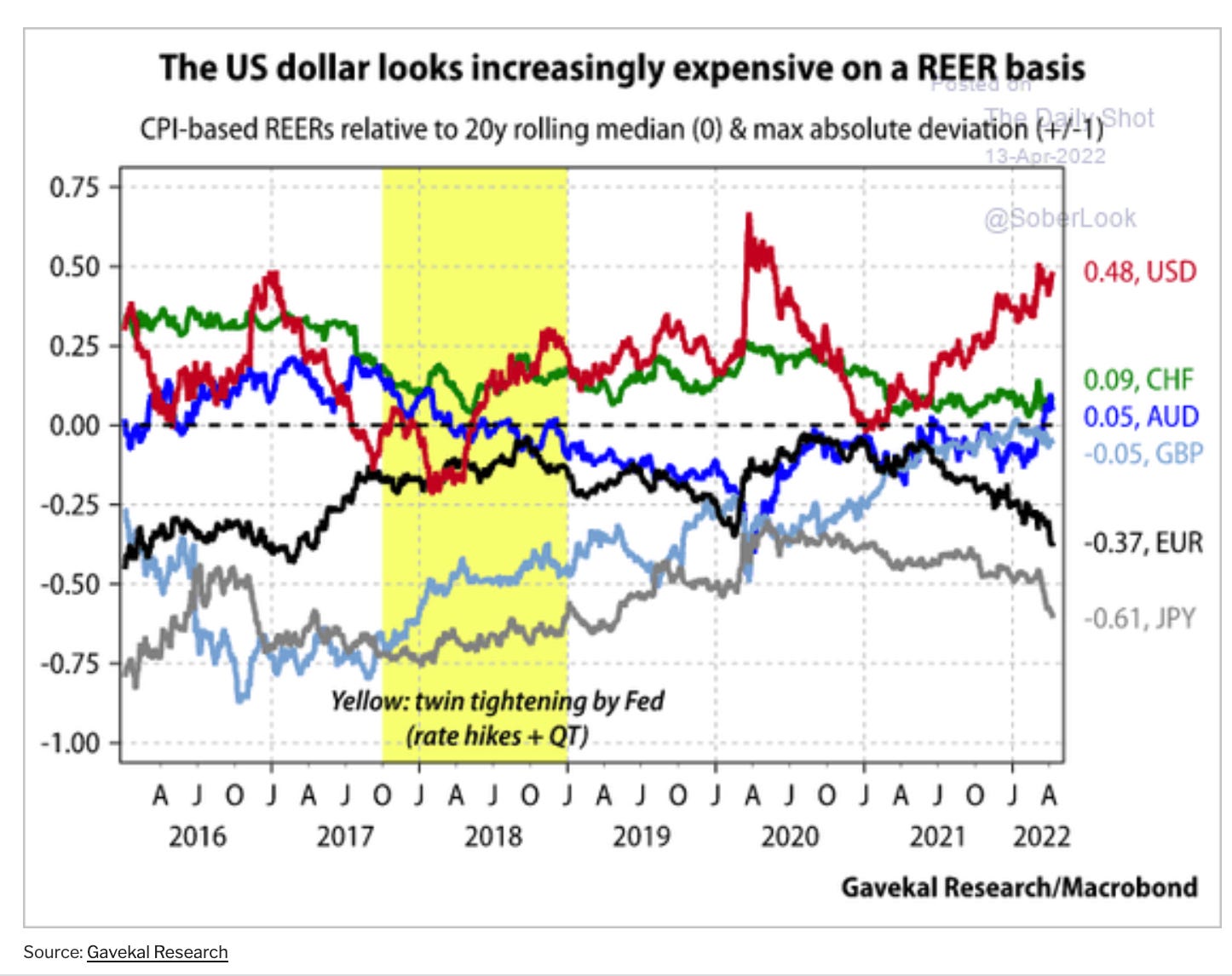

For the world economy, the biggest news of recent weeks is not so much the vicissitudes of the ruble, but the sudden movement in the Yen-dollar exchange rate. From a high of 102 Yen to the dollar over the winter of 2020-2021 the Yen has plunged to 128 per dollar and is heading towards 130, a devaluation not seen since the early 2000s. That is a thirty percent relative movement across one of the major currency pairings in the world economy. Balance sheets involving trillions of dollars in both yen and dollars are affected.

Source: Daily Shot

Why the devaluation? Japan is currently running a trade deficit. It is a major commodity importer and paying the price. But macroeconomic fundamentals do not explain this currency movement. Inflation in the US is running far ahead of Japan. What explains the movement are market reactions to central bank policy. Most of the depreciation is driven by the discrepancy between the Fed’s increasingly adamant commitment to monetary tightening and the Bank of Japan’s continued stimulus.

Historically, the big swings of the dollar and the yen tend to track the relative stance of central bank policy. The Yen strengthened between 2007 and 2012 under the impact of the financial crisis and Fed loosening. Then, when Japan adopted the massive monetary stimulus policies of Abenomics, this depreciated the yen.

To be clear, despite the scale of the exchange rate movement, we are not expecting a financial crisis. No banks are at risk on either side – as far as we know anyway. Nor will Japan in aggregate suffer an unbearable surge in debt service costs, as many low income borrowers may do. It is not inconceivable that there are dollar-denominated liabilities on Japanese balance sheets that now more expensive to service. That was the kind of effect we saw in 2015 when the Chinese yuan devalued. But that is not the story that is beginning to attract attention with regard to US-Japanese financial relations.

The issue of the moment is not so much Japanese borrowing, but the reverse, Japanese demand for dollar assets and, in particular, US Treasuries. Might the uncoordinated stance of the Bank of Japan and the Fed by unleashing a severe yen devaluation slash Japanese demand for US Treasuries? If so, that would blow back on US financial markets in a way that even the most severe crisis in an emerging market economy never could.

You might think that an appreciation in dollars relative to yen would be good for Japanese demand for American assets. Existing holders of US Treasuries are certainly reaping a windfall. But – to put it simply and the details here are quite tricky – new Japanese investors in US Treasuries have first to swap yen into dollars and hedge against exchange rate movement and due to the abrupt depreciation of the yen that conversion and hedging is getting more and more expensive.

Back in 2019 Brad Setser gave a lucid explanation of one of the mechanisms at work in this financial flow.

With a cross currency swap, Japanese investors get dollars that they can then invest abroad. And foreign investors—if they are the suppliers of dollars—get yen. Those yen are then invested into the local bond market. That’s why there has been a large inflow into the Japanese government bond market over the last five years even though JGBs yield zero. The suppliers of dollars are capturing the premium that Japanese financial institutions are willing to pay for dollars—not the yield (ha!) on offer in the JGB market.

Given the prospects for the yen, there are fewer investors outside Japan willing to go long yen in exchange for dollars. So, to get dollars, Japanese investors now have to pay an increased premium and a further premium to hedge against future exchange rate movements. Those costs, which are rising, make it less and less attractive for Japanese investors to buy US Treasuries even if the US bonds promise a premium in terms of yield. And that matters because Japan, unlike Sri Lanka or Indonesia, is a very big players in US financial markets.

As the United States experienced in March 2020, EM reserve holders can exercise significant pressure on US Treasury markets, if they simultaneously seek to liquidate substantial portfolios. But Japan’s investors are players in a different league.

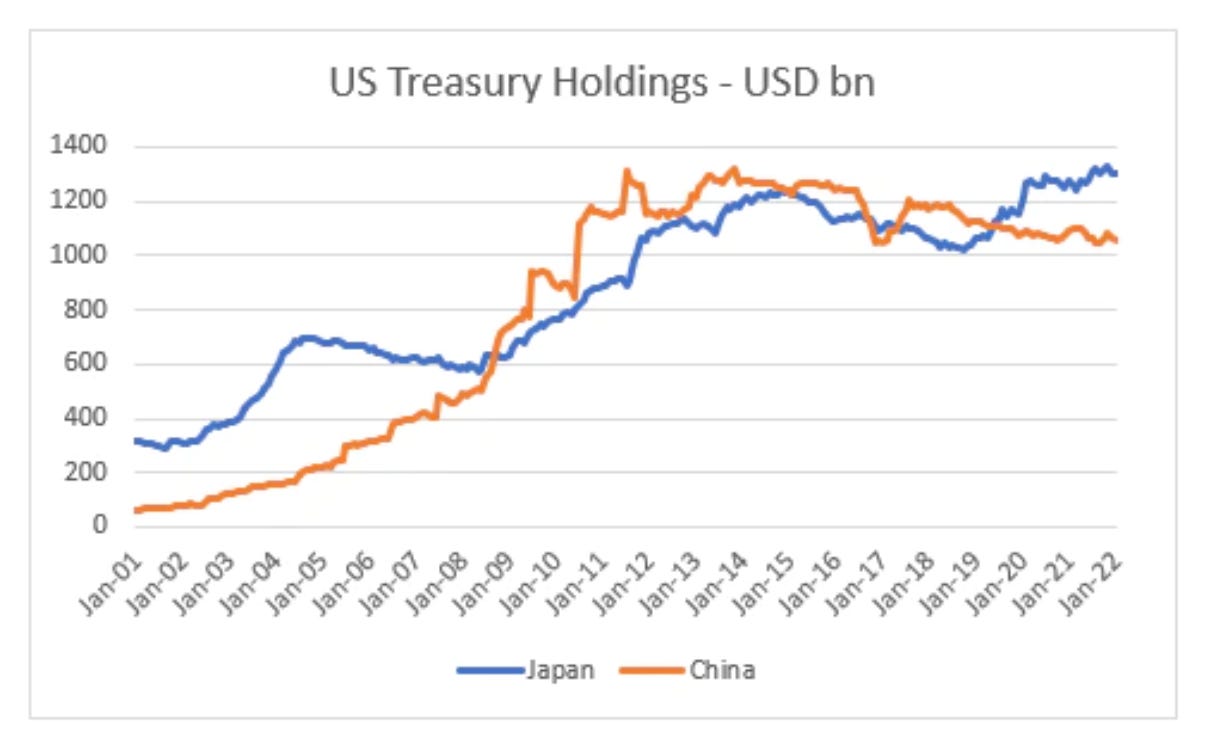

In the 1980s and 1990s Japanese investors were the largest foreign holders of US Treasuries. They lost that status to China in 2008, but in 2019 Japanese investors again surpassed the Chinese as the largest foreign holders of US Treasuries.

Source: Russell Clark

If Japanese demand for US Treasuries stalls as a side-effect of yen depreciation, this would be a significant effect for the US under any circumstances. It is particularly so, if the trigger for the development is tightening of US monetary and a decision by the Fed to reduce and then halt its own purchases of US Treasuries.

As Eric Platt and Joe Rennison pointed out in the FT:

That could pose a problem for the Fed, with demand from foreign investors for US assets seen as critical when the central bank begins to withdraw its pandemic-era bond-buying programme, increasing the supply of Treasuries for investors to buy. Minutes from the Fed’s March monetary policy meeting showed the central bank was keen to begin cutting the size of its balance sheet as soon as May, as it looks to curb surging inflation. …. “Who is the marginal buyer of Treasury issuance going to be after the Fed,” said Tim Wessel, a strategist at Deutsche Bank. “If the all-in cost of buying Treasuries is too high for these investors then that would reduce marginal demand for Treasuries and . . . that pushes Treasury yields higher.” The sharp rise in hedging costs stems from divergent central bank policies between the US and Japan and the relationship between benchmark interest rates and currencies. The Bank of Japan has committed to stimulus measures to help its economy, just as policymakers at the Fed signal their intent to raise interest rates to tamp down high levels of inflation. This has had the effect of pushing up short-dated US Treasury yields, which closely track interest rate expectations, and strengthening the US dollar. However, a bigger difference in yields between the US and Japan also means that forward foreign exchange rates are lower than the current, or spot, rate. This in turn pushes up the cost to lock in a hedge, in order to swap dollars back into yen in the future. “[Central bank policy is] driving the hedging cost for non-US countries because their central banks are very much behind what the Fed is doing in terms of rising interest rates,” said Logan Miller at Wells Fargo. … While higher bond yields in the US typically increase the appeal of American assets for foreign buyers, the cost to protect against currency swings over the coming years has eroded much or all of the potential gain. Strategists at Bank of America in late March forecast that the extra yield an investor in Japan would earn holding US corporate bonds would soon be completely lost if they converted it back into yen. They added that some Japanese money managers could even decide to sell out of their corporate bond positions, as holding costs become prohibitive. For now, Japanese traders have grown more cautious over US government debt. “You are seeing some investors shy away from the Treasury market,” said Lawrence Rhee, a rates trader at asset manager TCW. “Things have moved quickly since the beginning of the year and they [Japanese investors] have probably been taken aback by the movement and volatility.”

This scenario becomes even more interesting when you consider that it is not only the yen, but the euro too that is devaluing against the dollar. And European investors are big buyers of Treasuries too.

None of this is an immediate cause for panic. If it is true that Japanese investors have been big buyers of US Treasuries, they have made those purchases by borrowing money from American lenders of dollars. As Brad Setser explained back in 2019 what this means is that:

In broad terms, a number of Japanese financial institutions have become, in part, dollar based intermediaries. They borrow dollars from U.S. money market funds, U.S. banks, and increasingly the world’s large reserve managers (all of whom want to hold short-term dollar claims for liquidity reasons) and invest in longer dated U.S. bonds.

If the US banks and money market mutual funds no longer want to hold yen and so the trade gets more expensive to the point at which it is no longer attractive for Japanese investors to take short and long positions in dollars, then the intermediation may simply shift back to the United States. Rather than the Japanese borrowing the short-term US funds to hold US Treasuries, US investors may do so.

In the global dollar-centered system, the boundary between inside and outside is fluid. A declining appetite for US Treasuries on the part of Japanese or European investors might well be offset by demand internal to the US financial metabolism.

The dollar system has to be understood as containing within it the currencies that it subsumes, most notably the yen and euro-based financial systems. So long as exchange rate movements are small or can be hedged cheaply they function as effectively indistinguishable from the US financial system. That, however, depends on preserving a stable alignment of central bank policy – it does not need to be the same, but it does need to be aligned in a stable way. That stability of alignment. is now being put to the test.

Over the last 12 months the rise in prices in major economies is:

— Jason Furman (@jasonfurman) September 8, 2021

US: 5.3%

Euro area (Aug): 3.0

UK: 2.0

Japan: -0.3

Canada 3.5

That is very, very different.

(Note, measuring with same methodology *increases* the gap, as you can see from US inflation w/ HICP methodology.) pic.twitter.com/sZ4i2DcMY6

Chartbook’s bet is that the divergence in inflation that became evident in 2021 and the uncoordinated response of central banks to that pressures will prove to be a more significant test of the dollar-system than the fumbling efforts by Russia and its trading partners to find alternatives to the dollar.

*****

I love putting out Chartbook. I am particularly pleased that it goes out for free to thousands of subscribers around the world. But what sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press this button and pick one of the three options: