Triggered by the sanctions imposed on Russia’s central bank there is a lot of excited talk right now about the possibility of major holders of reserves diversifying away from the dollar.

I’ve been a skeptic. My sense is that the main lesson from Russia’s experience is that there is nowhere else to go. If you diversify out of dollars the only large-scale bolt hole is Euros and as far as major international crises are concerned the chances of the US and Europe not moving together is slight. And even if European governments did not take action, European financial institutions by now know the cost of finding themselves on the wrong side of the US authorities.

It is comforting to see my two esteemed fin-twitter colleagues @JosephPolitano and @RobinBrooksIIF in broad agreement.

Joseph Politano offers a typically well-argued and richly sourced take on why the dollars grip is likely to remain strong. The gist of his argument is that the dollar is simply too deeply dug into trade finance and global credit to be easily abandoned.

“”The US dollar will likely continue its 70 year reign as global reserve currency” doesn’t get clicks or sell papers, and so it doesn’t get written or shared. But that doesn’t make it any less true.” — @JosephPolitano illuminating as always https://t.co/oZXJ19pDxM

— Michael (@profplum99) March 26, 2022

Robin Brooks meanwhile tracks the daily capital flows with an eagle eye. And in this crisis he sees no erosion of the dollar’s strength. Rather the contrary.

There's chatter that Russia's invasion of Ukraine and ensuing US sanctions are causing a "stealth" erosion of US reserve currency status. This chatter is a long way from the reality in markets, where the Dollar is near record strength. There is no erosion of Dollar dominance… pic.twitter.com/cLuzDZXgJK

— Robin Brooks (@RobinBrooksIIF) March 28, 2022

But then, in yesterday’s FT none other than Barry Eichengreen weighed in to the debate with a short peace announcing the “stealth erosion of dollar dominance”.

Eichengreen is by far the most influential international economic historian of his generation. Books like Golden Fetters anchor the entire literature on the interwar period.

So, when Barry Eichengreen sneezes we listen. When he announces the stealth erosion of the dollar’s standing you really pay attention.

In reading Eichengreen’s FT piece it is useful to add some background.

Eichengreen has long argued that it is simplistic to assume that the dollar’s current dominance is baked in for the foreseeable future. In a book published in 2017 with European Central Bank economists Arnaud Mehl and Livia Chițu, How Global Currencies Work: Past, Present, and Future (Princeton University Press), Eichengreen challenged the traditional “winner-take-all” view that there can only be one dominant reserve currency at a time. This assumption about reserve currencies, Eichengreen and his co-authors argued, was an artifact of the historical transition from the British pound dominated to the US dollar took over. It may now apply to the future.

Using evidence on central bank reserves from the 1910s to early 1970s, Eichengreen and his co-authors found that reserve currencies can and do coexist. In the interwar period, the British pound and the US dollar functioned side by side. Also before World War I, even though sterling was the most important currency, the French franc and German mark also functioned as major reserve assets.

“From this vantage point, it is the second half of the 20th century that is the anomaly, when an absence of alternatives allowed the dollar to come closer to monopolizing this international currency role,” Eichengreen and his co-authors argue.

On this basis they see no reason why the dollar might not find its relative share of reserve assets declining “sooner rather than later.” The dollar will be forced to share prominence with the yuan and the euro, in particular.

Quartz spoke to Eichengreen in London on what to expect if the dollar loses its hold over global financial markets.

Quartz: This book dismantles a long-standing theory about the global currency system. What was wrong with the traditional theory?

Eichengreen: The traditional view is that international currency status is a winner-take-all game, that there’s room on the global stage for only one true international currency. The argument was that network effects are so strong they create a natural monopoly because it pays to use the same currency in cross-border transactions that everybody else has used. The new view is that financial technology has moved on and network effects are no longer so strong. It’s easier to switch between currencies. It’s similar to how operating systems for personal electronics have transformed. Everyone doesn’t have to use Windows anymore.

I like the historicized approach to modeling the global currency system. It is easy to agree that the situation after 1945 was profoundly anomalous. Indeed, recognizing this point marks an important evolution in Eichengreen’s own thinking about financial hegemony.

Since the 1970s the dominance of the dollar has been maintained by scrambling improvisation. And in recent decades the euro has emerged as an alternative. I sketched a possible historical narrative along these lines in a piece for Foreign Policy back in January 2021.

But, as the current crisis illustrates, a diversification out of dollars into euros has turned out, as far as Russia is concerned, to be a difference that does not make a difference. Russia finds itself in what amounts to a euro-dollar trap – a triangle consisting of dollars, offshore euro-dollars and euros. It is this triangle of currencies that dominates the North Atlantic and East Asian financial hubs. It is subtended by dollar swap lines in unlimited amounts and is buttressed by a similar expansive monetary relationship with Japan.

Eichengreen’s most recent FT piece is based, as ever, on original historical research, this time in collaboration with Serkan Arslanalp and Chima Simpson-Bell. Their paper, “The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies” was published by the IMF.

As they summarize their results in their abstract:

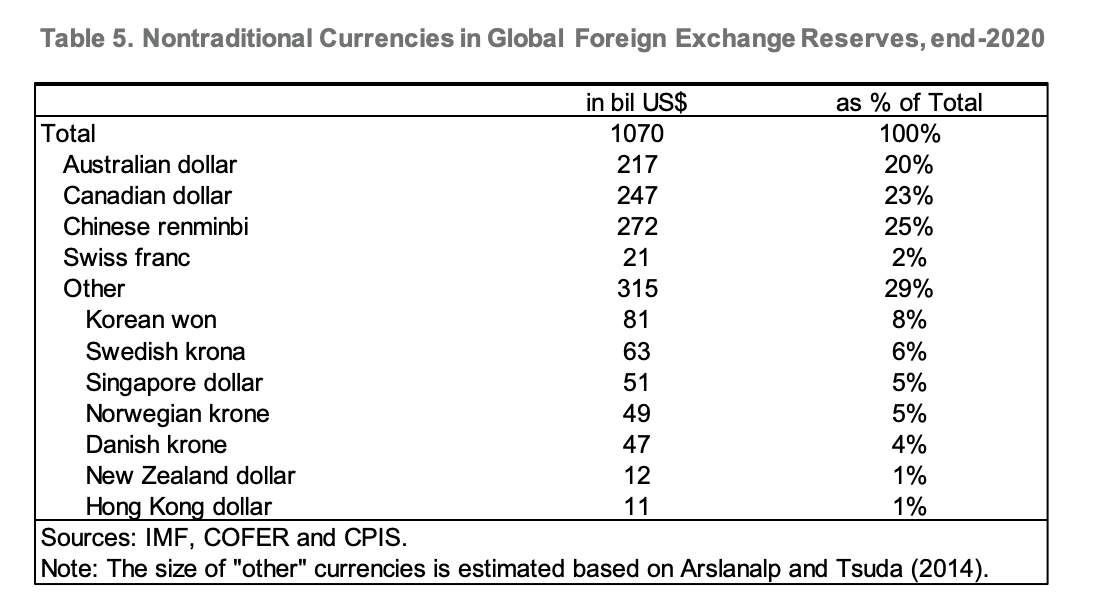

We document a decline in the dollar share of international reserves since the turn of the century. This decline reflects active portfolio diversification by central bank reserve managers; it is not a byproduct of changes in exchange rates and interest rates, of reserve accumulation by a small handful of central banks with large and distinctive balance sheets, or of changes in coverage of surveys of reserve composition. Strikingly, the decline in the dollar’s share has not been accompanied by an increase in the shares of the pound sterling, yen and euro, other long-standing reserve currencies and units that, along with the dollar, have historically comprised the IMF’s Special Drawing Rights. Rather, the shift out of dollars has been in two directions: a quarter into the Chinese renminbi,and three quarters into the currencies of smaller countries that have played a more limited role as reserve currencies. A characterization of the evolution of the international reserve system in the last 20 years is thus as gradual movement away from the dollar, a recent if still modest rise in the role of the renminbi, and changes in market liquidity, relative returns and reserve management enhancing the attractions of nontraditional reserve currencies. These observations provide hints of how the international system may evolve going forward.

Since 2000 the share of the dollar in global reserves has fallen from 70 to 59 percent in 2021. The chief beneficiaries are Canada, Australia, Sweden, South Korea and Singapore.

Now this is an interesting observation. And in the context of the debate about the financial sanctions on Russia is is likely to attract much attention as evidence for a shift away from the dollar.

In technical financial terms that is clearly true. Reserve managers are diversifying. But does this shift indicate a shifting balance of power in the global financial system, to the detriment of the dollar and the US authorities? That seems more than debatable.

All of the non-traditional currencies that Eichengreen and his co-authors identify are very much part of America’s extended financial security system. They are all recipients of swap lines. If it came to the crunch in a confrontation with Russia or China who would doubt which side they would be on? Rather than seeing them as rivals or substitutes to the core dollar system is it not plausible to see them as extended buttresses of that system, providing options for diversification whilst continuing to benefit from the liquidity and sophistication provided by America’s financial markets.

As far as the renminbi is concerned, the conclusions reached by Eichengreen and his colleagues is in fact downbeat. As Eichengreen puts it in the FT.

What about faster diversification towards the renminbi? Anyone contemplating moving reserves in that direction will have to consider the possibility that China could become subject to secondary sanctions. Moreover, Putin’s actions are a reminder that authoritarian strongmen can act capriciously when there are few domestic counterweights to restrain them. That President Xi Jinping has shown little inclination to interfere in the operations of the People’s Bank of China is no guarantee that he will maintain that stance in the future. It is no coincidence that every leading reserve-currency issuer in history has had a republican or democratic form of government, with checks on executive power. Russia’s reserve managers have no choice but to turn to the PBoC so long as it continues to grant them access. But for other central banks, an ironic result of the US decision to weaponise the dollar may actually be to slow international take-up of the renminbi.