Great links and reading on the price control debate

“The price per liter of LPG jumped to 120 tenge (28 U.S. cents) at gas stations in hydrocarbon-rich Mangystau – where up to 90% of vehicles run on LPG – at the start of this year, compared to the price of 50-60 tenge the year before, igniting the unrest.

The nearly 100% rise that doubled the prices in the oil-rich region prompted almost countrywide demonstrations. The unrest has already prompted the nation’s president to sack the Cabinet on the fourth day of the protests.” Source: Daily Sabah

Debates about price controls are getting out of hand https://t.co/daZjCYhe9a

— Max Jerneck (@MaxJerneck) January 6, 2022

Hands up anyone who predicted that we would start 2022 by discussing strategic price controls, 1971, 1946 and the crisis of the Kazakh regime.

This thread has great meme game:

The Guardian piece on price controls really triggered people. Alan Blinder wrote a famous paper on why these were ineffective in the 70s, only changing the timing of inflation rather than its magnitude: https://t.co/o7hqc76Ene

— Dario Perkins (@darioperkins) December 30, 2021

On the US situation and price controls

On the original piece by Isabella Weber on price controls that triggered this entire debate, I still like this thread by Eric Levitz and the piece it is attached to.

Jotted down a few thoughts on the burgeoning debate over price controls/other unorthodox approaches to inflation management:

— Eric Levitz (@EricLevitz) January 2, 2022

Anti-inflation tools:

For a wide ranging consideration of different anti-inflation measures, this by Buddy Yakov is excellent.

We are left with a huge set of tool kits to deal with prices. I like to see it as a layer cake:

- The first layer is an industrial policy designed to push forward innovative production and make sure there are sustainable supply chains for that production.

- The second layer is a savings and incomes policy that guarantees demand by putting a floor under consumption but also encourages households to invest in public instruments and thus put some caps on consumption.

- The third layer should be credit and price controls meant to tamper down on extremely volatile components of CPI.

- The fourth layer – the red button – should then be aggressive interest rate hikes.

The purpose of this post is to discuss some ideas for how to deal with short-term inflationary bouts to pave the way for a wage-led economy. In addition to commenting on the hikes v. price controls debate that Weber’s article has inspired, I want to propose another way – deferring consumption via public savings. This is the proposal made by Keynes during the Second World War and is also present in Adolph Lowe’s theory about how to cross a traverse toward a full-employment economy.

Inflation Management

This piece by By Skanda Amarnath and Arnab Datta of Employ America, is very interesting:

Policymakers outside of the Fed can get ahead of this scenario by proactively adopting an “inflation management” approach that better achieves its policy goals. This does not have to mean Nixonian price controls. It means that the White House and Congress should, where feasible, use targeted fiscal policies and structural reforms to equitably address the demand- and supply-side challenges that contribute to inflationary pressure.

Healthcare as a sector is unique in terms of the influence that the federal government can exert over inflationary dynamics through legislation and regulation. It also makes up about a quarter of the Fed’s preferred real-time gauge of forward-looking inflationary pressures–”core PCE.” Rent inflation is likely to contribute more substantially to inflation readings in 2022 (0.4% additional contribution according to our forecasts), but those effects can also be entirely offset with healthcare policies that current law and proposed rulemaking already favors.

Profits and Prices

For a skeptical take on the relationship between profits and prices, I quoted the fantastic piece by Joey Politano. Here is Joey Politano is being super charming and very modest.

I just have to clarify that I'm not an economist at BLS—the work I do there is financial/budgetary and I don't have a graduate degree in Econ.

— Joey Politano🐇🚴🌱🕊️ (@JosephPolitano) January 3, 2022

I know it seems pedantic, but as a federal employee I have to be careful not to misrepresent myself.

Thomas Philipon one of the key economists on profit-gouging weighed in here:

1/n. My take on this question of monopoly power and inflation: two things are true at the same time:

— Thomas PHILIPPON (@ThomasPHI2) January 4, 2022

1/ The proximate cause for inflation is not a sudden increase in monopoly power.

2/ High demand and inflation suggest now is a good time to crack down on monopoly rents. https://t.co/IiPuH6GpOK

Office of Price Administration and all that

Before Isabella Weber made her case for price controls with reference to the 1940s, David Stein did something similar in Democracy Journal.

In this way, wartime frugality became an explosive political flashpoint. The rural South was outraged that preachers and ministers were not considered essential, and so Franklin Delano Roosevelt was too. He called in John Kenneth Galbraith, his lieutenant in price management with the Office of Price Administration (OPA), to ask him to ensure that ministers received their proper designation.

During World War II, pricing and production were too important to let the market bid up the cost of war material. Tires, cars, coffee, sugar—these were issues of critical national security. The size of the OPA reflected this; its staff of 250,000 was rivaled in the federal bureaucracy only by the Post Office. OPA had twice the number of economists as the Treasury Department; its decisions made front-page headlines.

Amongst historical references, David Stein cites the work by Meg Jacobs Pocketbook Politics: Economic Citizenship in Twentieth-Century America published by Princeton UP

Wirtschaftswunder

One of the discoveries for me in Isabella Weber’s interesting book about shock therapy in China was her discussion of Uwe Fuhrmann’s recent book on the hidden history of West Germany’s economic miracle.

Fuhrmann shows how much social discontent and struggle went along with the famous plans by Ludwig Erhard to introduce the Deutschmark and liberalize prices. I have to say it was news for me.

Unfortunately, the book is only available in German, but here is Uwe offering a thread in English.

The story about the German Wirtschaftswunder (economic miracle) was – and is – crucial for the central neoliberal narrative about the alleged self-regulation of prices through supply and demand.

— Uwe Fuhrmann (@Uwe_Fuhrmann_) January 5, 2022

But neither the narrative nor the german example matches reality: A #Thread #prices

Why price controls are a bad idea

Skip the polemics with the MMT crowd, but read this by Noah Smith through to the end.

Perhaps we do need monetary measures.

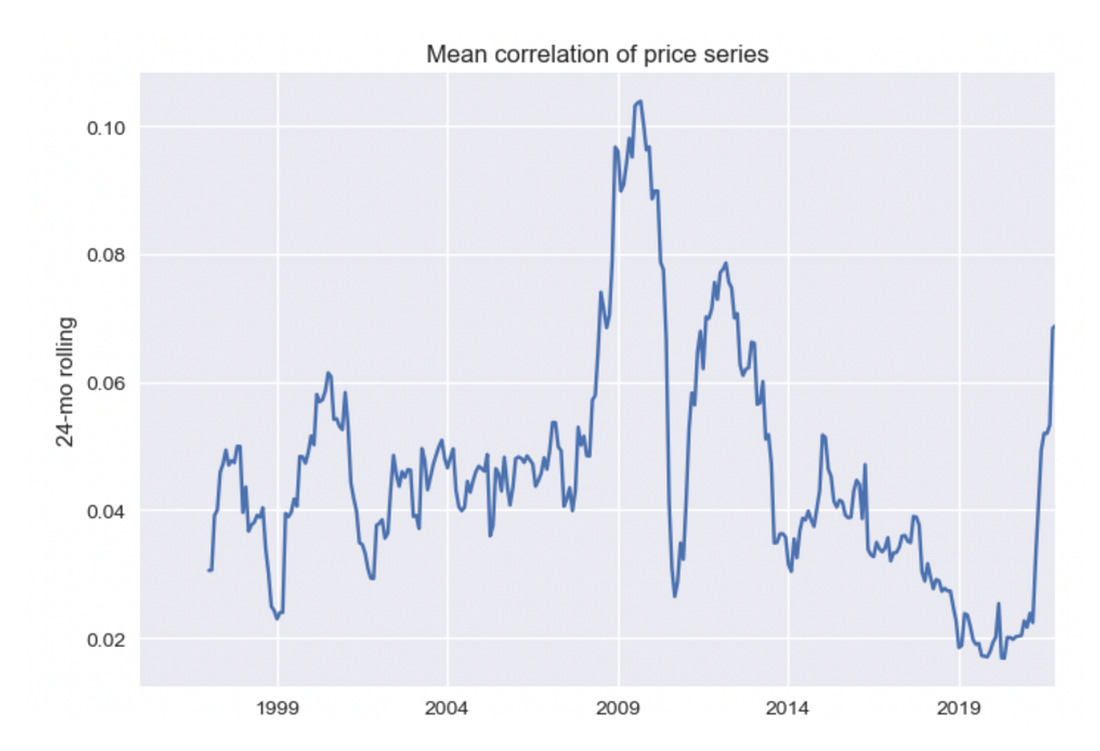

Policy Tensor thinks I am over optimistic about general inflation and therefore general, monetary measures against inflation are warranted. This graph from his post is particularly striking.

Clearly it shows a correlated upward surge in prices since 2020. But does this imply a true common cause or rather a common bounce back after a common shock?

We went back and forth on this on twitter.

Hi @policytensor thanks for taking this so seriously. I note the dramatic decline in correlation up to 2020, followed by the sudden co-movement. Is there a way of picking out the bit that is co-movement as a result of COVID-shock v. more general inflationary processes? pic.twitter.com/kbTkAbSfIY

— Adam Tooze (@adam_tooze) January 5, 2022

Forty centuries of price controls

Agree or not, the historical examples are great.

The delusion that governments can successfully manipulate prices has spanned cultures, nations and epochs.

— Peter Young (@petermiyoung) December 7, 2020

Inspired by Scheuttinger & @eamonnbutler's excellent book "Forty Centuries of Wage & Price Controls", I have catalogued my top 8 historical price control blunders.👇 pic.twitter.com/RX7unUUyyW

And here is the thread by way of a thread reader app.

*****

I love putting out Chartbook for free to a wide and diverse range of subscribers from all over the world. It is a pleasure to write and a great place to pull ideas together. It is also, however, a lot of work. If you feel moved to support the project, there are three subscription options:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club.