The US is engaged in a fiscal policy push of historic dimensions. This has unleashed a debate about inflation, overheating and the output gap. Those concerns have been overridden with the passage of the $1.9 trillion Relief Act.

Don’t expect the inflation hawks to give up easily. Inflation- angst will not go away and now there is an even more pressing fear to worry about. If some increase in inflation is now baked in, are we heading into a bond market storm? If so, what is to be done?

Source: FT

It is one thing to thumb your nose at Larry Summers, quite another to turn a blind eye to the $21 trillion bond market.

Since Jan 6 when markets woke up to the reality of Democratic control of Congress, interest rates have surged. Concerned about inflation, reasonably or not, investors are selling bonds, driving their yields up. The worry is that this could destabilize large portfolios and become self-sustaining, leading to a surge in rates like that which hit the Clinton administration in 1994.

See Chartbook Newsletter #14 about 1994.

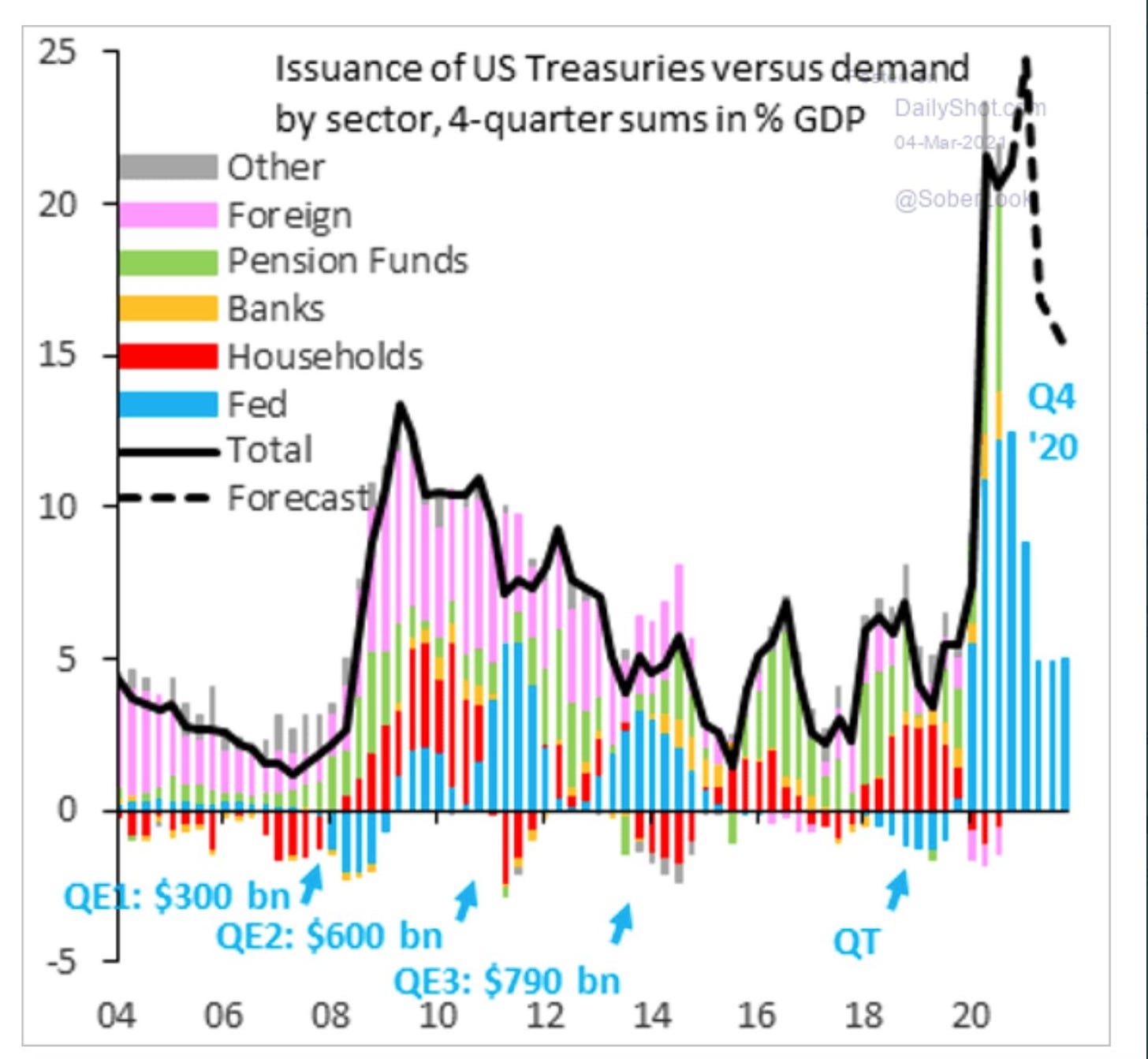

Of course, the Fed could step in to absorb bond selling and keep rates low. The Fed is currently in the market, buying Treasuries at the rate of $120 billion per month. Nothing to be sneezed at. The Fed could up the pace. If they did, how would the market react? It might stop the bond sell off. But, would it mean that we are caught in a vicious circle of endless intervention from which there is no escape?

The movement in Treasury prices is no doubt alarming, but are we exaggerating the fragility of markets? If inflation is accelerating mildly – which is to be welcomed – shouldn’t bond markets be allowed to adjust? If that means yields are somewhat higher, so be it. The movements so far, are dramatic for their pace rather than their overall size. Markets will calm down.

Furthermore, if markets are fragile, shouldn’t we be thinking about how to make them more robust? Do they need more discipline, or transparency?

Those are long term concerns. If the priority is to ensure that the fiscal program goes smoothly, should everything be done to maximize the capacity of the market to absorb bonds?

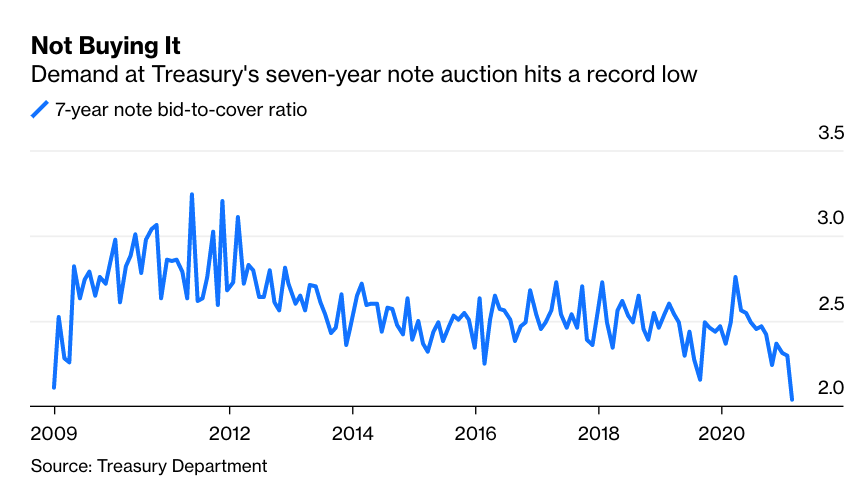

Worryingly, on February 25 a 7-year Treasury auction hit a serious bump in the road. The ratio of bids to the amount of bonds on offer was 2.04, the lowest on record. If that were to become a regular thing it could have serious implications for funding. Thankfully, the auctions since February 25 have been less eventful.

Source: Bloomberg

Ensuring there is demand for bonds is matter of price/interest rates. But it is also a matter of balance sheet capacity. Who will buy the bonds? What role do big banks play?

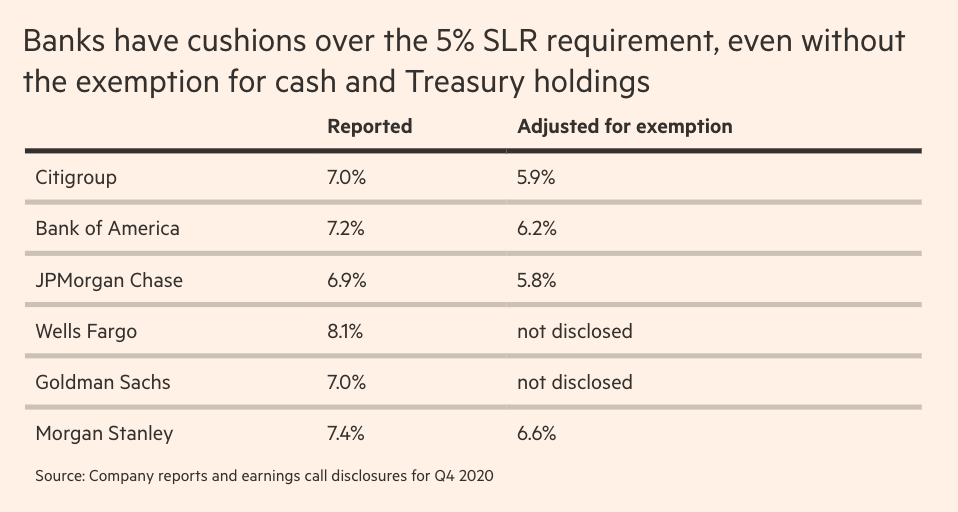

To ensure there is demand and there are banks able to make a market for bonds, does it make sense to ease regulations or extend existing concessions that enable the banks to buy more bonds and to make markets for them? Specifically, should we extend the exemption from the Supplementary Leverage Ratio (SLR) that was granted during the heat of crisis in the spring of 2020 and which expires on March 31st?

Right now the SLR issue bulks large in Treasury market talk. It has taken on totemic significance. Given the March 31 deadline, a decision by the Fed must be made soon. The markets are nervous.

This isn’t a matter of mute price movements. Prominent voices are making themselves heard. There is chatter on earnings calls. People are making worried phone calls. SLR relief extension has become politicized.

Following a report in the FT about bank lobbying on the issue, Senators Warren and Brown have issued a letter insisting that the SLR regulation be brought back into force.

On the other side there are voices in the market loudly declaring that if the SLR regulations do come back into effect, the banks could be forced to sell Treasuries, further destabilizing the market.

As Mark Cabana, an often-quoted rates strategist at Bank of America put it to the FT in early February: “If you force the banks to hold more capital by not adjusting SLR, guess what? It will make markets choppier. It will make the Treasury market less liquid, and it will make funding markets more problematic”.

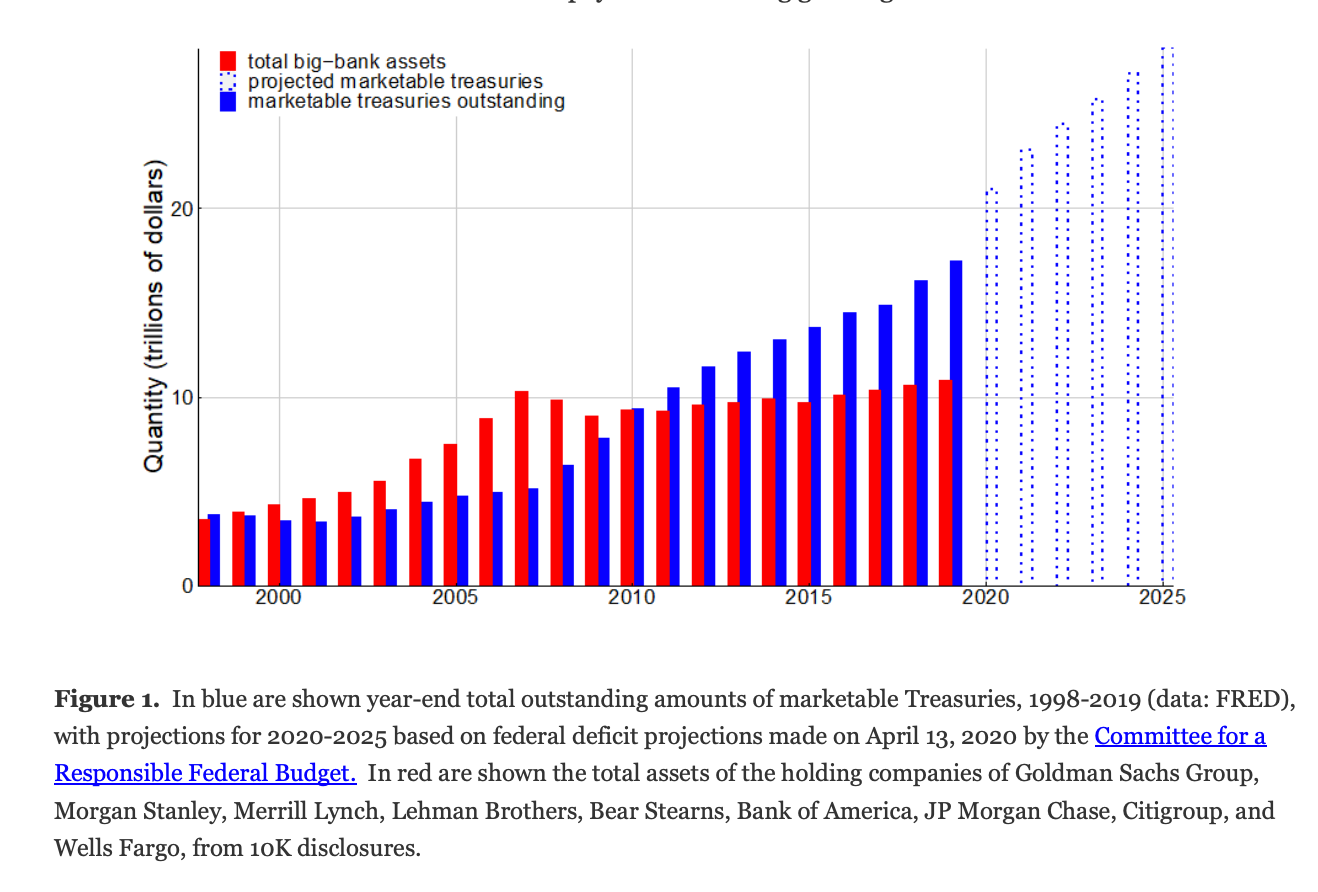

In light of the fiscal policy drama right now, it is tempting to think of these issues first and foremost as a matter of how to fund the Biden administration. But, government debt is not just a means of funding government. Treasuries are the rocket fuel of financial markets.

Source: Duffie (2020)

Since 2017 the market has absorbed a huge quantity of issuance, first with Trump’s deficits and then with the deficits of 2020. The stretch ahead looks even more gigantic. Investors and market players of all kinds are willing to buy Treasuries because – under normal circumstances – they are as good as cash. They are as good as cash because you can repo them – temporarily sell them to someone else for cash with an agreement to repurchase tomorrow, or a week, or three months from now. Making use of the repo market, repeatedly buying and reselling Treasuries, actors like hedge funds can hold huge portfolios with a very thin cover of capital.

Worryingly, twice in the last 18 months the repo market has shown its vulnerability. In September 2019 the repo market experienced serious dysfunction. In March 2020 there was another even more terrifying disruption. Since January 6, 2021 when the news sank in that the Democrats would have control of the Senate, not just the primary bond market, but the repo markets too have been jittery.

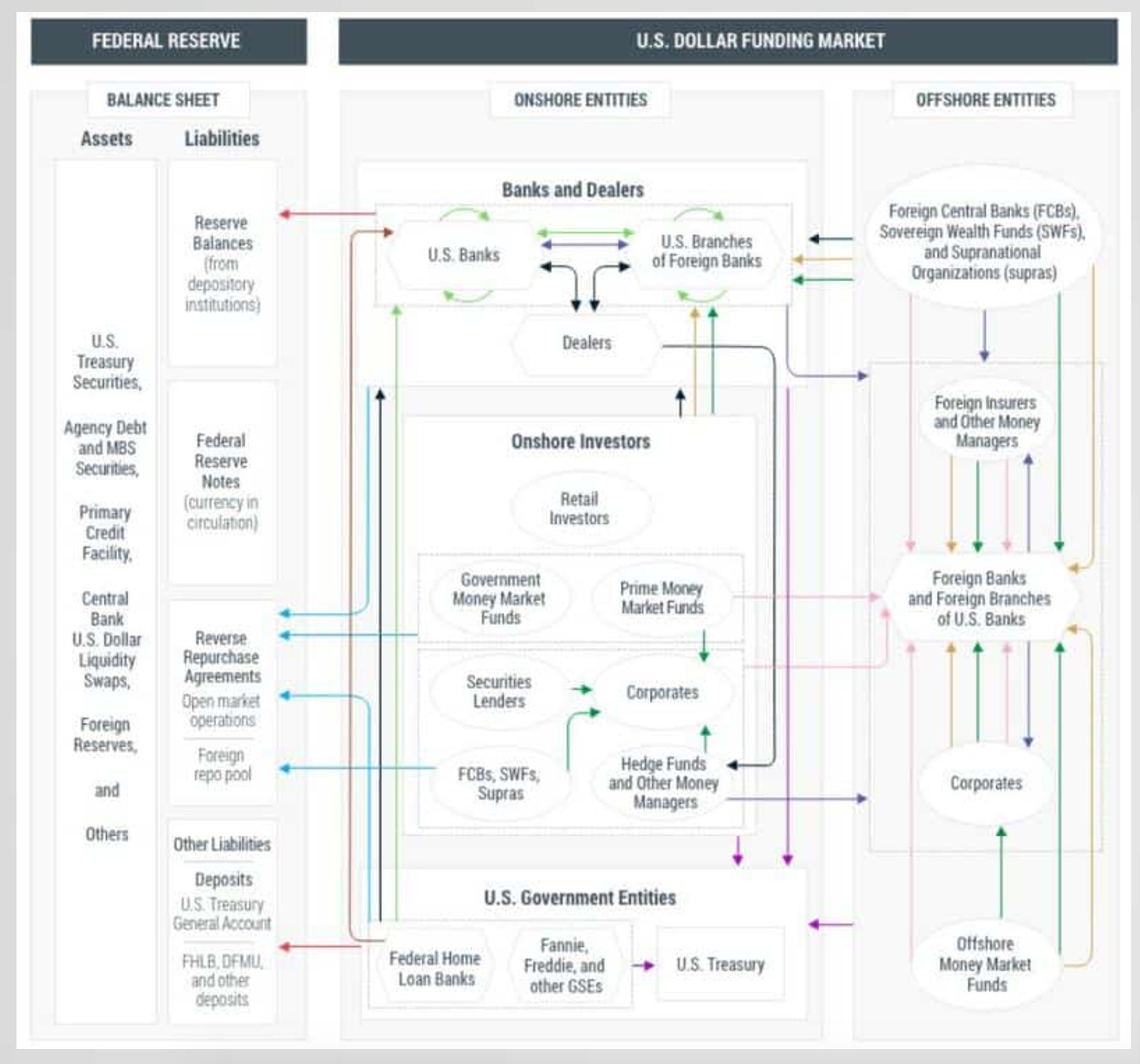

The subject matter is highly technical. It involves inside knowledge of markets and bank strategies. It is preeminently an issue of market plumbing.

Source: Pozsar

Though it is technical, it is also highly political. The last thing that the Biden administration wants to be firefighting is a bond market panic. In the most dramatic scenario, the future of the administration’s fiscal policy could be at stake. But so too are large amounts of profit to be made by the big banks As Warren and Brown have made clear this is the politics of money in action.

As concerned observers, how do we navigate our way through this terrain?

If you are in favor of large-scale debt-financed fiscal activism, what are the implications for the nitty-gritty of bank regulation and bond market functioning? Specifically, should you be for or against an extension of the exemption from the SLR for big banks beyond March 31st? How do you balance your interest in smooth market-functioning with your desire to see banks well-regulated? Is this an example of blackmail by market interests? Or is it an example of dysfunctional and overly complex regulation getting in the way of urgent fiscal imperatives?

The administration and the Fed are keeping schtum so far. That silence makes sense. It has costs too. Uncertainty spooks the markets.

I’m not a markets person, but I’m about as interested in this stuff as a non-market person can be. I try to read and understand the stakes. As I do so, I’m painfully aware that everything I read comes with an angle. Some of the best analysis comes from economists at JP Morgan or Credit Suisse, who, brilliant though they may be, are hardly disinterested actors. As Carolyn Sissoko’s recent work has powerfully reminded us, the repo market is not an ahistorical or neutral institution, it emerged from the 1990s through interactions between Treasury, Fed and JP Morgan. Whenever anyone says “repo”, a good first question is to ask: “where is JP Morgan in this story?”. If they are not part of the deal that is, in itself, interesting.

To add to the confusion, the big banks do not necessarily speak with one voice, or maintain a single position over time.

Over the last few weeks I’ve swung back and forth on the SLR exemption. A lot of the best journalists are admitting that “no one is quite sure what to make of it”. I was delighted to hear Zoltan Pozsar, who is rightly regarded as a guru of market plumbing, admit on the Oddlots podcast that had been having a hard time managing his reactions to the current bond market shocks. A few days ago, he made a call on Fed intervention that he regretted. Charmingly, he acknowledged that it was a matter of emotions. From the master of shadow banking wiring diagrams that means a lot.

This stuff is really hard! There may be no good answers. But, if we are serious about doing a democratic politics of money and financial regulation, this is where the rubber hits the road – on issues like the extension of SLR relief.

So where do we come down?

The SLR is an odd duck. On the whole you apply leverage ratios to limit risk-taking by banks. Treasuries are low risk assets and reserve deposits at the Federal Reserve, which is what a bank receives when it sells Treasuries to the Fed, are even more so. They are, therefore, assigned low or zero weight in risk-weighted leverage ratios. But, after 2008 regulators were wary of gamesmanship by big banks and decided to curtail it by supplementing the more sophisticated regulatory mechanisms with some simple rules. One of the simplest of all is the Supplementary Leverage Ratio. Tier 1 bank capital must be at least 3 percent of the entire balance sheet for all banks and 5 percent for the big, systemically important banks (G-SIBs).

This is both a simple overall cap and somewhat perverse in linking bomb-proof accounts used for transactions (central bank reserves) and the very safe asset (Treasuries), which the US Treasury would very much like banks to hold, to bank capital. Furthermore, if the Fed is engaged in QE operations, bank reserves with the central bank will automatically swell. The SLR ratio means that this could exercise a contractionary pressure on the rest of the bank balance sheet. As the BPI, the bank’s think tank, points out, in a useful post, the effect of QE is that bank capital requirements go up.

It was for this reason that in the midst of the crisis of March 2020, the decision was taken to suspend the SLR for twelve months. This would free up bank balance sheet capacity and remove the link between QE bond-buying and the capital squeeze. What we are arguing about is whether to restore the rule as of March 31 2021.

All in all, most experts seem to agree that the SLR rule, though useful as a blunt force regulatory device, lacks economic logic and should be revised, certainly as far as central bank reserve accounts are concerned.

As the BPI forcefully puts it: “those opposing reform (i.e. revision of the SLR rule) need to answer a hard question, “Why should the Treasury issuing a bond and the Fed buying a Treasury raise banks’ capital requirements (or newly empower regulators to set bank dividends)?””

However, the regulatory status quo is a balance of power and profit. Any shift gives opportunities for profit-making. So when on April 1, 2020 the Fed took the decision to relax the SLR constraints on the big banks, it was part of a suite of measures that also limited dividends and barred buybacks. Lighter regulation on the one hand, in exchange for tougher regulation on the other. It is that balance that is in question. Not just the SLR piece.

Without getting into details – we are still trying to figure out what happened – the spring 2020 stabilization package worked. Markets calmed.

Fast forward to the situation facing us in March 2021. It is defined by five factors: (1) Surging issuance of new debt impelled by fiscal policy. (2) Increasing nervousness in the market about the prospect of inflation. (3) The looming end of the twelve-month SLR exemption on March 31.

(4) The mobilization of the left-wing of the Democratic party whose votes matter in a finely-balanced Senate. For good reason the left are not lying down. They intend to seize the opportunity of the Biden administration to reverse the regulatory rollback of the Trump era.

What concerns Warren and Brown (5) is that following the stress tests of December 2020 the Fed cleared the banks to use retained profits to resume buybacks. Within minutes JP Morgan announced a $30 billion buyback program. With the new regulations of April 2020 having ended, so, in fairness, should the regulatory relief. Otherwise, the net effect of the 2020 crisis would be a deregulatory win on the part of the banks. Some revision of the SLR may be in order. But this is not how it should happen. As far as Warren and Brown are concerned, granting SLR exemption was a mistake in the first place. For the Biden administration to extend it, would be a “grave error”.

The trillion dollar question – no exaggeration – is whether one can safely reimpose the SLR cap without disrupting the Treasury market. The Treasury needs to sell a lot of debt and anything that limits demand could be a worry.

Source: IIF

For the alarmist view you have to look no further than Zerohedge on March 5. As “Tyler Durden” opined, “It’s almost as if the Biden administration and some of the most progressive Democrats out there, want the market to crash.” FDIC Chair Jelena McWilliams had let it be known that there was no obvious need to renew the exemption, but the final decision lay with the Fed and Powell was making no commitments.

Zerohedge often contains remarkable material. But it is also notorious as the “house of horrors” of the markets. You go there for thrilling gothic visions and on this occasion zerohedge does not disappoint.

Continuing the SLR exemption may offend the left because it enables the shenanigans of the banks, but, Zerohedge retorts:

“a bond market crash and deeply negative short-term yields would be a far more grave error, especially to the Democrats who are demanding that the Fed monetize trillions in debt in 2021 to fund Biden’s trillions in fiscal stimulus bills, something the Fed would not be able to do if the SLR exemption was not indefinitely extended.”

In other words, for whatever reason – and it certainly may be because they simply have no idea how dire the consequences would be, it now appears that there is a full-court press by the administration and Democrat politicians to not renew the SLR and unless the Fed steps in and overrides this, brace for impact as banks will have no choice but to dump tens of billions of holdings into the open market sparking the next full-blown crash as first yields soar and then all high-duration stocks, i.e., growth names, crater.”

That would clearly be very bad. So what are the chances?

You don’t have to roam very far on finance twitter to find knowledgeable actors advising you to take the panic mongering with a big pinch of salt. The turmoil in the Treasury and repo markets is part of a power game. “Crash the market. Force the Fed’s hand. Get extended regulatory relief. Let the good times roll.”

Without the belligerent rhetoric, leading figures at JP Morgan such as CFO Jennifer A. Piepszak are on the record as asking for SLR relief. Otherwise, she suggests that her bank would have to turn away deposits by big businesses. Those would then flood into short-term money funds and bill markets, driving down very short-term interest rates.

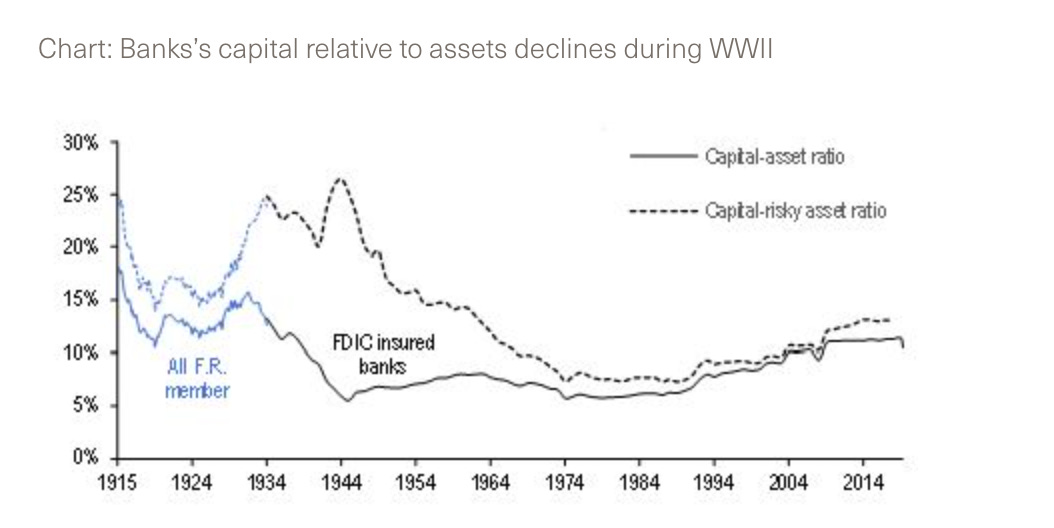

A few months back Josh Younger, a Managing Director at JP Morgan, and Antoine Martin of the New York Fed, put out a blog post from the Yale SOM on the historic parallel to World War II. Its punchline was clear:

“The last time the United States had levels of debt to GDP as high as those expected in the coming years was during WWII. Among other things, the 1940s show that, though the Fed certainly played an important role, private market participants were instrumental in financing the war effort. Commercial banks in particular played a key role, which lead to large increases in the sizes of their balance sheets and a dramatic decline in the leverage ratio, as measured by capital over assets. These changes required a more dynamic approach to capital adequacy, and regulators adapted to this unprecedented situation by excluding the safest assets, such as cash and Treasury securities, from the leverage ratio.”

Source. Younger and Martin (2020)

Furthermore, as to the immediate issue of extending the SLR relief beyond March 31, JP Morgan’s high-powered analytical team take a strikingly relaxed view. In a note they put out on March 11 (JP Morgan North American Credit Research, Still Waiting on SLR, March 11 2021), they remark:

“The expiration of the regulatory relief would add ~$2.1tn of leverage exposure across the 8 GSIBs. As well, Treasury Account reduction (at the Fed) and continued QE could add another ~$2.35tn of deposits to the system during 2021.”

Which sounds very alarming and is the basis for the horror scenarios sketched by zerohedge et al, but JP Morgan continues :

The expiry of the carve-out would not have an immediate impact on GSIBs, though the continued increase in leverage assets throughout the course of the year would increase long-term debt (LTD) and preferred requirements. We view even the “worst” case issuance scenario as very manageable,

(emphasis added)

In short, the key actor in the system, despite recognizing the scale of the problem and its historic dimensions, sees no reason to panic. They do not expect an unloading of existing bank holding of Treasuries. They do note that there could be an influx of liquidity into repo markets and other short-term money markets that could drive rates down.

Zoltan Pozsar of Credit Suisse has further illuminated the landscape for us. He usefully breaks down the scene by looking at each of the big banks in turn and asking, how much difference would a continuation of SLR exemption actually make to their balance sheets.

This overview originally appeared in the FT report:

Source: FT

Pozsar’s analysis adds a lot of crucial detail.

As far as JP Morgan is concerned, though it is closest to its SLR limit (i.e. has the biggest balance sheet relative to capital), it is not the SLR ratio that is binding. What is binding are other parts of the Basel III regulatory framework, known as G-SIB penalties. Those in turn are calculated in relation to the entire risk-weighted complex of JP Morgan’s massive balance sheet.

The bank that has the largest potential capacity with or without a SLR cap, is Wells Fargo. But this is due to the fact that following the 2016 phony accounts scandal it was subject to a balance sheet cap. Were that to be lifted, it could increase its balance sheet by as much as $500 billion without hitting any constraints.

The Bank which much attention has focused on is Bank of America. Pozsar highlights it as the retail bank that is likely to attract most stimulus checks and thus see its deposits expand most rapidly. It would probably benefit most from an SLR extension. But its management have not been vociferous in calling for the exemptions to be extended. And prominent spokespeople for the bank like the Cabana have given a variety of perspectives. In February the FT quoted Cabana as warning of the effects of not extending the exemption. In March Cabana remarked to Bloomberg that though “the market has “assigned almost mythical powers” to the SLR exemption, in reality, banks’ share of the demand for Treasuries is “very marginal”.”

The upshot:

If Pozsar thinks it is incoherent as an overall strategy for G-SIBs, if JP Morgan doesn’t think it is risky, if Warren and Brown think it is bad politics and, if the FDIC would have to reverse itself, then, despite worries about Treasury market panics, the SLR exemption should be allowed to expire.

If there is turmoil in the repo market, what we have learned from September 2019 and March 2020 is that given our market-based financial system, there is no alternative but for the Fed to intervene as the first responder. No amount of private balance sheet capacity will make a significant difference and it is better to keep the risks out of the G-SIB balance sheets.

If we do need Fed intervention, it should be massive and prompt and avoid the market plumbing becoming a political issue. The September 2019 and March 2020 panics were buried. No reason, if necessary, not to bury interventions in 2021.

Medium to long-term the entire structure needs looking at. Plumbing issues should not become sources of macro-instability. The SLR rule does not make a lot of sense. But there is clearly a case for looking at the Treasury market as a whole. Does it need a more transparent, clearing house style structure? Does the entire model of repo-based market finance need reevaluation? Do we need to revisit the question of overall bank size, and the balance sheet of conglomerate, universal banks like JP Morgan?

Above all we need to be prepared for the fact that the giant fiscal and monetary policy experiment that we are engaged in, will expose stresses and strains within the financial system. We need to develop the intelligence and the robust nerves necessary to ride out the interest group struggles this will unleash.