On a personal note – Conley & Silvers Zoom lecture, Monday 14 December 8 pm New York Time.

For those of you who enjoy zoom talks, every month I share some ideas on the state of the world economy and politics with client’s of Conley & Silvers, my wife’s boutique educational travel company. I often accompany Conley & Silvers trips as a lecturer, and during COVID times, we’ve been staying in touch with our community via zoom. To join my talk on Monday 14 December use the complimentary code GETAWAY at checkout. Go to the Conley & Silvers website, then find my next talk on the calendar (14th of December), click on that talk and book your slot.

There are other wonderful lectures on the C&S platform as well. So, if you enjoy travel, art, culture etc, you might enjoy checking out the full C&S calendar. Note: If you sign up for the lecture you will get the recording of it regardless if you actually are able to attend in person.

China

As far as the economy is concerned there are three types of story about China right now.

The baseline are the stories of dramatic and relentless economic growth. Not by accident, they lend themselves to statistical enumeration. They describe an ongoing, unprecedented, world-transforming growth surge.

Then there are the stories about a precarious structure of debt and credit built on that growth. It is as at risk of toppling or suddenly contracting.

Finally, there are the stories about regime interventions: managerial, regulatory, expansive and repressive, actions that range from concentration camps in Xinjiang, to giant commitments on decarbonization, to the abrupt cancelation of the largest IPO in the world.

Together, the three form a loosely articulated, vaguely dialectical whole.

China’s Growth

However many times you hear the China growth story it continues to have the capacity to shock and amaze. In scale and speed it is unlike any previous experience.

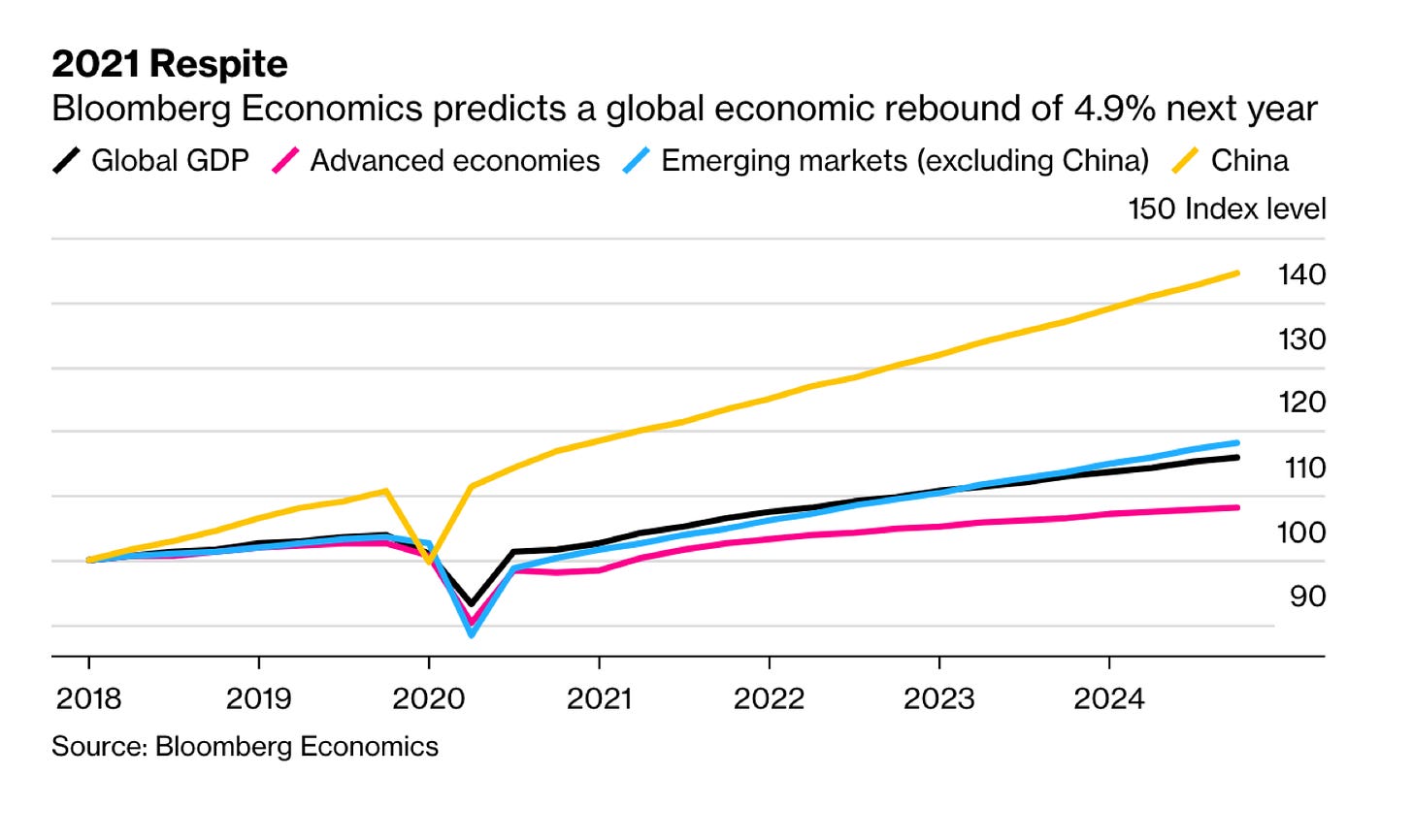

Right now, we are all in a haze, but when we wake up in Q4 2021 we will, according to the OECD, be in a world in which China has made a huge leap forward relative to both Europe and the weaker EM, who will still be far short of where they were in Q4 2019.

Source: Bloomberg

Btw 2018 and 2024 Bloomberg is predicting a >25 % disparity btw China and other EM in GDP growth and a >35% disparity to AE!

Source: Bloomberg

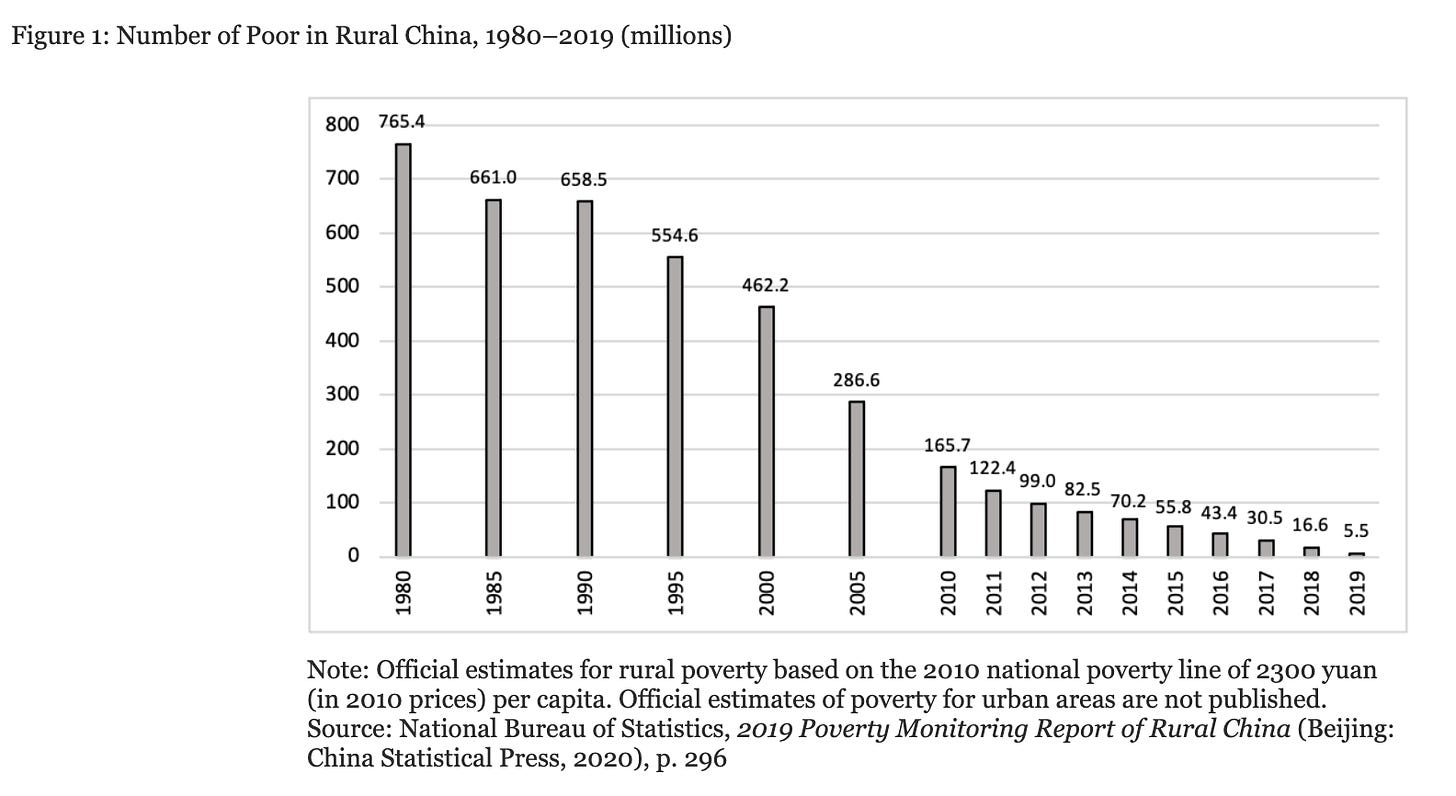

On the basis of this growth, Beijing is projecting the end of poverty in China, at least according to the official statistics. Estimates for rural poverty based on the 2010 national poverty line of 2300 yuan (in 2010 prices) per capita show a spectacular decline. That is a world historic event in its own right.

Source: Terry Sicular China Leadership Monitor Dec 2020

Energy

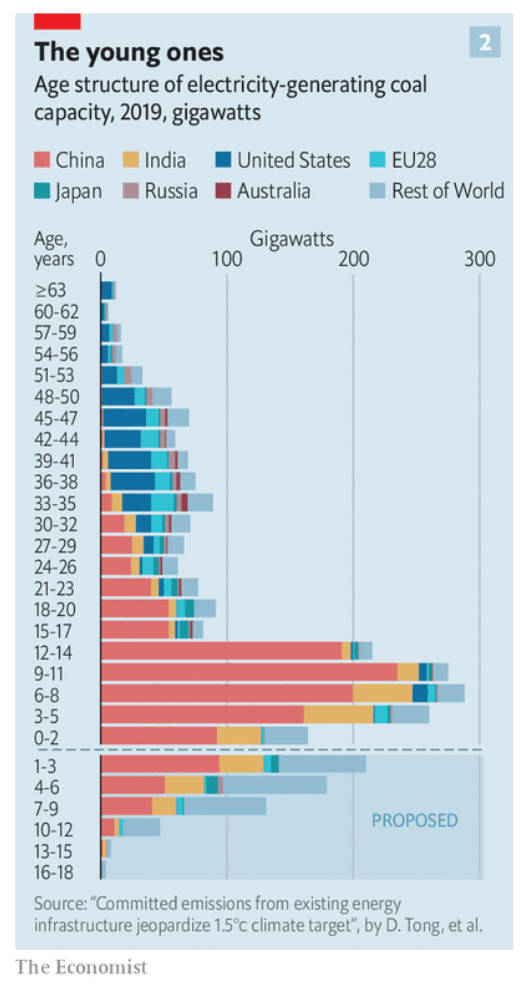

Fossil fuels have propelled this huge surge in economic output. It has ben the industrial revolution to end all industrial revolutions. The growth in China’s coal-fired generating capacity 2000-12 reshaped the global economy and nearly tripled China’s CO2 emissions, making it the largest emitter in world. Its effects on air quality in China hastened millions of deaths.

Source: Economist

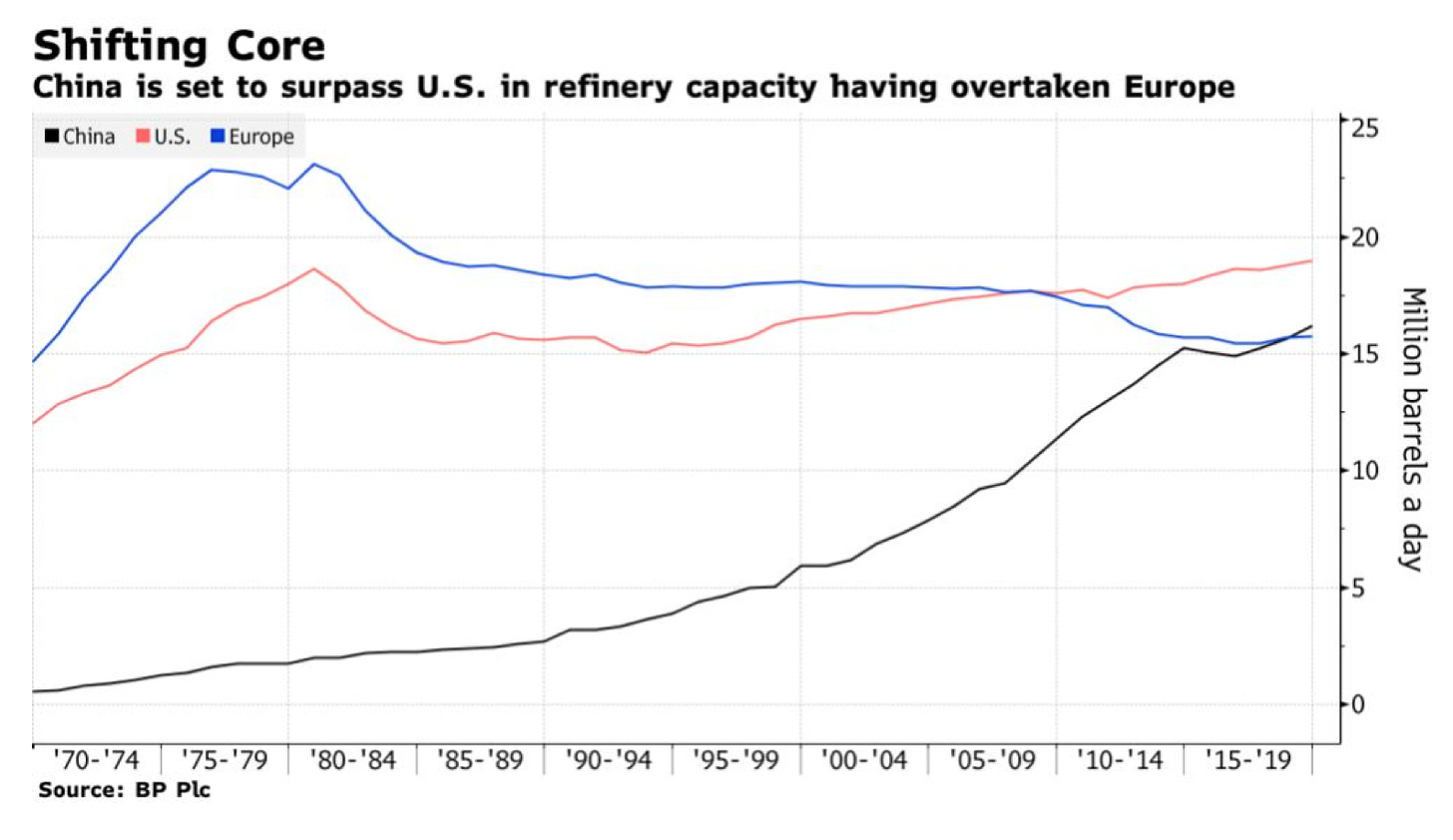

China has transformed other energy markets too. Since the start of the oil age in the mid-19th c. America has been the #1 oil refiner. Now, China will dethrone U.S. as early as 2021, according to @IEA The new capacity is concentrated in giant integrated petrochemical plants heavily focused on plastics. China is triggering a huge global restructuring, which will put older and smaller refineries out of business and risks the build up of a giant overhang of overcapacity.

Source: Bloomberg

Data

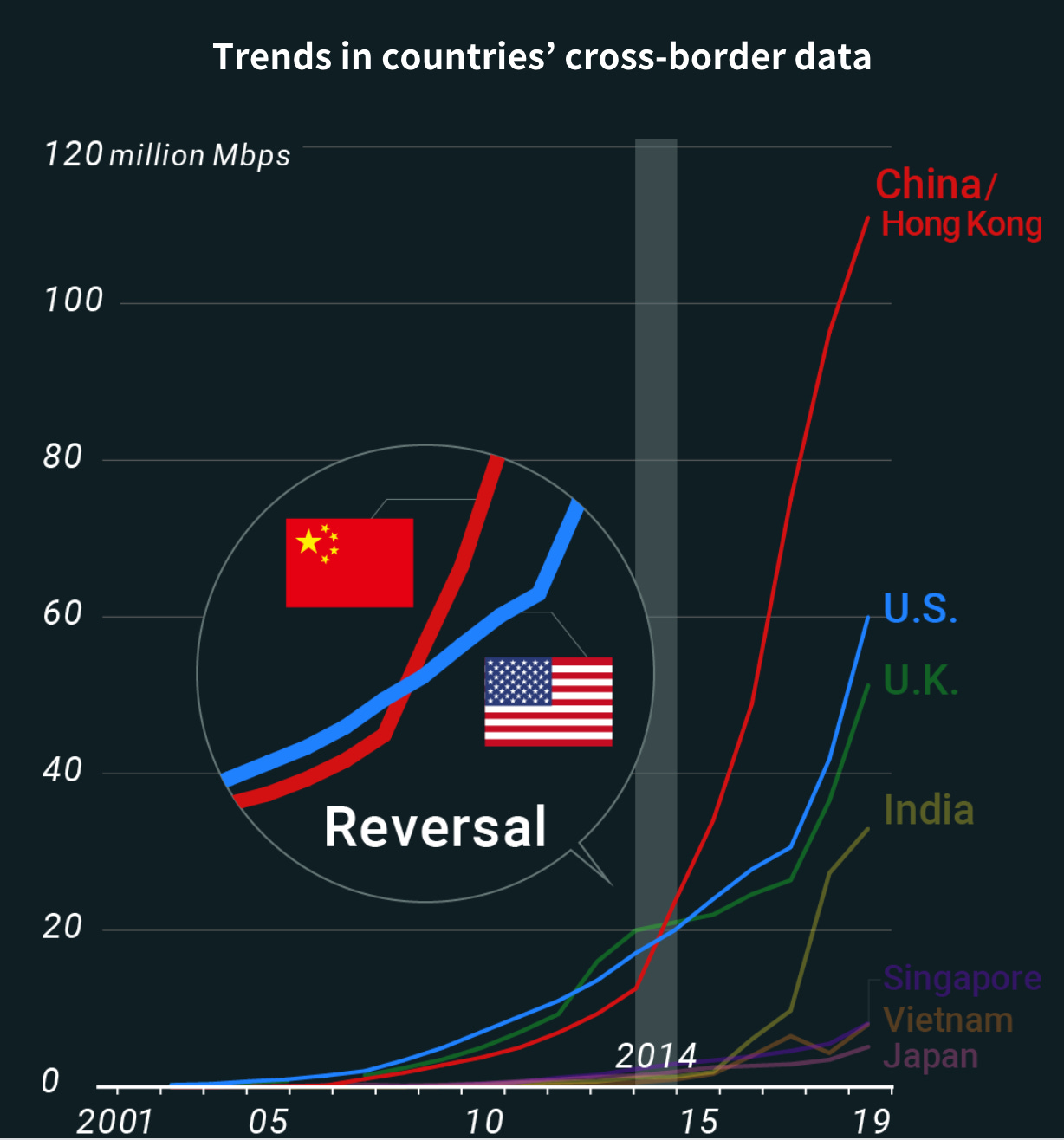

It isnt just the old economy in which China is the main driver of growth. China’s great data firewall and emergence of “splinter net”, has not prevented China/Hong Kong becoming by far the largest nodes in global data networks. China/Hong Kong crossborder traffic is twice that for US and it continues to boom.

Source: Nikkei

Wealth

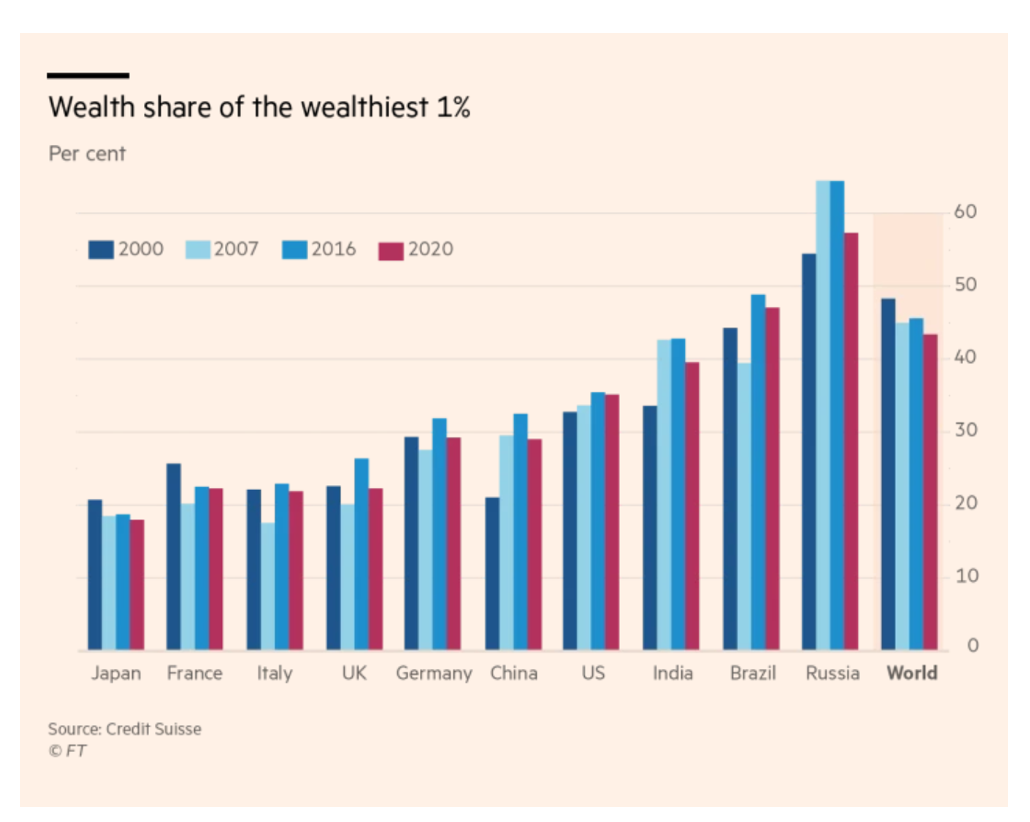

What has Western financial firms salivating, is the giant concentration of wealth that China’s growth has produced. Over last 20 years, China has seen most consistent and significant increase in wealth-share of the top 1%.

Source: FT

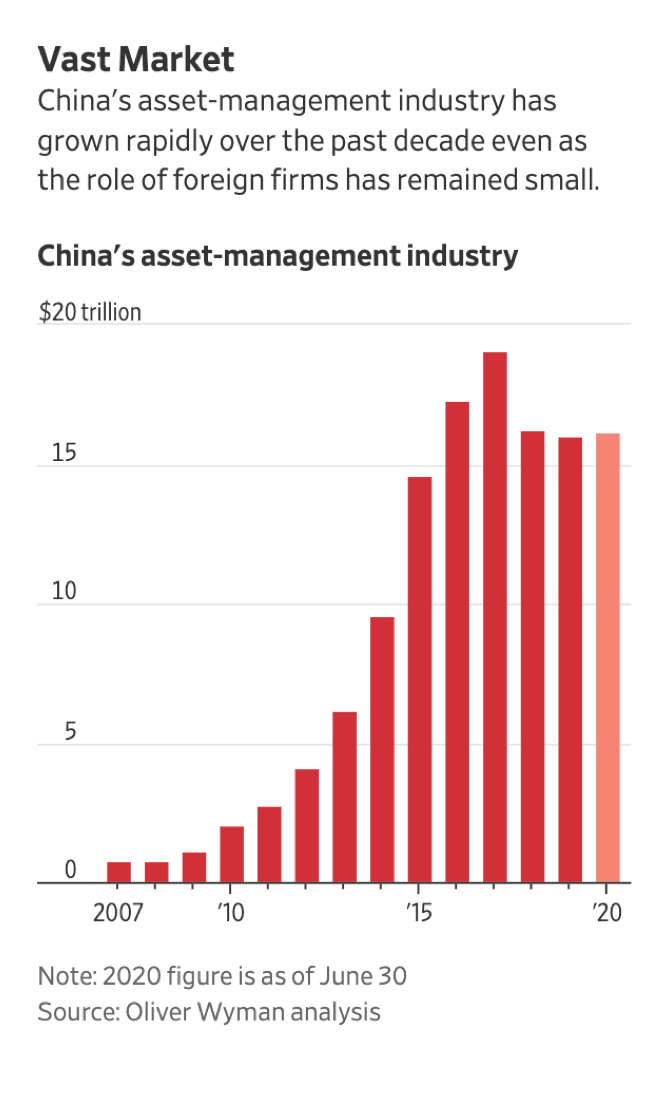

China’s asset management industry has grown to c. $18 trillion. But the foreign share has declined somewhat from 2 to closer to 1.5 percent. Big American asset managers would love to change that! They are no doubt waiting the new tune on China out of the Biden admin! But in the meantime Wall Street is China’s one remaining friend in the US. Check out this interesting WSJ piece by the team of: @Lingling_Wei @bobdavis187 @dawnmlim

Source: WSJ

The recent book on China-US economic relations by @Lingling_Wei @bobdavis187 is a good read.

I reviewed it over the summer in the LRB.

Safe Assets

The extraordinary growth of the Chinese economy has long made it into a magnet for foreign investors. The question is where to put your money?

And this is where the narratives get interesting.

On the one hand, Beijing is encouraging an upsurge of foreign interest in Chinese bonds. It doesnt need to do much persuading. China is one of the few large government borrowers that offers positive yields.

But it is important to be clear about the limits of this story. The Chinese bond market has three big parts:

Foreign money goes overwhelmingly into the bonds of government and policy-banks. Foreign investors own c. 10% of China’s central government public debt. They steer well clear of the corporate bond market and this is where the risks lie.

Debt Worries

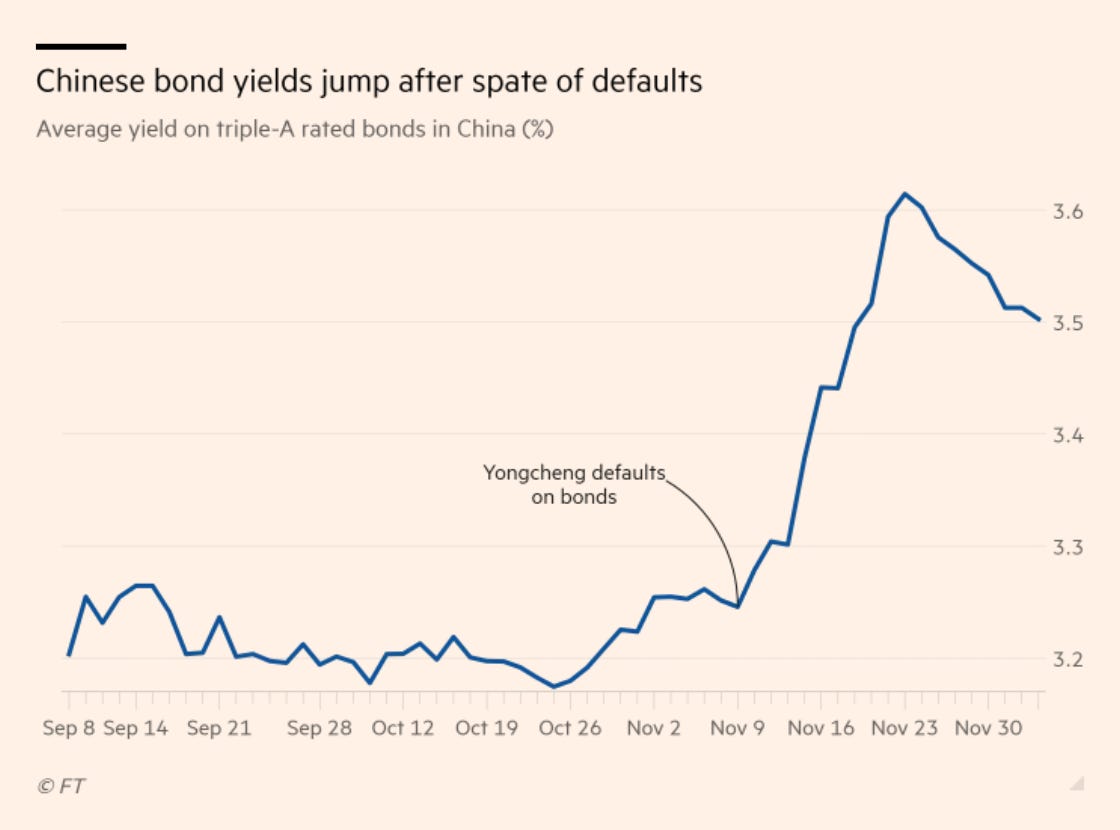

There are mounting worries about the debt of China’s state-owned enterprises (SOE). A wave of defaults has been triggered by that of coal company, Yongcheng. Its ill-fated expansion into coal-derived chemicals, led to a default in November that threatened a doom-loop with the finances of Henan regional government and delivered a shock that has rocked entire Chinese SOE bond market. Yields have surged.

Source: FT

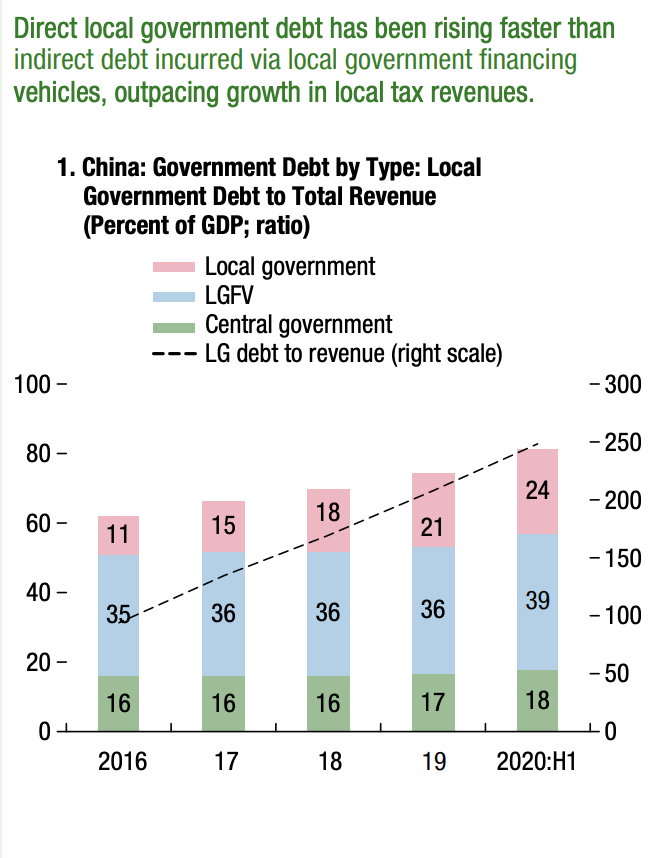

The link between business loans and local government are so-called LGFV (local government finance vehicles) – off balance sheet entities used by Chinese local government for infrastructure borrowing. They are the biggest creditor to local gov (which in China is a VERY big sector). They are the biggest debtor to the bank system. They are involved in 1/2 of all business loans, 1/3 corp bond issuance. They are the biggest financiers of construction. And as this excellent FT report by Sun Yu makes clear, they are under severe financial stress.

Presciently, Box 1.3 of the IMF’s latest Global Financial Stability Report highlighted the LGFV’s debts.

Source: IMF

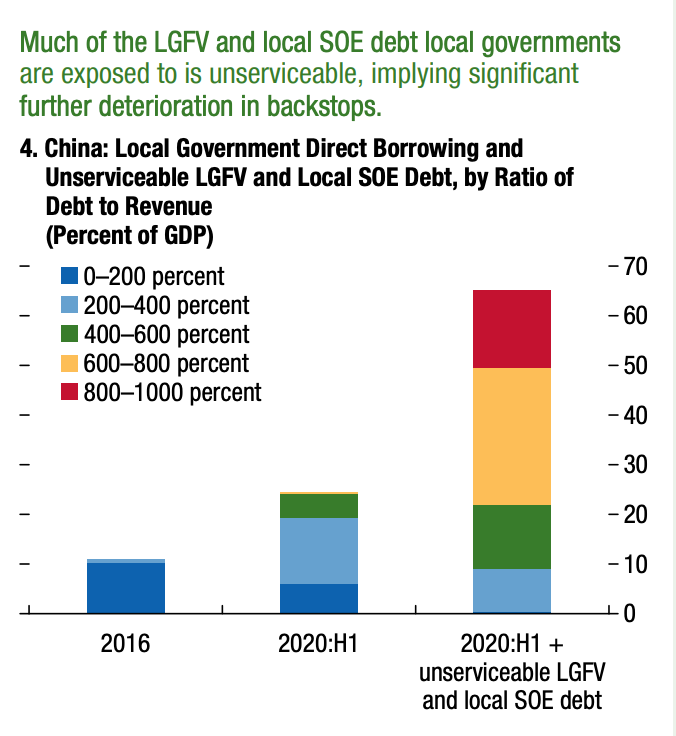

Imagine the worst case in China. Imagine all the unserviceable LGFV and SOE debts end up piled on their local gov backstops. Then the debt burden on local government would surge to 65% of GDP and vast majority of it would be piled on provinces with debt/revenue ratios greater than 400%. At that point the central government would have to step in.

Source: IMF

China is not just the most dramatic phase of economic growth we have ever seen. It also denaturalizes the political economy of growth. It is the most spectacularly dynamic political economy we have ever seen, the most gigantic, authoritarian exercise in managed growth.

For the trajectory of 21st-century capitalism few things are more important than the stance of the CCP on environmental and financial risks, the direction of China’s National Reform and Development Commission, the policies of the State-owned Assets Supervision and Administration Commission (SASAC) that oversees the big SOE, the State Grid Corporation of China that shapes energy policy, the People’s Bank of China that manages the yuan and the 14th Five Year Plan!