Crashed was in large part based on the work of economists working in the macrofinance school and in particular a group of analysts at the BIS. It was their work that first highlighted the vast expansion of the trans-Atlantic banking system and the scale of the European bank balance sheets as a driver of the 2008 crisis. They first suggested that trans-Atlantic overbanking was likely a more important immediate driver of the crisis in 2008 than the savings glut that Ben Bernanke attributed to the Asian emerging economies.

Tam Bayoumi of the IMF took up the argument in his excellent book Unfinished Business, which was published a few months before Crashed was finished.

Crashed used this framework to offer a comprehensive reading of both the Atlantic credit boom and the genesis of the Eurozone crisis. Now, in time for the ten year anniversary of 2008 the BIS Quarterly report includes an important elaboration and update of the story by Robert McCauley complete with video.

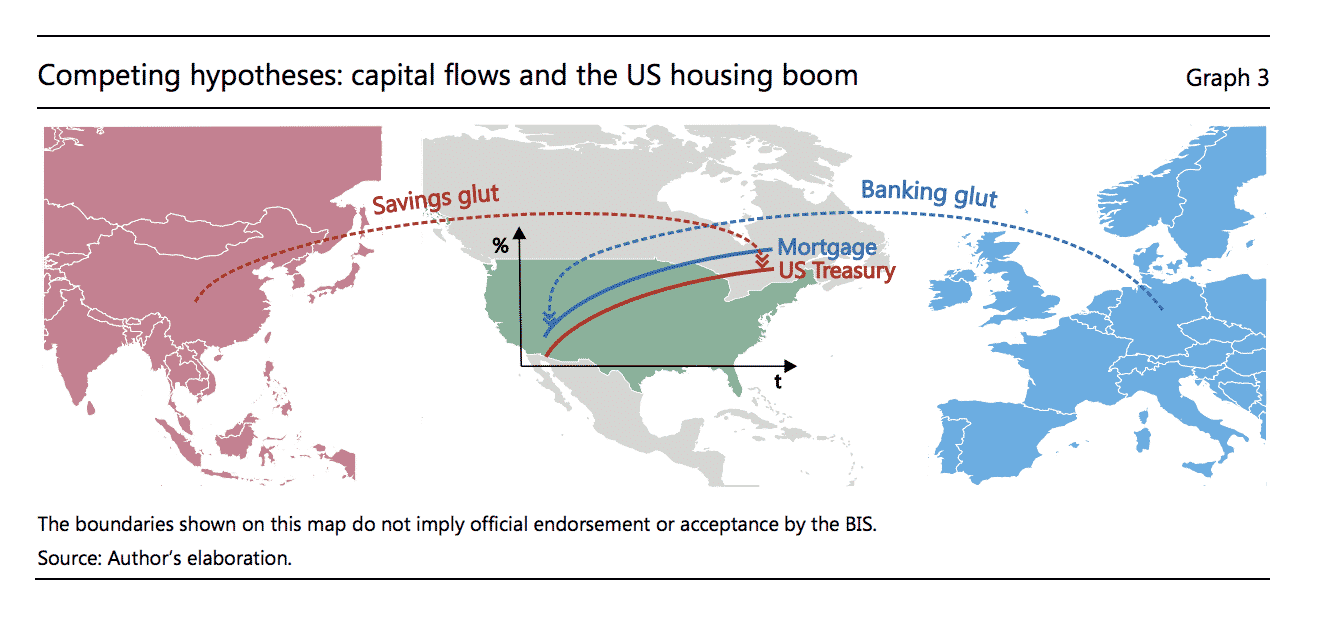

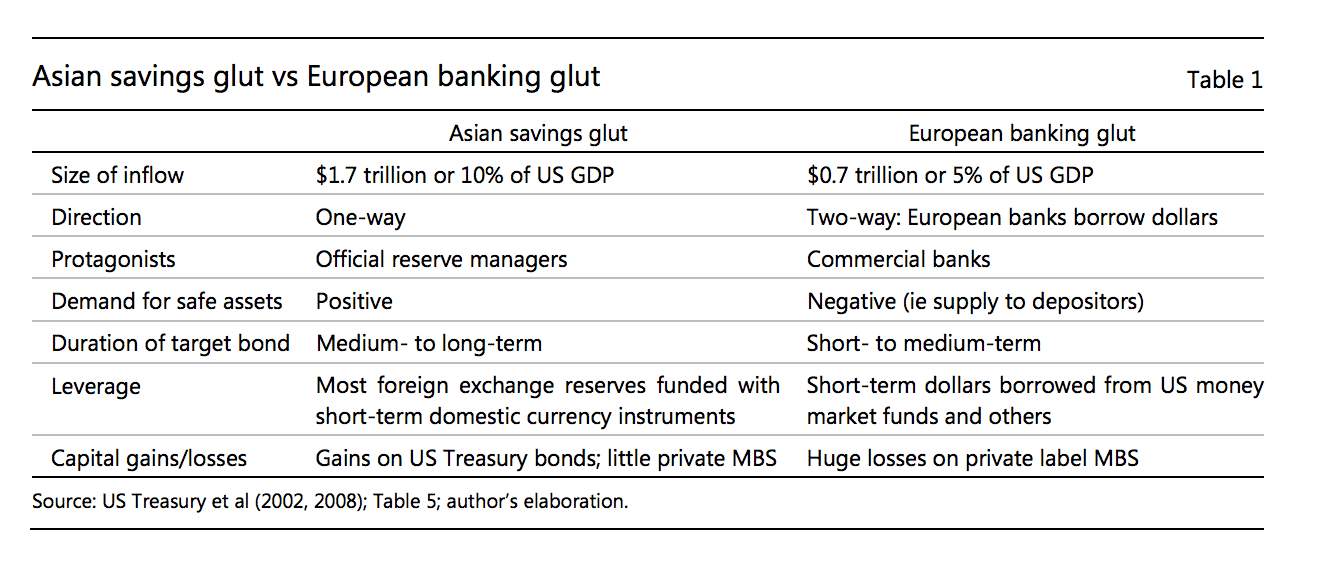

McCauley’s chapter is notable not only for providing an elegant graphical summary of the two competing arguments.

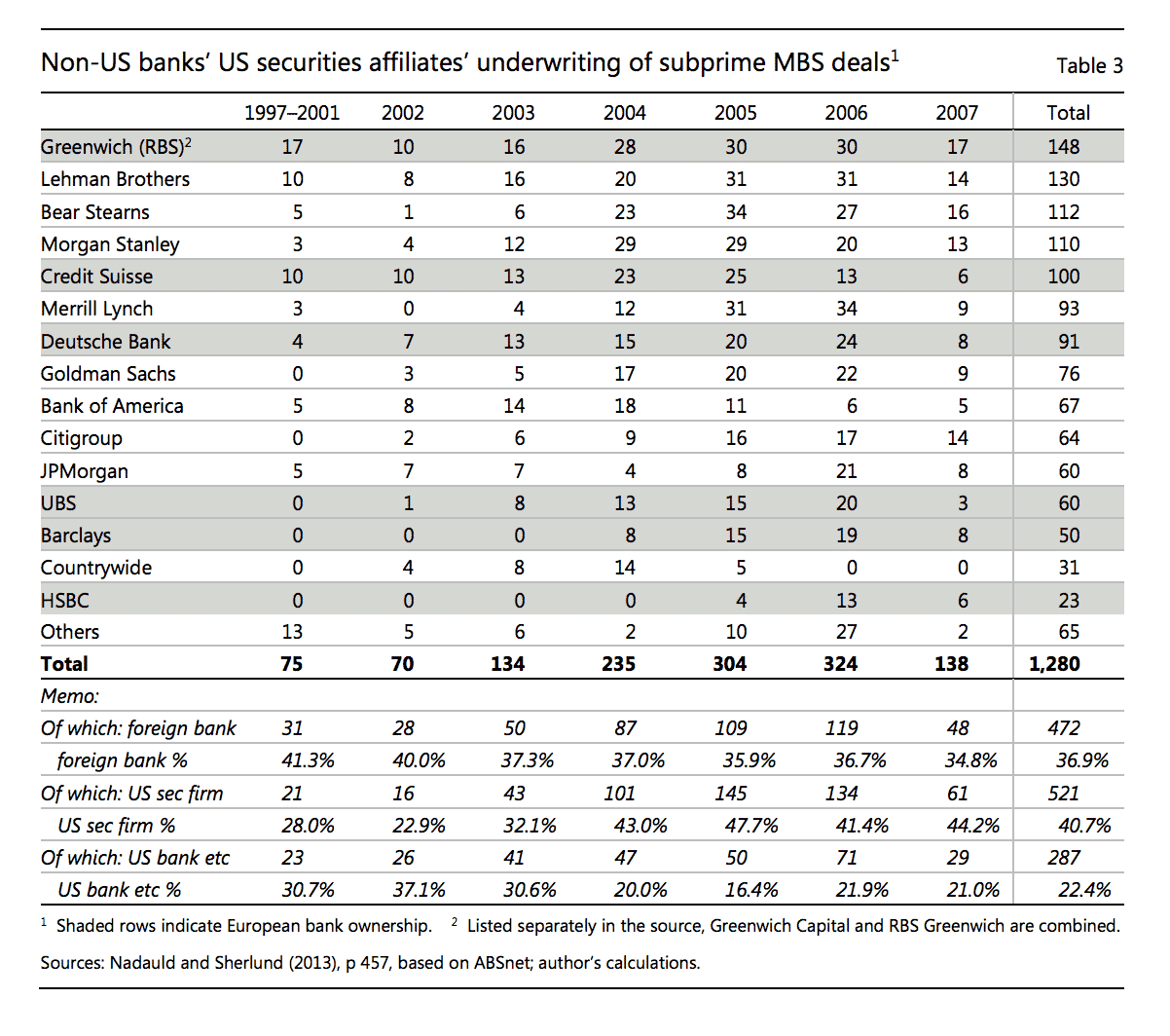

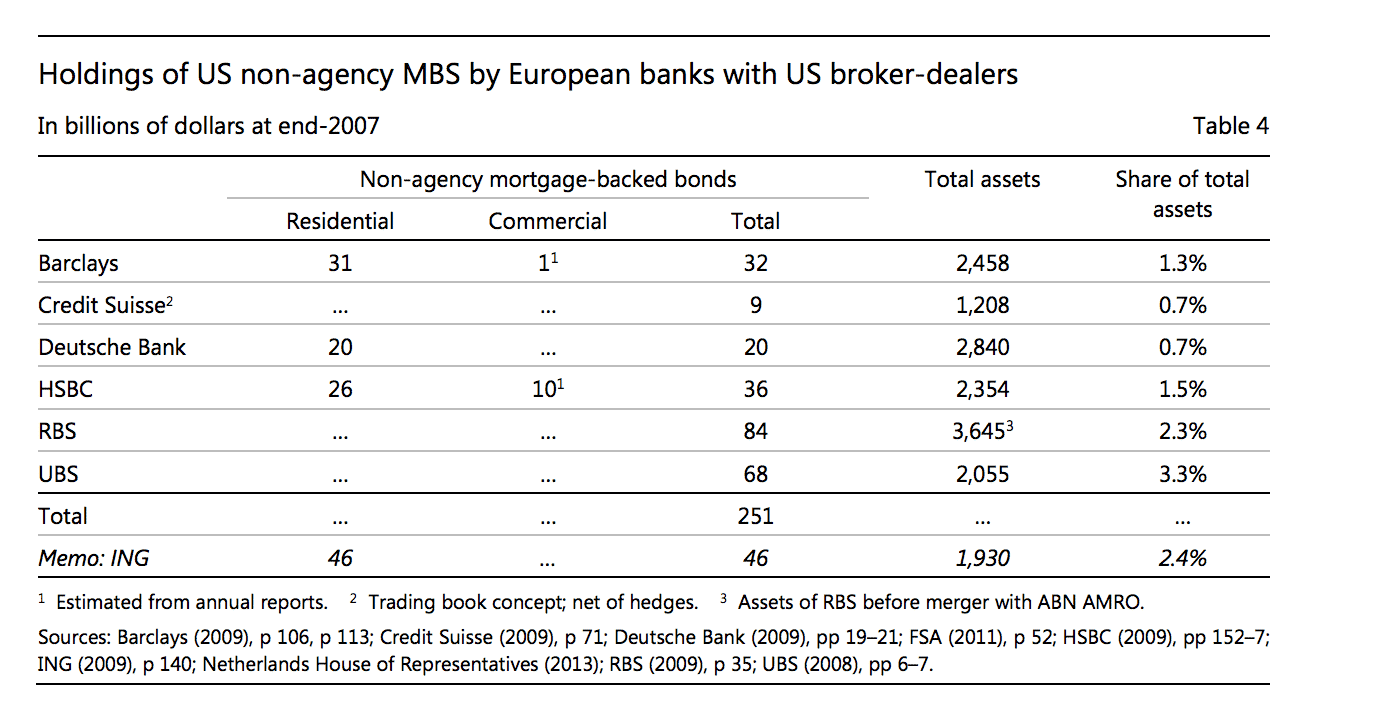

In addition he provides powerful new evidence, which shows the scale of European involvement in subprime securitization.

He also provides data for the amount of this dangerous paper that the European banks held on their balance sheet.

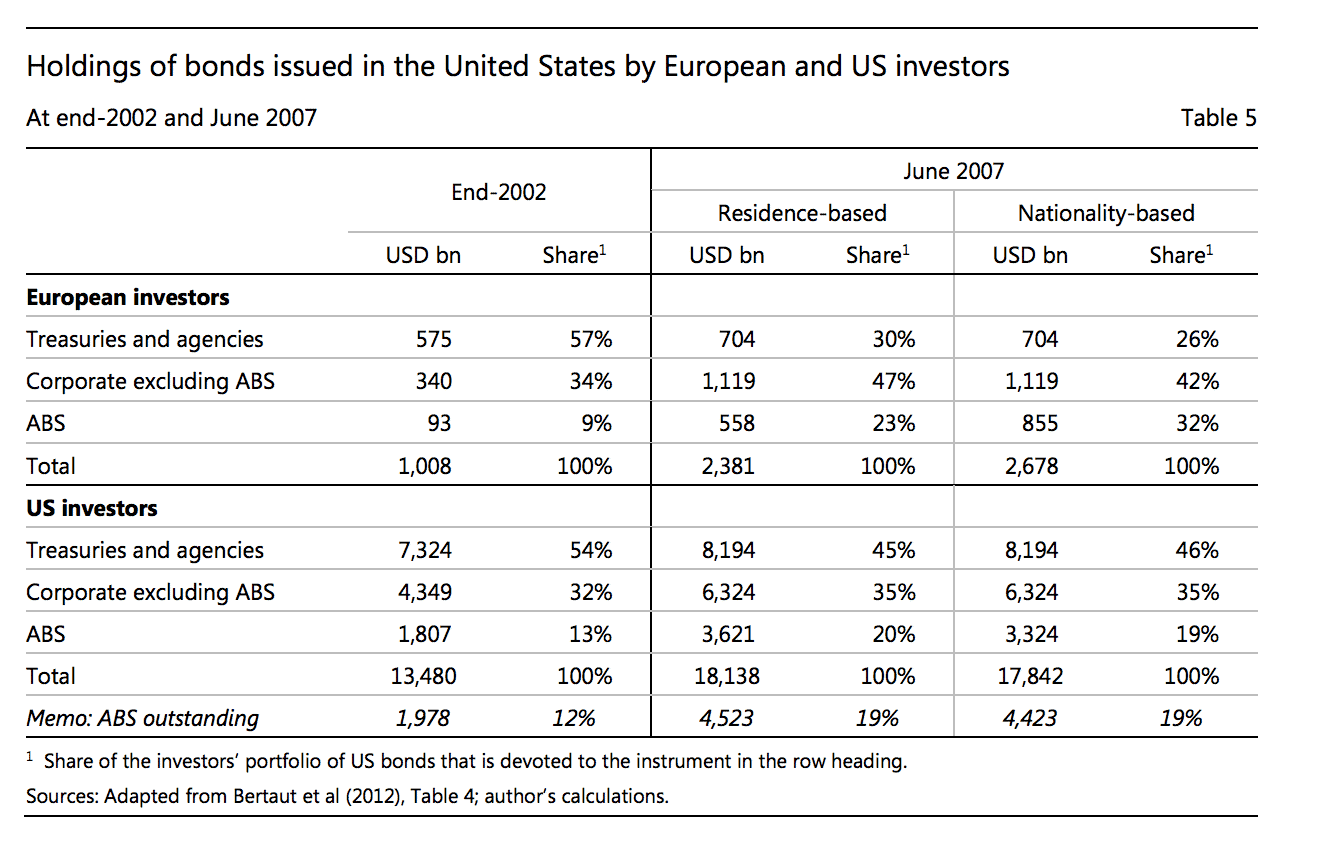

Crucially, he shows how heavily the European banks shuffled their portfolios away from more conventional safe assets.

Crucially, he shows how heavily the European banks shuffled their portfolios away from more conventional safe assets.

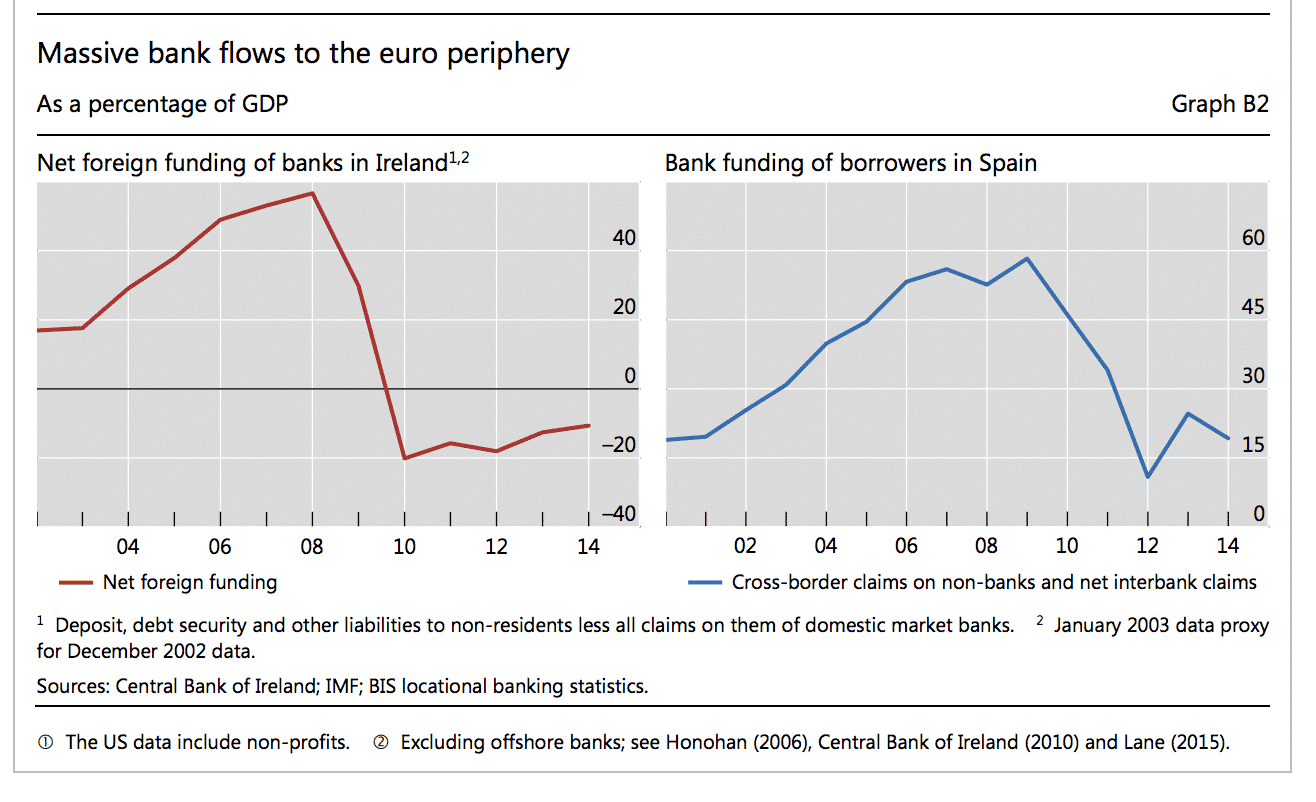

All in all it is a resounding confirmation of the Atlantic-centered banking glut story, which as McCauley points out also allows us to explain the even larger expansion of real estate credit and prices in Ireland and Spain.

As McCauley insists, one should not draw an overly sharp distinction between the two arguments: European overbanking v. Asian over-saving. The line that both Bayoumi and I adopt – following Caballero, Bertaut et al – combines the two. Emerging market acquisition of US safe assets crowded out other investors and created the opportunity, as Gorton and Metrick argued, for the private financial engineers to launch the securitization boom. The industry generated a new, private source of safe assets. The question that needs to be answered, is how the Europeans were sucked into that boom as deeply as they were. McCauley’s latests post is the best answer we have so far.