“The trade conflict between the U.S. and China is … a consequence of China’s internal class conflict. Tariffs will not fix anything as long as China’s elites remain committed to extracting as much as they can from Chinese workers.”

These rather striking lines come from a new column by Matt Klein at Barron’s.

Matt’s argument is that since wealth inequality and capital “flight” are the true drivers of the Chinese balance of payments, slapping tariffs on industrial exports will not make much difference. Instead, he argues the United States should target Chinese capital inflows, especially those that look like flight capital e.g. into luxurious real estate. Cutting off the money flow will hit the Chinese regime where it hurts and possibly cause a change in behavior.

The point is a good one. The capital control suggestion is intriguing.

It is linked to a historical diagnosis which argues that 1989 was a turning point in the political economy of modern China:

“After the pro-democracy movement met its violent end in 1989, Deng Xiaoping’s program of “reform and opening up” was modified so that party elites could capture as much of China’s new wealth for themselves as possible.

The result is that China is now one of the most unequal societies in the world. Between 1980 and 2010, the share of income officially earned by the top 1% of Chinese households rose by about nine percentage points.”

Matt then goes on to point out some of the peculiarities of China’s tax and welfare regime, which levies virtually no income tax, thus imposing a heavy regressive burden via indirect taxes on consumption.

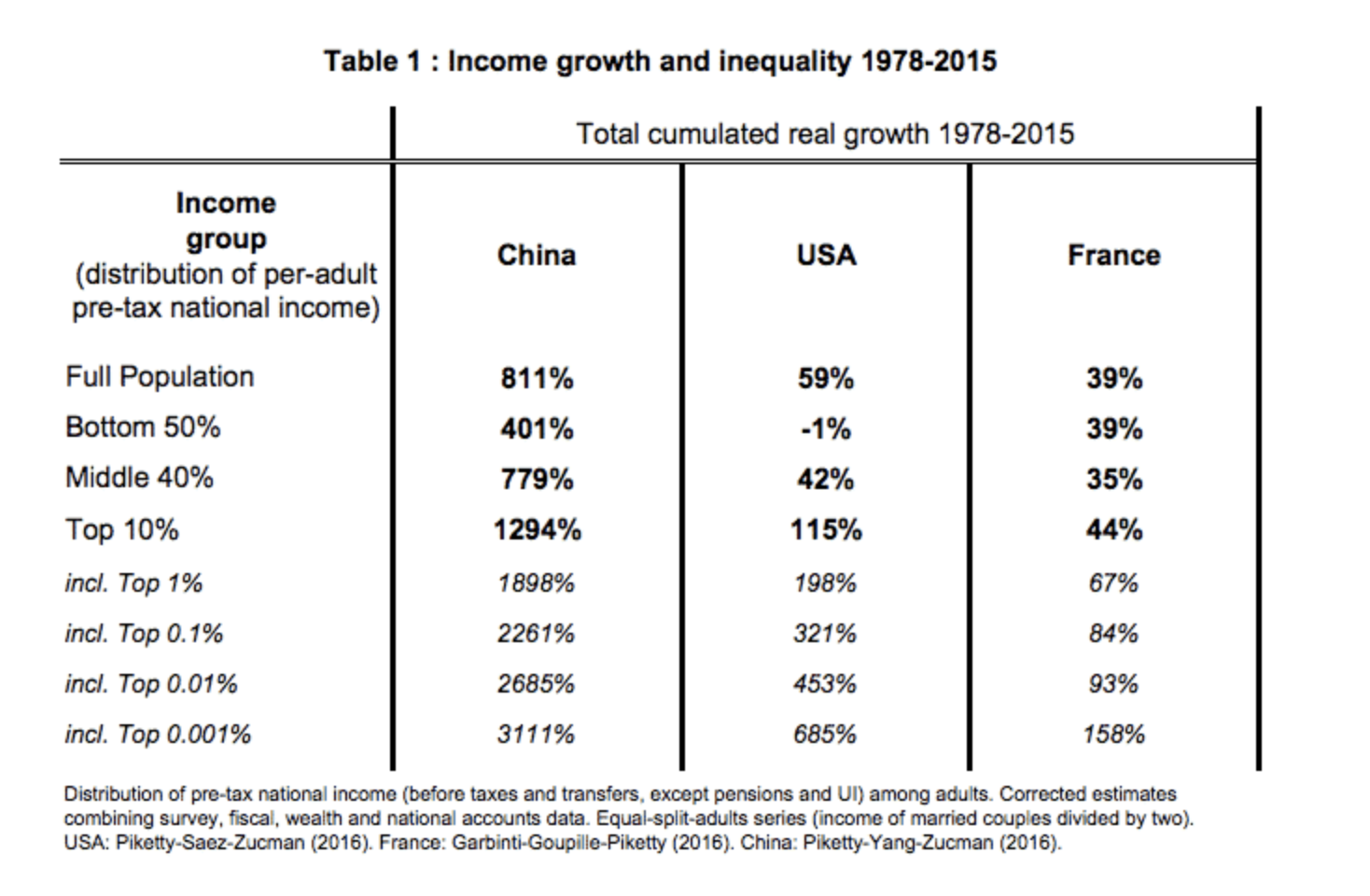

Matt’s points about the political economy of China could be expanded by reference to Alvaredo et al’s data, which characterized the inequality regime in China as one which did indeed see huge increases in income for those at the top, but also produced income growth for those at the bottom of the income pyramid. This is clearly crucial for the mass legitimacy of the regime.

Alvaredo et al contrasted the Chinese inequality regime with that of several other countries including, of course, the US. Since the 1970s what the US has witnessed is a surge in incomes at the top with very little income growth for those at the bottom.

What this points to is a significant gap left by Matt’s analysis: the need to integrate an account of inequality and class struggle in the United States.

If it is true that “The trade conflict between the U.S. and China is … a consequence of China’s internal class conflict.” The same is surely true of the United States.

This point can hardly be lost on Matt. So I suspect that he does not point to it for two reasons:

- It is not just social regimes but political regimes that are at stake in Matt’s article. The passage I quoted above actually reads like this: “China’s economic policies are a product of the Communist Party’s intolerance of alternative centers of power. After the pro-democracy movement met its violent end in 1989, Deng Xiaoping’s program of “reform and opening up” was modified so that party elites could capture as much of China’s new wealth for themselves as possible.” And, since I guess Matt is assuming that the United States is a pluralist democracy, it cannot have an analogous problem. It is China’s class and political system that are in question, not America’s.

- Matt’s purpose in the essay is to address American policy makers and to suggest a new approach for their consideration. Speaking to those policy makers about alternative policy options presumes that they will be open to new ideas that might actually be good for working-class Americans, unlike the Chinese elite who are bent on pursuing their strategy of wealth maximization, or are simply caught up in an intolerant and monolithic regime.

But clearly both those assumptions about the US are deeply problematic. In fact as countless critical investigations have shown, American democracy has long functioned as an extremely effective wealth protection and maximization mechanism and particularly so since the 1970s.

There is every reason to doubt that at key moments in American policy-making the common good is the main criterion for decision making. Remember Buffett: ‘There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

In fact, at a first approximation, a symmetrical class analysis would suggest that the strategy of China’s elite is entirely complementary to that of their American counterparts.

Imports of repressed Chinese savings help to fund the astonishingly lopsided reengineering of America’s political economy driven by the Republicans in successive phases of tax cuts.

For the Democrats Chinese inflows were more than helpful in coping with the fiscal aftermath of the global financial crisis, a crisis that was resolved highly successfully to the benefit of another wing of the US elite.

Meanwhile, US corporations as investors have done extremely well out of China’s lopsided economic growth miracle, by investing in China and spreading their supply chains to East Asia. “Designed in California, made in China.”

The benefit to ordinary Americans comes not through jobs but cheap manufactured imports that help to sustain a sense of mass affluence despite stagnating incomes.

Furthermore, the Chinese capital when it enters the US flows not just into Treasurys. It flows into circuits and property markets, which are key sites of accumulation, for factions of the American elite.

At the current moment, there is good reason to suspect that POTUS and his family are examples of precisely this transnational, oligarchic logic in play.

So if class and inequality help to explain the Chinese side of the Sino-American imbalance, they most certainly help to explain the American side too.

This is not to say that political regime does not matter. It shapes the way in which power and money work. As citizens we have an existential stake in the freedoms the West offers. But we should not allow this to blind us to basic structural parallels in political economy.

A book that I highly recommend, which applies this kind of symmetrical class analysis to all sides of global political economy is Herman M. Schwartz, Subprime Nation American Power, Global Capital, and the Housing Bubble.