How to read the current Italian crisis? Is it the latest manifestations of entrenched Italian national problems dating back decades? Is it another case of generic populist backlash? Is Italy collateral damage of the eurozone crisis?

In a talk, which I pulled together for a talk at Stanford’s center in Florence, I argue that the current constellation is new. The emergence of Italian Euroscepticism is a clear marker of that. And it results from the overlay of four different chronologies.

The party political system of Italy today is not of ancient vintage but a product of two crises: 1992 and 2011. Both these crises are Italo-European.

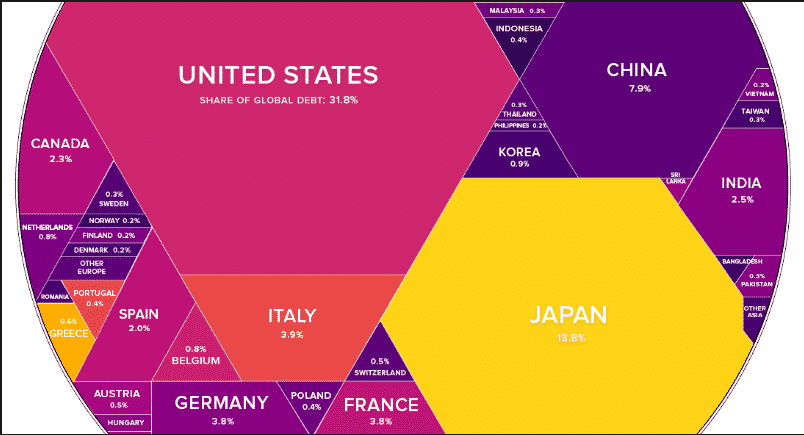

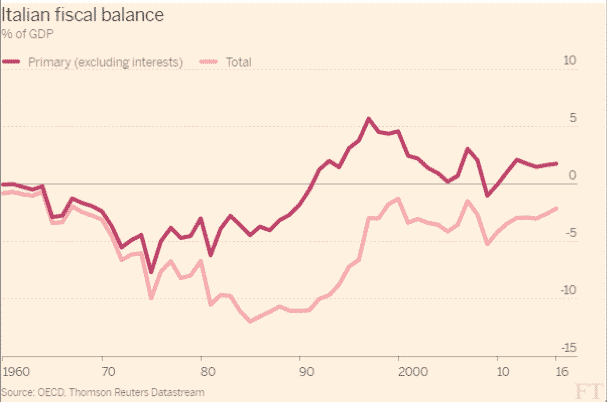

The debt burden that weighs on Italy and threatens the eurozone is a product of the remarkable burst of fiscal profligacy in the 1970s and 1980s.

Both in the decades after 1945 and since the early 1990s Italy’s fiscal position has been remarkable more for its austerity.

In the early 1990s a part of the Italian elite gambled on Europe. They saw it as a framework within which to master the crisis bequeathed to them by the previous decades, but also as a framework that they could shape in a manner congenial to Italy.

After 2008, above all due to the mishandling of the eurozone crisis, that gamble unravelled.

Our current situation is a manifestation of the overlaying of these four histories. The crisis is new. Euroscepticism is a clear marker of its novelty. But Italy retains agency both domestically and at the European level.

I plan to elaborate this narrative in further posts. But for now powerpoint is here: