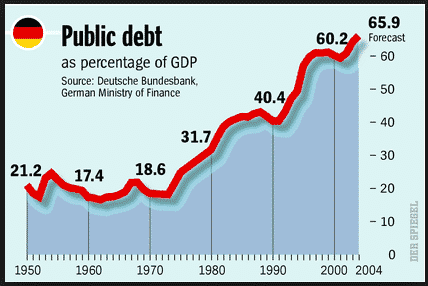

The “reform narrative” that is crucial to understanding the self-conception of Germany’s political class today has several strands. It addressed the labour market by way of welfare rights (Hartz IV, coming to a blog near you soon). It addressed the labour market by way of a new politics of childcare (see the blogpost last week). It also addressed the key issue of public finance. A wide ranging debate within Germany going back to the late 1990s swirled around the issue of public debt. Reunification had led to heavy borrowing. But as Germans acknowledged, the tendency to run deficits clearly went far beyond that.

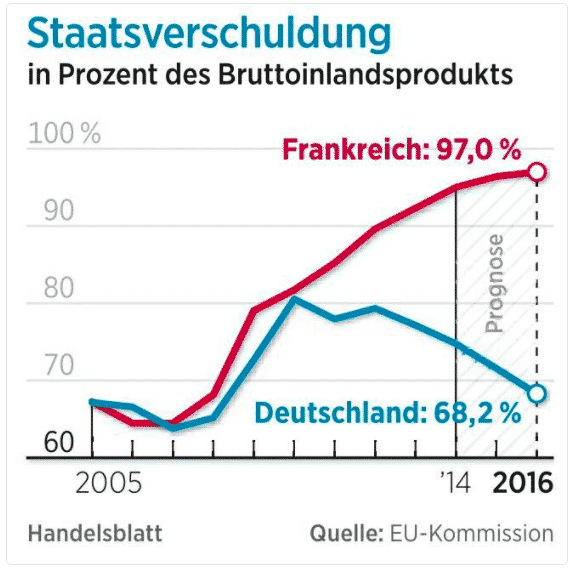

The short version of the story is that in response to a growing sense of alarm, German politicians rallied. Faced with the miserable track record of the last decades and the shock of the 2008 crisis, in 2009 they “did the right thing”. They applied the debt brake – a constitutional amendment requiring them to balance the books both at the national and local level. As a result Germany’s fiscal fortunes have since diverged radically from those of the rest of the industrialized world and the rest of the EU. The essential starting point of the Federal Republic’s agenda in the Eurozone crisis was to extend this new model of fiscal policy to the rest of Europe.

That is the short version. A more extended genealogy of the debt brake is laid out in the paper attached to this blogpost: Tooze Applying the Debt Brake 2017

The introduction sets out some of the key arguments of the paper.

Since 2010, austerity has been the central response to the financial crisis in the UK, the US and in the Eurozone. The ratio of debt to GDP has become the overriding preoccupation of policy. The promise of austerity in the form touted since 2010 has been not only that it will reduce the new accumulation of debt, but that it will actually raise growth thus improving both sides of the ratio at once. The idea of the “expansionary fiscal contraction”, pushed by the economist Alesina and others, has attracted remarkably widespread support. Mark Blyth has traced the networks through which “austerity politics” enjoyed a new popularity.[1] A key role in this was played by international institutions such as the OECD, the IMF and the EU and a cluster of Italian neoliberal economists associated with Bocconi University in Milan.[2] In political terms, however, there is little doubt that the main driver of the austerity agenda in Europe has been the German government of Angela Merkel with her dour Finance Minister Wolfgang Schaeuble as the battering-ram.

This association of austerity with Germany, of course, conforms to stereotypes. And true to type, Merkel’s government has doggedly insisted on a rule-bound policy in the style of a revamped ordoliberalism. In thinking about the strong hold of neoliberalism on Germany we tend, for obvious reasons, to stress its “deep history” and its role in the foundation of the Federal Republic, in the era of Konrad Adenauer and Ludwig Erhard.[3] The recent surge of interest in the history of neoliberalism has encouraged this backward movement to the 1930s and 1940s. This has only been reinforced by the rediscovery of Foucault’s lectures on neoliberalism from the 1970s. But as important as it no doubt is to appreciate the founding significance of the Freiburg school for the Federal Republic, the resulting histories tend to reify and fix a certain view of what Germany was and what Germany is. Such a simple and static vision of a German Sonderweg in economic policy cannot do justice to the pullulating complexity of Germany’s capitalist democracy.

Historians of the postwar period have labored long and hard to add complexity and nuance to the endlessly repeated story of ordoliberalism’s triumph in the Adenauer period. To attribute Germany’s economic miracle after 1947 to the influence of the Freiburg school increasingly seems like a crass simplification. Likewise, since the 1970s, the autonomy of the Bundesbank has proven robust, but it has had to be repeatedly asserted and defended, at times imposed with real aggression. Meanwhile, the stout defense of conservative rigor by the Bundesbank has compensated for the far more chequered performance of German fiscal policy. With regard to debt, Germany is a fairly “average” high income country. Under the reforming Social-Liberal coalition of the 1970s and 1980s, the growth in Germany’s public debt was exceptionally rapid. By 1989, before the impact of reunification made itself felt, Germany’s gross public debt at 42 % of GDP was higher than that of either France or Britain. In 2007 before the crisis struck, Germany’s debt at 66 percent of GDP was well-nigh identical to that of the Eurozone average. The question that needs to be posed is what the relationship is between this fairly average track record on public debt and Germany’s self-proclaimed role as the chief prophet of austerity. Clearly, if we are going to argue for a distinctive German history of fiscal austerity this cannot start from a simple “matter of fact”. It must be a dynamic history of struggle within Germany, in which aspirations as much as realities are at stake and in which there is no settled “German view”, but a series of conflicting points of view in tension with one another. One is reminded of the truism in the history of sexuality that a repressive culture, filled with talk of abstinence and moral sanctions should not be confused with an absence of desire or sex.

The austere line of the Merkel government can be traced back to a program of reform driven by a mounting sense of fiscal panic within Germany itself, which then collided with the financial crisis of 2008-9. The centerpiece of this reform program, in its latest iteration, is the so-called debt brake amendment (Schuldenbremse) to the German constitution passed in June 2009, in the last months of Angela Merkel’s first Grand Coalition government. Since 2010, the debt brake has been adopted as the model for fiscal reform in the EU and has been aggressively pushed by Schaeuble. It has been subject to withering criticism by economists both from within Germany and without.[4] And in its resolute refusal of commonplace economic logic, it is tempting to read it as a quintessential expression of an anti-state, anti-debt affect of the right-wing. But as the brief genealogical sketch offered by this paper will reveal, the debt brake in fact originated in a Federal Finance Ministry that for ten years between 1999 and 2009 was under the control not of the CDU, but of the right-wing of the SPD.[5] The prominent involvement of social democrats is not unusual in the recent history of neo-neoliberalism.[6] But the German case does add three additional components. The language of justification for German austerity, is redolent not of old-school conservatism, but of the environmental concern for “sustainability” injected into German politics by the Green Party. Furthermore, because of the dynamic competition on the left of the German political spectrum between the SPD, the Greens and Die Linke, the debt brake idea was subject from its inception to a powerful left-wing critique. The result is what one might term, a “reflexive” neoliberalism, a neoliberalism that sees its enemies coming, anticipates their arguments and seeks to disarm them at source. Against their opponents on the left, who argued that the debt brake was a depoliticizing, constraining corset for democracy, the right-wing Social Democrats around Peer Steinbrueck argued that the debt brake was both a means of restoring the agency of the state and enforcing the necessity of responsible democratic choice. Furthermore, as a response to the problems of Germany’ complex, multi-party federalism, the debt brake is an essential tool for governing the kind of multi-level, dispersed, “quasi-medieval”, “post-sovereigntist” political structures that are characteristic of the contemporary world and of which the EU is the quintessential example.

[1] Blyth, M. (2013) Austerity: The History of a Dangerous Idea (Oxford: Oxford University Press)

[2] The Political Power of Economic Ideas: The Case of ‘Expansionary Fiscal Contractions’ Sebastian Dellepiane-Avellaneda, BJPIR: 2014

[3] Dullien, Sebastian; Guérot, Ulrike (2012). The Long Shadow of Ordoliberalism: Germany’s Approach to the Euro Crisis [1]. London: European Council on Foreign Relations

[4] For critiques from within Germany, see P. Bofinger and G. Horn, Appeal: Die Schuldenbremse gefaehrdet die gesamtwirtschaftliche Stabilitaet und die Zukunft unserer Kinder 15.5.2009 Heiner Flassbeck, Friederike Spiecker Der Staat als Schuldner – Quadratur des Bösen? Wirtschaftsdienst 2011/7. A. Tooze, Germany’s unsustainable growth, Foreign Affairs Sep/October 2012.

[5] A point well made by Hans Kundani, Can Germany’s Social Democrats Offer an Alternative? Dissent Fall 2013.

[6] R. Abdelai, Capital Rules (Cambridge Mass HUP, 2007).