https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2912107

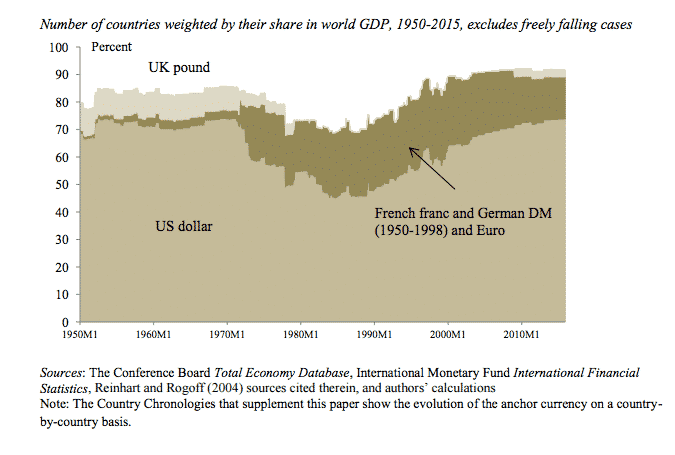

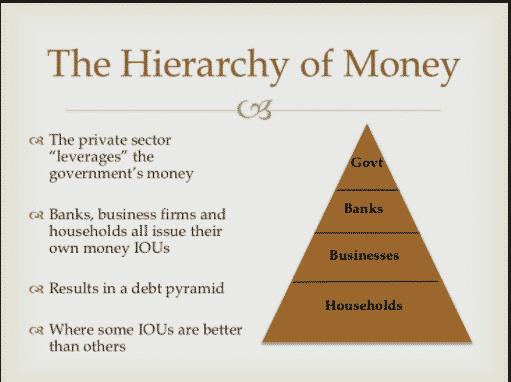

If it is true that the global economy relies more than ever on the dollar as discussed in a variety of recent posts. And if it is true that this dollarized global system is ultimately backed by the US state, as the hierarchical view of money suggests. Then this implies that the globalized economy depends in one of its primary facets in a very direct way on the US nation-state. We, therefore, need to get some purchase on the political economy of money and debt. This is all the more important because it is a field dominated by powerful cliches.

Three cliches are particularly important in framing the debate around the politics of money – the celebration of “glorious revolution”, the Weimar republic disaster scenario, and the “bond vigilante” nightmare of the left. These three scenarios overshadow our thinking about the politics of money to such an extent (obviously I have my exchange with Streeck at the back of my mind here) that it can be hard to see the muddy and complex reality which we inhabit. This muddy and complex reality doesn’t have a good name. It is a field explored by an increasingly rich literature on central banks from the early work on corporate liberalism and the origins of the Fed (Livingstone, Sklar etc) down to Krippner, Gabor and so many others in the present. I can’t do justice to that literature in this blog post. What I am trying to do is to mark out the space that it inhabits, precisely so as to hold at bay those other three scenarios (and yes a 2*2 will be involved). For sake of argument lets call this fourth narrative, the reality we inhabit, “managed money”.

Insisting on the central role of the state at the heart of the global financial system may be somewhat uncomfortable because the functional, hierarchical view of the monetary order that it implies can come across as celebratory and even triumphalist.

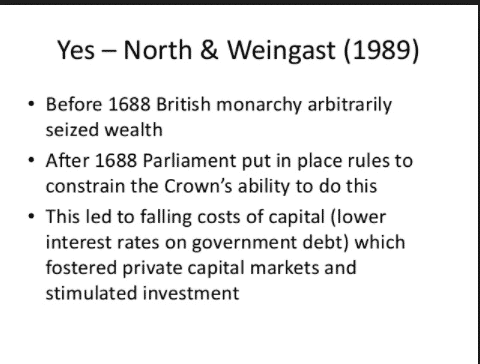

We see mild echoes of this triumphalism in the kind of narrative of hegemony that one can derive from a Marshall-Plan era Keynesian like Paul Kindleberger. It goes like this: Financial capitalism needs a hegemon. Periods of order and prosperity are periods of robust and intelligent hegemony, e.g. Victorian Britain, mid-century US etc. The triumphalism is made even more explicit in a powerful school of economic history exemplified by North and Weingast, popularized by Niall Ferguson and recently recapitulated by Acemoglu and Robinson.

They construct an entire narrative of the “rise of the West” on the basis of a virtuous circle between political representation, public credit, financial development and state-building. Crucially, the embryo of the modern financial system emerged from the Glorious Revolution of the 1680s in Britain, when a bond-holding elite gained parliamentary representation, political voice and thus the capacity to ensure debt repayment. That allowed the issuance of substantial public debts and on that basis the emergence of a modern monetary order with the Bank of England, a private manager of public debt, at its core.

Parliamentary systems can enter this virtuous circle and gain the advantages of mobilizing resources by way of public debt. Arbitrary absolutist sovereigns cannot because they have no way of overcoming so-called “original sin” i.e. the risk that a sovereign will expropriate its citizens. In the long run, so the story goes, the big battalions of modern money will be on the side of constrained, law-bound, parliamentary and constitutional regimes i.e. some version of liberalism. The logic chain runs like this: No military victory without public debt. No secure public debt without taxation. No taxation without representation. Debt, state power and political inclusion spiral upwards in a virtuous circle that loosely describes the rise of Britain to hegemony from the 17th to the 19th centuries.

In Ferguson’s work this becomes a manifestly triumphalist narrative. This may be obnoxious. But it does at least make one very important point. Securely funded public debt, far from being a public health hazard, is essential to the development of the modern world. If we did not have it, we would have to invent it. This is the core of any rational, functional account of debt and money.

This celebratory vision had its critics from the moment that it first emerged. There are a variety of great books on 18th century monetary thought. But my favorite remains the formidable, Before the Deluge by Mike Sonenscher. Sonenscher surveys the range of political fears associated with the advent of the modern credit and monetary system from the early 18th century and derives a radical new reading of the French revolution from it. If ever a book deserved the description “mind-blowing” this is it. NOT for the faint hearted!

To massively simplify there are at least two dark fantasies that haunt the happy story of money, debt and the Whig revolution:

One derives in its present day form from the disappointing historical experience of the left in power (the 1924 French Cartel, Labour in 1931, Pop Front in 1936, Mitterand in 1983 etc etc). Since the Eurozone crisis it dominates critical discussions of finance today, namely the image of the bond vigilante. In the “bond vigilante” narrative, democratically elected governments that run up debts are held hostage by aggressive speculators who buy and sell government debt and thus exert massive pressure on the government. Wolfgang Streeck is just one of many authors to base their accounts of the predicament of capitalist democracy on this image. One of the conclusions, is that debts constitute a political liability. They constrain freedom of maneuver, created conflicting obligations. Debt is a fetter on democracy.

The third scenario, which has a considerable hold on the political and historical imagination is that of the “Weimar Republic”. The fear of hyperinflation hangs over much discussion of public debt, the state and money. In this scenario, it is politics not the capital market that has the upper hand. The state, or “the government” simply “prints money” and bond holders find themselves the victims of expropriation, whether by a “populist” democracy, as a result of interest group struggle (indebted farmers win v. city creditors) or at the hands of a sovereign (a dictator for instance) unafraid to defraud its subjects. This is generally painted as a disaster scenario. But it can also be seen as a particularly aggressive form of taxation that may even be progressive if it targets monetary assets that tend, by definition, to be held by the wealthy. As Piketty most recently shows, wars and inflations tend to reduce inequality. Of course an important sub plot of the Weimar inflation narrative is that of the angry petty bourgeois deprived of all their savings turning to Nazism. Can this be squared with the progressive story that inflations reduce inequality? Yes. Very large wealth holders do tend to lose more than middle class people in inflations, but they get less angry because they can afford to take a bigger hit. By contrast, even a small reduction in the wealth of a petty bourgeois can threaten their identity. So an egalitarian inflation that hits the wealthiest hardest may, nevertheless, produce fascists. This, at least, seems to be the story for the Weimar Republic.

The puzzling thing is that though these three images remain very influential in debate, none of them capture our present day reality.

From 2008 onwards, states took on huge debts, not to fight a war but to compensate for the implosion of the credit pyramid that the “Whig” narrative celebrated. The surge in debt has no precedent outside wartime. But, except in the exceptional circumstances of the Eurozone, this has not resulted in a mass attack by bond vigilantes. Neither of the two economies most directly hit by the banking crisis, the US and the UK, both of which saw extraordinary increases in public debt, experienced any considerable bond market pressures. Indeed, bond yields crashed to historically unprecedented levels. The scenario on which left critiques of capital market politics tend to rely was, therefore, relevant only to rather special cases a la Grecque.

Sidebar on the bond vigilante scenario: apart from taking issue with his methodological nationalism, this is one of my main beefs with Streeck – the one dimensional and frankly unrealistic account he gives of how capital markets normally operate. In light of the traumas within the Eurozone the one-dimensionality of Streeck’s account is not surprising. Greece, Spain, Portugal, Ireland even Italy and France all experienced bond market attacks. But this is because they were left by the ECB in a situation which was as though they had borrowed their entire sovereign debt in a foreign currency with no central bank support. For much of the crisis period, this was the state of play in the eurozone. But it is extremely peculiar and by no means the norm in the history of modern capitalism. That peculiarity is the result of deliberate political construction. To generalize and reify it into a general theory of capitalist democracy in crisis is highly misleading. If a country experiences an attack by bond vigilantes in a more normal institutional setting, it is either because the (left-wing) government is being deliberately held on a short leash by the (conservative) central bank (as Clinton’s admin was by Greenspan in the early 1990s), or it has borrowed heavily in foreign currency, or because it is small and cannot easily withstand the devaluation likely to result if the central bank buys up and monetizes whatever public debt is being sold off.

In general, since 2008 the bond vigilantes have found themselves disarmed and frustrated. Why? Because the crisis took place against the backdrop of huge global demand for “safe assets”. Added to this there was a surge in new investors buying public debt, as they fled from the collapse of private securitization. And this private demand was reinforced and underpinned by the knowledge that the central bank would act as a purchaser of last resort through QE. The result was a huge surge in measured money supply. But we have not witnessed the Weimar Republic scenario. The vast surge in liquidity was contained within the structure of the banking system which has the balance sheet of the central bank as its organizing foundation. We, therefore, need to specify a fourth state, which for sake of argument we might call a state of “managed money”, others prefer the loaded term “financial repression”. It is reminiscent in many ways, of the models that were developed in the 1930s and 1940s to finance total war and to avoid the disruptive inflationary mistakes and dangerous bond holder politics produced by World War I and its chaotic aftermath.

How to organize these four cliches in relation to each other? The idea that makes most sense to me so far, is to distinguish situations in which the bond holders are dominant from those in which they do not dominate economic policy and then also to distinguish situations in which the state is or is not relatively autonomous. This gives us one of those simple 2*2 grids we love so much.

| Bond holders dominant | Bond holders non-dominant | |

| State subordinate | Glorious revolution | Weimar Republic |

| State relatively autonomous | Bond vigilante | Managed money |

In the “glorious revolution” scenario the bond holders subordinate the state, this ensures credibility. In the Weimar Republic scenario the state is subordinate to the interests of organized labour and industrial capital who burn off the war debt through hyperinflation at the expense of bondholders. The bond vigilante scenario is characterized by a tense stand off in which one might imagine a left-wing government trying to assert its autonomy against actually dominant bond holders. As a result the government comes to grief or conflict escalates. Finally, there is the managed money scenario in which the state is autonomous but bond holders are non-dominant so other social interests can be born in mind. But since the state is autonomous those other interests dont dominate as in the Weimar scenario. In this situation the technocrats in charge of the central bank and the treasury have the freedom to pursue broader macroeconomic objectives such as economic growth or 6.5 % unemployment even if this comes at the price of mild inflation and very low or even negative interest rates. This is the scenario of managed money.

One of the striking things about the grid is that the Weimar-bond vigilante cross is the cross of nightmares. Whereas the Glorious Revolution to “managed money” cross has the opposite problem, it tends to idealize the balance that is achieved. So let me state clearly, to avoid misunderstandings, that talk of an autonomous monetary policy free from domination by bond-holders is no more than a cliche. It is the cliche of what an ideal, “great moderation”, technocratic monetary policy would look like.

In terms of this matrix the politics of modern money is open-ended. But the world we are in is overwhelmingly characterized by neither the boosterism of a new “Glorious Revolution” nor the grim struggle of the bond vigilante story, but the ambiguous grey zone of managed money, in which bond markets, central banks and elected governments play a complex and never ending power game.

(How we fit the Eurozone with its bizarre constitution into this grid will have to be the stuff of another blog post). Suggestions VERY welcome.