Trump and the possibility of Trump may have brought down the curtain on American hegemony, but American power remains. Nowhere is this more evidently the case than with regard to the global currency regime. The dollar not only remains but is more than ever the anchor of the global financial system. The Economist has an excellent piece on the resulting risks, which draws on an important new paper by Ilzetki, Reinhart and Rogoff (Yes! Them again).

As The Economist puts it: “TRUMPISM is in part an expression of American exhaustion at bearing burdens it first took up 70 years ago. Donald Trump has moaned less about the dollar than about shirking NATO allies or cheating trade partners. Yet the dollar standard is one of the most vulnerable pillars of global stability. And the world is far from ready for America to ditch its global financial role. Unlike other aspects of American hegemony, the dollar has grown more important as the world has globalised, not less. … America wields enormous financial power as a result. It can wreak havoc by withholding supplies of dollars in a crisis. When the Federal Reserve tweaks monetary policy, the effects ripple across the global economy.

The dollar is central as an anchor for other currencies that are pegged to it. It is central as the currency in which key commodities like oil are priced. It is the main currency in which countries hold their reserves. It is the main currency of international lending.

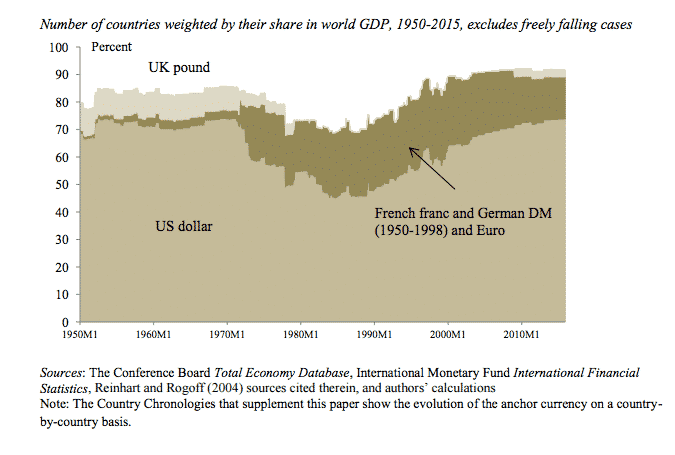

What the Ilzetki, Reinhart and Rogoff paper allows us to do is to track the ebb and flow of the dollar’s functioning in the global economy over time and across space.

In the years after 1945 when the US was overwhelmingly the dominant economy in the world with a share of global output of 28 %, the dollar was also the lead currency with the currencies of 75 % of world economy (measured in GDP terms) anchored to the dollar. Since then America’s share of global output has declined to 18 % and in the 1970s the share of global GDP anchored to the dollar fell to 45 %. But since the 1970s the share of currencies anchored to the dollar increased again, reaching 75 % in 2015. This is what analysts mean when they say that we live in the era of a second Bretton Woods, created not by design but by the unilateral anchoring of other currencies to the dollar.

As countries have abandoned exchange controls as a way of managing their balance of payments and pegging their currencies, they have resorted to holding huge currency reserves and these are principally held in dollars. Dollar-based financial markets provide you with the financial “depth” to hold really large reserves.

The vast majority of dollars used in the world are not created in any immediate sense by the Federal Reserve system. They are private credit money, much of it produced by banks and other financial intermediaries outside the US. But money is a hierarchical system (Perry Mehrling) and at its pinnacle is state money. And in a dollar-based global financial system, this means the Federal Reserve and the Treasury, which is responsible for issuing the ultimate safe asset i.e. US government debt.

So, when The Economist says: “Unlike other aspects of American hegemony, the dollar has grown more important as the world has globalised, not less”, it is pointing to a truly deep tension. As American hegemony disintegrates, the dollar, ultimately founded on the US state, is taking on an ever more central role in the global economy.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2912107##