Remarkable fall in real private…

Remarkable fall in real private non-housing investment in Germany since unification. nhttp://t.co/1DHyDBdNj3 http://t.co/uv8z31mYOO

Remarkable fall in real private non-housing investment in Germany since unification. nhttp://t.co/1DHyDBdNj3 http://t.co/uv8z31mYOO

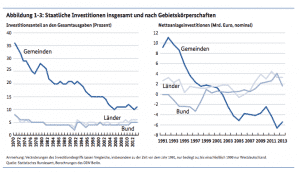

Net Public Investment in Ger is negative. Deterioration at local government level serious.nhttp://t.co/1DHyDAWbUt http://t.co/GRsOxPWPLl

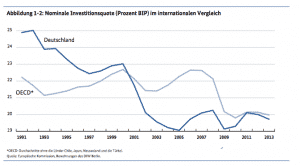

German investment below OECD average. Across Eurozone inv down 420bn v. 2007.nhttp://t.co/1DHyDBdNj3 http://t.co/bEnB5y8qMG

IG Metall demands that germany should borrow up to limit of 18bn euros and then lift the debt brake for investmentnhttp://t.co/JCOr9bhz9U

IG Metall convenes conference to oppose expensive public private partnerships in germany http://t.co/jkBiN9AHTQ via @SZ

Germany needs 100sbn Euros in pub invest.. Rates close to zero. But road forward blocked by debt brake nhttp://t.co/BtQMazVRNm via @FRonline

35 years on Remembering the Iran-Iraq War https://t.co/SHSy3lMbAn

86% of world's refugees are given refuge in developing countries, not in rich countries, according to UNHCR

Between 1959 and 1967 VW Brazil employed Nazi mass murderer Franz Stangl as is security chief.nhttp://t.co/ByInaIhwww

Extraordinary report on VW in Brazil where it faces charges over collaboration with murderous dictatorshipnhttp://t.co/ByInaIhwww

Die Zeit outraged at SPD Gabriel’s willingness to concede Putin’s linkage of Ukraine and Syria https://t.co/1dLZJs8aTJ

Juncker may have lied to parliament about Luxembourg low tax deals. https://t.co/tp6vhyXvOB

divisions between merkel/seehofer cdu/csu on change that German society can absorb https://t.co/tW5yw0r8bm

How can the UN security council, a relic of 1945, maintain its legitimacy? https://t.co/oaRNk1oQYS

Despite international applause Merkel’s popularity at home taking hit on refugee issue. https://t.co/Rn7aS4rb8a

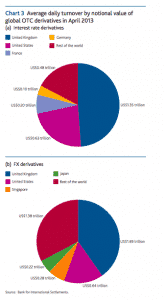

City of London at heart of derivatives business.nhttp://t.co/NIVETrWU2B http://t.co/JdvznHv2GY

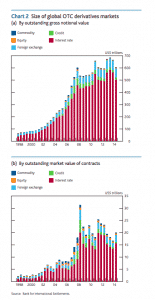

Interesting BofE data on OTC derivatives market development.nhttp://t.co/NIVETrWU2B http://t.co/4QDzTaBWat

Global regulators reach agreement on bail-in bonds plan for too-big-to-fail banks http://t.co/7Wxs2NCOat

China Outflows (estimates via BBG):nnJuly: $124.6 billionnAugust: $141.6 billionnnGoldman estimates that August outflows topped $178 billion

80% of Yemen’s population now need humanitarian assistance:nhttp://t.co/RdUevyouKI http://t.co/BdOTtbOFns

Japan’s exports to China fell 9.2% in August from a year earlier | Read @Aligarciaherrer at http://t.co/p3RnDVibWU http://t.co/bd7TLThqEx

How Germany is stepping out from its own shadow http://t.co/qScClNxVCI http://t.co/PAJ9mKrzpM

Isn’t it funny how so many things are “like entrepreneurship” these days. https://t.co/E3OoHj4qRc

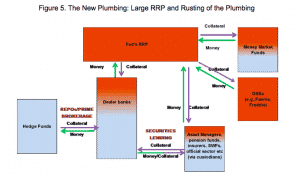

blanchard: crisis challenged macro profoundly. We have learned that the plumbing matters nhttp://t.co/WHhlapJwmj

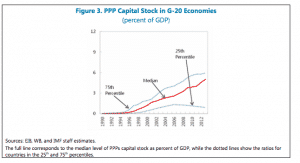

Neoliberalism’s chronology as measured by PPP investment programs. nhttp://t.co/lzFEoXTMQn http://t.co/skFBUbgMNB

IMF: dollarization across Caucasus and central Asia nhttp://t.co/pGqocP6mrd http://t.co/3zqhA6F8eO

IMF on Fed “lift off” and a useful map of the "new financial plumbing"nhttp://t.co/1GfBTaSW4X http://t.co/O9G1XuO4Vh

New blog post!!!nAn analysis of #ThisIsACoup http://t.co/1dYellr40R n#NSMNSS #PhDChat

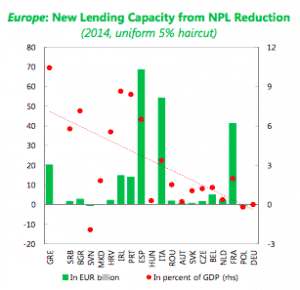

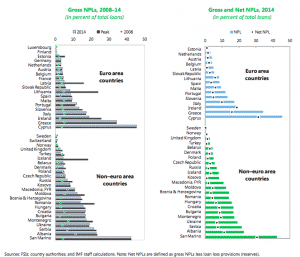

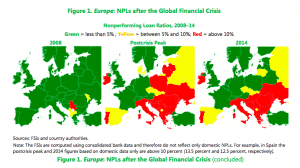

IMF restart growth in Spain, Italy and France by means of a bad debt haircut.nhttp://t.co/bzPWXLXHUG http://t.co/MKry16fKG4

Staggering non performing loans in Italy! This must be huge part of the stagnation there. nhttp://t.co/bzPWXLXHUG http://t.co/qqR55W2cBc

IMF on the 1trn Euro in bad loans dragging down European banking system.nhttp://t.co/bzPWXLXHUG http://t.co/n5LZ0ialnJ

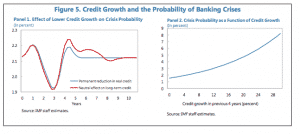

its state-dependent! IMF trading-off unemploy v. benefits of avoiding major crisis nhttp://t.co/jf9JhYguSW http://t.co/cYQQnryEsG

IMF: non-linear increase in probability of a crisis with credit-growthnhttp://t.co/jf9JhYguSW http://t.co/NKpoF0jbFL

IMF arguing that effects of interest rates may be “state-dependent” —> hawks underestimate impact of IR increases nhttp://t.co/jf9JhYguSW

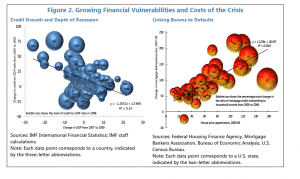

Nice IMF graph on bubbles and bustsnhttp://t.co/jf9JhYguSW http://t.co/tpDsKJHN2c

Great piece on the debate between IMF-macroprudentialism and BIS-interest rate credit cycle Wicksellians https://t.co/TzvoPa3Ayn