@zeithistoriker @davidsess @GeoffPMann And one…

@zeithistoriker @davidsess @GeoffPMann And one major difference between Keynesianism and neoliberalism is that NO s… https://t.co/spY3aKpLT7

@zeithistoriker @davidsess @GeoffPMann And one major difference between Keynesianism and neoliberalism is that NO s… https://t.co/spY3aKpLT7

@zeithistoriker @davidsess @GeoffPMann Keynes’s discussion of public/public opinion in Essays in Persuasion far mor… https://t.co/bqcZtbYlJH

Disaster waiting to happen. Weimar Germany’s balance of payments 1927 and its dependence on short-term foreign fund… https://t.co/3ZZmMrdmgx

@zeithistoriker @davidsess @GeoffPMann Hard to deny this as a fair reading of at least one version of Keynesianism.… https://t.co/8bMkPZdyVW

Figure head that almost sankthe ship: Britain leaves gold standard 19.9.1931. Saves UK but further exacerbates cris… https://t.co/a080ruW2wb

In Nov 1932 the last free election of Weimar Germany, in Germany’s capital city Berlin the KPD scored 37.7% v. 23.… https://t.co/3tazd6xVzu

@Shahinvallee @GEG_org @BRogerLacan Thanks Shahin. French edition out in October.

This was a really good BBC world service panel on the crisis. https://t.co/6vl1MqRpVq

Histories of democracy: new issue of Geschichte und Gesellschaft ably helmed by @RichterHedwig and Tim Mueller with… https://t.co/FOGZd7JCuC

“A heart attack kills the patient because it deprives blood to the critical organs,” @neelkashkari on the logic of… https://t.co/0lhpQ8HqXh

Heart attack: In Bernanke’s latest paper, he shows how credit market panic explains the shock to the US economy in… https://t.co/FUgxWgAW8T

@davidsess @poltheoryother The European and American situations are rather different.

Why its so much hotter in the city and stays hotter: How urban heat islands work @SoberLook @insideclimate… https://t.co/iRRhQ7amPS

Wells Fargo, Citigroup and BofA have all built substantial exposure to America’s revived shadow banking system. S&P… https://t.co/RvP4iG1dji

“we buy dollars like crazy” – in the first half of 2018 the Argentine non financial sector recorded a net flow of $… https://t.co/4RcJrZn1WJ

After two years of tightening, China’s credit impulse (change in new credit issue) is moving back into forward gear… https://t.co/88ZLBHtOhW

“IMF=Hunger” With inflation soaring towards 40% and lower incomes feeling pinch, can the IMF break the narrative in… https://t.co/w6O23vZLwd

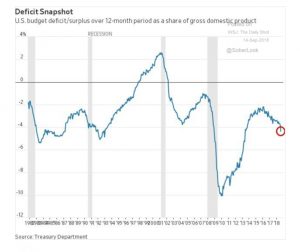

Fiscal tightening: Btw 2010 and 2015 the US federal government deficit was cut from 10% to 2.5% of GDP. @WSJ https://t.co/6lvbsL0Cb9

Hand-dug cobalt remains in the supply chain: “of course people die” shrugs one supplier. https://t.co/rAA4HjVgPS https://t.co/xZo7FKbQgv

Greece’s agonizingly slow recovery continues with unemployment falling below 20 % for first time since 2011. But ho… https://t.co/axLtynvWZ7

When @Nouriel wrtes "The space for fiscal stimulus is already limited by massive public debt," the word political i… https://t.co/FXQMNN9zfy

US house prices are very far from being the frothiest in the OECD. The repeated source of crisis is not housing mar… https://t.co/R3RVF5Rim6

How #Germany's political blocks have done over last 3 years: Left block quite stable since 2017 election. Right blo… https://t.co/UwYtvL1Kho

Finding a way to make computer prices go up – Trump’s $34bn tariff sends PC price inflation in the US into positive… https://t.co/XPDKEAq1Yh

@adam_tooze : «Nous habitons un monde économique sur lequel plane le présage d’une apocalypse différée» https://t.co/Hpw99Kr2IZ via @libe

Turkey looks to be confirming the lesson that “the trope of countries being able to “export out of crisis” is essen… https://t.co/SqTTsngNMQ

The EZ’s grotesquely complex budget rules lack economic rationale and should be revised both French and German offi… https://t.co/HR4oTcAynx

In an EM crisis what you really crave is Pizza. Domino’s Turkey franchise is raising prices along with inflation "w… https://t.co/HWbSWsPyrd

Not BRICS but briCs. China in a class of its own. Exports of the major emerging markets are tightly correlated with… https://t.co/rGkqbUV7fx

Ukraine's economy suffered a severe blow in 2008 and another in 2014 -> despite recent growth and good news stories… https://t.co/xaWNusENhe

How much Silicon is there still in the Valley? 13% of world chip production is still in the US. But production site… https://t.co/Qputq6CZgE

How vulnerable is corporate America to an interest rate hike? It has $2.3 trn in loans and bonds at floating rates… https://t.co/4FeMGMjz2a

2015-16 remains the most revealing episode of recent financial history: we saw new types of risk in China, new regu… https://t.co/wLQnRz7b9d

What do high school drop outs expect the S&P500 to be 1 year from now? The Fed actually asks this question. In a so… https://t.co/0QFmZU5LO3

For all the focus on its surplus with the US, China’s trade deficits with much of the ROW are large and getting lar… https://t.co/lOOFN784Ou

"China Bond Traders Boost Leverage With PBOC Watching Closely” – authoritarian “Keynesianism” in action as PBOC per… https://t.co/LN0a3x9lJX