Cement shipments in Eastern China…

Cement shipments in Eastern China are back to normal. Suggesting that real estate-construction is leading recovery… https://t.co/ASTQgkFjeD

Cement shipments in Eastern China are back to normal. Suggesting that real estate-construction is leading recovery… https://t.co/ASTQgkFjeD

With support for Greens collapsing Merkel’s CDU alone is now stronger than Red-Red-Green coalition. AfD on skids. https://t.co/wu8LmHGZ7a

Will the early recovery in China (driving imports) v. Recession in West (crushing exports) -> Chinese trade deficit… https://t.co/BlDV29y9xN

How South Korea flattened the curve. From the official report: Flattening the curve on COVID-191: How Korea respon… https://t.co/q0ISjR8pbA

Do you expect world to be back to normal by June? 85% Brazilians 83% Indians 49% Italians! 19% Japanese… https://t.co/qK35vTmBF5

“The depth of the recession, just in terms of jobs lost and fallen output, will not compare to anything we’ve seen… https://t.co/hBjsnGGhmk

With Ankara low on reserves, no swap line and refusing to consider IMF option, Turkish lira is sliding towards lows… https://t.co/j6N3gnmnWy

"What’s the same about 9/11 and the pandemic is that it altered your sense of reality instantly.” Jim Hackett, CEO… https://t.co/5Jmz1Gab2B

Early 2020 saw a surge in foreign holdings of US Treasurys that coincided with a slump in yields to record lows.… https://t.co/4IO1XDuGoz

War economy is not the right analogy! Postwar DEMOBILIZATION IS. US factory output in March falls by most since af… https://t.co/ZH5RbMdnIy

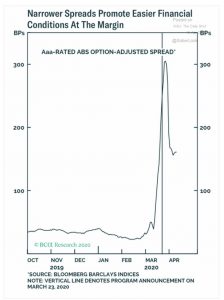

The announcement of TALF 2.0 was enough to bring ABS spreads down. @bcaresearch via @SoberLook https://t.co/A2hNtSdOPF

Our high-frequency tracker of non-resident portfolio flows to EM shows that the week ending today is the first one… https://t.co/IzqZUDMvZU

Following Fed intervention Junk bond ETFs now trade at premium to their net asset values! @PavilionGlobal via… https://t.co/m1FN7kYezV

At the current low oil prices you would expect HY energy spreads to be far larger. Market priced for V-shaped recov… https://t.co/6AYg8Oj4d2

@alexharfouche1 @business @SoberLook send link please

US banks are making huge provisions for losses to come. @business via @SoberLook https://t.co/ti8AWbeKIJ

Master avant-garde guitarist/composer, Palilalia Records imprinteur and Harry Pussy co-founder @billorcutt curates… https://t.co/Bh96k75xJL

Investors need to understand why Fed Chair Powell is taking these stunning gambles. Fed fears that looming economic… https://t.co/hYgwM9Nv6e

"Powell is fast becoming the least cautious — or dull — Fed chair in history.” @gilliantett https://t.co/yP7tKO2rRx https://t.co/dbfd3MWNMK

Lorie K. Logan is the force behind the Federal Reserve’s EPIC asset purchase programs. Veteran of 2008, her bio is… https://t.co/gQ5sgmNvMW

Fed purchases of assets in week starting March 23 2020 were simply staggering. Matching entire BofE and ECB program… https://t.co/iXqGfOLLgL

The Federal Reserve Bank of New York has set a number of central banking world records: buying most bonds in one op… https://t.co/bIEDuBvjAX

"The sorry conclusion to Europe’s decade of austerity, however, is just how little creativity it has inspired in it… https://t.co/6FfsOW9kkh

Lender of last resort Fiscal partner Investor of last resort A really helpful anatomy of Fed interventions in 2020… https://t.co/Xh5aAYItet

The Fed in the crisis. Anyone who enjoyed my piece in the @guardian https://t.co/Kkum2gYCKh May want to follow u… https://t.co/uS5EwUzDQM

Well … the good news is that gasoline demand has bottomed. The bad news … it's half what it was a month ago. Via… https://t.co/0ADq1Vu5z5

Investors need to understand why Fed Chair Powell is taking these stunning gambles. Fed fears that looming economic… https://t.co/pBLjMsk3b5

"Powell is fast becoming the least cautious — or dull — Fed chair in history.” @gilliantett https://t.co/yP7tKNKQZZ https://t.co/cPRjir8v8r

Lorie K. Logan is the force behind the Federal Reserve’s EPIC asset purchase programs. Veteran of 2008, her bio is… https://t.co/NoGTGgXvCZ

Fed purchases of assets in week starting March 23 2020 were simply staggering. Matching entire BofE and ECB program… https://t.co/A9EPy08ul0

The Federal Reserve Bank of New York has set a number of central banking world records: buying most bonds in one op… https://t.co/kgFYveTWyk

"The sorry conclusion to Europe’s decade of austerity, however, is just how little creativity it has inspired in it… https://t.co/6CuWE8oF6a

@adam_tooze Price talk began at 11% which raised eyebrows because it was 100 bps or more wider than other F. Fina… https://t.co/feE5JUdrzY

Lender of last resort Fiscal partner Investor of last resort A really helpful anatomy of Fed interventions in 2020… https://t.co/CZLyoO50Nm

The Fed in the crisis. Anyone who enjoyed my piece in the @guardian https://t.co/Kkum2gYCKh May want to follow u… https://t.co/bRpEF8CNG8

In Feb Ford borrowed at 3.5% Today with only its China operations actually selling cars it is looking at 10-11% and… https://t.co/THlZwAKERv