China experienced a net capital…

China experienced a net capital outflow of c $19bn in March. But this is modest compared to the huge drain in 2015.… https://t.co/SJEFn5i3Z1

China experienced a net capital outflow of c $19bn in March. But this is modest compared to the huge drain in 2015.… https://t.co/SJEFn5i3Z1

The huge surge in Fed purchases of Treasuries has had the effect of bringing volatility down and ensuring liquidity… https://t.co/w4JHjAC5ZI

About 20% of the CARES Act spending, $454 billion, will be used to backstop lending from the Federal Reserve. This… https://t.co/9CWgwpxbSc

The US deficit in 2020 will amount to $3.8trn $1trn predicted by @USCBO in Jan 2020 $2.2trn CARES act $0.6trn due… https://t.co/JBhyZgEDoi

The US debt to gdp ratio by 2023 is likely to exceed that reached during WWII CFRB aka @BudgetHawks… https://t.co/Qxlcl8eaMD

Coronavirus threatens $500bn hole in US state budgets – typically excellent piece by @bhgreeley on the huge financi… https://t.co/S1KhPVxXeo

Energy-sector corporate bond spreads are much too tight given what has transpired in the oil markets. The little re… https://t.co/iqaMSBcMP4

“Like eight elephants trying to fit through three small doors” In March the US commercial paper market began to ma… https://t.co/WLcsbfajjT

Stress Endures in Market Where Big Companies Turn for Cash REALLY good piece by @PaulJDavies @Annaisaac… https://t.co/70l506xSRI

What if Italian sovereign debt is downgraded to junk or comes even closer to the edge. Italian spreads have been ri… https://t.co/foVr3M4ylb

Turning Japanese – “slow debt monetization” – warehousing debt on the ECB balance sheet in the hope that voters and… https://t.co/YK6HVx8Oku

As California shuts down -> major refineries shutter -> oil now floats offshore in almost 36 huge tankers with enou… https://t.co/FhgEZx2yq6

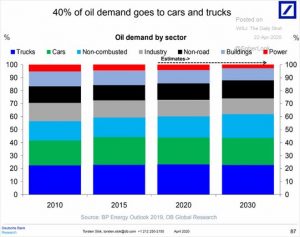

If you work your way back through the refinery process etc -=> 40% of all crude oil demand is attributable ultimate… https://t.co/KL8s7caHwY

The currency risk premium priced into Turkish Lira currency forwards is up (lhs, blue), as markets demand higher ra… https://t.co/HFG2nnzcsN

Having sabotaged the WTO’s appellate body, the US is now invoking the lack of rulings by that body to gain a free h… https://t.co/Th7f43Zdr8

Great @Brad_Setser thread on BoJ report on financial stability in Japan. Must read for swap-liners. https://t.co/l4rz4AiA4t

Breakdown of oil demand shows that 40% goes to cars & trucks alone @DeutscheBank @SoberLook https://t.co/7SQghsrLPG

Which is fair. There is no need for perpetuals at the moment. Government debt is usually just rolled over, and so w… https://t.co/Oy9pKdBJCx

Since 2010 there has been a threefold increase in US farms’ reliance on certified temporary agricultural labour. No… https://t.co/7tVMAlUOqU

Florida is the worst ranked state in the US at processing unemployment claims, the AP reports. The state has paid… https://t.co/Z9V7lRFDdd

A quick video for @cosmocene to explain the importance of the European Council this week both for Europe as well as… https://t.co/i2g2K9q5vA

Totally agree. https://t.co/IKBWEJk4DC

So I am now officially hostage to fortune especially given S&P sovereign rating review – still think this is right https://t.co/5QwSBr2F10

We dread to think how our #ChartOfTheWeek, from Chief International Economist @andres__abadia, would look if the… https://t.co/xbScyACbBc

Bank of England have bought enough gilts that they're now having to lend more of them back to the DMO to support re… https://t.co/ELE89ItXzB

Euro area public debt ratio declined for the fifth consecutive year, to 84.1% of GDP in 2019. Excluding ECB's hold… https://t.co/TDbn8aGdk7

Very interesting research cited by @Birdyword here on how global value chains were more a cause than a consequence… https://t.co/1lCYlL7Rz2

Forget the New Deal, baby boomers have transformed US federal government into a giant transfer payment machine. In… https://t.co/HzYcjzOREB

How global corporate profits fluctuate with GDP. These are not rates of profit, or shares of GDP. I think they are… https://t.co/QYQOIkITvt

This by @adam_tooze @HelenHet20 and @TPpodcast_ is a fantastic summary of where we stand on the Corona Crisi… https://t.co/vlOSSWJRFi

In February 2020 the Eurozone trade surplus reached a record 25.8 bn euros = sign of persistent imbalance in macro… https://t.co/9cDTf3BsPS

Amongst the Gulf oil states the weak link are Bahrain and Oman which are rated junk by the three major credit asses… https://t.co/yh62TcyySD

Was really quite exciting to record a session with @TheStalwart & @tracyalloway this morning for their legendary p… https://t.co/ppQXlW3Ys2

It isn’t just the Western oil majors that are rushing to issue bonds and draw down credit lines, the major Gulf oil… https://t.co/ucTF3oEDxk

After the goodwill shown towards low income debtors in the moratorium proposed by the G20 and supported by @IIF , p… https://t.co/sLi6dAvy6L

We can only hope that folks in the Italian government read the Spanish proposal, read @MESandbu and get behind it.… https://t.co/5ld7GKulg0