IMF data suggest that Moscow…

IMF data suggest that Moscow region per capita average income exceeds that of US with rest of Russia far behind… https://t.co/8bVMmd821g

IMF data suggest that Moscow region per capita average income exceeds that of US with rest of Russia far behind… https://t.co/8bVMmd821g

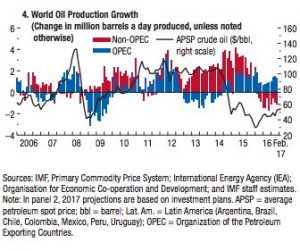

Investment in oil sector closely tracks prices since the 1970s https://t.co/qgPFkcRCW9 https://t.co/tTHUGK8rdI

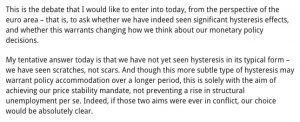

@shishiqiushi @de1ong its all in the service of arguing against running the EZ economy “hot”. price stability mandate is ALL!

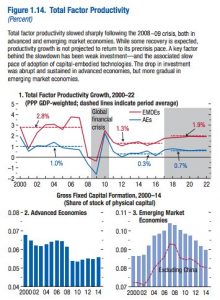

Total factor prod slowdown as a global phenomenon driven by slower investment https://t.co/qgPFkd9ekJ https://t.co/KbIPXt4KOB

Text of Coeuré speech on "Scars or Scratches" and EZ unemployment is really jaw-dropping https://t.co/YWDNY0DdMI https://t.co/Q58P3M0Bps

On the one hand you have data showing EU activity rate rising & > US. On other falling employment. What gives?… https://t.co/7YFDuwXl9e

Scar or scratch? Seriously Coeuré of ECB is asking question with this as his first slide! At least ECB talking jobs… https://t.co/AxROsKpFLl

Scars or Scratches? Double hit to Eurozone labour market: slide from Coeuré speech. I guess that will be scarring… https://t.co/tEsap4rsnA

Not so much a taper tantrum as a taper drought: net cap flow to EM dropped sharply in May 2013 & never came back… https://t.co/WXyT4PBBhl

Interesting and alarming reflexions on the collapse of the “axis of adults” narrative and the Trump admin’s foreign… https://t.co/JveUVTLYYo

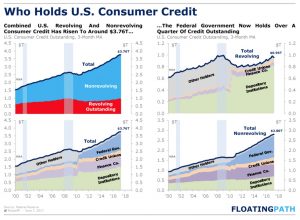

U.S. Consumer Credit Monitor – Floating Path https://t.co/UPSJ5HLBjE https://t.co/72VHfJRE4h

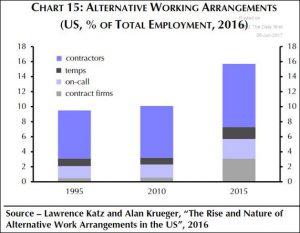

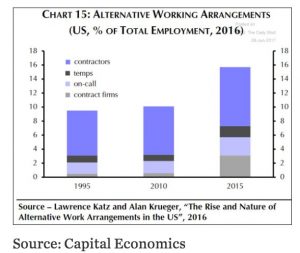

Alternative working arrangements = one of reasons for subdued wage pressures @WSJ @SoberLook https://t.co/y2nzSgr2AF

@NickatFP Fascinating. But one or two of the numbers are wild. 91 % fall in european sovereign bond funds in 2008? really? 2008?

Will we see capital saving effects in robots as the unit price continues to fall? @SoberLook https://t.co/GopunbE4Kh

The tops turvy post-OPEC global oil industry since 2006 https://t.co/qgPFkcRCW9 https://t.co/XuihEeL2Fg

EXCELLENT from @Brad_Setser on why banking crisis in China will pressure PBoC but is unlikely to cause Yuan crisis… https://t.co/gwsOyRMNG1

Should China’s countersteer in 2015 rank as one of the most successful acts of counter-cyclical macro policy in mod… https://t.co/kryg6IOsL7

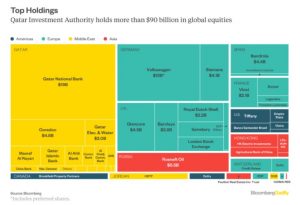

Up for sale? Things the Qatari Investment Authority owns: https://t.co/ox1dM33kLJ https://t.co/ktWLgOb90Q

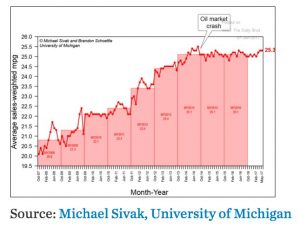

Its simple: release gas price pressure and American consumers stop caring about mileage @SoberLook https://t.co/IlP6ZdPh9O

Pipeline and railway politics in Central Asia mapped by Bruegel https://t.co/MXBWWmNobt https://t.co/gY6w3dEvY6

U.S. river system ferries nearly 3/4 of grain for export to ports, but inland waterways are in state of disrepair… https://t.co/bMOF2fbKyo

"Eurpean-quality labour at Chinese prices” fake news & plus dereg put Macedonia in Wrld Bnk top 10 ease of doing bi… https://t.co/sGKJDCeCVh

For excellent summary of severe competition conditions in global chemicals industry see https://t.co/h0B0iNDRhe &… https://t.co/3Nmt6muUCt

Standard employment model fragmenting in the US though not at a particularly rapid rate by intl standards @SoberLook https://t.co/C1ZgZpM18z

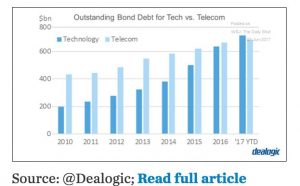

New Tech overtakes Old Tech in US corporate bond market @SoberLook https://t.co/DFtBxEbUbk

@gideonrachman @FT Hi @gideonrachman though I disagreed I thought yours was a really significant piece and crooked… https://t.co/LayjaLbfLr

@MESandbu currency union under conditions of financialization really raises the stakes!

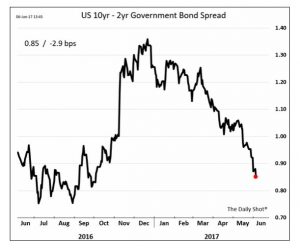

US bond market just keeps pushing back against Fed tightening cycle —> spread narrows @SoberLook https://t.co/t1Rlu78cJK

1184 BC: The Fall of Troy https://t.co/Wuw2wLl7ij https://t.co/VVQbr7VOhL

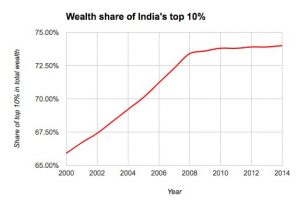

Surge in inequality in India was concentrated in 2000-2008 https://t.co/gngvHw2KEW https://t.co/E1gaxnmqfk

Obstfeld&Taylor nail the real missing parts of EMU. Hint: its financial stability not lack of fiscal union… https://t.co/oGJp1aY4bn

LOOK at the implosion of gross capital flows in 2008. Obstfeld&Taylor rightly put this at heart of story https://t.co/29C0WQwp7W

Other interp of Chinese bond buying is: want to signal return to good old days & stabilize ahead of party congress… https://t.co/2VbZfBP9bC

Brave or foolhardy new world? increasingly pegged exchange rates since the 1980s with surging capital mobility… https://t.co/1XSvOyAZwQ