Infrastructure-specific price deflators show costs…

Infrastructure-specific price deflators show costs of construction surging ahead of general infl @EconomicPolicy… https://t.co/uadSI1hlSo

Infrastructure-specific price deflators show costs of construction surging ahead of general infl @EconomicPolicy… https://t.co/uadSI1hlSo

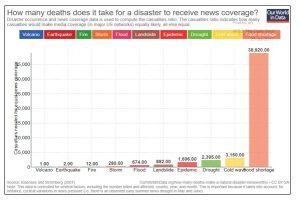

How many deaths does a "natural disaster” have to inflict to get US media attention? @SoberLook @worldindata https://t.co/iVJmvtPq57

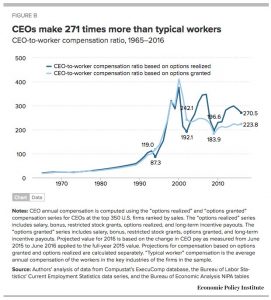

The great surge in CEO:worker inequality came in 1990s https://t.co/G7I0RCty1m https://t.co/fTq1N7oKoi

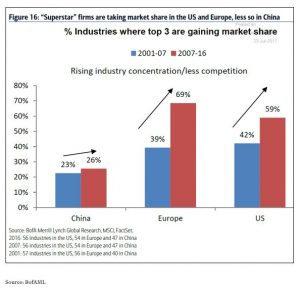

Both European and US industries increasingly dominated by top 3 firms @SoberLook @BofAML https://t.co/QVrraYDBFy

The really dramatic surge in CEO:worker inequality in US came in the 1990s https://t.co/G7I0RCL9pW https://t.co/6Kv6hzAzho

Euro already looks overvalued rel to US-German interest rate differential. Will ECB tightening simply close gap?… https://t.co/Wl1jpxLRGq

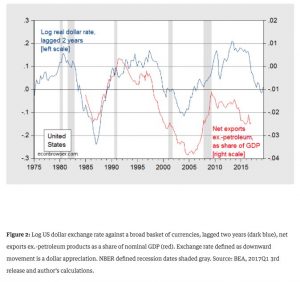

Price competition: US net exports closely tracked the lagged real exchange rate: https://t.co/o86l1vzhLu https://t.co/1nSks2YGVV

After beginning of ECB QE Japanese investors sold Bunds and picked up French debt https://t.co/AKJ49e7JaQ https://t.co/vxyPF4NShg

Will Euro rebound amplify the effect of ECB tightening in choking off EZ recovery? @SoberLook @Brad_Setser https://t.co/Db67LCBSas

Driven by yield differentials and QE Europe not Asia is now the main buyer of US government bonds… https://t.co/DOXF8LvwlD

China FDI to Africa has surged ahead of US FDI but China stock is half that of US and closing gap slowly… https://t.co/v2KST3IVhw

Ultimate test of a adults in room hypothesis? Short-term US Treasury Bill market is pricing in an October debt ceil… https://t.co/I56Z2dTP3V

As Eurozone QE from 2015 created yield differentials, European investors shifted into US&G7 bonds… https://t.co/fQTWcYXypL

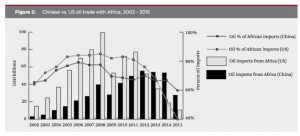

Commodity lottery: Fluctuations in oil prices dominate US&Chinese trade with Africa https://t.co/ucmC3T7hxO https://t.co/I0uUrPk2Nh

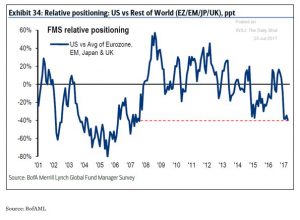

US fund managers are shifting funds out of US equities towards ROW @SoberLook https://t.co/OZcPfstUvc

As ECB QE kicked in, Eurozone investors increased their purchases of close equivalents i.e. foreign long-term debt https://t.co/AKJ49e7JaQ

Coeuré especially worth reading in conjunction with Fed governor Brainard's speech on international impact of QE/ Q… https://t.co/Kz1EdC4OvV

Did 2009 stress test really set stage for rebuilding of US bank balance sheets? Am I missing something? Data from… https://t.co/UfPnw06aRT

Beginning of ECB QE coincided with large net portfolio outflows from EZ. Coincidence? What are effects asks Coeuré.… https://t.co/bzz9obQ9dF

Driven by commodity prices and demand: China trade with Africa has surged ahead of US trade with Africa since 2002… https://t.co/Fz309lj6Eq

Macron's popularity has fallen 10 points in last month. Now lower than Hollande at similar stage in his presidency

100 % renewable future for the US? @TheEconomist featured article. But @SMerler @Bruegel_org takes it deeper.… https://t.co/C12AMG7X2G

Losses incurred by US and European banks 2007-9. Over this period US banks paid $80bn/Europeans c. $70bn in dividen… https://t.co/NcOrlujID3

Warehouse clubs and ecommerce define future of US retail. Great roundup on US retail crisis by @SMerler at… https://t.co/T21to7iugh

Hm. Der erste Band kostete 3 Taler 10 Groschen. 1867 ungefähr der Wochenlohn eines qualifizierten Arbeiters. #Kapital

No electorally viable movement in Spain espouses a nativist, xenophobic, or anti-globalization platform. https://t.co/WAN5ddu5l7

Asymmetric polarization: The entire GOP has moved to the right, where Dems have just become slightly less moderate.… https://t.co/e5xW9gxW1v

Monetary vs. Fiscal Policy: A debate between Heller and Friedman. https://t.co/uMkxiWGwT6 @Undercoverhist… https://t.co/B4huDiH9jk

"#Brexit is a negative supply shock for the UK economy" – explains @AdamPosen of @PIIE https://t.co/Ghb7yJlvR6 https://t.co/OJHDPHVNY4

New word: Corium = fuel from a nuclear meltdown i.e. a mixture of atomic fuel rods and other structural materials.… https://t.co/yGrPRBPrP7

Can the ECB and Fed work together both to “normalize” and to reverse macro imbalances? @Brad_Setser on Brainard… https://t.co/2FW5WLi50H

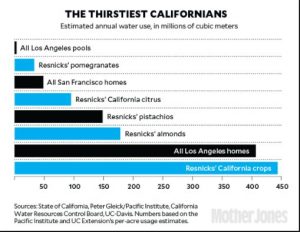

Rescnick owned agroindustrial complex in california consumes more water than LA population https://t.co/XsaC0Z8y0w https://t.co/zRuSSkeNcG

When all factors are counted, in Eurozone in 2012 income household income declined more sharply than in 2008… https://t.co/WCh0LY1MAl

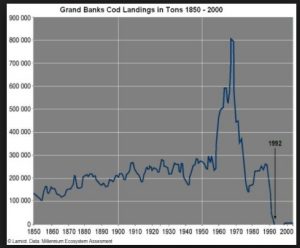

Tragedy of the commons: rise and collapsel of the Grand Banks Cod fisheries https://t.co/WSTddzvpYE https://t.co/ri8DwPXhHE

On labour markets and reifications … and yes BBC pay. But great use of Lukacs. https://t.co/uePIFyiucl https://t.co/LdXLl8kNUF

Don’t worry about US corporate leverage. Worry about what it tells us about corporate expectations for econ future.… https://t.co/VXJPfwmdeC