The euro area has the…

The euro area has the largest trade surplus in the world, c. 400 bn euro pa since middle of 2014. While it is easy… https://t.co/dXIQGCkL4o

The euro area has the largest trade surplus in the world, c. 400 bn euro pa since middle of 2014. While it is easy… https://t.co/dXIQGCkL4o

China’s Asian neighbors have responded to China's “rise” with policies designed to maintain weak currencies and pro… https://t.co/yVEai47iNl

Fantastic thread from @AntheaERoberts on history and atrocity. https://t.co/wB0M1u47fm

Europe needs to be investing an additional 260bn Euros per year to meet its climate goals. The bulk of that missing… https://t.co/HK1obmu81L

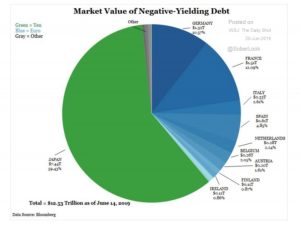

Japan and Eurozone sovereigns are the issuers of negative yielding debt. @biancoresearch via @SoberLook https://t.co/HkbpvBPTsf

In the 1990s half China’s exports came from SOEs. Now their share is only 10%. The trade war hits mainly privately… https://t.co/gNB5arA5nY

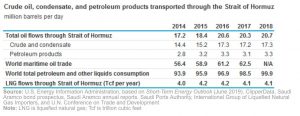

What is at stake in the Straits of Hormus is the shipment of gulf oil to the relatively fast-growing Asian economie… https://t.co/0e35HA5n1E

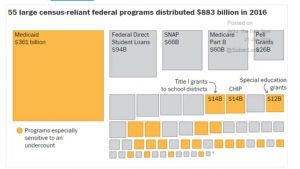

One reason the census matters! $883bn in Federal spending is keyed to its results. https://t.co/3kp0ZfVTXJ https://t.co/sfZEG8D4RK

If you want to make a play on domestic US equities you buy … real estate, utilities and financials! Kind of surpris… https://t.co/aQ4ZIPQbjq

Collectively, the United States, China, Japan, Taiwan, and South Korea historically accounted for about 60%–65% of… https://t.co/xnfroHXo5W

Russian and Canadian basic chemicals industries are led by fertilizers and petrochemicals = most energy intensive b… https://t.co/VSBVD9zXTo

Since 2008 the deleveraging of the financial sector and households, the key drivers of the financial crisis, has br… https://t.co/F8FYVynTOd

The story of Clean Line and the obstacles that stand in the way of a renewables revolution in the US … or why, as i…

FIX THE GRID: A transformation in power transmission systems is KEY to unlocking the potential for renewable energy… https://t.co/ClSZfRblJ3

Gas-Wind-Solar: Least expensive technologies for generating electricity, by county of the US. And yet 27% of power… https://t.co/uCMw54Y6wR

The industrial sector consumed more than half (55%) of all delivered energy in 2018 (@IEA) Within industry, chemica… https://t.co/sPBxaymjkc

In 1970 interest rate-sensitive manufacturing and construction accounted for 30% of US employment. Today with their… https://t.co/V7gvV7J1w6

1/3 of world maritime oil trade and 1/4 of LNG goes through the Strait of Hormuz. https://t.co/kaqG2kBrbu https://t.co/xkDKyRvF6R

What is at stake in the Straits of Hormus is the shipment of gulf oil to the relatively fast-growing Asian economie… https://t.co/QixqtvHkBZ

In the 1990s half China’s exports came from SOEs. Now their share is only 10%. The trade war hits mainly privately… https://t.co/hZ7tP0nXJw

500:1 5 m Chinese jobs rely on Apple's presence in the country, including those of more than 1.8 m software and iO… https://t.co/wMpHGg9dJQ

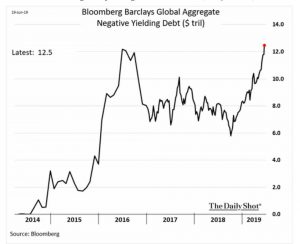

"Last year, the tally of negative-yielding paper was shrinking towards $6tn, only for the forces of financial repre… https://t.co/sPpWDDEmeM

Japan and Eurozone sovereigns are the issuers of negative yielding debt. @biancoresearch via @SoberLook https://t.co/r1hZGCSIPx

The amount of negative yielding debt has just hit an all time high of $12.5trn. @SoberLook https://t.co/4BupeaNeyp

US companies should fear China’s consumers more than its government. A consumer boycott could change the landscape… https://t.co/6sHZQnWsrE

500:1 5 m Chinese jobs rely on Apple's presence in the country, including those of more than 1.8 m software and iO… https://t.co/QYRE1OcEsa

As of 2018 China boasts more Apple suppliers than the US. But that is about to end as the US tech firms reconsiders… https://t.co/dfS7XBz2SC

Uncoupling – Apple has asked its major suppliers to evaluate the cost implications of shifting 15% to 30% of their… https://t.co/CpFNg5vqlg

Misery: "Argentina had its fifth quarterly GDP decline in its fifth recession over the past decade.” @SoberLook https://t.co/taegkqibED

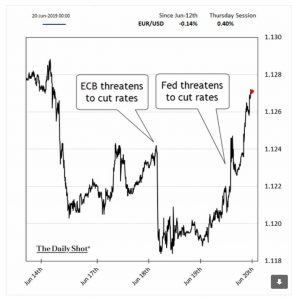

With both the Fed and the ECB signalling rate cuts, are we back in the territory of “currency wars”? @SoberLook https://t.co/CFFMrNFdxY

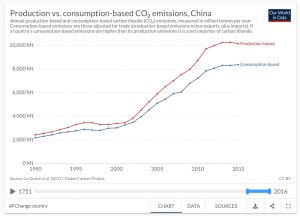

Of China’s 10.2 bn tons in annual CO2 output c. 2bn tons are accounted for by exports. https://t.co/klrSDvzx4l https://t.co/HF4ySwnHVo

Compared to other cyclical upswings since 1879 the current upswing is not just slow and sustained but features very… https://t.co/jrVL4WPSpp

Big Bubble? From March 2000 the NASDAQ index plunged from $6.6trn to $1.456trn and took 13 years to recover.… https://t.co/fIJ2SoNW71

@adam_tooze @colbyLsmith This is recent work of my *fab* colleague Shweta at @TS_Lombard . She deserves a tag here! @ShwetaSingh222

Which is the biggest financial bubble of all time. @dollarsanddata argues that it was not the housing boom 2000-7 b… https://t.co/rw5CHV95K6

À lire, pour comprendre que le « projet de budget de la zone euro » n’en est pas un : c’est surtout un échec pour l… https://t.co/SFCFQLtmLB