Whilst Xi and Putin maneuver and Russian tactical nuclear weapons trundle towards Belarus, big Western money is flowing into defense stocks.

As one private equity hawk commented: “Before it was seen as something to be ashamed of, so no one talked about investing in defence, but since the war in Ukraine, the dynamic has changed, and investors are bragging about it,” he said.

Meanwhile, I continue to be concerned that we don’t pay enough attention to the economy and society that is bearing the brunt of the struggle, Ukraine itself. Whether Ukraine can sustain another year of war depends not just on the battlefield but events on the home front.

***

A recent interview with Andriy Pyshnyy (Andriy Pyshnyi), the 48-year-old head of the National Bank of Ukraine, by the FT’s Ben Hall, gives an idea of the efforts that have been made since October last year to stabilize the Ukrainian war economy, at least in financial terms.

Andriy Pyshnyy took office in October after a significant clash between the central bank and the national government over the financing of the war effort. As the FT explained, “an “open conflict” with the government” had broken out over the monetary financing of the war, which ““created huge risks for macro-financial stability” when the bank was last year forced to print billions of hryvnia to plug a budget shortfall. “It was a quick remedy, but very dangerous,” said Pyshny … The finance ministry had been unwilling to tap domestic bond markets or raise revenues instead.” This also led to mounting tension with Ukraine’s Western backers who could see the writing on the wall in financial terms.

Pyshnyy’s predecessor Kyrylyo Shevchenko echoed those arguments in an opinion piece in the FT in September, adding to tensions with the government. Pyshnyy, a former banker who lost his hearing at aged 34, replaced Shevchenko in October. On his first day in office he set out to repair relations with the government, meeting finance minister Serhiy Marchenko “until the late hours of the night”. They struck a deal, with the central bank adjusting its bank reserve requirements and the ministry offering lenders more attractive terms. Pyshnyy said the NBU’s aim was to soak up excess liquidity by tougher reserve requirements and gradually return to a floating exchange rate.

Ukraine then entered a probationary period with the IMF.

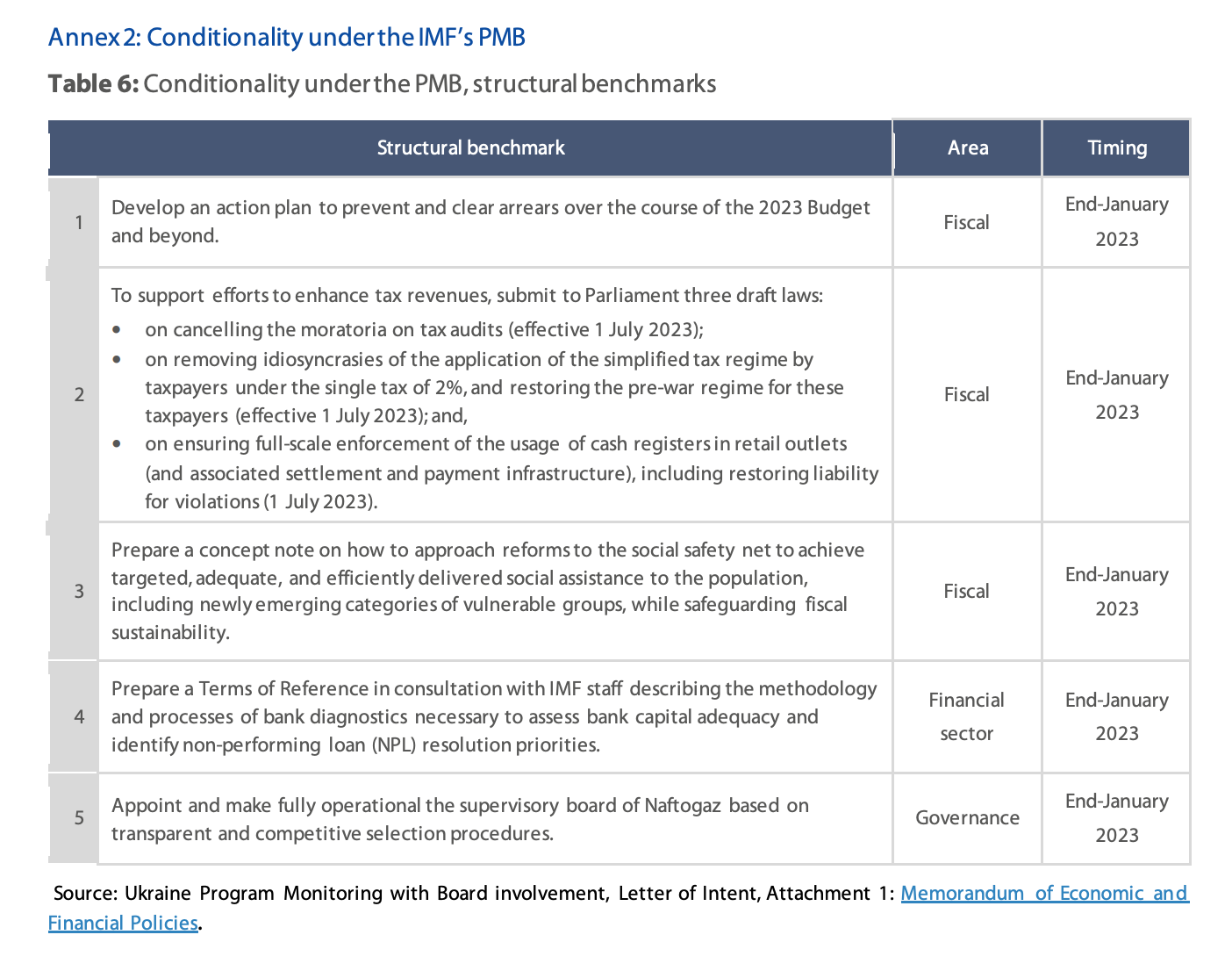

Ukraine has a poor record of meeting the IMF’s conditions during a succession of bailouts. But Kyiv built confidence by reaching the goals set by the fund during a four-month “programme monitoring with board involvement” (PMB) over the winter, Pyshnyy claimed.

As Pyshnyy spelled out in an interview with the IMF in December, the Fund’s involvement was crucial in sealing the domestic bargain:

The monitoring program is an important step that allows Ukraine to demonstrate its aspiration and readiness for reforms, regardless of the war. This will be also an opportunity to coordinate fiscal, monetary, and other policies, and facilitate interactions between the NBU as the institution with the mandate to ensure price and financial stability, and the Ministry of Finance, which has the mandate to seek necessary financing of the war. Ukraine understands how important it is to use all the potential of the domestic debt market and achieve the important strategic task of financing for the FY2023 budget. We have to finance colossal budget needs of least $38 billion with external funds. We coordinated with the Ministry of Finance and agreed that the financing of next year’s deficit will not be done by the central bank, as this would create additional risks and challenges for macroeconomic stability. Even though we need a record amount of money, the Government of Ukraine, the Ministry of Finance and the NBU plan to finance the budget through cooperation with the donor coalition and the domestic debt market as well as with the assistance from the IMF. We believe that the monitoring program will be one of the key elements that will allow Ukraine to attract financing from the coalition of international partners. They will look for a green light from the IMF. At the same time, we hope it will be the first step to an upper-credit tranche program that Ukraine is counting on next Spring. We are grateful to the IMF team for their intense and professional work during these past two very challenging months. There was continuous communication, 24/7. The two parties held conferences night and day. We finalized our agreement during a missile attack. This added significance to each word that was spoken and each decision that was made.to the IMF, their

Pyshnyy’s plan seems to have worked. The PMB with the IMF laid out a series of demanding administrative and political conditions for Ukraine.

Source: European Parliament

Successful completion of the Program Monitoring with Board Involvement set the stage on March 21 2023 for the announcement of a $15.6 billion agreement with the IMF.

This has been widely hailed as unprecedented in that it involves the IMF in backing a country involved in an all-out war with little prospect of securing financial viability any time soon. In fact, already in 2014 the IMF crossed the rubicon when it extended financing to Kyiv amidst the chaos and violence that followed the Maidan upheaval and the Russian sponsorship of the Donbas breakaway. In 2023 the quid pro quo from Kyiv, according to Pyshnyy, is “(a)n end to monetary financing, use of domestic bond markets and measures to increase tax revenues have been hard-wired into the IMF deal.” This severely constrains Zelensky’s government, but will certainly be regarded as a victory by the conservative monetary managers at the NBU.

The 48-month Extended Fund Facility (EFF) Arrangement with the IMF is divided into two phases. The first phase, according to the IMF:

…. currently envisioned during the first 12-18 months of the program, will build on the PMB, to strengthen fiscal, external, price and financial stability by (i) bolstering revenue mobilization, (ii) eliminating monetary financing and aiming at net positive financing from domestic debt markets, and (iii) contributing to long-term financial stability, including by preparing a deeper assessment of the banking sector health and continuing to promote central bank independence. New measures that might erode tax revenues will be avoided. The authorities are also committed to continuing reforms to strengthen governance and anti-corruption frameworks, including through legislative changes.

Both the IMF and Kyiv assume that the comprehensive agreement with the IMF will in turn “ensure the coalition of donors commits to providing assistance of about $40bn”. It had the immediate effect of triggering a moratorium on all debt repayment owed to G7 creditors.

So, this appears to be the sequence:

(1) Political crisis between NBU and Zelensky government, September-October 2022

(2) October 2022 Reshuffle at NBU & provisional agreement UNB-government

(3) Winter 2022-2023 IMF probation

(4) March 2023 IMF deal → hope of full external funding for 2023.

***

The question is what price Ukraine will pay for abiding to terms of the IMF deal, what kind of austerity measures and tax increases will be necessary to balance the books without resort to the UNB printing press. These questions are all the more urgent because hope for any substantial recovery of Ukraine’s economy has evaporated under impact of Russian assault on the electricity infrastructure.

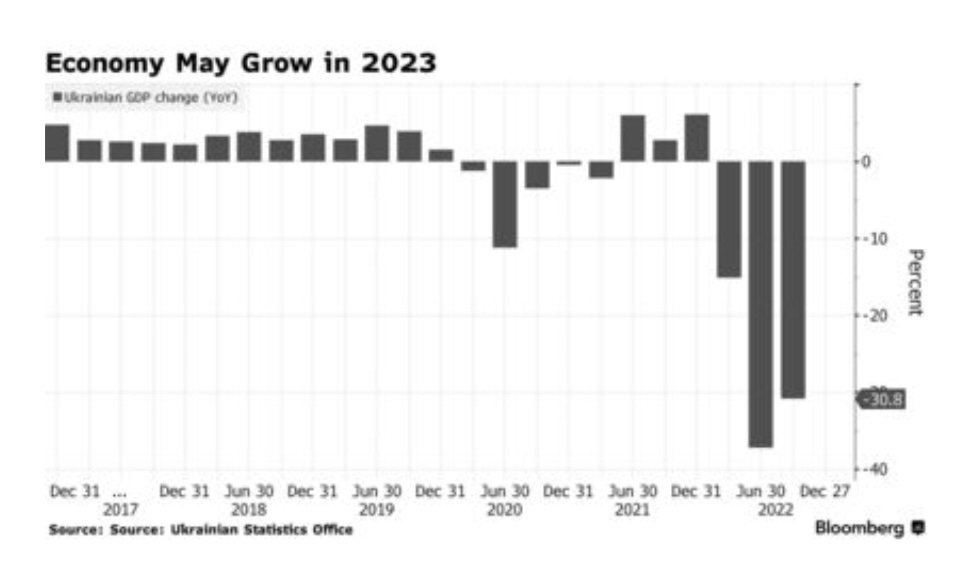

The governor told the FT that “the NBU would next month revise down its forecast for GDP growth in 2023 to just 0.3 per cent, after a 30 per cent fall over the past year, reflecting the impact of Russian missile strikes against Ukraine’s energy infrastructure over the winter.”

As Bloomberg reported, there are some signs optimism from short-run economic data:

One indication that households and business are learning to cope with the war’s impact is monthly increases in payment-card transactions despite increasingly frequent power outages, Pyshnyi said. Another is the number of diesel generators imported this year. Some 500,000 are helping the country continue working in the face of hours-long blackouts, according to the Prime Minister Denys Shmyhal.

But for all the remarkable resilience shown by the Ukrainian economy, the IMF team puts its growth outlook at between -3 and +1 percent for 2023, a stabilization, at best, after the disastrous impact of 2022.

In mid-March the NBU announced new measures to freeze as much purchasing power as possible in savings accounts and other bank deposits.

Meanwhile, the kind of austerity measures that may be in the pipeline are illustrated by an excellent report by Kateryna Semchuk on the OpenDemocracy site. She discusses how “a new salary structure for the Ukrainian military, introduced under the extreme economic pressures of Russia’s war, is leaving them unable to buy combat essentials or pay for medical treatment.” Since high military salaries helped to boost the home economy in the first months of the war, we should now expect a reverse austerity shock. Ukraine’s civilian medical system has been under severe funding pressure.

Ukrainian and European labour unions have expressed concern about the fact that controversial labour market deregulations measures that were blocked by popular protest in 2020 and 2021 are now being pushed through parliament. As Kateryna Semchuk Thomas Rowley report in OpenDemocracy:

Ukrainian trade union leaders have told the EU that they understand the need to limit workplace rights during wartime but are worried about the long-term consequences of deregulation. The reforms have so far “mostly resulted in the deterioration of employment conditions”, according to a December ‘needs assessment’ by the Council of Europe. … Ukrainian social policy analyst Natalia Lomonosova previously told openDemocracy that she feared that the government’s radical wartime socio-economic policy could exacerbate the vulnerable situation of millions of Ukrainians displaced by Russia’s war. The anonymous European diplomat’s summary was stark: “We are witnessing the breakdown of the social state in Ukraine. “Everything apart from the military is now outsourced internationally. Social affairs are more and more outsourced to international donors – which is why international donors should pay more attention to this,” they added. “The Washington Consensus has never been more alive than in Ukraine. It is Ukrainian-initiated, but in the West we accepted it,” the European official said, referring to the policy of pushing developing states to move away from state regulation and towards the free market. “And for Ukraine, this is a way to get closer to the West, and to fight the local oligarchs.”

In an impressive report from December 2022, Luke Cooper discussed the logic of “Market economics in an all-out-war?” that is at work in Ukraine. In the name of anti-corruption drives and austerity Kyiv seems wedded to a minimal state vision, whereas the opposite is actually required. “A genuinely modernizing economic strategy should start from ensuring the capacity of the state to protect its citizens and the environment. Investment in capital projects for a green transition, public services like healthcare and education, and the social safety net, will be critical to ensuring Ukraine’s long-term development.”

***

Often, in discussing the nightmarish trade-offs facing Kyiv in its effort to continue the war, commentators will turn their eyes from the immediate war-effort to the future and the reconstruction to come. As the FT remarks, “The one silver lining is that “The new forecast does not factor in any additional western aid for reconstruction, which Pyshnyy hoped would act as a “silver bullet” for the economy.””

But this only confirms the broader diagnosis offered by the OpenDemocracy authors and other worried observers. Reconstruction will rely not only on the World Bank but on the EU and a bevy of heavy hitters from the side of global fund management. An agreement between President Zelensky and Larry Fink of Blackrock was announced on December 28 2022. The question, as ever, is how real is the promise of public-private blended finance?

The latest World Bank estimate puts the figure for reconstruction costs at $411 billion. Given this huge sum, there is no doubt that private capital will have to be mobilized. But, as Cooper and others argue, this will not flow on anything like the scale required unless Ukraine can establish a truly competent fiscal apparatus. The focus should not be on stripping the state back to its minimal functions, but on building capacity.

As a report for the German Marshall Fund headed by Jacob Kirkegaard, Thomas Kleine-Brockhoff, Bruce Stokes and Ronja Ganster argues:

Even if there is a ceasefire or a settlement, Ukraine’s reconstruction will begin in a volatile environment, possibly including the risk of renewed Russian aggression. In the absence of a policy intervention, this situation will deter privatesector actors, especially foreign ones, from directly participating and investing in reconstruction, possibly for a prolonged period. Insurance premiums, if at all commercially available, will be prohibitively high for private-sector economic activity to commence

The NBU is no doubt right to be concerned about the inflationary impact of monetary financing. Stopping a descent into monetary chaos is essential for home front stability. But a policy of dramatic fiscal austerity that comes at the expense of the fabric of Ukrainian society and the state will have huge long-run costs. The EU, the United States and other outside supporters can soften this dilemma best a. by providing more generous funding and b. by urging Kyiv towards a strategy of civilian as well as military state-building, not by replacing domestic national institutions with international agencies, but by promoting the mobilization of local institutions and agencies. As Luke Cooper puts it, economic and social turmoil are “Ukraine’s critical downstream risk”.

***

Thank you for reading Chartbook Newsletter. It is rewarding to write. I love sending it out for free to readers around the world. But it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters and receive the full Top Links emails several times per week, click here: