Source: FT

As the Fed drives interest rates upwards, the impact ripples through the world economy. For good reasons there has been a lot of focus on emerging market economies under pressure from a combination of higher US interest rates and a strong dollar. But the impact is not confined to the emerging markets. Japan, the Eurozone and the UK have felt it too.

Though the polycrisis may deliver shocks from different directions, if history has confirmed anything in 2022, it is that the dollar credit-cycle remains a common denominator of much of the world economy. Astute analysts like Daniela Gabor highlighted this fact early on. The ECB was showing itself, Gabor opined, to be “just another central bank trapped in the global dollar financial cycle”.

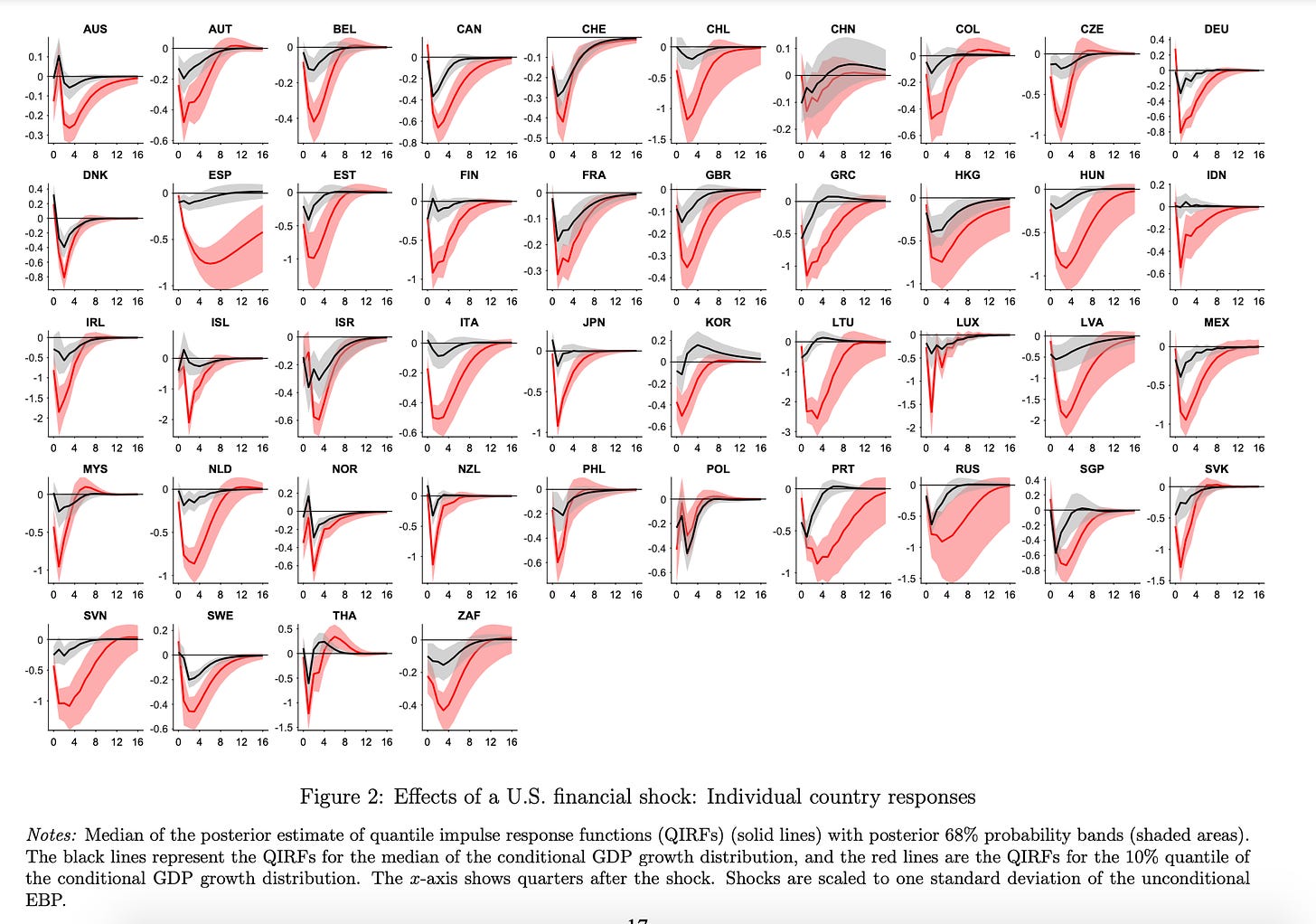

Now central bank analysts in the Eurozone have weighed in with heavy-hitting econometric studies to prove the point. In a recent Alphaville report Louis Ashworth picked up on a Bundesbank paper that tracks the impact of a US policy tightening around the world. The approach of the Bundesbank team is summarized as follows:

In this paper, we investigdate the effects of shocks to U.S. financial conditions and monetary policy on downside risks to growth around the world. To model the international transmission of U.S. financial and monetary policy shocks to tail risks, we estimate Bayesian quantile vector autoregressions on data for 44 advanced and emerging economies. We compute quantile impulse responses for the median, the upper tail and the lower tail of each country’s conditional GDP growth distribution, using the excess bond premium (EBP) proposed by Gilchrist and Zakrajsek (2012) as a measure of exogenous changes in U.S. financial conditions and a measure of U.S. monetary policy shocks derived from Miranda-Agrippino and Ricco (2020). We then relate the quantile impulse responses to various country characteristics.

Without getting too deep into the details, you can gauge some of the impact from the graphic below.

The effect of US financial shocks on really large economies like China is relatively muted. So too for France and, surprisingly, the UK. But Germany feels American shocks heavily, as heavily, indeed, as Canada and almost as heavily as Mexico.

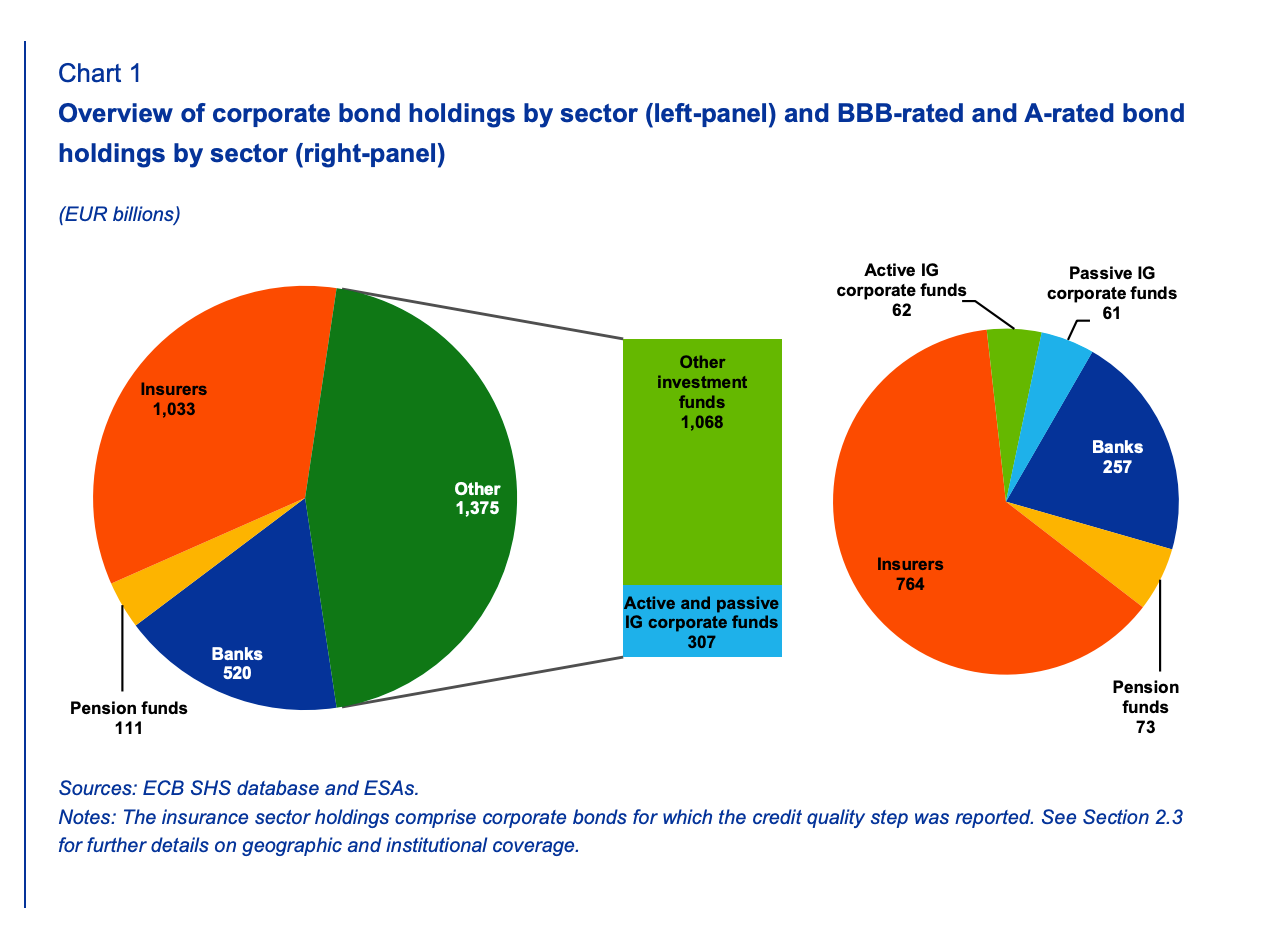

The Bundesbank paper is a large-scale econometric exercise. But the effect of the dollar cycle can also be detected at the level of particular financial markets. Recently, I was asked to comment on the prospects for European corporate bond markets. This isn’t normally my bailiwick, but I came away impressed. The total stock of European investment grade and high-yield corporate bonds (both financial and non-financial) comes to c. 3 trillion euros. And in 2022, as interest rates rise, this market has been suffering an epic sell-off.

Source: ESRB

If you consult the ECB’s latest Financial Stability Review for November 2022, it sketches an elaborate crisis scenario for the corporate debt sector. The model for this crisis is the dangerous instability in European bond markets in the first weeks of the COVID shock, in March 2022, when a a shock to confidence unleashed a run on open-ended investment funds. As investors withdrew their money, as they are permitted to do, the investment funds were forced to offload assets in fire sales threatening the stability of pricing and market liquidity. To cut a long story short, the basic structure of the open-ended investment fund is unsound because they promises exceptional returns without imposing limitations on client withdrawals. In other words they are a large-scale form of shadow-banking.

In 2022, there is no immediate threat of a COVID-style shock, but what the ECB is worrying about is that the pressure of Fed interest rate hikes could lead to dramatic sales of bond portfolios, which could unleash turmoil in European markets. That in turn might spread from investment funds to more heavily leveraged and fragile parts of the financial system.

To add to its worries, the ECB knows that in this tightening cycle, as far as European corporate finance is concerned, it is in uncharted territory. Since the financial crisis of 2008, the balance in European corporate finance has shifted significantly away from bank loans to bond issuance so there are more bonds in circulation and disturbances in bond markets matter more for the transmission of monetary policy.

Source: ECB

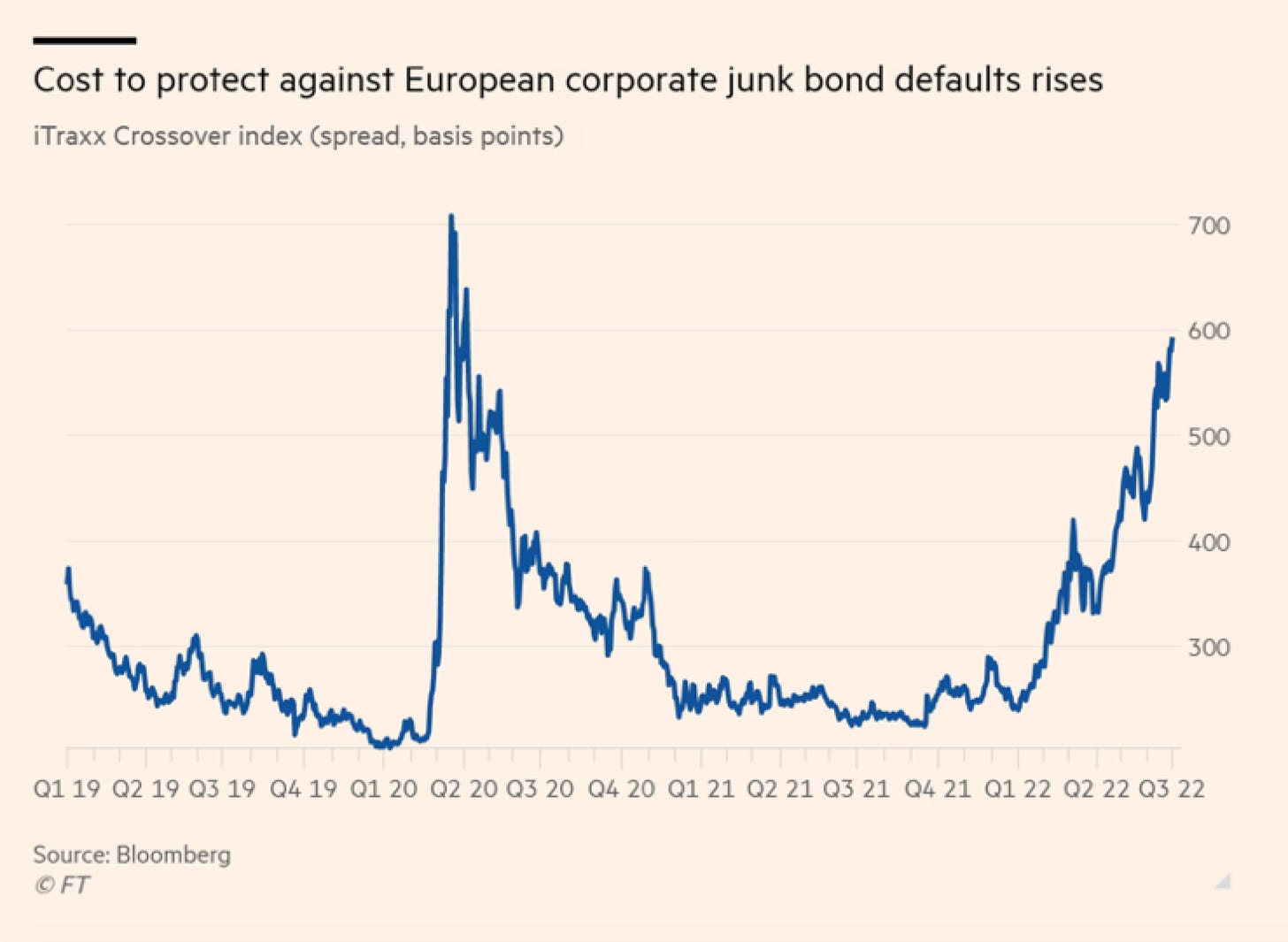

As a recession in the Eurozone looms, both investors and the ECB have reason to worry about deteriorating credit quality. Between May and June 2022, the stock of European corporate debt trading at spreads of over 10% doubled from 20 to 40 billion euros. As confidence has drained, the market has become more illiquid. The Bid-ask spread for high-yield European corporate debt has surged, indicating considerable hesitation on the demand side. JPMorgan spoke of an “alarming freeze in capital market lending conditions, which has gradually spread up the quality curve.”

CDS insurance against bond default has surged in price to levels last seen in 2020.

There is particular concern about defaults in sectors exposed to the energy price shock. ECB research shows that the gap between European and American credit default swaps is now strongly related to the differential in gas prices between the United States and Europe. In other words, corporate bond markets are pricing in the devastating impact of the energy shock on European industry.

Banks are not in general large holders of Eurozone non-financial corporate bonds, which is good news from the perspective of financial stability. It is less good news that they hold as much debt issued by banks as they do.

What worries the ECB is that banks tend to hold a disproportionally larger share of bonds issued by smaller firms. But above all the authors of the Financial Stability Review highlight the risk of the kind of unraveling of open-ended investment funds that occurred in March 2020.

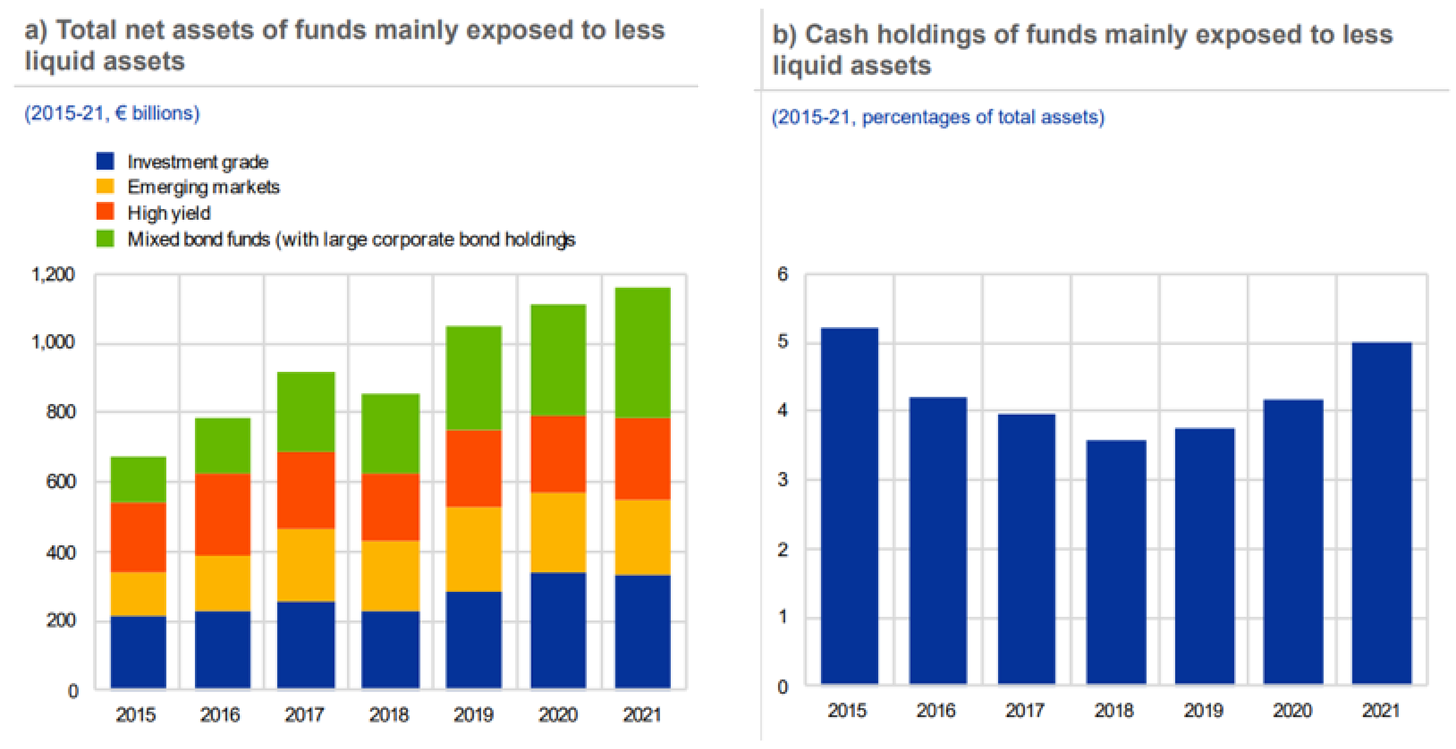

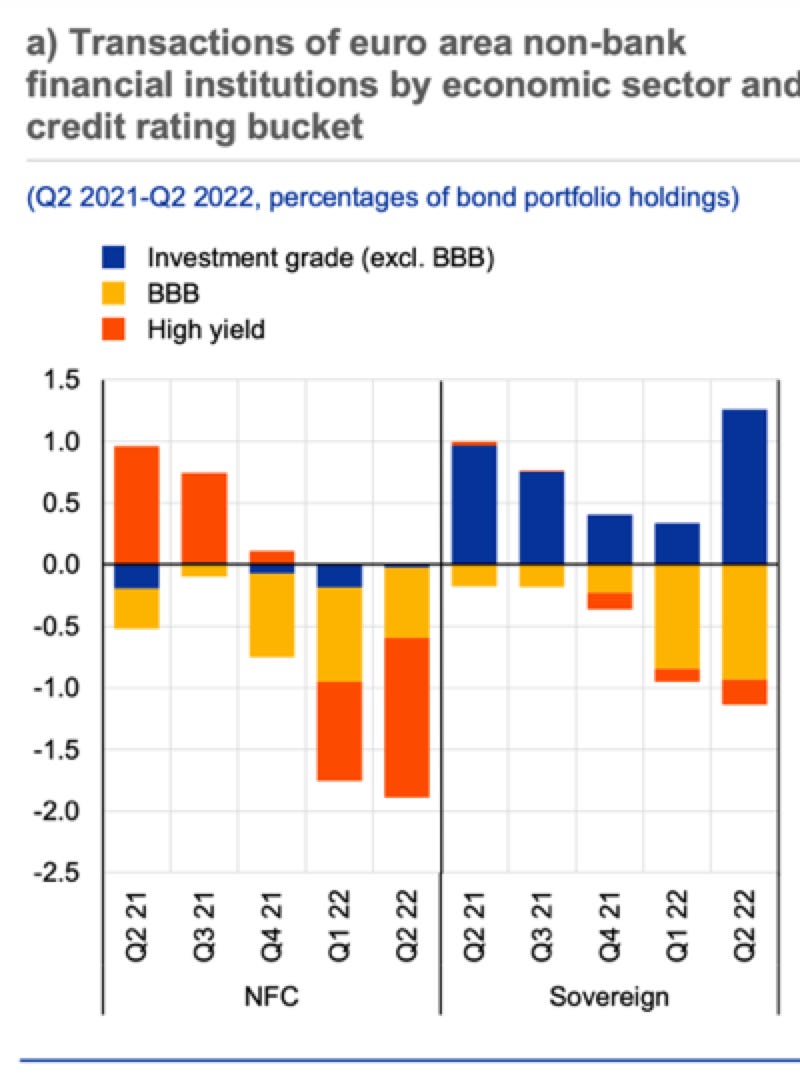

The potential liquidity needs of relatively illiquid funds can amplify negative market dynamics. Outflows from certain investment funds, such as corporate bond funds, can pose financial stability concerns. This is because such funds are characterised by a high liquidity mismatch, given that they invest in markets with relatively shallow liquidity, hold little liquid assets and often offer daily redemptions to their investors. Such outflows, especially if abrupt and large, can force these funds to sell less liquid assets. Forced sales can further amplify losses and adverse price dynamics, especially if market liquidity in the euro area corporate bond markets continues to deteriorate. This can potentially lead to a vicious cycle of negative performance and redemptions accelerating market stress. And for investment funds using derivatives, such adverse dynamics may be amplified by assets being sold to meet margin calls. In an environment of increased market volatility, the vulnerability of funds to such outflows, cash needs and forced selling has increased, despite their recent slight de-risking. While funds have somewhat reduced their credit risk and increased their cash positions, the overall share of portfolio holdings of BBB and high-yield bonds still stands above 50% and portfolio liquidity remains at low levels. Furthermore, aggregate duration in the bond portfolio of investment funds remains almost unchanged, although it is partly hedged. Amid recession fears, high inflation and the normalisation of monetary policy, these vulnerabilities are more likely to materialise than in the past.

The total net assets of funds mainly exposed to less liquid assets in 2021 was close to 1.2 trillion euros. That is an amount larger enough to unleash a considerable avalanche. Despite the ECB’s urgings those funds have made no serious effort to build cash cushions.

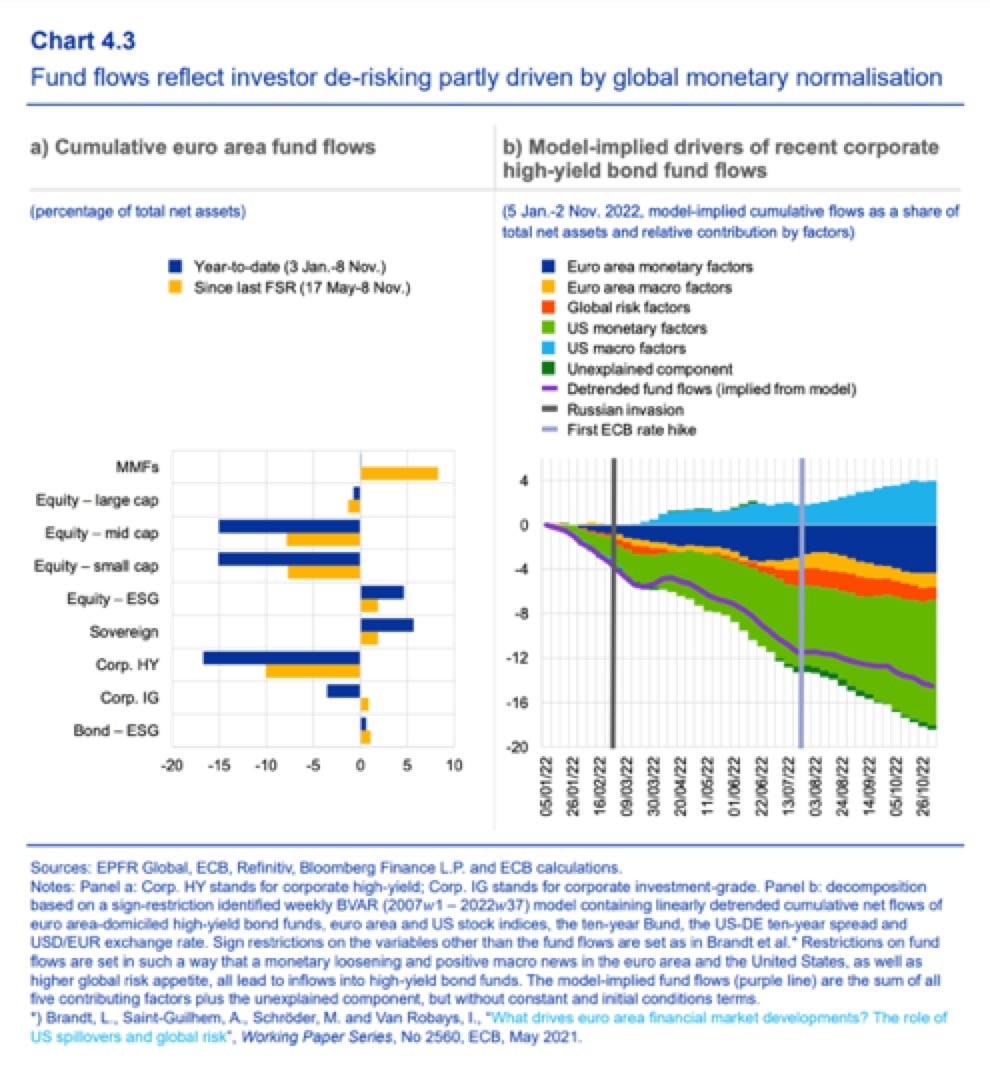

In light of this, the ECB notes with a mixed feelings that high-yield corporate bond funds have experienced outflows above 15% of total net assets since the start of the year. The ECB’s assessment is mixed because on the one hand, such sales put stress on bond markets. On the other hand the unwinding of the exposure reduces the risks in the sector. So far, the sales of high-yield corporate bonds exceed the 12% outflows seen during the March 2020 market turmoil, although this year’s outflows took place over a longer period.

What the ECB also notes, however, is not just the scale of the portfolio adjustment. It also remarks on the factors triggering this sell-off. In 2022 the prime driver of the action in European bond markets is the Fed’s tightening of monetary policy. Nor is this merely an anecdotal impression. This is the clear implication of applying an econometric model first estimated in 2021 by a group of ECB economists – Lennart Brandt, Arthur Saint Guilhem, Maximilian Schröder, Ine Van Robays. They found that between January 1999 and June 2020, US shocks explained closed to 40% of variation in euro area yields and equity prices. If their framework is applied to the first 10 months of 2022 it suggests that roughly two thirds of the selling of high-yield bonds by European investment funds was explained by the US monetary policy shock.

Source: ECB Financial Stability Review

Unlike the LDI strategies that destabilized the UK gilt market earlier in September 2022, the structural vulnerability of the investment fund sector is in no way obscure. Efforts have been afoot to improve the liquidity and resilience of the sector at least since 2017, but to little avail. The most recent report is by the Financial Stability Board. The intensity of the inflation surge and the Fed’s response may come as a surprise, but if this does indeed result in serious instability in European corporate bonds, no one should say that they were not warned. There are no doubt some corners of financial markets that are obscure. This one is not.