If there is one financial market that could put in doubt the stability of the entire global financial system it is the $23 trillion US Treasury market.

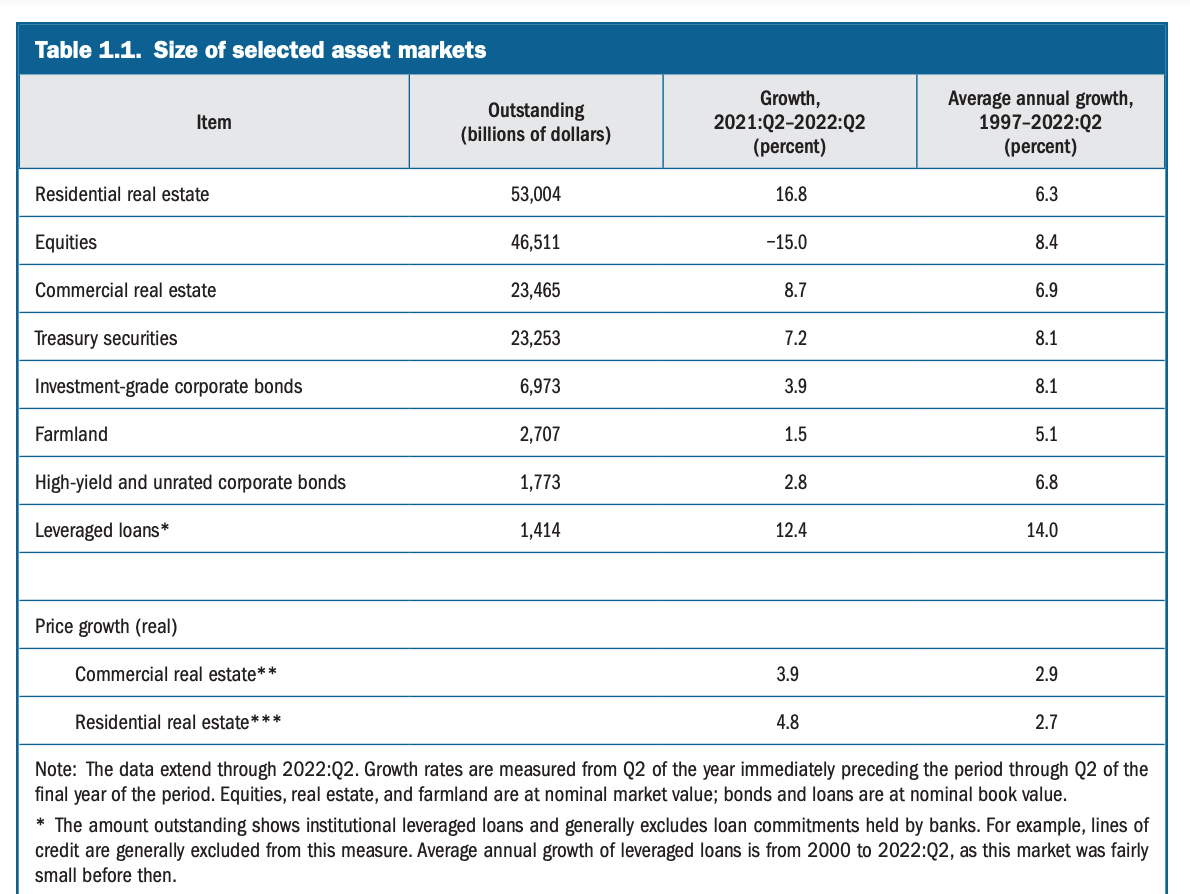

Source: Fed Financial Stability Report

The housing market may be the biggest single macroeconomic force. US residential real estate alone is worth $53 trillion. But it is illiquid. US equities are valued at $46 trillion. They can be easily bought and sold, but no two equities are alike. You have to pick and choose. The $23 trillion market for US government debt offers a relatively smooth spectrum of homogenous assets that differ only in terms of their duration, ranging from a few weeks to 30 years. They trade on a curve defined in terms of maturity. They are safe assets with no serious default risk offering an extremely liquid market, which provides the ideal platform for financial engineering supercharged with algorithmic high frequency trading. As the largest pool of fixed-income, safe assets, the Treasury market registers vibrations from every piece of economic and policy news in a matter of millisecond. Every day hundreds of billions of Treasuries change hands in hundreds of thousands of trades.

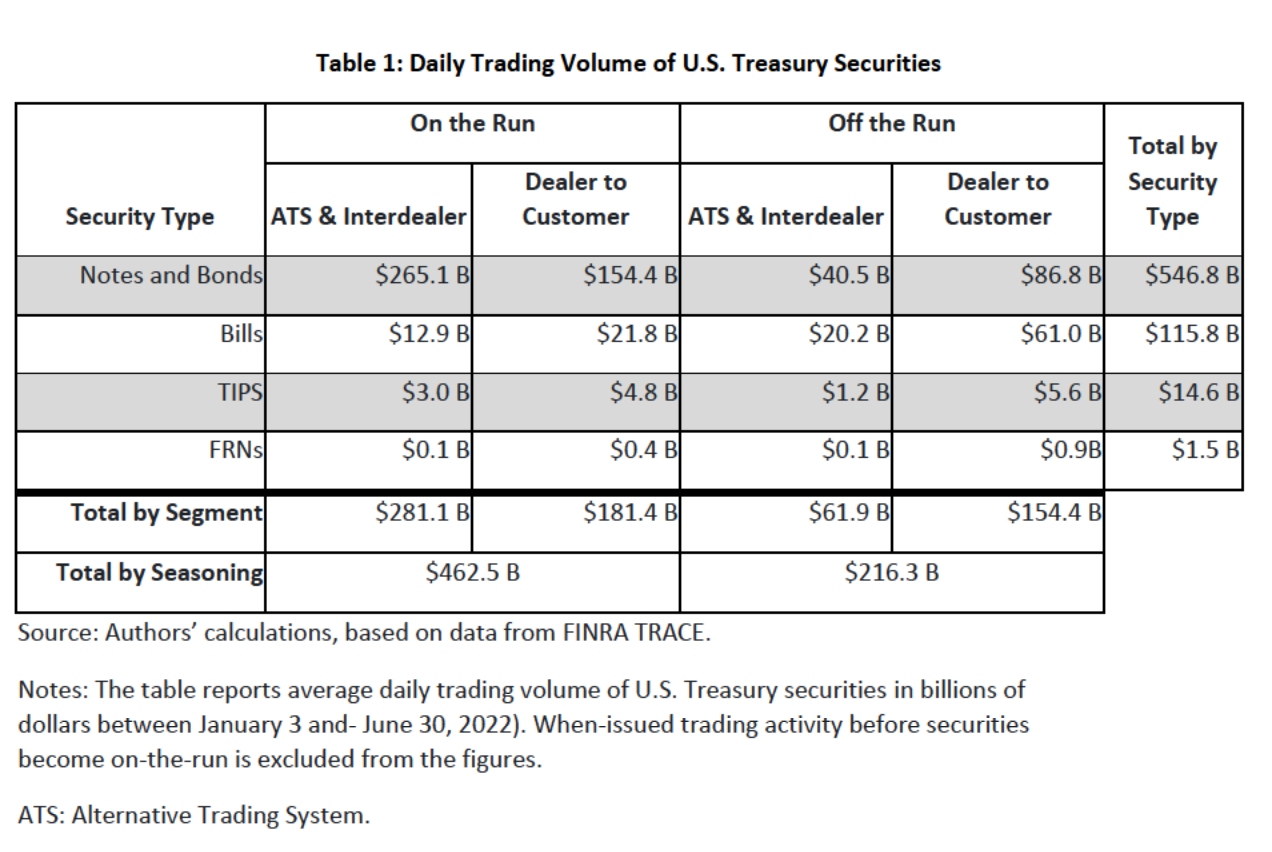

Source: NYFED

The prices and yields that result from these trades set the benchmark for all other borrowing and lending. The question that haunts the markets right now is what happens when the entire structure of interest rates lurches violently upwards in response to a sudden surge in inflation and the promise of severe central bank action?

The risk is not that Treasuries suddenly become worthless, as a result of US government default or hyperinflation. Nor is there much prospect of a geopolitically motivated bear raid on the US by its foreign enemies. The risk is more mundane, the risk is that the market, driven by greed and fear, will stop working, that prices and yields will become anomalous and upset trillions of dollars in portfolio allocations unleashing a landslide, as hedge funds, banks and other investors scramble for cash.

So large a shock would this be that there is little prospect that it would be allowed to play out to its full catastrophic extent. We dont live in the 1930s anymore. There is an answer to such a crisis – the central bank. But if the Fed were forced to step in, it would imply a shuddering reversal of policy. The shock would move from the markets to the institutions. Credibility would be in tatters. It would amount to a severe intra-elite crisis. Something like the UK suffering but at the heart of the world’s financial hegemony.

You might counter that in 2020 the Fed dealt with a crisis in the US Treasury market and emerged with its reputation for competent crisis-management enhanced. But that malfunction was triggered by a pandemic, a shock that, as far as the financial system was concerned, was exogenous. If something similar were to occur in 2022/23 there would be no excuse. Of course, the inflationary surge that began in 2021 is itself attributable, whether demand- or supply-induced, to COVID. But today what is causing the stress in financial markets is not inflation as such but the policy response of the central banks. They are raising rates as the macroeconomic situation demands. If they cannot do so without triggering a malfunction in the world’s most important financial market, then, “Houston”, we have a problem.

***

For many readers of this newsletter, the 2008 banking crisis will be the benchmark of financial terror. But in 2008 the American government balance sheets was the platform from which the rescue of the banks was mounted. The Treasury market remained solid. Indeed, investors ran to safety in Treasuries. Only in weaker members of Eurozone – Ireland was the prototype – did we see a full doom-loop develop in which a banking crisis overloaded the public balance sheet, precipitating a public debt crisis, which in turn destabilized the private financial system.

The US Treasury market is not immune to shocks. It wobbled badly in September 2019 in the so-called repo market crash. But the real scare came in March 2020 when the Treasury market stopped working for several weeks. This precipitated a panic even more acute than in 2008 and a truly gigantic intervention by the Fed. On several days in late March 2020 the Fed bought more bonds than Ben Bernanke’s Fed’s bought in an entire month at the highpoint of the first round of Quantitative Easing. This story is at the heart of Shutdown, my book about 2020.

It is important to emphasize, in light of the comparison with the Eurozone, that what caused the panic in March 2020 was not concern about the solvency of the US government. The volume of Treasuries has continuously increased because of the deficits run over the last quarter century. And ahead of 2020 the balance sheets of the main actors in the Treasury market were stuffed full by the large deficits run by the Trump administration. In relation to GDP, US government debt was rising and it surged at a wartime rate due to the COVID stimulus. But that was not what the panic of March 2020 was about. Nor is the deficit and new public debt issuance the main worry in 2022. What matters is what private financial actors – banks, investment funds, hedge funds – do with Treasuries and their constant need to churn them through a liquid market. What concerns us is not a crisis of public finances, but a crisis triggered by the private use of public debt.

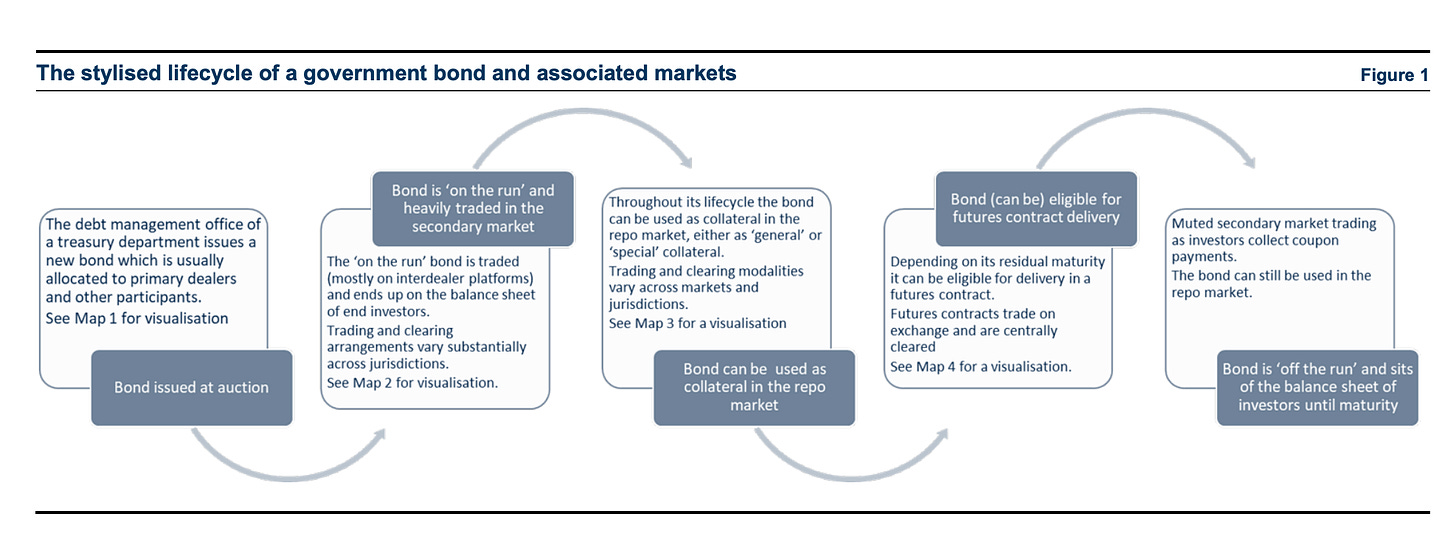

Source: FSB

For all that public debt is a liability of the taxpayer, it is also an asset. You buy assets to benefit from appreciation and their yield. You can use them as collateral for further borrowing. Crucially, you need to be able to sell them in an emergency. That is what US Treasuries normally offer you. But in March 2020 the market stopped working. There were too many sellers and not enough buyers, so the price of highly rated entirely safe securities suddenly plunged and yields surged. To avoid disaster the Fed stepped in as the buyer of last resort. It also offered repo facilities, i.e. loans against Treasury collateral, in the hope that if they could be used to raise funds by way of the Fed, private investors would have less reason to sell their holdings. The combined effect was to flush trillions of dollars of liquidity into the system and to stop the run.

In 2020 inflation was not a concern. Prices were falling. Today, with prices rising the Fed is trying to reverse course. It is trying to tighten monetary conditions. It is raising interest rates and rather than buying Treasuries to provide liquidity, it is selling them, draining reserves out of the financial system. Between September and November the Fed planned a $95 billion tightening. The question is whether the Treasury markets can take it. Without the Fed as the buyer of last resort, will private investors still be able to buy and sell Treasuries smoothly or will the market again become dysfunctional?

***

The signs of stress are clearly there. Both anecdotal evidence and some quantitative indicators suggest a worsening liquidity situation.

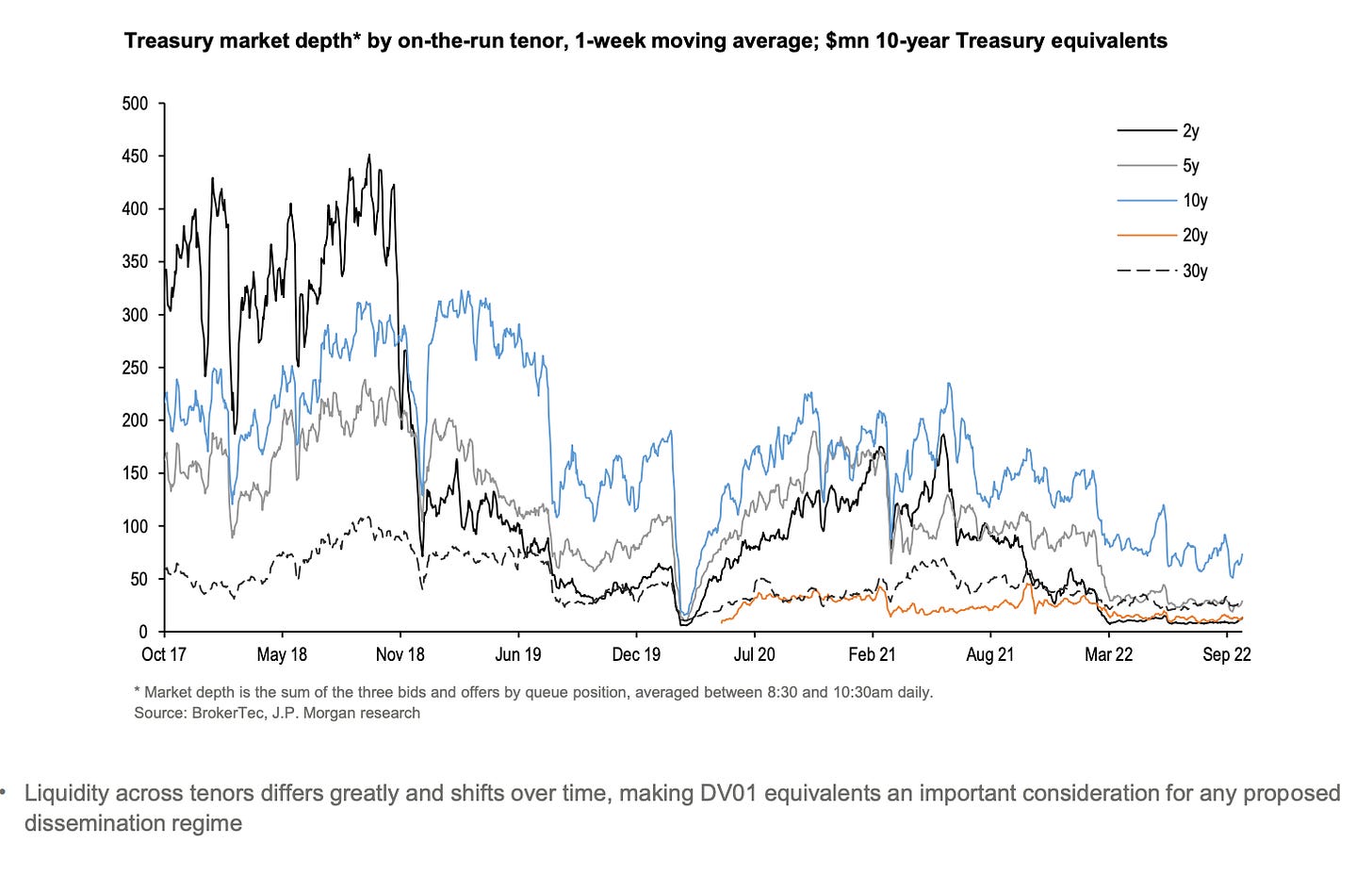

The market depth for US Treasuries varies by duration. It collapsed entirely in March 2020, but though it has recovered, it remains well below 2019 levels.

Source: US Treasury

Bid-to-ask ratios that measure how difficult it is to sell Treasuries are at uncomfortably high levels. And, at the primary Treasury auctions, when fresh Treasuries are sold, there is a noticeable weakness of new demand.

Clearly, market conditions are not easy. But the difficulty is to decide how serious these signs are. There are technical reasons discussed in the Fed’s latest Financial Stability Report why some of the commonly cited indicators may exaggerate the liquidity squeeze. Furthermore, as market participants point out, it is not surprising that liquidity should be somewhat tight right now. As we move from one level of interest rates to another, you would expect more volatility and with more volatility you should expect less liquidity. This is a normal market adjustment.

The worry expressed by several market participants to the FT is that causality is also beginning to run the other way around. It is not just that volatility is driving illiquidity. Illiquidity is beginning to cause volatility. If both effects operate at the same time they form a vicious spiral in which volatility surges and liquidity collapses. Given this possibility the question of what is the precipitating factor may become moot. The terrifying thing about a run is that it operates by itself. If you hold treasuries for liquidity and a surge of panic-selling causes the market to seize up, then on precautionary grounds you must try to sell too, so as not to miss your chance. Whatever your underlying long-term motivation, you must join the crowd.

As a recent paper from the New York Fed by Thomas Eisenbach and Gregory Phelan shows, this kind of run dynamic with “precautionary selling” appears to have built up in Treasury markets in 2020. It would be disastrous if it were to recur.

***

At this point you might wonder why this vital market is so opaque. If this is the most important financial market, if this is the sovereign debt of the most powerful state, why is there so much uncertainty and volatility?

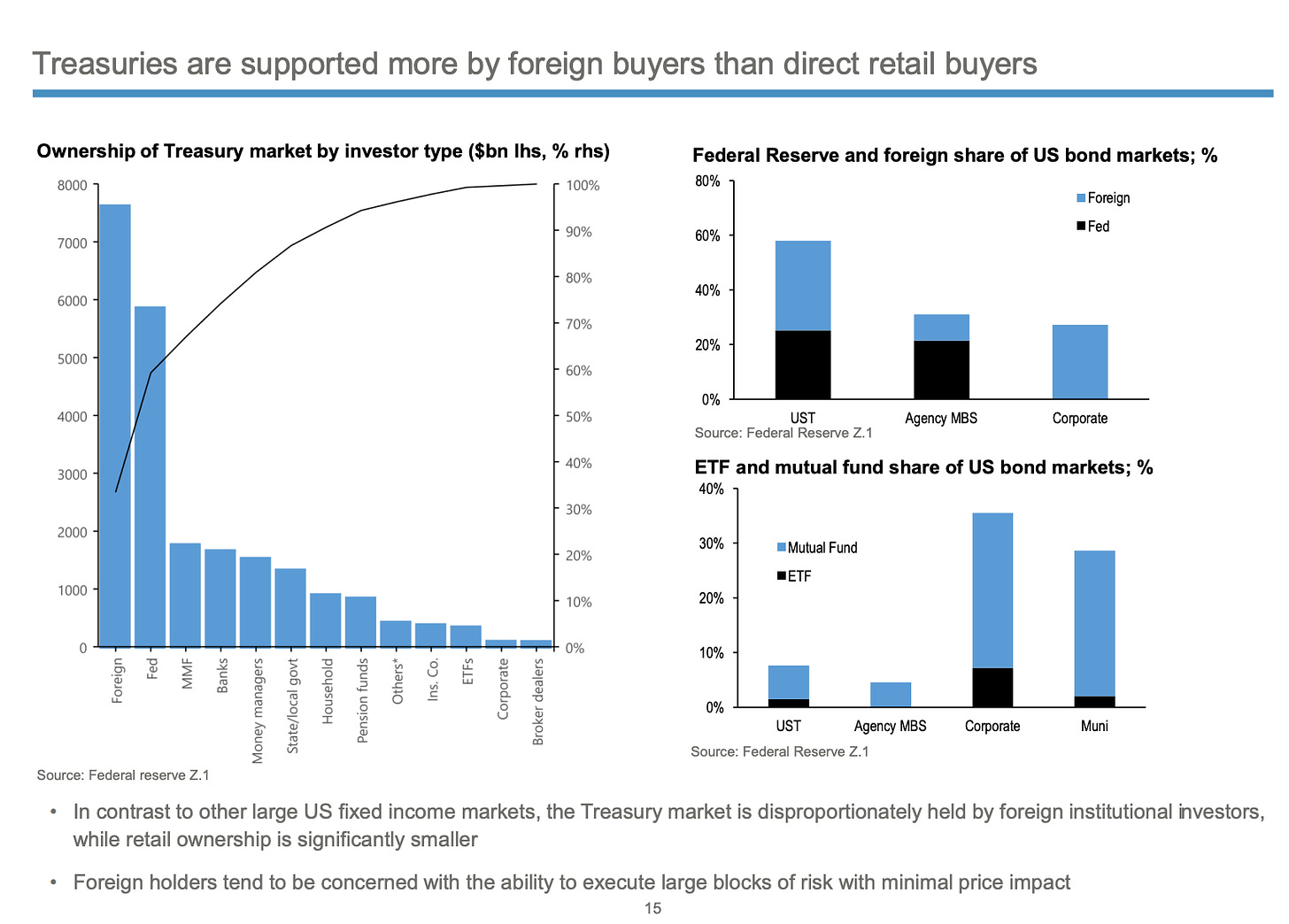

Part of the problem is that the range of investors holding treasuries is huge. The largest single group of Treasury investors are reserve managers from across the entire world.

Source: US Treasury

Given the scale of foreign involvement, shocks emanating from anywhere in the world will reverberate in the market. Foreign sales were an important part of the shock in 2020, when there were significant emerging market reserve sales. In 2022, given the savage devaluation of the yen and the prospect of a major course correction by the Bank of Japan, the main worry are sales by Japanese investors. We will return to that in a future installment of this series.

But pointing finger at foreign investors can be a way of diverting from the main problem. Japanese pension funds and banks are just one part of the giant transnational system of shadow banking for which US Treasury bonds are the rocket fuel. The main hub of this system is not in Tokyo but in New York.

The emergence of this system from the 1950s onwards is beautifully chronicled by Tracy Alloway in an extraordinary essay for Bloomberg which draws heavily on the work of the brilliant Josh Younger. As Younger put it:

“In the early 1950s, the Federal Reserve and Treasury leaned heavily on dealers to jump start a ‘free’ Treasury market — one where prices were set by investors not the government,” explains Younger. “In many ways, we’re still living with the legacy of those policy decisions. The Treasury market today is arguably only as healthy as the shadow banking system on which those dealers depend.”

The system that has emerged is fragmented and unstable. The Financial Stability Board provides the following map for the secondary market, with further complexity added by repo and futures markets.

Source: FSB (PD = primary dealer, HF = hedge fund. Check out the paper for the full legend)

As Vanderbilt Law Professor Yesha Yadav points out, it is not just the markets themselves, but the regulators of the markets that are fragmented.

Whereas equities or corporate bonds are overseen by a primary regulator (the SEC), Treasuries are supervised by five or more major agencies, none of which has lead status. The Treasury writes the rules, the Federal Reserve Bank of New York (N.Y. Fed) facilitates debt auctions, the SEC and the Financial Industry Regulatory Authority (FINRA) supervise securities firms that trade Treasuries, the Fed monitors banks, and the Commodity Futures Trading Commission (CFTC) oversees the derivatives markets linked to Treasuries.8

Though this kind of fragmentation is typical of the US administrative state, it is highly dysfunctional in the case of a market as large, dynamic and essential as the Treasury market. Yadav joins other academics, notably Darrell Duffie of Stanford, in calling for central clearing to achieve greater transparency and security in trading. Her conversation with David Beckworth on his Mercatus podcast makes for great listening.

As The Economist neatly summarized the options, reform entails one of three options:

allowing the banks to trade more bonds with investors (by loosening reserve requirements on the banks – their preferred option 😉 ), let investors trade more bonds with each other (with some kind of clearing or improved trading mechanism), or let investors trade or swap more bonds with the Federal Reserve (by way of a widened repo facility).

So important is the US Treasury market that it has attracted the attention of the G30 and the Financial Stability Board that advises the G20 and the IMF has also chimed in (as linked above).

***

The US authorities are not oblivious to the need for reform. The 2020 crisis was serious.

The Inter-Agency Working Group for Treasury Market Surveillance (IAWG), which was formed in 1992 after the Salmon brothers auction bidding scandal convenes staff from the U.S. Department of the Treasury, the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of New York (FRBNY), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC), has taken on task of coordinating reform discussions across the different branches of government.

The most consequential recommendations to date have come from Gary Gensler and the SEC. The SEC is pushing for an extension of central clearing both in Treasury Trading and in repo. It also wants to have more oversight over the firms involved in the market. Earlier this year it proposed that all firms that trade more than $25bn in Treasuries per month to, in future, be registered and regulated as dealers. This has triggered furious blowback back from market makers, investment funds and other firms — almost everyone but the primary dealers, who are already heavily regulated – who all denounced the suggestions as dangerous. They will cause key actors to limit their involvement thus deepening the liquidity problems.

Given the asymmetry of information between market participants, regulators and journalists, and given the lack of overall information, the Treasury market is one in which forming an independent judgement is truly difficult.

And in any case as Alexandra Scaggs of FT Aphaville has noted, tinkering with regulations affecting one group of market participants alone is a partial fix at best.

There isn’t much the SEC can do about high levels of Treasury issuance and economic uncertainty (that’s the job of Treasury, Congress and the Fed). But it can expand its surveillance into Treasury markets to get a better idea of who these price-sensitive traders are, and put de facto limits on leverage. If the goal were solely to create a robust Treasury market structure independent of political pressures, which is surely a fantasy in the US, regulators could be focusing on systemic solutions to deal with funding costs in times of crisis. They could look into clearing solutions, or make more policy about countercyclical changes in dealer regulations. But if regulators are instead using the Pottery Barn rule, the hedge-fund focus makes perfect sense.

A conference will be held on November 16th (tomorrow) with industry players and experts at New York Fed to address the issues.

***

Will there be a market incident before new regulations come in place? It cannot be ruled out. But if it were to occur, we already know how it would be contained. The Fed would buy assets and offer expanded repo facilities to all comers. That is what all the central banks did in 2020. It is what the Bank of England briefly did after the nasty incident with Trussonomics. But if this is the future, it raises the question: are we on a ratchet in which macroeconomic shocks and weak market structure force central banks repeatedly to intervene? Each time they expand their balance sheets and flush liquidity into the system, expanding commercial bank reservers. Then, when they seek to reverse course and “normalize”, they unleash market stress, which causes them to intervene again.

That appeared to be the case in 2019, when Jerome Powell’s first attempt at tightening ended in the repo market shock of September. If we are repeating that cycle now, it forces us to ask: why is it so hard to normalize? Why is it so hard to reverse QE with QT? The answer provided by Raghuram G. Rajan and Viral Acharya in a project syndicate column, and with co-authors in several other papers, is that expanding and shrinking reserves is not symmetrical. It is not symmetrical because of the way that commercial banks respond to the increase in their reserves during the expansionary phase of QE.

When the Fed buys bonds, it does so in exchange for reserves. The bonds that the banks sell to the Fed come from customers who end up with deposits at the banks. The banks make a small interest margin on this trade. But as highly incentivized profit-driven businesses they cannot be satisfied with these slim pickings so they go in search of bigger business.

commercial banks have created additional revenue streams by offering reserve-backed liquidity insurance to others. This generally takes the form of higher credit card limits for households, contingent credit lines to asset managers and non-financial corporations, and broker-dealer relationships that promise to help speculators meet margin calls (demands for additional cash collateral)

And that is what creates the ratchet effect. The commercial banks become more vulnerable to shocks due to their exposure to contingent credit lines. But when the central banks wants to carry out normalization and shrink reserve, the banks are slow to reel in their profitable lines of new business, putting further stress on their balance sheets. If things get rough they can, after all, rely on being able to sell more Treasuries and if that market freezes up, they will count on the Fed to ride to the rescue.

As Rajan and his colleagues point out, normalization after post-2008 QE may never have happened. But history is moving fast. In the wake of second round of gigantic balance sheet expansion we are now embarked on serious monetary tightening, and not just in the US. The stakes are high. A UK-style “incident” played out in the US Treasury market would rock the global financial system.

***

Thank you for reading Chartbook Newsletter. I love sending out the newsletter for free to readers around the world. I’m glad you follow it. It is rewarding to write, but it takes a lot of work. What sustains the effort are voluntary subscriptions from paying supporters.

Several times per week, paying subscribers to the Newsletter receive the full Top Links email with great links, reading and images.

If you would like to join the group of supporters there are three subscription models:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club:$ 120 annually, or another amount at your discretion – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club.