The politics of inflation in 2022 are surprising.

Perhaps my priors were wrong, but as price indices surge by almost 10 percent I would have expected more talk about the losses inflicted on “small savers” and their vulnerable bank accounts, in other words the classic “petty bourgeois” politics of inflation.

Perhaps the relative lack of such talk points to the fact that no one actually believes that this inflation will be anything more than transitory, so that it amounts not to a landslide devaluation, but a one-off tax on savers and there is thus less reason for panic. Perhaps savers now have more diversified portfolios and are better protected. If so, the collapse in stock market prices hardly offers much comfort.

Or perhaps, as some historians have long suggested, talk of protecting the “widow’s pension”, was never more than an instrument in a broader anti-inflation politics and right now there are better instruments to hand.

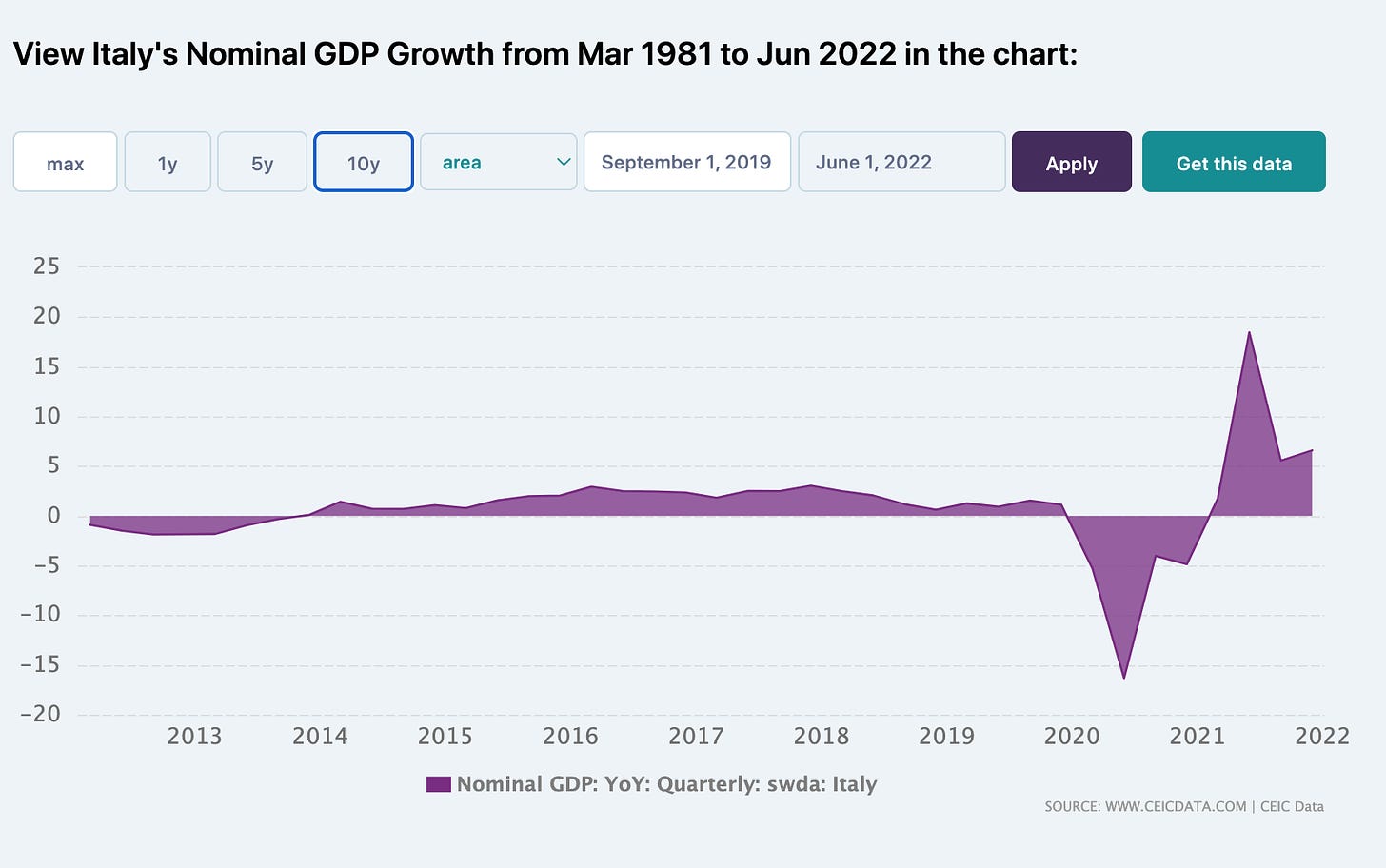

In light of the furious debates over debt sustainability since 2008, one might have expected more discussion of the extraordinary windfall (to tax payers) delivered by a surge in nominal GDP – a surge in the denominator of the debt/gdp ratio, or, in other words, a real devaluation of the public debt. In Italy, long seen as the weak link amongst the G7 economies, nominal GDP growth reached 7.919 percent in March 2022.

Source: CEIC DATA

Back in 2019 many of us would have cheered ecstatically at the prospect of such an acceleration in nominal GDP growth, promising, as it does, to bring down the debt/GDP ratio. Clearly rapid real growth would be preferable. But inflation too serves to reduce the ratio. Indeed, as experience since 1945 has shown, the best way to undramatically liquidate an unmanageable debt burden is to modestly elevate the rate of inflation. Though higher inflation for longer is now what many are predicting, they say it like it is a bad thing.

If a conversation about the balance sheet effects of the current inflation – both the costs and the benefits – has been going on somewhere and I have missed it, please let me know.

Instead, what has taken center stage is a feverish debate about the cost of living, price controls, the risk of Gilets Jaunes style protests. This is not by itself surprising. For far too many people, the cost of living crisis is acutely real. What is striking however is how seemingly disparate or even opposed strands of politics and policy debate have converged around what amounts to an anti-inflation consensus. If you frame inflation as a problem of the cost of living, it seems, there really is no alternative but to end inflation by all means necessary.

Even Jacobin magazine – the flagship journal of the American new new left – whose beautiful new issue I had the pleasure of helping to launch a few weeks ago, chimes in with this chorus, denouncing inflation and unconventional monetary policy as an attack on the American working-class. You can listen to the spirited discussion we had here:

But stand back for a second and consider an alternative framing. Consider for instance the vision offered by the BIS earlier in the summer. They argued that inflations were dangerous because they tend to induce a comprehensive societal shift towards greater inflation-sensitivity. I discussed their report in Chartbooks 133.

Chartbook #133 Under the hood of the power dynamics of inflation

As I explained there, what really worries the BIS is that rising prices may become a comprehensive unsettlement of the status quo:

Ultimately, the most reliable warning indicator is signs of second-round effects, with wages responding to price pressures, and vice versa. These can be especially worrying if they go hand in hand with incipient changes in inflation psychology. Examples include demands for greater centralisation of wage negotiations or indexation clauses, or surveys indicating that firms have regained pricing power, as part of broader changes in the competitive environment, as observed in some countries recently (Chapter I).

Their concern is more abstract terms is that inflation will emerge as a macroeconomic and, one might say, a macrosocial phenomenon.

Chartbook #134: Inflation as an emergent macroeconomic phenomenon

All of that is code for a world in which organized labour is stronger and in which workers receive not gratuitous handouts from socially minded employers to help with the grocery bills, but proper cost of living adjustments.

As the FT recently reported, many well-meaning UK employers are currently handing out one off payments to the their staff. But none of them are willing to actually properly adjust wages. Talk about “team transitory” with a vengeance.

The upshot of the BIS analysis is that it is crucial for central banks to act fast to prevent a price surge unleashing a social avalanche. This is the classic justification for anti-inflation politics. From a historical point of view moments of inflation have undeniably been moments of opening for the left – think of the 1914-1925, 1940s and 1970s. But if the latest issue of Jacobin is anything to go by, there seems little appetite for such a militant politics of collective organization in the current moment.

Read Henwood’s article with this link.

Of course the left does not speak with one voice and Jacobin has also offered a platform to those, like Hadas Thier, arguing for a more assertive approach to the class politics of inflation.

In the UK, faced with the omnishambles of Tory economic policy, Keir Starmer’s labour party has distanced itself from the strikes of the railway workers and has adopted a “sound money” line.

Perhaps they are right. Perhaps Jacobin and Starmer are merely realistic when they register that militant class politics around the cost of living is a losing political proposition. Perhaps talk of wage-price spirals is either over-excited (from the left) or alarmist (from the right). Certainly there is precious little evidence right now of a spiral.

In Europe, wages even for highly organized German industrial workers continue to lag behind inflation.

Where is the "wage-price spiral" in Germany? The latest agreement in the chemical industry leads to annual increases of 3.25% over two years, with one-offs. This will almost certainly imply further real wages losses in 2023/2024.

— Philipp Heimberger (@heimbergecon) October 20, 2022

chart via @OliverRakau pic.twitter.com/d4FNKxuCtq

In the US in some sectors wages have caught up, but they are not driving prices on a broad front.

But might things change? Inflation is a dynamic. Will a prolonged period of rising prices unleash the much feared spiral?

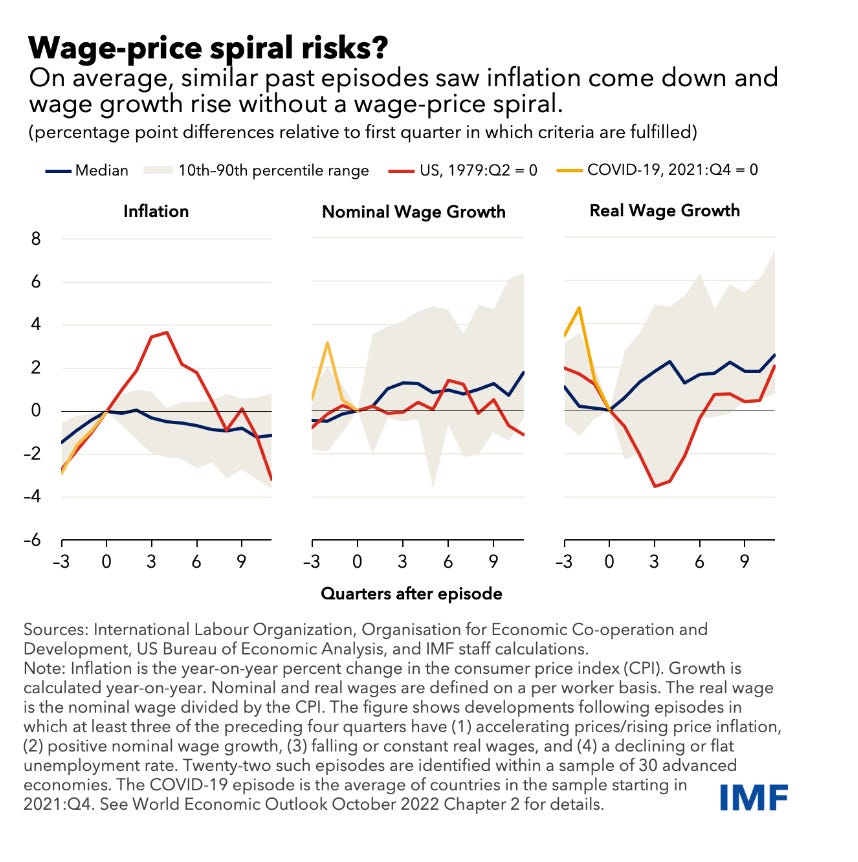

The BIS suggests as much. But in the latest issue of the World Economic Outlook, another team of high-powered mainstream economists, this time from the IMF, takes a look at the question of wage-price spirals and comes to rather different conclusions. The IMF find that apart from a few very unusual incidents, which they discuss at some length, there is, in fact, remarkably little systematic evidence that periods of rising inflation, rising nominal wages and falling real wages – our current situation – tend to develop into sustained spirals of wages and prices.

Source: IMF blog

So, no wage-prices spiral. Less fear of inflation? Less need to stamp on the monetary break? That is what would follow from the “classic” experience of the 1970s. That has been the orthodoxy for half a century. But that is not our world in 2022. Au contraire. What the IMF foregrounds is the real wage shock. If there is no wage price spiral, if expectations are backward-looking then as prices spike, real wages will fall. To prevent that, what policy should we adopt, in the interests both of working people and aggregate economic growth? The IMF’s conclusion seems clear: A severe does of anti-inflationary medicine, administered as soon as possible!

When wage and price expectations are more backward-looking, monetary policy actions need to be more front-loaded to minimize the risks of inflation de-anchoring. Using a newly developed model of expectations and wage and price setting, scenario analysis suggests that the observed decline in real wages has acted as a drag so far, reducing price pressures and thereby helping inhibit development of a wage-price spiral dynamic. However, the more backward-looking (adaptive) expectations are, the greater the chances that inflation could de-anchor to a higher-than-target level. The monetary policy response in this inflationary environment should depend on the nature of wage and price expectations: the more backward-looking they are, the quicker and stronger the tightening needed to avert inflation de-anchoring and prevent large declines in the real wage.

So in 2022 it turns out that whether or not you fear wage-price spirals (BIS) or doubt that they are an immediate threat (IMF), or simply don’t think that the Democrats can win on the back of large-scale working class militancy (Jacobin) you conclude that we should put an end to inflation as soon as possible by all means necessary.

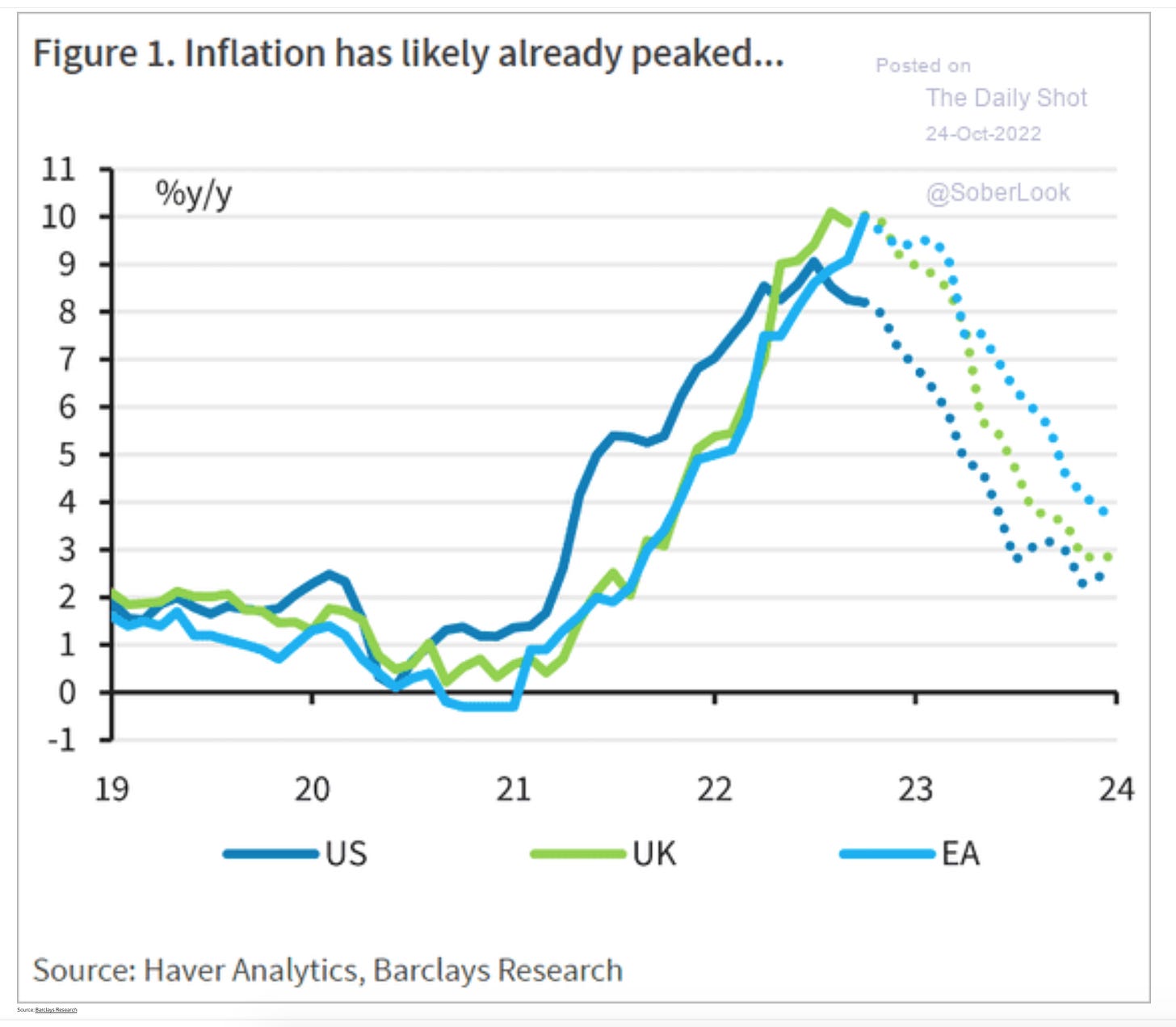

At this point, I don’t want to revert to the question of whether US inflation is actually transitory or not. Call it what you will, the consensus forecast right now is that inflation has peaked in the US, the Euro-area and the UK. And it is unlikely that the monetary policy turn of the last few months has very much to do with that. If central bank policy has an influence it will be mainly on what happens next.

Source: Daily Shot

I want simply to register this remarkable convergence of analyses around the conclusion that there is no alternative to stopping inflation as quickly as possible. And to ask, in a Keynesian spirit, whether that is really persuasive.

As far as balance sheet effects are concerned there are good reasons for thinking that the more time we take in getting inflation back down to 2 percent, the better. If we live in a world of debt, a sharp spike in interest rates is very dangerous indeed. On the other hand, a sustained period of modestly elevated inflation is exactly what the doctor ordered. Why else did many of the best and the brightest in macro policy once advocate an inflation target of 4 percent or more. That is now easily within our grasp. Why spurn the opportunity?

The cost of living crisis on the other hand is not properly speaking a macroeconomic issue at all. It is a problem of poverty, inequality, precarity and unequal power relations in labour markets. If one is serious about addressing those problems, the solutions are clear enough: Raise benefit levels substantially above the rate of inflation. Control the prices of essentials, if you must, but only for the purchases of those on the lowest incomes. Make the tax system more progressive and remove punitive benefit traps for those on low incomes. Rebalance the labour market by institutional reforms that empower trade and individual workers. Run positive labour market schemes. Redress the overlapping structures of racism and discrimination that concentrate poverty amongst minorities, single mothers and children. Do all of this not slowly, but with the urgency of the cost of living crisis at your back.

This cannot be a top down, drawing board exercise. Addressing inequality, discrimination, poverty is not as simple as conducting monetary policy. The world is designed to make central banks and their instruments pivotal to the economy. They are structurally empowered, designed to be the ultimate technocrats perch. By contrast, in the vast majority of settings welfare and social services are more or less deliberately underfunded, understaffed, underpowered and institutionally hemmed so as to ensure that they are unable to deliver real uplift and lasting and sustainable protection for their “clients”. They are not empowering but disempowering mechanisms both for those they serve and their staff. So a true answer to the “cost of living crisis” would be a question not just of more spending but of political organization and mobilization to create a state structure actually capable of securing a decent standard of living for those in the bottom half of the income and wealth distribution.

This, you might say would be not just a wage-price spiral but something closer to a comprehensive politics of the standard of living, of well-being, of living well. It is the care agenda of the Green New Deal updated for the inflation moment.

Of course, this will likely involve more public spending. So if you are worried about excess demand – inflation hawks and MMT advocates can agree on this – impose offsetting increases in taxes on those on higher incomes who are better able to pay and, despite lower marginal propensities to spend, are also responsible for the majority of consumer expenditure. If that lower propensity to spend means that the tax increases have to be stiff, so be it.

But adopt this macroeconomic anti-inflation stance only if you judge that it is not actually in the interests of a broader social balance to allow modest rates of inflation to continue for a while until it has redressed dangerous debt overhangs.

This, or something like it, would be a “functional finance”, left-Keynesian response to our current predicament. Has it any chance of being realized? I don’t think it does. Of course Europe is experimenting with energy price controls and various types of subsidy regime. This is clearly essential. But one should not mistake emergency policy measures for a broader political shift. To exalt over the politics of price control in the EU in the name of post-Keynesian heterodoxy, is a bit like exalting over central bank asset purchases in 2020 as the harbinger of an MMT-inspired total mobilization of the fiscal and monetary state.

Ultimately, spelling out this alternative vision of a progressive response to inflation serves, therefore, to drive home a rather grim realization: the anti-inflation consensus of 2022 is conditioned by not one, but two moments of resignation.

It is conditioned by the fact that there is no powerful wage price spiral, nor much prospect of one developing and for a party like Labour to give political backing to a militant wage push seems, to its current leadership, like a risky proposition. As a result, real wages are taking a savage hit. And so left-wing criticism comes to focus on inflation itself as the problem that needs to be addressed.

But why are the social problems exposed by the cost of living crisis not the focus rather than general inflation? Why conflate the two? For some this is no doubt a cynical conflation, an updated version of the rentier interest that hides behind the “window’s pension” argument. But that cannot explain the breadth of the anti-inflation appeal. It surely reflects a deep skepticism about the efficacy of a proactive state-led policy of redistribution and uplift for those most seriously victimized by the cost of living crisis.

So out of this double resignation – both about the chances of social mobilization and the possibility of progressive state policy – “sound money” progressivism emerges by default as the best defensive option. We are back to TINA (there is no alternative), it seems.

****

I love writing Chartbook and I am particularly pleased that it goes out free to thousands of readers all over the world. But it takes a lot of work and what sustains the effort is the support of paying subscribers. If you appreciate the newsletter and can afford a subscription, please hit the button and pick one of the three options.