The shift in Western discourse on China over the last five years has been dramatic. Trade wars, tech wars, COVID, Xi Jinping’s crackdowns, the real estate bubble, Omicron and now Putin’s war have all contributed. On this shift hinges our entire outlook for the global economy and world affairs more generally.

The front page of the FT this weekend was full of China gloom.

Faced with a cumulation of difficulties local commentators are so concerned that remarkably critical remarks are leaking to Western media

Weijian Shan, a veteran China investor, said in a recent recorded video meeting that the country was embroiled in a “man-made” crisis. “Large parts of [the] Chinese economy including Shanghai have been semi paralysed and the impact on the economy is going to be very profound,”

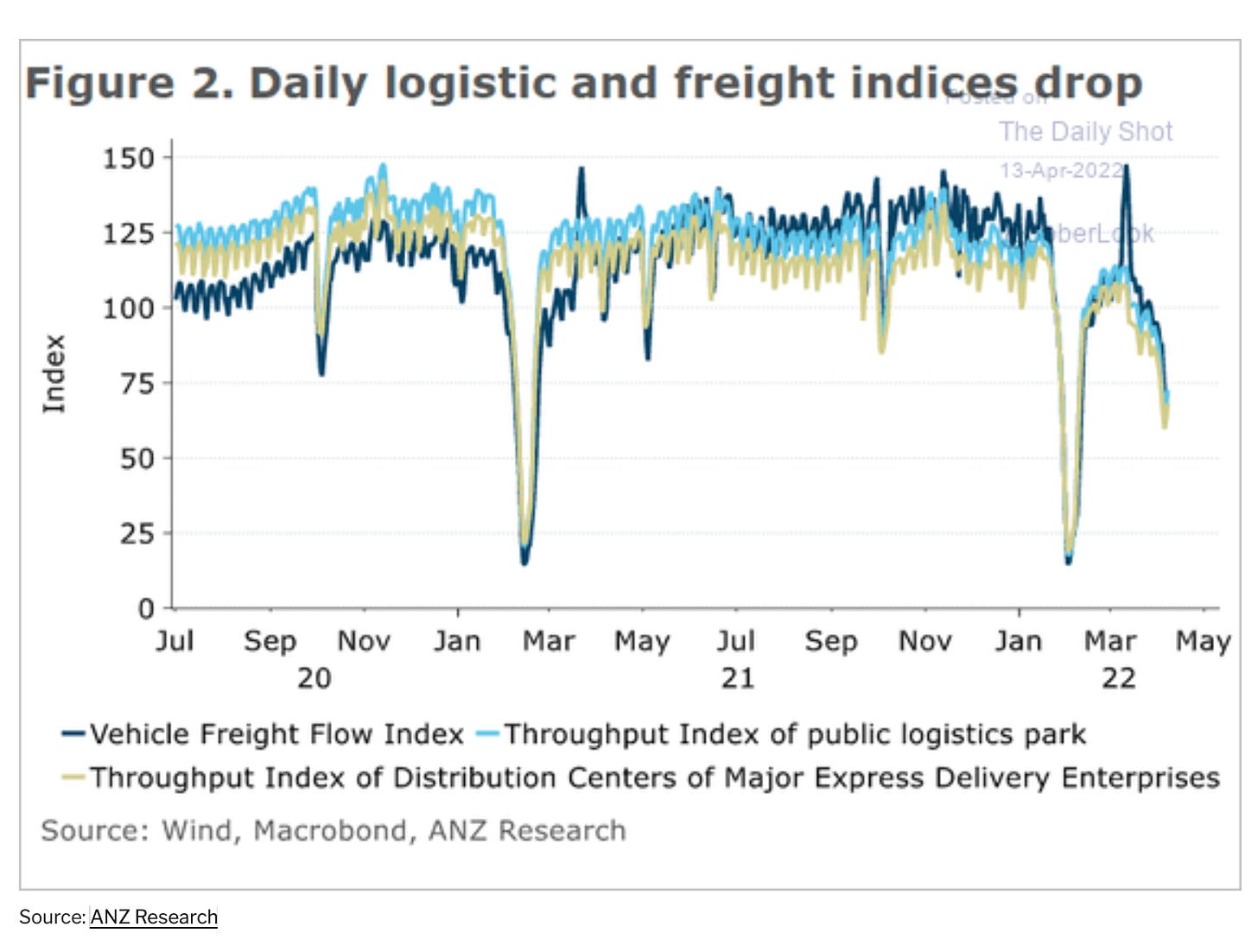

Covid lockdowns continue to disrupt logistics around the economy.

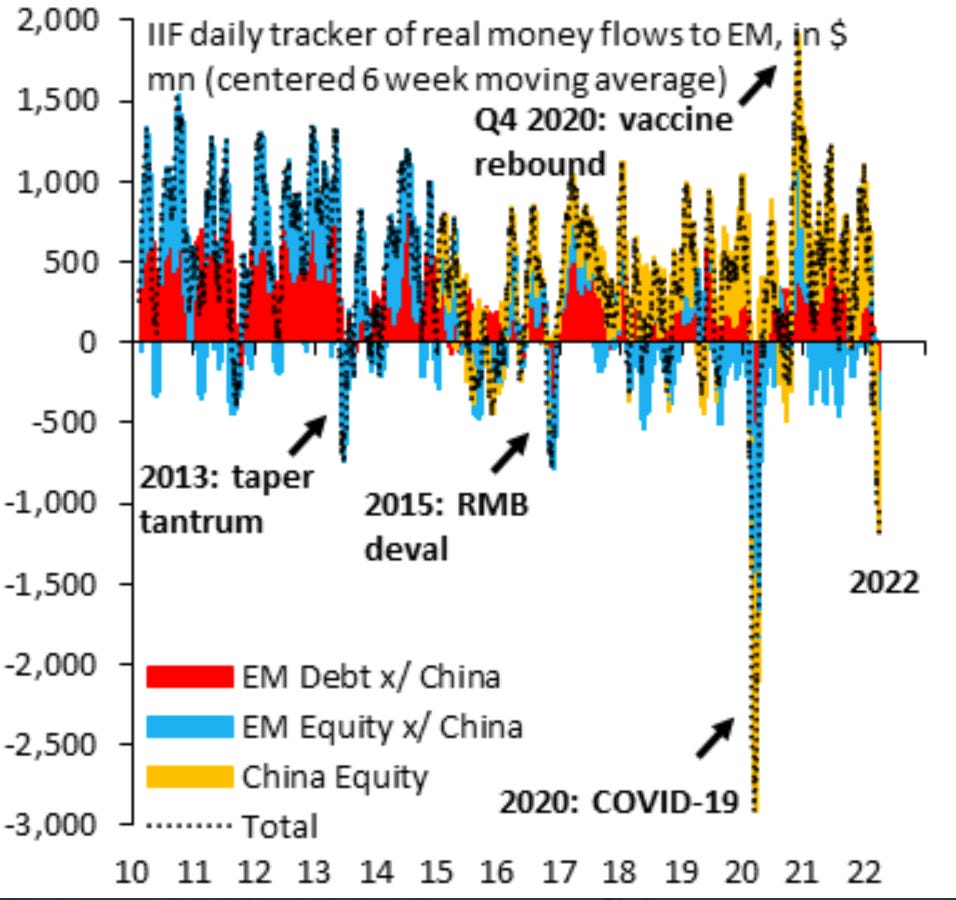

Foreign investors have recently pulled money out of China at a rapid rate, which goes hand in hand with a dramatic devaluation of the yuan.

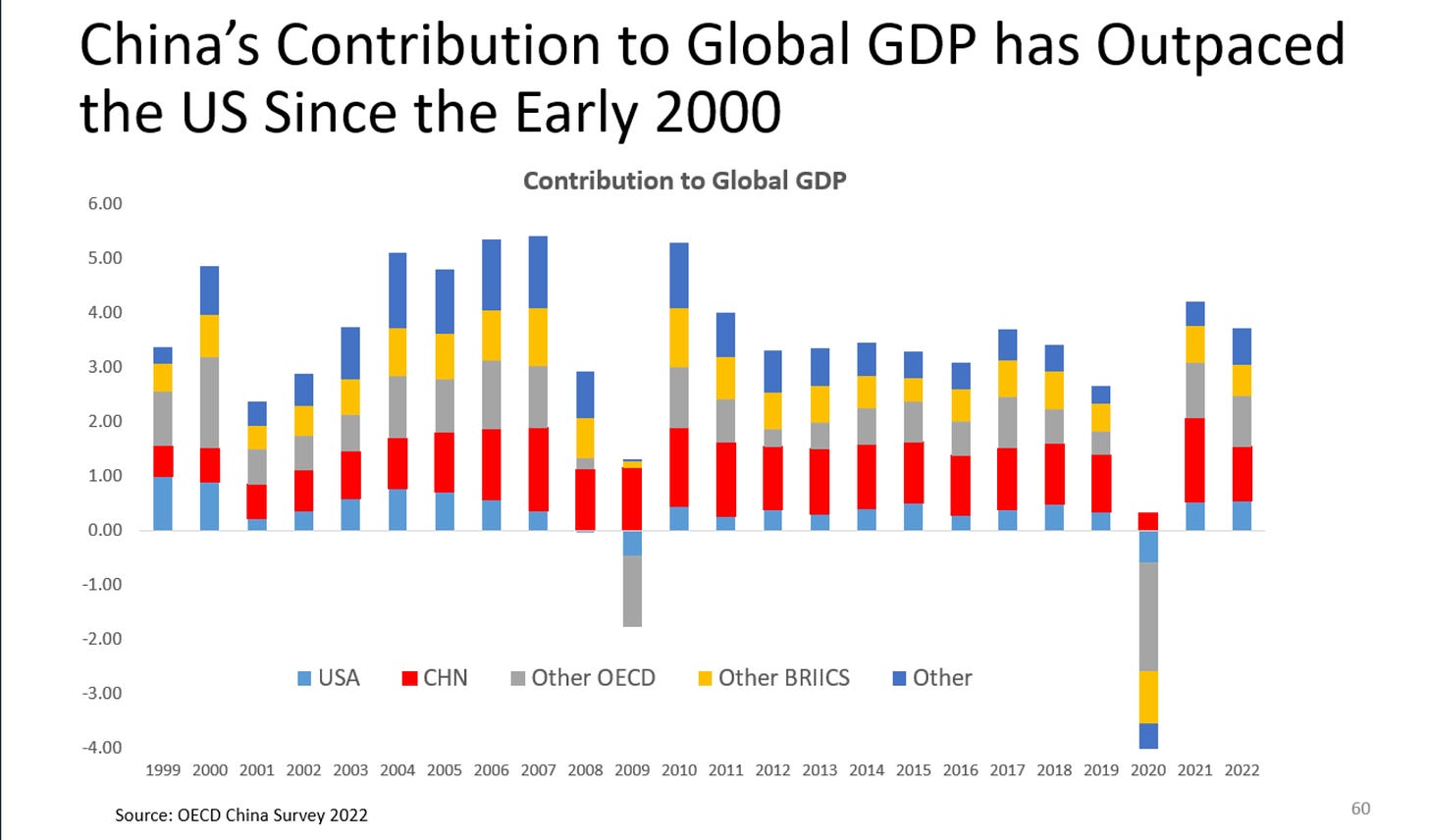

All of this matters as much as it does, because the increasing polarization of global politics around the simplified axis of democracy v. “autocracy” (as seen through the lenses of many Western commentators) cuts across the interconnectednes of the global economy to which China over the last twenty years has been essential.

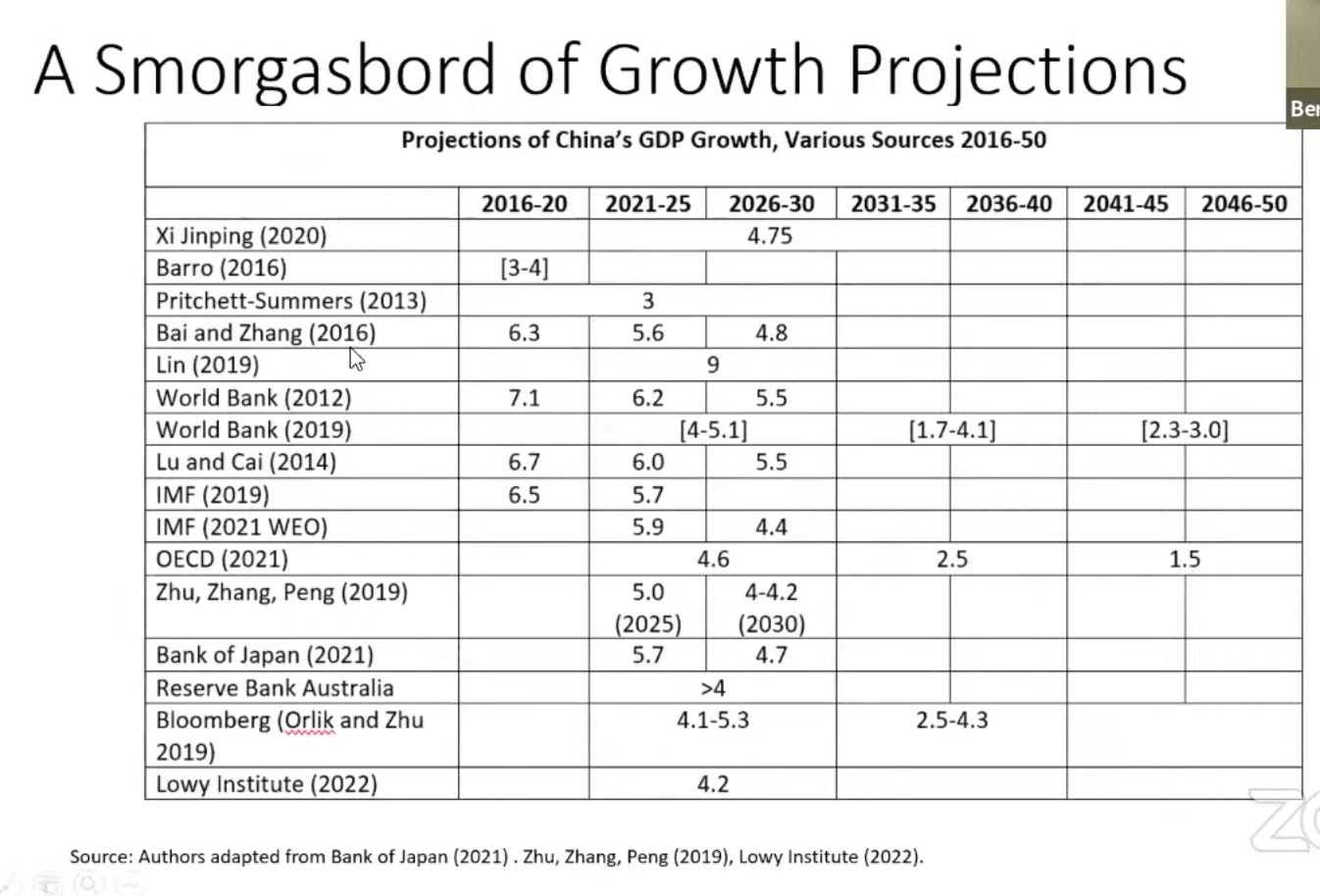

So this makes the question of China’s growth prospects into one of the key questions. of world affairs. And on this question – How Fast Can China Grow? – I strongly recommend this recent report by the Lowy Institute and this excellent presentation by Bert Hofman ex of World Bank, now National University Singapore.

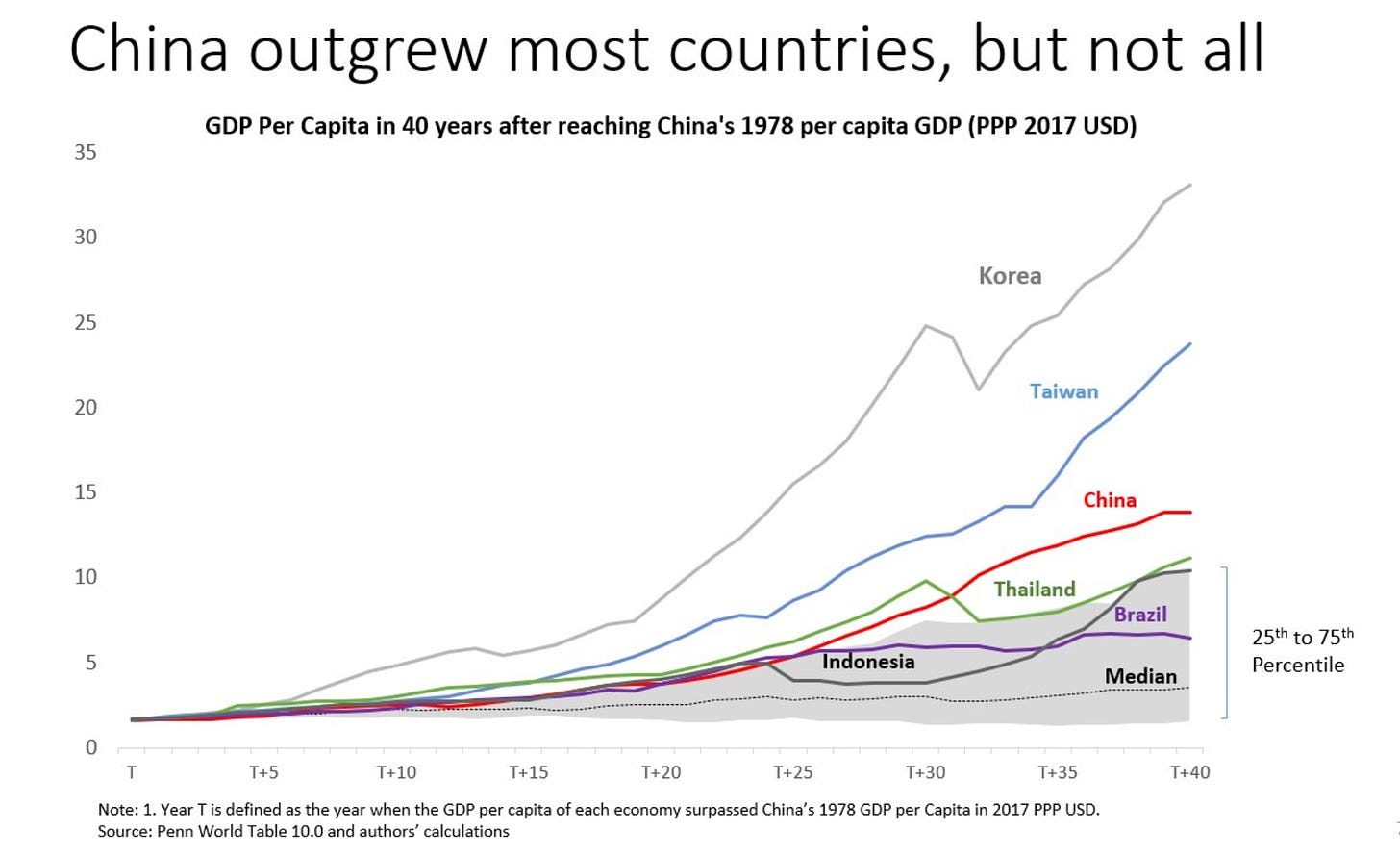

Hofman starts by making the nice point that though China has grown very fast it was outpaced from a similar GDP per capita baseline by South Korea and Taiwan.

Of course those are much smaller countries with different initial conditions. I wonder how that comparison would look, if one applied the “California school” move to the present day i.e. compare S Korea and Taiwan not to China as a whole but to China’s most rapidly growing regions – Shanghai, Beijing, Shenzhen, Chongqing, Guangzhou.

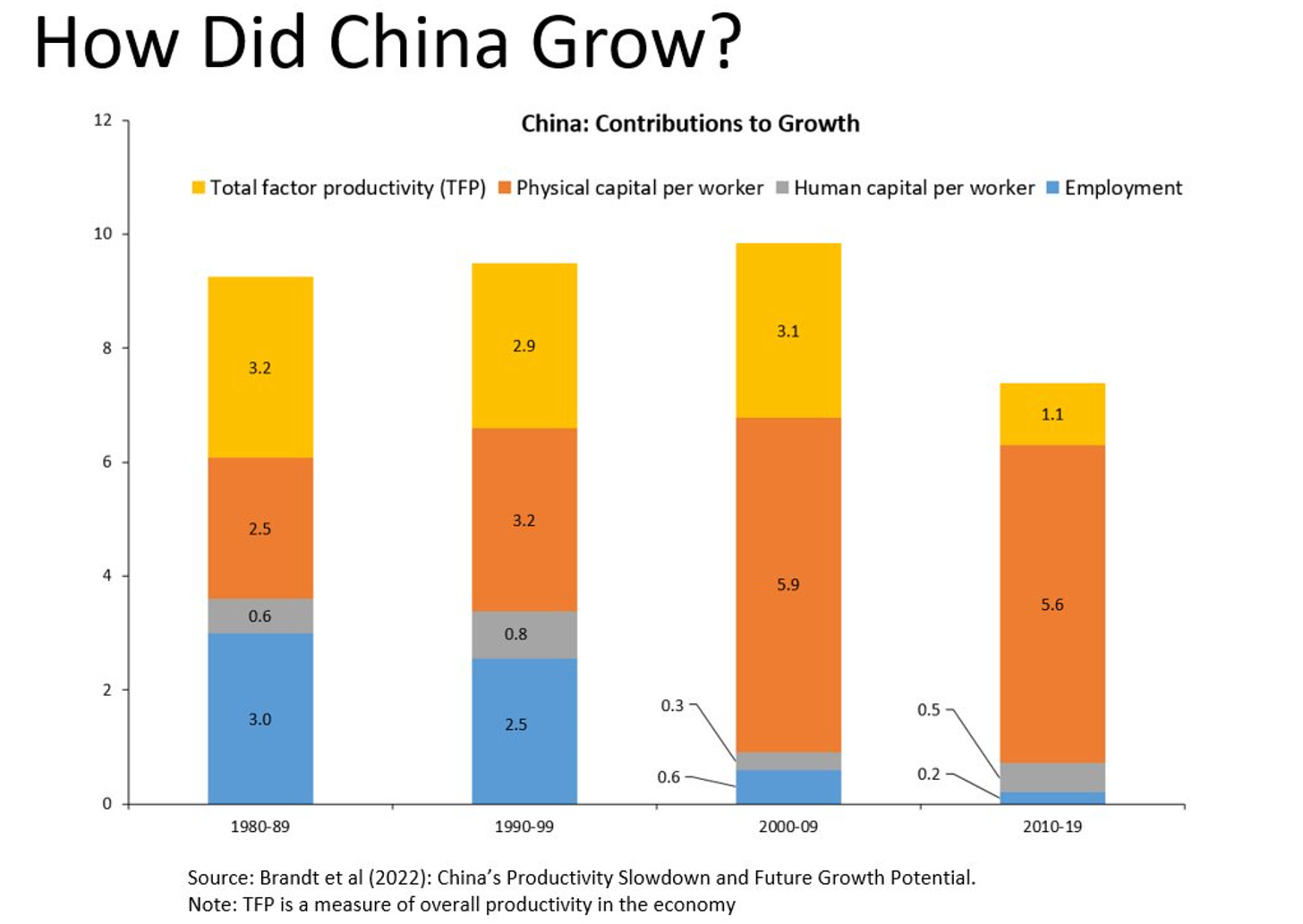

What is clear is that the pattern of growth in China has shifted in recent years and not in a good direction.

Clearly, the contribution of physical capital investment to growth has become dominant since 2000. But what it substitutes for is not productivity growth, but the decline in labour input from 2000, which comes earlier than I would have expected. When TFP growth slowed down after 2007, capital input also slowed and the result was simply a slow down in overall growth.

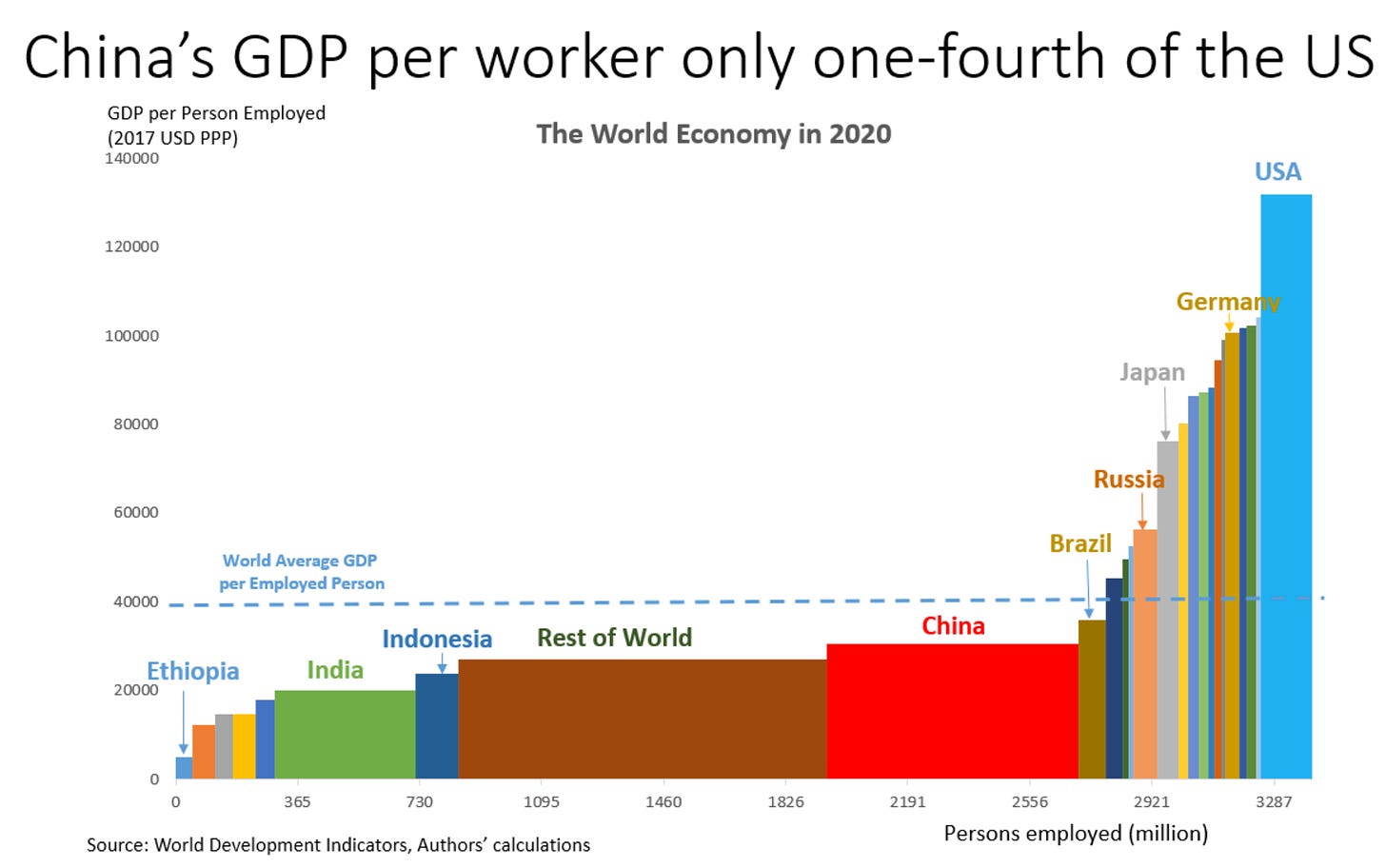

The upshot of this remarkable burst of growth is that the Chinese economy is large, but in gdp per capita terms it still lagged Brazil and lagged far behind Russia, ahead of the current crisis.

The good news is that this implies huge potential for catchup. As we all know, China faces demographic headwinds. But particularly with regard to the labour force there is vast unexplored potential both with regard to rural elementary and secondary education and tertiary education. As Hofman points out, China’s tertiary enrollment is soaring.

This is changing rapidly, though. By 2020, according to China's statistics, almost 60 percent of the age cohort is enrolled in tertiary education, up from less than 8 percent only 2 decades ago. China is almost following the steep trajectory that Korea followed in the 80s and 90s pic.twitter.com/FXC5TnEu9i

— Bert Hofman(郝福满) (@berthofmanecon) April 28, 2022

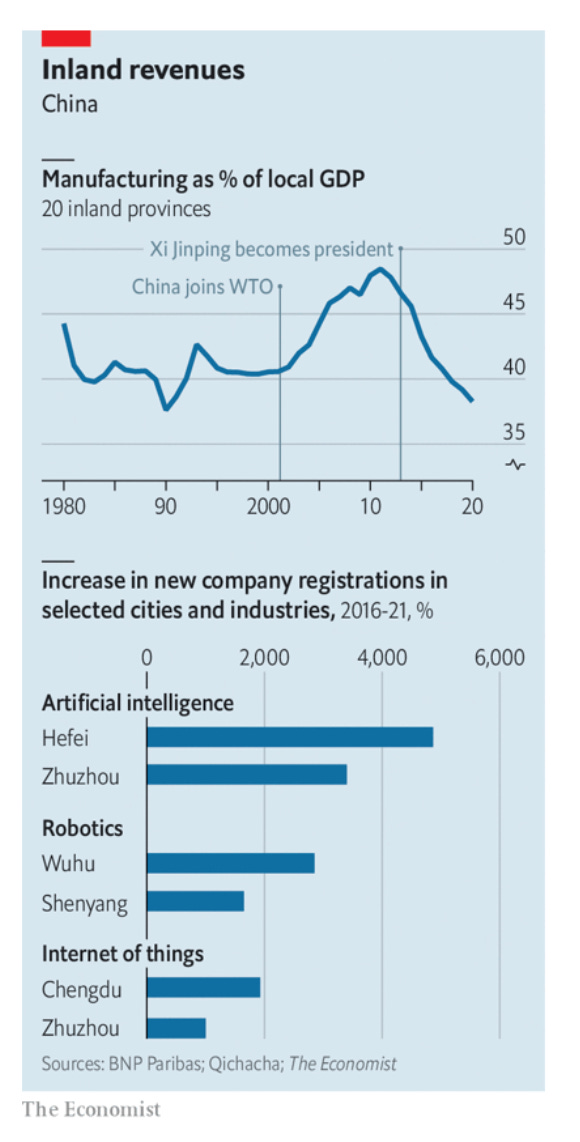

China is in a technological race and it knows it. The Economist recently had an excellent survey on China’s tech strategy and regional development.

As the Economist described it:

Mr Xi’s strategy is best understood as a weighty bet that China is on track to become the world’s centre of innovation over the next decade. A shift towards homegrown tech is altering the geographical layout of China’s manufacturing machine. New investment and migration are being rerouted from rich coastal hubs to inland cities such as Zhuzhou. A second feature is an unprecedented rise in the number of new tech companies. The government is nurturing thousands of groups, big and small, in the fields of data science, network security and robotics. Mr Xi and his advisers are also taking firmer control over markets. Their ability to direct capital flows is already evident in how private-equity groups invest in China.

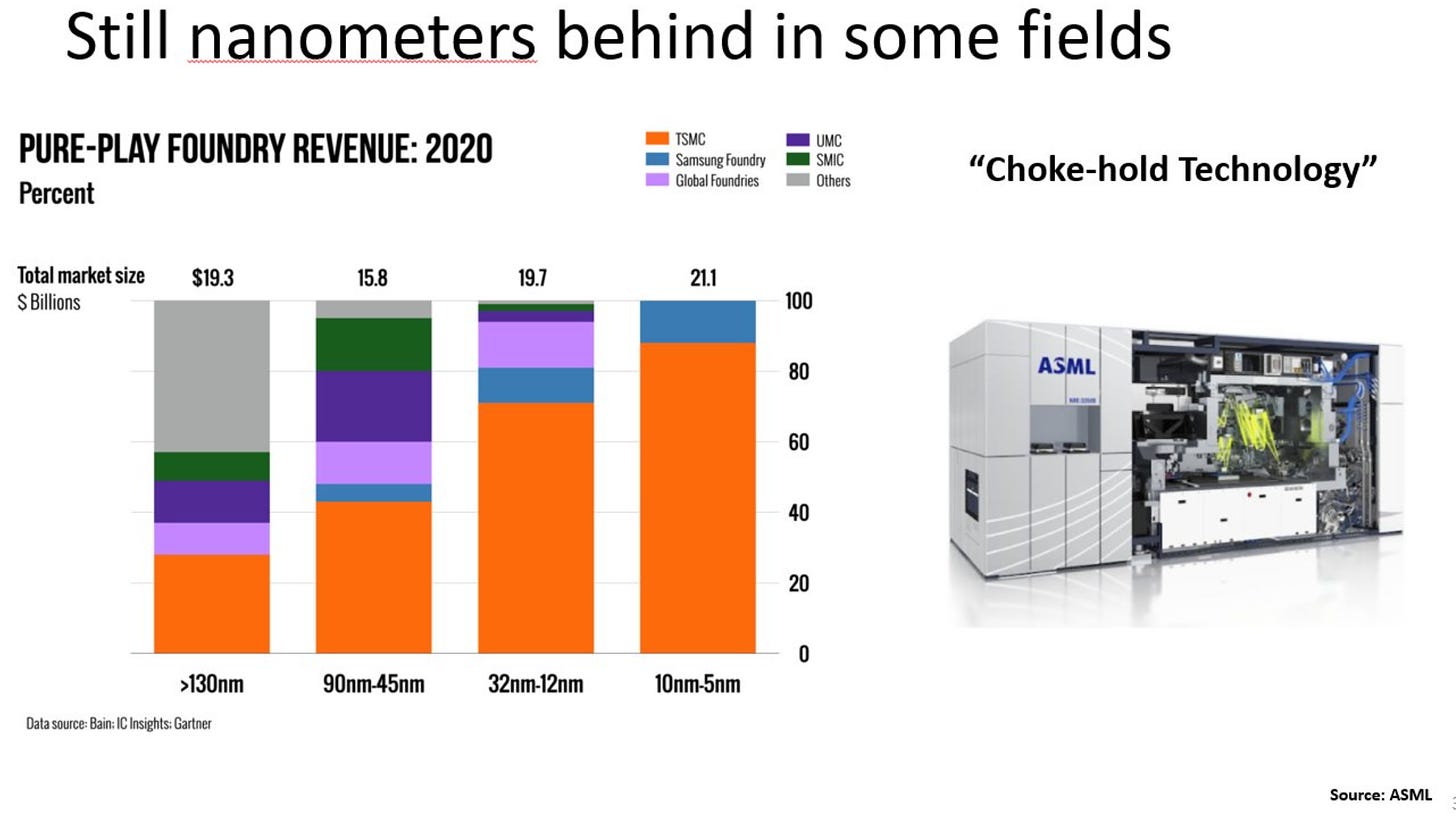

The crucial battlefield is clearly microchips and, as Hofman points out, citing data from ASML, China (like everyone else) still has a very, very long way to go to match TSMC and Samsung.

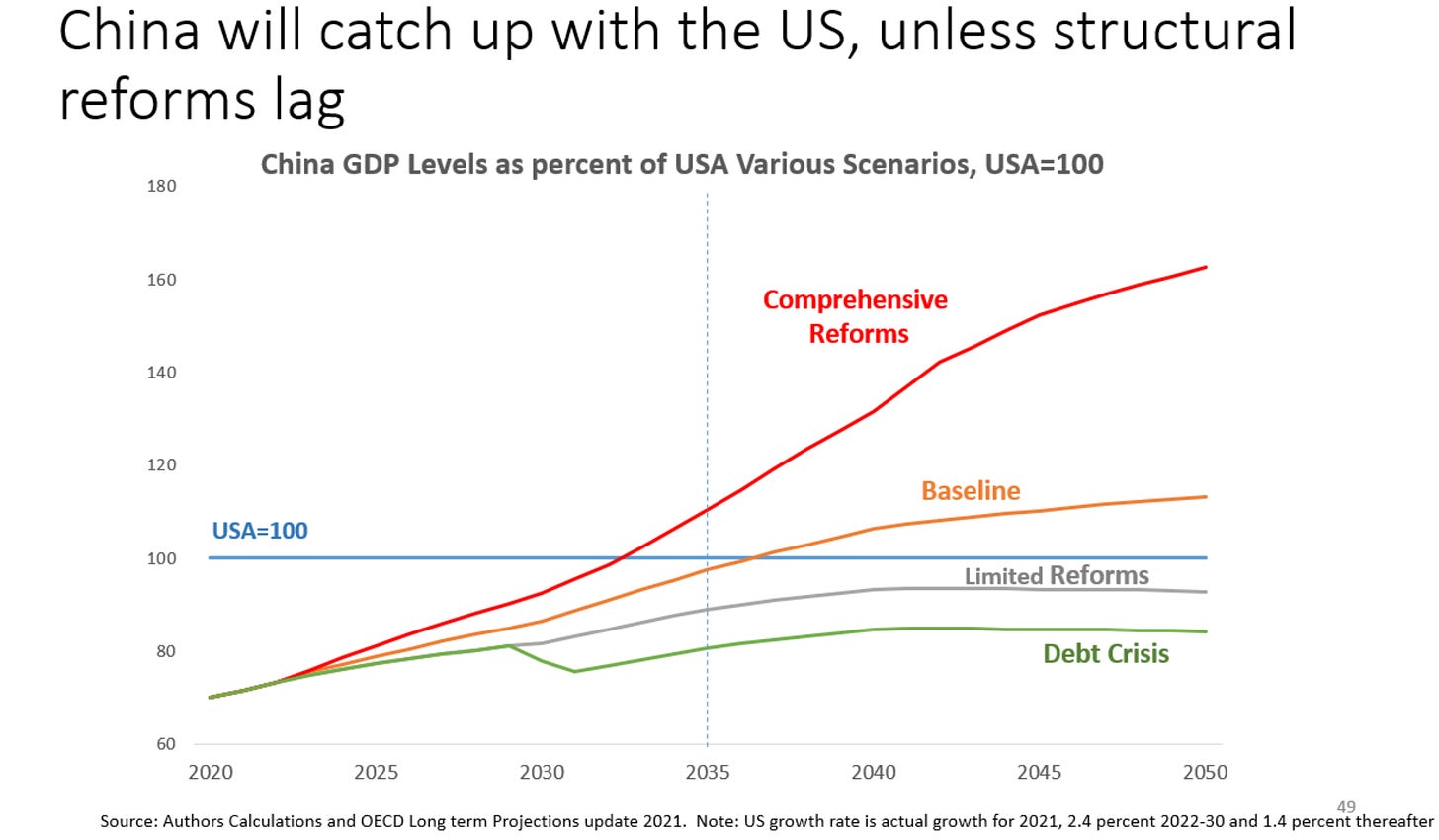

Will China catch up with the US in terms of GDP in terms of current dollars? It is a simplistic question but that is the nature of the beast. GDP is a brute force aggregate measure and it permits one to easily sketch competing scenarios.

Hofman’s answer is, maybe. If China takes advantage of its many opportunities, it could easily overtake the United States by the mid 2030s. That depends on choices made in Beijing and on broader political economy. The big downside risk is not so much of uncoupling (on which Hofman is reasonably optimistic), or stagnation, but of a major debt crisis that could cripple growth. Either way, there is no determinism here, politics and political economy matter.

And whatever scenario unfolds, the China market is still too big to ignore. And amidst mounting geopolitical tension, the Omicron surge and China gloom, the search for profit by global investors continues. As we read in the FT, there is huge excitement about China’s private pension market amongst Western money managers.

Some of the world’s largest asset managers are clamouring for a slice of the action after China announced plans this month to push more of the country’s vast pool of household savings into financial markets. Under the new schemes, employees will be able to contribute up to Rmb12,000 a year ($1,860) to private pension plans, which the government said would be adjusted in line with “economic development” and would benefit from preferential tax treatment. BlackRock, Goldman Sachs, JPMorgan and Amundi have been expanding their presence in China in the past couple of years. Now they are positioning to grab a piece of a potentially huge new business. … Some investors have declared the country to be “uninvestable”. … But that has not dented enthusiasm for Beijing’s latest retirement initiatives, which are “signals the government is embarking on a new growth programme”, according to Xiaofeng Zhong, chair of Amundi Greater China. “It’s a significant long-term opportunity for global asset managers.” China’s pension market reached Rmb12tn at the end of 2020, doubling from 2014, according to EY. The new proposals could fuel a massive expansion. … The pension reforms come as Chinese regulators are supporting foreign institutional investors in establishing operations on the ground. …. BlackRock, the only multinational participant in an earlier pilot involving retirement accounts that did not have tax advantages, will begin enrolling investors in that pilot next month. Goldman Sachs received preliminary approval … JPMorgan is also getting ready for the pensions experiment. … “A healthy and strong pension system helps bring in more long-term oriented capital into the market, so it is also a priority for the government.” …securities, banking and insurance regulators all appear to be making this a high priority in the wake of Vice Premier Liu He’s high profile promise in March that the government would intervene to stabilise markets and the economy. “The benefit of a well designed, well accepted retirement scheme is that it is going to make people more comfortable about their retirement. That in turn will encourage them to reduce savings and spend more, encouraging consumption,” said an executive at one of the firms working in China.

In accommodating the wealth of an aging population and achieving macroeconomic rebalancing, the interests of the regime and those of global finance, are still aligned – at least so the stories goes. If the richest provinces of China with a population numbering in the hundreds of millions have a slower growth future in store that in many ways converges with the West rather than dramatically surpassing or breaking with it, Wall Street still sees plenty to like.

*****

I love putting out Chartbook. I am particularly pleased that it goes out for free to thousands of subscribers around the world. But what sustains the effort are voluntary subscriptions from paying supporters. If you are enjoying the newsletter and would like to join the group of supporters, press this button and pick one of the three options: