Placing Isabella Weber and Chris Miller in dialogue.

Some time in the next 10-15 years, China’s GDP will likely overtake that of the United States. That is the future.

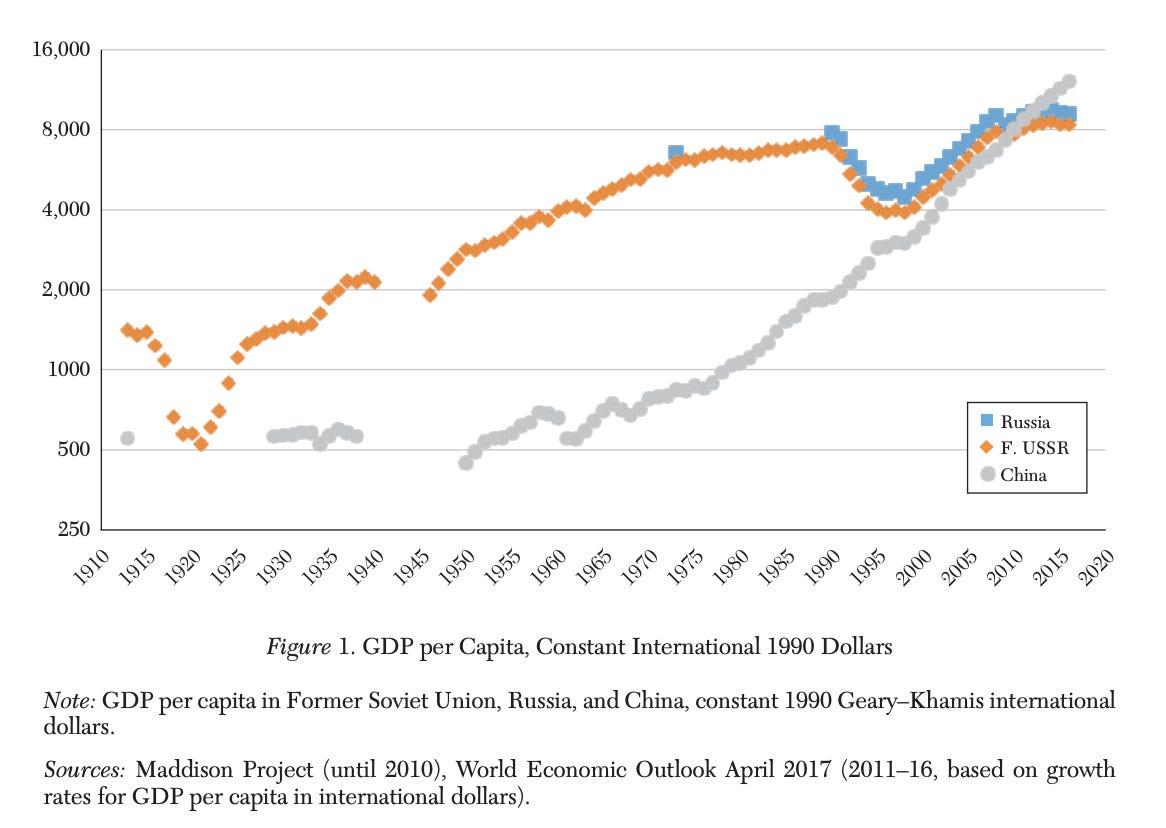

One of the momentous that already happened early in the 21st century is China’s overtaking of Russia. The dramatic surge in China’s GDP per capita contrasts with the catastrophic collapse in the Soviet Union and Russia after 1989.

Source: Guriev JEL 2019

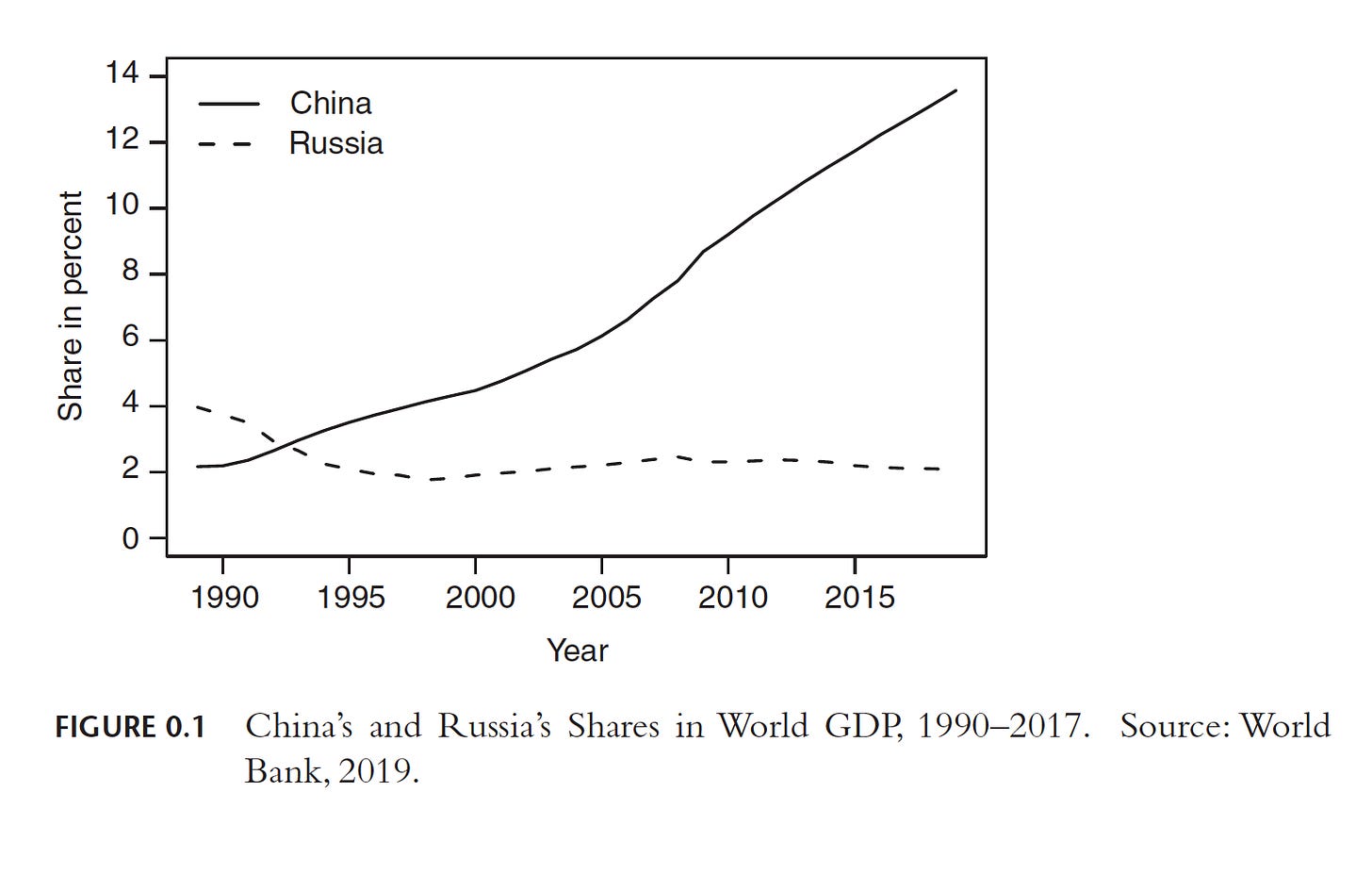

The result is to reverse China and Russia’s relative shares of global GDP.

Source: Weber, How China Escaped Shock Therapy (2021)

For the balance of power in Eurasia this has huge implications. In a piece that appeared today in Noema, I revisit the China-Russia divergence.

The piece starts with Gorbachev’s visit to China in the spring of 1989, amidst the protests in Tiananmen square.https://www.youtube-nocookie.com/embed/zXNkbdKQrdc?rel=0&autoplay=0&showinfo=0&enablejsapi=0

The essay is anchored by Isabella Weber’s book that has been one of the most discussed of recent months.

A rich discussion of Weber’s book appeared on the ever-excellent Politics Theory Other podcast series:https://w.soundcloud.com/player/?auto_play=false&buying=false&liking=false&download=false&sharing=false&show_artwork=true&show_comments=false&show_playcount=false&show_user=true&hide_related=true&visual=false&start_track=0&url=https%3A%2F%2Fapi.soundcloud.com%2Ftracks%2F1044843415

This in-depth critical appreciation of Weber’s work by Joel Andreas in the New Left Review is highly recommended.

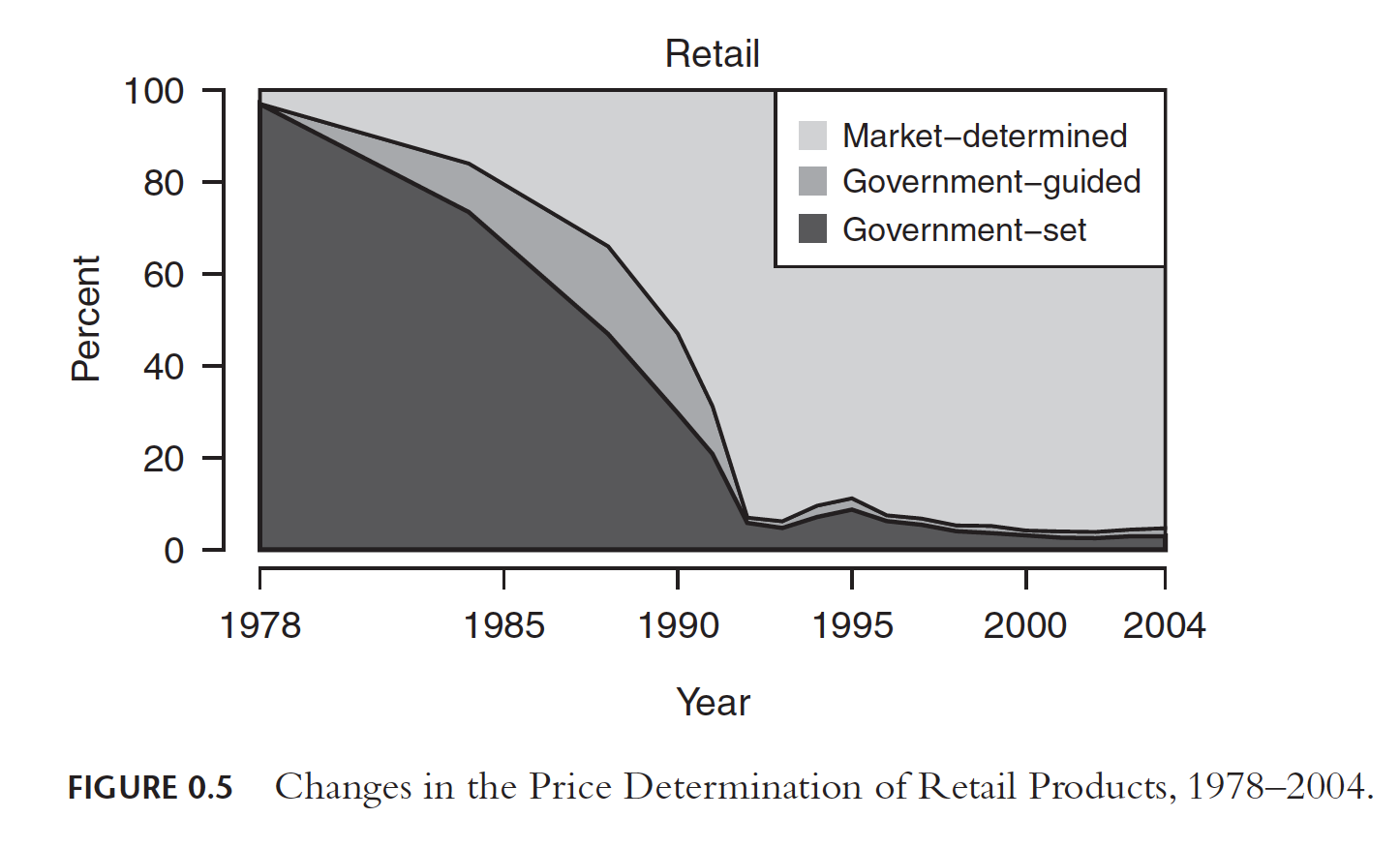

Weber’s book offers a fascinating account of struggles over economic policy in China in the 1980s. She explains how in 1986 and 1988 the Chinese leadership came close to opting comprehensive and sudden price liberalization known as “package reform”, only to reject the option. Rather than liberalizing all prices in one fell swoop, as Russia was forced to do in January 1992, the Chinese adopted a gradualist approach. Rather than crashing out of the planned economy, they grew out of it, to paraphrase Barry Naughton.

Source: Weber, How China Escaped Shock Therapy (2021)

In the Noema piece, I explore more deeply Weber’s implied comparison with the Soviet Union and the framing assumptions of an argument that focuses, to the degree that Weber does, on debates amongst economists.

*******

Before we get into this, a quick note about Chartbook. I love putting this stuff together. I am delighted it goes out free to a wide readership. But it takes a lot of work. If you can afford to chip in to support the project, click one of the subscription buttons here:

*********

To get the Soviet side of the story to match with Weber’s for China, I draw on Chris Miller’s recent book on The Struggle to Save the Soviet Economy, which I highly recommend.

This is a short talk in which Chris sets out his interpretation: https://www.youtube-nocookie.com/embed/6hvhzRz0DjE?rel=0&autoplay=0&showinfo=0&enablejsapi=0

To help me articulate this comparison, I turned to the hive mind of twitter, for a truly wonderful set of exchanges. Adam Tooze @adam_toozeAn interesting exchange here about 1990s Soviet Union/Russian economic transition, shock therapy etc. Which is the account of that transition – book/article- that folks on the left find most convincing? Looking for reading. https://t.co/5YnGarfo6rAugust 15th 202124 Retweets154 Likes

This thread ran over severals days. It developed multiple branches. It is really worth digging into. Thanks to an entire roster of brilliant folks who took part!

What distinguishes the two books is that whereas Weber focuses on doctrinal and policy debates amongst economists, Miller combines an account of late-Soviet reform efforts with a bold sketch of the actual political economy of the Soviet Union in its final dysfunctional stage. This involves a strategic divide between Miller and Weber in terms of both analytical style and intellectual framing.

To motivate his explanation of Gorbachev’s failure, Miller plumps for a particular model of the political economy of inflation. By contrast, for Weber it is precisely the rival models of inflation that are the object of her painstaking reconstruction.

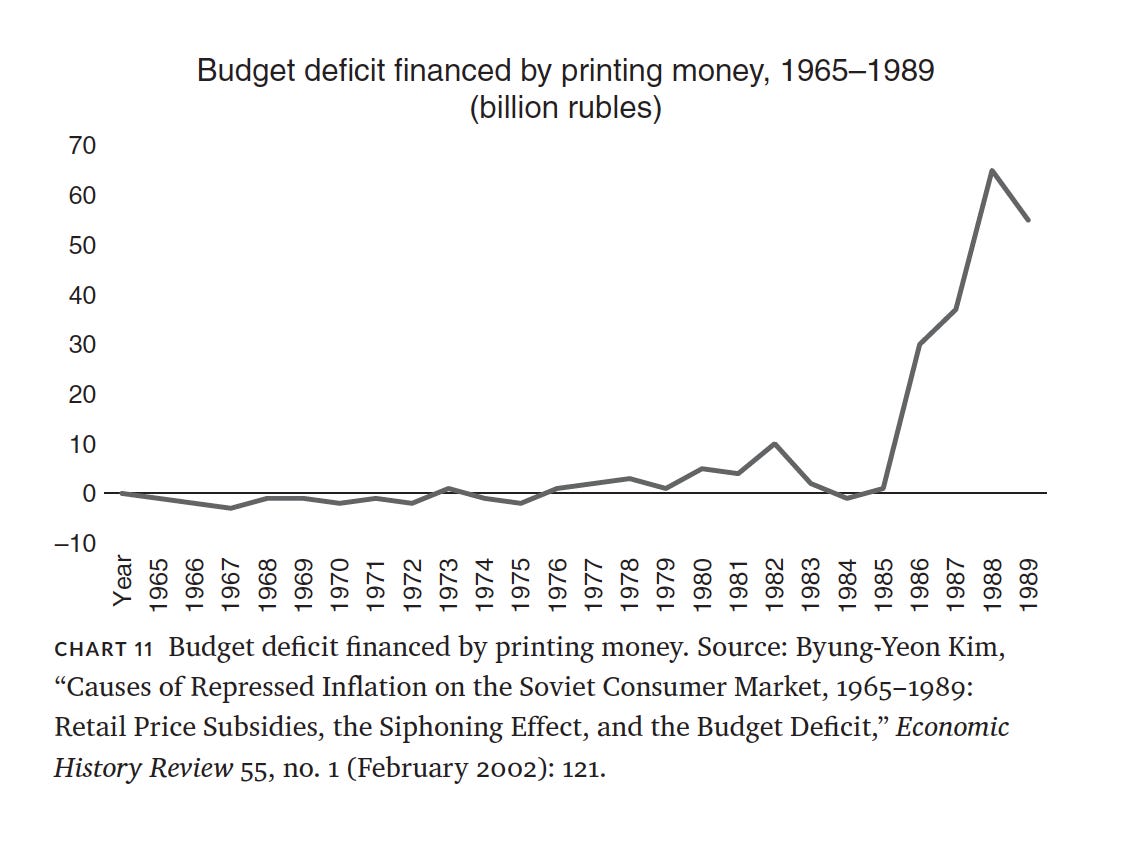

Miller’s account of the Soviet crisis is anchored by the data on the monetary overhang compiled by Byung-Yeon Kim in an important 2002 paper in the Economic History Review.

To explain this sudden surge in the macroeconomic imbalance, Miller invokes the political economy of so-called “wars of attrition” – struggles in which warring interest groups, defending the current distribution of the spoils, obstruct reforms.

As Guriev notes in his excellent review of Miller’s work in the Journal of Economic Literature, these political economy models emerged from the fusion of economics and political science that was itself a product of the reform economics of the 1980s and 1990s. They offered shock therapists an explanation for why they were necessary. What kind of political and economic impasse made it necessary to resort to such radical measures?

The model of wars of attrition provides Miller with a powerful explanation for why gradualist reform was simply not an option for the Soviet Union.

So what about China? In the Noema piece I draw on some of the analogous political economy studies of China to bridge the gap from Miller to Weber. One might be tempted to say that what I am doing is filling in the background to Weber’s argument, but reasons that I hope will become obvious in a second that would be to prejudge the issue.

In any case, in the Noema piece, I draw on Victor Shih’s intriguing work on horizontal and vertical interest group competition within the Chinese power structure to explain why no, Soviet-style war of attrition developed. That in turn explains why the choice of economic policy remained open in Beijing, whereas in Russia, the hands of policy-makers were forced.

Even the great Branko Milanovic concurs that by January 1992 Yeltsin really had no option. Shock therapy – in Weber’s terms – was not, in fact, a choice for Russia, but simply the only way out of a dangerous economic impasse.

Connecting intellectual history to political economy in this way is a productive exercise. The question is: how do we specify the relationship between ideas-concepts-knowledge from context, when it is in fact those ideas-concepts-knowledge that we use to describe the context.

In the Noema piece I made a choice. Of the two rival interpretations of inflationary pressures that Weber identifies in China in the 1980s, it is the package reformers who offered an interpretation closest to the kind of political economy of inflation that Shih and Miller apply to China and the Soviet Union. As Daniela Gabor and I teased out in one of the many branches of the twitter exchange, to postulate that inflation is the result basically of a monetary overhang is not a matter of fact, it implies a particular (“monetarist”) interpretation of the inflationary process. It is an interpretation that aligns with one side of the ding-dong intellectual argument that Weber’s book lays out for us. In effect in proceeding as I do, I make the monetarist package reform approach into the key to understanding the actual political economy of the situation, whereas Weber’s intention is precisely to refuse that retrospective coronation of the conventional monetarist – package reform approach.

Obviously, I had my reasons for making that choice. I am sympathetic to the monetarist diagnosis of inflationary pressure, not as an article of faith, not as a universal and necessary explanation, but as what seems to me to be a plausible description of a state that a planned economy with fixed prices may find itself in under conditions of serious macroeconomic and financial imbalance. I don’t see any reason to doubt that that was the case in the late Soviet Union. But I may be wrong, and it may not apply to China. Weber’s book gives us good reason to take seriously the more “bottom up”, “cost-push” models of inflation favored by the gradualist reformers with their deep knowledge of particular market process and their focus on certain key commodity markets.

What, then, if one opted the other way? Rather than situating Weber in a Shih-Miller-”monetary overhang” political economy framework, one might seek to rewrite the political economy of both China and Russia drawing on the rich seam of post Keynesian-aligned theory that Weber has exposed. I think that would be very interesting. At this point, I just don’t know how to do it. Perhaps others do.

In any case, this dialogue between politico-economic history and the history of political economy is fascinating. As on previous occasions – “The Trouble With Numbers”, a piece I did about Weimar trade statistics, comes to mind – I am grasping for what Bruno Latour would call symmetry.

Thank you to Alex Tippett (@alex_tippett85) for evoking Bruno Latour’s friendly spirit on, of all places, a CFR call the other day. It came completely out of the blue, but it was a tonic in the midst of a long week of interviews and podcasts.

Follow Alex here:

Thanks to Nils Gilman for commissioning the Noema piece, to Peter Mellgard for editing and to Isabella Weber and Chris Miller for providing such food for thought.