The Alice in Wonderland world of multilateral development finance.

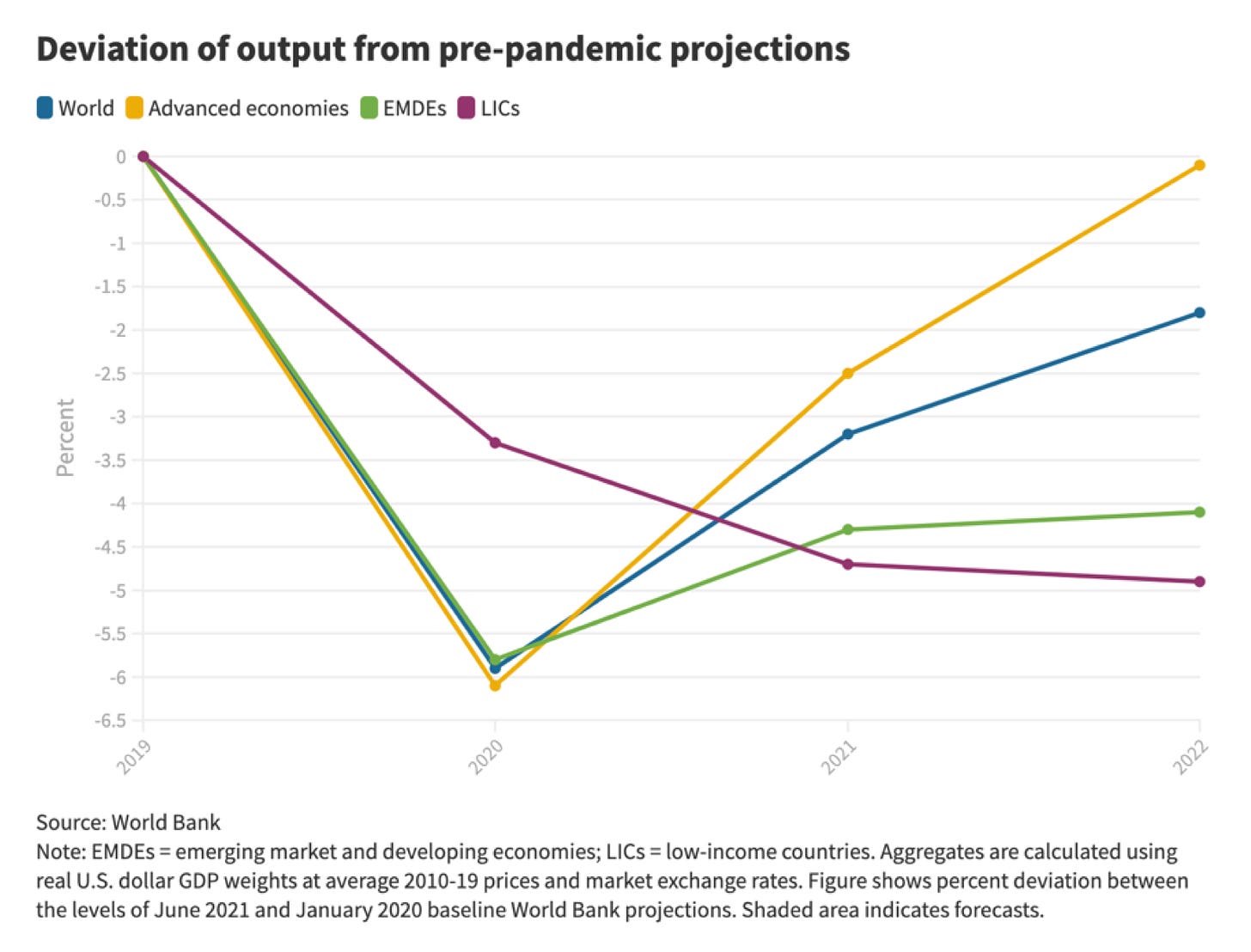

As the advanced economies rebound from the pandemic shock of 2020, what is being exposed is the severe damage to low-income and emerging-market economies. Whereas the advanced economies, on average, are likely to have returned to pre-pandemic trend levels by 2022, the same is not true for the rest of the world.

Measured against pre-crisis trends, this growth gap reflects the higher expectations for emerging markets before the crisis. But above all it reflects the ongoing pandemic in many poorer countries, the lack of comprehensive vaccinate, the asymmetric impact of pandemic measures on economies with large tourist sectors and large informal labour markets, and their relative inability to provide large-scale fiscal and monetary stimulus.

In light of this, one of the big questions in Shutdown is why more generous debt relief measures were not set in motion in 2020.

So far we have avoided a rash of huge debt crises. But it may only be a matter of time.

As one knowledgeable observer wrote this week:

“The combined response by the multilateral development bank (MBD) system in response to the global pandemic” in terms of new lending or concessions to debtors, “amounts to about $300bn, which is considerably less than the increase in lending after the global financial crisis. In the case of some MDBs, a sizeable portion of this number is accounted for by the repurposing of pre-Covid lending rather than an expansion of their total lending exposure.’“

Apart from the modest level of new lending, debt relief measures have been derisory. The Debt Service Suspension Initiative (DSSI) that has now been extended to the end of 2021 has delivered, according to the World Bank, no more than $5 billion in relief to 40 eligible countries.

As I argue in Shutdown, the DSSI is indicative not so much of generosity as of a comprehensive failure to grasp the scale of the damage and the scale of need. It is a suspension initiative only i.e. it reduces payments now and increases them later. With regard to the net present value of the loans to the creditors, it is neutral. It was up to countries to request relief. Ratings agencies have made clear that even the whisper of the possibility of an appeal to DSSI would trigger a downgrade.

Crucially, the DSSI did not include the big multilateral lenders. The debt relief effort for low-income countries did not include the World Bank, the preeminent multilateral lender to low-income countries. The World Bank supports implementation but does not itself offer concessions under the initiative.

Why did the World Bank not participate?

One of the main reasons given, is that the World Bank fears that if it made substantial concessions to struggling low-income debtors, it would not only be the debtors, but the World Bank itself that would suffered a downgrade by the ratings agencies.

Yes, you read that right. The World Bank fears losing its AAA-rating! If you are doubting your eyes, I recommend this excellent piece published by the debt NGO CADTM.

What? How? The shareholders of the World Bank are all the largest and most powerful countries in the world. How could it go bankrupt? Why does it even have a credit-rating?

The World Bank is not actually going to “run out of money”. But the World Bank chooses to operate as though it will. And it is reinforced in that tendency by its reliance on international capital markets for funding.

The bank basically understands itself as an intermediary, issuing bonds at better rates than developing countries can do and then passing the proceeds on to low-income borrowers at concessional rates. The AAA rating has, therefore, come to be seen as core to its business model. It needs to have the highest bond rating possible to be able to offer the best terms. And it can on lend the fund to far less creditworthy borrowers because it enjoys preferred creditor status i.e. the fact that the countries it lends to are required to place it first in the line of creditors.

Any concessions it made as part of a debt service suspension initiative would jeopardize both the quality of its loan book and its precious preferred creditor status. It might be taken second place to another lender.

In the context of the COVID crisis one obvious question to ask, is why the World Bank did not call on its shareholders to underwrite any losses it suffered as a result of concessions on debt, by injecting new capital. The IMF operated a donor-backed Catastrophe Containment and Relief Trust. This was the question posed by CGDEV.

But at a more fundamental level, why is the World Bank even subject to the judgement of ratings agencies? It is a Bretton Woods institution, backed by governments around the world. It is not going to default or go bankrupt. Why are the ratings agencies even called up on to rate its debt?

As Scott Morris a leading American expert commented.

Agree that default by any major multilateral development bank is a fantasy. A measure of existing support from major govts in the face of any stresses: nearly $1 trillion in "callable" capital commitments, none of which has ever been called.

— Scott Morris (@Morris_ScottA) September 7, 2021

Others chimed in, Alan Beattie of the FT remarked that

Long time since I covered this but I think it's a fear that the US Congress would go totally mental if they thought they were funding an institution taking risks with its credit rating.

— Alan Beattie (@alanbeattie) September 7, 2021

IIRC we went through this before when the Bank and Fund (which doesn't have a credit rating obvs) were worried that HIPC was going to damage its creditworthiness. Big fight over the IMF selling off some of its gold holdings to pay for the relief.

— Alan Beattie (@alanbeattie) September 7, 2021

The World Bank could conceivable suffer a cash flow problem though it is very hard to envision how that would happen in practice. Were a national shareholder to default on its obligations another would surely jump in.

Voting rights in the World Bank are delicately balanced. The US commands the largest share and also on that basis jealously guards its “right” to nominate the World Bank President (the Europeans claim the top job at the IMF). With good reason the US is regarded as one of the less reliable backers of global institutions. But if the US, for whatever reason, withdrew or failed to honor its obligations, does anyone doubt that other powers would step up to claim its share?

So let us reconstruct this Alice in Wonderland situation:

The World Bank is set up as a global public development bank. It is backed by major nation states as shareholders. In those nation-state shareholders – particularly in the US – the pervasive influence of the free market model dictates that the World Bank be imagined as operating like a private bank. And that vision seems to be shared inside the bank itself. The bank issues bonds to fund its lending. That means that the bank subjects itself to the ratings agency and they exercise a whip-hand over whether or not it maintains its AAA rating. That in turn constricts its ability to lend to risky borrowers i.e. low-income countries and to make concessions to them when necessary. What is supposedly a development bank is thereby morphed into something rather different

For better or worse, keeping donor/private sector confidence has to be a top WB priority. A default would totally seize up the IFC's blended finance work… But then again a drop to AA+ (where the US government is) or AA- (where Berkshire Hathaway is) wouldn't imperil anything.

— Stephen Paduano (@StephenPaduano) September 7, 2021

As 2020 demonstrates this is not merely a technical matter. It has material effects.

As an article by Leslie Maasdorp, Vice-president and chief financial officer of the New Development Bank, in the FT noted this week:

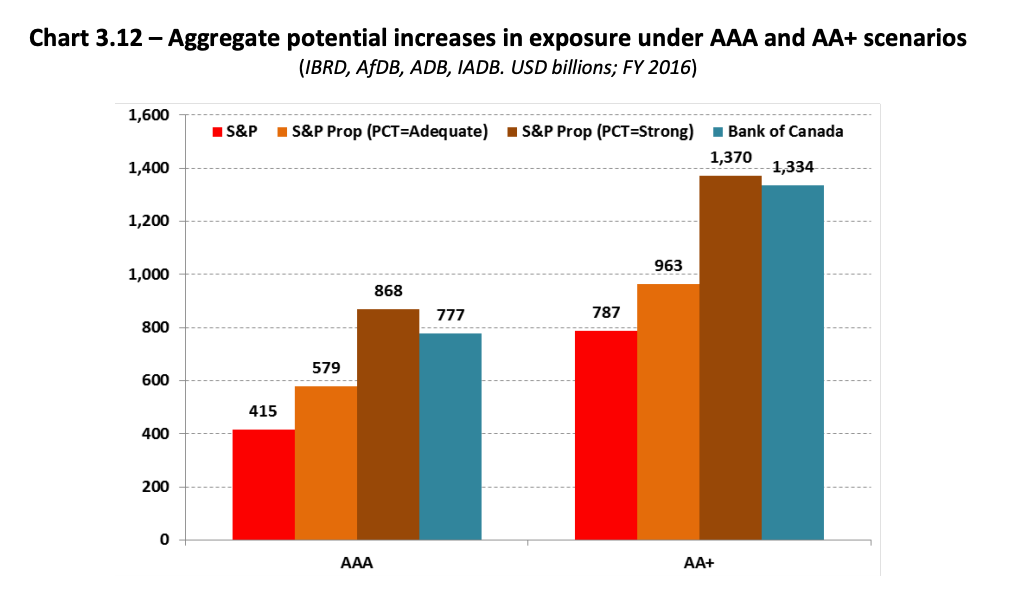

“A 2019 study by Riccardo Settimo of the Bank of Italy concluded that four MDBs — the World Bank, Asian Development Bank, Inter-American Development Bank and African Development Bank — could more than triple their spare lending capacity from $415bn to $1.3tn if they moderately increased their leverage ratio and opted for a AA+ credit rating instead.”

Settimo’s paper is a truly fascinating insight into the way in which ratings agencies seek to process the peculiar reality of multilateral development banks in numerical terms and evaluate the risks. Technical, but fascinating.

What is to be done about this situation? This week in the FT, Maasdorp of the New Development Bank made a cogent and powerful case for change. As he explained:

“In 2015 the BRICS countries (Brazil, Russia, India, China and South Africa) established the New Development Bank. It was strongly encouraged to revert to first principles, to question the conventional wisdoms and established practices of development finance. In 2015 KV Kamath, the bank’s first president, questioned the benefits of a AAA credit rating for development banks given the considerable costs in terms of the levels of capital required, low leverage ratios and ultra-conservative risk limits.”

As the writer goes on:

“The experience of the New Development Bank (AA+ rated) in the international capital markets has demonstrated that there is a negligible difference of between 10 to 15 basis points in the funding cost of a AA+ institution compared with a AAA one.“

Further support came in 2017 from the G20. It appointed an eminent persons group (EPG) led by former deputy prime minister of Singapore, Tharman Shanmugaratnam to recommend reforms to the global financial architecture.

The list of names in these groups is fascinating in its own right:

The group made wide-ranging suggestions, amongst which were the reassessment of the “regulatory capital and other prudential norms for the multilateral development banks (MDBs)”. The group’s report specifically called for the “establishment of tailor-made capital and liquidity frameworks for the MDBs”. Though couched in bureaucratese this is an indication that current current capital adequacy policies of MDBs are too conservative.

“Currently, the regulatory capital and liquidity standards and rating methodologies applied to MDBs are adapted from those developed for commercial banks and do not sufficiently reflect their distinctive shareholding structures, preferred creditor status and default experience. The different rating agencies also adopt varying methodologies for the MDBs. As a consequence, the MDBs each have different adaptations and capital and liquidity buffers. The larger the buffers, the more constrained the MDBs will be in their financial capacity.”

Where do you go if you want to change a situation like this? The G20 committee recommends approaching the Basel Committee, which sets global banking standards:

“An independent review by the Basel Committee and the development of a tailor-made regulatory framework would promote the adoption of harmonized capital and liquidity approaches across the system, and provide a basis for rating agencies to also review their rating methodologies for MDBs. The aim is for MDBs and rating agencies to more accurately quantify the risk taken on by the MDBs and so determine the appropriate capital and liquidity requirements. Should some balance sheet capacity be freed up, this can be deployed to take on risk. The issues that could be addressed include:

• Taking into account the key elements that differentiate MDB operating models from commercial banks, including the recognition of preferred creditor treatment, callable capital and concentration risk.35

• Actual default experience across the MDBs.

• The treatment of credit guarantees/enhancement and insurance as compared to more traditional loan instruments should be risk and evidence-based.”

It is worth lingering over the implications of this: The World Bank, commonly thought of as an institution at the very top of the monetary hierarchy, co-owned by all the most powerful nations in the world, applies to the Basel banking committee to have them “independently” assess what guidelines should be issued to the ratings agencies for purposes of rating the World Bank. The circularity and the entanglement of public and private power is dizzying.

Where is sovereignty? Where is the power that declares the exception? The power that says: “NO the World Bank is not like other banks. The rules for this very different kind of bank are as follows!”

For me, the most jaw-dropping passage in the report comes at this point:

“The MDBs also currently do not have access to any support facility in case of extreme liquidity stress and are treated by the rating agencies as such. As a result, they are holding more liquidity (excessive self-insurance) and/or pay a higher cost of capital (the rating agencies treat the MDBs as financial institutions without access to liquidity backstops) than needed if the MDBs were viewed as a system.36 As part of their approach to the Basel Committee on the establishment of a regulatory framework for the MDBs, they should also seek guidance on the appropriateness of a liquidity back-stop. From time to time, the system as a whole should be stress-tested with a view to strengthening its overall resilience, and better understanding resource needs both in normal times and in crisis.”

In other words, the World Bank does not have a lender of last resort.

Not much was done in response to the publication of the report in 2018. But as Maasdorp notes,

“recently the idea has been given renewed momentum. In July the G20, under the Italian presidency, announced an independent review of the capital adequacy frameworks of multilateral development banks. This may appear to be a narrowly technical exercise, but it could result in a rewriting of the rule book as it applies to MDBs. While he is at the helm of the G20, Italian prime minister Mario Draghi can leave a lasting legacy by invoking the same “whatever it takes” spirit he showed in dealing with the eurozone crisis when he was president of the European Central Bank.”

This for me is a striking example of both the necessity and the limits of expert politics. Clearly we need to understand in detail the mechanisms that constrain and guide the functioning of institutions like the World Bank, to gauge their scope for action in alleviating global crises. It is when we understand those mechanisms that we may also be able to unlock significant unused potential. But, at some point, there also needs to be an intervention that amounts to a political decision. It is that which might change the terms of the conversation and break out of the cycle of mutually reinforcing constraints and the limitations of a model of market-based finance. It is telling that Draghi and the “whatever it takes moment” should be invoked in this context – the ideal type of technical capacity and sovereign authority in one.

Unfortunately, as the twitter exchange with Alan Beattie and Scott Morris reveals, the political constraints that are binding here run outwards. In particular, they run outwards to the US Congress and the deeply entrenched interests and prejudices of that body.

This is number #3 in the series Chartbook on Shutdown. These are posts that elaborate and deepen arguments in the book.