… deciphering cognitive dissonance.

On Wednesday National Security Advisor Jake Sullivan made the following statement:

The climate policy powerhouse that goes by the handle Albert Pinto aka @70sBachchan circulated the statement within minutes. If this newsletter causes a few folks to follow his twitter account, it will have been worthwhile. His assessment was bleak:

“RIP Climate Policy”. Depressed as I was, I would not go as far as that. But I do think that Sullivan’s interventions reflects deep and disabling tensions in the Biden administration’s climate policy. I fired off my own response to the Guardian that afternoon. Adam Tooze @adam_toozeBy pushing for more oil production, the US is killing its climate pledges | Adam Tooze By pushing for more oil production, the US is killing its climate pledges | Adam ToozeJoe Biden must use his country’s leverage to curb fossil fuels, not boost them, says professor of history Adam Toozetheguardian.comAugust 14th 2021

I was quick off the mark because I was primed. I’ve been worrying about Biden and OPEC for a while. But, before we get into this, a brief note about Chartbook.

******

I enjoy putting Chartbook together. I hope you find it interesting. I know that Chartbook is read by folks in many walks of life, all over the world. I am delighted that it goes out free to many readers.

But, assembling all this material takes a lot of work. So, if you appreciate the Chartbook content and can afford to chip-in, please consider signing up for one of the paying subscriptions. You will be supporting the mission, earning great karma and some goodies too.

There are three options:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club: $120 annually (or another amount at your discretion) – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions.

As a thank you, paying subscribers receive regular emails with links to some of the most interesting, intriguing and unusual material I come across, around the web. Check out Top Links here.

Shutdown sessions:

Following the release of Shutdown in September, subscribers will be invited, in the fall, to a series of seminars I will be hosting to discuss the book. Details tba.

**********

For the last few months, I have been worrying about OPEC price policy and the Biden administration. As the world economy recovers from COVID, oil prices have picked up. Earlier in the summer, before the Delta variant rocked expectations, there was talk of oil at $100 per barrel. OPEC has been debating its response. There had been rumors of US intervention in favor of higher production. Back on July 4, I was already fretting: Adam Tooze @adam_toozeCritical test for Biden’s climate policy. Will White House pressure OPEC to raise production and curb a rise of oil prices towards $100? ft.com/content/6f0580… July 4th 202116 Retweets39 Likes

July 4th 202116 Retweets39 Likes

Whilst walking Ruby the dog that holiday morning, I remember regaling Dana with my concern that the administration was going to flinch.

If we are in the business of decarbonization, higher prices for oil should not be bad news. Of course, if you consider the politics – and the Biden administration must – it is is more complicated. It was a significant moment in gauging the kind of risk that the administration is willing to take in pursuit of its climate goals.

Sullivan’s blunt statement confirmed the suspicion that in key regards the Biden administration is committed to a thoroughly conventional and, thus, thoroughly disastrous policy of growthmanship in pursuit of the endless promise of the “American way of life”. Affirming the responsibility of the US government to muscle OPEC for the sake of cheap gas for American consumers, is business as usual. And that is precisely the problem. It activates the wrong muscle-memory.

Jake Sullivan is not someone who is oblivious to the climate problem. But the idea to which he and his key advisors have hitched their band wagon is “foreign policy for the middle class”. In the final lines of his statement, Sullivan alludes to the need for “competitive markets”. No coincidence that at the same moment Biden’s National Economic Council has ordered FTC to look into price rigging in US petrol markets. Breaking cartels, demanding the best prices for consumers, it’s old school politics. It also reinforces old school consumption habits. It focuses on making the status quo more affordable, not on transforming it. We can no longer afford to do that. It is a recipe for disaster.

If the aim is to help folks in America on middle to low incomes, the priority should clearly be Biden’s Jobs Plan, the Families Plan and giant investment. If energy poverty is a problem, let there be targeted support for low-income households. The tragedy of the eviscerated infrastructure bill, is that until there are affordable, low carbon alternatives, the doom loop between economic growth, electoral support and climate destruction remains in place.

If your instinct is to say, well in the short-run the Biden administration needs to get through the mid-terms in 2022 , I know where you are coming from. I have made a similar tactical argument about the need to reappoint Jay Powell to the Fed despite his checkered record on climate policy. Seven major environmental groups, including the Sierra Club, disagree with me.

For me the difference between the Fed chair question and Sullivan’s statement, is that the former is a relatively indirect influence on climate policy, whereas Sullivan is directly aiding and abetting fossil fuel addiction. As much as I think central banks ought to join the climate push, they are not as important as oil markets, OPEC and Biden’s National Security policy. Fed staff will find ways to gee up Powell on the climate issue. A GOP backlash against a “green Fed chair” would be a truly unnecessary distraction in 2022. A senior member of the Biden team urging the oil oligarchs to ramp up production is a far more immediate and serious problem.

What we have to wrap our heads around is that the climate crisis is no longer a long-run issue. The oil consumption of the next twelve months will make an appreciable impact on what is left of the global carbon budget. What the IPCC, the IEA and every other report is telling us is that the distinction between the short-run and the long-run has collapsed. The movements of the business-cycle, sudden surges in energy demand and energy prices, they all matter, as does each new temperature record. If our eyes are fixed on targets in 2030, then the first two years of the Biden administration are one fifth of the time available to us. That too is a compelling imperative.

Of course, these trade offs do not apply only to the United States. Around the world this summer the news is dispiriting. The G7 couldn’t agree on an endpoint for coal. The G20 environment ministers couldn’t agree on anything. The UK is hosting COP26 in Glasgow, but its political parties are fragmented on the issues. The German Greens have fallen off their opinion poll highs and this is not simply due to the weakness of Baerbock as a candidate. Petrol prices are a big deal in Germany too.

Compared to the spring, the shift in the mood is dramatic. Earlier in the year there was as sense that fossil fuels were on the run. Shell was instructed by a Dutch court to up its targets for decarbonization. Exxon was humbled by activist shareholders. The German constitutional court lectured the German government on the need to ramp up its climate effort. The IEA, the organization created in the 1970s to represent oil consumers against OPEC, came out with an aggressive net zero scenario.

In a matter of months the mood has shifted dramatically.

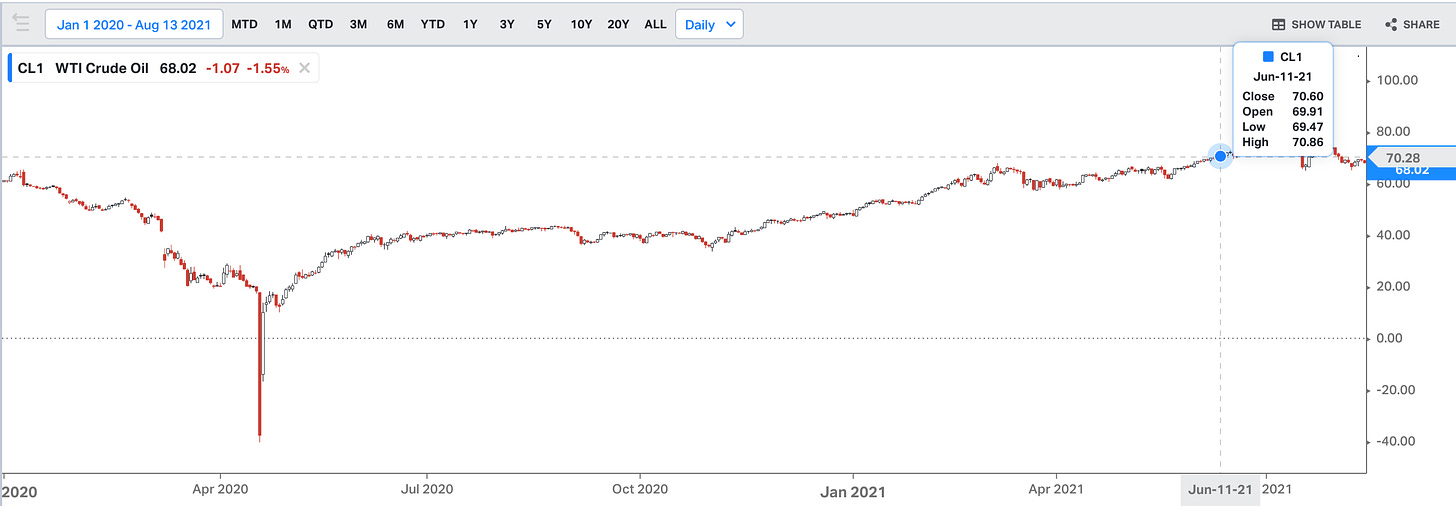

My worry is that this reflects not just the shifting winds of politics, but also the economic cycle and the movement of energy prices. When the economy is slowing and demand is collapsing, the fossil fuel industry has little bargaining power. Low prices squeeze profits. The game changes when the business-cycle picks up. Back in May, smart oil market folks on twitter were expressing their disbelief that Green campaigners could be celebrating given what was happening in the markets. After the horrible shock of 2020, oil was clawing its way back towards $70, there was talk of $100 within the next 12 months.

Source: Koyfin

I tried to capture that ambiguity in a Foreign Policy piece in early June. EXXON’s management was no doubt having a bad time, but the industry itself was bouncing back.

The IEA, which with one face was saying that we need to end new development of fossil fuel projects immediately, was, with another face, saying we need to raise production.Adam Tooze @adam_toozeCognitive Dissonance 2021: To hit net zero, even @IEA says: we have to end all new oil development NOW Faced with Econ recovery, same @IEA calls for “taps open” -> @FTLex worries that oil majors not investing ENOUGH! One for @70sBachchan @HelenHet20 ft.com/content/d728b9… June 29th 202125 Retweets75 Likes

June 29th 202125 Retweets75 Likes

Whereas Shell was under pressure to speed up its decarbonization timeline, Saudi Aramco, the world’s largest oil producer by far, announced that it was planning not just a temporary increase in output, but major investment in new capacity to raise its production to 13 million barrels a day. As an Aramco spokesman remarked: “Seeing that there is a lot of under-investment in [oil] supply it’s a great opportunity for us. We are diligently working to increase capacity.”

Meanwhile, in 2021 US shale producers are biding their time. One of reasons that global oil prices are going up, is that unlike in previous cycles the American shale firms have not plunged into capacity expansion. For once, Wall Street is demanding some of its cash back and they are delivering dividends.

Nor is this only happening in oil. David Sheppard in the FT has pointed to the same dynamic in the gas industry. Faced with a deluge of climate talk, there is something akin to a capital strike in oil and gas. With inelastic supply, facing surging demand, we must prepare for rising prices.

The knee jerk response is the one we have seen from the Biden administration. Increase production to relieve the pressure on consumers. That is to reinforce the fossil fuel status quo.

None of this is to say that for the US to be talking to OPEC is a bad thing. On the contrary, it is essential. But what we need to be talking about is not lowering prices ahead of the midterms, but the low carbon future. Kate Aronoff in the New Republic has even suggested, somewhat tongue in cheek, that the US should join OPEC. It could serve as a useful forum to coordinate policy.

As folks like Michael Dobson have pointed out, it is possible that major players in OPEC, chief amongst them Saudi Arabia, might be won over as partners in global decarbonization. Their long run future as oil and gas producers is, in fact, fairly secure According to predictions by agencies such as the IEA, it will be the powerful Gulf oil and gas suppliers who will still be in the oil and gas business, even in a net zero scenario.

To understand how that works, the key is the “net” in “net zero”. Most scenarios for decarbonization assume that we will deploy substantial capacity for carbon capture and storage (a technology still in its infancy). That will enable us to continue a minimum level of oil and gas consumption even at net zero, for things like air travel and long-range ocean cargo shipping. The suppliers of choice will be the low-cost high-quality producers in the Gulf.

The only thing that will guarantee that we get to that point, however, is if the main consumer economies – China, US, EU – can organize a systematic and sustained repression of demand. That is the side of the equation that climate policy can control. The question to be discussed with OPEC is how hard the producers may seek to push back against this rundown of their industry, for instance, with aggressive pricing and production strategies.

It is not just a simple problem of maximization. It is a field in which the optimal strategy for each player on both the demand and supply side depends on the strategies adopted by all the others. It is a field, therefore, for diplomacy. Crucial in any such game is the question of commitment, which is why Sullivan’s intervention is so dismaying. Watching Biden’s National Security Advisor in action who could be blamed for betting against the credibility of decarbonization? The message it sends is that the party supposedly committed to decarbonization will flinch at the slightest sign of pressure. Instead, the US should be deploying its unique heft as a geopolitical actor, as a giant energy market and an energy producer in the opposite direction.

It is not enough to send John Kerry to COP26 and meetings of environment ministers. A United States that aspired to be a true leader on the climate issue would pursue a climate diplomacy that incorporates and subsumes the entire field of geopolitics and energy.

Jason Bordoff, ex of the Obama administration and now my colleague at Columbia has argued for taking a holistic view on energy policy. In a far more radical way, Kate Aronoff’s OPEC essay pushes in this direction. The advocates of the Global Green New Deal argue along the same lines, as described in this excellent review by Quinn Slobodian. A while back, I had this piece in Foreign Policy.

Not that negotiating a global green energy strategy with OPEC is a simple proposition.

The Gulf oil producers may have a long-term future, but they have a precarious domestic balance to strike. They have huge public spending to fund, lifestyles to maintain and investments they need to make in diversification. Even amongst the Gulf oil producers, divisions have emerged over production and price policy. UAE, normally a loyal follower of Saudi, arguably America’s most active ally in the region, favors a strategy of flat-out production to maximize revenue before global demand collapses. It risked a clash with Saudi over this issue. When Sullivan argues for more production, he is, I think, taking the UAEs side. This stuff is very opaque. Others may know better.

Amongst the Gulf producers, Saudi, UAE and Kuwait are the most privileged. OPEC also has many members who are far more stretched in budgetary terms. Iraq is a case in point. It needs to maximize revenue, simply to pay salaries to civil servants.

OPEC also has members that are both poor and high-cost producers – Nigeria and Angola, for instance. They are extremely vulnerable to a decarbonization push that shrinks investment and picks off the highest cost producers. It is the elite not the broader population that has benefited from oil in both those economies, so the politics go to the very heart of power and privilege. As Nick Mulder and I argued back in 2020, a top priority should be to offer adequately funded off ramps for these producers. The same goes for Venezuela and Ecuador.

In his statement, Sullivan alluded to OPEC+. The plus sign is Russia, potentially the greatest obstacle to comprehensive decarbonization – a nuclear superpower, which is heavily dependent on oil and gas. It is also a country that is immediately and severely affected by climate change. Putin has expressed concern, but at the moment even the readers of Kommersant are by no means convinced of the urgency of the issue. In 2019 16.5% thought climate change would benefit Russia. 18% thought it was a problem for the distant future. 24.7 % thought it was fabricated. Only 41% considered it an immediate and serious threat. More recent data gathered by Andrei Semenov confirm the impression that there is no powerful constituency in Russia for aggressive action on decarbonization, other than for investment in renewables.

And then there is the United States itself. Since the early 2010s, the great swing variable in the global energy market has been US shale. The risk facing OPEC and Russia if they push for a high price strategy is that this draws more shale producers into the market. It was to deal a death blow to shale that Russia in March 2020 pushed for an all out price war helping to precipitate not just the oil price slump, but the broader financial turmoil of that month. It was to redress the collapse in the market and rescue shale, that Trump breached a taboo and entered into direct negotiations with OPEC+ about restricting output.

Yes, you read that right. Last year it was the Trump administration that bullied OPEC into restricting production so as to raise prices so as to save America’s oil producers. Now it is the Biden administration, supposedly committed to climate, that is bullying OPEC into raising production to reduce prices so that American consumers can afford more petrol.

It was also the Obama administration in 2015, only days after it celebrated the Paris climate accord, that lifted the decades-old ban on the export of US oil, thus bringing US production fully into play in world markets. The Obama administration touted US shale gas, as a triple win: for the US economy, for the climate (because gas is lower carbon than either coal or oil) and for democracy (because American gas, unlike Russian gas is made of “molecules of freedom”).

There are countries in the world that can make the case that fossil fuel exports are essential to their economic and social development. The United States is not one of them. If Green industrial policy is popular right now in Washington, the counterpart should be ending support for fossil fuel exports. Kate Aronoff and David Adler argued back in 2019 for reimposing the oil export ban. That makes perfect sense, but it would hand a huge win to Russia and OPEC, for which the US would need to extract major concessions. And it seems unthinkable in political terms. It would presumably scupper any chances the Democrats might have in Texas. If an outright ban is impractical, at the very least support in all other forms for US fossil fuel exports, should be wound down, as quickly as possible.

The difficulty of reversing the decision in 2015 to turn the US into an energy exporters, demonstrates the ratchet effects that operates in fossil fuel political economy. Sullivan’s intervention this week is further evidence of how hard it is to reverse that structural dependence.

And let us be clear, that is what we need to do. If climate is merely an “add on”, a vote winning issue for the College-educated. If it is not repositioned at the core of the agenda, as a “middle class” issue – in Biden-speak – the outlook for US climate policy is grim.