Deciphering the trans-Atlantic divergence over climate policy.

Whilst Trump held the White House, the question of trans-Atlantic climate diplomacy did not arise. The advent of the Biden administration has brought the United States back into the Paris climate agreement. The White House insists that climate is “everywhere” in its program. This is welcome. But, after initial excitement the Biden program has stalled. At home, the wrangling over the infrastructure program has slowed progress . The stand-off with China leaves Washington with no leverage over the largest polluter. At the G20 meeting of environment ministers, John Kerry was a prominent presence, but there was no deal. Even with the Europeans, who might be thought of as climate allies, big differences have emerged. So much so that we are hearing talk of a trans-Atlantic carbon trade war. That would be a disaster.

In this long read for Foreign Policy I tried to take stock:

The issue at stake is rather technical – carbon pricing and how it should be reflected in so-called carbon border adjustments. But it has much wider implications. It is yet another reflection of trans Atlantic difference in the politics of economic government.

In this newsletter I want to dig deeper into the thinking that may be informing the American position.

Before we get into that, a brief note about Chartbook.

******

I enjoy putting Chartbook together. I hope you find it interesting. I know that Chartbook is read by folks in many walks of life, all over the world. I am delighted that it goes out free to readers.

But, assembling all this material takes a lot of work. So, if you appreciate the Chartbook content and can afford to chip-in, please consider signing up for one of the paying subscriptions. You will be supporting the mission, earning great karma and some goodies too.

There are three options:

- The annual subscription: $50 annually

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club: $120 annually (or another amount at your discretion) – for those who really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions.

As a thank you, paying subscribers receive regular emails with links to some of the most interesting, intriguing and unusual material I come across, around the web. Check out Top Links here.

Shutdown sessions:

Following the release of Shutdown in September, subscribers will be invited, in the fall, to a series of seminars I will be hosting to discuss the book. Details tba.

In the mean time, a very big “thank you” to all those who have given their support to Chartbook. I am very excited about the future of the project.

**********

Back to business.

First some basics. Carbon pricing is the economists’ preferred weapon to address the climate crisis. Two methods are proposed: (1) tax or (2) “cap and trade”.

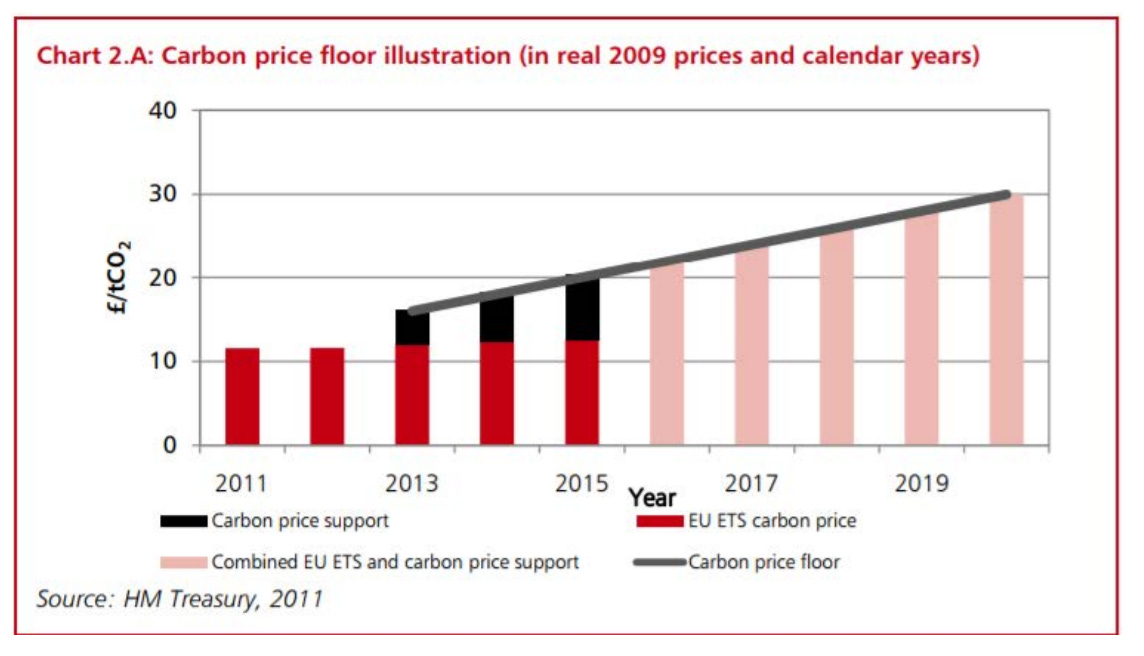

Carbon taxes curb emissions by raising their price. The logic is simple and the problems are obvious. Taxes are unpopular. And you have to make sure to pick the right rate. If you do manage to get acceptance and get the tax right, the effect can be powerful. It is especially effective if you can fix an escalating tax rate that provides an incentive to long-term investment in emissions saving. In the UK, an adjustable tax was introduced in 2013 to establish a rising minimum price floor for carbon emissions from power generation. The foreseeable escalation of costs accelerated the rapid end of coal-burning in the UK.

Source: House of Commons Research Briefing

Cap and trade systems are more complex. The authorities issue permits for a given amount of pollution. These are auctioned off to the highest bidder and a market is created in which polluters can trade permits amongst themselves. Rather than imposing a tax the government creates a kind of currency – emissions certificates – and a market for those certificates. To many economists since the 1980s, this has looked like the best solution. Rather than imposing taxes it creates an asset and allows a market mechanism to determine who is willing to pay to continue polluting. The absolute level of pollution is capped and can be progressively adjusted downwards. It is, however, hedged with problems, which will occupy us for much of this newsletter.

Above all if the aim of the game in adopting cap and trade is to avoid the painful politics of taxation, cap and trade more often than not proves to be a dead end. Rather than deciding on the tax rate you have to decide on the quantity of permits. If you dodge that question and issue them for free, the system becomes an absurd and counterproductive shell game. It discredits the entire model.

For all the problems, in one form or another, the vast majority of economists support carbon pricing. In January 2019 in the largest public petition by economists ever organized, 3623 American economists put their names to an appeal published in the Wall Street Journal. The list included 4 former Chairs of the Federal Reserve, 28 Nobel Laureates and 14 former chairs of the Council of Economic Advisers. The idea receives support from conservatives. It was under George H.W. Bush’s administration that the idea really caught on, but Joe Stiglitz is amongst its most consistent and sophisticated exponents. Janet Yellen has also long been a supporter.

But what comes of these ideas in practice?

Europe has long taxed energy. In the 1990s after the first major climate conferences, the EU attempted to agree on a carbon tax, but couldn’t get the deal done. At the urging of American NGOs and key European corporate leaders, the EU opted for a cap and trade system. In political terms, a cap and system that is not a tax has the advantage that the rules of the EU do not require unanimity. Launched in 2005, the EU’s Emissions Trading System was, until China began to roll out its system in 2021, the largest in the world. But, for most of its existence to date, the EU’s Emissions Trading System (ETS) was a sad joke. Far too many permits were handed out free by national governments. Prices were prone to crashing. When they did not, polluters could earn a subsidy by selling their free certificates to other polluters. The amount of revenue collected was derisory.

However, things have begun to change. Brussels now runs the EU ETS with a much firmer hand. The supply of certificates has tightened. In electricity generation all permits are auctioned and prices have surged to an appreciable 50 euros per ton of emissions. This will end coal-fired power generation whether the Poles like it or not.

The US, by contrast, has never taxed energy heavily. In the 1990s Clinton’s effort to pass a carbon tax failed. In 2009-2010 Congressional opposition defeated the Obama administration’s somewhat lack luster effort at cap and trade. Al Gore’s Inconvenient Truth may have been a global hit, but even with elaborate preparation there simply were not the votes. As a result, the Green New Deal proposed by the climate left dropped any mention of carbon pricing in favor of investment and regulation. The Biden administration has continued in that vein. Robinson Meyer of The Atlantic recently published an obituary for carbon taxes in the US.

The result is a stand off, in which the EU is the eager student that drank the Kool-Aid of 1990s market economics, whereas the US are the hard-bitten pragmatists hoping to do whatever they can. There are echoes of 2008 and the Eurozone crisis.

Or course, the two approaches could and should coexist side by side. But a serious push towards decarbonization, however you do it, involves up-front costs. To avoid outsourcing and undercutting from imported high-carbon competition, national efforts have to be shielded by carbon border adjustments – tariffs on high carbon imports – and it is over those that the EU and the US are at odds. That was the trigger for the FP piece, in which I attempt to diagnose the conflict and bring together some ideas as to how trans-Atlantic climate politics might be given a more positive direction.

In this newsletter I want to dig more deeply into the question of why US environmentalists have soured on carbon pricing. It is a question with wide implications. The putative death of “neoliberalism” is one of the big questions of the day. In economic policy it is most widely discussed in relation to fiscal and monetary policy, stimulus, debt, inflation etc. The extraordinary shift against carbon pricing in Washington, whilst the American economics profession remains overwhelmingly committed to it, is further testimony to the turmoil in the American political scene.

**********

The simplest explanation for the current disenchantment with carbon pricing in Washington is political. There is no hope of any legislation passing the usual conservative opposition in Senate. But the climate left isn’t keen either. As one report remarked: “California’s first-in-the-nation program, created in 2013, has drawn charges of environmental racism from critics who say it allows industries to achieve compliance without reducing pollution in marginalized communities. Late last year, California’s top air regulator fell out of the running to lead the U.S. Environmental Protection Agency after dozens of environmental justice groups warned President Joe Biden about what they said was her “bleak track record in addressing environmental racism.”

Nor is it simply the left and the right that are skeptical. More centrist green activists are backing away as well. To my mind, the contribution which most comprehensively sums up the critique of carbon pricing that is prevalent in the US today is Danny Cullenward and David G. Victor’s timely book, Making Climate Policy Work. Their sophisticated argument, based in political science and political economy, deserves a hearing on both sides of the Atlantic.

Cullenward is an economist, lawyer and activist attached to (carbon)plan noted for critical work on carbon offset schemes. Victor (UC San Diego) is an IPCC veteran and a well-known critic of “top down” efforts at carbon regulation. He champions the kind of “bottom up” model of climate policy that triumphed in Paris in 2015.

Rather than seeking to distribute an overall global carbon budget from the top down, which triggers an acrimonious zero-sum distributional battle, the Paris agreement adopted a more minimal approach. All that national governments adhering to the Paris agreement are required to do, is to state their best offer. There is no requirement to achieve consistency and no hard enforcement mechanism. It was this “light touch” model that enabled a truly comprehensive agreement to be stitched together.

In Making Climate Policy Work, Cullenward and Victor extend the critique of over-generalized climate solutions from the plans to distribute a carbon budget across the world’s nations, to the plan to regulate all emissions by way of setting a carbon price. Cullenward and Victor show how and why such schemes systematically fail. Apart from Europe’s ETS, the two models that they discuss in depth are North American: the Western Climate Initiative (WCI) linking California and Québec, and the northeastern United States’ Regional Greenhouse Gas Initiative (RGGI).

Rather than attempting a perfect and comprehensive market solution, they propose that we should focus on devising a set of proposals for industrial policy and regulation to address each of the five major areas of pollution: power generation, industry, transport, buildings and agriculture.

Conceptually, this preference for ad hoc “bottom up” solutions is influenced by Victor’s collaboration with Chuck Sabel and the project of experimental governance that Sabel has been developing with his long-time writing partner Jonathan Zeitlin. Rather than grand schematics like a global carbon budget or a universal carbon price they focus on the need to break down big problems into smaller more manageable challenges that can be addressed by pragmatic and adaptive experimentation.

The “bottom up approach” and experimental governance both have their critics. And if Cullenward and Victor’s arguments are to gain the hearing they deserve, it is important to address those general objections first.

The knock on the “bottom up” approach is that it does not produce an adequate overall package to address the global crisis. The knock on experimental governance is that it offers a sugar-coated account of the operation of power. The result is that Cullenward and Victor’s approach is liable to be dismissed as inadequately forceful and comprehensive. Like Obama’s climate policy it is vulnerable to criticism as sophisticated liberal “greenwashing”, or even a soft form of denial.

These objections are, as far as Cullenward and Victor’s book is concerned, wide of the mark.

Clearly, the “bottom up” Paris model, which aggregates the maximum offer that every national government is willing to make, does not guarantee that the sum of all the plans will add up to an adequate global solution. That was obvious. It was also obvious that a binding, top down allocation of carbon rations would have been better. The problem is that in climate policy as in other areas of life, pigs don’t fly. The classic “top down” Kyoto model was never going to be ratified by the US, nor did it offer a framework within which the largest emitter, China, could easily be incorporated. Though it is clear that the rich countries should bear the largest cost for carbon reduction, it was by the early 2000s also clear that a decarbonization push that does not include China is pointless.

The Paris agreement was the first attempt to get a comprehensive deal. But that does not mean that the work is done. Rather the opposite. The first round of inadequate national commitments was simply the starting point. The point of the Paris agreement is not the initial deal, but the iterative process it sets in motion. Nations are required to regularly come back to the table and update their proposals, progressively raising the bar of ambition. The spirit of the Paris deal was not to argue over a finished scheme, but to generate collective movement in the right direction.

Contrary to the suggestion that this iterative and experimental approach to governance is naive about power, it was chosen precisely out of an acute awareness of the limits that the existing distribution of power and influence impose on any possible agreement. Read Cullenward and Victor between the lines and it reads like Machiavelli – as disillusioned, realistic, situated advice to a climate prince. Their critique of carbon pricing, starts precisely from where the locus of decision-making is. They seek to be realistic about what might motivate action and what might serve as a check. For that reason they actually favor carbon taxation as a simple and direct means of shifting resource allocations. Their criticism is directed towards cap and trade and the fantasy of markets.

If at Paris the crucial thing was to unleash a process by enrolling even quite conservative climate skeptics, when it comes to carbon pricing, what is striking is that Cullenward and Victor converge with the climate left. Though there is little love lost between a climate centrists like Victor and an activists of Naomi Klein’s ilk, on carbon pricing and cap and trade they agree. Cullenward and Victor deliver a devastating critique of how, rather than delivering an actual shift in resources, overblown and overhyped visions of carbon markets serve to sustain the status quo. Every leftists should read it.

Though they don’t say so in so many words, their book is a powerful critique of the neoliberal ideology that has sustained the carbon market idea in the North Atlantic. Indeed, it is an exercise in critical political economy, charting how interest groups mobilize around carbon pricing schemes to render them ineffective or even counterproductive. The idea of carbon trading as an idea is favored by “academic and policy elites”, Cullenward and Victor argue. They may be well-intentioned but in practice their support for cap and trade serves to uphold the disastrous status quo.

In a great turn of phrase they describe cap and trade carbon markets as “Potemkin markets” – arrangements that look like markets but in fact fail to exercise any meaningful discipline. That is certainly an excellent way to describe how the EU system operated until recently.

But, as fitting as the term may be, to talk of “Potemkin markets”, in fact sells their argument short. Cullenward and Victor’s claim is not merely that carbon pricing schemes hide a more modest reality – as in the facade of a Potemkin village. In their view the idea of comprehensive carbon pricing is a dangerous fantasy, a mirage – a shimmering, promising illusion on the far horizon that lures desperate traveler to their doom. Ideology, one might say, functions not just by deceiving, but playing on and engendering desire. Cap and trade markets are a cute idea. And there is a certain sort of economist – in general, one should avoid generalizing about a gigantic and complex profession – but there is a certain sort of economist that cannot resist a cute idea, a gimmick, a clever incentive scheme, a device, a mechanism. Cap and trade is that kind of idea.

As Cullenward and Victor show, it is not just clever economists who are attracted to carbon pricing. There is nothing in the recent Greenpeace exposé of Exxon’s lobbyists – revealing that Exxon backed carbon pricing because it knew it would never get enacted – that would surprise you after reading Cullenward and Victor.

Carbon market proposals fail to work systematically because interest groups manipulate them. They also fail because the very idea is a simplistic fantasy. When Cullenward and Victor talk of cap and trade markets as “visions”, one is reminded of Karl Polanyi’s famous critique of 19th-century classical economics not as a realistic description of the world, but as a draconian project of remaking that world in its simplified image. Except that cap and trade markets are not draconian. They are not so much high modernist brutalism as pleasing escapists fantasies. As Cullenward and Victor forcefully put it, there is, in fact, no such thing as “the” market. What there are are distinct sectors each with its own specific logic, each with its particular pattern of fossil fuel use. Rather than attempting to create a single overarching carbon price, what we need, to drive decarbonization are a series of precise interventions, each following the logic of a particular sector.

But if the Cullenward and Victor critique demolishes the promise of carbon markets as a general purpose solution, their critique has a sting in its tail. The rejection of “one size fits all”, extends to the critique of “one size fits all” itself. If the idea of introducing a general carbon pricing model in the United States is a dangerous mirage, it does not follow that carbon pricing in particular industries – notably electricity generation – is a bad idea, even in the US. And the fact that a general pricing scheme has no prospects in the United States, does not imply that it will not work in other places. Sometimes an airy confection actually materializes in the form of a brittle, but nevertheless real and delicious meringue.

Which brings us back to the trans-Atlantic dispute. Cullenward and Victor are duly critical of the failed early stages of the EU’s ETS. They also alert to the risks of extending the carbon pricing model to new areas – motor vehicles and domestic fuels – as the Commission proposes. But they recognize that in the EU, carbon pricing has a unique and propitious political backdrop. They also recognize the institutional learning that is owed to the decade-long engagement by the EU’s institutions. Measures such as the Market Stability Reserve introduced in 2019, which drain excess certificates from the system, exercise a steadying upward pressure on prices. The system can be made to work much better. It was in that spirit that I argued in Social Europe the summer of 2020 for a tactical doubling-down on the ETS system. It was also in that spirit that I offered by my critique of the exploitation of false memories of the Gilets Jaunes, in Chartbook #27.

The EU’s carbon pricing strategy is a work in progress. The current plans pose very real distributional concerns. Serious questions have been raised about whether the proposed social funds is large enough. But whatever the ultimate policy chosen, it is crucial that policy learning not be based on unhelpfully simplified and tendentious constructions and boogeymen. If iterative learning is how we improve policy, we must guard against a cycle of “Garbage in. Garbage out”.

Overall one might describe Cullenward and Victor’s approach as one of liberal pluralism – against top down carbon budgeting, against over grandiose carbon pricing, in favor of ad hoc, differentiated, iterative, variegated, specific, evidence- and expertise-based problem-solving. This is one way, at least, to rationalize the mood of the moment amongst advocates of climate policy in Washington in 2021. But it could also form the intellectual rationalization for a trans-Atlantic détente. After all, one should not simplify the trans-Atlantic gap. The American criticisms of simplistic carbon taxing and pricing models are shared by Green activists in Europe as well. See, for instance, this comment and this in-depth report from the Boell Foundation, the party foundation of the German Greens. The EU’s ETS, is not the be all and end all of European climate policy.

But one might also spin Cullenward and Victor’s disillusioned critique of carbon pricing in a different direction. If the main driver of decarbonization has to be industrial policy and regulation, then we urgently need to turn to the question of political economy and not political economy in the abstract, but sectoral political economies. If the question is how to move five key sectors that drive emissions – power generation, transport, industry, buildings and agriculture – in the right direction, then the first thing we need is to understand how they work. Only then can we decide what incentives, what innovation, what muscle is necessary to drive the shift. And figuring that out is not as obvious as you might think.

In the last few days I have been fighting my way through Andreas Malm and the Zetkin collective’s sprawling opus White Skin, Black Fuel. Its politics – a self-consciously militant, Fanonian Marxism – contrasts sharply with Cullenward and Victor’s. Malm and co are to the left of Naomi Klein. But allowing for differences in terminology I see no reason why Cullenward and Victor’s political economy could not be translated into their conceptual framework. Put in the terms of Malm and Co, Cullenward and Victor’s goal is a strategic approach to capitalist climate governance whose basic aim is to uncouple the links that tie “fossil capital in general”, to the particular interests of the primary extractive sectors – coal, oil and gas.

In fact in musing on these parallels, I can’t help being struck by the intertwined intellectual genealogies. In their monumental effort, Malm and his co-authors productively reanimate Marxist state theory of the 1970s and 1980s, notably Poulantzas and Stuart Hall. I suspect that one of the models for their book is Policing the Crisis. Cullenward and Victor for their part draw on a lineage that also goes back to the 1980s, namely Chuck Sabel and Jonathan Zeitlin’s work on flexible specialization and alternatives to mass production. The two crossed paths and were entangled in the intellectual milieu of Eurocommunism and the social and economic realities of central and Northern Italy. And for a teenager coming of age in 1980s Britain, like yours truly, both were captured in various ways in the pages of Marxism Today and the Financial Times. Not by accident, one of the first pieces I published was a review of a collection edited by Sabel and Zeitlin. It was a crucial backdrop to my collaboration with Cristiano Ristuccia on the history of machine tools and our intersection with the work of David Edgerton on the history of production. More on this to follow.

Though this is a rather academic note to end on, the point, I think, is a deep one. What is exposed in the debates about decarbonization is ultimately the question of what actually drives the accumulation of capital, what makes the economy go, what the productive machinery actually is. That is what is being exposed in real time, in arguments over carbon pricing v. industrial policy etc.