You are invited to join the supporters of Chartbook Newsletter.

Chartbook is a blast to write. But it is quite time-consuming. To see where it should fit in my portfolio of other activities, I am launching a paid subscription model.

Don’t panic. If you like the newsletter but can’t afford a paid subscription, I get it. You don’t have to do anything. You will continue to receive Chartbook, as before. But, if you can afford it, if you think the content is valuable, if you would like to support the mission, or simply buy me the equivalent of a cup of coffee once a month, there are three options:

- The annual subscription: $50

- The standard monthly subscription: $5 monthly – which gives you a bit more flexibility.

- Founders club: If you really love Chartbook Newsletter, or read it in a professional setting in which you regularly pay for subscriptions, please consider signing up for the Founders Club with a recommended contribution of $120 annually, or another amount at your discretion. Good karma guaranteed.

To support the project please click here:

One of the remarkable things about China under the rule of the Communist Party is its aversion to inflation. Since 2020 the regime has been making a point of emphasizing its resistance to Western-style monetary experimentation. Fascinating background is provided by Isabella Weber’s timely book about China’s price reform discussion of the 1980s.

Weber argues that the stability of the CCP regime today owes much to the rejection of shock therapy a la Russe, urged on it by Western and East European advisors in the 1980s. Instead China opted for a gradualist program of price liberalization combined with the crackdown of 1989. This more cautious and ultimately far more successful approach was justified in the eyes of CCP experts by concerns about inflation. And that in turn owed much to the lessons learned by the Communists during the period of World War II and the civil war. One of the main forces enabling the CCP’s overthrow of Chiang Kai-shek in 1949 was the economic disaster suffered by the Nationalist regime. The Communists were swept to power on a tidal wave of dissatisfaction over a ruinous hyperinflation.

Given the focus of Western historical memory of World War II on either Europe (D-Day, Italy, Eastern Front) or the Pacific, it is easy to forget how dramatic was the military struggle between China, led by the nationalist regime, and Japan between 1937 and 1945, followed by the Chinese civil war between Nationalist and Communist forces that followed between 1946 and 1949. The work of Rana Mitter and Hans van de Ven is an essential corrective. Accounting for casualties is imprecise, but if we reckon with 25 million Soviet casualties in World War II, the figure for China is likely somewhere between 15 and 20 million. As well as intense combat and scorched earth counterinsurgency perpetrated by the Japanese, a large part of that giant death toll is due to famine, disease and environmental disaster. Large parts of China suffered a comprehensive economic and social crisis. And, as is normally the case in market or semi-market societies, comprehensive societal dislocation goes hand in hand with monetary disorder. Think Europe during the 17th century. Think Hobbes, “No arts; no letters; no society; and which is worst of all, continual fear and danger of violent death; and the life of man, solitary, poor, nasty, brutish, and short.”

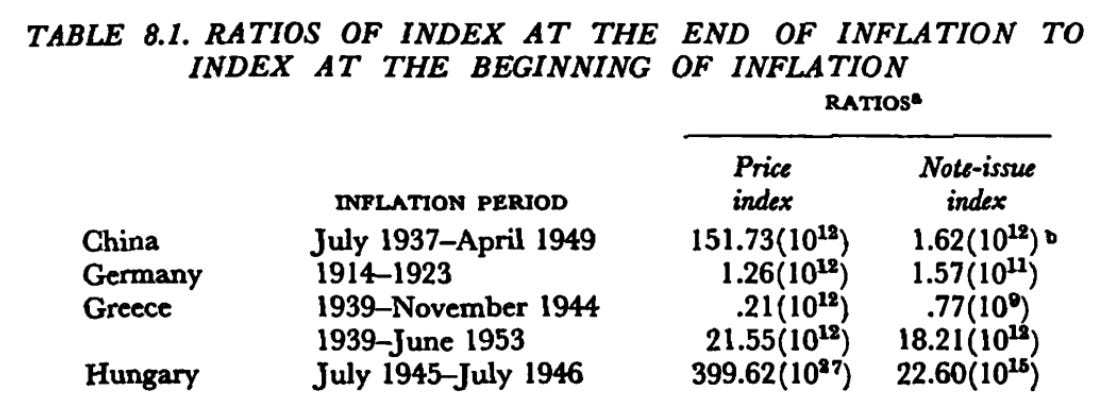

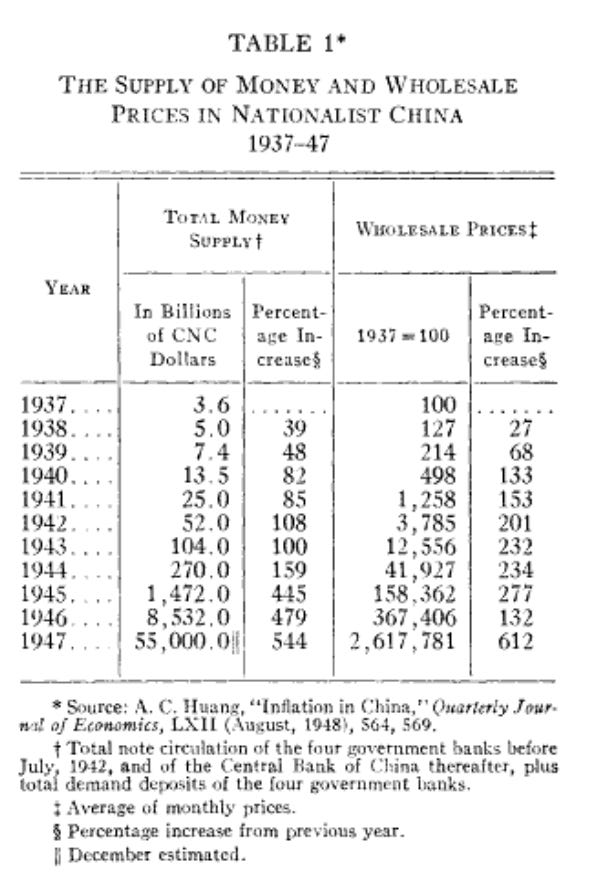

Between 1937 and the collapse of the nationalist regime in the spring of 1949 China experienced an inflationary surge that is amongst the worst ever recorded.

Source: Chang, The inflationary spiral ; the experience in China, 1939-1950, (1958)

As measured by the final price index, it was one hundred times worse than that of the Weimar Republic in 1923. Of course, once we are talking about astronomic numbers a factor of a hundred hardly weighs in the balance, but what China experienced was indisputably one of the very worst hyperinflations on record.

There is, as far as I can tell , no recent treatment of the Chinese inflation. Certainly nothing to compare with the work on the Weimar Republic, though the crisis would clearly merit a history on the scale of Gerald Feldman’s biblical The Great Disorder. For this piece I consulted a variety of sources including Chou, Shun-hsin. The Chinese inflation, 1937-1949, Campbell and Tullock’s essay of 1953 and Arthur N. Young China’s wartime finance and inflation, 1937-1945. By far the most useful was Chang Kia-Ngau, The inflationary spiral: the experience of China, 1939-1950 (New York: John Wiley & Sons, 1958). Unless otherwise stated, Chang 1958 is the source of the charts in this post.

In light of recent debates about inflation, this literature from the 1950s and 1960s would merit closer attention. It combines an interesting blend of macroeconomic, macrofinancial and supply-side stories. To my mind at least it adds up to a quite satisfactory synthesis.

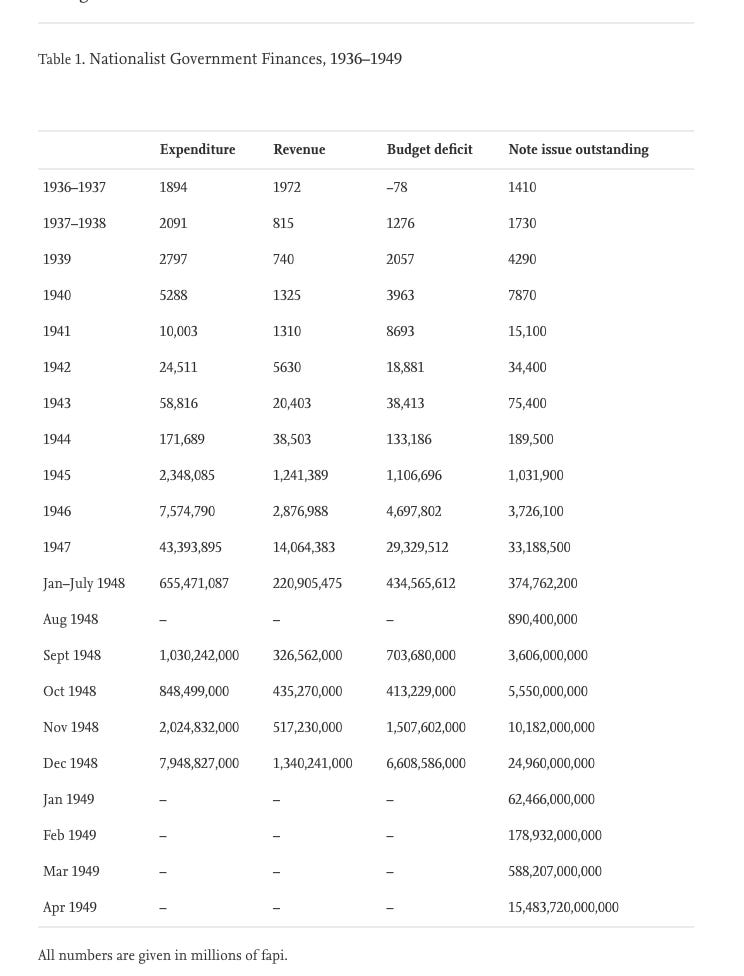

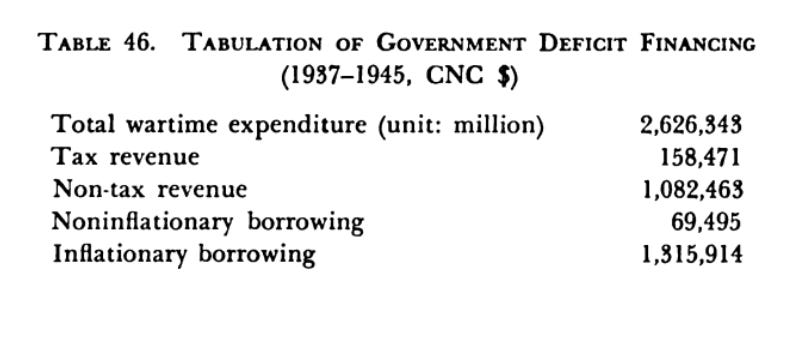

At a first approximation, China’s hyperinflation was the result of the imbalance between the demands of wartime mobilization and the limited ability of the Nationalist regime to raise revenue.

Source: Burdekin 2005

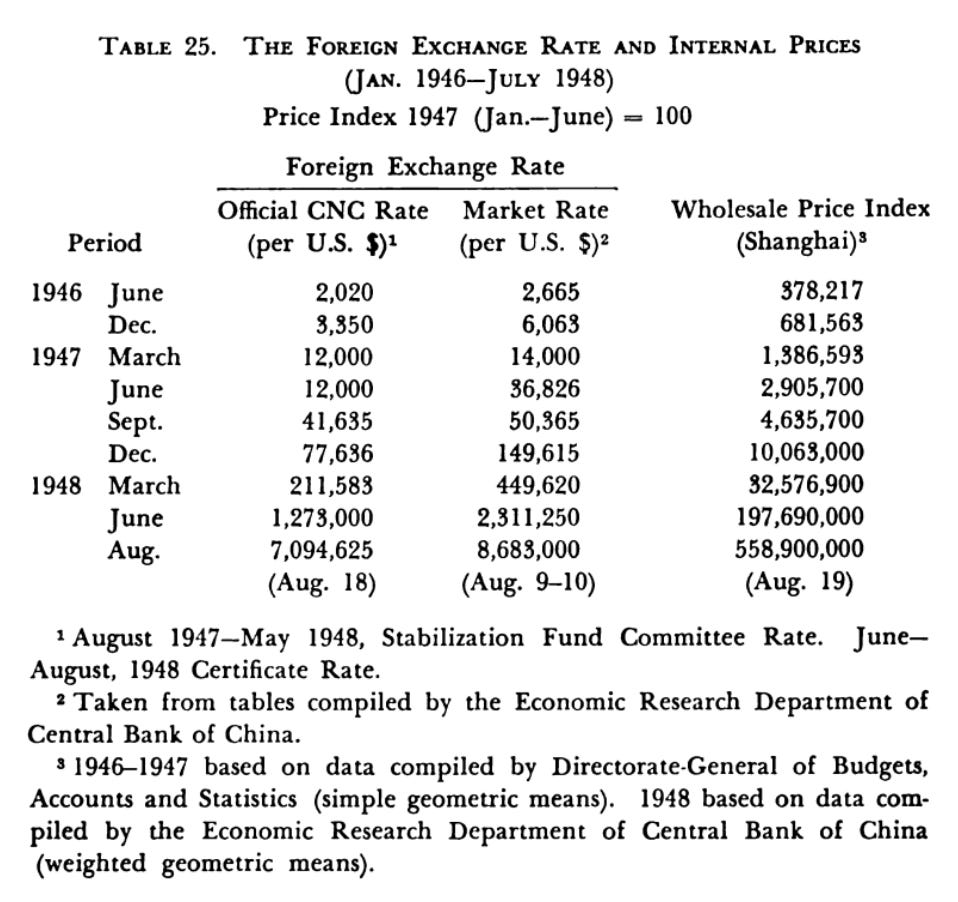

Added to the monetization of deficits, after 1945, as the inflation gathered pace, it was impelled by a spectacular spiral of private credit and a flight out of “bad money” into whatever real value could be saved.

Since the late 19th century the Chinese state had been in crisis. The fiscal structure of the Republic founded after the revolution of 1911 was fragile. No national budget could be drawn up before 1927 because so much revenue was withheld by regional warlords. Between 1927 and 1937 the nationalists consolidated power. The Central Bank of China was established in 1928. From 1935 a consolidated system of bank note issuance was organized around the Central Bank of China, the Bank of China and the Bank of Communications. The Farmers Bank was added in 1936.

Governments finances may have been more consolidated than before, but deficits were persistent and large. Despite repeated efforts to cut military spending, it continued to consume 40-50% of the total national budget in the 1930s. Another 30-40 percent of the budget were consumed by debt service to domestic and foreign creditors. The vast majority of revenue came from indirect taxes – customs duties, salt tax and other commodity taxes. At the end of the war, monopoly profits added a key element of revenue. Since 1911, an income tax had been repeatedly discussed. An attempt by the nationalist government was shelved in 1930. Implementation of an income tax was begun in 1936 only to be interrupted by the Japanese attack in 1937. Progress in land taxation was made difficult by the fact that records had not been updated since the Imperial period. The one bright spot was that the nationalist government at first enjoyed considerable domestic credit and was able to float loans. However, successive “debt reorganizations” in 1932 and 1936 left that credit in tatters.

Between 1937 and 1945, a huge surge in government spending to fight the war, unmatched by new revenue unleashed a tidal wave of liquidity into a fragile economy. Unable to borrow on a large scale, the government resorted to credits from the three main banks, in effect it resorted to printing money.

It took time for this to feed through to rapid inflation. At first prices and wages responded relatively sluggishly. There was still confidence that the currency would recover and so additional liquidity was hoarded. The initial catastrophes of the nationalist forces drove them back into the interior of China. Fortunately, the territory held by Free China was rich in agricultural output. Japan’s policy of blockade and starvation could be resisted. Food prices did not immediately surge.

But in 1940 the dam broke. A combination of pressures came together to unleash an inflationary surge.

Campbell and Tullock (1953)

The harvest of 1940 was a failure, delivering a shock to food prices. At the same time, in 1940 Chiang Kai-shek launched an ambitious new program for long-term resistance that required both a dramatic increase in troop strength and significant investment. From 2.5 m in 1940 it is estimated that China’s military strength surged to 4.5 m in 1941. The deficit surged. But drafting troops from Southern areas that had not previously been part of China’s military system also had supply side effects. It led to dramatic dislocation in the countryside. At the same time it concentrated purchasing power around base camps, setting off local wage-price spirals. The rations and clothing allowance of a modern army were lavish by comparison with the standard of living of rural Chinese. All this compounded the effect of the harvest failure.

Whereas in 1939 the inflation rate had been 68 percent. In 1941 it was twice that rate. Then in December 1941 Japan launched its all-out offensive in Asia. The huge advances of the Japanese armies cut off the Nationalist regime from any source of outside supply other than the arduous route North to the Soviet Union. This shook confidence in the regime and its currency. Relative to 1941 in 1942 the price index tripled.

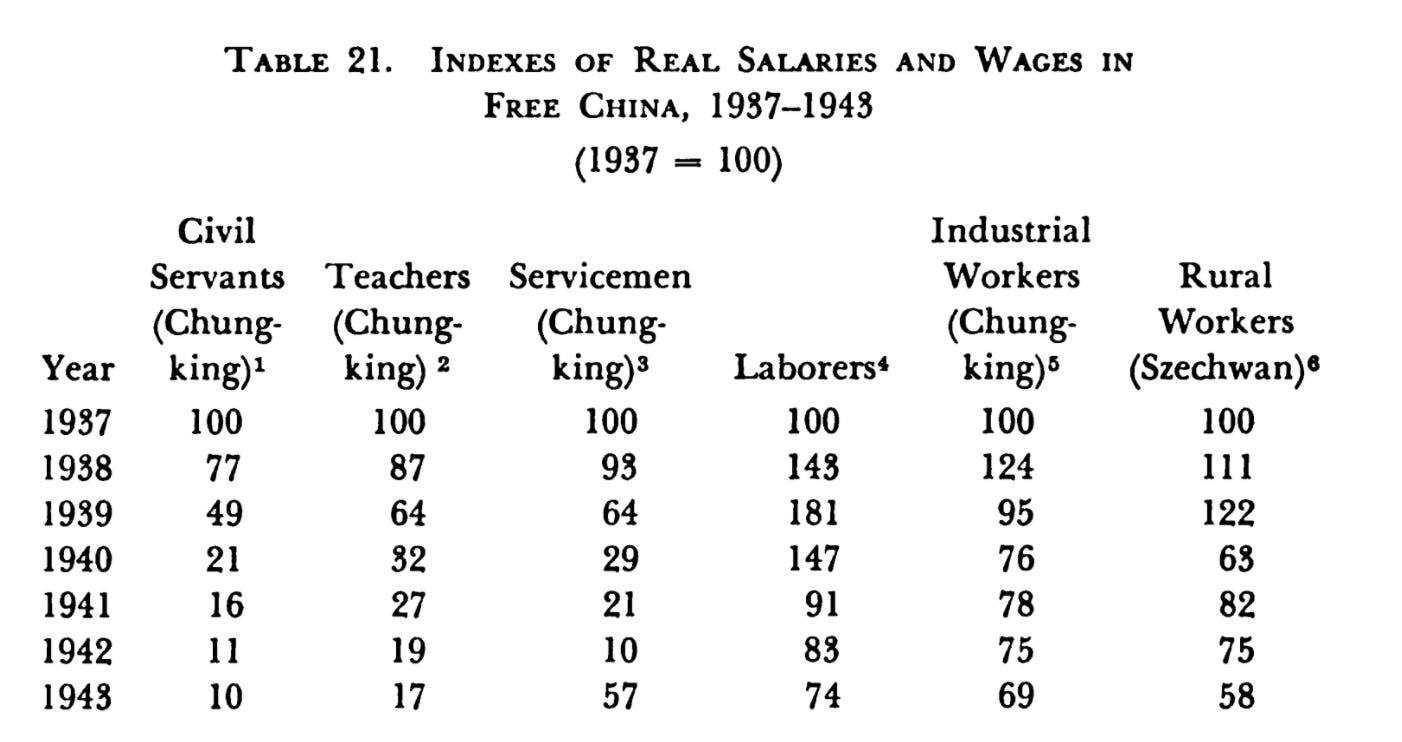

As is commonly the case in severe inflations, the distributional impacts were highly uneven. The principal victims of China’s wartime inflation were all those who depended on the government for salaries.

There can be little doubt that this contributed to the general demoralization of the nationalist regime. The fact that government employment actually surged across this period, from 8000 staff in central government departments in 1936 to 200,000 by March 1945, is a sign of desperation. It was better to be on the payroll than not, even if one could not survive on a government salary. The incomes of soldiers and civil servants had to be supplemented by special rice rations. Unsurprisingly, corruption was rife, which further contributed to low morale.

Several attempts were made during the war to implement a price freeze of the type implemented in the United States. But the nationalist regime lacked the wherewithal to make administrative regulation stick.

The only way to have halted this spiral would have been to raise new sources of revenue. Forced loans were used with modest success 1942-1944 but suffered from same assessment and enforcement problems as income and property tax. They were deeply resented by the peasant population whose land was assessed. Unsurprisingly, given this impasse, bond issuance was a total failure with subscriptions in total not reaching more than 5% of the bonds offered.

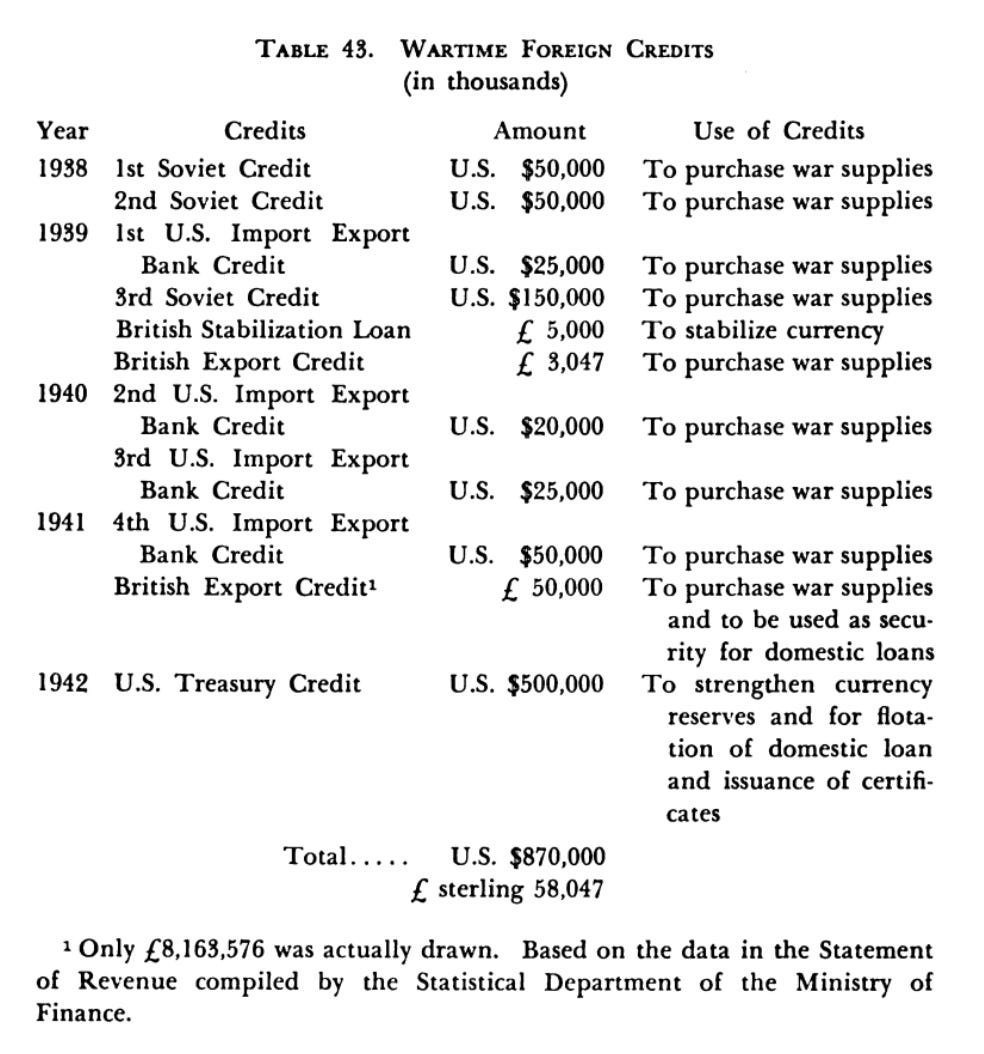

Foreign credits to the nationalist regime flowed regularly but only in modest amounts.

All in all, the mode of wartime finance was highly inflationary.

Though in 1945 the nationalist ultimately found themselves on the winning side, Free China staggered into the “postwar” period on the brink of economic collapse. At least 50 million people were displaced.

The Communists, meanwhile, fought their own war in the North. They were far more successful in controlling inflation. But, their influence remained confined to their base areas. More on this in another post.

Japan’s defeat buoyed the Nationalist regime with false confidence. Rather than continuing their ineffectual system of wartime controls, following the advice of foreign experts, they decided to stake their future on laissez-faire and the confidence of victory. At first this confidence seemed confirmed. As wartime shortages eased, prices fell somewhat over the summer of 1945. It was to prove a false dawn.

The resumption of hostilities with the Communists in 1946 meant that efforts to reduce NRA troop strength had to be abandoned. The unpopular taxes and forced loans levied on peasants were rolled over into 1946 and 1947. Faced with surging prices for industrial goods the peasants detested the harvest levies. On-going conscription compounded the sense of grievance.

In May 1946 a new central bank governor was appointed who proposed fiscal consolidation. Rather than take such painful measures, in February 1947 the regime made one last attempt to implement a price freeze. Without the prospect of actual monetary stabilization the result was to trigger hoarding of stocks, a surge in black market activity and a further acceleration in inflation.

In May 1947 the Central Bank made a final attempt to stabilize the situation. Their proposal was to cut the monthly deficit from CNC $ 1.5 trillion to CNC $ 1 trillion. That was an amount that the bank though it could finance from savings deposits and through the issuance of US dollar bonds and short term bills. In April 1947 the central bank offered for sale $100 million in dollar bonds redeemable in foreign currency and short term bills that was repayable in domestic currency indexed to the official dollar exchange rate. The idea was that after a serious effort at domestic stabilization, China could make an appeal to the US for aid.

Success depended on the willingness of the government to take painful political decisions. Meetings were held with Chiang Kai-shek, the Prime Minister and Minister of Finance. The Central Bank found itself facing determined opposition from the Finance Ministry which insisted that price stabilization had to come before fiscal consolidation.

The histories of China’s inflation that I have been able to read offer scant explanation of the underlying political economy. The fundamental point is simply that the regime lacked fiscal capacity and the necessary will to act. One can’t help wondering about the political economy. Extrapolating from the Weimar case one imagines that a coalition of profiteers resisted fiscal consolidation. The hanger on of the regime depended on its handouts to survive. Furthermore the military pressure from the Communists made it hard to justify cutting defense spending. Chiang prevaricated and the Central Bank’s consolidation plan was abandoned. The dollar bonds never raised more than $25 million and was reduced to worthlessness when the government defaulted on its obligation to service them in dollars.

Instead of fiscal consolidation in the summer of 1947 the authorities attempt to soften the impact of price increases by distributing subsidized rations. It concentrated these rations on the industrial centers of the coast, offering cheap supplies of imported food and cotton to the 11 million inhabitants of Shanghai, Tientsin, Peking, Nanking and Canton. The effect outside the favored urban areas was to induce domestic suppliers to further reduce their deliveries, raising price pressure.

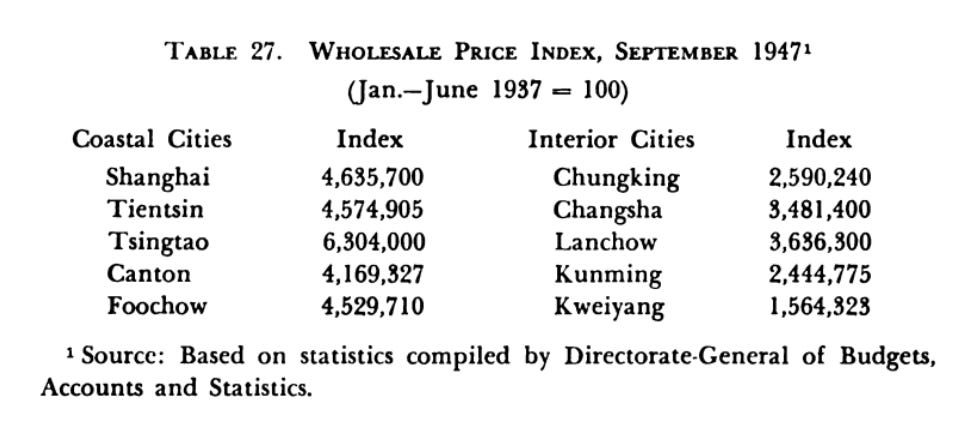

The Chinese economy was coming apart. Huge differences in prices gaped between interior cities close to rural sources of supply and coastal conurbations.

Fearing an imminent collapse, at the end of 1947 the US State Department proposed an Economic Aid Program for China. Even without any realistic prospect of reform on the part of the nationalist regime, the China Aid Act passed in January 1948 providing $275 m for cotton, petroleum, food, construction goods imports and $125 m in military aid. The Nationalists were disappointed that it was not larger. But American experts did not think that the regime could actually transport more aid to the frontline. And the grant of $275 m was twice the foreign exchange reserves on hand in the summer of 1948.

By Jan 1948 with prices doubling every two months Chiang Kai-shek himself was panicking. The Generalissimo ordered an immediate halt to any new bank credits. Though the ban was officially maintained for three months, banking went underground. In June 1948 wholesale price inflation in Shanghai hit a new record at 260 percent in one month. The black market price of gold trebled and the money stock was doubling monthly.

It was time for desperate measures. On August 19 1948 the regime introduced a new currency. The Gold Yuan notionally backed by 0.2217 centigram of pure gold was to be exchanged for existing currency at rate of $3m CNC to one GY. The total Gold Yuan issuance was to be capped at $200 million with 40 percent backing with gold, silver and forex. Given the shrunken real value of the CNC currency in circulation at the time (the huge surge in inflation meant that a large quantity of money in circulation actually had a shrinking real value), that was not an unreasonable target. To ensure that the new currency retained its purchasing power, all prices were to be frozen at their converted rates as of August 19 1948. To ensure that the Central Bank had enough reserves to back the currency, all private holdings of gold, silver and forex were to be surrendered. The regime’s fearsome secret police were mobilized to enforce the new currency regime and the declaration of all foreign exchange. $170m in assets were surrendered in Shanghai alone. As Chang remarks: “For Six weeks Shanghai was more or less terrorized into a state of monetary equilibrium”. (80)

But outside Shanghai the regime’s writ no longer ran and the entire exercise was doomed to failure if it could not close its deficit and stop the new issuance of currency. Predictably the effort at stabilization failed. By October the circulation of Gold Yuan was 8 times the prescribed amount. Panic buying ensued and traders refused to sell at fixed prices. In one week at the end of 1948 prices increased elevenfold.

This Pathe newsreel from the end of 1948 give a sense of the atmosphere of Weimar-style panic. https://www.youtube-nocookie.com/embed/3GkdLYAc0Tk?rel=0&autoplay=0&showinfo=0&enablejsapi=0

In November 1948 in an act of bravado, with foreign reserves of no more than $190 m in hand (compared to $850 m in December 1945), the central bank offered to make the Gold Yuan fully convertible into gold.

But the population were no longer willing to cooperate. Organized gangs of unemployed workers put in applications to convert. When the government responded by restricting the amount that could be converted, in early December a crowd of 60,000 desperate people mobbed the state banks in Shanghai. There was rioting and dozens were killed.

Henri Cartier-Bresson captured the chaos in Shanghai in this remarkable image taken in December 1948 https://www.moma.org/collection/works/105310

In the second week of February 1949 Chiang Kai-shek resigned and went into exile on Formosa and Amoy, taking a large slice of the remaining gold reserves with him. On the eve of the communist entry into Shanghai in May 1949 the exchange rate had depreciated 40 fold since March and the price of rice had risen 451 times in 2 months.

As one contemporary observer remarked: